Global Stannous Octoate Market Size, Share, And Business Benefits By Form (Liquid, Solid), By Application (Catalyst, Curing Agent, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166439

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

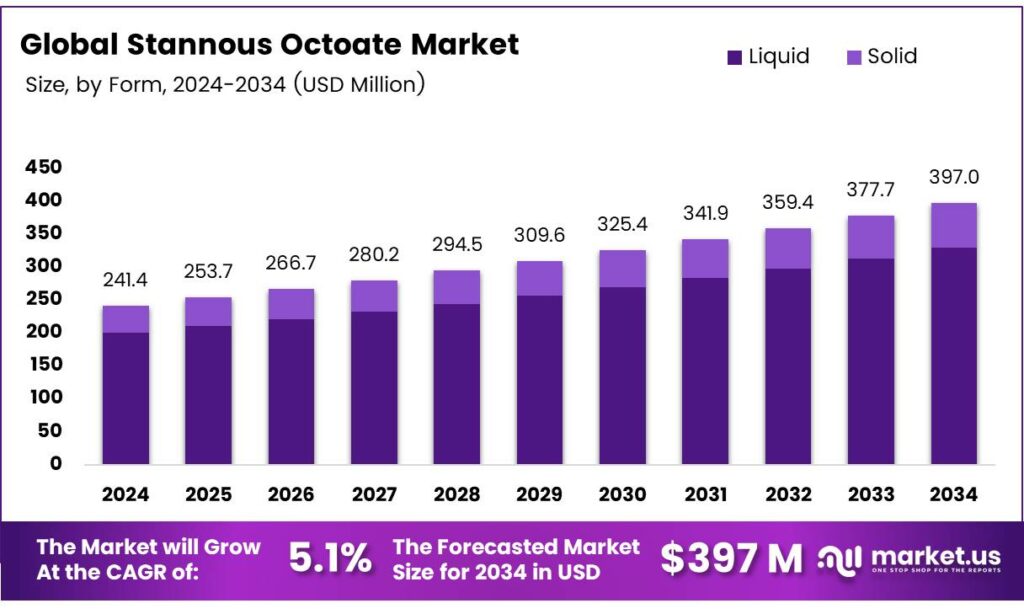

The Global Stannous Octoate Market size is expected to be worth around USD 397.0 million by 2034, from USD 241.4 million in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

Stannous octoate is a widely used catalytic agent that accelerates ring-opening polymerization in polyurethane foams, elastomers, and biodegradable polymers. The Stannous Octoate Market reflects growing demand from medical polymers, packaging materials, and specialty plastics, where consistent catalytic efficiency and controlled polymer chain growth remain essential for performance and safety across industries.

The market also benefits from increasing research into adaptable copolymer systems. For instance, l-lactide monomer assay > 99.5% with < 0.02% water ensures high-quality polymerization outcomes. Similarly, ε-caprolactone assay > 98%, supporting precise property adjustments when used with stannous octoate catalysts in advanced polymer formulations.

Additionally, stannous octoate assay 95% is routinely employed alongside bismuth subsalicylate (99.9% metals basis) to synthesize Poly(l-lactide/ε-caprolactone) (PLCL) copolymers. Research indicates PLCL structures with 70% l-lactide and randomness ratios R = 0.47, 0.69, 0.92 exhibit different strain capabilities. Improving randomness enhances recovery and minimizes supramolecular arrangements at 21 ± 2 °C, creating opportunities for flexible biomedical materials.

Furthermore, studies using sulfuric acid (98%) and nitric acid (67%) for ICP-AES digestion confirm how composition alters physical behavior. When 5–30% caprolactone is added, Tm shifts to 162.7–148 °C and Tg to 50.2–20.4 °C, demonstrating the market potential for tailored polymers. These findings reinforce demand for stannous octoate as industries pursue customizable, high-value materials driven by performance, regulation, and sustainability goals.

The Stannous Octoate Market presents steady growth as manufacturers shift toward biodegradable and high-performance polymers. expanding medical device regulations, supportive government funding for sustainable materials, and rising industrial interest in tailored polymer properties create significant commercial opportunities. These trends also encourage investments in safer catalyst handling, compliance-driven production, and improved purity grades to meet regional regulatory expectations.

Key Takeaways

- The Global Stannous Octoate Market is projected to reach USD 397.0 million by 2034, rising from USD 241.4 million in 2024, at a CAGR of 5.1% from 2025–2034.

- Liquid form leads the market with a dominant 82.9% share in 2024.

