Global Smartphone Market Report By Operating System (Android, iOS, Others), By Distribution Channel (OEMs Store, Retailers, E-Commerce), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 26287

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Smartphone Market size is expected to be worth around USD 939.2 Billion by 2033, from USD 539.5 Billion in 2023, growing at a CAGR of 5.7% during the forecast period from 2024 to 2033.

A smartphone is a mobile device that combines traditional phone features with advanced computing capabilities. It allows users to make calls, send messages, and access the internet. Smartphones also support apps for various functions like navigation, entertainment, banking, and productivity.

The smartphone market refers to the global industry involving the production, distribution, and sales of smartphones. It includes different players like manufacturers, suppliers, and technology providers. The industry is highly competitive, driven by innovation and consumer demand for better technology, features, and designs.

The global smartphone market remains a dynamic and fast-evolving sector. As of 2024, there are approximately 4.88 billion smartphone users, accounting for 60.42% of the global population as per Grabon. This figure shows steady growth, with an annual expansion rate of 14.9% compared to 2023.

The market’s growth is fueled by advancements in technology, consumer demand for connectivity, and the increasing penetration of smartphones in developing regions. 5G adoption is expected to accelerate, with Newzoo predicting that 45% of the 5.3 billion active smartphones in 2024 will be 5G-ready, up from the current 15%.

Smartphone demand is heavily driven by technological advancements, such as AI integration, 5G services, and foldable display technologies. Flagship models and foldable smartphones are gaining traction, particularly those from leading players like Samsung.

In Q1 2024, Samsung reported sales of over 60 million smartphones, solidifying its dominant market share. Their flagship models, including the Galaxy S24 Ultra and foldable versions like the Galaxy Z Flip 6 and Z Fold 6, showcase the company’s focus on AI capabilities and innovative display technology. The success of these models highlights a trend towards durability and functionality, which is increasingly important to consumers.

Despite Samsung’s dominance, competition remains fierce. Xiaomi, for instance, experienced a 27.4% increase in shipments during the same period, indicating a competitive landscape that pushes brands to innovate continuously. This competitiveness is pivotal in driving market development and encouraging players to invest in new technologies and customer experience improvements.

The smartphone market is characterized by high competitiveness, as established players like Samsung, Apple, and Xiaomi battle for market share. Smaller brands and new entrants also contribute to this competitive environment, especially in regions with high growth potential. This competition benefits consumers by providing them with a wider range of choices and more advanced technologies at varying price points.

On a broader scale, the proliferation of smartphones impacts the digital economy significantly. It drives mobile commerce, entertainment, and social media usage, reshaping industries and consumer behavior. Locally, smartphones have enabled connectivity in remote and underserved areas, improving access to education, healthcare, and financial services, particularly in developing regions.

Key Takeaways

- The Smartphone Market was valued at USD 539.5 Billion in 2023 and is projected to reach USD 939.2 Billion by 2033, with a CAGR of 5.7%.

- In 2023, Android dominated the operating system segment with 63.4%, driven by its affordability and widespread adoption across regions.

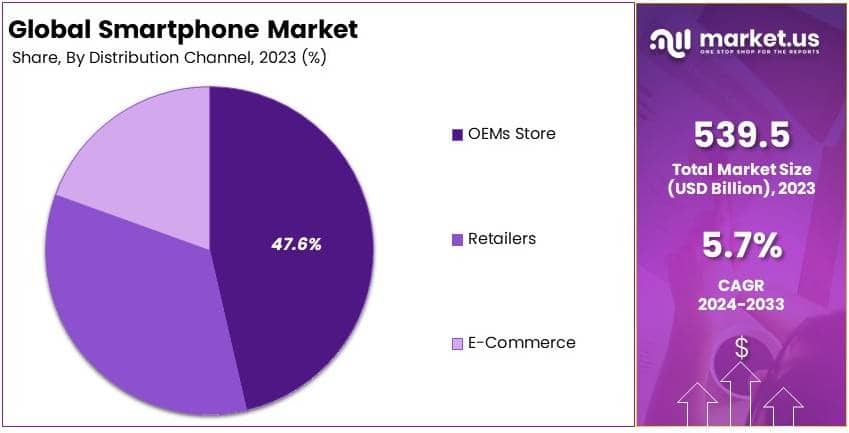

- In 2023, OEMs Store led the distribution channel segment with 47.6%, owing to the trust and support services provided by manufacturers.

