Global Snus Market By Product Type (Loose, Portion Snus), By Flavor (Original and Unflavored, Flavored), Distribution Channel (Tobacco Stores, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 20974

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

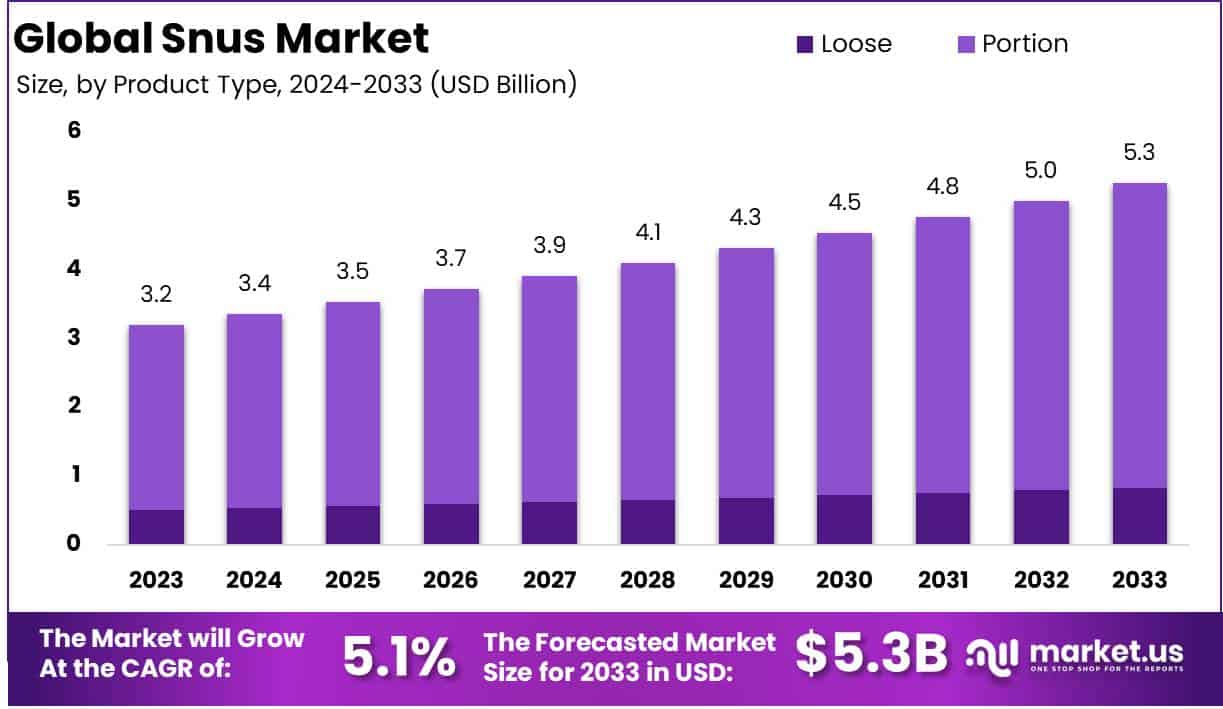

The Global Snus Market size is expected to be worth around USD 5.3 Billion by 2033, from USD 3.2 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

Snus is a type of smokeless tobacco product originating from Sweden, typically consumed by placing it under the upper lip. Unlike traditional chewing tobacco, snus does not require spitting and is available in both loose and pre-packaged pouch formats.

It contains nicotine and has gained popularity as an alternative to cigarettes, particularly in regions with strict smoking regulations. The product is known for its varying flavors and nicotine strengths, catering to diverse consumer preferences.

The market includes key players ranging from established tobacco companies to niche manufacturers specializing in innovative flavor profiles and packaging. Geographic market dynamics are influenced by regulatory environments, cultural acceptance, and public health policies.

Several factors are driving growth in the snus market. Increasing awareness of the health risks associated with smoking has shifted consumer preference towards less harmful nicotine products, positioning snus as a viable alternative.

The adoption of harm reduction policies in many countries and a growing emphasis on smoke-free environments further support market expansion. Additionally, product innovations, including enhanced flavors and discreet packaging, are attracting a broader demographic, including younger and female consumers.

Demand for snus is experiencing a steady rise, particularly in regions like Scandinavia, the U.S., and parts of Europe. Scandinavian countries remain the largest consumers due to historical and cultural acceptance.

