Global Smart Hospital Market By Component (Hardware, Software, Services), By Technology (Cloud Computing, IoT, Artificial Intelligence, Other Technologies), By Route of Connectivity (Wireless, Wired), By Application (Remote Medicine Management, Medical Connected Imaging, Medical Assistance, Electronic Health Record & Clinical Workflow, Outpatient Vigilance, Other Applications), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 105185

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

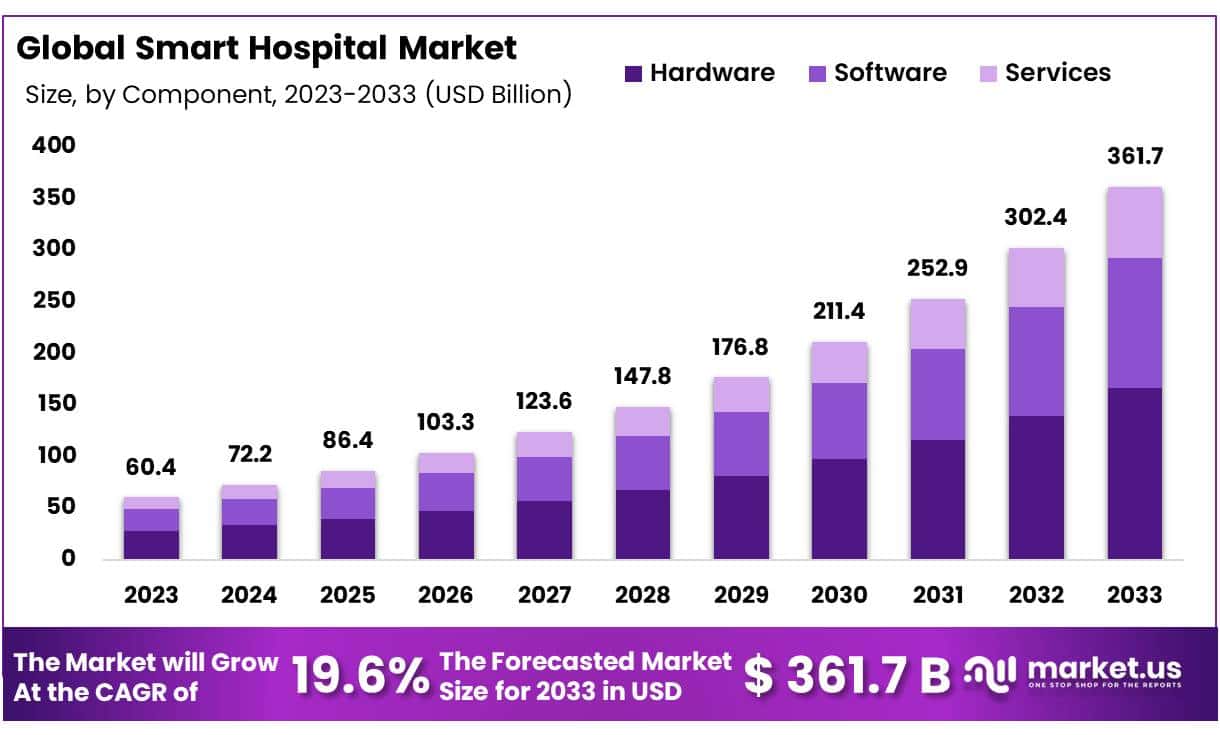

The Global Smart Hospital Market size is expected to be worth around USD 361.7 Billion by 2033 from USD 60.4 Billion in 2023, growing at a CAGR of 19.6% during the forecast period from 2024 to 2033.

A Smart Hospital is basically a high-tech healthcare facility. It uses fancy gadgets and digital tools to make patient care better, improve how the hospital runs, and overall make things work smoother. They use cool stuff like the Internet of Things (IoT), Artificial Intelligence (AI), Big Data analytics, and automation to create a super-connected and smart healthcare setup.

In simpler words, a Smart Hospital is like a tech makeover for regular hospitals. It brings in all the latest tech to make hospitals more digital and focused on giving patients the best experience. This includes keeping an eye on patients, managing medical equipment, handling electronic health records, improving communication systems, and taking care of the hospital space.

