Global Smart Pill Boxes & Bottles Market Analysis By Product Type (Smart Pill Boxes, Smart Pill Bottles), By Disease Area (Dementia, Diabetes Care, Cancer Management, Geriatric Care, Other Chronic Diseases), By Component (Hardware, Software & Connectivity Components), By End-User Setting (Homecare, Assisted Living/Long-Term Care Facilities, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165325

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

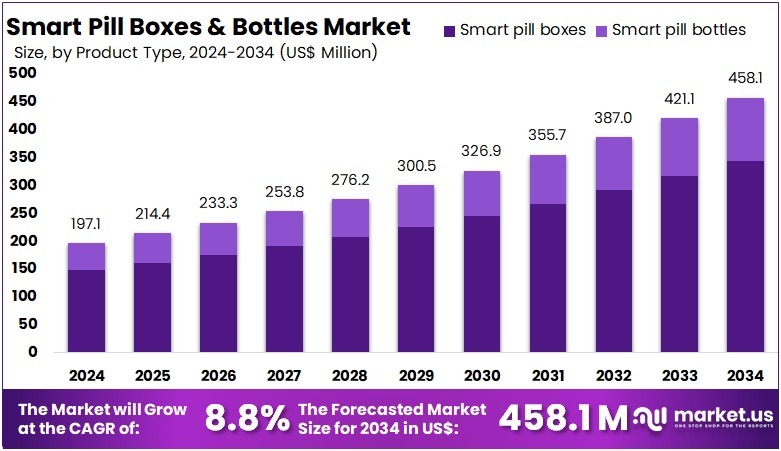

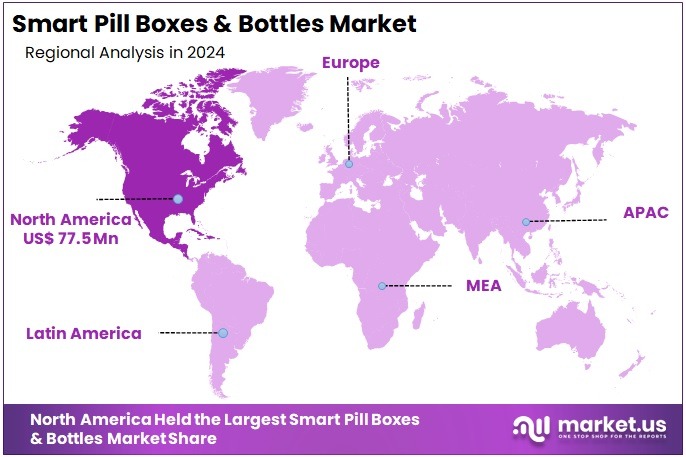

The Global Smart Pill Boxes & Bottles Market Size is expected to be worth around US$ 458.1 Million by 2034, from US$ 197.1 Million in 2024, growing at a CAGR of 8.8% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 39.3% share and reaching a market value of USD 77.5 million for the year.

Smart pill boxes and bottles represent a growing category of digital health tools designed to enhance medication adherence and safety. These intelligent devices combine sensors, Bluetooth connectivity, and mobile applications to help users manage medication schedules efficiently. They can alert patients through sound, light, or smartphone notifications and transmit adherence data to caregivers or clinicians. The market for these connected medication systems is expanding as healthcare increasingly shifts toward digital monitoring and remote patient management.

The rise in chronic diseases globally is one of the primary drivers of this market. Noncommunicable diseases such as heart disease, diabetes, cancer, and chronic respiratory illnesses now account for nearly 75% of all global deaths, according to the World Health Organization (WHO). This trend highlights a growing population requiring lifelong medication, creating sustained demand for devices that simplify daily dosing. Smart pill containers thus play a crucial role in ensuring consistent therapy for chronic patients, helping prevent complications and hospital readmissions.

Another major factor fueling demand is the rapid ageing of populations worldwide. Across OECD countries, the proportion of citizens aged 65 and older continues to rise and is expected to increase significantly by 2050. Ageing brings challenges such as multimorbidity and complex medication routines, where older adults may handle five or more prescriptions daily. Automated pill boxes with reminders and locking features offer essential support for this demographic, reducing risks associated with missed or incorrect doses and improving independence in daily medication routines.

