Global Stemware Market Size, Share, Growth Analysis By Product (Wine Glasses, Martini Glasses, Cocktail Glasses, Champagne Glasses, Others), By Distribution Channel (Offline, Home Improvement Stores, Specialty Stores, Hypermarkets/Supermarkets, Others, Online/E-Commerce), By Application (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 150714

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

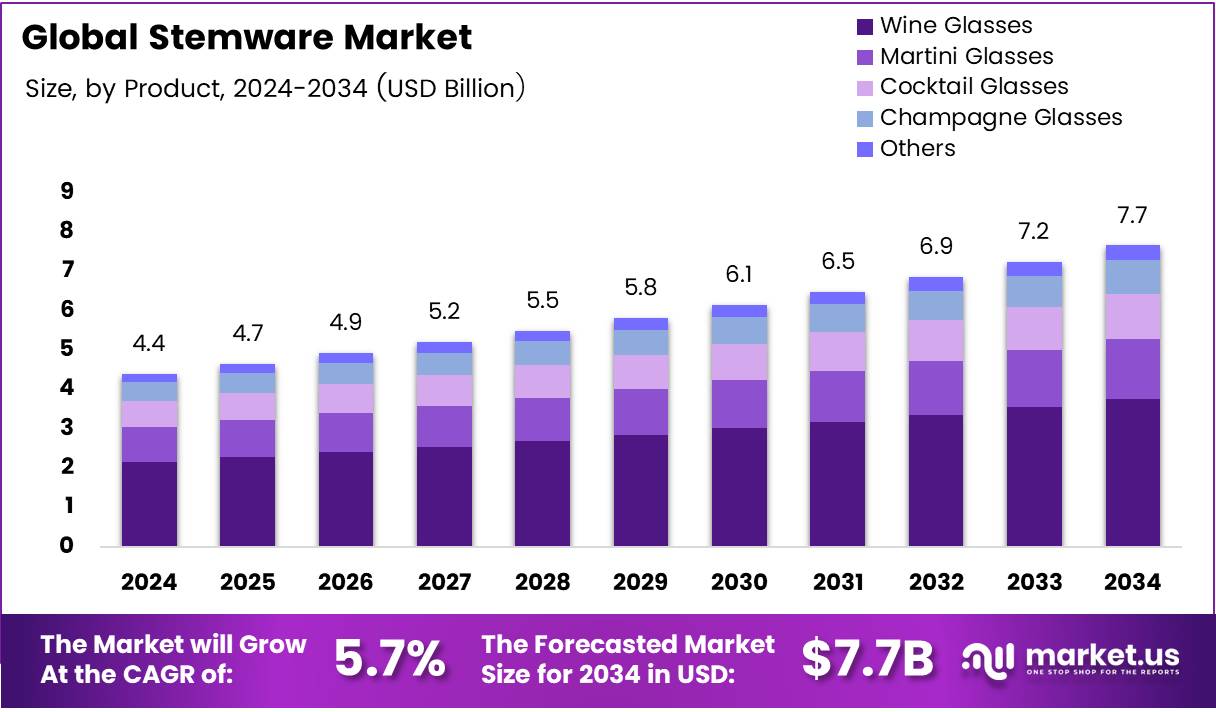

The Global Stemware Market size is expected to be worth around USD 7.7 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

The Stemware Market refers to the industry involved in the production, distribution, and sale of glassware designed with stems, such as wine glasses, champagne flutes, and cocktail glasses. These products are essential in enhancing the drinking experience by providing functionality and aesthetic appeal, making them a key segment within the broader glassware and barware markets.

Growth in the stemware market is driven by increasing consumer interest in home entertainment and luxury lifestyle products. For instance, according to HomeAdvisor, building a home bar costs on average $8,000, reflecting significant investment in premium bar accessories like stemware. This trend underscores the growing demand for high-quality glassware in private settings.

Furthermore, opportunities are expanding due to changing consumer preferences. A recent survey by the National Association of Home Builders found that 60% of luxury home buyers desire a wet bar in their homes. This statistic suggests a direct correlation between luxury housing development and increased stemware demand, opening new revenue streams for manufacturers and retailers alike.

