Global Space-Based Laser Communication Market Size, Share, Industry Analysis Report By Solution (Space-to-Space, Space-to-Ground station, Space-to-Other applications), By Component (Optical head, Laser receivers and transmitters, Modems, Modulators, Others), By Range (Short range (Below 5,000 Km), Medium range (5,000-35,000 Km), Long range (Above 35,000 Km), By End Use (Commercial, Government, Military), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160610

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

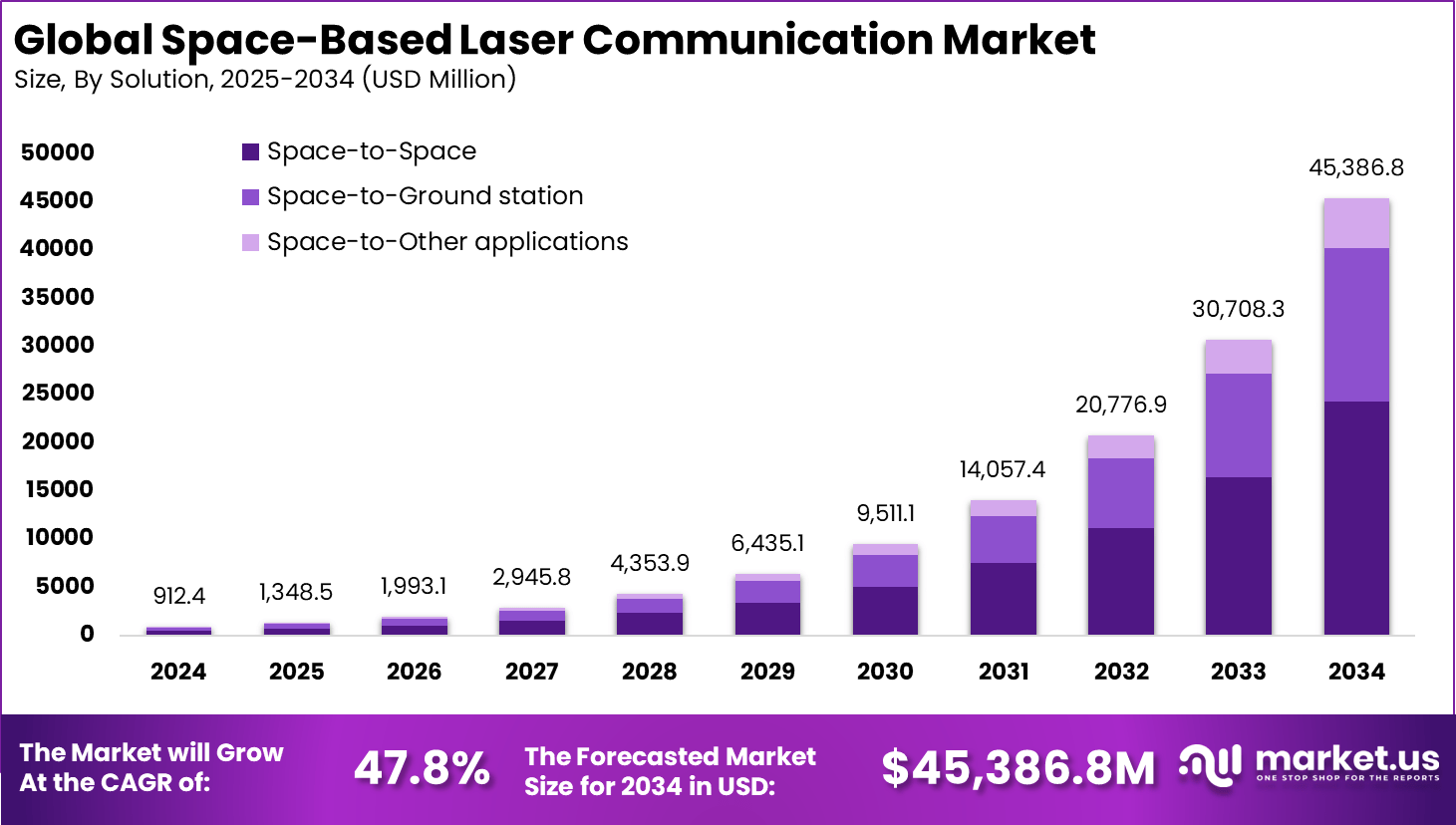

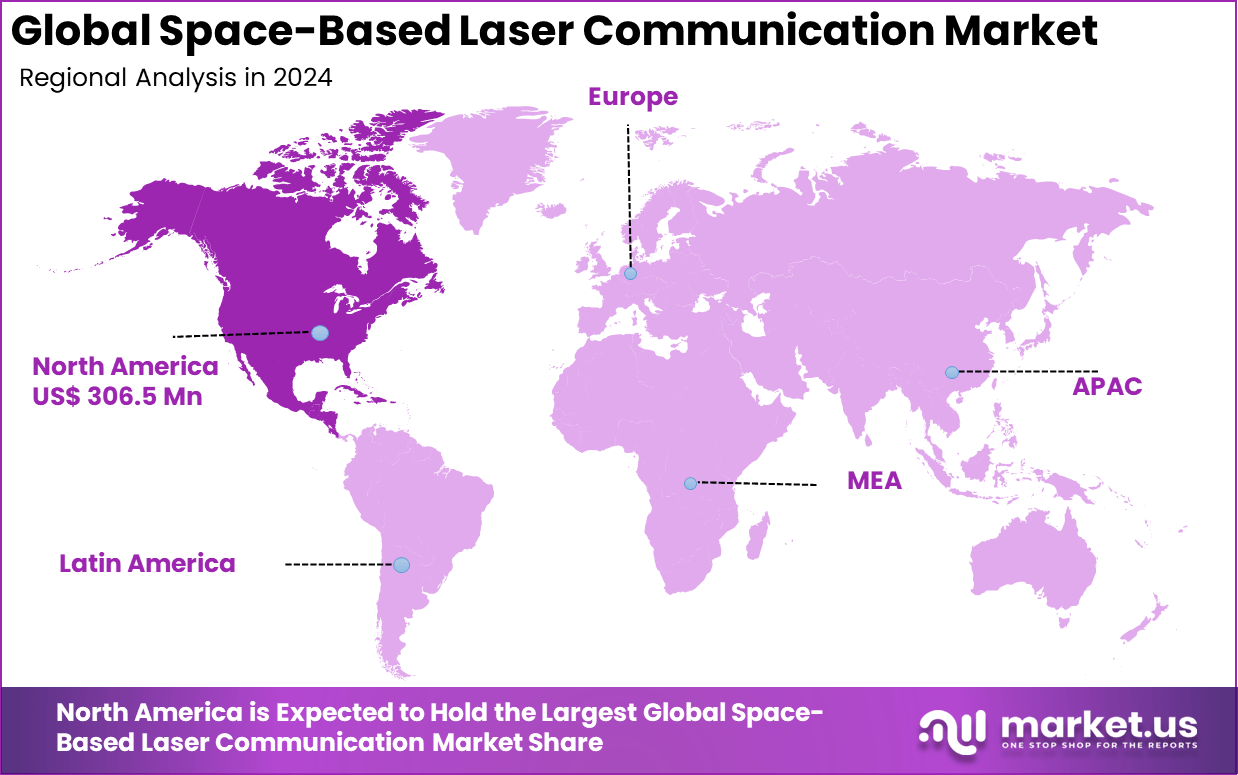

The Global Space-Based Laser Communication Market size is expected to be worth around USD 45,386.8 million by 2034, from USD 912.4 million in 2024, growing at a CAGR of 47.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 33.6% share, holding USD 306.5 million in revenue.

Space-based laser communication (also called optical satellite communication or free-space optical links) refers to the transmission of data via laser beams between satellites, and between satellites and ground stations. These systems are gaining prominence because they can support much higher data rates, lower latency, and greater directionality than traditional radio frequency (RF) systems. The market is shifting from lab testing to steady deployment in satellite constellations and Earth observation missions.

