Global Soda Maker Market Size, Share, Growth Analysis By Product (CO2 Cylinder, Soda Maker), By Mode of Operation (Manual, Electric), By Type (Portable, Desktop), By Distribution Channel (Offline, Online) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174047

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Soda Maker Market Overview

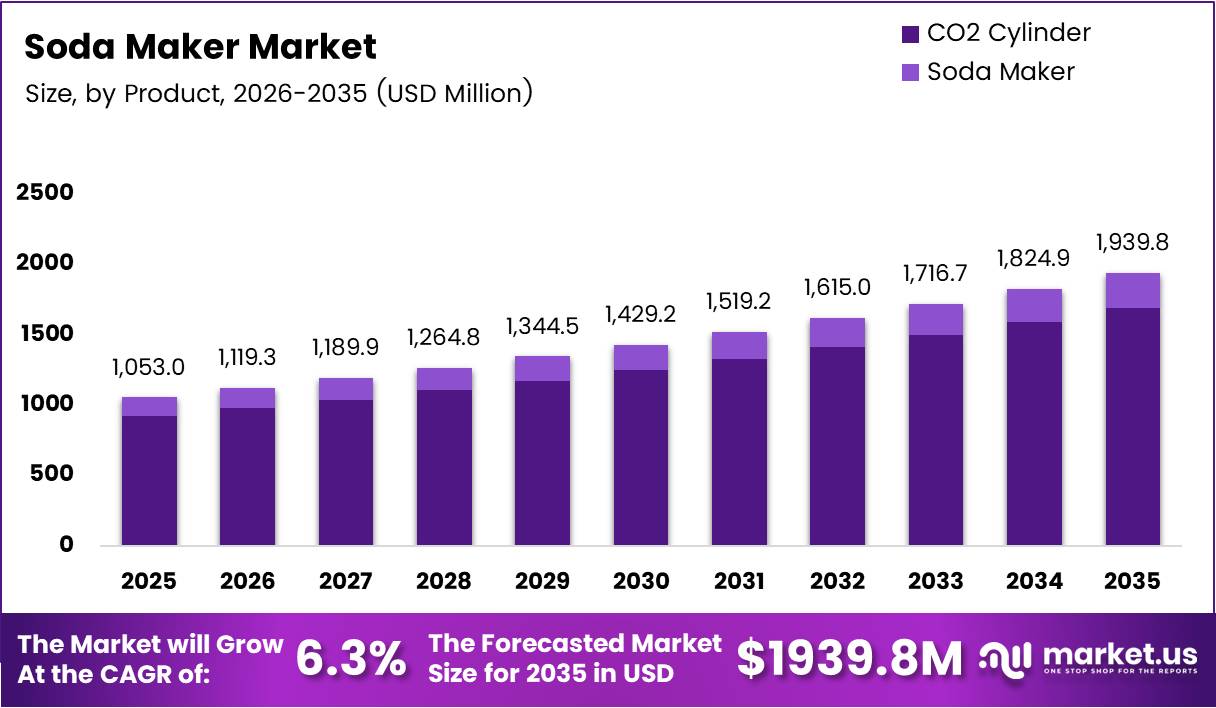

Global Soda Maker Market size is expected to reach approximately USD 1,939.8 Million by 2035 from USD 1,053.0 Million in 2025, growing at a CAGR of 6.3% during the forecast period 2026 to 2035. This growth trajectory reflects significant consumer adoption across urban households seeking healthier beverage alternatives.

The Soda Maker Market represents a rapidly expanding segment within home beverage appliances. It encompasses devices designed for at-home carbonation of water and flavored drinks. These compact systems offer consumers convenient alternatives to commercially bottled carbonated beverages while promoting customization and sustainability in daily beverage consumption.

The market demonstrates substantial potential driven by health-conscious consumer behavior and environmental awareness. Urban millennials increasingly prefer DIY beverage customization over traditional sodas. Moreover, compact living spaces demand versatile kitchen appliances that optimize functionality. Consequently, portable soda makers gain traction among space-constrained households seeking convenient carbonation solutions.

Government regulations supporting single-use plastic reduction further accelerate market expansion. Environmental initiatives promote reusable bottle systems and sustainable packaging solutions. Additionally, retail partnerships facilitate convenient CO₂ cylinder exchange programs. Therefore, accessibility improvements strengthen consumer confidence in adopting home carbonation technology for everyday use.

