Specific Imaging Solution Market By Product Type (App-based Solutions, On-premise Solutions, and Cloud-based Solutions), By Technology (3D Imaging, 2D Imaging, and Multispectral Imaging), By Application (Wound Care, Orthopedics, Ophthalmology, Dermatology, and Others), By End User (Hospitals & Clinics, Research & Academic Institutes, Diagnostic Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159178

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

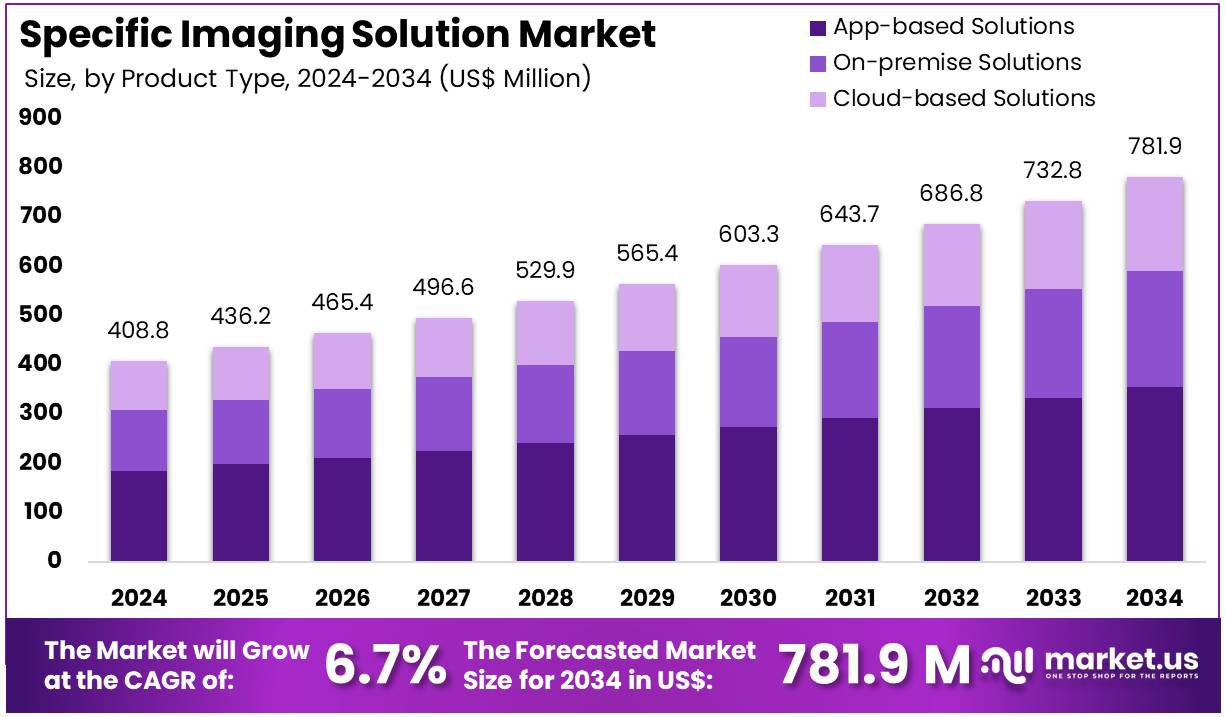

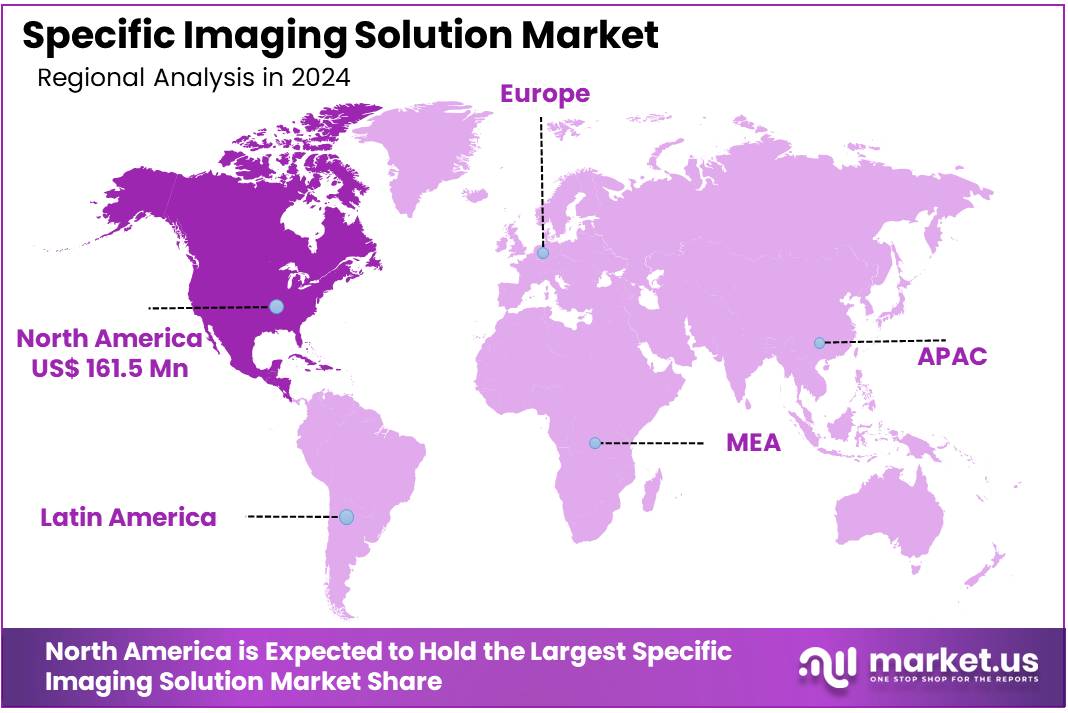

The Specific Imaging Solution Market Size is expected to be worth around US$ 781.9 million by 2034 from US$ 408.8 million in 2024, growing at a CAGR of 6.7% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.5% share and holds US$ 161.5 Million market value for the year.

Rising demand for precise diagnostic tools fuels the specific imaging solution market as healthcare providers prioritize early detection and personalized treatment strategies. Clinicians increasingly adopt advanced imaging platforms for applications like intraoperative visualization, enabling real-time tissue assessment during complex surgeries such as tumor resections. This driver intensifies with the growing prevalence of chronic diseases, where solutions like hyperspectral imaging guide non-invasive monitoring of wound healing.

Hospitals leverage these technologies for cardiology, assessing myocardial perfusion to optimize stent placements. According to the CDC, approximately 20.1 million adults in the US have coronary artery disease, amplifying the need for accurate imaging solutions. These drivers underscore the market’s critical role in enhancing clinical outcomes across diverse applications.