The Space-Based Laser Communication Market is gaining strong momentum as it offers significantly faster and more reliable data transmission than traditional radio frequency systems. This technology uses focused laser beams to transmit data between satellites or from space to ground, enabling much higher bandwidth and faster communication speeds. Laser communication offers up to 100 times higher data rates than radio waves and is less prone to interference, making it ideal for satellite internet, Earth observation, and scientific research.

For instance, in September 2025, Honeywell announced an advanced collaboration with Redwire to enhance quantum-secured satellite communications. This partnership is part of the Quantum Key Distribution Satellite (QKDSat) initiative, backed by the European Space Agency and various European national space agencies. The collaboration focuses on developing next-generation secure communication systems that will serve both civil and defense sectors.

Demand analysis indicates rising adoption across defense, commercial, and government space agencies. Defense sectors prioritize laser communication for secure, jam-resistant transmissions amid heightened geopolitical tensions. Commercial satellite networks leverage this technology to improve broadband services, while scientific missions employ it for deep-space communication and precise Earth monitoring. The increasing number of satellites and their reliance on uninterrupted high-volume data exchange fuels this demand.

Technologies driving adoption include advanced laser terminal hardware, integration of AI for smart beam steering, and optical inter-satellite links that form robust mesh networks in space. These advances enable smaller, lighter, and more power-efficient communication systems compared to conventional radio hardware. The narrow, focused laser beams reduce latency and offer stronger security against interception and jamming, which are key reasons why organizations prefer laser communication over radio frequency systems.

Key Takeaway

- Space-to-space solutions dominate with 53.6%, highlighting their importance in inter-satellite communication and data relay.

- Optical head components hold 32.4%, reflecting their critical role in ensuring precision and efficiency of laser links.

- Short-range systems (below 5,000 km) account for 42.3%, supported by demand in LEO constellations and regional satellite networks.