However, emerging markets are showing increased interest, driven by rising disposable incomes and changing lifestyles. The convenience and perceived reduced health risks of snus compared to smoking continue to be key factors fueling demand across demographic groups.

The Snus market presents significant opportunities for growth, particularly in untapped regions such as Asia-Pacific and Latin America, where awareness of smokeless tobacco alternatives is gradually increasing. Strategic partnerships and mergers among key players can help penetrate these markets.

Furthermore, the development of organic and all-natural snus products, alongside targeted marketing campaigns emphasizing health benefits, can attract health-conscious consumers. Expanding online retail channels also offers a pathway to reach a wider audience, leveraging digital marketing and direct-to-consumer sales strategies.

According to the Centers for Disease Control and Prevention (CDC), approximately 2.1% of U.S. adults, or 5.2 million individuals, currently use smokeless tobacco products, including snus. Usage rates vary significantly by gender, with 4.2% of men and only 0.2% of women reporting use. Among racial groups, 2.9% of non-Hispanic White adults are current users, the highest prevalence among all demographics.

In younger populations, 3.7% of high school students reported using more than one type of tobacco product in 2024. These figures highlight targeted growth opportunities in specific consumer segments within the snus market.

According to PubMed, current nicotine pouch use is more prevalent among boys 11.3% than girls 3.3%, with higher usage in VOC regions 15.4% compared to COMP 6.8% and GEN 4.3%. Daily use of other nicotine products strongly correlates with nicotine pouch use, especially among snus users.

Among Norwegian women aged 18-45, snus ever-use prevalence ranges from 29.6% in those aged 18-19 to 4.5% in the 40-45 age group. Notably, 54.1% of younger snus users and 22.8% of older ones never smoked. These insights underscore snus’s role as a primary alternative to smoking, particularly for younger, non-smoking demographics.

Key Takeaways

- The global snus market is projected to grow from USD 3.2 billion in 2023 to USD 5.3 billion by 2033, with a CAGR of 5.1% driven by rising demand for smokeless tobacco products.

- The Portion segment dominated the snus market in 2023, accounting for 84.2% of the product type share, driven by its convenience and discreet usage.

- The Flavored snus segment led with an 84.2% market share in 2023, with mint flavors alone contributing over 40%.

