Global Solar Tracker Market By Product Type(Single-Axis Solar Tracker, Dual-Axis Solar Tracker), By Technology(Photovoltaic (PV), Concentrated Solar Power (CSP), Concentrated Photovoltaic (CPV)), By Tracking Mechanism(Active Solar Trackers, Passive Solar Trackers), By Installation Type( Ground-Mounted, Roof-Mounted), By Application(Utility-Scale, Commercial and Industrial, Residential), , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116176

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

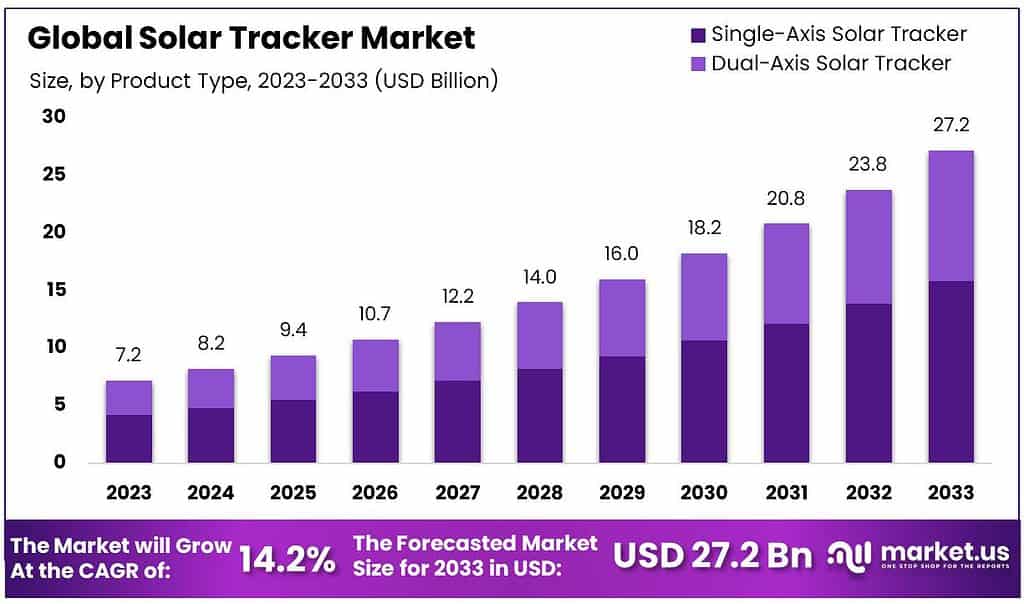

The global Solar Tracker Market size is expected to be worth around USD 27.2 billion by 2033, from USD 7.2 billion in 2023, growing at a CAGR of 14.2% during the forecast period from 2023 to 2033.

The Solar Tracker Market refers to the industry involved in the design, manufacturing, and deployment of solar tracking systems. These systems are crucial components in solar power generation, enhancing the efficiency of photovoltaic (PV) solar panels by optimizing their orientation and tracking the sun’s movement throughout the day.

A solar tracker is a device that follows the sun’s trajectory, adjusting the tilt and orientation of solar panels or mirrors to maximize sunlight exposure. This dynamic alignment ensures that solar panels receive direct sunlight for an extended period, increasing the overall energy output and efficiency of solar power generation systems.

Solar trackers are categorized into two main types: single-axis and dual-axis trackers. Single-axis trackers follow the sun’s movement on one axis, either horizontally or vertically, while dual-axis trackers can adjust along both axes, providing more precise solar panel positioning. These trackers are widely used in utility-scale solar projects, commercial installations, and even some residential solar systems.

The Solar Tracker Market plays a pivotal role in advancing solar energy technology, offering solutions that contribute to higher energy yields, improved return on investment, and a more sustainable and efficient utilization of solar resources. As the demand for renewable energy sources continues to grow, the Solar Tracker Market remains a key player in optimizing solar power generation systems for increased performance and cost-effectiveness.

Key Takeaways

- Market Growth: Solar Tracker Market is projected to reach USD 27.2 billion by 2033, growing at 14.2% CAGR from USD 7.2 billion in 2023.