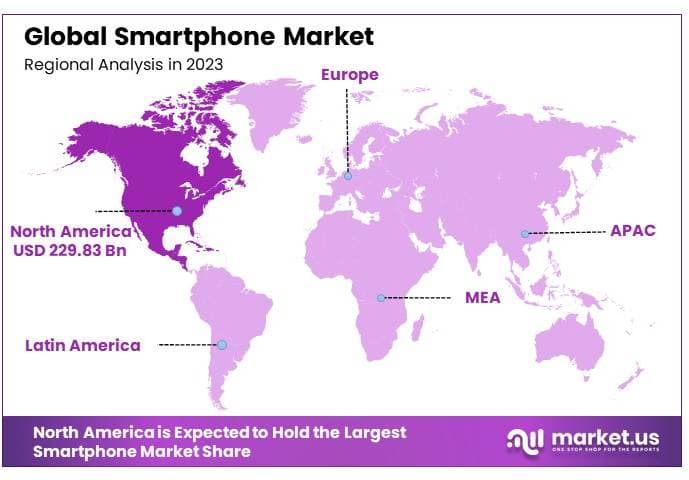

- In 2023, North America held the dominant market share at 42.6%, valued at USD 229.83 Billion, due to high penetration of premium smartphone brands.

Operating System Analysis

Android dominates with 63.4% due to its open-source platform and wide manufacturer support.

The smartphone market is primarily segmented based on the operating system (OS), with Android, iOS, and others forming the main categories. Android leads this segment significantly, holding a 63.4% market share, largely due to its open-source nature and the flexibility it offers to both manufacturers and developers.

Android’s dominance is supported by a wide range of device manufacturers from Samsung to Huawei, offering a variety of devices across all price points, which appeals to a broad consumer base globally.

The success of Android can be attributed to its customization options, which allow manufacturers to tailor devices to specific market needs and preferences. Additionally, Android’s compatibility with a wide range of hardware and its extensive app ecosystem, bolstered by Google Play Store, contribute to its leading position.

iOS, while holding a smaller share of the market, targets premium consumers with its high-quality hardware, seamless software integration, and strong security features. The iOS platform benefits from a strong brand loyalty seen with Apple users, which ensures a consistent market share. This segment thrives on innovation and a high customer satisfaction rate, driving repeat purchases among existing Apple users.

Other operating systems, including those developed by smaller tech companies or for specific regional markets, hold a niche segment. While they represent a minor portion of the market, these alternatives benefit from targeting specific user needs that are unmet by the two leading platforms, such as increased privacy or low-cost options.

While Android continues to expand its reach, iOS’s focus on high-end segments suggests a stable future growth potential, especially in developed markets where spending power is higher. The other OS segment may see growth in emerging markets where cost-effectiveness is crucial.

Distribution Channel Analysis

OEMs Store dominates with 47.6% due to direct customer relations and brand loyalty.

In the smartphone market, distribution channels are key to reaching consumers, segmented into OEMs store, retailers, and e-commerce. The OEMs (Original Equipment Manufacturers) store segment, including dedicated brand shops and official online stores, holds the largest share with 47.6%.

This dominance is driven by consumer preferences for purchasing directly from the manufacturer, which often ensures authenticity, better customer service, and direct access to brand-specific promotions or warranties.

OEM stores are particularly effective for establishing brand loyalty and delivering a comprehensive brand experience, including after-sales support and first access to new releases, which are significant factors in consumer decision-making. This channel’s control over the customer experience helps in maintaining a strong brand image and customer satisfaction.