Medication nonadherence remains one of healthcare’s most persistent challenges, leading to major clinical and economic costs. According to WHO, adherence to long-term therapies averages just 50% in developed regions and is even lower elsewhere. In the United States alone, nonadherence contributes to approximately 125,000 deaths each year and costs the healthcare system between USD 100–300 billion in avoidable spending. This scale of loss highlights the potential savings and patient benefits that connected medication devices can deliver by ensuring on-time, accurate dosing and enabling healthcare professionals to monitor patient behavior remotely.

Global policy efforts also support the adoption of smart adherence technologies. The WHO’s Medication Without Harm initiative aims to reduce severe, avoidable medication-related harm by 50%. A WHO policy brief further notes that nearly half of all preventable harm in healthcare is due to medication-related issues. In this context, smart pill boxes and bottles provide practical tools to reduce such harm by tracking dose timings, minimizing human error, and improving communication between patients, caregivers, and healthcare providers.

EHR Adoption, Connectivity, and Regulation Strengthen Market Growth

The global expansion of digital prescribing and electronic health systems is creating a strong foundation for connected medication management devices. As more healthcare operations move online, integration between pharmacies, clinicians, and patient apps becomes seamless. According to the Centers for Disease Control and Prevention (CDC), adoption of certified Electronic Health Record (EHR) systems among U.S. office-based physicians reached 77.8% in 2021, while overall EHR use rose to 88.2%. This high digital uptake allows smart pill boxes and bottles to connect directly with prescription records, improving adherence tracking and enabling automated refill alerts.

In addition to digital readiness, regulatory and reimbursement clarity has improved, encouraging healthcare providers to incorporate smart adherence solutions into care plans. For example, Medicare recognizes remote patient monitoring (RPM) as a reimbursable service when connected devices transmit patient data for ongoing management. Similarly, the U.S. Food and Drug Administration (FDA) has issued clear enforcement policies on non-invasive remote monitoring devices, helping manufacturers comply with safety standards. These policies ensure both patients and providers can adopt smart medication devices confidently under recognized clinical frameworks.

Prescription management trends also favor the growth of smart pill containers. In England, NHS data reports over one billion community-dispensed prescription items annually, with nearly all processed electronically. Digital repeat prescription orders through the NHS App have surged, reflecting a shift toward virtual pharmacy workflows. Smart pill boxes and bottles integrate well into this environment, helping users track doses, manage multiple medications, and receive refill notifications automatically. This functionality supports both patient convenience and system efficiency by reducing missed refills and medication waste.

Connectivity growth globally is further enabling the smart medication ecosystem. According to UN-affiliated telecommunications data, mobile broadband penetration has reached approximately 95 subscriptions per 100 inhabitants, while around two-thirds of the global population now uses the internet. Such digital access allows Bluetooth and cellular-enabled pill devices to work reliably across both developed and emerging markets. Moreover, studies by the National Center for Biotechnology Information (NCBI) show that medication-related errors contribute to 5%–41% of all hospital admissions and about 22% of readmissions after discharge. Among older adults aged 75+ and patients managing five or more drugs, the risk of medication-error-related admission rises by 30–40%. These findings underline the urgent need for smart medication systems that can safeguard patients and support healthcare efficiency.

The Smart Pill Boxes & Bottles Market is evolving at the intersection of technology, healthcare policy, and demographic transformation. The growing burden of chronic diseases, global ageing, widespread medication errors, and the expansion of remote patient monitoring collectively drive the adoption of connected adherence devices. Supported by strong digital infrastructure, regulatory clarity, and public-health initiatives, these smart medication tools are set to become indispensable components of future healthcare ecosystems worldwide.

Key Takeaways

- The Global Smart Pill Boxes & Bottles Market is projected to reach nearly USD 458.1 million by 2034, expanding at a CAGR of 8.8%.

- In 2024, Smart Pill Boxes dominated the Product Type segment, securing over 75.3% of the total market share.

- The Dementia segment accounted for a significant 45.2% share in the Disease Area category, maintaining its leading position in 2024.

- Hardware components captured more than 62.6% of the total market share in 2024, leading the Component segment of the market.

