Global Spectacles Market Size, Share, Growth Analysis By Parts (Lens, Frames), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 150592

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

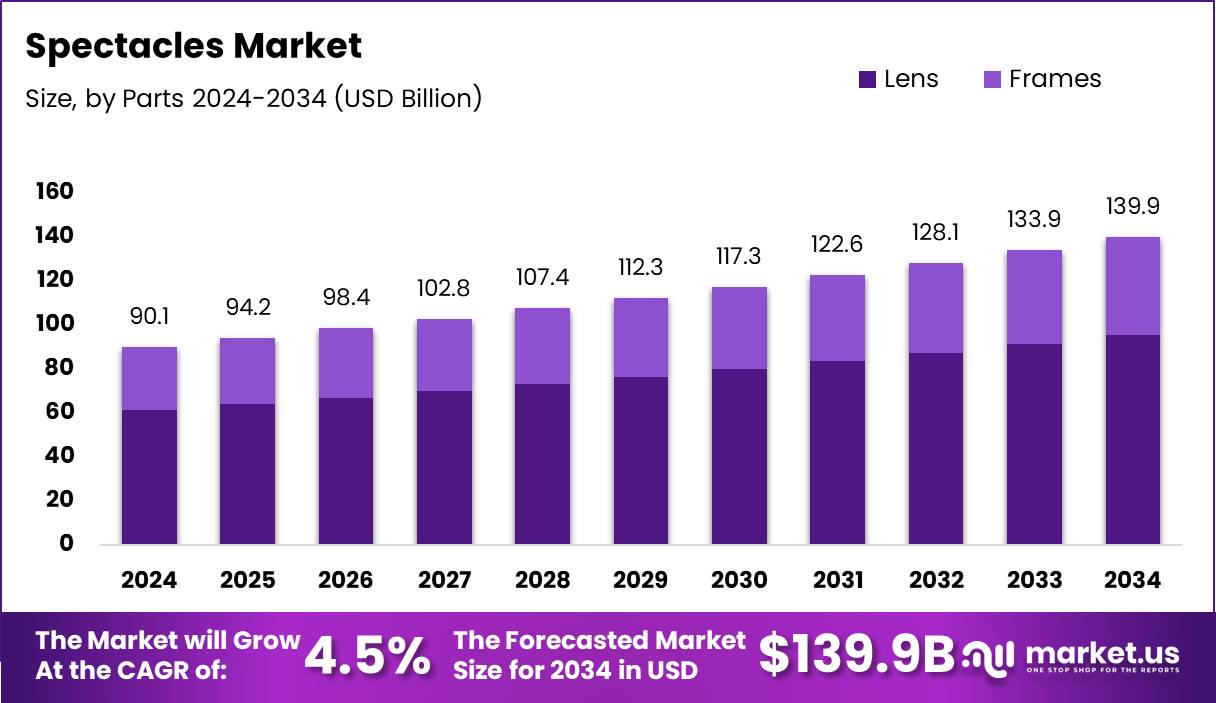

The Global Spectacles Market size is expected to be worth around USD 139.9 Billion by 2034, from USD 90.1 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

The spectacles market represents a vital segment of the global vision care industry, catering to the growing demand for corrective eyewear such as prescription glasses, reading glasses, and protective lenses. It serves both medical and lifestyle needs, making it a dual-purpose product with functional and fashion-driven consumer interest.

The market is primarily driven by rising vision problems, with growing digital screen time being a core contributor. According to Opticstown, 61% of people experience nearsightedness, while 22% have farsightedness. This high prevalence creates consistent demand for optical correction products and services.

In terms of demographics, the aging population plays a significant role in market expansion. As per Opticstown, 45% of spectacle users are aged over 60, followed by 26% aged 45–59, and 21% between 18–44. Only 8% are under 18, pointing toward strong opportunities in elderly care and adult eyewear solutions.

Gender dynamics in the market also show a skew toward female users. Sightconnection reports that 58% of eyeglass wearers are women, while 42% are men. This shift opens up targeted product design and marketing strategies, especially in premium and fashion-forward eyewear segments.

