Global Spectrometry Market By Type [Molecular Spectrometry (Visible and Ultraviolet Spectroscopy, Infrared Spectroscopy, Nuclear Magnetic Resonance (NMR) Spectroscopy and Others) Mass Spectrometry (MS) (MALDI-TOF, Triple Quadrupole, Quadrupole-Trap, Hybrid Linear Ion Trap Orbitrap and Quadrupole-Orbitrap) Atomic Spectrometry (Atomic Absorption Spectroscopy (AAS), Atomic Emission Spectroscopy (AES), Atomic Fluorescence Spectroscopy (AFS), X-ray Fluorescence (XRF) and Inorganic Mass Spectroscopy)] By Product (Instrument, Consumables and Services) By Application (Proteomics, Metabolomics, Pharmaceutical Analysis, Forensic Analysis and Others) By End-Use (Government & Academic Institutions, Pharmaceutical & Biotechnology Companies, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 78343

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

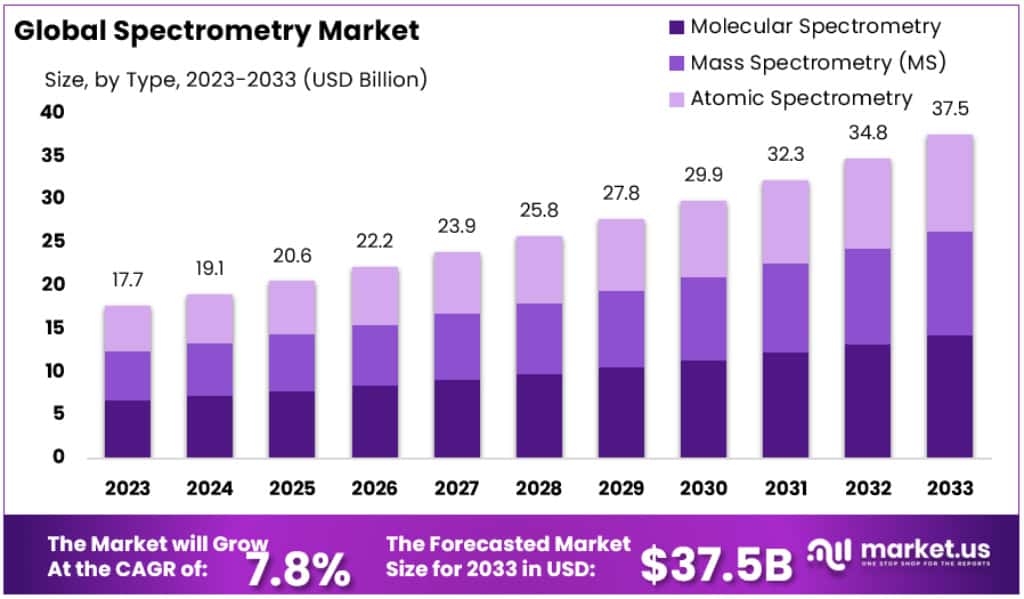

The Global Spectrometry Market size is expected to be worth around USD 37.5 billion by 2033, from USD 17.7 billion in 2023, growing at a CAGR of 7.8% during the forecast period from 2024 to 2033.

Spectrometry involves studying how light interacts with various substances, measuring both the intensity and the wavelength of the radiation involved. Essentially, it’s a technique used to analyze and measure a particular spectrum, commonly employed in examining the composition of different materials.

The spectrometry market is set to grow, driven by continuous improvements in mass spectrometry consumables and instruments. As spectrometry techniques advance, more industries are adopting spectrometers, increasing market demand. These advancements lead to products that are simpler to use and provide superior results. Skilled professionals using these advanced tools are likely to further fuel market expansion in the coming years.

Key Takeaways

- Market Size: Spectrometry Market size is expected to be worth around USD 37.5 billion by 2033, from USD 17.7 billion in 2023.

- Market Growth: The market growing at a CAGR of 7.8% during the forecast period from 2024 to 2033.

- Type Analysis: Molecular mass spectrometry equipment dominated this market. It accounted for 38% of the total revenue share in 2023.