Retailers, both in physical and online forms, provide consumers with the opportunity to compare different brands and products in one place, offering convenience and competitive pricing. This segment remains vital due to its accessibility and the ability to cater to immediate purchase needs.

E-commerce platforms have seen rapid growth and is poised to continue expanding, driven by the increasing comfort of consumers with online shopping and the convenience it offers. Online platforms frequently provide competitive pricing, extensive reviews, and easy comparison shopping, which are highly valued by today’s consumers.

While OEM stores currently lead the distribution channel in market share, the growth of e-commerce represents a significant shift in consumer buying patterns, potentially reshaping future sales strategies for smartphone manufacturers. Retailers are also adapting to this changing landscape by integrating online and offline experiences to maintain their market relevance.

Key Market Segments

By Operating System

- Android

- iOS

- Others

By Distribution Channel

- OEMs Store

- Retailers

- E-Commerce

Drivers

AI and AR Enhance User Experience Drives Market Growth

The smartphone Market is propelled by several driving factors that significantly contribute to its expansion. Enhanced user experience through artificial intelligence (AI) and machine learning is a primary driver. AI enables smartphones to offer personalized services, improve camera functionalities, and optimize device performance, making them more appealing to consumers.

Additionally, the increasing integration of augmented reality (AR) features into smartphones provides immersive experiences for gaming, shopping, and navigation. AR technology not only enhances user engagement but also opens up new application avenues, driving demand for advanced smartphones.

Another key factor is the growing demand for dual-SIM and multi-functional devices. Consumers are seeking smartphones that can handle multiple tasks efficiently, such as managing personal and professional communications on a single device.

Furthermore, the expansion of mobile health and fitness applications is boosting the market. With more individuals focusing on health and wellness, smartphones equipped with health monitoring features and fitness apps are in high demand.

Restraints

Data Privacy and Supply Chain Issues Restrain Market Growth

Despite robust growth drivers, the smartphone Market faces several restraining factors that hinder its expansion. One significant restraint is the increasing concerns over data privacy and security. As smartphones become central to personal and professional activities, the risk of data breaches and cyber-attacks rises.

Consumers are becoming more cautious about the information they store and share on their devices, leading to hesitancy in adopting new technologies that may compromise their privacy. This concern can slow down the adoption of advanced smartphone features that require extensive data access and processing.

Additionally, supply chain disruptions due to geopolitical tensions pose a major challenge. Trade wars, tariffs, and political instability in key manufacturing regions can lead to delays and increased costs in smartphone production. These disruptions not only affect the availability of components but also escalate the overall cost of smartphones, making them less affordable for consumers.

Another restraining factor is the limited availability of a skilled workforce in technology. The rapid pace of innovation in the smartphone industry demands a highly skilled workforce, and shortages in this area can impede product development and technological advancements.

Opportunity

Sustainable Innovations and Remote Work Expand Market Opportunities

The smartphone Market is ripe with growth opportunities driven by various strategic factors. One significant opportunity lies in the development of sustainable and eco-friendly smartphones. As environmental concerns become more prominent, consumers are increasingly seeking devices that are manufactured using sustainable practices and recyclable materials.

Manufacturers that prioritize eco-friendly designs and reduce their carbon footprint can tap into this growing market segment, enhancing their brand reputation and attracting environmentally conscious consumers. Another promising opportunity is the expansion of smartphone use in education and remote work.

This trend is likely to continue, creating a sustained demand for smartphones with enhanced productivity features and robust connectivity options. Additionally, the growth of subscription-based smartphone services presents a lucrative avenue for manufacturers and service providers.

Furthermore, leveraging blockchain technology for enhanced security features offers a unique opportunity. Blockchain can provide secure and transparent methods for data management and transactions, addressing growing concerns over data privacy and security.