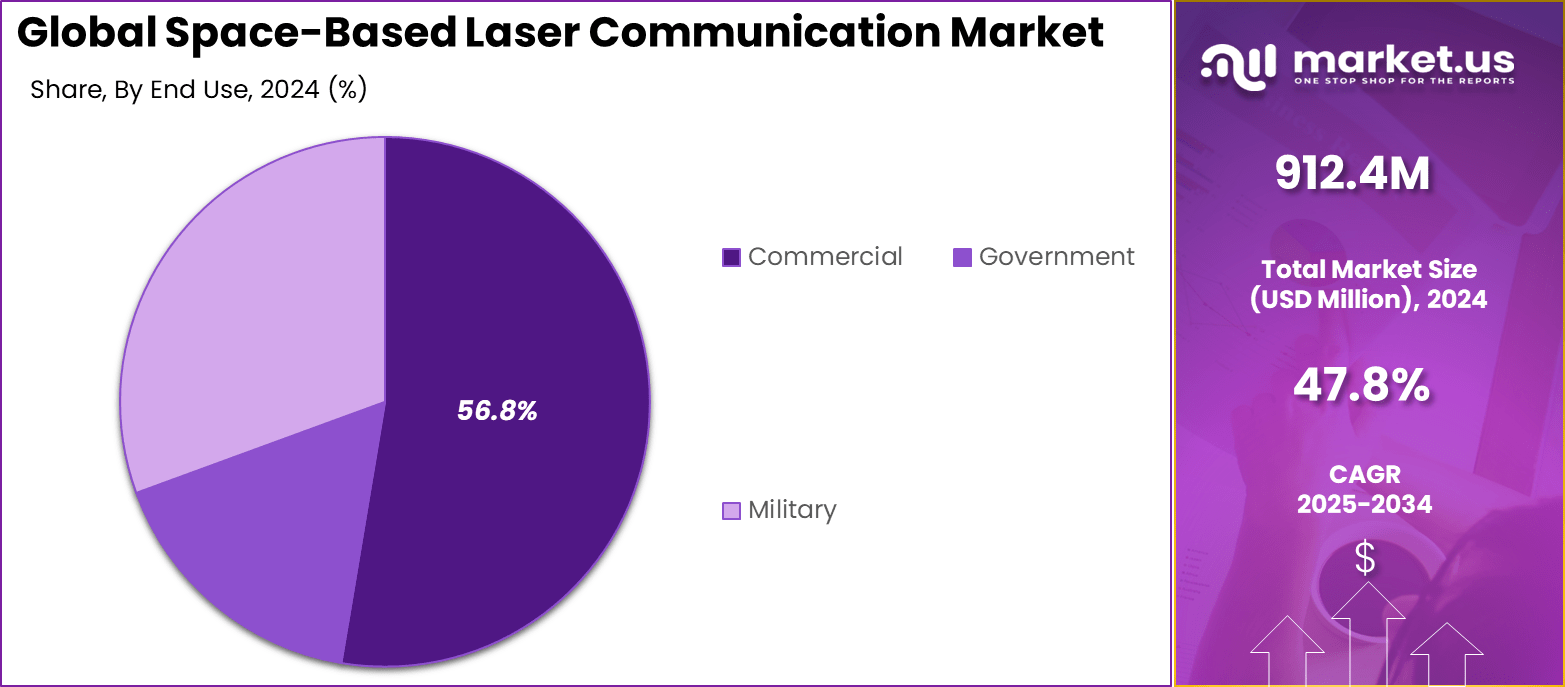

- Commercial end use leads with 56.8%, driven by broadband providers, satellite operators, and private space ventures.

- North America contributes 33.6%, fueled by government programs and commercial satellite deployments.

