Global Smartwatch Market Size, Share and Analysis Report By Operating System (Wear OS, HarmonyOS, WatchOS, Proprietary / RTOS), By Display Technology (AMOLED, Micro-LED, TFT-LCD), By Connectivity (Bluetooth-only, Cellular (4G/LTE), 5G-enabled), By Application (Fitness and Wellness, Medical and Chronic-care, Personal Assistance and Payments, Other Applications), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 118336

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Operating System

- By Display Technology

- By Connectivity

- By Application

- By Geography

- Technology Enablement Analysis

- Emerging Trends

- Growth Factors

- Opportunity

- Challenge

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

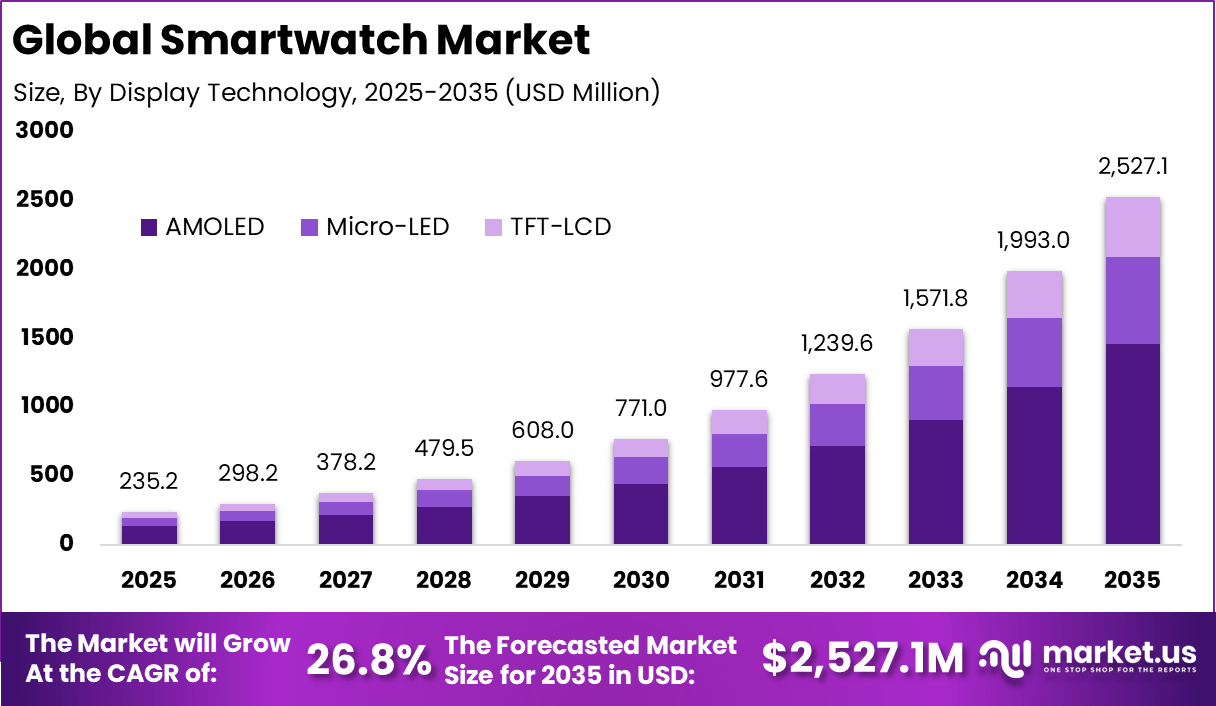

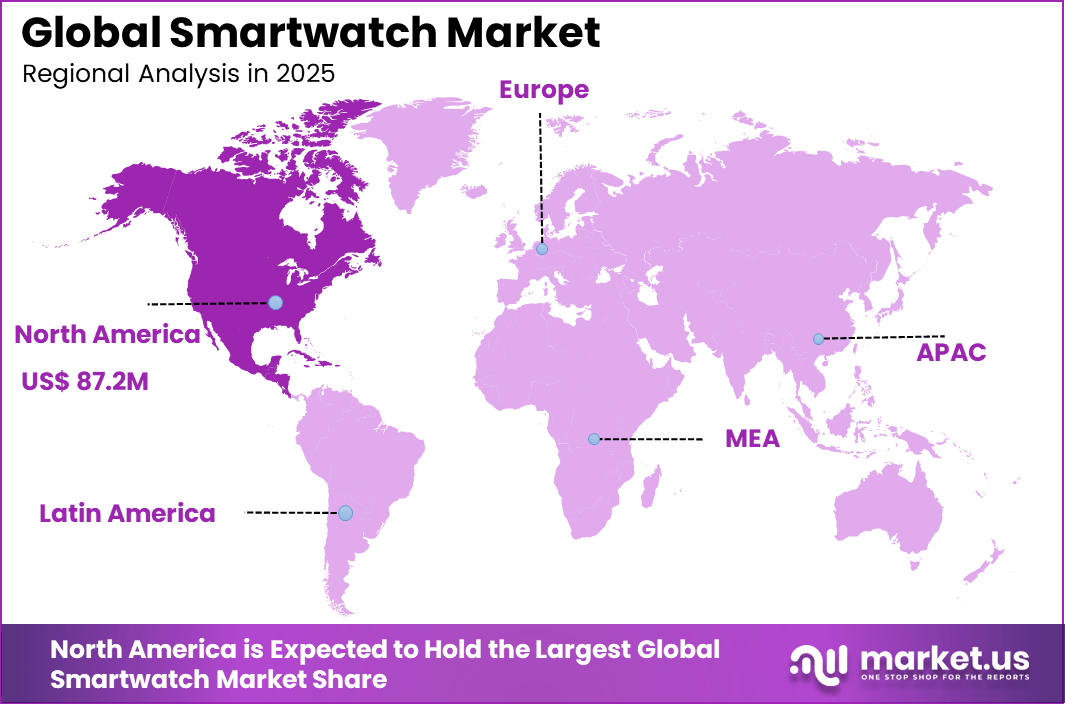

The Global Smartwatch Market size is expected to be worth around USD 2,527.1 Million By 2035, from USD 235.5 Million in 2025, growing at a CAGR of 26.8% during the forecast period from 2026 to 2035. North America held a dominan Market position, capturing more than a 37.1% share, holding USD 87.2 Million revenue.

The smartwatch market refers to wearable devices that integrate computing capabilities with timekeeping functions to support fitness tracking, notifications, health monitoring, and mobile connectivity. Smartwatches typically include sensors for heart rate, accelerometers, GPS, and interfaces for apps, messaging, and voice interaction. They are paired with smartphones or operate independently via cellular connectivity.

