Global Solar Power Sunroom Systems Market Size, Share, And Enhanced Productivity By Type (Centralized Photovoltaic Power Plant, Distributed Photovoltaic Power Plant), By Technology (Monocrystalline, Polycrystalline, Thin Film), By Product Type (Attached System, Detached System, Skylight System), By Installation Type (New Installation, Retrofit Installation), By Application (Commercial (Hospitality, Industrial, Office Buildings, Retail), Residential (Multi Family, Single Family)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175525

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

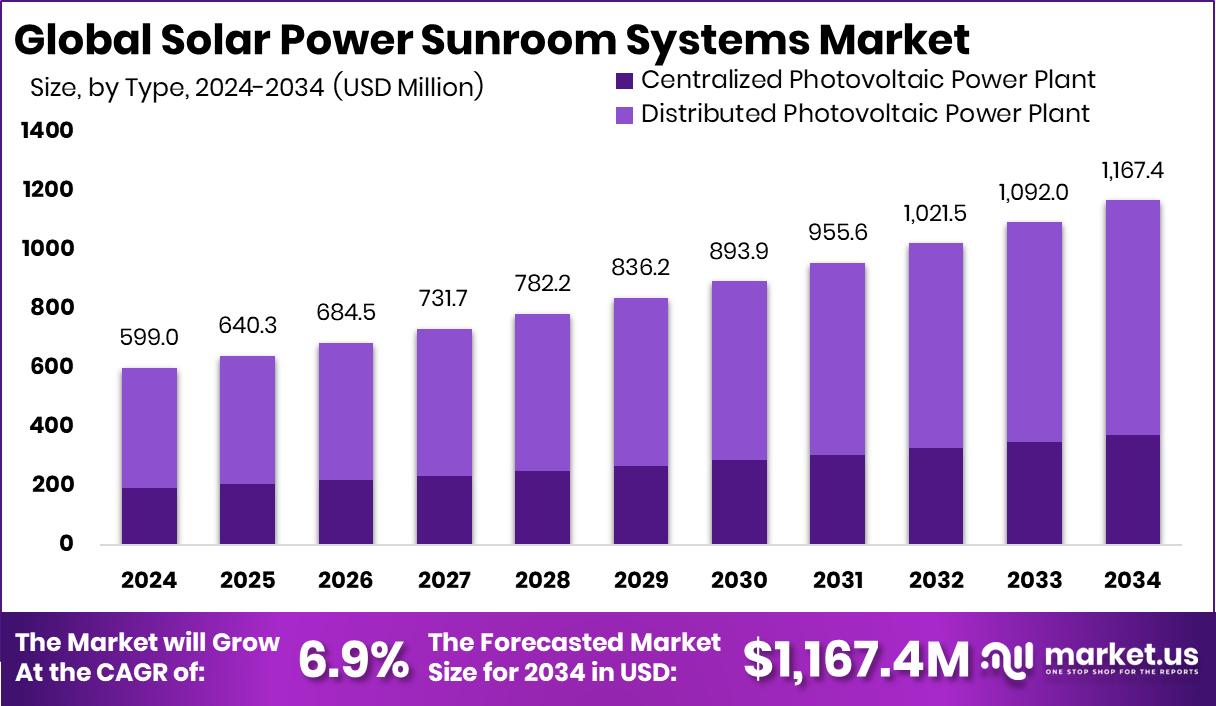

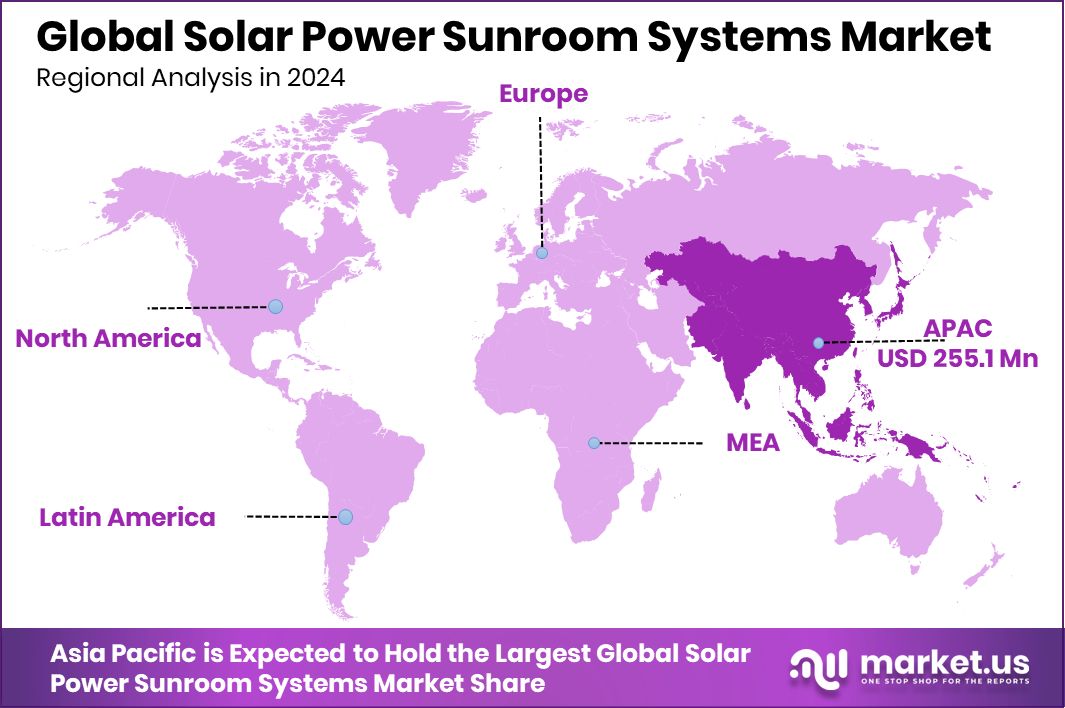

The Global Solar Power Sunroom Systems Market is expected to be worth around USD 1,167.4 million by 2034, up from USD 599.0 million in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034. Asia Pacific maintains dominance at 42.6%, securing a USD 255.1 Mn market size.

Solar Power Sunroom Systems combine a sun-filled living space with integrated photovoltaic panels that generate electricity while enhancing natural light and thermal comfort. These systems create a functional room that acts as both an extension of the home or building and a clean energy source. In practice, they are used across attached, detached, and skylight-based structures and can be installed in residential, commercial, office, or hospitality settings.