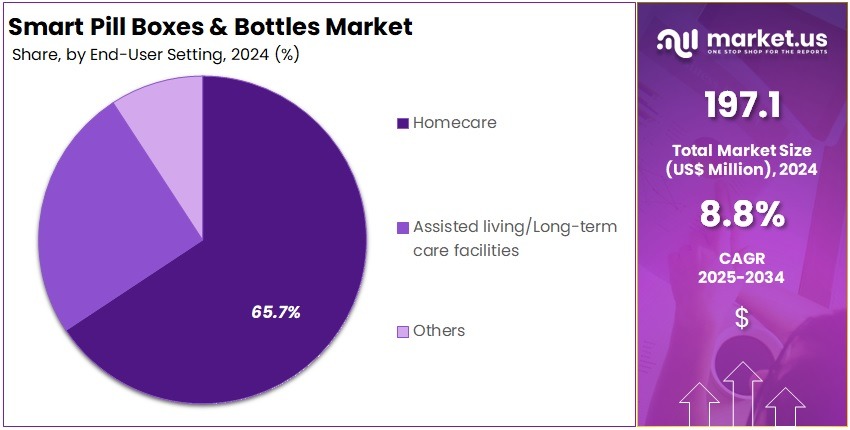

- Homecare settings represented the largest End-User segment in 2024, with a commanding 65.7% share of the global market.

- North America led the regional market in 2024, accounting for over 39.3% share, equivalent to approximately USD 77.5 million.

Product Type Analysis

In 2024, the Smart Pill Boxes section held a dominant market position in the Product Type Segment of the Smart Pill Boxes & Bottles Market and captured more than a 75.3% share. The segment’s growth was supported by advanced tracking features and user-friendly designs. It became highly preferred among elderly and chronic patients. Smart pill boxes include automated alerts, reminder systems, and real-time connectivity. These features have improved medication adherence and enhanced patient monitoring efficiency in home healthcare settings.

The rising demand for Bluetooth and Wi-Fi-enabled devices has strengthened this segment’s presence. Smart pill boxes can store multiple medications and monitor daily consumption patterns. They also send timely alerts to patients and caregivers. This helps in preventing missed doses and supports effective healthcare management. Increasing cases of lifestyle-related diseases and awareness of digital medication systems have further contributed to this segment’s steady expansion across global markets.

In contrast, the Smart Pill Bottles segment held a smaller market share but displayed gradual growth. These bottles are typically used for single-medication storage and feature basic reminder functions. Their low cost and portable nature make them suitable for short-term use. However, their limited storage capacity and fewer connectivity options have restricted adoption. The overall market is projected to expand with the integration of AI-based systems and IoT technologies, driving innovation in smart medication management solutions.

Disease Area Analysis

In 2024, the Dementia Section held a dominant market position in the Disease Area Segment of the Smart Pill Boxes & Bottles Market, and captured more than a 45.2% share. This dominance was mainly due to the rising number of dementia and Alzheimer’s patients across the globe. Increasing dependence on smart reminders and connected medication systems improved treatment adherence. These solutions enabled remote monitoring and timely alerts, which helped caregivers manage doses effectively. The segment benefited from advancements in digital health integration.

The Diabetes Care segment also accounted for a significant share. The growing cases of type 1 and type 2 diabetes increased the use of smart pill devices for managing daily medications. Patients benefited from features such as dose tracking, real-time alerts, and cloud-based health reports. These devices reduced the risk of missed or duplicate doses. Their adoption was supported by the rising demand for home-based healthcare and self-management tools in chronic conditions.

The Cancer Management and Geriatric Care segments showed steady growth. Cancer patients required precise multi-drug management, making digital adherence tools essential for treatment accuracy. The elderly population adopted these devices for reminders and simplified medication schedules. In addition, other chronic diseases such as cardiovascular and respiratory disorders boosted product use. Increasing awareness about medication adherence and IoT-enabled packaging supported overall market expansion. Continuous innovation in smart health monitoring is expected to sustain this upward trend.

Component Analysis

In 2024, the Hardware Section held a dominant market position in the Component Segment of the Smart Pill Boxes & Bottles Market and captured more than a 62.6% share. This dominance was supported by the growing use of sensors, microcontrollers, and automated dispensing mechanisms. These components improved dosage accuracy and real-time tracking. The use of energy-efficient designs and durable materials further strengthened market growth. The increasing adoption of connected medical devices with longer battery life also contributed significantly to the segment’s expansion.