Additionally, government investment in home construction and urban development indirectly supports the stemware market. Policies encouraging residential upgrades and luxury home development stimulate demand for sophisticated barware. As a result, stemware producers can capitalize on these macroeconomic factors to boost sales and innovate product lines.

Regulatory frameworks related to manufacturing standards and safety guidelines also impact the stemware market. Compliance with food-grade material regulations ensures consumer safety and maintains product quality, which is crucial in building brand trust. Adherence to these regulations enhances market credibility and supports sustainable growth.

Moreover, the stemware market benefits from evolving lifestyle trends such as premiumization and increased at-home socializing. Consumers are now more willing to invest in elegant, durable stemware that complements their sophisticated home bars. This shift presents an opportunity for companies to diversify offerings through unique designs and materials.

Key Takeaways

- The global stemware market is projected to reach USD 7.7 Billion by 2034, growing at a CAGR of 5.7% from 2025 to 2034.

- Wine Glasses led the product segment in 2024, holding a 54.6% market share.

- Offline sales dominated the distribution channel in 2024, accounting for 74.2% of the market.

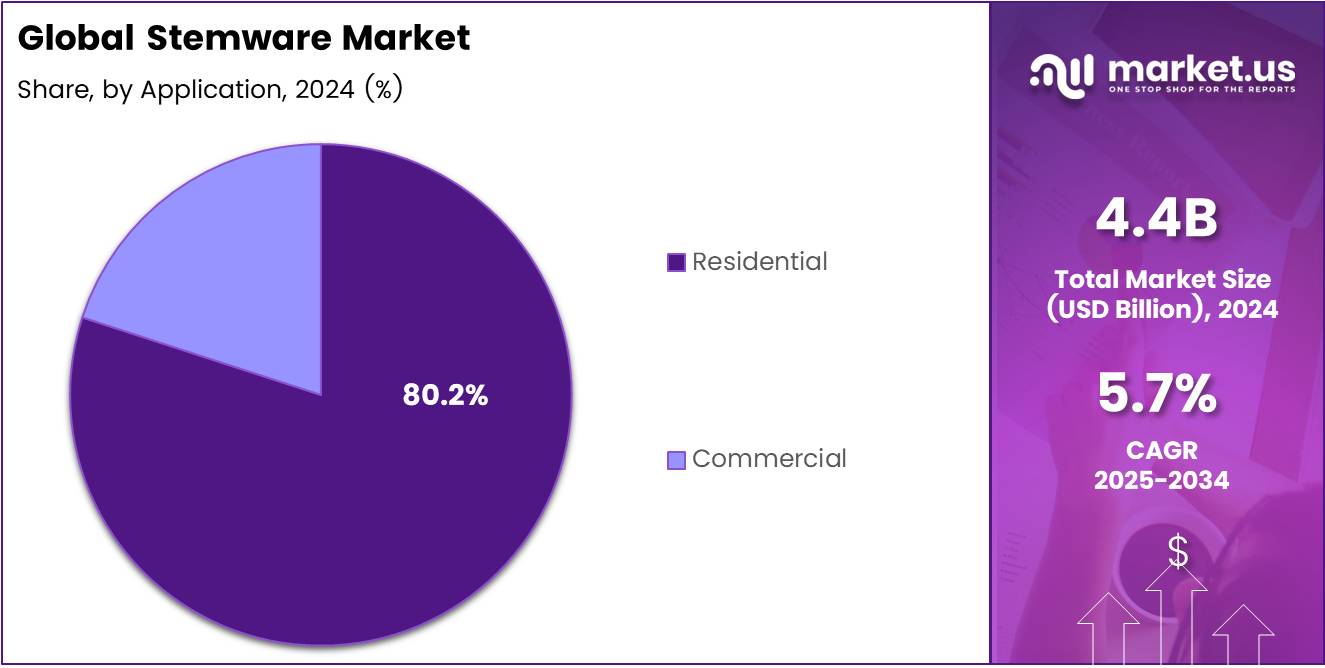

- Residential applications held the largest share in 2024, with 80.2% of the market.