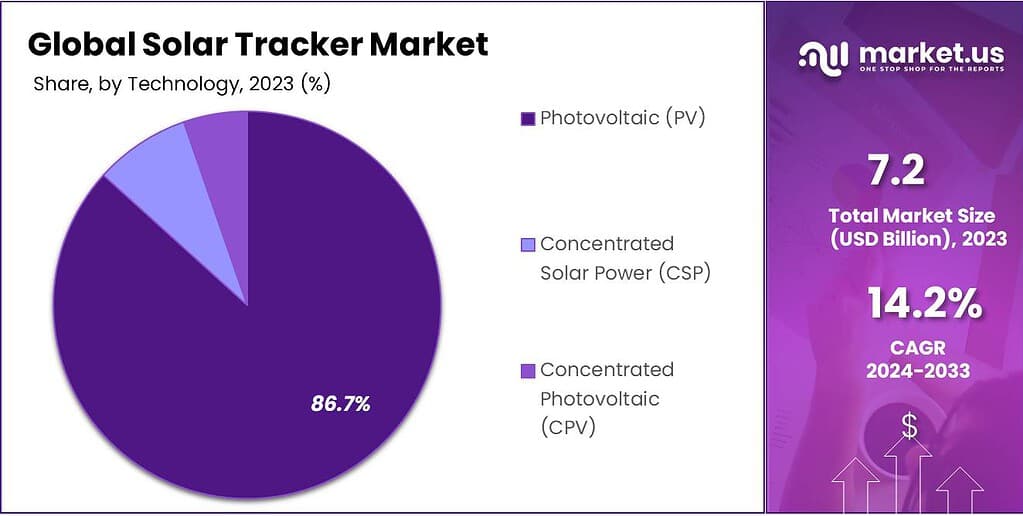

- Technology Dominance: PV technology holds 86.7% market share in 2023, leading solar tracker adoption for efficient electricity conversion.

- Product Preference: Single-Axis Trackers claim 58.4% market share in 2023, favored for simplicity and effectiveness in orientation optimization.

- Application Focus: Utility-Scale trackers capture 82.4% market share in 2023, pivotal in large-scale solar power projects.

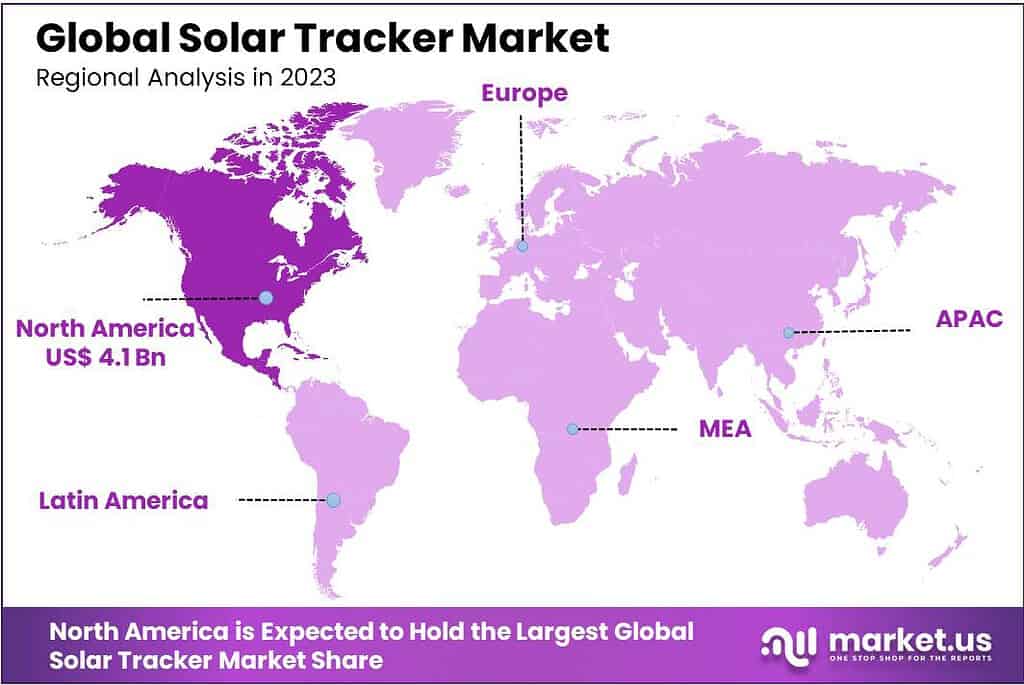

- Regional Influence: North America holds 57.4% global market share in 2023, driven by renewable energy awareness and innovation.