Growing advancements in artificial intelligence and machine learning create substantial opportunities in the specific imaging solution market. Innovators develop AI-driven image analysis for automated lesion detection in dermatology, improving diagnostic speed for skin cancer screenings. Research institutions utilize these platforms for neurology studies, mapping brain activity to advance epilepsy treatment protocols.

Opportunities also arise in orthopedics, where imaging software supports 3D modeling for precise joint replacement planning. Pharmaceutical firms apply these solutions in drug development, visualizing biomarker responses in clinical trials. The FDA reports over 1,200 AI-enabled medical devices cleared by September 2024, highlighting the potential for imaging innovations to transform healthcare delivery.

Recent trends in the specific imaging solution market emphasize enhanced interoperability and strategic infrastructure investments to support scalable diagnostics. Developers integrate cloud-based platforms for seamless data sharing, enabling remote consultations for applications like telemedicine-based radiology reviews.

In August 2023, Kent Imaging Inc. expanded its office and upgraded its production facility in Calgary, Alberta, to drive technology innovation, enhancing capabilities for advanced imaging tools in precise diagnostics and treatment. Trends also include portable imaging devices for point-of-care applications, such as emergency trauma assessments in field settings. Key players note a 30% increase in demand for mobile imaging solutions, per industry reports, reflecting a shift toward flexible, patient-centric systems. These advancements signal a dynamic market poised for sustained growth and integration.

Key Takeaways

- In 2024, the market generated a revenue of US$ 408.8 million, with a CAGR of 6.7%, and is expected to reach US$ 781.9 million by the year 2034.

- The product type segment is divided into app-based solutions, on-premise solutions, and cloud-based solutions, with app-based solutions taking the lead in 2024 with a market share of 45.5%.