The Solar Power Sunroom Systems Market reflects growing interest in energy-efficient design, where sunrooms are designed to produce electricity using monocrystalline, polycrystalline, or thin-film solar technologies. Demand has risen as consumers seek lower energy bills and better use of available space. The UK’s announcement of £15bn for solar and green tech has reinforced confidence in solar-integrated home upgrades.

Growth is strongly supported by global financing activity. Large-scale commitments such as Egg Power’s £400 million debt financing, Hive Energy’s £60 million HSBC support, and SolarBank and CIM Group’s $100M financing show that solar-linked structures are attracting sustained investment.

Market opportunity continues to widen due to innovation funding, including a $5M solar-agriculture research grant, ePower’s €30m raise, ¥31.5 billion for Sharing Energy, and emerging solar innovation backed by $60 million and US$1.5M in new rounds. These investments create room for next-generation solar sunroom designs that blend architecture, efficiency, and clean power.

Key Takeaways

- The Global Solar Power Sunroom Systems Market is expected to be worth around USD 1,167.4 million by 2034, up from USD 599.0 million in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034.

- The Solar Power Sunroom Systems Market grows as Distributed Photovoltaic Power Plants reach 68.2% share.

- Strong adoption of Monocrystalline technology at 59.7% significantly drives the Solar Power Sunroom Systems Market expansion.

- The attached system dominance with 49.1% boosts overall demand in the Solar Power Sunroom Systems Market globally.

- New Installation projects capturing 67.8% fuel rapid scaling in the Solar Power Sunroom Systems Market segment.