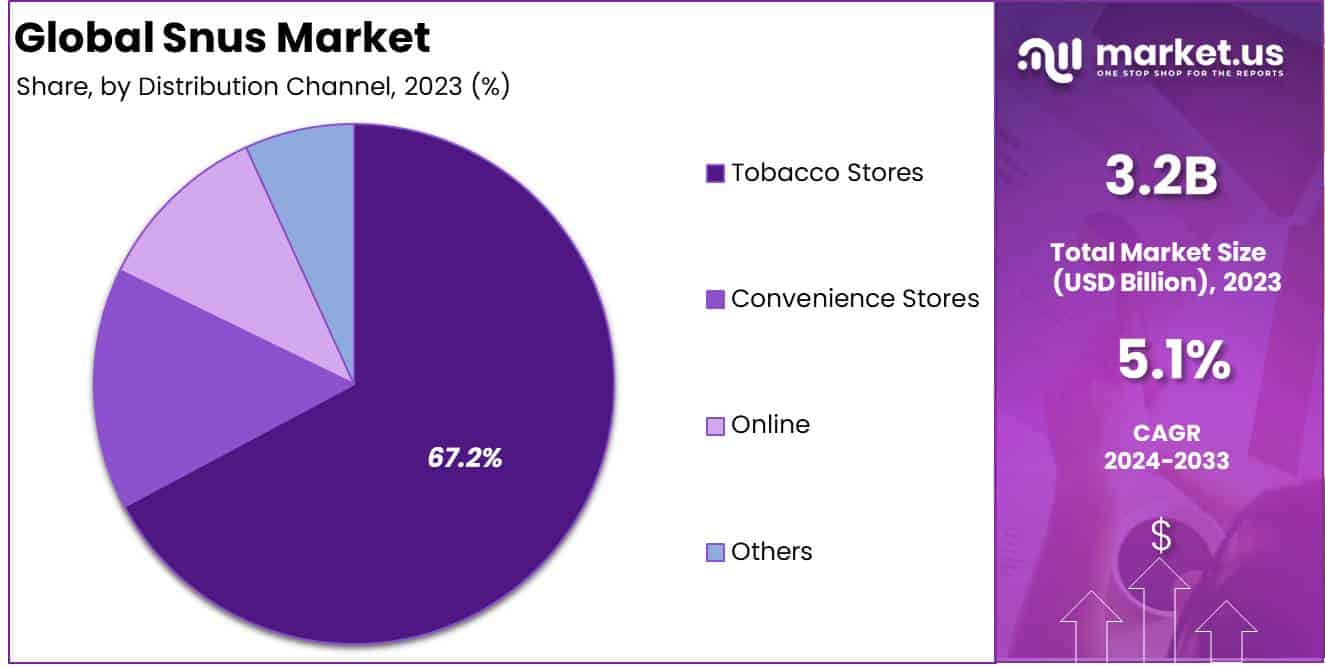

- Tobacco Stores captured a dominant 67.2% share of the distribution channel in 2023, benefiting from specialized product offerings and consumer trust.

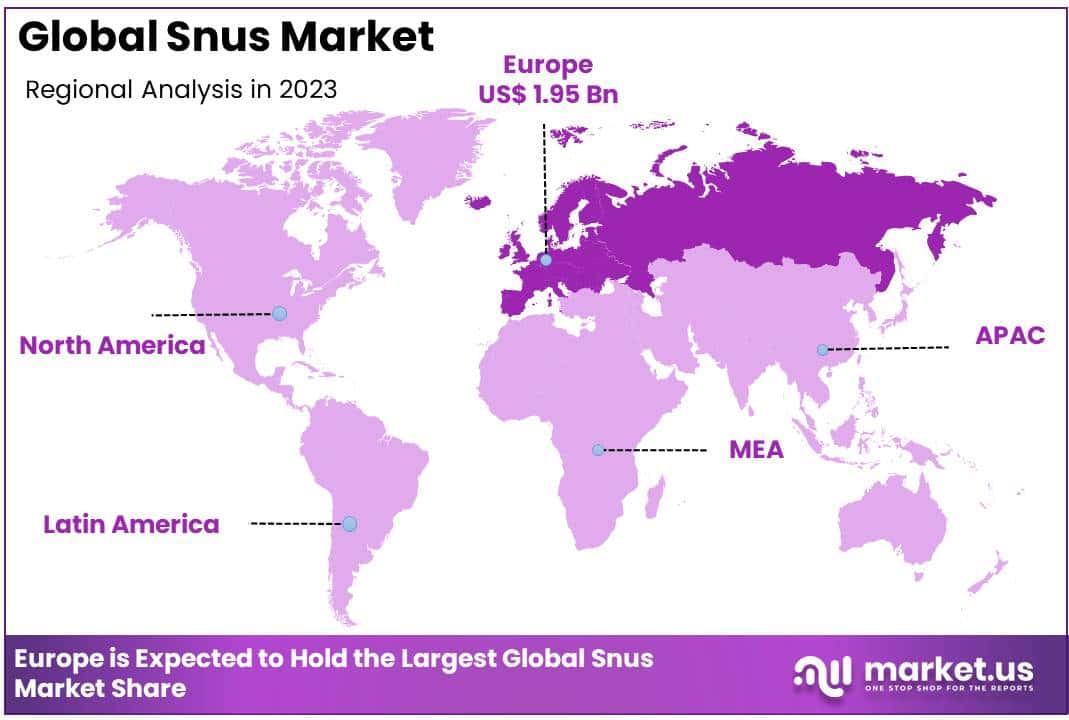

- Europe led the global snus market in 2023, holding a 61.2% share, driven by the cultural acceptance of snus in Scandinavian countries and favorable regulatory policies.

By Product Analysis

Portion Segment Dominates the Snus Market with an 84.2% Share in 2023

In 2023, the Portion segment dominated the snus market by product type, capturing an impressive 84.2% share. This dominance is attributed to the convenience and discreet usage offered by portioned snus, which appeals to both seasoned users and newcomers.

The pre-measured pouches ensure consistent dosage and ease of use, making them particularly popular in regions with high snus consumption, such as Scandinavia. The segment’s growth is further bolstered by the availability of diverse flavors and nicotine strengths, catering to a wide range of consumer preferences.

Conversely, the Loose snus segment accounted for a smaller market share in 2023. Despite its traditional appeal and the ability for users to customize portion sizes, loose snus has seen limited growth.

This is primarily due to its less user-friendly format and lower adoption among younger consumers who prefer the convenience of portioned products. However, it continues to enjoy steady demand among long-time snus users who value its richer flavor profile and the traditional experience it offers.