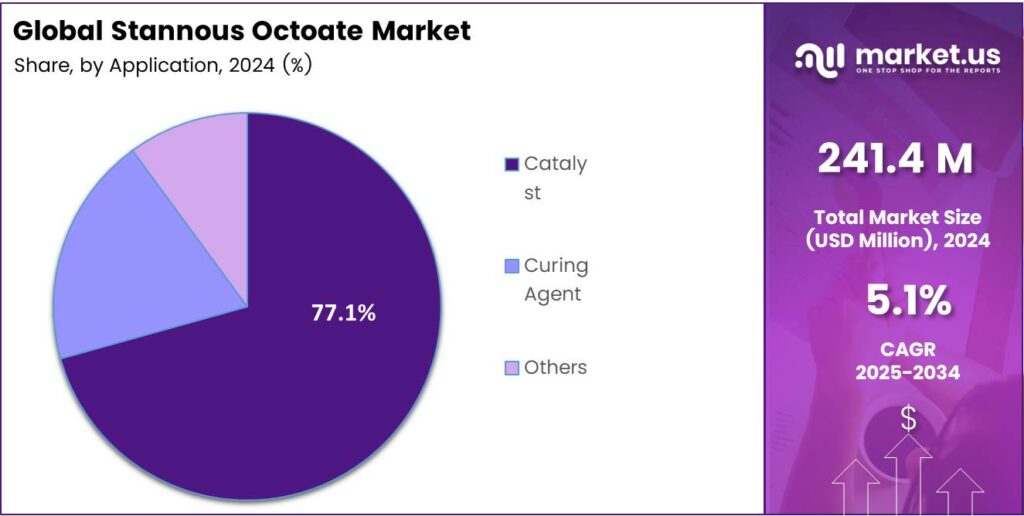

- Catalyst application accounts for the largest share at 77.1% in 2024.

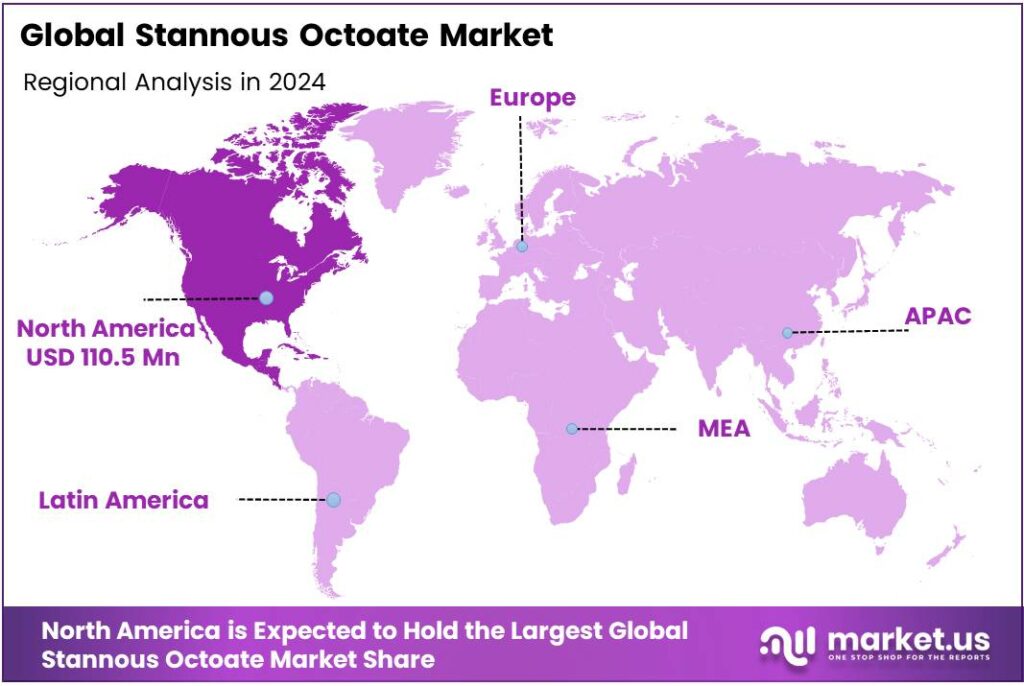

- North America dominates the global market with a 45.8% share, valued at USD 110.5 million.

By Form Analysis

Liquid dominates with 82.9% due to its easier handling and strong compatibility with polyurethane systems.

In 2024, Liquid held a dominant market position in the By Form Analysis segment of the Stannous Octoate Market, with an 82.9% share. Its smooth flow properties improved dosing accuracy, and manufacturers preferred it for scalable production. The liquid form also supported consistent catalytic behavior, enabling better performance across flexible and rigid foam applications in industrial settings.