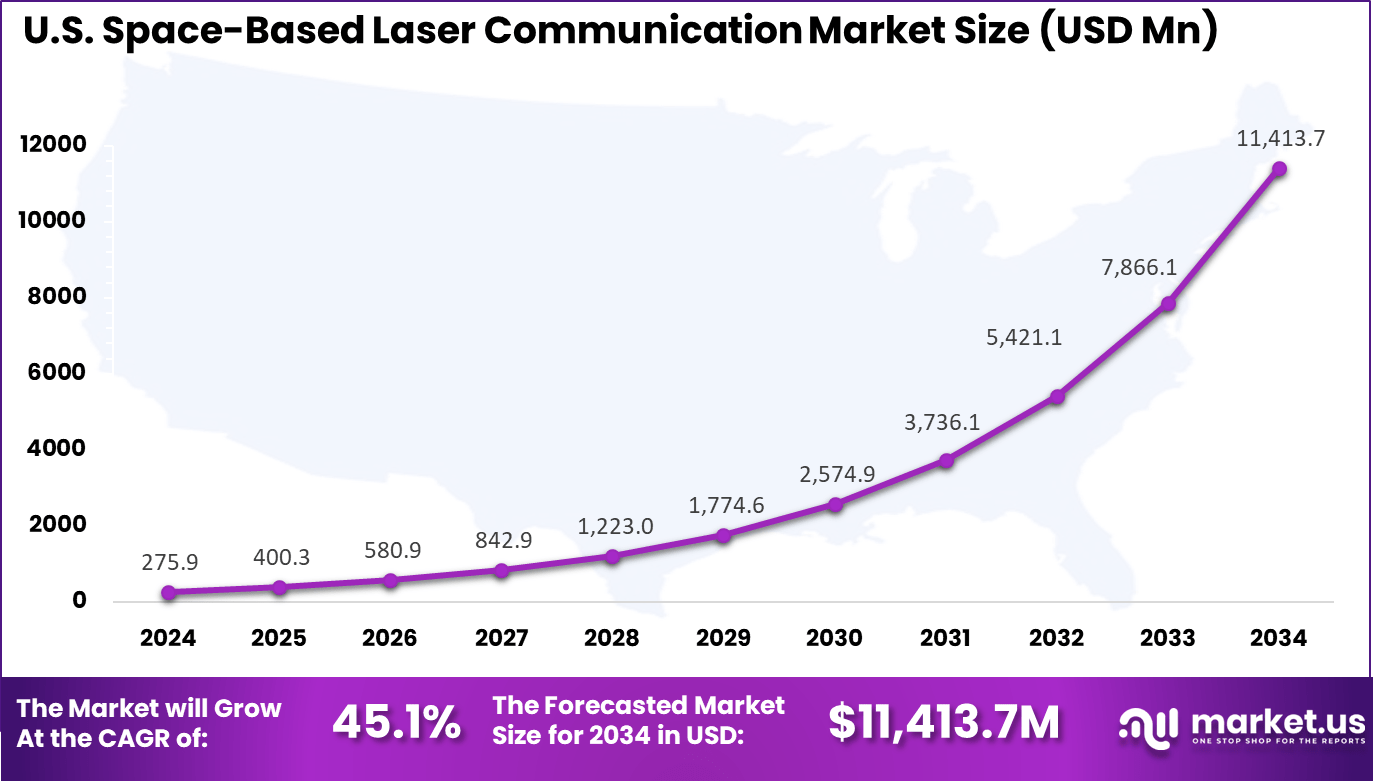

- The US market reached USD 275.9 million and is expanding at a remarkable CAGR of 45.1%, underscoring rapid growth in advanced satellite communication technologies.

Role of Generative AI

Generative AI is playing a significant role in enhancing space-based laser communication by improving the security and efficiency of data transmission. It has the ability to synthesize data, understand complex semantic information, and adaptively manage communication protocols, which helps optimize signal processing and counteract signal degradation in space communication links.

For example, generative AI techniques can reconstruct disrupted signals and improve the accuracy and reliability of laser communication between satellites and ground stations, with studies showing AI can increase overall system robustness by up to 30% in challenging conditions. This integration promises smarter, more resilient networks capable of handling the growing data demands in space communications effectively.

Furthermore, generative AI supports predictive maintenance by analyzing operational data to foresee hardware failures, which is crucial given the difficulty of repairing space terminals. This use of AI reduces downtime and enhances the longevity of laser communication assets. Currently, around 25% of advanced satellite communication projects in 2025 incorporate AI-based optimization models to boost system performance, highlighting the growing importance of AI in this domain.

U.S. Market Size

The market for Space-Based Laser Communication within the U.S. is growing tremendously and is currently valued at USD 275.9 million, the market has a projected CAGR of 45.1%. The market is growing tremendously due to significant investments in space infrastructure and technology by both government agencies, like NASA, and private companies such as SpaceX and Amazon.

The U.S. government’s focus on advancing national security, along with the rapid expansion of satellite constellations for global connectivity, is driving demand for high-speed, secure communication solutions. Additionally, ongoing technological innovations in laser communication systems and the commercialization of satellite services are further fueling growth.

For instance, In January 2025, York Space Systems and the Space Development Agency demonstrated a successful space-to-ground optical laser communication link using a Tranche 0 satellite, marking a key milestone for the Proliferated Warfighter Space Architecture. The test confirmed secure, high-speed connectivity for defense applications such as missile warning, tracking, and tactical data transfer.

Governments worldwide are actively investing to accelerate the development and deployment of space-based laser communication infrastructure. The U.S. Space Force has allocated substantial funds since 2023 to establish optical ground stations and inter-satellite laser links within its satellite constellations, aiming to enhance secure communication capabilities.

Investments have grown by over 35% year-on-year in 2025, reflecting strategic prioritization amid rising defense communication needs. Internationally, various space agencies are funding research in laser terminals and ground segment enhancements, with an estimated 20% increase in government grants in 2025 dedicated specifically to free-space optical communication technologies.

In 2024, North America held a dominant market position in the Global Space-Based Laser Communication Market, capturing more than a 33.6% share, holding USD 306.5 million in revenue. This dominance is due to its strong investment in space exploration and satellite infrastructure.

The U.S. leads with major players like NASA, SpaceX, and Amazon developing advanced laser communication technologies for satellite constellations and national security applications. Additionally, the region benefits from significant government funding and research, driving innovation in laser communication systems. The presence of leading aerospace and defense companies further strengthens its leadership.