The Hardware category consists mainly of microprocessors, sensors, wireless modules, and batteries. These elements are vital for ensuring accurate monitoring and seamless device performance. Their integration improves user convenience and system reliability. Experts observed that the shift toward compact device architecture and enhanced energy management systems has increased demand. Furthermore, advancements in manufacturing technologies have lowered costs, making hardware-driven smart pill systems more accessible across healthcare facilities and patient applications.

The Software and Connectivity segments are showing promising growth. The software segment benefits from the use of mobile applications and data analytics platforms that support remote health monitoring. Connectivity components such as Bluetooth, Wi-Fi, and cellular networks enable data synchronization between devices and healthcare systems. This interconnection improves treatment compliance and patient engagement. Industry experts predict that the combined role of software and connectivity will enhance smart medication management and drive future innovation in the market.

End-User Setting Analysis

In 2024, the Homecare Section held a dominant market position in the End-User Setting Segment of the Smart Pill Boxes & Bottles Market, and captured more than a 65.7% share. The rise in chronic diseases and the growing elderly population have increased the demand for smart medication devices at home. These devices are simple to use and improve medication adherence. Their smartphone connectivity and real-time alerts enable users and caregivers to monitor schedules effectively, supporting better treatment compliance and patient safety.

Analysts observed that home-based solutions gained preference due to convenience and affordability. Many patients now choose homecare devices over facility-based care, as they reduce hospital visits and costs. Caregivers also find them efficient for remote tracking of medicine intake. This shift toward self-managed health routines has accelerated product adoption. Increasing digital health awareness and supportive government initiatives have also strengthened the overall growth of the homecare segment globally.

The Assisted Living and Long-Term Care Facilities segment is projected to grow steadily during the forecast period. Rising numbers of elderly residents and the need to prevent medication errors are key growth factors. Smart dispensing systems support nursing staff by automating dosage and keeping electronic medication records. This improves workflow and ensures accurate administration. Other settings, including hospitals and community centers, are adopting such technologies gradually. Their focus on digital transformation and patient monitoring is expected to drive moderate but consistent growth across this category.

Key Market Segments

By Product Type

- Smart Pill Boxes

- Smart Pill Bottles

By Disease Area

- Dementia

- Diabetes Care

- Cancer Management

- Geriatric Care

- Other Chronic Diseases

By Component

- Hardware

- Software & Connectivity Components

By End-User Setting

- Homecare

- Assisted Living/Long-Term Care Facilities

- Others

Drivers

Measurable Clinical Need for Better Medication Adherence

A major driver for the Smart Pill Boxes & Bottles Market is the measurable clinical need to improve medication adherence among patients with chronic conditions. Nonadherence continues to be one of the biggest barriers to effective disease management, leading to poor health outcomes and higher healthcare costs. Smart pill devices offer a technology-driven approach that enhances patient compliance through reminders, real-time tracking, and caregiver alerts. These capabilities address a persistent gap in medication-taking behavior that traditional interventions have failed to resolve.

Medication adherence rates remain alarmingly low despite decades of clinical focus. According to the World Health Organization (WHO), adherence among patients with chronic diseases averages only about 50% in developed countries. This means that half of all prescribed therapies are not taken as directed, resulting in worsened disease progression and hospital readmissions. Such statistics underline the urgency for digital adherence solutions that can simplify dosing schedules and ensure timely intake, which smart pill boxes effectively deliver.

For instance, a comprehensive analysis by McKinsey & Company revealed that across therapeutic categories, between 26% and 63% of patients fail to follow their prescribed treatment regimen. Moreover, fewer than 50% of patients continue therapy one year after initiation. These figures highlight the challenge of sustaining long-term adherence. Smart pill bottles, which provide data-driven monitoring and behavioral feedback, directly respond to this gap by promoting consistent medication usage and improving clinical outcomes.

