Staphylococcus Aureus Testing Market By Test Type (Nucleic Acid Amplification Tests, Coagulase Test, Agar-based Tests, and Ancillary Tests), By Application (Clinical, Pharmaceutical, Food Testing, and Other), By End-user (Hospitals, Diagnostic Clinics, Food Testing Laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168236

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

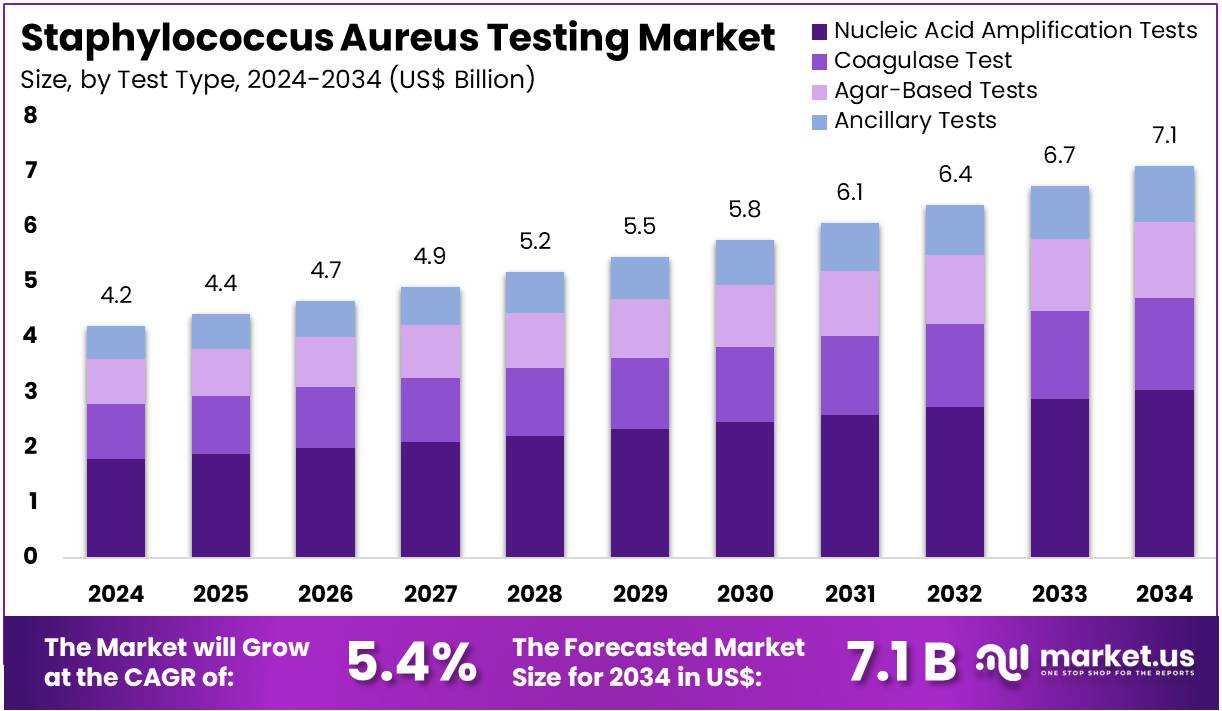

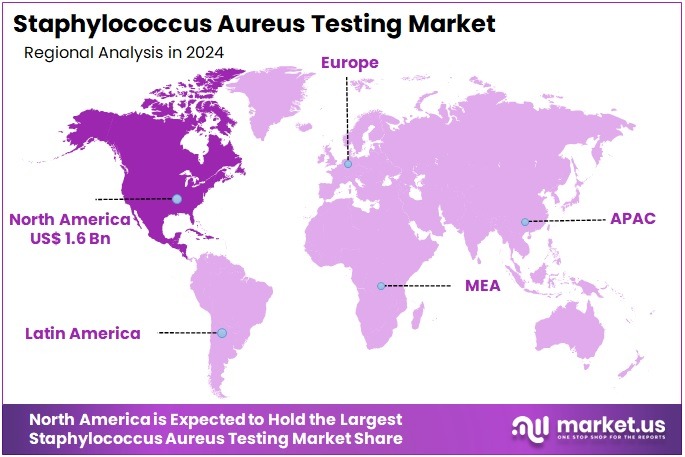

The Staphylococcus Aureus Testing Market Size is expected to be worth around US$ 7.1 billion by 2034 from US$ 4.2 billion in 2024, growing at a CAGR of 5.4% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.3% share and holds US$ 1.6 Billion market value for the year.