According to SodaStream, consumer consumption in 2023 resulted in approximately 5.5 billion single-use plastic bottles avoided, demonstrating environmental impact. Furthermore, the company’s 440ml flavor bottles utilize 100% recycled PET materials. However, traditional vending machines generate $200-$500 monthly profit, indicating competitive commercial alternatives. Nevertheless, subscription-based refill models and smart app integration position soda makers favorably within evolving consumer preferences.

Key Takeaways

- Global Soda Maker Market valued at USD 1,053.0 Million in 2025, projected to reach USD 1,939.8 Million by 2035

- Market growth rate of 6.3% CAGR during forecast period 2026-2035

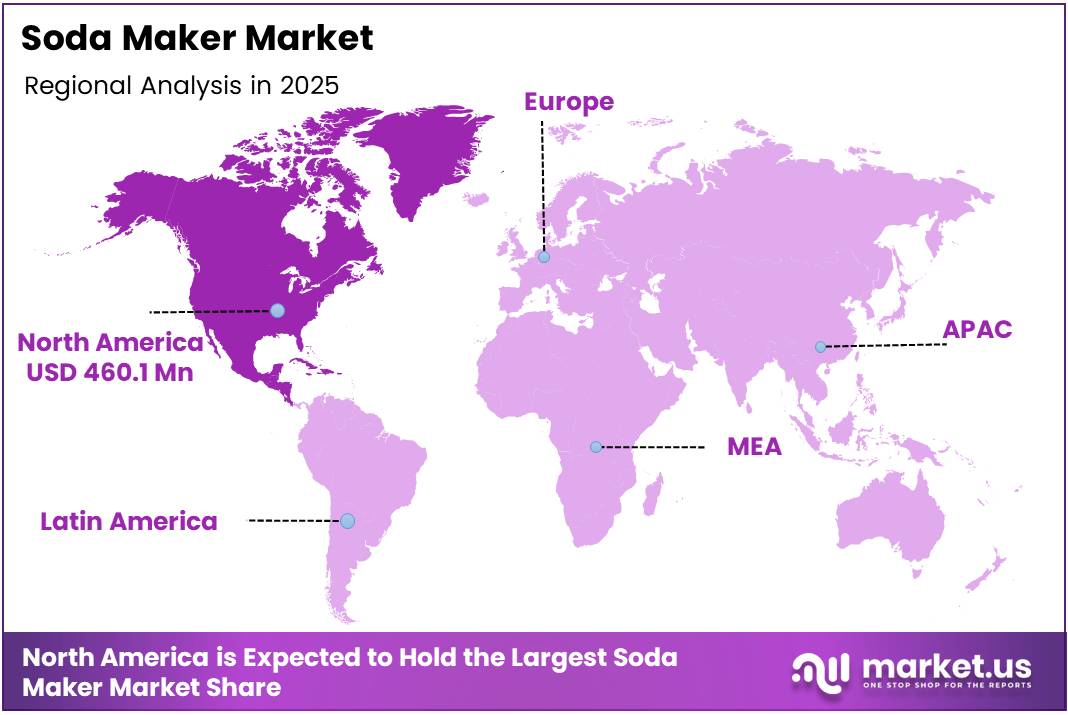

- North America dominates with 43.7% market share, valued at USD 460.1 Million

- CO2 Cylinder segment leads By Product category with 87.2% market share

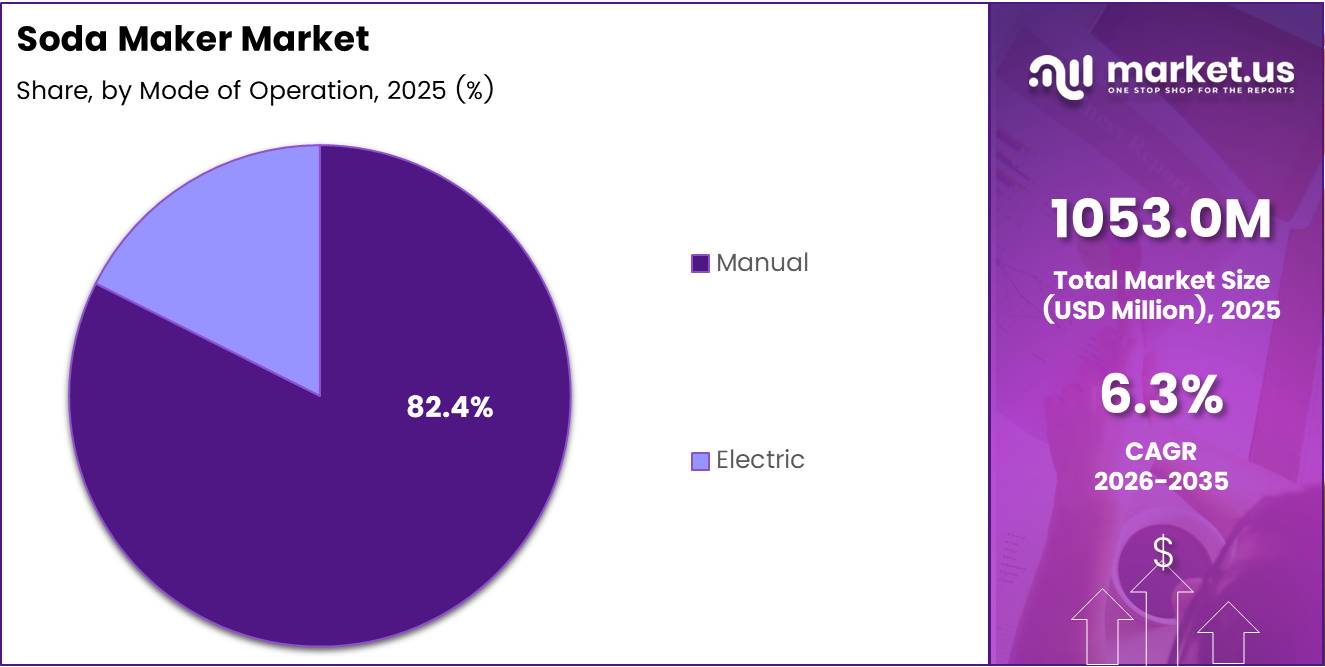

- Manual mode of operation holds 82.4% market dominance

- Portable type captures 88.3% of market preference

- Offline distribution channel commands 75.9% market presence

By Product Analysis

CO2 Cylinder dominates with 87.2% due to essential refill requirements and recurring revenue models.

In 2025, CO2 Cylinder held a dominant market position in the By Product Analysis segment of Soda Maker Market, with an 87.2% share. This segment represents the consumable component essential for carbonation functionality across all soda maker devices. Moreover, recurring purchase requirements create predictable revenue streams for manufacturers and retailers. Consequently, widespread availability through retail partnerships and exchange programs ensures consistent consumer accessibility and brand loyalty.

Soda Maker represents the hardware component comprising the carbonation device itself. These appliances feature varying designs from portable units to countertop models with advanced digital controls. Additionally, product innovation focuses on aesthetic appeal and user-friendly operation. Therefore, manufacturers emphasize durability and warranty coverage to justify initial investment costs for consumers.

By Mode of Operation Analysis

Manual dominates with 82.4% due to cost-effectiveness and mechanical reliability without electrical requirements.