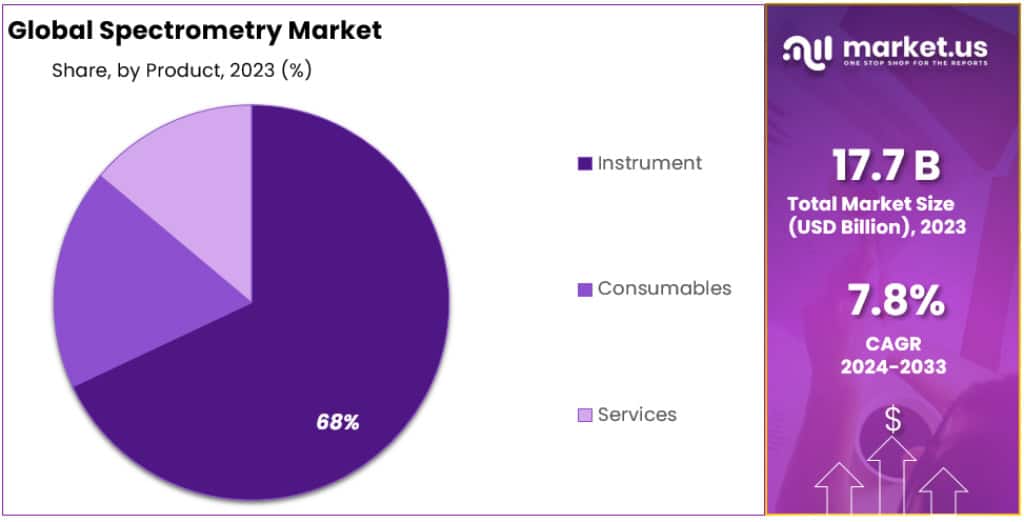

- Product Analysis: Instrument segment, which accounted 2023 for the largest revenue share at 68%.

- Application Analysis: Pharmaceutical analysis held a dominant market position in the spectrometry market, capturing more than a 36.2% share.

- End-Use Analysis: Government and academic institutions held a dominant market position in the spectrometry market, capturing more than a 43.8% share, in 2023.

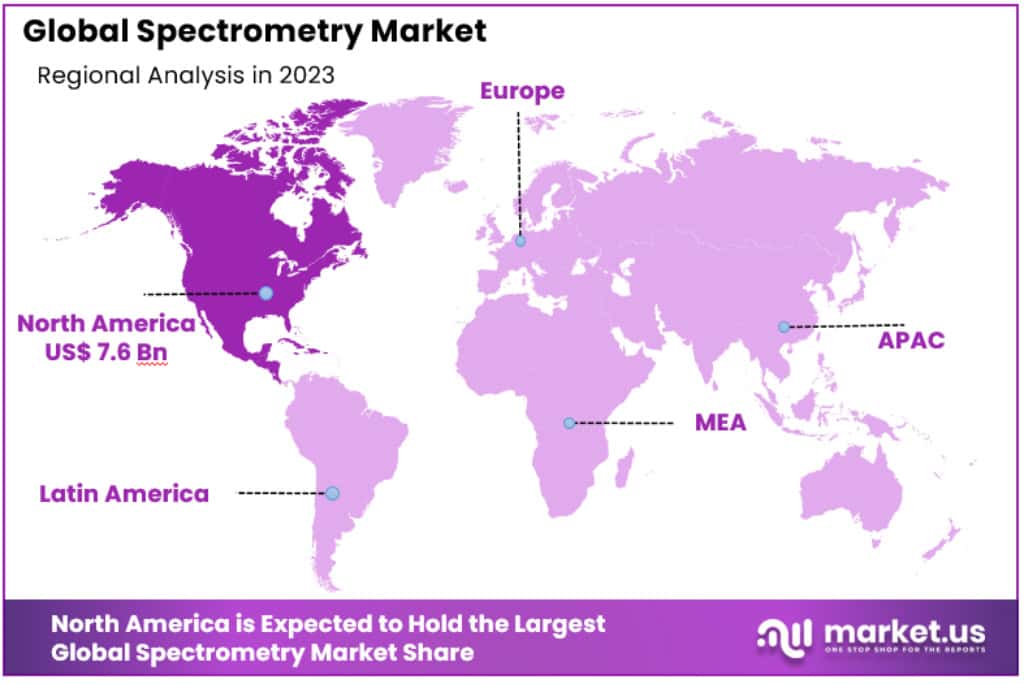

- Regional Analysis: North America is leading the spectrometry market with a 42.8% share in 2023.

- Challenges: High costs of spectrometry equipment and the need for skilled personnel to operate advanced instruments can be barriers to market growth.