Increasing prevalence of hospital-acquired infections drives the Staphylococcus Aureus Testing market, as healthcare facilities implement stringent screening protocols to curb MRSA transmission and improve patient safety outcomes. Diagnostic companies advance chromogenic agar media and molecular platforms that differentiate S. aureus from coagulase-negative staphylococci within hours.

Laboratories utilize these tests for active surveillance cultures in surgical wards to prevent outbreak escalation, rapid identification in blood cultures for sepsis management, nasal screening of high-risk patients upon admission, and environmental monitoring in intensive care units for decontamination efficacy.

Automation advancements create opportunities for integrated workflows that reduce manual errors and accelerate result reporting. BD received FDA clearance on May 4, 2023, for its Kiestra Methicillin-resistant Staphylococcus aureus application, which employs AI-driven evaluation of microbial growth on culture plates to enhance processing efficiency. This software innovation streamlines laboratory operations and supports the growing need for precise, time-sensitive bacterial identification.

Growing adoption of molecular diagnostics accelerates the Staphylococcus Aureus Testing market, as clinicians demand assays that detect mecA gene mutations for targeted antibiotic stewardship and de-escalation strategies. Biotechnology firms develop PCR-based kits and lateral flow devices that deliver results in under 30 minutes from diverse specimen types. These tools enable vancomycin susceptibility confirmation in endocarditis cases, toxin gene profiling for toxic shock syndrome evaluation, biofilm detection in prosthetic device infections, and colonization assessment in dialysis patients.

Point-of-care formats open avenues for decentralized testing in outpatient clinics and emergency departments. Pharmaceutical developers increasingly incorporate these assays into clinical trials for novel anti-staphylococcal agents. This shift toward nucleic acid amplification enhances therapeutic precision and reduces empirical broad-spectrum antibiotic use.

Rising integration of next-generation sequencing invigorates the Staphylococcus Aureus Testing market, as researchers leverage genomic profiling to trace outbreak sources and monitor resistance evolution in real time. Technology providers offer benchtop sequencers paired with bioinformatics pipelines for whole-genome analysis of isolates.

Applications encompass epidemiological surveillance in long-term care facilities for clonal strain mapping, virulence factor identification in community-onset skin infections, phage typing for historical outbreak correlation, and pharmacodynamic modeling for beta-lactam alternative evaluation.

Advanced analytics create opportunities for predictive modeling of resistance emergence and vaccine candidate validation. Academic consortia actively collaborate with diagnostic firms to standardize sequencing protocols for routine implementation. This genomic approach establishes comprehensive testing as essential for proactive infection control measures.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.2 billion, with a CAGR of 5.4%, and is expected to reach US$ 7.1 billion by the year 2034.

- The test type segment is divided into nucleic acid amplification tests, coagulase test, agar-based tests, and ancillary tests, with nucleic acid amplification tests taking the lead in 2023 with a market share of 42.8%.

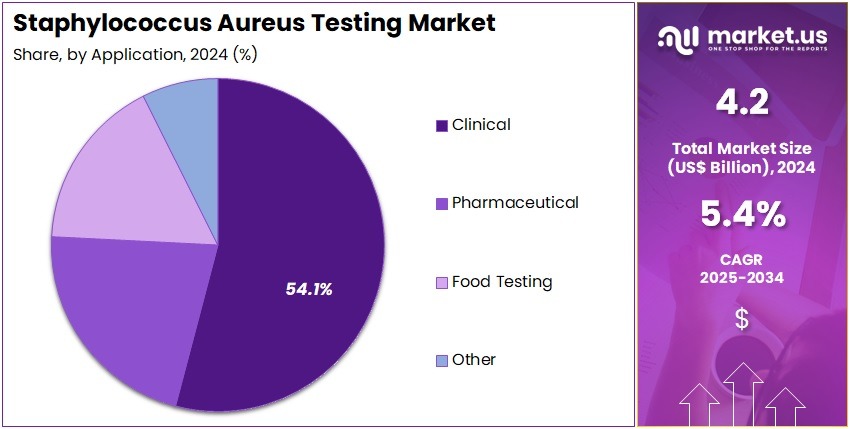

- Considering application, the market is divided into clinical, pharmaceutical, food testing, and other. Among these, clinical held a significant share of 54.1%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, diagnostic clinics, food testing laboratories, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 47.3% in the market.

- North America led the market by securing a market share of 38.3% in 2024.

Test Type Analysis

Nucleic acid amplification tests, holding 42.8%, are expected to dominate due to their superior sensitivity and rapid detection capability for Staphylococcus aureus, including MRSA strains. Clinical teams prioritize these tests for early diagnosis, enabling faster therapeutic decisions. Rising hospital-acquired infection rates increase adoption of rapid molecular detection platforms. Manufacturers develop multiplex PCR assays that identify resistance genes, strengthening clinical relevance.