By Product Type

In 2023, the Single-Axis Solar Tracker claimed a dominant market position, securing over 58.4% of the share in the Solar Tracker Market. This type of solar tracker is a pivotal player in the renewable energy landscape, standing out for its widespread adoption and effectiveness in optimizing solar panel orientation.

Single-Axis Solar Tracker: Single-Axis Solar Trackers adjust solar panels along one axis, typically following the sun’s east-to-west trajectory. Their significant market share reflects their popularity due to simplicity, cost-effectiveness, and improved energy capture. These trackers ensure solar panels maintain an optimal angle relative to the sun, enhancing overall energy efficiency in solar power systems. Single-Axis Solar Trackers are commonly used in various solar projects, contributing to their dominance in the market.

Dual-Axis Solar Tracker: While Single-Axis Solar Trackers lead the market, Dual-Axis Solar Trackers showcase their own prowess. In 2023, they held a notable market share, offering enhanced solar panel adjustment along both horizontal and vertical axes. This capability allows Dual-Axis Solar Trackers to precisely follow the sun’s complete path, maximizing energy capture throughout the day. Although they may involve higher costs and complexity, their efficiency in capturing sunlight from different angles positions them as a compelling choice for solar projects where optimal energy output is paramount.

The Solar Tracker Market dynamics reflect a balance between the widespread adoption of Single-Axis Solar Trackers for their simplicity and cost-effectiveness and the specialized efficiency of Dual-Axis Solar Trackers in maximizing energy capture through precise orientation adjustments.

By Technology

In 2023, Photovoltaic (PV) technology dominated the Solar Tracker Market, securing an impressive market share exceeding 86.7%. This technology plays a pivotal role in harnessing solar energy, reflecting its widespread adoption and efficiency in converting sunlight into electricity.

Photovoltaic (PV) Technology: Photovoltaic (PV) technology involves the direct conversion of sunlight into electricity using semiconductor materials. In the Solar Tracker Market, PV technology is the frontrunner due to its versatility, ease of integration, and widespread application in various solar power projects. PV solar trackers follow the sun’s path, optimizing the angle of solar panels to maximize energy capture throughout the day. The dominance of PV technology underscores its reliability and effectiveness in generating clean and sustainable energy.

Concentrated Solar Power (CSP) Technology: While Photovoltaic technology leads, Concentrated Solar Power (CSP) technology holds its ground as a noteworthy player in the market. This technology employs mirrors or lenses to concentrate sunlight onto a small area, generating heat that drives a power-generating turbine. Though it held a smaller market share in 2023, CSP technology is recognized for its potential in large-scale solar projects, especially those requiring thermal energy storage. The role of CSP technology in the Solar Tracker Market showcases its suitability for specific applications where concentrated solar energy is a preferred choice.

Concentrated Photovoltaic (CPV) Technology: In 2023, Concentrated Photovoltaic (CPV) technology accounted for a share in the Solar Tracker Market, presenting a niche yet promising segment. CPV systems use optical elements to focus sunlight onto small, high-efficiency solar cells, enhancing electricity generation. While its market share might be modest compared to PV technology, CPV’s focus on efficiency makes it an attractive option in regions with abundant sunlight. The Solar Tracker Market recognizes CPV technology for its potential to deliver higher energy output per unit area, catering to specific solar energy requirements.

By Tracking Mechanism

In 2023, Active Solar Trackers held a dominant market position in the Solar Tracker Market. These innovative tracking mechanisms showcased their significance in optimizing solar panel orientation for enhanced energy capture.