The Smart Hospital market is all about the businesses that provide the tools and services needed to make regular hospitals into smart ones. This includes companies that make the technology, write the software, put everything together, and offer advice to make sure hospitals get what they need. It’s like a whole industry working to upgrade hospitals and healthcare organizations into smart and connected spaces.

Key Takeaways

- Market Size: Smart Hospital Market size is expected to be worth around USD 361.7 Billion by 2033 from USD 60.4 Billion in 2023.

- Market Growth: The market growing at a CAGR of 19.6% during the forecast period from 2024 to 2033.

- Market Components: Hardware dominates the market, with over 41% market share, providing essential devices like IoT sensors and medical equipment.

- Key Technologies: IoT leads with over 34% market share, enabling real-time data monitoring and patient tracking.

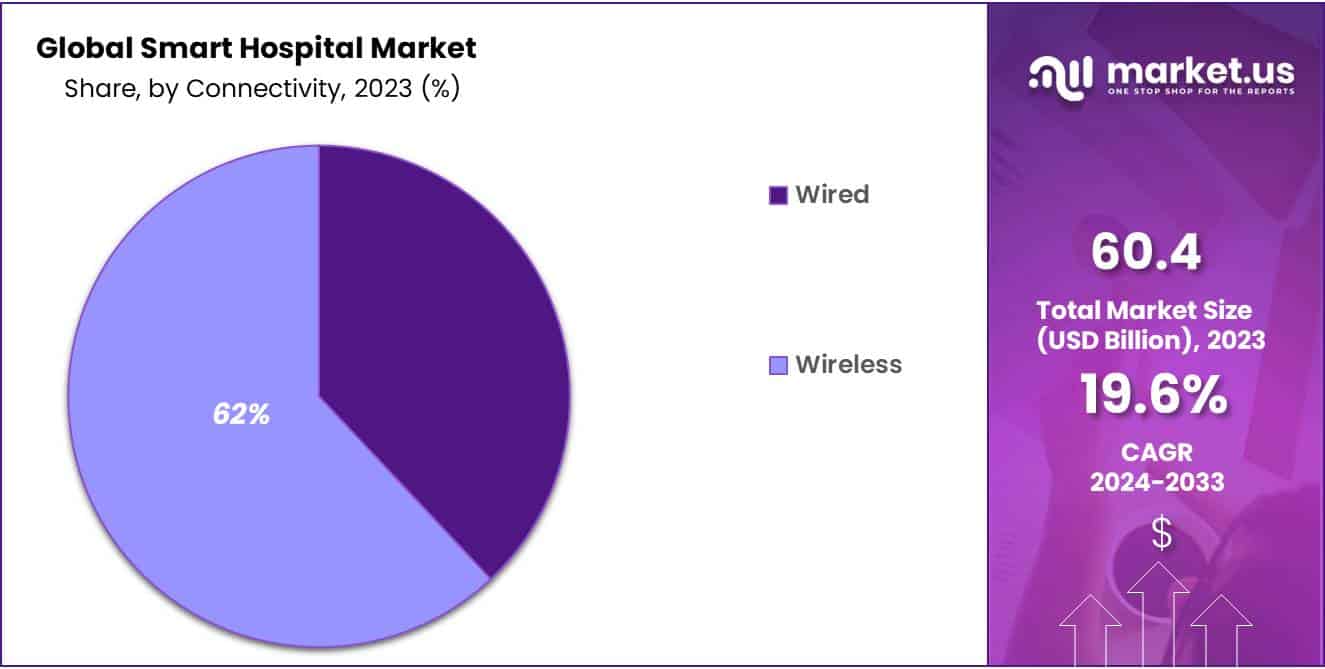

- Connectivity: Wireless connectivity dominates with over 62% market share, enabling real-time data exchange and remote monitoring.

- Application Analysis: Medical Connected Imaging Segment firmly establishing its dominance by capturing a substantial market share of over 27%.