Public-health systems emphasize early detection to control transmission in healthcare settings. Laboratories integrate automated extraction and NAAT systems to enhance throughput. Research groups investigate molecular markers for improved strain differentiation, increasing assay utilization. Outbreak monitoring programs depend on NAAT accuracy, raising testing volumes. Technological improvements enhance limit-of-detection performance. These factors keep nucleic acid amplification tests anticipated to remain the dominant test type.

Application Analysis

Clinical applications, holding 54.1%, are anticipated to dominate as hospitals and clinics prioritize rapid detection of Staphylococcus aureus infections to manage sepsis, skin infections, respiratory complications, and surgical-site infections. Rising antibiotic resistance strengthens the need for precise identification to support targeted therapy. Emergency departments rely on fast diagnostic workflows to treat severe infections promptly.

Clinical laboratories expand molecular-testing capabilities to address increasing patient loads. Surgeons depend on accurate testing to reduce postoperative infection risks. Intensified infection-control programs increase routine screening for S. aureus carriers.

Clinical research expands studies on pathogen virulence and resistance, raising diagnostic demand. Outpatient centers also increase testing volumes as community-associated MRSA cases rise. Population-level surveillance strengthens clinical-testing frequency. These drivers keep clinical applications projected to remain the most influential segment.

End-User Analysis

Hospitals, holding 47.3%, are expected to remain dominant end-users because they manage the highest burden of S. aureus–related infections. Inpatient departments frequently screen patients before surgeries, intensive-care admissions, and high-risk procedures. Infection-prevention teams use diagnostic results to control outbreaks and guide isolation protocols. Hospitals invest in rapid molecular systems to improve diagnostic turnaround times.

Rising surgical-site infections increase reliance on accurate S. aureus detection. High prevalence of MRSA in hospital settings strengthens the need for routine screening. Pediatric and geriatric wards increase testing due to higher vulnerability. Hospital laboratories adopt automated workflows to meet daily diagnostic demand. Public-health guidelines encourage hospitals to conduct periodic surveillance programs. These factors keep hospitals anticipated to remain the leading end-user segment in the Staphylococcus aureus testing market.

Key Market Segments

By Test Type

- Nucleic acid amplification tests

- Coagulase test

- Agar-based tests

- Ancillary tests

By Application

- Clinical

- Pharmaceutical

- Food testing

- Other

By End-user

- Hospitals

- Diagnostic clinics

- Food testing laboratories

- Others

Drivers

Increasing Incidence of Methicillin-Resistant Staphylococcus Aureus Infections is Driving the Market

The growing incidence of methicillin-resistant Staphylococcus aureus infections has become a pivotal driver for the Staphylococcus aureus testing market, as healthcare facilities require advanced diagnostic tools to identify resistant strains promptly. This rise in MRSA cases, particularly in hospital and community settings, underscores the urgency for rapid screening to guide antibiotic stewardship and prevent outbreaks. Laboratories are investing in molecular assays that differentiate MRSA from methicillin-sensitive strains, ensuring targeted therapies and reduced treatment failures.

Regulatory bodies promote testing protocols to mitigate transmission risks, integrating them into infection control guidelines. Manufacturers are developing high-sensitivity kits compatible with automated platforms, supporting high-volume processing in clinical environments. Collaborative surveillance programs between health agencies and diagnostic providers enhance data-driven responses to regional resistance patterns. The financial implications of untreated MRSA, including prolonged hospital stays, justify expanded budgets for testing infrastructure.

Professional societies advocate for routine nasal screening in high-risk populations, embedding products in preoperative protocols. This driver accelerates innovation in point-of-care formats, enabling bedside identifications to expedite isolation measures. Educational initiatives for clinicians emphasize the role of accurate testing in curbing antimicrobial resistance. The Centers for Disease Control and Prevention estimated 80,461 MRSA infections and 10,999 associated deaths in the United States for 2021, with data reflecting trends into 2022. These numbers highlight the persistent threat necessitating robust diagnostic advancements.

Restraints

Stringent Regulatory Validation Requirements is Restraining the Market

Rigorous regulatory validation processes for Staphylococcus aureus testing kits continue to act as a substantial restraint, prolonging development timelines and increasing compliance costs for innovators.

Agencies demand extensive performance data across diverse strains and sample types, delaying market entry for novel assays. This barrier particularly burdens small-scale developers lacking resources for multi-site trials and post-approval monitoring. Laboratories hesitate to adopt unproven products, favoring established methods despite their limitations in speed. The restraint fosters dependency on centralized reference labs, slowing decentralization efforts in remote areas.