In 2025, Manual held a dominant market position in the By Mode of Operation Analysis segment of Soda Maker Market, with an 82.4% share. Manual systems operate through mechanical lever action requiring no electrical power source. Furthermore, simplicity reduces manufacturing costs and retail pricing barriers. Consequently, budget-conscious consumers prefer manual models for basic carbonation needs without technological complexity.

Electric soda makers incorporate automated carbonation controls with digital interfaces and customizable pressure settings. These devices appeal to tech-savvy consumers seeking precise carbonation levels. Moreover, smartphone app integration enables personalized beverage profiles and usage tracking. However, higher price points and electrical dependency limit widespread adoption compared to manual alternatives.

By Type Analysis

Portable dominates with 88.3% due to space efficiency and flexibility for small kitchens and mobile use.

In 2025, Portable held a dominant market position in the By Type Analysis segment of Soda Maker Market, with an 88.3% share. Portable units offer compact dimensions suitable for limited counter space in urban apartments. Additionally, lightweight construction facilitates storage flexibility and occasional outdoor use. Therefore, space-constrained households prioritize portability over permanent countertop installations for convenience.

Desktop soda makers provide larger capacity and enhanced stability for frequent household use. These models typically feature premium materials like stainless steel with minimalist aesthetic designs. Moreover, permanent countertop placement signals lifestyle commitment to home carbonation routines. However, larger footprints require dedicated kitchen real estate limiting appeal among compact living environments.

By Distribution Channel Analysis

Offline dominates with 75.9% due to physical product demonstration and immediate availability preferences.

In 2025, Offline held a dominant market position in the By Distribution Channel Analysis segment of Soda Maker Market, with a 75.9% share. Traditional retail environments enable hands-on product evaluation before purchase decisions. Furthermore, established kitchen appliance retailers provide expert consultation and warranty services. Consequently, consumer confidence increases through tangible product interaction unavailable in digital shopping experiences.