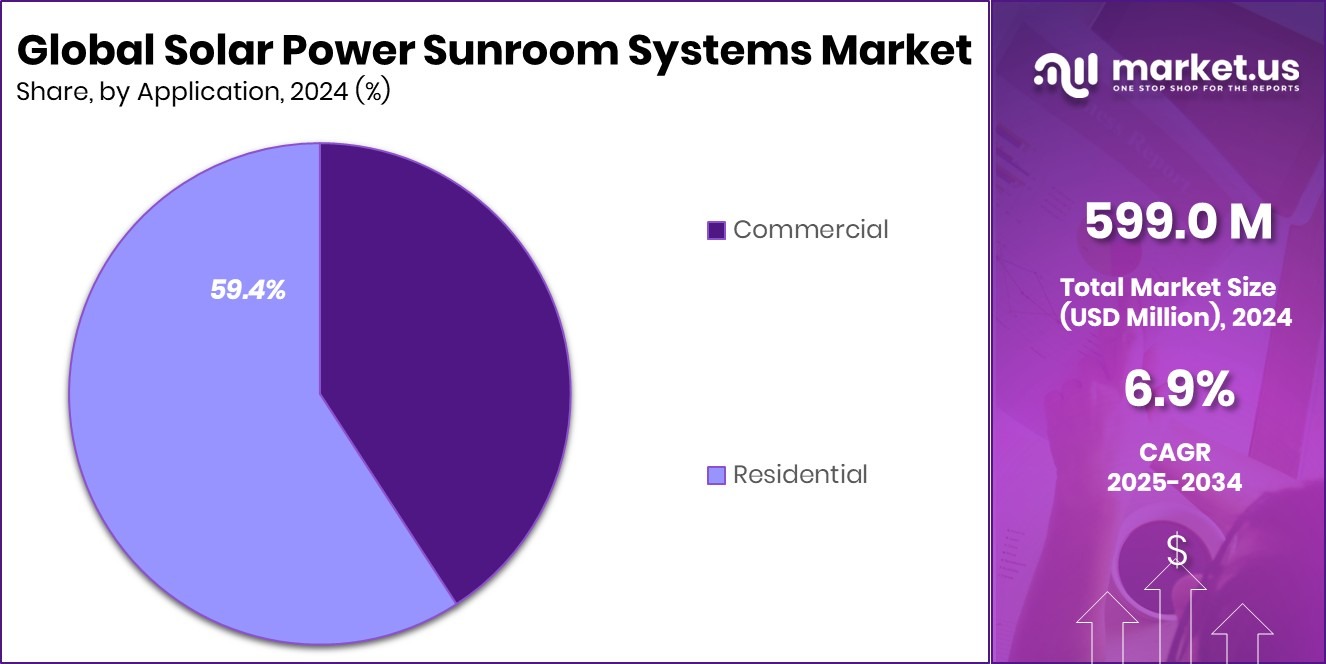

- Residential applications holding 59.4% continue to strengthen consumer preference in the Solar Power Sunroom Systems Market.

- Strong solar adoption in the Asia Pacific drives its 42.6% share and USD 255.1 Mn revenue.

By Type Analysis

Solar Power Sunroom Systems Market is dominated by Distributed Photovoltaic Power Plants with 68.2% share.

In 2024, the Solar Power Sunroom Systems Market saw strong momentum as Distributed Photovoltaic Power Plants dominated with 68.2%, driven by rising rooftop solar adoption and expanding residential renewable installations. Consumers increasingly preferred distributed solar setups because they reduce dependence on grid electricity and offer predictable long-term savings. Sunrooms integrated with photovoltaic panels became a practical choice for households seeking both functional living spaces and energy production.

Supportive policies, such as net metering and household solar incentives, further strengthened demand for distributed systems. Homeowners valued their reliability, easy integration with existing structures, and ability to optimize energy generation during peak daylight hours. This segment’s growth reflects the shift toward decentralised, efficient, and aesthetically integrated solar solutions.

By Technology Analysis

In the Solar Power Sunroom Systems Market, Monocrystalline technology dominated strongly with 59.7% total share.

In 2024, Monocrystalline technology held a leading 59.7% share in the Solar Power Sunroom Systems Market due to its high efficiency, longer lifespan, and sleek appearance—features especially valued in modern residential sunrooms. As homeowners looked for systems capable of generating maximum output within limited roof or enclosure space, monocrystalline panels stood out as the preferred choice. Their performance in low-light conditions and ability to drive higher return on investment made them ideal for year-round use.

Manufacturers increasingly incorporated monocrystalline modules into sunroom designs that balance aesthetics with energy performance. With technology improvements and declining per-watt costs, this segment continued to expand, reinforcing its position as the most dependable option for high-efficiency solar-integrated sunrooms.

By Product Type Analysis

Solar Power Sunroom Systems Market saw the Attached System dominate the segment with 49.1% share.

In 2024, Attached Systems dominated with a 49.1% share of the Solar Power Sunroom Systems Market, supported by their affordability, stability, and ease of installation. Attached sunroom structures are integrated directly with a home’s existing walls, making them cost-effective while maximizing structural support for solar panels. Homeowners increasingly preferred attached systems for their ability to expand living space without major construction costs. These systems also improve thermal efficiency, allowing solar power and natural heating to work together.

Growing adoption of energy-efficient home upgrades, combined with rising interest in multi-functional sunrooms that serve as relaxation areas, greenhouses, or workspaces, reinforced demand. This segment continues to lead as homeowners seek seamless and durable solar-integrated architectural solutions.