The issue extends beyond developed regions. A study by BioMed Central reported that in Pakistan, only 36.6% of patients on antihypertensive therapy adhered to their prescribed medications, based on pill-count evaluations. Similarly, the Pan American Health Organization (PAHO) reaffirmed that poor adherence remains a global problem, even in structured health systems. These insights collectively emphasize the strong, measurable clinical demand for adherence-support technologies like smart pill boxes and bottles, positioning them as essential tools in modern healthcare delivery.

Restraints

Cost and Digital Equity Barriers Limit Adoption of Smart Pill Boxes & Bottles

High costs and limited digital equity remain major barriers to the adoption of smart pill boxes and bottles. These connected adherence tools often require smartphones, internet access, or paid subscriptions—costs that many older or low-income patients cannot afford. As medication nonadherence due to financial constraints persists, these added expenses can further exclude those who need adherence support the most. This financial gap challenges widespread deployment and limits the potential impact of smart medication management technologies.

According to the U.S. Centers for Disease Control and Prevention (CDC), over 9 million adults reported not taking medications as prescribed because of cost. Out-of-pocket prescription spending increased sharply during the pandemic, worsening this issue. Such cost-related nonadherence highlights that affordability remains a major determinant of health technology uptake. When patients cannot afford their basic medications, investment in digital adherence tools like smart pill boxes becomes unrealistic, particularly among those on fixed or low incomes.

A 2022 national survey published in JAMA Network found that nearly 18% of older U.S. adults skipped, delayed, or failed to fill medications due to cost. This indicates that affordability challenges remain widespread among seniors—one of the core target groups for smart pill boxes. When combined with technology-related costs such as data plans or device upgrades, the affordability gap widens. These realities show that even as innovation advances, economic disparities continue to restrict digital health adoption in medication adherence management.

On the digital-access front, a study by BioMed Central showed that between 2017 and 2020, about 23% of U.S. adults aged 65 and above had no access to electronic devices. Furthermore, 57–64% did not use digital tools for health communication. Similarly, a PubMed study in Saudi Arabia found that older adults—especially women, rural residents, and those with lower education—faced personal and technical barriers to smartphone use. These findings reinforce that cost, device access, and digital literacy collectively restrain the smart pill box market’s equitable growth.

Opportunities

Clinical Evidence Supports Smart Pill Boxes and Bottles for Improved Medication Adherence

The growing body of clinical evidence demonstrates that smart pill boxes and bottles can significantly enhance medication adherence, presenting a major opportunity for their wider integration in healthcare. These devices offer real-time reminders, electronic tracking, and adherence monitoring, which are crucial for managing chronic diseases. Improved adherence translates directly into better treatment outcomes and reduced hospital readmissions. As health systems move toward value-based care models, smart medication management solutions are increasingly seen as cost-saving tools that support both patients and payers.

According to recent clinical trials, smart pill bottles not only improve self-reported adherence but also show measurable changes in objective adherence data. For instance, a randomized study among breast-cancer survivors found that patients using a smart bottle with a mobile app showed a statistically significant improvement in medication adherence (P = .004) compared to the control group. This underscores their potential in improving compliance in long-term therapies where adherence often declines over time.

In another study involving 160 atrial-fibrillation patients, smart pill bottles tracked adherence over six months and recorded an average adherence rate of 90.0%. When adjusted for provider and patient feedback, this rate rose to 93.6%. Such consistency in medication-taking behavior demonstrates how digital adherence tools can strengthen therapeutic effectiveness and reduce disease complications, aligning with the goals of remote patient monitoring and pharmacist-led care management initiatives.

Furthermore, a pilot randomized trial among HIV patients reported notable biochemical improvements tied to smart bottle usage. The study found median TFV-DP levels increased by +252 fmol/punch in the intervention group versus –41 fmol/punch in the control. This biological correlation provides robust evidence that smart pill devices can deliver clinically meaningful outcomes, not just behavioral changes. These findings strengthen the opportunity for integrating smart dispensers into reimbursement frameworks and chronic disease programs across healthcare systems.

Trends

Integration of Smart Pill Boxes & Bottles into Remote Patient Monitoring and Digital-Medicine Pathways

The integration of smart pill boxes and bottles into remote patient monitoring (RPM) systems is becoming a defining trend in digital healthcare. These connected adherence devices are evolving from standalone medication reminders into components of broader digital-medicine pathways. Healthcare providers are increasingly embedding them within chronic care and telehealth models to ensure real-time medication tracking and improved patient outcomes. This shift reflects a growing alignment between digital health infrastructure, clinical workflows, and reimbursement mechanisms that recognize RPM as a standard element of care delivery.