By Flavor Analysis

Flavored Segment Leads Snus Market Growth with an 84.2% Share in 2023

In 2023, the Flavored snus segment captured a dominant 84.2% market share by flavor, underscoring a strong consumer shift towards flavored options in the global snus market. This demand for flavors is largely fueled by the popularity of mint-based flavors, which account for over 40% of the flavored snus market, followed by whiskey and fruit flavors.

Mint flavors are especially popular due to their refreshing taste, with consistent demand across Europe and North America, while whiskey-flavored snus is preferred by users seeking a bold, distinctive profile.

The overall trend in the flavored snus segment also aligns with changing consumer expectations and increased interest in smokeless tobacco options that provide a variety of taste experiences. Younger users, in particular, have shown a strong preference for flavored varieties, driving demand for innovative options within the category.

The availability of multiple flavors and strengths has allowed manufacturers to expand consumer reach and retention, which further contributes to the robust growth of this segment.

The Original/Unflavored snus segment, while capturing a smaller market share, remains steady with a loyal base of traditional users. Comprising around 15.8% of the total market, this segment appeals to consumers who prefer the unaltered taste of tobacco.

While not experiencing significant growth, this segment has managed to maintain demand among long-time snus users, particularly in Scandinavian markets, where unflavored snus holds a unique cultural value.

By Distribution Channel Analysis

Tobacco Stores Dominate Snus Distribution with a 67.2% Market Share in 2023

In 2023, Tobacco Stores held a dominant position in the snus market, capturing over 67.2% of the market share by distribution channel. These stores benefit from their specialized product offerings and knowledgeable staff, catering directly to the preferences of snus consumers.

Their extensive network and ability to offer a variety of brands and flavors make them the preferred choice for many users, solidifying their leadership in the distribution landscape.

Convenience Stores widespread presence and extended hours provide easy access for consumers seeking quick purchases. Although their product range is typically narrower compared to tobacco stores, convenience stores serve as a critical distribution channel for on-the-go snus buyers.

The Online distribution channel increasing consumer preference for convenience and discretion. E-commerce platforms provide access to a broader range of products, competitive pricing, and direct-to-door delivery, making them an increasingly popular option, particularly among younger, tech-savvy users.

The Others category, which includes supermarkets, hypermarkets, and specialty shops. These channels play a supplementary role, offering consumers additional purchasing options, often in regions or contexts where traditional tobacco or convenience stores may be less accessible.

Key Market Segments

By Product Type

- Loose

- Portion

By Flavor

- Original/Unflavored

- Flavored

- Mint

- Whiskey

- Fruit

- Others

By Distribution Channel

- Tobacco Stores

- Convenience Stores

- Online

- Others

Driver

Rising Demand for Smokeless Tobacco Products

The global snus market is experiencing significant growth, primarily driven by an increasing consumer shift towards smokeless tobacco products. This trend is largely attributed to heightened health awareness and the desire for less harmful alternatives to traditional smoking.

Snus, a moist, smokeless tobacco product placed under the upper lip, offers a discreet and smoke-free nicotine experience, appealing to health-conscious individuals seeking to reduce exposure to the harmful effects of smoking.

This shift is evident in the growing adoption of snus among various demographics, including younger consumers and those in regions with strict smoking regulations. Moreover, the convenience and social acceptability of snus contribute to its rising popularity.

Unlike cigarettes, snus can be used in smoke-free environments without causing secondhand smoke, making it a preferred choice in public spaces and workplaces.

The availability of diverse flavors and nicotine strengths further enhances its appeal, catering to a wide range of consumer preferences. As public health campaigns continue to highlight the dangers of smoking, the demand for smokeless alternatives like snus is expected to sustain its upward trajectory, bolstering market growth in the foreseeable future.

Restraint

Stringent Regulatory Frameworks

Despite the growing demand, the snus market faces significant challenges due to stringent regulatory frameworks imposed by governments and health organizations. In many countries, snus is subject to strict regulations concerning its sale, marketing, and consumption. For instance, in the European Union, the sale of snus is banned in all member states except Sweden, limiting market expansion within the region.

These regulations are often implemented to curb tobacco use and protect public health, but they pose substantial barriers for market players aiming to introduce or expand snus products in regulated markets. Additionally, regulatory hurdles can lead to increased compliance costs and operational complexities for manufacturers and distributors.