Active Solar Trackers: Active Solar Trackers are at the forefront of the Solar Tracker Market, capturing a substantial share in 2023. These trackers use motors and control systems to adjust the position of solar panels, actively following the sun’s path throughout the day.

The adaptability of Active Solar Trackers ensures that solar panels are constantly aligned to receive maximum sunlight, boosting energy efficiency. The market dominance of Active Solar Trackers emphasizes their effectiveness in addressing the dynamic nature of sunlight and maximizing electricity generation in solar power installations.

Passive Solar Trackers: While not as dominant as their active counterparts, Passive Solar Trackers held their ground in the Solar Tracker Market in 2023. These trackers rely on a more straightforward approach, utilizing natural elements, such as gravity and buoyancy, to align solar panels with the sun.

While less complex than active systems, Passive Solar Trackers still contribute to optimizing solar energy capture by utilizing simple, passive mechanisms. The market presence of Passive Solar Trackers reflects their role in providing cost-effective tracking solutions, particularly in scenarios where sophisticated active systems may be less practical or necessary.

By Installation Type

In 2023, Ground-Mounted solar trackers held a dominant market position in the Solar Tracker Market, capturing more than an 84.5% share. This underscores the widespread preference for ground-mounted installations, reflecting their advantages in terms of efficiency and scalability.

Ground-Mounted Solar Trackers: Ground-Mounted solar trackers secured a substantial market share in 2023 due to their prominence in solar energy projects. These trackers are installed directly on the ground, allowing for optimal positioning of solar panels to track the sun’s movement.

The dominance of Ground-Mounted installations highlights their versatility, making them suitable for large-scale solar farms and projects where expansive land availability facilitates efficient energy production. The ease of installation and maintenance further contributes to their market leadership.

Roof-Mounted Solar Trackers: While not as prevalent as Ground-Mounted counterparts, Roof-Mounted solar trackers maintained a presence in the Solar Tracker Market in 2023. These trackers are installed on rooftops, providing a viable solution for solar energy integration in limited-space scenarios.

Roof-Mounted installations are particularly relevant for commercial and residential applications, where available ground space may be constrained. The market share of Roof-Mounted solar trackers emphasizes their role in decentralized solar projects, catering to diverse consumer needs and contributing to the overall growth of solar energy adoption.

By Application

In 2023, Utility-Scale solar tracker applications held a dominant market position, capturing more than an 82.4% share. Utility-Scale solar trackers are primarily deployed in large-scale solar power projects designed to generate electricity for public utilities. These trackers efficiently follow the sun’s movement, optimizing energy capture and enhancing the overall performance of utility-scale solar installations. The dominance of Utility-Scale applications signifies their widespread adoption in powering the electrical grid and meeting the energy demands of a broader community.

Commercial and Industrial solar tracker applications, while not as dominant as Utility-Scale, maintained a significant market presence in 2023. Capturing a notable share, these solar trackers are employed in medium to large-scale commercial and industrial projects. The use of solar trackers in these applications contributes to on-site power generation, allowing businesses and industries to reduce their reliance on traditional energy sources and embrace sustainable practices. The versatility of solar trackers makes them valuable assets for enhancing energy efficiency in commercial and industrial settings.

Residential solar tracker applications, although representing a smaller market share, play a crucial role in decentralized energy generation. In 2023, Residential solar trackers gained traction as homeowners increasingly embraced solar energy solutions. These trackers are designed for smaller-scale installations on residential properties, offering homeowners the opportunity to harness solar power for their household needs. The market position of Residential applications reflects the growing interest and awareness among homeowners in adopting renewable energy sources to reduce environmental impact and achieve energy independence.

Market Key Segments

By Product Type

- Single-Axis Solar Tracker

- Dual-Axis Solar Tracker

By Technology

- Photovoltaic (PV)

- Concentrated Solar Power (CSP)

- Concentrated Photovoltaic (CPV)

By Tracking Mechanism

- Active Solar Trackers

- Passive Solar Trackers

By Installation Type

- Ground-Mounted

- Roof-Mounted

By Application

- Utility-Scale

- Commercial and Industrial

- Residential

Drivers

Increasing Demand for Renewable Energy

As awareness and concern about environmental issues grow, so does the interest in renewable energy sources. Solar power, being clean and inexhaustible, has gained popularity, driving demand for technologies that enhance its efficiency, such as solar trackers. These devices optimize the angle of solar panels throughout the day, ensuring they capture the maximum amount of sunlight.