This transformation is being supported by strong policy momentum. Regulatory and clinical frameworks now increasingly treat RPM as part of routine care, driven by U.S. Department of Health and Human Services (HHS) and telehealth policy updates. These frameworks enable reimbursement and clinical integration of connected adherence tools such as smart bottles that sync with patient dashboards. The trend highlights how health systems are expanding digital pathways for continuous data exchange between patients, providers, and payers, strengthening adoption across chronic disease management programs.

According to a U.S. survey of healthcare providers, approximately 81% of clinicians reported using RPM tools in 2023, a sharp rise from around 20% in 2021 — marking a nearly 305% increase in two years. Moreover, 84% of those clinicians plan to expand usage further in 2024. This surge in RPM utilization underlines the rising demand for connected medication management technologies that seamlessly integrate into telehealth platforms and electronic health records, positioning smart pill boxes and bottles as essential tools for modern care delivery.

For instance, a “2025 Landscape Report” estimates that over 71 million Americans, or about 26% of the U.S. population, will use RPM services by 2025. Adoption spans multiple specialties, including internal medicine (29%), cardiology (21%), and family practice (19%). Supporting this integration, a PubMed study found a smart pill bottle prototype achieved 88% dispense adherence and a high usability score (79.3/100). Such clinical evidence, combined with regulatory precedents like the FDA-cleared Abilify MyCite ingestible sensor system, is accelerating pharma–digital collaborations and solidifying smart adherence devices within connected care ecosystems.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 39.3% share and reaching a market value of USD 77.5 million for the year. The region’s leadership is driven by high medicine usage, rapid population aging, and policy emphasis on adherence improvement. According to a U.S. health survey, around 60% of adults reported taking at least one prescription in 2021, while over one-third took three or more. This extensive user base has created ongoing demand for smart pill boxes and bottles that enhance medication management and adherence monitoring.

Rising out-of-pocket costs for prescription drugs have further reinforced the adoption of these devices. Study findings show that increasing drug expenses have been linked to skipped doses or delayed refills, behaviors that smart adherence tools help prevent. The growing elderly population also supports market growth. For instance, in 2024, about 61.2 million Americans were aged 65 and above, marking a 3.1% year-over-year rise. These adults often manage multiple chronic conditions, making connected pill organizers essential for accurate dose reminders and refill alerts.

Public health policies and payer-driven initiatives have also played a significant role. Medicare’s Part D Star Ratings include three drug-class adherence measures that directly influence plan performance. Consequently, health plans and pharmacies have invested in digital adherence solutions. For example, smart pill bottles are increasingly used in pharmacy care programs to improve the proportion-of-days-covered metric. Such initiatives have institutionalized adherence as a quality benchmark and accelerated the integration of smart devices into healthcare workflows.

Regulatory clarity has supported regional market expansion. The U.S. FDA classifies medication reminder apps as device software functions that are generally exempt from strict enforcement, simplifying approval. It also recognizes remote medication management systems as Class II devices, offering manufacturers a well-defined regulatory route. Similarly, Health Canada’s guidance on “software as a medical device” has encouraged innovation and adoption of connected medication technologies across the country.

The region’s digital infrastructure and clinical evidence have strengthened commercialization. Studies reviewed by the Agency for Healthcare Research and Quality have confirmed that reminder-based interventions improve adherence and satisfaction. Federal digital initiatives promoting interoperability have facilitated seamless data integration between patients, pharmacies, and health systems. Combined with high broadband and mobile connectivity, these factors have enabled North America to lead the global smart pill boxes and bottles market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Smart Pill Boxes and Bottles market is experiencing strong competition due to growing demand for connected healthcare solutions. Companies are focusing on improving medication adherence and remote monitoring. Key players such as MedMinder Systems, AdhereTech, and Vaica have established leadership through innovative smart devices that combine real-time alerts, dosage tracking, and data connectivity. These firms are integrating advanced analytics and cloud platforms, which enhance patient engagement and enable healthcare professionals to monitor medication use more effectively, ensuring better treatment outcomes and compliance.