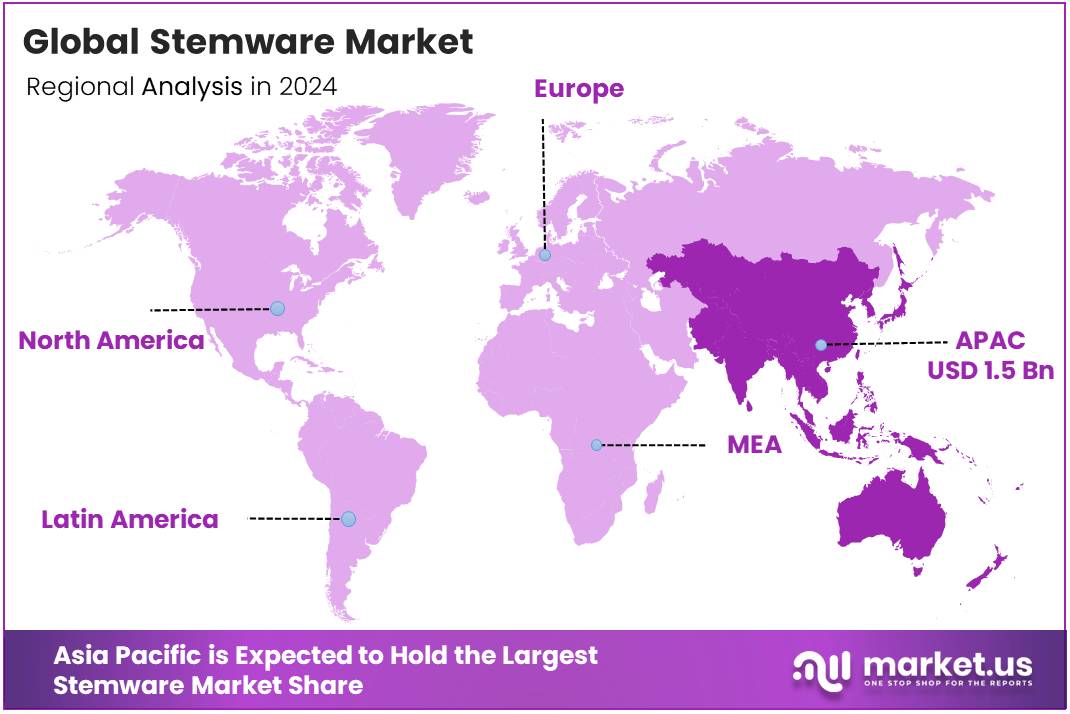

- Asia Pacific contributed 35.4% of the global stemware market in 2024, valued at USD 1.5 Billion.

Product Analysis

Wine Glasses dominate with 54.6% share due to their popularity for both casual and formal occasions.

In 2024, Wine Glasses took the lead in the By Product Analysis segment of the Stemware Market, holding a share of 54.6%. Their widespread use in various settings, such as casual dinners and formal events, makes them the most popular choice. Wine glasses are versatile and appeal to a broad range of consumers, from casual drinkers to wine enthusiasts.

Martini Glasses and Cocktail Glasses follow, but their shares are much smaller. Martini Glasses are especially popular in upscale bars and restaurants, while Cocktail Glasses are used for a variety of drinks. Champagne Glasses, though often used in celebrations, hold a smaller portion of the market due to their more specific use.

Overall, Wine Glasses are the dominant product in the stemware market, thanks to their versatility and widespread appeal in both home and commercial settings.

Distribution Channel Analysis

Offline dominates with 74.2% share due to its well-established retail network and customer preference for in-store shopping.

In 2024, Offline sales led the By Distribution Channel Analysis segment of the Stemware Market, capturing 74.2% of the market. This is largely due to the strength of traditional retail stores, where customers can physically see and touch products before purchasing. The hands-on shopping experience remains a key factor for many consumers.

While online sales have seen growth, they still make up a smaller portion of the market. Consumers are increasingly shopping online for convenience, but offline stores continue to lead, especially for products like stemware, where people may prefer seeing the quality and design in person before buying.