Government Policies and Incentives

Many governments worldwide are supporting renewable energy through subsidies, tax incentives, and favorable regulations. These policies make solar investments more attractive, stimulating the solar tracker market. By reducing the initial costs and improving the ROI on solar installations, these government actions serve as a powerful catalyst for market growth.

Technological Advancements

Continuous improvements in solar tracker technology have made these systems more reliable and efficient. Innovations in materials, design, and software for monitoring and control systems have reduced the cost and increased the performance of solar trackers. This makes solar energy more competitive with traditional energy sources, driving further investments in the sector.

Restraints

High Initial Investment

Despite the long-term savings and environmental benefits, the upfront cost of installing solar trackers can be a significant barrier for some investors. The initial investment for solar tracker systems is higher than for fixed solar panel installations, which can deter smaller projects or individuals from adopting this technology.

Maintenance and Reliability Concerns

Solar trackers have moving parts, which can lead to higher maintenance requirements and potential reliability issues compared to stationary solar panel setups. These concerns can act as restraints, especially in areas with harsh weather conditions that might damage the trackers or in remote locations where maintenance is more challenging.

Complexity in Installation and Integration

Installing and integrating solar trackers into existing solar power systems can be complex and require specialized knowledge. This complexity can slow down the adoption rate, as potential users may prefer simpler, less hassle-prone solutions despite the lower efficiency.

Opportunity

Emerging Markets and Rural Electrification

Developing countries and rural areas present a significant opportunity for the solar tracker market. In regions with limited access to the traditional power grid, solar energy, enhanced by trackers, can provide a viable and sustainable electricity source. The growth potential in these markets is substantial, especially as costs continue to decrease.

Advancements in Material Science and Engineering

Innovations in materials and engineering present opportunities for making solar trackers lighter, more durable, and less expensive. Materials that can withstand extreme weather conditions without corroding or degrading can reduce maintenance needs and extend the lifespan of solar trackers, making them more appealing to a broader audience.

Hybrid Systems and Microgrid Integration

As the focus on sustainable and resilient energy systems grows, there’s an opportunity for solar trackers to be integrated into hybrid systems and microgrids. These systems combine various renewable energy sources, like wind and solar, with storage solutions to create a reliable, off-grid power supply. Solar trackers can be crucial in optimizing these systems’ energy production.

Trends

Growing Preference for Dual-Axis Trackers

Dual-axis trackers, which can move in two directions, are becoming increasingly popular because they can follow the sun’s path more accurately than single-axis trackers. This results in significantly higher energy output, making dual-axis systems especially appealing for utility-scale solar projects despite their higher initial cost.

Integration with Energy Storage Systems

As the solar industry matures, there’s a growing trend of integrating solar trackers with energy storage systems. This combination allows for the storage of excess energy generated during peak sunlight hours, which can be used when solar energy production is lower. This trend enhances the value proposition of solar trackers by enabling a more stable and reliable energy supply.

Smart and Autonomous Solar Trackers

With advancements in IoT (Internet of Things) and AI (Artificial Intelligence), solar trackers are becoming smarter and more autonomous. Modern trackers can adjust themselves based on weather conditions and historical data to maximize energy production. This trend toward automation and intelligence is making solar tracker systems more efficient and less labor-intensive.

Regional Analysis

North America is a key player in the Solar Tracker Market, commanding a notable 57.4% of the global market share as of 2023. The region, with the United States leading the way, has embraced solar tracker technology, spurred by an increasing need for efficient and sustainable energy solutions. This surge is largely due to the growing awareness of the benefits of renewable energy sources, amidst concerns over traditional power grid vulnerabilities and the impact of climate change.