Policy updates, while aiming for harmonization, introduce additional scrutiny on false-positive rates, complicating submissions. Manufacturers must allocate significant budgets to bioequivalence studies, diverting funds from R&D expansions. These demands exacerbate supply inconsistencies, as validated kits face backlogs in production scaling.

International discrepancies in standards further hinder global rollouts, confining opportunities to approved jurisdictions. Mitigation through streamlined pathways remains gradual amid evolving resistance profiles. Addressing this restraint calls for collaborative regulatory frameworks to balance safety with accessibility.

Opportunities

Advancements in Point-of-Care Molecular Diagnostics are Creating Growth Opportunities

The evolution of point-of-care molecular diagnostics for Staphylococcus aureus detection is forging key growth opportunities, allowing immediate results in outpatient and emergency settings without laboratory dependency. These portable systems support on-site MRSA identification, facilitating swift decolonization protocols and reducing transmission. Opportunities emerge in customizing assays for low-prevalence regions, where rapid tools address surveillance gaps cost-effectively.

Regulatory fast-track mechanisms expedite approvals for these innovations, linking them to outbreak response initiatives. Partnerships between diagnostic firms and health networks enable integrated workflows, enhancing data interoperability for epidemiological tracking. This landscape diversifies revenue through consumable cartridges tailored to specific resistance markers. Economic analyses project savings from averted hospitalizations, appealing to value-based care models.

Global health programs prioritize these tools for resource-limited environments, spurring localized manufacturing. The convergence with telemedicine previews remote testing validations, broadening reach in underserved communities. Sustained clinical evidence will solidify their role in preventive screening. The World Health Organization’s 2024 Bacterial Priority Pathogens List classifies methicillin-resistant Staphylococcus aureus as a critical priority for research and development. This prioritization signals expansive potential for diagnostic expansions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic tailwinds powerfully advance the Staphylococcus Aureus Testing market as healthcare systems worldwide boost budgets for infection control programs and antimicrobial stewardship initiatives. Leading companies respond decisively by launching rapid molecular assays and point-of-care platforms that sharply reduce detection time and curb hospital outbreaks. Inflation and tighter capital markets, however, squeeze mid-size laboratories and force hospitals in emerging regions to delay or downsize testing programs.

Ongoing US-China trade tensions seriously disrupt supplies of magnetic beads, lysis buffers, and PCR master mixes, driving manufacturers to maintain higher inventory levels and accept longer lead times. These geopolitical pressures also complicate regulatory submissions and slow collaborative R&D across borders. Current US tariffs on Chinese-origin diagnostic reagents and instruments directly raise landed costs by 15-25%, compelling suppliers to increase prices and temporarily slowing volume growth in competitive US segments.

Forward-thinking players counter aggressively by expanding US and Mexico production footprints, qualifying alternative Asian and European suppliers, and securing long-term domestic contracts that lock in volume and pricing stability. As a result, the Staphylococcus Aureus Testing market exits this challenging period with stronger, more resilient supply chains and positions itself as an essential pillar in global infection prevention and precision antimicrobial therapy.

Latest Trends

FDA Approval of Bioluminescence-Based MRSA Test is a Recent Trend

The U.S. Food and Drug Administration’s approval of bioluminescence technology for MRSA detection has emerged as a defining trend in the Staphylococcus aureus testing market in 2024, revolutionizing rapid viability assessments. This innovation enables same-hour results by measuring bacterial metabolic activity, surpassing traditional culture methods in speed. The trend emphasizes integration with existing workflows, allowing labs to process samples without specialized equipment overhauls. Developers are refining the technology for multiplex capabilities, targeting co-infections alongside S. aureus.

Regulatory endorsements highlight its role in antimicrobial stewardship, guiding empirical therapy adjustments. Adoption in acute care facilities accelerates due to reduced turnaround, minimizing unnecessary isolations. This shift intersects with AI analytics for automated result interpretation, enhancing objectivity. Competitive advancements include adaptations for environmental monitoring in healthcare settings.

Broader applications preview uses in veterinary diagnostics, adapting the tech for animal reservoirs. The trend fosters collaborations for field-deployable variants in outbreak scenarios. On April 10, 2024, the U.S. Food and Drug Administration approved a new diagnostic test using bioluminescence for faster MRSA detection. This breakthrough exemplifies the trend’s transformative efficiency in infection control.