Online distribution channels experience gradual growth through e-commerce platforms offering convenient home delivery. Digital channels provide comprehensive product comparisons and customer review access. Moreover, subscription services for CO₂ refills and flavor concentrates integrate seamlessly with online purchasing habits. However, shipping costs and delivery delays deter immediate gratification preferences among consumers.

Key Market Segments

By Product

- CO2 Cylinder

- Soda Maker

By Mode of Operation

- Manual

- Electric

By Type

- Portable

- Desktop

By Distribution Channel

- Offline

- Online

Drivers

Rising Household Shift Toward At-Home Carbonated Beverage Preparation

Consumer preferences increasingly favor convenient at-home beverage customization over retail purchasing. Health-conscious households seek control over ingredient selection and sugar content. Moreover, cost savings accumulate through reduced packaged beverage purchases over time. Consequently, soda makers appeal to budget-minded families prioritizing long-term value.

Urban millennials drive adoption through social media influence showcasing creative beverage crafting. DIY culture promotes personalized flavor experimentation and presentation aesthetics. Additionally, compact kitchen appliances align with minimalist lifestyle trends. Therefore, manufacturers position soda makers as essential modern kitchen accessories beyond traditional appliance categories.

Environmental awareness motivates sustainable consumption choices reducing single-use plastic waste. Refillable systems eliminate packaging disposal associated with bottled beverages. Furthermore, government initiatives supporting waste reduction validate consumer environmental responsibility. However, initial investment costs require consumer education emphasizing cumulative savings and ecological benefits.

Restraints

High Replacement Cost of CO₂ Cylinders and Flavor Refill Cartridges

Recurring expenses for CO₂ cylinder replacements create ongoing financial commitments for consumers. Refill cartridge costs accumulate significantly over extended usage periods. Moreover, limited retail availability in certain regions restricts convenient access to replacement supplies. Consequently, total ownership costs exceed initial purchase price expectations among budget-sensitive households.

Product awareness remains limited across semi-urban and rural consumer segments. Traditional beverage purchasing habits persist without exposure to home carbonation alternatives. Additionally, retail distribution gaps prevent hands-on product demonstration opportunities. Therefore, market penetration faces barriers beyond urban metropolitan areas where specialty kitchen appliance retailers concentrate their presence.

Growth Factors

Expansion of Refillable Cylinder Exchange Programs Through Retail Partnerships

Strategic retail partnerships facilitate convenient CO₂ cylinder exchange locations nationwide. Expanded accessibility reduces consumer friction associated with refill logistics. Moreover, competitive exchange pricing improves value perception among price-sensitive consumers. Consequently, streamlined refill infrastructure accelerates adoption rates and customer retention.

Organic and botanical flavor concentrate lines appeal to health-focused consumer demographics. Functional beverages incorporating vitamins and probiotics expand product appeal beyond traditional soda alternatives. Additionally, premium flavor varieties justify higher margin opportunities for manufacturers. Therefore, product diversification strategies capture emerging wellness-oriented consumer segments.

Smart integration with mobile applications enables personalized carbonation preferences and usage tracking. Digital connectivity enhances user experience through recipe suggestions and maintenance reminders. Furthermore, commercial adoption in cafés and co-working spaces demonstrates professional versatility. However, technological complexity requires intuitive interface design ensuring accessibility across diverse user demographics.

Emerging Trends

Launch of Countertop Soda Makers with Digital Carbonation Level Controls

Advanced digital interfaces provide precise carbonation intensity customization for varied beverage preferences. Touchscreen controls simplify operation while communicating premium product positioning. Moreover, automated pressure regulation ensures consistent carbonation results reducing user error. Consequently, technology integration differentiates premium models from basic manual alternatives.

Subscription-based models for flavor concentrates and cylinder refills ensure recurring revenue streams. Automated delivery schedules eliminate consumer replenishment planning and stockout frustration. Additionally, exclusive subscriber flavor varieties create brand loyalty incentives. Therefore, recurring revenue models stabilize manufacturer cash flow while enhancing customer lifetime value.

Sustainable packaging initiatives utilize recyclable glass bottles replacing plastic alternatives. Environmental messaging resonates with eco-conscious consumer values driving purchase decisions. Furthermore, social media influencers showcase home beverage crafting culture through visual content platforms. However, authentic user-generated content proves more influential than traditional advertising approaches among younger demographics.

Regional Analysis

North America Dominates the Soda Maker Market with a Market Share of 43.7%, Valued at USD 460.1 Million

North America commands the largest market share at 43.7%, valued at USD 460.1 Million, driven by established consumer awareness and robust retail distribution networks. High disposable income levels support premium appliance adoption. Moreover, health-conscious lifestyle trends accelerate demand for sugar-controlled beverage alternatives. Consequently, strong brand presence and marketing investments maintain regional market leadership positions.