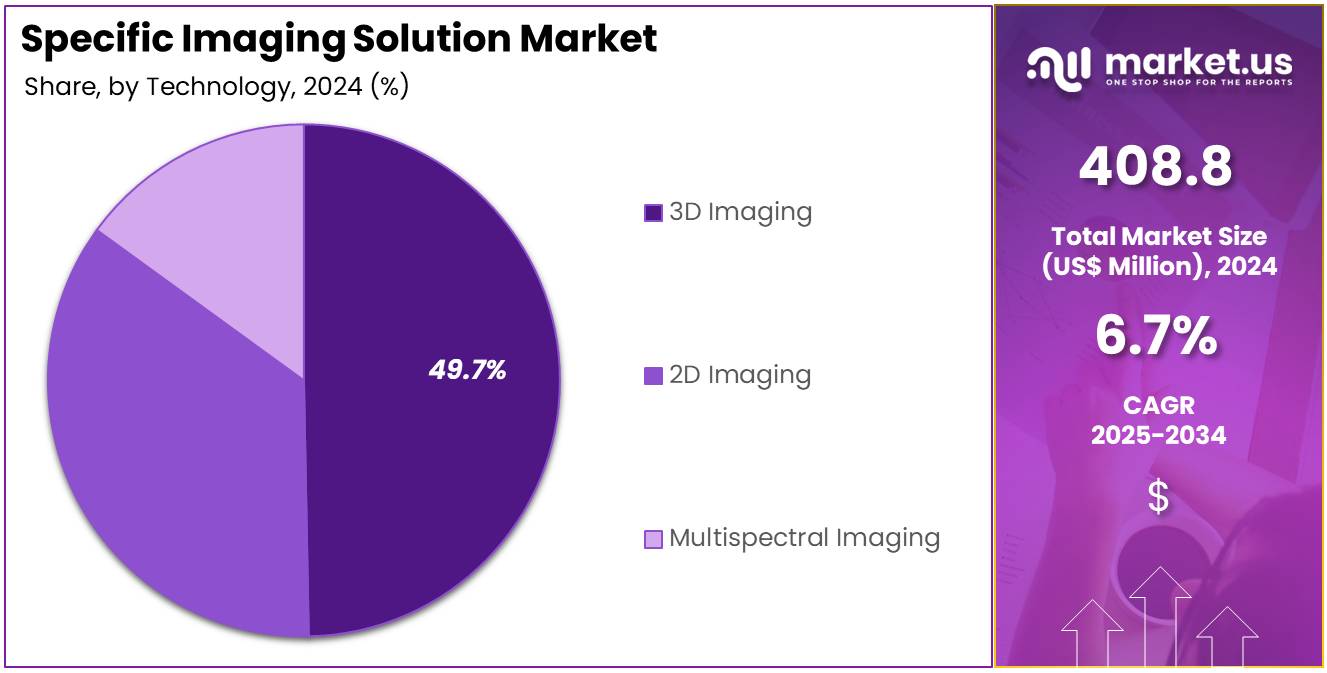

- Considering technology, the market is divided into 3d imaging, 2d imaging, and multispectral imaging. Among these, 3d imaging held a significant share of 49.7%.

- Furthermore, concerning the application segment, the market is segregated into wound care, orthopedics, ophthalmology, dermatology, and others. The wound care sector stands out as the dominant player, holding the largest revenue share of 40.5% in the market.

- The end user segment is segregated into hospitals & clinics, research & academic institutes, diagnostic centers, and others, with the hospitals & clinics segment leading the market, holding a revenue share of 55.3%.

- North America led the market by securing a market share of 39.5% in 2024.

Product Type Analysis

App-based solutions lead the product type segment with 45.5% share. This dominance is largely driven by the surge in mobile health applications and the shift toward more accessible, flexible healthcare solutions.

Healthcare professionals increasingly prefer app-based solutions due to their ability to provide real-time access to imaging data, making it easier for them to consult with colleagues and make faster, more informed decisions. As the demand for telemedicine and remote healthcare solutions grows, app-based platforms become even more critical in ensuring seamless data sharing and improving patient care.

The growing integration of mobile devices into medical workflows is also likely to boost demand for these solutions in areas such as diagnostics, treatment planning, and patient monitoring. This segment is anticipated to grow further as innovations continue to enhance the usability, accessibility, and functionality of these platforms.