Additionally, Healthline notes that over 150 million people in the U.S. wear corrective eyewear, highlighting the massive scale and embedded necessity of spectacles in everyday life. This positions the spectacles market as a stable and recurring revenue stream across optical retailers.

Government investments in public healthcare and vision screening programs further support the sector. Policies that promote early eye diagnostics in schools and elderly care centers are encouraging the use of corrective eyewear, especially in urban and semi-urban regions.

Meanwhile, regulations surrounding quality standards and prescription verification continue to safeguard the market. These ensure product credibility and promote ethical practices, which in turn elevate consumer trust in branded eyewear providers.

Growth opportunities also lie in emerging markets where access to eye care is improving. Increasing disposable income and expanding optical retail networks are helping to boost sales in regions like Southeast Asia, Latin America, and parts of Africa.

Key Takeaways

- The Global Spectacles Market is projected to reach USD 139.9 Billion by 2034, up from USD 90.1 Billion in 2024.

- The market is expected to grow at a CAGR of 4.5% from 2025 to 2034.

- Lenses dominated the Spectacles by Parts segment in 2024 with a 55.8% market share.

- Offline distribution channels held the leading position in 2024, reflecting consumer preference for in-person eyewear selection.

- North America led the global market with a 32.3% share, valued at USD 29.1 Billion in 2024.

- The North American market benefits from strong healthcare infrastructure and high purchasing power.

- Growth is driven by advancements in lens materials, coating technologies, and fashion-forward frame designs.

By Parts Analysis

Lens leads the market with 55.8% share due to its critical role in vision correction and quality demand.

In 2024, Lens held a dominant market position in the Spectacles

By Parts Analysis” segment of the Spectacles Market, with a 55.8% share. This significant lead reflects the essential function lenses serve in visual correction, which remains the primary purpose of spectacle usage. Advancements in lens materials and coating technologies have further fueled this preference, making lenses the most valued component in consumer purchase decisions.

Frames, while necessary for structure and style, held the remaining market share. Though frames contribute heavily to aesthetics and brand differentiation, their functional impact is secondary compared to lenses. Consumer preferences are increasingly gravitating toward lightweight and customizable lens options, reinforcing lens dominance.

Demand for specialized lenses, such as blue light filtering or progressive lenses, has also expanded, contributing to the surge in lens-focused innovation. These trends indicate a continuing emphasis on optical performance and eye protection, solidifying the lens’s market leadership position in the segment.