The Solid form continued to serve niche requirements where safer handling and spill-free logistics were important. Although it lacked the widespread use of liquid grades, the solid variant remained relevant in controlled environments. Users valued its longer shelf stability and reduced risk of contamination, allowing selective adoption in specialized polymer and elastomer formulations.

By Application Analysis

Catalyst dominates with 77.1% due to its essential role in polyurethane and polymer processing.

In 2024, Catalyst held a dominant market position in the By Application Analysis segment of the Stannous Octoate Market, with a 77.1% share. It remained crucial for accelerating polyurethane reactions, improving foam rise, and enhancing polymer uniformity. Industries preferred it for its predictable catalytic rate, supporting high-volume manufacturing lines.

The Curing Agent application gained steady adoption as users sought reliable crosslinking performance. It played a key role in coatings, sealants, and elastomers, where controlled curing improved overall product durability. Although not dominant, this segment benefited from rising demand for high-performance polymer materials across construction and industrial sectors.

The Others segment included specialized and emerging uses where Stannous Octoate offered functional advantages in adhesives, biomedical polymers, and niche synthesis processes. These applications, though smaller in scale, continued gaining attention as research groups and manufacturers explored advanced material innovations where tin-based catalysts delivered unique reaction efficiencies.

Key Market Segments

By Form

- Liquid

- Solid

By Application

- Catalyst

- Curing Agent

- Others

Emerging Trends

Growing Use of Advanced Polymer Processing Supports Market Expansion

The Stannous Octoate market is becoming more active as manufacturers look for efficient catalysts that help produce high-quality polymers. Many industries prefer materials that offer flexibility, strength, and durability, and Stannous Octoate plays a key role in achieving these properties. Its consistent performance in polymerization makes it a preferred choice in modern production lines.

- Global production capacity for bio-based polymers is set to rise sharply. The trade association European Bioplastics reports that capacity will increase from around 2.47 million tonnes to approximately 5.73 million tonnes. This more than doubling of capacity signals a large upstream demand pull for catalysts and polymerisation systems associated with lactide, glycolide, and other cyclic ester-based monomers.

Another important trend is the growing use of polyurethane-based products in construction, automotive, and furniture manufacturing. Stannous Octoate helps speed up curing and improves product quality, making it suitable for foams, coatings, and adhesives. This trend is expected to continue as these industries expand with new infrastructure projects and lightweight material needs.

Drivers

Growing Use of Stannous Octoate as a Key Catalyst Boosts Market Expansion

The Stannous Octoate market is gaining steady momentum as industries increasingly rely on this catalyst for producing a wide range of polymers. Its strong ability to accelerate reactions makes it a preferred choice in polyurethane foam manufacturing, helping companies improve production speed and reduce energy use.

A major driver comes from the rising global demand for flexible and rigid polyurethane foams used in furniture, construction, automotive interiors, and insulation materials. As these sectors expand, they require efficient catalysts to maintain consistent product quality, pushing manufacturers to adopt Stannous Octoate more widely.

The medical and healthcare industries are also contributing to market growth. Stannous Octoate plays a crucial role in the synthesis of biodegradable polymers used for medical implants, sutures, and drug-delivery systems. As research into bio-based and biocompatible materials grows, so does the need for reliable catalysts like Stannous Octoate.

Restraints

High Sensitivity to Moisture Limits Wider Use

The Stannous Octoate market faces restraint due to the material’s high sensitivity to moisture. When exposed to humidity, it can degrade quickly, reducing its effectiveness as a catalyst. This creates challenges for manufacturers who must maintain controlled storage and handling conditions, increasing operational complexity.

Another strong limitation is the strict regulatory environment surrounding chemical catalysts. Many countries have tightened rules for catalyst use in plastics, coatings, and medical materials, pushing companies to invest more in compliance. These added requirements often slow production and raise costs for small- and medium-sized manufacturers.

- Environmentally, organotin compounds carry legacy concerns. A risk assessment published by the European Commission reported that the mono/di-substituted organotins used as catalysts in the EU were estimated at approximately 1,300-1,650 t/yr. The magnitude highlights the scale of industrial use and, correspondingly, the regulatory attention. The International Tin Association (ITA) notes that “the major product, stannous octoate, may also have issues with the octoate component.

Growth Factors

Rising Adoption of Advanced Polymer Processing Creates Strong Market Opportunities

The Stannous Octoate Market is witnessing steady growth as industries search for efficient catalysts to improve polymer production. One major opportunity comes from the rapid expansion of biodegradable and bio-based polymers. Companies making eco-friendly packaging and medical materials increasingly prefer catalysts that ensure clean reactions, and stannous octoate fits well due to its reliability and compatibility with lactide-based polymers.