Technology Analysis

3D imaging holds the largest share of 49.7% in the technology segment, a position that reflects its critical role in providing accurate, high-resolution visualizations of anatomical structures. This technology has revolutionized fields such as orthopedics, wound care, and ophthalmology, where detailed imaging is essential for effective diagnosis and treatment planning.

3D imaging solutions allow healthcare professionals to visualize and analyze complex structures in three dimensions, significantly improving diagnostic accuracy and enabling more personalized treatment approaches. With ongoing advancements in 3D imaging technology, such as enhanced resolution, faster scan times, and improved portability, the adoption of 3D imaging systems is expected to continue growing across medical applications. The increasing use of 3D imaging in telemedicine and remote diagnostics further strengthens the segment’s market growth, ensuring its prominent position in the industry.

Application Analysis

Wound care dominates the application segment with 40.5% share. This growth is driven by the rising global prevalence of chronic wounds, such as diabetic ulcers, venous leg ulcers, and pressure sores, which require advanced monitoring and care. 3D imaging and multispectral imaging technologies, which allow for detailed assessment and real-time tracking of wound healing, are becoming indispensable tools in modern wound care management. These technologies help clinicians better understand the progression of wounds, assess tissue regeneration, and make more informed decisions about treatment options.

As healthcare systems focus on improving patient outcomes through early intervention and better care strategies, the demand for advanced imaging solutions for wound care is expected to increase. This segment’s growth is also supported by a growing awareness of the importance of wound care management and the need for cost-effective solutions that improve healing times and reduce complications.

End-User Analysis

Hospitals and clinics lead the end-user segment with 55.3% share. The adoption of imaging solutions in hospitals and clinics is being driven by the need for more efficient, accurate, and timely diagnostics. Digital imaging technologies, particularly 3D and multispectral imaging, enable healthcare providers to make faster, more precise diagnoses, especially in critical care situations. These solutions also facilitate better collaboration among medical teams, improving patient outcomes through shared insights and comprehensive treatment plans.

As hospitals and clinics continue to integrate digital tools into their workflows, the demand for advanced imaging solutions will increase. This is especially evident in departments like orthopedics, wound care, and ophthalmology, where high-quality imaging is essential for diagnosis and monitoring treatment effectiveness. The continued expansion of telemedicine and remote healthcare will also drive the adoption of these technologies in hospitals and clinics, contributing to this segment’s robust growth.

Key Market Segments

By Product Type

- App-based Solutions

- On-premise Solutions

- Cloud-based Solutions

By Technology

- 3D Imaging

- 2D Imaging

- Multispectral Imaging

By Application

- Wound Care

- Orthopedics

- Ophthalmology

- Dermatology

- Others

By End-user

- Hospitals & Clinics

- Research & Academic Institutes

- Diagnostic Centers

- Others

Drivers

The increasing prevalence of chronic diseases is driving the market

The market for specific imaging solutions is being driven by the rising global burden of chronic diseases, particularly complex conditions like cancer and neurological disorders. These specialized solutions, which include modalities such as PET-CT, SPECT, and high-resolution MRI, are essential for the early and accurate diagnosis, staging, and monitoring of these diseases.

As populations age, the incidence of these conditions is increasing, leading to a greater demand for advanced diagnostic tools that can provide detailed anatomical and functional information. These imaging systems are crucial for guiding treatment decisions and assessing a patient’s response to therapy, making them an indispensable part of modern medicine.

The scale of this driver is demonstrated by the number of new disease diagnoses. According to the National Cancer Institute, there were an estimated 2,001,140 new cancer cases in the United States in 2024. This significant figure underscores the constant and growing need for sophisticated diagnostic imaging technologies that are at the core of effective cancer care.

Restraints

The high capital cost of equipment is restraining the market

A significant restraint on the specific imaging solution market is the extremely high capital cost of the equipment. These advanced medical imaging systems are complex, require specialized components, and are subject to stringent regulatory approvals, all of which contribute to their prohibitive price tag. For many hospitals and clinics, especially in developing regions or smaller healthcare systems, the immense financial investment required to purchase, install, and maintain a high-end scanner is a major barrier to adoption.

In addition to the purchase price, there are ongoing costs for maintenance contracts, specialized staff training, and facility upgrades to accommodate the large, heavy machines. This financial burden often leads to institutions delaying or forgoing the acquisition of this technology. For example, a new GE HealthCare PET/CT scanner can cost millions of dollars, with one model, a refurbished GE Discovery LS 4, 8, 16 PET, CT Scan, being listed for around US$350,000 in 2024. This figure represents a massive capital expenditure for any healthcare facility, which acts as a major market restraint.