Challenges

Technological Shifts and Regulatory Hurdles Challenge Market Growth

The smartphone Market encounters several challenging factors that complicate its growth trajectory. Managing rapid technological changes is a primary challenge, as the industry is characterized by constant innovation and the introduction of new features. Manufacturers must continually invest in research and development to keep up with the latest advancements, which can be costly and resource-intensive.

This rapid pace of change can also lead to shorter product lifecycles, forcing companies to frequently update their offerings to stay competitive. Balancing innovation with cost efficiency presents another significant challenge. While consumers demand the latest technology and features, manufacturers must also manage production costs to maintain profitability.

This balance is particularly difficult in price-sensitive markets where consumers may prefer more affordable smartphones over high-end models with advanced features. Additionally, navigating complex regulatory environments poses a hurdle for smartphone manufacturers.

Addressing consumer demand for longer battery life is also a pressing challenge. As smartphones become more integral to daily life, the need for devices that can last longer on a single charge is growing. Developing batteries that are both high-capacity and durable without significantly increasing costs remains a technological challenge.

Growth Factors

Connectivity and Content Drive Smartphone Market Growth

The smartphone Market is experiencing robust growth fueled by several key growth factors. Enhanced connectivity through Wi-Fi 6 and beyond is a major driver, providing faster and more reliable internet connections.

As Wi-Fi 6 becomes more widespread, the demand for compatible smartphones increases, driving market growth. Rising demand for high-resolution displays is another significant growth factor. Consumers are seeking smartphones with superior display quality for better visual experiences in media consumption, gaming, and professional applications.

High-resolution screens with vibrant colors and higher refresh rates enhance user satisfaction and differentiate premium smartphones from standard models. Additionally, the growth in mobile content consumption is propelling the market forward.

This trend drives the need for more advanced and capable smartphones that can handle diverse and intensive applications. Furthermore, increasing investment in smartphone startups and innovation hubs is fostering technological advancements and market expansion. These investments support the development of new technologies, features, and services that enhance smartphone functionality and appeal.

Emerging Trends

Biometric and Modular Designs Are Latest Trending Factors

The integration of biometric authentication technologies is a prominent trend, enhancing security and user convenience. Features such as fingerprint scanners, facial recognition, and iris scanning provide robust security measures, protecting user data and personal information.

These technologies not only improve the user experience by enabling quick and secure access to devices but also build consumer trust in smartphone security. Another significant trend is the increasing popularity of edge computing in smartphones. Edge computing allows data processing to occur closer to the data source, reducing latency and improving performance.

This trend supports the development of more responsive and efficient applications, particularly for gaming, augmented reality (AR), and virtual reality (VR) experiences. By leveraging edge computing, smartphones can deliver faster and more reliable performance, meeting the demands of modern applications and services.

The adoption of modular smartphone designs is also gaining traction. Modular smartphones allow users to easily upgrade or replace specific components, such as cameras, batteries, or processors, without needing to purchase an entirely new device. This trend appeals to consumers who seek flexibility and customization, as well as those who are environmentally conscious and prefer to extend the lifespan of their devices.

Regional Analysis

North America Dominates with 42.6% Market Share

North America leads the smartphone Market with a 42.6% market share, valued at USD 229.83 billion. This dominance is driven by high consumer spending on premium smartphones, extensive 5G infrastructure, and strong brand loyalty. The presence of major players like Apple and Google, along with constant technological innovations, fuels the region’s leadership.

North America’s advanced technological infrastructure and strong demand for high-performance smartphones drive the market. The region benefits from a culture of early adoption, where consumers are keen on upgrading to the latest models. Additionally, the rapid expansion of mobile payment systems and integrated AI features enhances the value proposition of smartphones in this market.

North America is likely to maintain its dominant position, as the adoption of 5G technology continues to rise. Further innovations in mobile services, gaming, and AI-driven applications are expected to fuel market growth, potentially increasing the region’s share even more.

Regional Mentions:

- Europe: Europe holds a strong position in the smartphone Market, with increasing demand for 5G-enabled devices and a focus on sustainability. The region’s regulatory framework promotes eco-friendly smartphone designs, which attract environmentally conscious consumers.