Europe Soda Maker Market Trends

Europe demonstrates significant growth potential through environmental regulations restricting single-use plastics. Sustainability-focused consumers actively seek reusable beverage solutions. Additionally, compact living spaces in urban centers favor space-efficient portable models. Therefore, regulatory tailwinds and cultural preferences support steady market expansion.

Asia Pacific Soda Maker Market Trends

Asia Pacific experiences rapid urbanization creating opportunities among emerging middle-class households. Western lifestyle adoption influences beverage consumption patterns toward carbonated alternatives. Moreover, e-commerce infrastructure facilitates market penetration beyond traditional retail channels. However, price sensitivity requires localized product strategies emphasizing affordability.

Middle East and Africa Soda Maker Market Trends

Middle East and Africa present nascent market opportunities constrained by limited retail distribution infrastructure. Affluent urban consumers demonstrate interest in premium kitchen appliances. Additionally, hospitality sector adoption provides commercial growth avenues. Therefore, targeted marketing toward high-income segments precedes mass-market penetration strategies.

Latin America Soda Maker Market Trends

Latin America shows gradual adoption driven by increasing health awareness and disposable income growth. Traditional beverage preferences compete with modern carbonation alternatives. Moreover, economic volatility influences discretionary appliance purchases. Consequently, value-oriented product positioning and flexible payment options facilitate market entry.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Soda Maker Company Insights

SodaStream Inc. maintains dominant market leadership through extensive product portfolios and global retail presence. The company pioneered home carbonation systems establishing strong brand recognition across consumer segments. Moreover, strategic acquisition by PepsiCo provides distribution synergies and flavor innovation capabilities. Consequently, integrated marketing campaigns leverage corporate resources strengthening competitive positioning against emerging rivals.

Aarke AB. positions itself within premium market segments emphasizing Scandinavian design aesthetics and stainless-steel construction quality. The brand targets affluent consumers valuing minimalist kitchen aesthetics and product durability. Additionally, limited distribution channels maintain exclusivity perception supporting premium pricing strategies. Therefore, differentiation through design excellence creates defensible market niche resistant to price competition.

i-Drink Products Inc. focuses on innovation-driven product development incorporating advanced carbonation technology and user-friendly features. The company emphasizes patent-protected mechanisms differentiating offerings from commodity alternatives. Moreover, direct-to-consumer sales channels reduce retail margin pressures enabling competitive pricing. Consequently, technology leadership attracts early adopters seeking cutting-edge beverage preparation solutions.

Mysoda concentrates on European markets leveraging regional sustainability trends and environmental consciousness. The brand emphasizes recyclable materials and carbon footprint reduction throughout product lifecycles. Additionally, cylinder exchange programs facilitate convenient refill accessibility across retail partnerships. Therefore, values-based marketing resonates with eco-conscious demographics prioritizing environmental impact over price considerations.

Key Players

- SodaStream Inc.

- Aarke AB.

- i-Drink Products Inc.

- Mysoda

- iSi GmbH

- Drinkpod

- Mr. Butler

- Sparke

- Ninja Thirsti drink system

Recent Developments

- In March 2025, PepsiCo announced acquisition of prebiotic soda brand Poppi for approximately $1.95 billion, expanding functional beverage portfolio and demonstrating corporate commitment toward health-focused carbonated alternatives.

- In January 2025, SodaStream launched new Pepsi Wild Cherry and Pepsi Zero Sugar Wild Cherry drink mixes, broadening flavor variety and leveraging PepsiCo brand equity to attract traditional soda consumers.

- In 2024, SodaStream introduced the Enso model featuring minimalist stainless-steel design, targeting premium consumer segments seeking aesthetic kitchen appliances with enhanced durability and contemporary styling.

Report Scope

Report Features Description Market Value (2025) USD 1053.0 Million Forecast Revenue (2035) USD 1939.8 Million CAGR (2026-2035) 6.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (CO2 Cylinder, Soda Maker), By Mode of Operation (Manual, Electric), By Type (Portable, Desktop), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape SodaStream Inc., Aarke AB., i-Drink Products Inc., Mysoda, iSi GmbH, Drinkpod, Mr. Butler, Sparke, Ninja Thirsti drink system Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SodaStream Inc.

- Aarke AB.

- i-Drink Products Inc.

- Mysoda

- iSi GmbH

- Drinkpod

- Mr. Butler

- Sparke

- Ninja Thirsti drink system