For instance, in August 2025, RPMC Lasers expanded its portfolio to focus on space-based laser solutions, supporting applications such as free-space optical communication (FSOC), LIDAR, and planetary exploration. Their lasers are optimized for extreme conditions, including vacuum environments and radiation-hardening options.

Solution Analysis

In 2024, The Space-to-Space segment held a dominant market position, capturing a 53.6% share of the Global Space-Based Laser Communication Market. This dominance is due to the growing need for efficient inter-satellite communication, particularly for large-scale satellite constellations in Low Earth Orbit (LEO).

Laser communication offers high-speed data transfer with minimal latency, making it ideal for space-to-space applications. The increasing demand for reliable, high-bandwidth connections between satellites, driven by global internet coverage initiatives and space exploration, has further fueled the growth.

For Instance, in January 2025, SpaceX and York Space Systems successfully demonstrated space-to-space laser communication as part of the Space Development Agency’s (SDA) Proliferated Warfighter Space Architecture (PWSA). The demonstration involved satellites from different vendors establishing an optical link using standardized communication protocols.

Component Analysis

In 2024, the Optical head segment held a dominant market position, capturing a 32.4% share of the Global Space-Based Laser Communication Market. This dominance is due to the critical role optical heads play in enabling precise and efficient data transmission in laser communication systems.

Optical heads are essential for the accurate pointing, tracking, and beam-steering required for high-speed communication between space-based systems. As demand for faster and more reliable communication increases, the need for advanced optical heads in satellite communication applications continues to drive their market growth.

For instance, in July 2025, ESA successfully established Europe’s first deep-space optical communication link with NASA’s Psyche spacecraft, located 265 million kilometers away. This milestone, achieved using two advanced optical ground stations in Greece, demonstrates the power of laser communication technology for high-speed data transfer.

By Range Analysis

In 2024, The Short range (Below 5,000 Km) segment held a dominant market position, capturing a 42.3% share of the Global Space-Based Laser Communication Market. This dominance is due to the increasing demand for high-speed communication between Low Earth Orbit (LEO) satellites, which typically operate within this range.

Laser communication systems offer high data transfer rates and low latency, making them ideal for short-range communication between satellites in LEO. The growing use of satellite constellations for global connectivity further drives the demand for short-range laser communication solutions.

For Instance, in September 2025, General Atomics and Kepler Communications successfully demonstrated the world’s first in-flight laser communication link between an aircraft and a satellite. Using a 10-watt laser with a range of 5,500 km, they achieved a data transfer rate of 1 Gbps, showcasing the potential of short-range space-based laser communication.

End Use Analysis

In 2024, The Commercial segment held a dominant market position, capturing a 56.8% share of the Global Space-Based Laser Communication Market. This dominance is due to the increasing demand for high-speed, reliable communication systems for satellite internet and global connectivity services.

Private companies, such as SpaceX, OneWeb, and Amazon, are heavily investing in satellite constellations that rely on laser communication for efficient, low-latency data transfer. The growth of commercial satellite-based services and the need for scalable communication solutions further drive the demand in this segment.

For Instance, in March 2025, BlueHalo demonstrated significant progress in space-based laser communication, showcasing its long-haul capabilities for both defense and commercial applications. The company successfully achieved high-speed data transfer over extended distances, paving the way for more efficient communication systems in space.

Emerging Trends

One of the most notable emerging trends is the integration of space laser communication links into large satellite constellations, enabling ultra-high capacity connections across multiple orbits. These optical inter-satellite links can deliver data transmission speeds exceeding 1 gigabit per second, often 100 to 1000 times faster than traditional radio frequency systems, according to recent field tests.

This development is transforming satellite networks by providing seamless high-speed data flow with minimal latency, supporting real-time applications like Earth observation and broadband internet services. Another emerging trend involves the deployment of optical ground stations with advanced tracking and modulation technologies designed to counter atmospheric disturbances, ensuring reliable data reception even in varying weather conditions.

Around 40% of current projects now focus on enhancing ground segment capabilities with adaptive optics and dynamic beam steering, which significantly reduce disruptions and improve link availability. The shift from limited radio frequency bands to laser communications marks a technological leap poised to redefine space data handling.