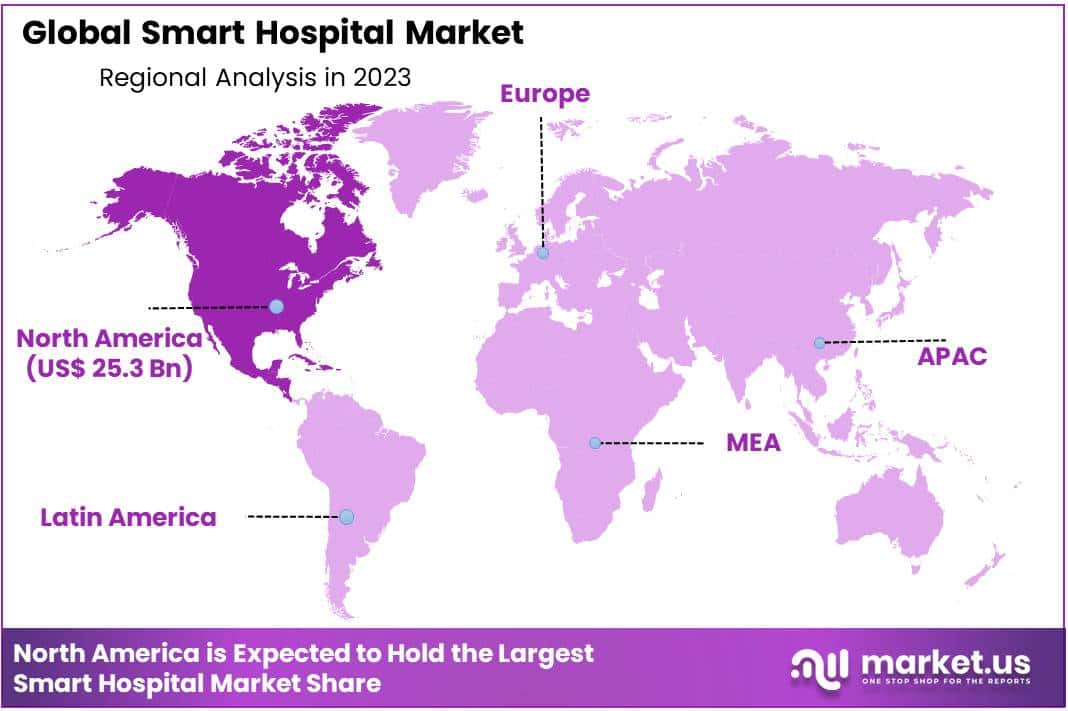

- Regional Analysis: North America firmly securing its dominant market position by capturing a substantial share of over 42%.

- Driving Factors: Smart hospitals improve patient care through real-time monitoring and personalized treatment.

By Component Analysis

In 2023, the Smart Hospital market exhibited a distinct segmentation among its components, with the Hardware Segment firmly establishing its dominance by capturing a significant market share of over 41%. This commanding position underscores the pivotal role of hardware in the transformation of traditional healthcare facilities into smart and digitally integrated environments.

Hardware components cover a bunch of devices, like IoT sensors, medical gadgets, and connected systems. These things are super important because they help gather real-time data from patients, let doctors monitor from afar, and keep the whole smart hospital setup running smoothly. As hospitals get more into using digital tech to make patient care better and manage everything more efficiently, the Hardware Segment is right there in the front lines. It’s the go-to for all the evolving tech needs in the healthcare world, making sure hospitals stay up to date.

The Software Segment also plays a vital role in the smart hospital ecosystem, offering solutions for data analytics, electronic health records (EHR), and patient management systems. These software applications enable healthcare providers to leverage the wealth of data generated by hardware components, facilitating informed decision-making, predictive analytics, and personalized patient care.

The Services Segment, complementing hardware and software, encompasses consulting, implementation, and support services, ensuring the seamless integration and maintenance of smart hospital solutions. Together, these components form a comprehensive ecosystem that empowers healthcare institutions to deliver advanced, patient-centric care while optimizing operational efficiency. The Hardware Segment’s dominant position reflects the foundational role of tangible devices in the ongoing evolution of smart hospitals, poised to continue driving innovation and progress in healthcare delivery.

By Technology Analysis

In 2023, the Smart Hospital market exhibited a notable segmentation among its technology components, with the IoT (Internet of Things) Segment firmly establishing its dominance by capturing an impressive market share of over 34%. This commanding position underscores the pivotal role of IoT in reshaping the healthcare landscape, as it enables the seamless connectivity of medical devices, sensors, and equipment within smart hospital environments.