- Asia Pacific: Asia Pacific is experiencing rapid growth in the smartphone Market, driven by massive urbanization and industrial growth. China, India, and South Korea lead the region with high demand for affordable and premium smartphones.

- Middle East & Africa: The Middle East and Africa are emerging markets for smartphones, with growing mobile connectivity and increasing demand for low-cost devices. Investments in 5G infrastructure are also contributing to regional growth.

- Latin America: Latin America is seeing steady growth in the smartphone Market, fueled by expanding mobile internet access and rising consumer interest in mid-range smartphones.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The smartphone market is highly competitive, with both established and emerging companies offering a wide range of devices. The market is driven by the demand for high-performance smartphones with advanced features, such as 5G connectivity, AI capabilities, and improved cameras.

Key players offer a variety of smartphones targeting different customer segments, from high-end flagship models to budget-friendly devices. In addition to hardware, many companies provide software services, including operating systems, cloud storage, and apps.

Companies use different strategies to target various consumer groups. Premium brands focus on innovation, quality, and user experience. Budget-focused brands compete by offering feature-rich smartphones at lower prices. Some companies position themselves as leaders in 5G, AI, and eco-friendly technology.

Pricing in the smartphone market varies widely. Premium brands like Apple and Samsung maintain higher prices due to brand value and advanced features. In contrast, companies like Xiaomi and Oppo target price-sensitive customers by offering affordable smartphones without compromising on essential features.

Most key players have a global presence, with strong markets in North America, Europe, and Asia. Some companies, such as Huawei, are especially focused on expanding in emerging markets like Africa and Southeast Asia.

Innovation is a key driver in this market. Companies are heavily investing in 5G technology, foldable displays, AI, and camera enhancements. They are also working on sustainable manufacturing practices and longer battery life.

The competitive edge of leading companies lies in their technological innovation, strong brand reputation, and ability to meet diverse consumer needs. Their global distribution networks and continuous focus on new features ensure their leadership in the market.

Top Key Players in the Market

- Apple Inc.

- Samsung Group

- Guangdong Oppo Mobile Telecommunications Corp., Ltd.

- Huawei Device Co. Ltd.

- OnePlus Technology (Shenzhen) Co., Ltd.

- Sony Group Corporation

- Xiaomi Corporation

- HTC Corporation

- Google LLC

- Other Key Players

Recent Developments

- Lynk Global and Slam Corp: In February 2024, Lynk Global merged with Slam Corp., valuing the company at $800 million. The deal supports Lynk’s satellite constellation project for global smartphone connectivity, targeting completion by the second half of 2024.

- Yettel and Piceasoft: In October 2024, Yettel implemented Piceasoft’s PiceaOnline SDK, offering a smartphone diagnostics service to enhance customer self-service for device issues like battery health and connectivity.

- ABB and Sevensense: In January 2024, ABB acquired Sevensense to integrate AI-based 3D vision technology into its mobile robots, enhancing capabilities for logistics and manufacturing applications.

Report Scope

Report Features Description Market Value (2023) USD 539.5 Billion Forecast Revenue (2033) USD 939.2 Billion CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Operating System (Android, iOS, Others), By Distribution Channel (OEMs Store, Retailers, E-Commerce) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., Samsung Group, Guangdong Oppo Mobile Telecommunications Corp., Ltd, Huawei Device Co. Ltd, OnePlus Technology (Shenzhen) Co., Ltd., Sony Group Corporation, Xiaomi Corporation, HTC Corporation, Google LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Apple Inc.

- Samsung Group

- Guangdong Oppo Mobile Telecommunications Corp., Ltd

- Huawei Device Co. Ltd

- OnePlus Technology (Shenzhen) Co., Ltd.

- Sony Group Corporation

- Xiaomi Corporation

- HTC Corporation

- Google LLC

- Other Key Players