One major driving factor of the smartwatch market is the growing focus on health and fitness monitoring. Consumers increasingly use wearable devices to track steps, heart rate, calories burned, sleep quality, and stress levels. Smartwatches provide real time insights and personalized goals that support active lifestyles. This focus on self monitoring and wellbeing encourages adoption across age groups.

Demand for smartwatches is shaped by shifting consumer preferences toward wearable and connected devices. Modern lifestyles favor convenience and continuous access to information, which smartwatches deliver. Younger demographics and tech savvy professionals are particularly responsive to wearable innovations. This demographic alignment supports sustained demand.

Global smartwatch adoption is expanding steadily, with worldwide users expected to reach 454.6 Mn in 2025, up from 323.99 mn in 2023, according to ElectroIQ. Market leadership remains concentrated, with Apple holding a 28% share of global shipments in 2025, while Huawei accounts for 21% of the overall market. User behavior highlights a strong focus on health and convenience.

More than 92% of users rely on smartwatches for health and fitness monitoring, with fitness tracking representing 39% of total use cases. Around 30% of users make contactless payments through smartwatches, and over 60% consider battery life a key purchase factor. In the United States, smartwatch ownership has reached 25% of the adult population in 2025, indicating strong mainstream adoption.

Key Takeaways

- By operating system, watchOS held a dominant 52.3% share, supported by strong ecosystem integration, smooth user experience, and high brand loyalty among premium smartwatch users.

- By display technology, AMOLED led with a 57.7% revenue share in 2024, driven by demand for high contrast visuals, better power efficiency, and improved outdoor readability.