Growth Factors

Several growth drivers underpin the rapid adoption of space-based laser communication. The demand for high-speed data links to support satellite mega-constellations in low Earth orbit is paramount, as these networks require low-latency, high-throughput communication beyond what radio frequency can provide efficiently.

The technology’s power efficiency and compact size are critical for satellites, reducing weight by up to 50% compared to traditional systems, which lowers launch costs and facilitates more payload capacity for scientific instruments. Additionally, enhanced security features inherent to laser communication, such as highly directional beams that are difficult to intercept or jam, are attracting government and defense interest.

Recent market observations show that over 60% of government satellite programs initiated in 2025 include laser communication components to meet stringent cybersecurity requirements, reflecting the critical role of secure communication in space operations.

Key Market Segments

By Solution

- Space-to-Space

- Space-to-Ground station

- Space-to-Other applications

By Component

- Optical head

- Laser receivers and transmitters

- Modems

- Modulators

- Others

By Range

- Short range (Below 5,000 Km)

- Medium range (5,000-35,000 Km)

- Long range (Above 35,000 Km)

By End Use

- Commercial

- Government

- Military

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

High Data Transfer Rates

Laser communication systems provide much higher data transfer speeds compared to traditional radio frequency (RF) communication. This enables efficient transmission of large volumes of data, such as high-definition satellite imagery or real-time Earth observation data.

With growing demand for bandwidth-intensive services, laser communication is poised to revolutionize applications like satellite internet, inter-satellite links, and scientific research, offering much faster and more reliable communication channels for a wide range of space-based applications.

For instance, in June 2025, Chinese scientists achieved a breakthrough in satellite communication by transmitting data 5x faster than Starlink using a 2-watt laser from a distance of 36,000 kilometers. The data transfer reached 1 Gbps, outperforming Starlink’s network, even though the Chinese satellite operates in a much higher geostationary orbit.

Restraint

Environmental and Operational Challenges

Despite its potential, space-based laser communication faces significant environmental and operational restraints. The technology must operate reliably under extreme space conditions including intense radiation, wide temperature fluctuations, and vacuum.

Space optics components experience wear due to harsh environmental factors, which can reduce system lifespan and increase maintenance difficulties. Additionally, precise beam pointing and tracking are essential but challenging in space, requiring advanced technology to maintain stable communication links. Operational complexities also include the inability to perform routine repairs or upgrades once equipment is launched.

The lack of maintenance options means systems must be highly durable and redundant, which adds to design complexity and costs. These factors increase the total price of ownership and pose a hurdle to widespread adoption. Developers must carefully balance robustness, size, weight, power consumption, and cost, which limits the speed of deployment and broad market penetration.

Opportunities

Expanding Global Connectivity

Space-based laser communication offers a significant opportunity for extending global communication networks beyond terrestrial limitations. By enabling high-speed data exchange between satellites and between space and ground stations, it can facilitate seamless internet connectivity worldwide, including remote and underserved regions.

This capability promises to close digital gaps and support next-generation technologies like satellite-based IoT, advanced 5G/6G services, and secure global communications. Furthermore, laser communication supports emerging commercial and defense markets by providing faster, more secure links for satellite constellations and space exploration missions.

It can transform satellite connectivity into a backbone for global digital infrastructure, enabling applications such as edge computing and virtual private networks in space. These prospects attract investments from aerospace companies and governments, creating a thriving ecosystem for growth and innovation in space communications.

For instance, in March 2025, BlueHalo advanced its long-haul laser communication capabilities, enhancing the ability to transmit high-bandwidth data over vast distances in space. The company successfully demonstrated high-speed, secure laser communication links, achieving improved data transfer rates and reduced latency for satellite constellations.

Challenges

Environmental Factors

Environmental conditions, including atmospheric turbulence, clouds, rain, and fog, can interfere with laser signals, disrupting space-to-ground communications. These environmental factors cause signal degradation, which compromises the reliability of laser communication systems.