Opportunities

The rising adoption of hybrid imaging techniques is creating growth opportunities

A key growth opportunity for the specific imaging solution market lies in the rising adoption of hybrid imaging technologies that combine two or more modalities into a single device. The most prominent example of this is the PET-CT scanner, which integrates the functional imaging capabilities of Positron Emission Tomography (PET) with the detailed anatomical information from Computed Tomography (CT). This combination provides a more complete picture of a patient’s condition, allowing for more precise diagnoses and treatment plans, especially in oncology and cardiology.

By fusing the data, these systems provide clinicians with a more powerful tool than either modality could offer on its own. This trend is demonstrated by the revenue performance of key industry players. Siemens Healthineers, a leader in the imaging space, reported that its Imaging segment’s comparable revenue grew by 7.7% in the fourth quarter of its 2024 fiscal year, a strong performance driven in large part by the demand for its advanced, integrated imaging solutions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert profound influence on the specific imaging solution market, presenting both obstacles and opportunities for growth. Elevated inflation and economic volatility constrain healthcare budgets, prompting institutions to defer capital expenditures on advanced imaging technologies, such as holographic systems and AI-enhanced diagnostics. Geopolitical tensions, including US-China trade frictions and regional instabilities, disrupt global supply chains, escalating costs for critical components like semiconductors and rare earth metals integral to MRI and CT systems.

Nevertheless, these challenges catalyze innovation, as industry leaders pursue localized production and diversified sourcing strategies to mitigate risks. Robust demand for precise diagnostics, driven by aging demographics and rising chronic disease prevalence, continues to propel market expansion. Through strategic adaptation, companies strengthen resilience, fostering technological breakthroughs that elevate imaging performance and market competitiveness.

Current US tariffs significantly reshape the specific imaging solution market by altering cost dynamics and supply chain frameworks. Tariffs on imported components, including electronics and steel, increase production costs for imaging equipment such as X-ray and MRI systems, pressuring margins for manufacturers like GE Healthcare and Siemens. These trade measures elevate procurement costs for healthcare providers, potentially delaying equipment upgrades and limiting patient access to state-of-the-art diagnostics.

On the positive side, tariffs incentivize domestic manufacturing, with firms capitalizing on US-based production to minimize tariff impacts. This shift drives job creation and fortifies local supply chains, enhancing market stability. By leveraging localization and forging strategic partnerships, the industry positions itself for sustained growth and innovation, ensuring long-term success.

Latest Trends

The integration of artificial intelligence is a recent trend

A major trend in the specific imaging solution market in 2024 is the accelerated integration of artificial intelligence (AI) and machine learning for image reconstruction and analysis. AI is being used to improve the quality of medical images, reduce scanning times, and assist in the detection of diseases. For example, AI algorithms can reconstruct clearer images from lower radiation doses, which is beneficial for patient safety, or automatically detect and flag abnormalities for a radiologist’s review. This technology promises to make imaging diagnostics more efficient, accurate, and personalized. This trend is clearly supported by a sharp increase in regulatory approvals.

According to data from the US Food and Drug Administration (FDA)’s database, the number of AI-enabled medical devices receiving approval has surged. In 2023, the FDA authorized 226 AI-enabled medical devices, and in 2024, it authorized another 235 devices. A significant majority of these approvals were for products in the medical imaging space, underscoring the central role AI now plays in the development of new diagnostic technologies.

Regional Analysis

North America is leading the Specific Imaging Solution Market

In 2024, North America held a 39.5% share of the global specific imaging solution market, fueled by surging demand for AI-driven diagnostics in oncology and cardiovascular care. Healthcare systems embraced hybrid PET-CT and MRI systems to enhance tumor characterization and monitor treatment responses. The FDA’s streamlined approvals for AI-based imaging software reduced diagnostic variability through automated segmentation. Academic-industry partnerships developed cloud-native platforms for secure, cross-institutional data sharing, boosting algorithm precision.