The trend is expected to continue, with offline sales still holding a strong position due to consumer shopping habits.

Application Analysis

Residential dominates with 80.2% share due to its wide use in everyday life and social settings.

In 2024, Residential applications took the top spot in the By Application Analysis segment of the Stemware Market, with a share of 80.2%. Stemware is commonly used in homes for social events, dinners, and casual gatherings. Consumers are looking for both functionality and style in their glassware for home use, which drives this large market share.

Commercial applications, though important, represent a smaller portion of the market. While stemware is used in bars, restaurants, and hotels, it does not match the volume of usage seen in residential settings. The strong preference for quality and stylish stemware in homes continues to keep the residential segment dominant.

Key Market Segments

By Product

- Wine Glasses

- Martini Glasses

- Cocktail Glasses

- Champagne Glasses

- Others

By Distribution Channel

- Offline

- Home Improvement Stores

- Specialty Stores

- Hypermarkets/Supermarkets

- Others

- Online/E-Commerce

By Application

- Residential

- Commercial

Drivers

Drivers Fueling Growth in the Stemware Market

The stemware market is seeing an upward trend due to the increasing popularity of home bars and DIY cocktails. With more people creating personalized drinks at home, there is a growing demand for quality stemware that enhances the drinking experience. This trend is particularly visible among younger consumers who enjoy experimenting with cocktails.

Another key driver is the expansion of the premium wine and spirits market. As more consumers indulge in high-quality beverages, they seek suitable glassware to complement their fine drinks. This increase in premium product consumption is significantly influencing the demand for premium stemware, contributing to market growth.

Additionally, the growth of fine dining and luxury hospitality sectors is further driving demand for sophisticated stemware. As upscale restaurants, hotels, and bars prioritize elegant table settings, there is a consistent need for high-quality stemware that reflects the luxury experience.

Restraints

Challenges Hindering Stemware Market Growth

One of the main restraints in the stemware market is the high cost of premium and custom stemware. The materials, craftsmanship, and attention to detail involved in creating these products contribute to their high prices. As a result, some consumers may opt for more affordable alternatives, limiting the market’s potential growth.

The fragility and transportation challenges of glass stemware are another restraint. The delicate nature of glassware increases the risk of breakage during shipping, which can be costly for both manufacturers and retailers. This fragility also limits the expansion of stemware sales, as it requires careful handling and packaging.

Growth Factors

Growth Opportunities in the Stemware Market

There are significant growth opportunities in the stemware market due to the emergence of sustainable and eco-friendly materials. Consumers are becoming increasingly aware of environmental concerns and are opting for glassware made from recycled or eco-friendly materials, thus driving demand for more sustainable products.

The stemware market also has expansion potential in untapped regions such as Asia-Pacific and Africa. As these regions experience economic growth and the rise of a middle-class population with disposable income, the demand for quality homeware, including stemware, is expected to increase.

Furthermore, there is rising demand for personalized and custom engraved stemware. Consumers are looking for unique products that reflect their personal style or make memorable gifts. The integration of smart features in luxury stemware also offers new opportunities, with advanced innovations like temperature-sensitive glasses or built-in technology for a more interactive drinking experience.

Emerging Trends

Trending Factors Shaping the Stemware Market

The popularity of vintage and retro glassware styles is one of the key trends currently shaping the stemware market. Consumers are increasingly drawn to designs that evoke nostalgia, especially those that feature classic patterns and timeless elegance. This trend is prominent among collectors and those looking to create a unique home bar experience.

Social media has a significant influence on aesthetic drinkware purchases, with platforms like Instagram showcasing stunning glassware designs. The visual appeal of well-crafted stemware has made it a popular subject in lifestyle content, encouraging consumers to invest in aesthetically pleasing products.

There is also growing demand for colored and hand-blown glassware. These pieces add a personalized touch to drinkware collections, and their unique craftsmanship appeals to consumers who value individuality and artistry in their purchases. This trend is contributing to a shift towards more distinctive and creative stemware.