Technological innovation is shaping the competitive landscape of smart medication devices. Centor Inc. and DoseTap are leveraging packaging expertise and smart closure systems to improve medication safety and user convenience. Their developments in connected packaging enable pharmacies to track and manage prescriptions with precision. The integration of child-resistant, tamper-proof designs has increased adoption among healthcare institutions. Growing partnerships between packaging firms and digital health startups are also expanding the reach of smart medication dispensing across consumer and institutional healthcare markets.

Regional and global players are intensifying efforts to strengthen their presence through service differentiation. Firms like Wisepill Technologies, Tenovi, and Livi provide cellular-based and automated dispensing systems that address the needs of both developed and emerging markets. These companies are targeting chronic disease management and elderly care, offering solutions that enhance medication accuracy and adherence. Increasing government support for telehealth and homecare solutions is expected to create favorable conditions for these vendors to expand their product portfolios and geographical footprint.

Market dynamics further reveal the importance of data-driven adherence management. Companies such as AARDEX Group, etectRx, Hero Health, PillDrill, and PatchRx are advancing digital medication ecosystems that combine device hardware with analytics and patient engagement tools. These firms are emphasizing clinical validation, data security, and interoperability with healthcare systems. Strategic collaborations with pharmaceutical companies and payers are strengthening their role in digital therapeutics and remote patient monitoring, making data integration a decisive factor for sustained market competitiveness and growth.

Market Key Players

- MedMinder Systems

- AdhereTech

- Vaica

- Centor Inc.

- DoseTap

- Wisepill Technologies

- Tenovi

- Livi

- PatchRx

- AARDEX Group

- etectRx

- Hero Health

- Loba

- MedReady

- Pill Connect

- PillDrill

Recent Developments

- In 23 April 2025: Centor launched a new LTE-enabled “smart weekly pill organizer” (co-developed with RxCap) targeted at pharmacies in the U.S. to support medication-adherence monitoring.

- In October 2024: Wisepill announced a newly released API (for its smart pill-boxes) with specific emphasis on reinforcing TB-treatment adherence programmes (digital adherence technologies). The update is positioned to support improved connectivity, data exchange and intervention triggers in high-burden settings for chronic treatments.

- In April 2024: Tenovi launched its new smart pill-box product: the Tenovi Pillbox, described as the first FDA-listed cellular-connected smart pillbox that requires no apps, WiFi, or syncing. The device resembles a standard 7-day pill organizer but includes built-in sensors detecting compartment openings or refills, and data transmission occurs via the included cellular gateway when the patient is within ~30 ft of the gateway. The launch supports Tenovi’s focus on medication-adherence monitoring as part of its RTM and RPM ecosystem, addressing a major gap in chronic-care compliance.

- In August 2022: MedMinder announced a new funding arrangement: the company closed an additional US $35 million financing via a credit facility from SWK Holdings Corporation together with further investment from existing partner Accelmed Partners. This capital injection was intended to expand MedMinder’s capacity to serve the growing home-care and ageing-at-home market, broaden its national reach for its connected pill-dispenser and pharmacy services, and build further virtual-care, clinical and technology capabilities.

Report Scope

Report Features Description Market Value (2024) US$ 197.1 Million Forecast Revenue (2034) US$ 458.1 Million CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Smart Pill Boxes, Smart Pill Bottles), By Disease Area (Dementia, Diabetes Care, Cancer Management, Geriatric Care, Other Chronic Diseases), By Component (Hardware, Software & Connectivity Components), By End-User Setting (Homecare, Assisted Living/Long-Term Care Facilities, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape MedMinder Systems, AdhereTech, Vaica, Centor Inc., DoseTap, Wisepill Technologies, Tenovi, Livi, PatchRx, AARDEX Group, etectRx, Hero Health, Loba, MedReady, Pill Connect, PillDrill Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Pill Boxes & Bottles MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Pill Boxes & Bottles MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- MedMinder Systems

- AdhereTech

- Vaica

- Centor Inc.

- DoseTap

- Wisepill Technologies

- Tenovi

- Livi

- PatchRx

- AARDEX Group

- etectRx

- Hero Health

- Loba

- MedReady

- Pill Connect

- PillDrill