Expanded Medicare reimbursements for outpatient imaging encouraged adoption of 4D flow MRI for heart disease assessments. Venture capital inflows supported startups innovating in spectral CT for stroke risk analysis. Portable ultrasound with AI triage gained traction in community hospitals, addressing rural access gaps. Post-acute care networks integrated intraoperative imaging for transplant surgeries, improving vascular mapping accuracy. These advancements solidified North America’s leadership in precision diagnostics. The FDA authorized 107 AI-enabled medical devices in the first half of 2024, many enhancing imaging capabilities.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific specific imaging solution sector to expand rapidly during the 2024-2030 forecast period, driven by rising chronic disease burdens. Governments invest in low-dose CT scanners for lung cancer screening in pollution-heavy regions. Pharma firms partner with local AI developers to quantify hepatic fibrosis via elastography for drug trials.

Innovation hubs in Shenzhen and Bangalore promote open-source diffusion tensor imaging for neurodevelopmental diagnostics. Southeast Asian nations deploy mobile fluoroscopy units for trauma care in remote areas. Japan advances hyperpolarized MRI to phenotype prostate cancers, guiding targeted therapies. India’s telemedicine networks utilize edge-computing ultrasound for obstetric monitoring in rural zones. Australia invested US$ 107.2 million in digital health programs in 2022-23, supporting imaging technology advancements.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the medical imaging sector, including GE HealthCare, Siemens Healthineers, and Koninklijke Philips N.V., aggressively pursue inorganic growth through strategic partnerships and acquisitions to accelerate innovation and expand market reach. These companies invest heavily in research and development to integrate artificial intelligence and advanced analytics into diagnostic tools, enhancing precision and operational efficiency. They also prioritize geographic expansion into high-growth regions like Asia-Pacific by bolstering local manufacturing capabilities and tailoring solutions to emerging healthcare demands.

Furthermore, leaders focus on sustainable practices, such as developing eco-friendly imaging equipment, to align with regulatory trends and appeal to environmentally conscious stakeholders. GE HealthCare, a prominent global leader in this domain, operates as an independent entity spun off from General Electric in 2023, delivering comprehensive healthcare technologies that encompass imaging systems, ultrasound, and patient monitoring solutions to over 1,000 facilities worldwide. With annual revenues exceeding US$19 billion in 2024, GE HealthCare drives value through its Precision Care strategy, emphasizing data-driven diagnostics and collaborative ecosystems to improve patient outcomes.

Top Key Players in the Specific Imaging Solution Market

- WoundVision

- WoundMatrix, Inc

- Spectral MD USA

- Perceptive Solutions

- Net Health Company

- Kent Imaging Inc

- HyperMed Imaging, Inc

- Carestream Health

- Barco

- ARANZ Medical Limited

Recent Developments

- In November 2024: Perceptive Solutions launched WoundZoom LIGHT, a mobile app designed for clinicians in post-acute wound care. This new development is expected to stimulate growth in the specific imaging solution market by providing healthcare professionals with a portable and efficient imaging tool, enhancing the accuracy of wound monitoring and promoting better patient outcomes.

- In September 2024: Perceptive Solutions partnered with MolecuLight to offer an integrated cloud-based wound management solution by combining the WoundZoom platform with MolecuLightDX, a point-of-care bacterial imaging device. This collaboration is set to drive advancements in the specific imaging solution market by merging cutting-edge imaging and cloud technology, improving the precision and accessibility of wound care management and bacterial detection for clinicians.

Report Scope

Report Features Description Market Value (2024) US$ 408.8 million Forecast Revenue (2034) US$ 781.9 million CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (App-based Solutions, On-premise Solutions, and Cloud-based Solutions), By Technology (3D Imaging, 2D Imaging, and Multispectral Imaging), By Application (Wound Care, Orthopedics, Ophthalmology, Dermatology, and Others), By End User (Hospitals & Clinics, Research & Academic Institutes, Diagnostic Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape WoundVision, WoundMatrix, Inc, Spectral MD USA, Perceptive Solutions, Net Health Company, Kent Imaging Inc, HyperMed Imaging, Inc, Carestream Health, Barco, ARANZ Medical Limited. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Specific Imaging Solution MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Specific Imaging Solution MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- WoundVision

- WoundMatrix, Inc

- Spectral MD USA

- Perceptive Solutions

- Net Health Company

- Kent Imaging Inc

- HyperMed Imaging, Inc

- Carestream Health

- Barco

- ARANZ Medical Limited