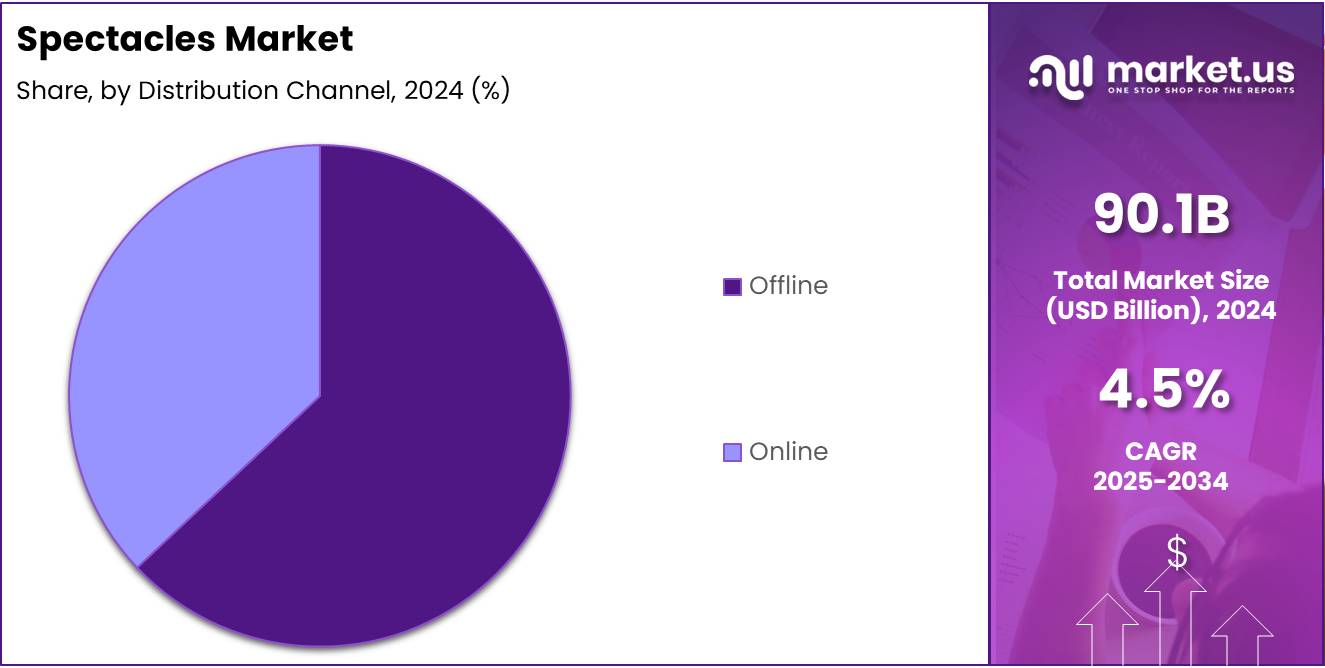

By Distribution Channel Analysis

Offline channels dominate with a strong preference for in-store fittings and personalized service.

In 2024, Offline held a dominant market position in the Spectacles By Distribution Channel Analysis” segment of the Spectacles Market. Physical retail channels continue to be the go-to choice for many consumers due to the tactile nature of eyewear selection, where comfort and fit are best assessed in person.

The offline segment thrives on customer trust, in-person eye exams, and professional guidance—factors that are especially important for first-time buyers and those with complex prescriptions. The ability to physically try on frames and instantly assess lens comfort contributes to higher conversion rates in physical stores.

Online, while growing, remained a secondary channel. Its convenience and accessibility appeal to tech-savvy shoppers, but concerns over fit, prescription accuracy, and return policies hinder its wider adoption. Despite its potential, the online channel continues to face trust and experience barriers compared to traditional retail.

Overall, the offline segment’s ability to deliver a comprehensive, confidence-building buying journey ensures its continued dominance in the distribution landscape of the spectacles market.

Spectacles Market Distribution Channel Analysis Key Market Segments

By Parts

- Lens

- Frames

By Distribution Channel

- Offline

- Online

Drivers

Integration of Smart Technology in Eyewear Drives Market Growth

Smart eyewear is gaining attention for blending traditional vision correction with modern technology. Features like fitness tracking, notifications, and augmented reality are becoming popular. These innovations appeal to tech-savvy consumers and are helping to grow the spectacles market.

The growth of online optical stores has also supported market expansion. Consumers now enjoy the convenience of browsing, trying on virtually, and ordering glasses from home. These digital platforms also offer better price comparisons and a wider variety, boosting overall sales.

Consumers are increasingly looking for frames that reflect their personality. This trend of personalization is driving companies to offer custom designs, sizes, and colors. Such tailored solutions are making spectacles more attractive and boosting brand loyalty.

Rising disposable income, especially in emerging economies like India and Brazil, is fueling demand for premium and branded eyewear. As more people can afford better-quality products, the demand for stylish and functional eyewear continues to increase.

Restraints

High Cost of Branded and Designer Spectacles Limits Market Reach

Premium and designer spectacles often come with high price tags, making them unaffordable for many consumers. This cost barrier limits the market, especially in price-sensitive regions.

In rural areas, access to eye care services remains limited. Without proper eye testing facilities and professionals, the demand for spectacles remains untapped, slowing market growth.

The rise of counterfeit and poor-quality spectacles also poses a problem. These products not only harm brand reputation but also reduce customer trust and satisfaction.

Traditional retail channels still dominate in many regions, making it harder for innovative or new brands to enter the market. This dependence slows down adoption of new styles and technologies.

Growth Factors

Penetration into Untapped Rural and Semi-Urban Markets Offers Growth Potential

Rural and semi-urban areas present large opportunities for market expansion. With growing awareness and improving infrastructure, companies can reach new customers and boost sales.