The necessity to adhere to varying regulations across different regions requires substantial investment in legal expertise and compliance measures, potentially affecting profitability.

Moreover, stringent labeling requirements and advertising restrictions can impede marketing efforts, limiting consumer awareness and acceptance of snus products. These regulatory challenges necessitate strategic navigation by industry stakeholders to ensure compliance while striving for market growth.

Opportunity

Expansion into Emerging Markets

The snus market holds substantial growth potential through expansion into emerging markets, particularly in regions where smoking rates remain high, and there is a growing awareness of the health risks associated with traditional tobacco products. Countries in Asia, Africa, and Latin America present untapped opportunities for snus manufacturers to introduce their products as harm-reduction alternatives.

As public health initiatives in these regions intensify efforts to reduce smoking prevalence, snus can be positioned as a viable option for smokers seeking less harmful nicotine consumption methods. Furthermore, the increasing disposable incomes and urbanization in these emerging markets contribute to a consumer base more receptive to new products.

The younger demographic, in particular, is inclined towards innovative and convenient alternatives to smoking. By tailoring marketing strategies to resonate with local cultures and preferences, snus companies can effectively penetrate these markets.

Collaborations with local distributors and adherence to regional regulatory requirements will be crucial in capitalizing on these opportunities, thereby driving global market growth.

Trends

Diversification of Product Offerings

A notable trend shaping the snus market is the diversification of product offerings to cater to evolving consumer preferences. Manufacturers are introducing a wide array of flavors, nicotine strengths, and packaging formats to appeal to a broader audience. Flavored snus products, such as mint, fruit, and coffee variants, are gaining popularity, especially among younger consumers seeking variety and a more palatable experience.

This diversification not only enhances consumer satisfaction but also fosters brand loyalty and attracts new users to the category. In addition to flavor innovation, there is a growing emphasis on developing tobacco-free nicotine pouches, which offer a similar experience to traditional snus without containing tobacco.

These products appeal to health-conscious consumers and those looking to reduce tobacco intake while still enjoying nicotine. The focus on sustainable and eco-friendly packaging solutions is also gaining traction, aligning with the increasing consumer demand for environmentally responsible products.

By continuously innovating and expanding product portfolios, snus manufacturers can maintain a competitive edge and drive market growth in a dynamic consumer landscape.

Regional Analysis

Europe Leads Snus Market with Largest Market Share of 61.2% in 2023

In 2023, Europe solidified its position as the dominant player in the global snus market, capturing a substantial 61.2% share and generating approximately USD 1.95 billion in revenue. This dominance is largely attributed to the entrenched cultural acceptance and historical usage of snus in Scandinavian countries, notably Sweden and Norway, where it serves as a prevalent alternative to traditional smoking.

The European market’s growth is further propelled by favorable regulatory frameworks that recognize snus as a harm-reduction product, thereby encouraging its consumption over combustible tobacco products.

In North America, the snus market is experiencing a steady expansion, driven by increasing consumer awareness of smokeless tobacco alternatives and a growing preference for reduced-risk nicotine products. The United States, in particular, has seen a rise in snus usage, supported by marketing efforts that position it as a discreet and potentially less harmful option compared to cigarettes.

However, the market’s growth is moderated by stringent regulatory policies and ongoing public health debates concerning smokeless tobacco products.

The Asia-Pacific region presents a nascent yet promising market for snus, with countries like Japan and South Korea witnessing gradual adoption. Factors such as urbanization, changing consumer lifestyles, and increasing exposure to Western tobacco products contribute to this emerging trend.

Nonetheless, the market faces challenges due to strict regulatory environments and limited consumer awareness, which may impede rapid growth in the near term.

Latin America and the Middle East & Africa remain emerging markets for snus, characterized by gradual growth trajectories. In these regions, evolving regulatory landscapes and increasing efforts to raise consumer awareness about smokeless tobacco alternatives are key factors influencing market development.

However, cultural preferences for traditional tobacco products and economic constraints pose challenges to widespread adoption.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global snus market is characterized by the strategic maneuvers of several key players, each leveraging their unique strengths to capture market share and drive growth.

Swedish Match AB continues to lead the market, capitalizing on its extensive product portfolio and strong brand recognition. The company’s focus on innovation and quality has solidified its position as a market leader.

British American Tobacco (BAT) has expanded its presence in the snus segment through strategic acquisitions and product diversification. BAT’s commitment to reduced-risk products aligns with evolving consumer preferences, enhancing its competitive edge.