IoT technology empowers healthcare providers with real-time data monitoring, remote patient tracking, and predictive analytics, enhancing patient care, reducing operational costs, and improving overall efficiency. The IoT Segment’s prominence signifies the industry’s recognition of the transformative potential of connected devices in delivering patient-centric care and optimizing hospital operations.

Simultaneously, other advanced technologies like Cloud Computing and Big Data play crucial roles in storing, managing, and analyzing the vast volumes of healthcare data generated by IoT devices. These technologies empower smart hospitals to harness actionable insights, streamline decision-making processes, and deliver personalized medical services.

Artificial Intelligence (AI) contributes to diagnosis and treatment optimization, while Wearable Technologies and Radio Frequency Identification (RFID) offer innovative solutions for patient monitoring and asset tracking, respectively. The multifaceted nature of these technologies, working in synergy, enables smart hospitals to provide cutting-edge healthcare services while ensuring operational excellence. While IoT leads the charge, it does so within a comprehensive technological ecosystem that continues to drive the evolution of smart hospitals, ultimately enhancing the quality of healthcare delivery.

By Route of Connectivity Analysis

In 2023, the Smart Hospital market exhibited a clear distinction in market share between its Route of Connectivity segments, with the Wireless Segment firmly establishing its dominance by capturing an impressive market share of over 62%. This commanding position highlights the industry’s shift towards wireless technologies as the preferred mode of connectivity within smart hospital environments.

Wireless connectivity offers unparalleled flexibility, enabling seamless communication among a multitude of medical devices, sensors, and systems, while eliminating the constraints associated with physical wiring. With the increasing deployment of IoT devices and wearable technologies in healthcare, wireless connectivity provides the agility required to support real-time data exchange, remote monitoring, and patient care coordination, ultimately enhancing the efficiency and responsiveness of smart hospitals.

Conversely, the Wired Segment, while still relevant, held a comparatively smaller market share in 2023. Wired connections are typically employed for critical applications where high reliability and stability are paramount. These connections are often used for mission-critical medical equipment and infrastructure to ensure uninterrupted service.

However, as wireless technology continues to advance, offering improved reliability and security, the Wired Segment is expected to experience a gradual decline in market share. The dominance of the Wireless Segment underscores the industry’s recognition of the pivotal role of wireless connectivity in the evolution of smart hospitals, providing the agility and scalability needed to deliver advanced healthcare services in a digitally connected ecosystem.

By Application Analysis

In 2023, the Smart Hospital market displayed distinctive segmentation among its Application segments, with the Medical Connected Imaging Segment firmly establishing its dominance by capturing a substantial market share of over 27%. This commanding position underscores the pivotal role of connected imaging technologies in revolutionizing healthcare within smart hospital environments. Medical Connected Imaging encompasses advanced modalities such as digital radiography, PACS (Picture Archiving and Communication Systems), and telemedicine, which enable healthcare providers to acquire, store, and share medical images and diagnostic information seamlessly.

These technologies facilitate rapid access to critical patient data, enabling remote consultations, timely diagnosis, and enhanced treatment planning. The prominence of the Medical Connected Imaging Segment reflects the industry’s recognition of the transformative impact of digital imaging on patient care, while also emphasizing the integral role it plays in shaping the future of smart hospitals.

Simultaneously, other applications like Remote Medicine Management, Medical Assistance, Electronic Health Record & Clinical Workflow, and Outpatient Vigilance contribute significantly to the comprehensive smart hospital ecosystem. Remote Medicine Management supports remote patient monitoring and telehealth services, bridging geographical barriers and ensuring continuity of care.

Medical Assistance applications enhance patient engagement and communication, while Electronic Health Record & Clinical Workflow solutions streamline administrative and clinical processes. Outpatient Vigilance solutions extend healthcare beyond hospital walls, enhancing patient safety and experience. Each of these applications, while diverse in function, collectively contributes to the advancement of smart hospitals, ultimately delivering patient-centric, efficient, and digitally integrated healthcare services.

Driving Factors

- Improved Patient Care: Smart hospitals enhance patient care through real-time monitoring, telemedicine, and personalized treatment plans, driving the adoption of these technologies.