To mitigate these effects, adaptive optics and advanced technologies are being developed to adjust and correct for atmospheric disturbances. However, overcoming these challenges remains a key hurdle for the widespread adoption of space-based laser communication systems, particularly for long-distance transmissions.

For instance, in October 2022, a study published in Scientific Reports demonstrated the challenges posed by atmospheric turbulence in free-space optical communications. The research highlighted the importance of overcoming environmental factors, such as turbulence, to maintain high-speed, reliable data transmission between spacecraft. The study used a coherent optical link between a deployable optical terminal and a drone-mounted retroreflector, successfully correcting for atmospheric distortions.

Key Players Analysis

The Space-Based Laser Communication Market is led by major aerospace and defense innovators such as Ball Aerospace, Honeywell International, Thales Group, and General Atomics. These companies develop high-speed optical terminals that enable secure, high-bandwidth communication between satellites, ground stations, and airborne platforms.

Emerging optical communication specialists such as Mynaric, Tesat Spacecom, BridgeComm, and Laser Light Communication (Halo Network) are accelerating adoption through scalable inter-satellite link technologies. These companies develop compact, interoperable optical terminals with mesh networking to enable real-time GEO–LEO and LEO–LEO data relay across Earth observation, broadband, and deep-space missions.

NewSpace entrants including AAC Clyde Space (Hyperion Technologies), Rocket Lab USA Inc., Space Exploration Technologies Corp. (SpaceX), Space Micro, ODYSSEUS SPACE SA, and Analytical Space Operation contribute by integrating laser communication modules into nanosatellites and small satellite platforms. Their solutions enable cost-efficient deployment of space-based optical networks.

Top Key Players in the Market

- Ball Aerospace

- AAC Clyde Space (Hyperion Technologies)

- BridgeComm

- HENSOLDT

- Honeywell International

- Analytical Space Operation

- General Atomics

- Laser Light Communication (Halo Network)

- Mynaric

- ODYSSEUS SPACE SA

- Rocket Lab USA Inc

- Space Exploration Technologies Corp. (SpaceX)

- Tesat Spacecom

- Space Micro

- Thales Group

- Others

Recent Developments

- In June 2025, Thales Alenia Space was selected by the French space agency CNES to develop the SOLiS (Secure Optical Space Link Service) project, a very-high-throughput laser communications demonstrator. The project aims to demonstrate optical communication services using geostationary satellites, offering data transfer rates up to one terabit per second.

- In March 2024, SpaceX revealed plans to sell its satellite laser technology commercially. This technology, which enables high-speed, low-latency communication between satellites in orbit, is currently utilized in SpaceX’s Starlink satellite network.

Report Scope

Report Features Description Market Value (2024) USD 912.4 Mn Forecast Revenue (2034) USD 45,386.8 Mn CAGR(2025-2034) 47.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (Space-to-Space, Space-to-Ground station, Space-to-Other applications), By Component (Optical head, Laser receivers and transmitters, Modems, Modulators, Others), By Range (Short range (Below 5,000 Km), Medium range (5,000-35,000 Km), Long range (Above 35,000 Km), By End Use (Commercial, Government, Military) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ball Aerospace, AAC Clyde Space (Hyperion Technologies), BridgeComm, HENSOLDT, Honeywell International, Analytical Space Operation, General Atomics, Laser Light Communication (Halo Network), Mynaric, ODYSSEUS SPACE SA, Rocket Lab USA Inc, Space Exploration Technologies Corp. (SpaceX), Tesat Spacecom, Space Micro, Thales Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Space-Based Laser Communication MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Space-Based Laser Communication MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ball Aerospace

- AAC Clyde Space (Hyperion Technologies)

- BridgeComm

- HENSOLDT

- Honeywell International

- Analytical Space Operation

- General Atomics

- Laser Light Communication (Halo Network)

- Mynaric

- ODYSSEUS SPACE SA

- Rocket Lab USA Inc

- Space Exploration Technologies Corp. (SpaceX)

- Tesat Spacecom

- Space Micro

- Thales Group

- Others