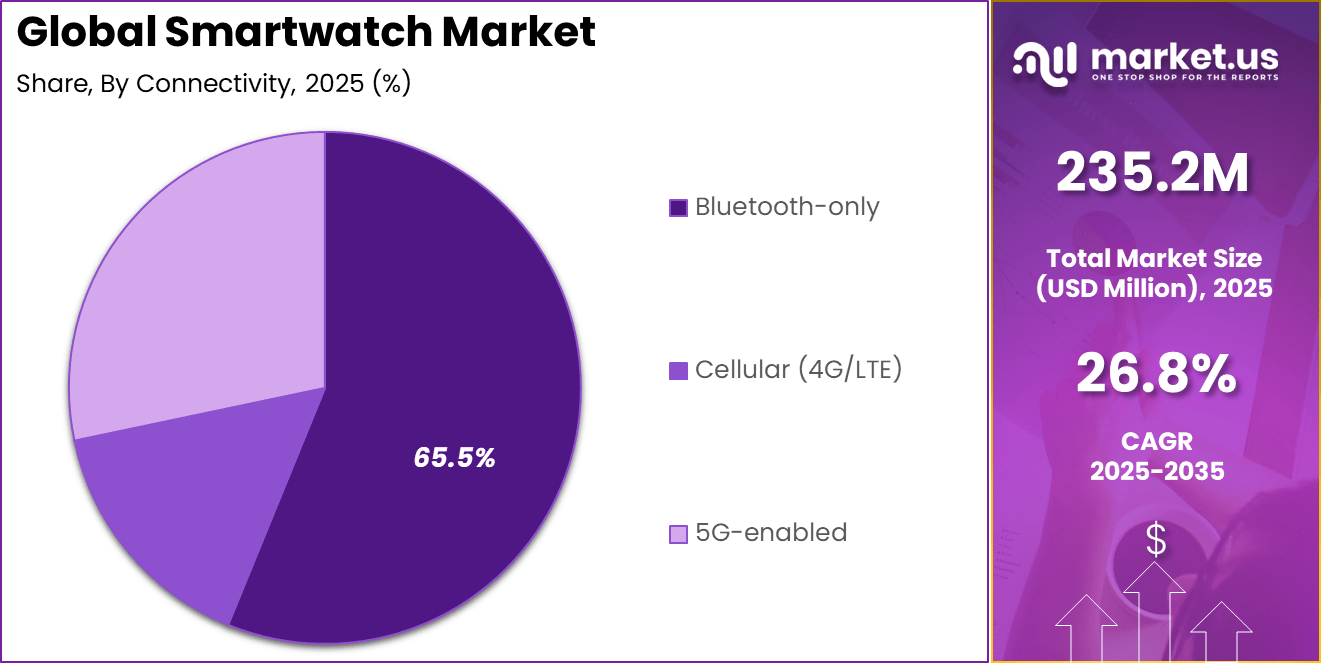

- By connectivity, Bluetooth only models commanded 65.5%, reflecting consumer preference for lower cost devices with longer battery life and seamless smartphone pairing.

- By application, fitness and wellness accounted for a 45.8% share, supported by rising health awareness and widespread use of activity tracking, heart rate monitoring, and sleep analysis features.

- By geography, North America held 37.1% share, backed by high smartwatch penetration, strong consumer spending, and early adoption of connected health technologies.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Rising health awareness Growing focus on daily fitness tracking ~6.4% Global Short Term Integration of health sensors Continuous monitoring of vital signs ~5.8% North America, Asia Pacific Short Term Smartphone ecosystem expansion Seamless device connectivity ~5.1% Global Mid Term Adoption of wearable payments Convenience driven feature usage ~4.6% North America, Europe Mid Term Lifestyle digitization Data driven personal wellness ~4.9% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Data privacy concerns Handling of sensitive health data ~5.2% North America, Europe Short Term Battery life limitations Constraints on continuous monitoring ~4.3% Global Short Term Device price sensitivity Affordability challenges ~3.7% Emerging Markets Mid Term Platform dependency Reliance on smartphone OS ecosystems ~3.1% Global Mid Term Rapid product obsolescence Frequent model upgrades ~2.6% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact Limited medical certification Restricted clinical use cases ~4.8% Global Mid Term Accuracy concerns Variability in sensor precision ~4.1% Global Mid Term Short replacement cycles Consumer fatigue ~3.3% Global Long Term Interoperability issues Limited cross platform compatibility ~2.7% Global Long Term After sales service gaps Maintenance and repair challenges ~2.1% Emerging Markets Long Term By Operating System

WatchOS held a 52.3% share, making it the leading operating system in the smartwatch market. The platform is known for its stable performance and smooth user experience. Strong integration with smartphones improves functionality and usability. Users benefit from consistent updates and security features. This strengthens user trust and long-term adoption.