Imperial Brands has invested in the development of smokeless tobacco products, including snus, to offset declining cigarette sales. The company’s emphasis on harm reduction and product innovation positions it favorably in the evolving tobacco landscape.

US Smokeless Tobacco Co., Inc., a subsidiary of Altria Group, leverages its strong distribution network and brand loyalty to maintain a significant market share in the United States. The company’s focus on premium products caters to a discerning consumer base.

Philip Morris International has entered the snus market as part of its broader strategy to transition to smoke-free products. The company’s global reach and research capabilities support its efforts to capture a share of the snus market.

Swisher has diversified its product offerings to include snus, aiming to attract consumers seeking alternatives to traditional tobacco products. The company’s agility in product development enables it to respond to changing market dynamics.

Mac Baren Tobacco Company A/S has expanded into the snus market, leveraging its expertise in tobacco blending to offer high-quality products. The company’s focus on craftsmanship appeals to traditional snus users.

Nordic Snus emphasizes Scandinavian heritage and quality in its product offerings. The company’s commitment to authentic snus production resonates with consumers seeking traditional experiences.

Ministry of Snus positions itself as a modern and innovative brand, targeting younger demographics with unique flavors and contemporary branding. The company’s approach aligns with trends favoring novel and diverse snus products.

Northerner Scandinavia Inc. operates as a significant online retailer, providing a wide range of snus products to a global audience. The company’s e-commerce platform facilitates accessibility and convenience for consumers worldwide.

Collectively, these companies shape the competitive landscape of the global snus market in 2024, each contributing to the industry’s evolution through strategic initiatives, product innovation, and responsiveness to consumer preferences.

Top Key Players in the Market

- Swedish Match AB

- British American Tobacco

- Imperial Brands

- US Smokeless Tobacco Co., Inc.

- Philip Morris International

- Swisher

- Mac Baren Tobacco Company A/S

- Nordic Snus

- Ministry of Snus

- Northerner Scandinavia Inc.

Recent Developments

- In 2024, BAT will introduce a revolutionary synthetic nicotine product in the U.S. market. The company plans to roll out an innovative version of its Velo nicotine pouches, made from synthetic nicotine. This new product, created in laboratories instead of being derived from tobacco, is designed to sidestep the stringent regulatory processes typically required by the Food and Drug Administration (FDA) for tobacco-based items.

- In 2024, Philip Morris International Inc. (PMI) announces a significant investment of $600 million over the next two years. This funding will establish a high-tech manufacturing facility in Aurora, Colorado, through one of its U.S. affiliates. The facility is poised to create 500 jobs directly and generate an ongoing economic benefit of $550 million annually for Colorado. The production at this plant will focus on ZYN nicotine pouches, catering to the rising global demand for smoke-free alternatives among adult consumers. PMI is headquartered in Stamford, Connecticut.

- In 2023, Altria Group, Inc. disclosed its fourth-quarter and full-year business outcomes for 2023 and outlined its earnings projections for 2024. Billy Gifford, CEO of Altria, highlighted the year’s milestones, noting advancements in their smoke-free product range and robust performance despite economic challenges. He reported a growth in adjusted diluted EPS of 2.3% and emphasized the company’s continued commitment to shareholder value through nearly $7.8 billion in dividends and share buybacks.

- In 2024, Turning Point Brands, Inc., known for its portfolio of consumer products including alternative smoking accessories, reported its financial achievements for the second quarter, concluding on June 30, 2024.

Report Scope

Report Features Description Market Value (2023) US$ 3.2 Bn Forecast Revenue (2033) US$ 5.3 Bn CAGR (2023-2032) 5.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Loose, Portion Snus), By Flavor (Original/Unflavored, Flavored), Distribution Channel (Tobacco Stores, Convenience Stores, Online, Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC, Latin America: Brazil, Mexico, and Rest of Latin America, Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa Competitive Landscape Swedish Match AB, British American Tobacco, Imperial Brands, US Smokeless Tobacco Co., Inc., Philip Morris International, Swisher, Mac Baren Tobacco Company A/S, Nordic Snus, Ministry of Snus, Northerner Scandinavia Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- British American Tobacco PLC

- Dacapo Silver

- Swedish Match

- AG Snus

- Altria Group Inc.

- GN Tobacco

- Burger Söhne Sweden AB

- Fiedler & Lundgren AB

- Other Key Players