- Healthcare Sector: The healthcare sector is increasingly adopting spectrometry for clinical diagnostics, metabolomics, and biomarker discovery, contributing to market expansion.

- Future Outlook: The spectrometry market is expected to continue its upward trajectory, driven by ongoing technological advancements, expanding applications in various sectors, and increasing emphasis on research and quality control.

Type Analysis

Due to its widespread application in the life science industry and the commercial availability of technologically advanced product launches, molecular mass spectrometry equipment dominated this market. It accounted for 38% of the total revenue share in 2023. This segment, which includes Visible and Ultraviolet Spectroscopy, Infrared Spectroscopy, and Nuclear Magnetic Resonance (NMR) Spectroscopy, has been pivotal in diverse industries ranging from pharmaceuticals to environmental testing. The demand for these techniques has been driven by their precision and reliability in molecular analysis.

Mass Spectrometry (MS), encompassing MALDI-TOF, Triple Quadrupole, Quadrupole-Trap, Hybrid Linear Ion Trap Orbitrap, and Quadrupole-Orbitrap, has also witnessed significant growth. This growth can be attributed to advancements in analytical capabilities and the expanding applications in proteomics and genomics research. MS’s versatility in detecting and quantifying complex molecules makes it indispensable in biotechnology and life sciences.

Atomic Spectrometry, comprising Atomic Absorption Spectroscopy (AAS), Atomic Emission Spectroscopy (AES), Atomic Fluorescence Spectroscopy (AFS), X-ray Fluorescence (XRF), and Inorganic Mass Spectroscopy, remains crucial in material science and chemical analysis. The precision in elemental analysis offered by these techniques supports their widespread adoption in mining, metallurgy, and chemical industries.

Each of these spectrometry types caters to specific analytical needs, contributing to the overall growth and diversification of the spectrometry market. As industries continue to demand more sophisticated analytical techniques, the spectrometry market is expected to maintain a trajectory of growth and innovation.

PerkinElmer, Inc. offers a variety of instruments, and consumables, as well as software and informatics for molecular spectroscopy. The company provides infrared spectroscopy as well as fluorescence spectroscopy. It also offers ultraviolet-visible (UV-Vis), fluorescence spectroscopy, and FTIR microscopy. Molecular spectroscopy, which has been popularized in the biotechnology and pharmaceutical industries as well as in forensic science, is now a common tool.

Infrared spectroscopy technology innovations have made it possible to increase efficiency and lower costs. Near-infrared spectroscopy (NIRS) has been proven to be useful in the comprehensive analysis of body fluids. It can also differentiate between normal tissues and cancerous tissue.

Danaher Corporation Bruker Corporation and Thermo Fisher introduced Neoma multi-collector ICP–MS, an Inductively Coupled Plasma MS (ICP–MS) instrument, in December 2020. This Product is expected to help researchers perform reliable and accurate isotope analysis for multiple research purposes.

Product Analysis

The market was dominated by the instrument segment, which accounted 2023 for the largest revenue share at 68%. This segment, which includes Visible and Ultraviolet Spectroscopy, Infrared Spectroscopy, and Nuclear Magnetic Resonance (NMR) Spectroscopy, has been pivotal in diverse industries ranging from pharmaceuticals to environmental testing. The demand for these techniques has been driven by their precision and reliability in molecular analysis.

The consumables segment, although smaller in comparison, plays a vital role in the spectrometry market. This segment includes essential items such as filters, lamps, and sample preparation tools. The recurring need for these consumables, coupled with the expanding base of spectrometry instruments in operation, ensures a steady growth trajectory for this segment.

Services, encompassing maintenance, calibration, and software upgrades, form a critical component of the spectrometry market. The complexity of spectrometry instruments necessitates specialized support, contributing to the steady demand for services. The growth in this segment is propelled by the increasing emphasis on accurate and reliable instrument performance in critical research and industrial applications.

Together, these segments – instruments, consumables, and services – create a comprehensive market structure, each contributing uniquely to the overall development and sustainability of the spectrometry industry. As technological advancements continue to unfold, these segments are expected to evolve, further cementing their respective positions in the market.

Application Analysis

In 2023, pharmaceutical analysis held a dominant market position in the spectrometry market, capturing more than a 36.2% share. This segment’s growth is driven by the crucial role of spectrometry in drug discovery, quality control, and regulatory compliance. The precision and accuracy offered by spectrometry make it indispensable in the pharmaceutical industry.