Another key opportunity emerges from the growing medical device and healthcare materials sector. Stannous octoate plays an important role in producing medical-grade polymers used in implants, drug-delivery systems, and sutures. As global healthcare spending rises and more firms invest in high-performance biocompatible materials, demand for this catalyst is set to grow further.

The market also benefits from rising investments in R&D for polymer customization. Manufacturers want materials with improved flexibility, strength, and durability, and stannous octoate supports controlled polymerization that enables these tailored features. This shift toward specialized materials creates new opportunities for catalyst suppliers.

Regional Analysis

North America Dominates the Stannous Octoate Market with a Market Share of 45.8%, Valued at USD 110.5 Million

North America stands as the leading regional market for stannous octoate, supported by strong demand from polyurethane foam production, advanced polymer processing, and medical-grade material applications. The region’s share of 45.8%, worth USD 110.5 million, reflects robust industrial adoption and steady investment in high-performance catalyst technologies.

Europe shows consistent growth driven by its mature chemical manufacturing base and rising focus on sustainable and efficient catalyst systems. The region benefits from strong R&D investments, particularly in polymerization technologies and medical polymers. Adoption of stannous octoate as a reliable catalyst in coatings, adhesives, and packaging materials further reinforces its regional market strength.

Asia Pacific is emerging as a high-growth region, backed by expanding industrialization, rapid polymer manufacturing, and rising demand in electronics, automotive, and construction. Countries such as China, India, and South Korea show increasing preference for advanced catalytic agents. Growing investment in polyurethane foam and biodegradable polymer production enhances the region’s long-term market potential.

The U.S. plays a crucial role within the global market, benefiting from advanced manufacturing capabilities and large-scale polymer production facilities. Demand is influenced by strong consumption in medical devices, polyurethane foams, and industrial coatings. The country’s focus on high-purity catalyst grades and technology-driven production keeps it a significant contributor to overall market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Air Products and Chemicals continued strengthening its role in the Stannous Octoate market by focusing on material performance and stable catalyst supply. The company’s long-standing specialty chemicals expertise enabled it to support emerging polymer applications, especially in flexible packaging and medical-grade polymers. Its consistent emphasis on purity and formulation stability positioned it as a reliable supplier to global manufacturers.

Changzhou Chemistar maintained steady momentum by expanding its portfolio of organometallic catalysts used across polyurethane and polymer synthesis. The company benefited from strong demand in Asian manufacturing hubs, where cost-efficient catalytic systems are increasingly preferred. Its ability to ensure batch-to-batch consistency supported its presence among mid-scale polymer processors.

Evonik remained a strategic participant due to its broad footprint in specialty additives and catalyst technologies. With continued advances in high-performance polymers and sustainable material solutions, the company leveraged its R&D infrastructure to explore improved catalytic pathways. Its global customer base and diversified product ecosystem ensured stable demand for stannous-based catalysts in multiple downstream sectors.

Gulbrandsen sustained growth by focusing on scalable and economically efficient catalyst solutions suited for polyurethane, elastomer manufacturing and emerging industrial applications. The company’s integrated chemical production processes supported dependable supply, helping customers address quality and performance requirements. Its adaptability to market shifts enabled it to serve both established and high-growth polymer-processing regions.

Top Key Players in the Market

- Air Products and Chemicals

- Changzhou chemistar

- Evonik

- Gulbrandsen

- Jiangsu Yoke

- Nitto Kasei Co., Ltd

- TIB Chemicals AG

- Others

Recent Developments

- In 2025, Changzhou Chemistar, a Chinese manufacturer specializing in organotin catalysts, continues to list stannous octoate (alongside DBTDL and chelate tins) as a core product for polyurethane and environmentally friendly applications. The company maintains active production of stannous octoate for industrial and experimental grades.

- In 2025, Evonik partnered with Schneider Electric to automate thermoplastic processing at its Essen site, advancing recycling of PET waste (relevant to polyurethane supply chains). The Health Care line on growth areas like lipids for mRNA therapies.

Report Scope

Report Features Description Market Value (2024) USD 241.4 Million Forecast Revenue (2034) USD 397.0 Million CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Solid), By Application (Catalyst, Curing Agent, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Air Products and Chemicals, Changzhou Chemistar, Evonik, Gulbrandsen, Jiangsu Yoke, Nitto Kasei Co., Ltd, TIB Chemicals AG, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Stannous Octoate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Stannous Octoate MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Air Products and Chemicals

- Changzhou chemistar

- Evonik

- Gulbrandsen

- Jiangsu Yoke

- Nitto Kasei Co., Ltd

- TIB Chemicals AG

- Others