By Installation Type Analysis

New Installation dominated the Solar Power Sunroom Systems Market landscape, holding a 67.8% share firmly.

In 2024, the New Installation segment dominated with 67.8%, highlighting the preference for designing solar-powered sunrooms from the start rather than retrofitting existing spaces. Consumers found that new installations allow better panel alignment, stronger structural integration, and optimized energy output. The rise in new residential constructions and renovation projects worldwide boosted demand for purpose-built solar sunrooms.

Builders and architects increasingly collaborated with solar providers to incorporate sustainable features early in project planning. This approach reduces installation complexity and long-term maintenance costs. With rising environmental awareness and incentives for first-time solar adopters, new installations became the go-to choice for homeowners seeking modern, energy-efficient sunroom solutions tailored to their lifestyle and design preferences.

By Application Analysis

The Solar Power Sunroom Systems Market is dominated by Residential applications, capturing 59.4% share.

In 2024, the Residential segment held a dominant 59.4% share in the Solar Power Sunroom Systems Market as households prioritized clean energy and multifunctional living spaces. Solar sunrooms became popular among homeowners looking to increase natural lighting, add usable square footage, and produce renewable electricity simultaneously. The rising trend of home-based lifestyles, including remote work and indoor gardening, further supported adoption.

Residential users appreciated the long-term cost savings from reduced utility bills and the added property value provided by solar-integrated extensions. Government incentives for rooftop solar installations and sustainable home upgrades also contributed to segment growth. As energy prices increased globally, more families embraced sunrooms as practical, eco-friendly home enhancements that align with modern living needs.

Key Market Segments

By Type

- Centralized Photovoltaic Power Plant

- Distributed Photovoltaic Power Plant

By Technology

- Monocrystalline

- Polycrystalline

- Thin Film

By Product Type

- Attached System

- Detached System

- Skylight System

By Installation Type

- New Installation

- Retrofit Installation

By Application

- Commercial

- Hospitality

- Industrial

- Office Buildings

- Retail

- Residential

- Multi Family

- Single Family

Driving Factors

Rising demand for integrated solar architecture

The Solar Power Sunroom Systems Market is benefiting from growing interest in integrated solar architecture, where energy generation is built directly into living spaces. Homeowners and developers are increasingly choosing sunrooms that function as both bright leisure areas and productive solar assets, reducing grid dependence and improving long-term energy efficiency. This shift is reinforced by strong public investment supporting U.S. solar innovation.

The U.S. Department of Energy recently announced $71 million directed toward advancing solar manufacturing research and development, which strengthens the broader ecosystem of solar materials, components, and design technologies. As manufacturing improves and efficiency standards rise, solar sunrooms become easier to integrate into new buildings and retrofits. The blending of architecture, natural lighting, and renewable energy positions integrated solar sunroom systems as an appealing solution for households seeking sustainable home enhancements.

Restraining Factors

High installation costs limit affordability

Despite growing enthusiasm, the Solar Power Sunroom Systems Market faces affordability challenges due to high installation costs. Building a structurally sound sunroom that supports photovoltaic panels requires skilled labor, engineered materials, and precise electrical integration. These upfront expenses often discourage homeowners who might otherwise consider solar additions.

On the supply side, cost pressure is tied to global solar component pricing. A recent development saw the United States backing a major $870 million polysilicon project in Morocco aimed at lowering reliance on Chinese supply chains. While this support may eventually reduce material bottlenecks, benefits for consumers are not immediate. For now, premium installation costs continue to limit adoption, especially in regions where incentives or financing options remain limited.

Growth Opportunity

Innovation funding boosts advanced solar designs

The Solar Power Sunroom Systems Market is entering a strong opportunity phase as innovation funding accelerates next-generation solar design. Manufacturers are exploring lighter modules, improved glass integration, and advanced framing systems that make sunrooms more efficient and visually appealing. Supportive financing worldwide continues to open doors for engineering upgrades.

A notable example is the UDB-backed Xsabo Solar Power Plant, targeted to generate 20 MW, demonstrating how development banks are fueling reliable solar infrastructure. These types of global renewable investments indirectly stimulate demand for residential solar adaptations by expanding technical knowledge and lowering long-term costs. For sunroom systems, opportunity lies in merging architectural creativity with improved solar performance, enabling homeowners to adopt sustainable spaces with better energy output and reduced maintenance.