Proteomics, involving the large-scale study of proteins, is another significant application of spectrometry. The demand in this segment is fueled by the increasing research in protein functions and structures, particularly in understanding diseases and developing targeted therapies. Spectrometry’s ability to analyze complex protein structures contributes to its growth in this sector.

Metabolomics, the study of chemical processes involving metabolites, also relies heavily on spectrometry. The segment’s growth is boosted by the need for comprehensive metabolic profiling in medical research and personalized medicine. Spectrometry’s sensitivity and specificity make it a preferred choice in metabolomics studies.

Forensic analysis is another key application area. Spectrometry is utilized extensively for the detection and quantification of chemical substances in forensic laboratories. The accuracy and reliability of spectrometry support its use in legal and criminal investigations.

Other applications of spectrometry, including environmental testing, food and beverage quality control, and chemical analysis, collectively contribute to the market’s diversity. Each application leverages spectrometry’s strengths, such as sensitivity, accuracy, and the ability to analyze complex mixtures, driving the overall market growth in various sectors.

End-Use Analysis

Government and academic institutions held a dominant market position in the spectrometry market, capturing more than a 43.8% share, in 2023. This sector’s growth is largely fueled by extensive research activities and educational purposes, where spectrometry plays a pivotal role in various scientific studies. The continuous funding and grants in academic and government research projects further support this segment’s growth.

Pharmaceutical and biotechnology companies form another crucial segment in the spectrometry market. The demand here is driven by the need for spectrometry in drug development, quality control, and regulatory compliance. This segment benefits from the technological advancements in spectrometry, aiding in more precise and efficient analysis, crucial for the pharmaceutical industry.

The “others” category, encompassing sectors like environmental testing, food and beverage, and chemical industries, also contributes significantly to the market. These sectors utilize spectrometry for quality assurance, regulatory compliance, and research and development activities. The versatility of spectrometry in handling diverse sample types and its analytical precision make it a valuable tool across these varied industries.

Overall, the spectrometry market is bolstered by these end-use segments, each utilizing the technology’s capabilities to fulfill specific industry requirements. The continued advancements in spectrometry technology and its expanding application scope suggest sustained growth and diversification in its use across these sectors.

Key Market Segmentation

By Type

- Molecular Spectrometry

- Visible and Ultraviolet Spectroscopy

- Infrared Spectroscopy

- Nuclear Magnetic Resonance (NMR) Spectroscopy

- Others

- Mass Spectrometry (MS)

- MALDI-TOF

- Triple Quadrupole

- Quadrupole-Trap

- Hybrid Linear Ion Trap Orbitrap

- Quadrupole-Orbitrap

- Atomic Spectrometry

- Atomic Absorption Spectroscopy (AAS)

- Atomic Emission Spectroscopy (AES)

- Atomic Fluorescence Spectroscopy (AFS)

- X-ray Fluorescence (XRF)

- Inorganic Mass Spectroscopy

By Product

- Instrument

- Consumables

- Services

Basis of Application

- Proteomics

- Metabolomics

- Pharmaceutical Analysis

- Forensic Analysis

- Other Applications

By End-Use

- Government & Academic Institutions

- Pharmaceutical & Biotechnology Companies

- Biotechnology Sector

- Petroleum Sector

- Other End-Uses

Drivers

The spectrometry market is primarily driven by the increasing demand for advanced analytical techniques in various industries. In the pharmaceutical and biotechnology sectors, spectrometry is essential for drug discovery, development, and quality control, providing precise and accurate analysis of complex compounds. Environmental regulations have also spurred the demand for spectrometry, as it is used to monitor and control pollutants in air, water, and soil.

Additionally, the food and beverage industry relies on spectrometry for quality assurance and safety testing. The growing emphasis on research and development, supported by government funding and private investments, further propels the market. The continuous advancements in spectrometry technologies, such as high-resolution and tandem mass spectrometry, enhance the capabilities and applications of these instruments, driving market growth.

Trends

One significant trend in the spectrometry market is the increasing adoption of mass spectrometry due to its high accuracy, sensitivity, and versatility. High-resolution mass spectrometry (HRMS) and tandem mass spectrometry (MS/MS) are particularly popular for their ability to provide detailed molecular information. The integration of spectrometry with other technologies, such as chromatography and capillary electrophoresis, is also gaining traction, offering comprehensive analytical solutions.