- Operational Efficiency: The automation of administrative tasks, asset management, and resource allocation improves operational efficiency, reducing costs and enhancing hospital performance.

- Rising Healthcare Costs: The need to contain rising healthcare costs and optimize resource utilization encourages hospitals to invest in smart technologies for cost-effective healthcare delivery.

- Aging Population: The aging global population increases the demand for healthcare services, making smart hospitals essential for managing patient volumes and maintaining quality care.

Restraining Factors

- High Implementation Costs: The initial investment required for smart hospital infrastructure, including IoT devices and connectivity, can be a barrier for some healthcare institutions.

- Data Security Concerns: The increased connectivity in smart hospitals raises concerns about data security and privacy breaches, necessitating robust cybersecurity measures.

- Resistance to Change: Resistance from healthcare professionals to adopt new technologies and workflows can slow down the implementation of smart hospital solutions.

- Interoperability Challenges: Integrating various systems and devices within a smart hospital can be complex, posing interoperability challenges that hinder seamless data exchange.

Growth Opportunities

- Telemedicine Expansion: The expansion of telemedicine services presents significant growth opportunities as smart hospitals leverage virtual consultations and remote monitoring to reach broader patient populations.

- AI and Analytics Integration: Integration of Artificial Intelligence (AI) and analytics for predictive diagnostics and personalized treatment plans offers growth avenues for enhancing patient care and clinical decision-making.

- IoT Device Proliferation: The proliferation of IoT devices and wearables for patient monitoring and data collection creates opportunities for enhancing patient engagement and healthcare delivery.

- Healthcare Ecosystem Collaboration: Collaboration among healthcare stakeholders, including hospitals, technology providers, and insurers, fosters a holistic approach to smart healthcare delivery.

Key Market Trends

- Patient-Centric Care: Smart hospitals prioritize patient-centric care, focusing on improving the patient experience, satisfaction, and outcomes.

- Digital Twin Technology: The use of digital twin technology for simulating hospital operations and optimizing workflows is a prevailing trend in smart hospitals.

- Data Analytics for Decision Support: Advanced data analytics tools are increasingly used for real-time decision support, helping healthcare providers make informed choices for patient care.

- Robotics and Automation: The adoption of robotics and automation in surgery, diagnostics, and logistics is a key trend, enhancing precision and efficiency in healthcare processes.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Technology

- Cloud Computing

- Internet of Things (IoT)

- Artificial Intelligence

- Other Technologies

By Route of Connectivity

- Wireless

- Wired

By Application

- Remote Medicine Management

- Medical Assistance

- Medical Connected Imaging

- Electronic Health Record

- Other Applications

Regional Analysis

In 2023, the global Smart Hospital market displayed distinct regional dynamics, with North America firmly securing its dominant market position by capturing a substantial share of over 42%. The demand for Smart Hospital in North America was valued at USD 25.3 billion in 2023 and is anticipated to grow significantly in the forecast period. This commanding presence can be attributed to North America’s robust healthcare infrastructure, early adoption of advanced technologies, and a strong focus on healthcare innovation.

The region boasts a thriving ecosystem of smart hospitals, driven by substantial investments in digital health solutions, telemedicine, and IoT-enabled healthcare devices. Moreover, a growing aging population and the need for efficient healthcare services further fuel the demand for smart hospital solutions in North America.

Europe, while holding a significant market share, showcases a competitive landscape within the smart hospital market. European countries emphasize healthcare quality and patient outcomes, fostering the adoption of smart technologies. The Asia-Pacific (APAC) region demonstrates remarkable growth potential, driven by its dynamic healthcare industry, rapid urbanization, and increasing investments in healthcare infrastructure. APAC’s embrace of telehealth and digital health initiatives reflects its commitment to transforming healthcare delivery.

Latin America, although with a smaller market share, exhibits opportunities for smart hospital adoption, particularly in countries with evolving healthcare systems. The Middle East and Africa, while in the nascent stages of smart hospital implementation, showcase promising growth prospects as governments and healthcare providers increasingly recognize the benefits of digital transformation in healthcare.