Sustainable eyewear is becoming a strong selling point. Consumers are looking for eco-friendly materials like recycled plastics and biodegradable frames, encouraging brands to innovate responsibly.

Tele-optometry services and virtual try-on tools are transforming customer experience. These tools allow users to get prescriptions and try eyewear online, increasing accessibility and purchase rates.

Partnering with fashion and sports brands is another growth path. These collaborations bring in new customers who follow trends, creating excitement around eyewear products.

Emerging Trends

Rise in Blue Light Blocking Glasses Demand Influences Market Trends

The increasing use of screens has led to higher demand for blue light blocking glasses. Consumers are becoming more aware of digital eye strain and are choosing spectacles that protect their vision.

Minimalist and lightweight frames are gaining popularity. People want comfort along with style, which is leading to simpler designs that are both functional and trendy.

Subscription-based eyewear services are also becoming a trend. These services offer regular frame updates and maintenance at affordable monthly costs, making eyewear more accessible.

Celebrity-endorsed eyewear collections are attracting attention. Influencers and stars promoting specific brands increase demand and build strong emotional connections with customers.

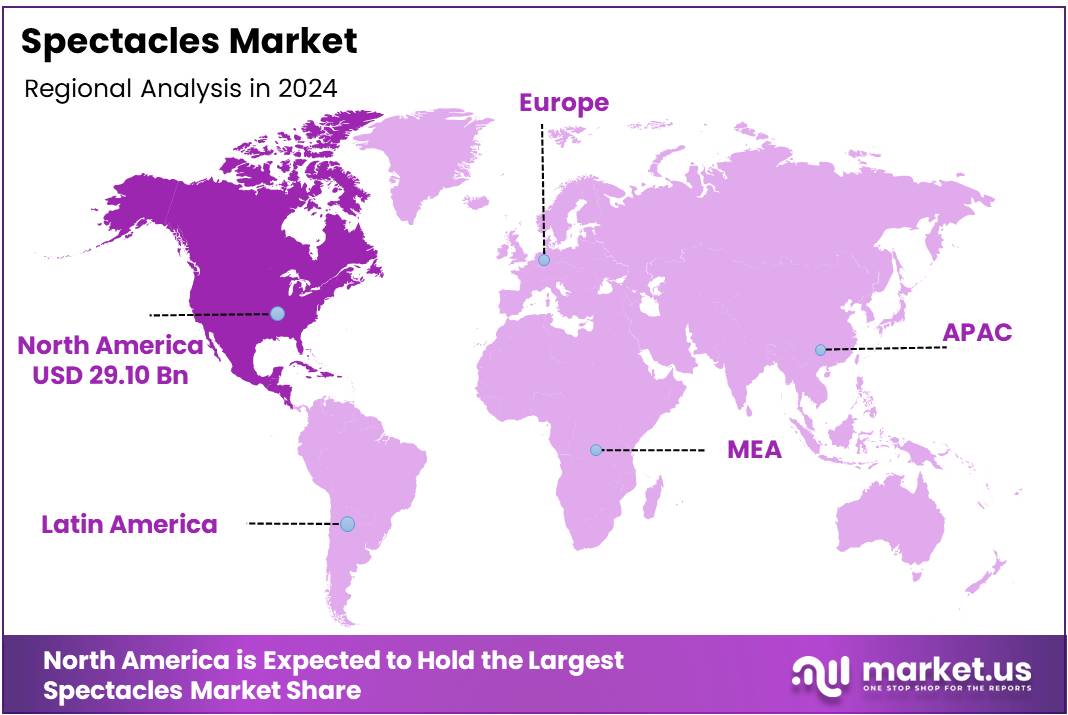

Regional Analysis

North America Dominates the Spectacles Market with a Market Share of 32.3%, Valued at USD 29.1 Billion

North America holds the leading position in the global spectacles market with a Market Share of 32.3%, Valued at USD 29.1 Billion, driven by advanced optical technologies, widespread awareness regarding eye health, and a high prevalence of vision correction needs.