Automation and miniaturization of spectrometry instruments are becoming prevalent, making them more accessible and user-friendly. Furthermore, the use of artificial intelligence (AI) and machine learning (ML) in spectrometry data analysis is emerging, enabling more efficient and accurate interpretation of complex data sets.

Restraints

Despite its numerous advantages, the spectrometry market faces certain restraints. The high cost of spectrometry instruments and their maintenance can be prohibitive, especially for small and medium-sized enterprises (SMEs) and research laboratories with limited budgets. Additionally, the complexity of spectrometry techniques requires skilled personnel for operation and data interpretation, posing a challenge for widespread adoption.

The lengthy approval processes and stringent regulations in certain applications, such as pharmaceuticals and environmental testing, can also hinder market growth. Furthermore, the availability of alternative analytical techniques, such as nuclear magnetic resonance (NMR) and infrared spectroscopy, provides competition to spectrometry.

Opportunities

The spectrometry market offers numerous opportunities for growth and innovation. Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth potential due to increasing industrialization, healthcare infrastructure development, and environmental awareness. The expanding applications of spectrometry in clinical diagnostics, such as biomarker discovery and metabolomics, create new avenues for market expansion. Advances in biotechnology and nanotechnology also provide opportunities for developing novel spectrometry-based solutions.

Additionally, the increasing focus on personalized medicine and targeted therapies necessitates precise analytical techniques, driving the demand for advanced spectrometry. Companies that can offer cost-effective, user-friendly, and innovative spectrometry solutions are well-positioned to capitalize on these opportunities.

Regional Analysis

In 2023, North America is leading the spectrometry market with a 42.8% share, valued at USD 7.6 billion. This region’s growth is powered by advanced spectrometry technologies, strong healthcare infrastructure, and significant government funding for research. The region’s focus on food safety, adoption of mass spectrometry in life sciences, and increased R&D spending by pharmaceutical companies also fuel its market dominance. The presence of key players like Danaher Corporation and Agilent Technologies strengthens this position.

Asia Pacific is rapidly growing in the spectrometry market. This growth is driven by its use in food testing, agriculture, and environmental testing, especially in China and India. These countries are adopting new spectrometry methods due to increasing industrial activities and a robust biopharmaceutical sector. The presence of a strong research base for new drug development in these countries contributes to this growth.

Major Regions and Countries

- North America

- US

- Canada

- Mexico

- Latin America

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- The Middle East and Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Some major companies included in the mass spectrometry market report are: Agilent Technologies and ThermoFisher Scientific, Inc., Shimadzu Corporation, Agilent Technologies, and Kore Technology’s extensive product, and service portfolios have resulted in an increase in terms of revenue for spectrometry. Its market share has been significantly boosted by its extensive distribution network.

To increase their capital costs market leaders use organic growth strategies. Agilent Technologies Inc. released a new 7850 ICP/MS mass-spectrometry market instrument. The ICP-MS instrument now features a smart software feature that will enhance the ICP/MS laboratory’s ability. Some of the leading players in the market for spectrometry include:

Маrkеt Prominent Players

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- PerkinElmer Inc.

- Agilent Technologies

- Waters Corporation

- Shimadzu Corporation

- Bruker Corporation

- DANI Instruments

- JEOL Ltd.

- FLIR Systems, Inc.

- Kore Technology

- Endress+Hauser Group

- MKS Instruments, Inc.

- LECO Corporation

- Rigaku Corporation

- Other Key Players

Recent Development

- June 2023: Thermo Fisher Scientific Inc., a biotechnology research company, launched its Thermo Scientific Orbitrap Astral mass spectrometer. The new instrument is designed to help researchers identify new clinical biomarkers and develop new interventions for a variety of diseases, including cardiovascular disease and cancer.

- February 2023: SCIEX announced a collaboration with HighRes Biosolutions to bring customizable automation solutions powered by Cellario software to the Echo MS system. The new automation solutions are designed to help researchers improve the efficiency and accuracy of their mass spectrometry workflows.

- September 2022: Agilent Technologies partnered with MOBILion Systems for ion mobility separation technology called Structures for Lossless Ion Manipulation (SLIM) on its Q-TOF mass spectrometers. The new technology is designed to help researchers separate and identify complex molecules that are difficult to analyze using traditional methods.