The dominance of WatchOS is driven by ecosystem alignment. Seamless connectivity with other devices improves daily usage. Application availability supports diverse use cases. Reliability remains a key factor for consumers. This sustains its leading position.

By Display Technology

AMOLED displays accounted for 57.7% of revenue share, reflecting strong consumer preference. This display technology offers high contrast and vibrant colors. Power efficiency improves battery performance. Clear visibility supports outdoor usage. These advantages enhance user satisfaction.

Adoption of AMOLED is driven by demand for premium visuals. Smartwatch users value display clarity. Manufacturers prefer AMOLED for design flexibility. Thin display profiles support modern designs. This keeps AMOLED widely adopted.

By Connectivity

Bluetooth-only models commanded 65.5%, highlighting their widespread use. These models rely on paired smartphones for connectivity. Lower power consumption improves battery life. Simpler hardware reduces device cost. This appeals to a broad consumer base.

The popularity of Bluetooth-only models is driven by affordability and convenience. Many users prefer smartphone-linked functionality. Reduced complexity improves reliability. These models suit daily fitness and notification use. This sustains strong demand.

By Application

Fitness and wellness applications accounted for 45.8%, making them the primary use case. Smartwatches track activity, heart rate, and sleep patterns. Health monitoring supports lifestyle management. Users rely on real-time feedback. Wellness features drive regular usage.

Growth in this segment is driven by health awareness. Consumers focus on preventive care. Wearable data supports personal fitness goals. Integration with mobile apps improves insights. This keeps fitness and wellness central.

Industry Vertical Primary Use Case Adoption Share (%) Adoption Maturity Fitness and wellness Activity and health monitoring 45.8% Advanced Lifestyle and fashion Smart notifications and personalization 22.4% Advanced Healthcare Preventive monitoring 16.3% Developing Sports and athletics Performance tracking 9.8% Developing Enterprise wellness Workforce health programs 5.7% Early By Geography

North America held 37.1%, reflecting strong smartwatch adoption. High consumer spending supports market growth. Digital health awareness remains high. Advanced retail infrastructure improves availability. The region remains influential.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Mn) Adoption Maturity North America Advanced fitness and health tracking adoption 37.1% USD 87.3 Mn Advanced Europe Preventive healthcare and wellness trends 28.4% USD 66.8 Mn Advanced Asia Pacific Large consumer base and smartphone penetration 24.6% USD 57.9 Mn Developing to Advanced Latin America Growing lifestyle wearables demand 5.6% USD 13.2 Mn Developing Middle East and Africa Early stage wearable adoption 4.3% USD 10.1 Mn Early Adoption in North America is driven by technology acceptance. Consumers value connected health devices. Fitness trends support smartwatch usage. Innovation drives replacement demand. This sustains regional leadership.

Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Optical heart rate sensors Continuous fitness monitoring ~6.1% Mature Motion tracking sensors Activity and workout analysis ~5.4% Mature Health analytics software Personalized wellness insights ~4.8% Growing Wireless connectivity Real time data synchronization ~4.2% Mature AI based health insights Predictive wellness trends ~3.6% Developing Emerging Trends

In the smartwatch market, one trend is the growing integration of health and wellness monitoring features. Smartwatches increasingly include sensors that track heart rate, sleep patterns, blood oxygen levels, and stress indicators. Users and organisations seeking better insight into personal wellbeing are adopting devices that provide this health data efficiently throughout daily routines.

Another trend is the expansion of connectivity and communication functions. Modern smartwatches are enabling standalone voice calls, messaging, and notifications without requiring constant connection to a smartphone. This allows users to remain reachable while engaged in activities where a phone may be impractical, such as exercise or work environments.

Growth Factors

A key growth factor in the smartwatch market is the increasing consumer interest in wearable technology for lifestyle support. Individuals value convenience, activity tracking, and the ability to receive information at a glance. Smartwatches meet these preferences by delivering timely data and reminders directly on the wrist, which supports widespread adoption.

Another factor supporting growth is the integration of smartwatch platforms with broader digital ecosystems. Smartwatches that link with health apps, calendars, navigation tools, and smart home interfaces provide unified user experiences. The ability to synchronise across devices and services encourages users to remain engaged and derive broader value from wearable investments.

Opportunity

An opportunity exists in the development of specialised versions for niche segments such as older adults, children, outdoor sports enthusiasts, or clinical health monitoring. Devices designed with specific needs, comfort preferences, and feature sets can attract targeted user groups who may not be fully served by general purpose models.