The region benefits from strong healthcare infrastructure and a consumer base with high purchasing power. Innovation in lens technologies and fashion-forward frame designs further fuels the market in the region.

Europe Spectacles Market Trends

Europe follows closely behind, supported by a well-established eyewear industry and growing demand for premium and prescription eyewear. Increasing screen time and aging population are major factors contributing to the rise in vision issues, thus boosting the spectacles market. Regulatory standards also drive demand for high-quality and durable optical products across the region.

Asia Pacific Spectacles Market Trends

Asia Pacific is witnessing rapid growth in the spectacles market due to increasing awareness about vision care, rising middle-class income levels, and expanding urbanization. Countries such as China, India, and Japan are leading contributors owing to their large populations and rising incidence of myopia and other vision disorders. Additionally, growth in e-commerce is making spectacles more accessible in remote areas.

Middle East and Africa Spectacles Market Trends

The Middle East and Africa region shows gradual growth in the spectacles market, supported by improving

access and increased awareness about eye care. Economic development and urban lifestyle changes are contributing to rising adoption of vision correction products. Though market penetration is lower compared to other regions, potential for expansion remains high.

Latin America Spectacles Market Trends

In Latin America, the spectacles market is steadily growing due to rising visual impairment cases and a growing emphasis on personal appearance. Increasing demand for affordable yet stylish eyewear, especially in countries like Brazil and Mexico, is driving the market. The retail segment is also evolving, with optical chains and online platforms gaining traction.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Spectacles Company Insights

In 2024, the global spectacles market continues to evolve with the influence of several key players leading innovation and expanding their reach.

Warby Parker remains a disruptive force in the eyewear industry with its direct-to-consumer model and emphasis on affordable, stylish frames. Its integration of virtual try-on technology enhances customer experience and keeps it competitive in the digital age.

ZEISS Group, a pioneer in precision optics, leverages its expertise to offer high-quality lenses and coatings. Its continued investment in research and development positions it as a top choice for consumers seeking premium vision correction solutions.

Titan Company, under its eyewear brand Fastrack and Titan Eyeplus, maintains strong market presence, particularly in India. The company focuses on accessibility and stylish, affordable options, targeting a broad demographic with a growing middle-class base.

HOYA Corporation emphasizes advanced lens technologies and personalized solutions, helping it maintain a solid position in both the medical and consumer optics segments. Its focus on innovation and partnerships with optometrists supports its global growth strategy.

These companies are shaping the competitive landscape of the spectacles market through a mix of innovation, brand strength, and customer-centric approaches, catering to diverse consumer needs worldwide.

Top Key Players in the Market

- Warby Parker

- ZEISS Group

- Titan Company

- HOYA Corporation

- Lenskart

- ZENNI OPTICAL, INC

- Alcon

- Essilor International

- MODO

- Johnson & Johnson Vision

Recent Developments

- In Feb 2024, ZEISS Vision Care acquired the intellectual property portfolio for electronic eyewear from Mitsui Chemicals, aiming to accelerate its innovation in smart lens technology.

This move positions ZEISS to lead in the emerging electronic eyewear segment by integrating advanced materials and optics. - In Feb 2025, VSP Vision completed the acquisition of Eyemart Express, expanding its retail footprint with over 240 new stores across the U.S.

The deal strengthens VSP’s direct-to-consumer offerings and enhances accessibility to affordable vision care. - In May 2025, Google committed $150M to co-develop AI-powered smart glasses in partnership with Warby Parker.

The investment focuses on integrating generative AI features into consumer eyewear, blending fashion with cutting-edge tech.

Report Scope

Report Features Description Market Value (2024) USD 90.1 Billion Forecast Revenue (2034) USD 139.9 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Parts (Lens, Frames), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Warby Parker, ZEISS Group, Titan Company, HOYA Corporation, Lenskart, ZENNI OPTICAL, INC, Alcon, Essilor International, MODO, Johnson & Johnson Vision Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Warby Parker

- ZEISS Group

- Titan Company

- HOYA Corporation

- Lenskart

- ZENNI OPTICAL, INC

- Alcon

- Essilor International

- MODO

- Johnson & Johnson Vision