The push towards renewable energy, coupled with a focus on technological innovation, has made North America a hub for solar tracker adoption. Industries and residential communities alike are recognizing the value of enhancing solar panel efficiency through tracking systems. These systems offer significant advantages, including maximized energy production, cost efficiencies, and a decrease in carbon footprint, investing in solar tracker technology is a logical step for forward-thinking consumers and businesses.

With its sophisticated energy infrastructure and a strong network of energy technology experts and providers, North America is well-equipped to integrate and expand solar tracker solutions. The region’s commitment to renewable energy is supported by a culture of innovation and a concentration of industry leaders in solar technology. Significant investments in research and development have led to the creation of advanced, high-quality solar tracker products, further solidifying North America’s leadership position in the global Solar Tracker Market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Solar Tracker Market is characterized by a diverse and competitive landscape, with several key players contributing to its growth and innovation. Among these, companies like NEXTracker, Array Technologies, and SunPower stand out due to their significant market presence, technological advancements, and comprehensive product offerings.

These companies, along with others such as Soltec and First Solar, are at the forefront of driving innovation in the Solar Tracker Market. Their focus on research and development has led to the introduction of dual-axis trackers, smart control systems, and integration with artificial intelligence to maximize solar energy yield.

The competitive dynamics within the market push these companies to continuously improve their offerings, reducing costs, and enhancing system performance.

Market Key Players

- NEXTracker

- Array Technologies, Inc.

- First Solar, Inc.

- Soltec

- Arctech Solar

- SunPower Corporation

- Convert Italia S.p.A.

- Mahindra Susten

- PVH Solar

- STi Norland

- Scorpius Trackers

- Mechatron

- GameChange Solar

- Powerway Renewable Energy Co., Ltd.

- Ideematec Inc.

Recent Developments

- NEXTracker: In 2023, NEXTracker launched its NX Horizon tracker, a single-axis tracker designed for large-scale solar projects. They also announced a partnership with Enel Green Power to supply trackers for a 1.3 GW solar project in Brazil.

- Arctech Solar: In 2023, Arctech Solar signed a contract to supply trackers for a 1 GW solar project in Vietnam. They are also investing in research and development of bifacial trackers that can capture sunlight from both sides of the solar panel.

Report Scope

Report Features Description Market Value (2022) US$ 7.2 Bn Forecast Revenue (2032) US$ 27.2 Bn CAGR (2023-2032) 14.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Single-Axis Solar Tracker, Dual-Axis Solar Tracker), By Technology(Photovoltaic (PV), Concentrated Solar Power (CSP), Concentrated Photovoltaic (CPV)), By Tracking Mechanism(Active Solar Trackers, Passive Solar Trackers), By Installation Type( Ground-Mounted, Roof-Mounted), By Application(Utility-Scale, Commercial and Industrial, Residential) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape NEXTracker, Array Technologies, Inc., First Solar, Inc., Soltec, Arctech Solar, SunPower Corporation, Convert Italia S.p.A., Mahindra Susten, PVH Solar, STi Norland, Scorpius Trackers, Mechatron, GameChange Solar, Powerway Renewable Energy Co., Ltd., Ideematec Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Solar Tracker Market?Solar Tracker Market size is expected to be worth around USD 27.2 billion by 2033, from USD 7.2 billion in 2023

What is the CAGR for the Solar Tracker Market?The Solar Tracker Market expected to grow at a CAGR of 14.2% during 2023-2032.

Who are the key players in the Solar Tracker Market?NEXTracker, Array Technologies, Inc., First Solar, Inc., Soltec, Arctech Solar, SunPower Corporation, Convert Italia S.p.A., Mahindra Susten, PVH Solar, STi Norland, Scorpius Trackers, Mechatron, GameChange Solar, Powerway Renewable Energy Co., Ltd., Ideematec Inc.

-

-

- NEXTracker

- Array Technologies, Inc.

- First Solar, Inc.

- Soltec

- Arctech Solar

- SunPower Corporation

- Convert Italia S.p.A.

- Mahindra Susten

- PVH Solar

- STi Norland

- Scorpius Trackers

- Mechatron

- GameChange Solar

- Powerway Renewable Energy Co., Ltd.

- Ideematec Inc.