Note- The figures presented here are subject to change in the final report.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASIAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The key players are adopting serval strategies to enhance their businesses, strengthen geographic presence across the world, and product offerings. Approval of digital technology, mergers & acquisitions, product portfolio, and technological advancements are likely to drive companies’ presence worldwide. Additionally, the rise in disease prevalence worldwide is likely to prompt companies to recruit awareness campaigns related to the approval of technologies to develop smart hospitals.

Top Key Players in Smart Hospitals Market

- Medtronic Plc.

- Koninklijke Philips N.V.

- GE Healthcare

- Stanley Healthcare

- Siemens AG

- Athenahealth

- Allscripts Healthcare Solutions Inc.

- Microsoft Corporation

- SAP SE

- Samsung Healthcare

- Honeywell International Inc.

- Other Key Players

Recent Developments

Danaher Corporation:

- April 2023: Partnered with Microsoft to developcloud-based solutions for smart hospitals, leveraging Microsoft Azure cloud platform and Danaher’s expertise in medical devices and diagnostics.

Siemens Healthineers:

- July 2023: Showcased itscomprehensive smart hospital solutions at the HIMSS Asia Pacific conference, including connected medical devices, data analytics platforms, and clinical decision support tools.

Philips Healthcare:

- August 2023: Introduced thePhilips IntelliVue Guardian software, an AI-powered patient monitoring system that helps predict and prevent potential complications, enabling proactive care in smart hospitals.

GE Healthcare:

- November 2023: Unveiled theEdison Health Outcomes Platform, a cloud-based platform that aggregates and analyzes data from disparate sources to provide actionable insights for smarter decision-making in hospitals.

Report Scope

Report Features Description Market Value (2023) USD 60.4 Billion Forecast Revenue (2033) USD 361.7 Billion CAGR (2024-2033) 19.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Technology (Cloud Computing, IoT, Big Data, Artificial Intelligence, Wearable Technologies, Radio Frequency Identification, Other Technologies), By Route of Connectivity (Wireless, Wired), By Application (Remote Medicine Management, Medical Connected Imaging, Medical Assistance, Electronic Health Record & Clinical Workflow, Outpatient Vigilance, Other Applications) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Medtronic Plc., Koninklijke Philips N.V., GE Healthcare, Stanley Healthcare, Siemens AG, Athenahealth, Allscripts Healthcare Solutions Inc., Microsoft Corporation, SAP SE, Samsung Healthcare, Honeywell International Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a smart hospital?A smart hospital integrates advanced technologies such as IoT devices, AI algorithms, and data analytics to enhance patient care, optimize operations, and improve overall efficiency.

How big is the Smart Hospital Market?The global Smart Hospital Market size was estimated at USD 60.4 Billion in 2023 and is expected to reach USD 361.7 Billion in 2033.

What is the Smart Hospital Market growth?The global Smart Hospital Market is expected to grow at a compound annual growth rate of 19.6%. From 2024 To 2033

Who are the key companies/players in the Smart Hospital Market?Some of the key players in the Smart Hospital Markets are Medtronic Plc., Koninklijke Philips N.V., GE Healthcare, Stanley Healthcare, Siemens AG, Athenahealth, Allscripts Healthcare Solutions Inc., Microsoft Corporation, SAP SE, Samsung Healthcare, Honeywell International Inc., Other Key Players.

What are some key technologies driving the growth of smart hospitals?Key technologies driving the growth of smart hospitals include Internet of Things (IoT) devices for real-time monitoring, Artificial Intelligence (AI) for predictive analytics and personalized treatment, and Telemedicine solutions for remote patient care.

What are the primary benefits of smart hospitals?Smart hospitals offer several benefits, including improved patient outcomes through personalized care, enhanced operational efficiency leading to cost savings, and better resource utilization resulting in reduced waiting times.

What is the market outlook for smart hospitals?The smart hospital market is projected to experience significant growth in the coming years, driven by increasing demand for efficient healthcare delivery, advancements in technology, and growing investments in healthcare infrastructure worldwide.

-

-

- Medtronic Plc.

- Koninklijke Philips N.V.

- GE Healthcare

- Stanley Healthcare

- Siemens AG

- Athenahealth

- Allscripts Healthcare Solutions Inc.

- Microsoft Corporation

- SAP SE

- Samsung Healthcare

- Honeywell International Inc.

- Other Key Players