Another opportunity lies in enhancing interoperability with healthcare and wellness systems. Smartwatches that can securely share relevant metrics with medical providers or wellness programmes may support preventive care, long-term patient monitoring, and personalised guidance. This integration can reinforce the role of wearables in broader health ecosystems.

Challenge

One challenge for the smartwatch market is ensuring ongoing relevance in the face of rapid technological change. As features evolve quickly, manufacturers must balance innovation with long-term support for existing users. Frequent updates and clear upgrade paths help maintain loyalty without forcing premature device replacement.

Another challenge involves achieving meaningful accuracy and consistency in sensor data. User trust in health and activity metrics hinges on the reliability of sensor readings across diverse conditions and populations. Continuous improvement in calibration, validation, and adaptive algorithms is essential to deliver dependable insights.

Key Market Segments

By Operating System

- WatchOS

- Wear OS

- HarmonyOS

- Proprietary / RTOS

By Display Technology

- AMOLED

- Micro-LED

- TFT-LCD

By Connectivity

- Bluetooth-only

- Cellular (4G/LTE)

- 5G-enabled

By Application

- Fitness and Wellness

- Medical and Chronic-care

- Personal Assistance and Payments

- Other Applications

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Smartwatch Market is led by global consumer electronics companies with strong brand presence and integrated ecosystems. Apple Inc. dominates through deep integration with smartphones, health tracking, and software services. Samsung Electronics Co. Ltd. and Google LLC focus on Android-based platforms and wearable software innovation. Huawei Technologies Co. Ltd. and Xiaomi Corporation compete through feature-rich devices at competitive pricing.

Lifestyle and fitness-focused brands strengthen product diversity in the market. Garmin Ltd. emphasizes fitness, outdoor, and sports performance tracking. Fossil Group Inc. targets design-driven smartwatches that blend style and technology. Sony Corporation focuses on sensor accuracy and hardware reliability. OnePlus Technology Co. Ltd. positions itself around seamless ecosystem integration and premium user experience.

Emerging and niche players contribute to innovation and affordability. Mobvoi Inc. supports AI-enabled wearables with voice and health features. Amazfit is recognized for long battery life and value-focused devices. Other key players continue to enter the market with specialized health sensors and localized offerings. This competitive environment supports rapid product innovation.

Top Market Leaders

- Apple Inc.

- Google LLC

- Samsung Electronics Co. Ltd.

- Huawei Technologies Co. Ltd.

- Xiaomi Corporation

- Fossil Group Inc.

- Garmin Ltd.

- Sony Corporation

- OnePlus Technology Co. Ltd.

- Mobvoi Inc.

- Amazfit

- Other Key Players

Recent Developments

- September, 2025: Apple rolled out the Apple Watch Ultra 3 with satellite communications for off-grid safety, a bigger display, and 42-hour battery life, alongside the Apple Watch Series 11 introducing sleep scores and watchOS 26.

- August, 2025: Google expanded Pixel Watch capabilities through a partnership with Skylo for satellite connectivity. This allows SOS messaging without cellular service on the Pixel Watch 4. The Qualcomm W5 chip powers standalone features like calls and texts.

Report Scope

Report Features Description Market Value (2025) USD 235.2 Mn Forecast Revenue (2035) USD 2,527.1 Mn CAGR(2026-2035) 26.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Operating System (Wear OS, HarmonyOS, WatchOS, Proprietary / RTOS), By Display Technology (AMOLED, Micro-LED, TFT-LCD), By Connectivity (Bluetooth-only, Cellular (4G/LTE), 5G-enabled), By Application (Fitness and Wellness, Medical and Chronic-care, Personal Assistance and Payments, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., Google LLC, Samsung Electronics Co. Ltd., Huawei Technologies Co. Ltd., Xiaomi Corporation, Fossil Group Inc., Garmin Ltd., Sony Corporation, OnePlus Technology Co. Ltd., Mobvoi Inc., Amazfit, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Apple Inc.

- Google LLC

- Samsung Electronics Co. Ltd.

- Huawei Technologies Co. Ltd.

- Xiaomi Corporation

- Fossil Group Inc.

- Garmin Ltd.

- Sony Corporation

- OnePlus Technology Co. Ltd.

- Mobvoi Inc.

- Amazfit

- Suunto Oy

- Other Key Players