Regional Analysis

North America is leading the Staphylococcus Aureus Testing Market

North America accounted for 38.3% of the overall market in 2024, and the region recorded notable growth as hospitals strengthened surveillance for community- and hospital-acquired S. aureus infections. Clinical laboratories expanded rapid PCR-based detection panels to manage rising skin, soft-tissue, and bloodstream infection cases, especially across high-risk patient groups.

Adoption of molecular assays increased as emergency departments prioritized faster turnaround times for sepsis-related diagnostics. Demand also grew because outpatient centers widened screening protocols for pre-operative patients to reduce surgical-site infections. The CDC AR Lab Network tested more than 24,000 Staphylococcus aureus isolates in 2022 (CDC AR Lab Network Annual Report 2022), and this high testing volume directly supported broader deployment of advanced diagnostic platforms.

Academic medical centers accelerated antimicrobial-resistance research, pushing laboratories to adopt high-sensitivity culture and molecular workflows. Pharmaceutical collaborations stimulated biomarker-driven assay development. These aligned factors strengthened regional market expansion throughout 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to see steady expansion during the forecast period as healthcare systems scale infection-control programs and broaden access to rapid microbial diagnostics. Hospitals enhance microbiology infrastructure to manage increasing bloodstream and postoperative infections, particularly in densely populated countries. Diagnostic centers introduce high-throughput PCR technologies to improve early detection accuracy.

Growth accelerates as public-health agencies intensify surveillance for resistant strains across community and hospital settings. The Japan Nosocomial Infections Surveillance (JANIS) program reported that MRSA accounted for 42.5% of S. aureus isolates in 2023 (JANIS Annual Open Report 2023), and this high resistance burden increases testing demand across the region. Research institutions strengthen clinical microbiology capacity to support epidemiological studies. Manufacturers improve reagent availability to meet rising laboratory procurement volumes. These developments collectively position Asia Pacific for sustained forward growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players advance their market position by launching rapid molecular assays and point-of-care platforms that accelerate detection timelines and improve clinical decision-making, thereby gaining preference in hospital protocols. They invest heavily in reagent and instrument automation while standardising workflows across global sites to reduce manual variability and enhance throughput. They pursue growth through geographic expansion into underserved regions, enabling penetration into emerging hospital networks and diagnostics labs.

They integrate data management and connectivity features into diagnostic solutions to appeal to laboratories seeking efficiency and compliance. They forge strategic alliances and licensing deals with healthcare institutions and biotech firms to broaden their test menus and access complementary technologies.

Becton, Dickinson and Company (BD) exemplifies this approach: the company operates globally in medical technology, diagnostics and life-sciences, utilises its scale to support laboratory automation and microbiology solutions, and leverages its diagnostic division to reinforce its presence in infectious-disease testing.

Top Key Players in the Staphylococcus Aureus Testing Market

- Thermo Fisher Scientific Inc.

- bioMérieux SA

- Becton, Dickinson and Company (BD)

- Abbott Laboratories

- Cepheid (a Danaher company)

- F. Hoffmann‑La Roche Ltd

- QIAGEN N.V.

- Grifols S.A.

- Hain Lifescience GmbH

- 3M Company

Recent Developments

- On December 18, 2024: Cepheid, part of Danaher Corporation, obtained FDA clearance for the Xpert MRSA/SA SSTI test. This molecular test can rapidly identify and distinguish MRSA from S. aureus directly from skin and soft-tissue infection samples, helping clinicians make faster, more precise treatment choices.

- On June 25, 2024: The FDA officially adopted the updated CLSI M100 standard for testing Ceftaroline fosamil against Staphylococcus aureus, including MRSA. This update ensures that clinical laboratories and diagnostic developers use susceptibility guidelines that match current dosing recommendations, influencing how AST assays are designed and validated.

Report Scope

Report Features Description Market Value (2024) US$ 4.2 billion Forecast Revenue (2034) US$ 7.1 billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type (Nucleic Acid Amplification Tests, Coagulase Test, Agar-based Tests, and Ancillary Tests), By Application (Clinical, Pharmaceutical, Food Testing, and Other), By End-user (Hospitals, Diagnostic Clinics, Food Testing Laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., bioMérieux SA, Becton Dickinson and Company, Abbott Laboratories, Cepheid (Danaher), F. Hoffmann‑La Roche Ltd, QIAGEN N.V., Grifols S.A., Hain Lifescience GmbH, 3M Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Staphylococcus Aureus Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Staphylococcus Aureus Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- bioMérieux SA

- Becton, Dickinson and Company (BD)

- Abbott Laboratories

- Cepheid (a Danaher company)

- F. Hoffmann‑La Roche Ltd

- QIAGEN N.V.

- Grifols S.A.

- Hain Lifescience GmbH

- 3M Company