- February 2022: Waters Corporation acquired Charge Detection Mass Spectrometry technology assets and intellectual property rights of Megadalton Solutions, Inc., to broaden its application in Cell and Gene Therapy. The acquisition is expected to help Waters develop new products and services for the cell and gene therapy market.

- January 2022: Thermo Fisher and Symphogen extended their collaborative partnership with the aim to deliver workflows for simplified characterization and quality monitoring of complex therapeutic proteins using the Thermo Scientific Q Exactive Plus Orbitrap LC-MS/MS system. The collaboration is expected to help researchers develop new drugs and therapies more quickly and efficiently.

Report Scope

Report Features Description Market Value (2023) USD 17.7 Billion Forecast Revenue (2033) USD 37.5 Billion CAGR (2023-2032) 7.8% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type [Molecular Spectrometry (Visible and Ultraviolet Spectroscopy, Infrared Spectroscopy, Nuclear Magnetic Resonance (NMR) Spectroscopy and Others) Mass Spectrometry (MS) (MALDI-TOF, Triple Quadrupole, Quadrupole-Trap, Hybrid Linear Ion Trap Orbitrap and Quadrupole-Orbitrap) Atomic Spectrometry (Atomic Absorption Spectroscopy (AAS), Atomic Emission Spectroscopy (AES), Atomic Fluorescence Spectroscopy (AFS), X-ray Fluorescence (XRF) and Inorganic Mass Spectroscopy)] By Product (Instrument, Consumables and Services) By Application (Proteomics, Metabolomics, Pharmaceutical Analysis, Forensic Analysis and Others) By End-use (Government & Academic Institutions, Pharmaceutical & Biotechnology Companies and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc, Bio-Rad Laboratories, Inc, PerkinElmer Inc, Agilent Technologies, Waters Corporation, Shimadzu Corporation, Bruker Corporation, DANI Instruments, JEOL Ltd, FLIR Systems, Inc, Kore Technology, Endress+Hauser Group, MKS Instruments, Inc, LECO Corporation, Rigaku Corporation and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is driving the growth of the spectrometry market?The growth is driven by increasing demand for advanced analytical techniques in pharmaceuticals, biotechnology, environmental monitoring, and food and beverage quality control. Advancements in technology and growing R&D investments further propel the market.

How big is the Spectrometry Market?The global Spectrometry Market size was estimated at USD 17.7 Billion in 2023 and is expected to reach USD 37.5 Billion in 2033.

What is the Spectrometry Market growth?The global Spectrometry Market is expected to grow at a compound annual growth rate of 7.8%. From 2024 To 2033

Who are the key companies/players in the Spectrometry Market?Some of the key players in the Spectrometry Markets are Thermo Fisher Scientific Inc, Bio-Rad Laboratories, Inc, PerkinElmer Inc, Agilent Technologies, Waters Corporation, Shimadzu Corporation, Bruker Corporation, DANI Instruments, JEOL Ltd, FLIR Systems, Inc, Kore Technology, Endress+Hauser Group, MKS Instruments, Inc, LECO Corporation, Rigaku Corporation and Other Key Players.

What are the key trends in the spectrometry market?Key trends include the rising adoption of high-resolution and tandem mass spectrometry, integration with other technologies like chromatography, automation and miniaturization of instruments, and the use of AI and machine learning for data analysis.

Which industries primarily use spectrometry?Spectrometry is widely used in pharmaceuticals, biotechnology, environmental testing, food and beverage quality control, and healthcare for clinical diagnostics.

What challenges does the spectrometry market face?Challenges include high costs of instruments and maintenance, the need for skilled personnel to operate complex techniques, stringent regulatory approval processes, and competition from alternative analytical techniques like NMR and infrared spectroscopy.

What opportunities exist in the spectrometry market?Opportunities include growth in emerging markets, expanding applications in clinical diagnostics and personalized medicine, advancements in biotechnology and nanotechnology, and the development of cost-effective and user-friendly spectrometry solutions.

-

-

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- PerkinElmer Inc.

- Agilent Technologies

- Waters Corporation

- Shimadzu Corporation

- Bruker Corporation

- DANI Instruments

- JEOL Ltd.

- FLIR Systems, Inc.

- Kore Technology

- Endress+Hauser Group

- MKS Instruments, Inc.

- LECO Corporation

- Rigaku Corporation

- Other Key Players