Regional Analysis

Asia Pacific Dominates the Stemware Market with a Market Share of 35.4%, Valued at USD 1.5 Billion

In 2024, Asia Pacific holds the largest share in the global stemware market, contributing 35.4%, valued at USD 1.5 Billion. The region’s growth is driven by the increasing popularity of fine dining and luxury hospitality, along with the rising demand for premium wine and spirits. The expanding middle-class population and improving disposable incomes are further fueling market growth in countries such as China and Japan.

North America Stemware Market Trends

North America remains a key player in the stemware market, driven by a strong demand for high-quality wine glasses and other premium stemware products. The region benefits from a well-established wine culture, with the U.S. being a significant contributor to the market’s growth. The rising trend of home bars and DIY cocktails is boosting demand for high-end stemware in the region.

Europe Stemware Market Trends

Europe is witnessing steady growth in the stemware market, with countries like France and Italy leading the demand for wine glasses and related products. The region’s rich wine culture plays a crucial role in supporting the stemware market, while the expansion of the luxury hospitality sector also propels the demand for premium products. European consumers’ preference for fine dining contributes significantly to the market’s evolution.

Middle East and Africa Stemware Market Trends

In the Middle East and Africa, the stemware market is experiencing gradual growth, supported by the expansion of high-end dining establishments and luxury hotels. Increased interest in western-style dining, particularly in the Gulf countries, is driving the demand for premium stemware. Furthermore, the region’s affluent population is fueling the demand for luxury products, including stemware.

Latin America Stemware Market Trends

The Latin American stemware market is growing as a result of rising consumer interest in wine and fine dining. The market is supported by both local and international wine consumption, especially in countries like Brazil and Argentina. While the demand for luxury stemware is relatively smaller compared to other regions, it is steadily increasing as disposable incomes improve.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Stemware Company Insights

In 2024, Baccarat continues to solidify its dominance in the global stemware market with its luxury glassware offerings. Known for exceptional craftsmanship and elegant designs, Baccarat appeals to high-end consumers, contributing significantly to the market’s premium segment.

Glasvin, a key player in the market, stands out for its innovative and modern designs, catering to both luxury and functional markets. Their focus on producing high-quality stemware with durable and aesthetically pleasing features has led to a strong presence in both retail and online channels.

Libbey, a well-established name in the glassware industry, is recognized for its broad market reach and diverse product range. Its extensive distribution network, combined with cost-effective manufacturing, enables Libbey to cater to various market segments, from casual dining to upscale hospitality.

Bormioli Luigi S.p.A. continues to be a significant player, offering premium Italian-designed stemware. Known for combining innovation with traditional craftsmanship, the company serves both the high-end and mass-market sectors, solidifying its position as a key competitor in the global market.

Top Key Players in the Market

- Baccarat

- Glasvin

- Libbey

- Bormioli Luigi S.p.A.

- Cristal d’Arques Paris

- Zwiesel Kristallglas AG

- Tiroler Glashütte GmbH

- Bayerische Glaswerke GmbH

- Stölzle Lausitz

- Waterford

Recent Developments

- In April 2024, Full Glass Wine raised US$14 million to expand its direct-to-consumer (DTC) offerings, aiming to enhance its market presence and streamline its customer experience.

- In September 2024, Hayden Beverage welcomed an Idaho wine merchant into its portfolio, strengthening its distribution network and expanding its wine offerings in the region.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Billion Forecast Revenue (2034) USD 7.7 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Wine Glasses, Martini Glasses, Cocktail Glasses, Champagne Glasses, Others), By Distribution Channel (Offline, Home Improvement Stores, Specialty Stores, Hypermarkets/Supermarkets, Others, Online/E-Commerce), By Application (Residential, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Baccarat, Glasvin, Libbey, Bormioli Luigi S.p.A., Cristal d’Arques Paris, Zwiesel Kristallglas AG, Tiroler Glashütte GmbH, Bayerische Glaswerke GmbH, Stölzle Lausitz, Waterford Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Baccarat

- Glasvin

- Libbey

- Bormioli Luigi S.p.A.

- Cristal d'Arques Paris

- Zwiesel Kristallglas AG

- Tiroler Glashütte GmbH

- Bayerische Glaswerke GmbH

- Stölzle Lausitz

- Waterford