Latest Trends

Smart automation enhances sunroom energy management

The latest trend shaping the Solar Power Sunroom Systems Market is the rapid adoption of smart energy automation within sunroom installations. Homeowners increasingly want sunrooms that not only generate power but also manage usage intelligently through app-based controls, real-time energy monitoring, and automated shading systems. This trend aligns with rising interest in personal energy storage solutions.

Recently, BLUETTI secured nearly $9.5 million through Indiegogo to support the delivery of its AC500 and B300S backup power units, reflecting growing consumer demand for reliable home energy independence. As backup systems become more accessible, sunrooms equipped with solar panels offer a more complete and resilient home energy package. The blending of automation, storage, and solar design is defining the next stage of sunroom innovation.

Regional Analysis

Asia Pacific leads the market with 42.6%, reaching a USD 255.1 Mn value.

In the Solar Power Sunroom Systems Market, Asia Pacific emerged as the dominant region in 2024, holding a 42.6% share and reaching USD 255.1 Mn, supported by strong residential solar adoption and growing interest in integrated energy-efficient home structures across urban centers.

North America continued to show steady uptake as consumers favored sunroom systems that enhance property value and reduce household energy dependence, particularly in solar-active states. Europe maintained consistent demand driven by sustainability-focused home upgrades and rising preference for hybrid solar architectural designs.

In the Middle East & Africa, adoption grew gradually as sun-rich environments motivated interest in sunrooms that combine comfort with energy production. Latin America also saw improving traction, supported by rising awareness of solar-based home extensions and increasing residential retrofitting activity across key countries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, General Electric continued strengthening its role in solar-integrated residential solutions by leveraging its established expertise in power electronics and grid-support technologies. Within the Solar Power Sunroom Systems Market, GE’s advancements in inverters, smart energy controls, and home-energy optimization systems supported greater efficiency and improved energy flow management for sunroom-based photovoltaic setups. Its focus on durability and system reliability helped position GE as a trusted technology partner for residential solar integration.

Siemens Energy also played a meaningful role by supplying intelligent electrical components, safety systems, and energy-management technologies suited for hybrid home environments. Its engineering capabilities in distributed energy solutions helped enhance the performance of solar sunrooms, particularly where users required stable grid interaction and seamless load handling. Siemens Energy’s emphasis on modular power systems supported easy integration with modern architectural designs.

Meanwhile, ABB maintained a strong influence through its advanced power distribution units, home-automation interfaces, and efficient solar balance-of-system components. ABB’s expertise in smart home electrification enabled solar sunrooms to operate with improved monitoring, protection, and energy conversion. Its long-standing innovation in residential solar hardware positioned the company as an important enabler of safe, scalable, and high-performing sunroom energy systems.

Top Key Players in the Market

- General Electric

- Siemens Energy

- ABB

- Schneider Electric

- Hitachi

- ReNew Power

- Tata Power

- ACWA Power

- Mitsubishi Corporation

- Sungrow Power

Recent Developments

- In April 2025, Schneider Electric teamed up with Indian rooftop solar company Freyr Energy to integrate its Wiser Smart Home energy management system with Freyr’s rooftop solar solutions. This collaboration helps homeowners view and manage solar energy production and use through smart automation, encouraging cost savings and cleaner energy use in homes. This move expands Schneider’s reach into residential solar-linked solutions by combining digital control with rooftop solar tech.

- In January 2024, Hitachi Energy finished buying COET, a company that designs and makes power electronics and charging equipment. This helps Hitachi Energy broaden its technology and strengthen its ability to support electric systems at the grid edge, which can benefit renewable energy integration, like solar power connections.

Report Scope

Report Features Description Market Value (2024) USD 599.0 Million Forecast Revenue (2034) USD 1,167.4 Million CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Centralized Photovoltaic Power Plant, Distributed Photovoltaic Power Plant), By Technology (Monocrystalline, Polycrystalline, Thin Film), By Product Type (Attached System, Detached System, Skylight System), By Installation Type (New Installation, Retrofit Installation), By Application (Commercial (Hospitality, Industrial, Office Buildings, Retail), Residential (Multi Family, Single Family)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape General Electric, Siemens Energy, ABB, Schneider Electric, Hitachi, ReNew Power, Tata Power, ACWA Power, Mitsubishi Corporation, Sungrow Power Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Solar Power Sunroom Systems MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Solar Power Sunroom Systems MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- General Electric

- Siemens Energy

- ABB

- Schneider Electric

- Hitachi

- ReNew Power

- Tata Power

- ACWA Power

- Mitsubishi Corporation

- Sungrow Power