Global Smart Classroom Market Size, Share Analysis Report By Component (Hardware, Software, Services), By Educational Level(Kindergarten, Primary Schools, Secondary Schools, Higher Education (Colleges/Universities), Vocational Education), By End-User(Academic Institutions, Corporates (Training & Development), Government Organizations), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151109

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

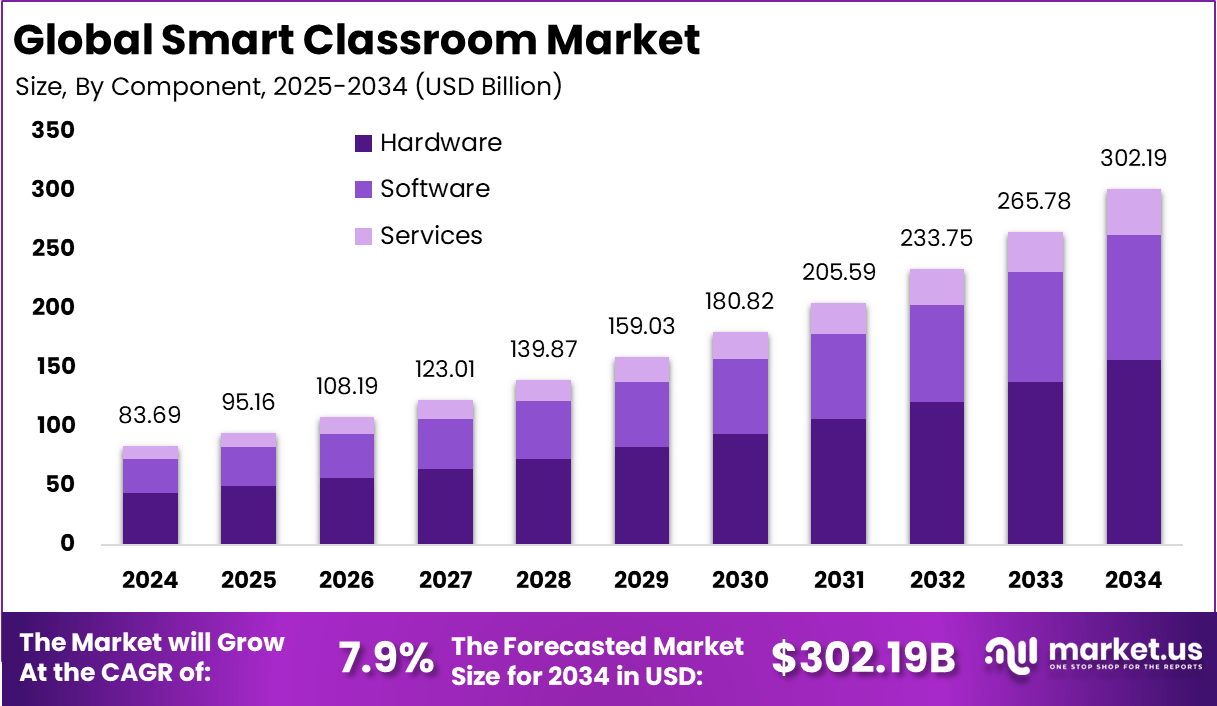

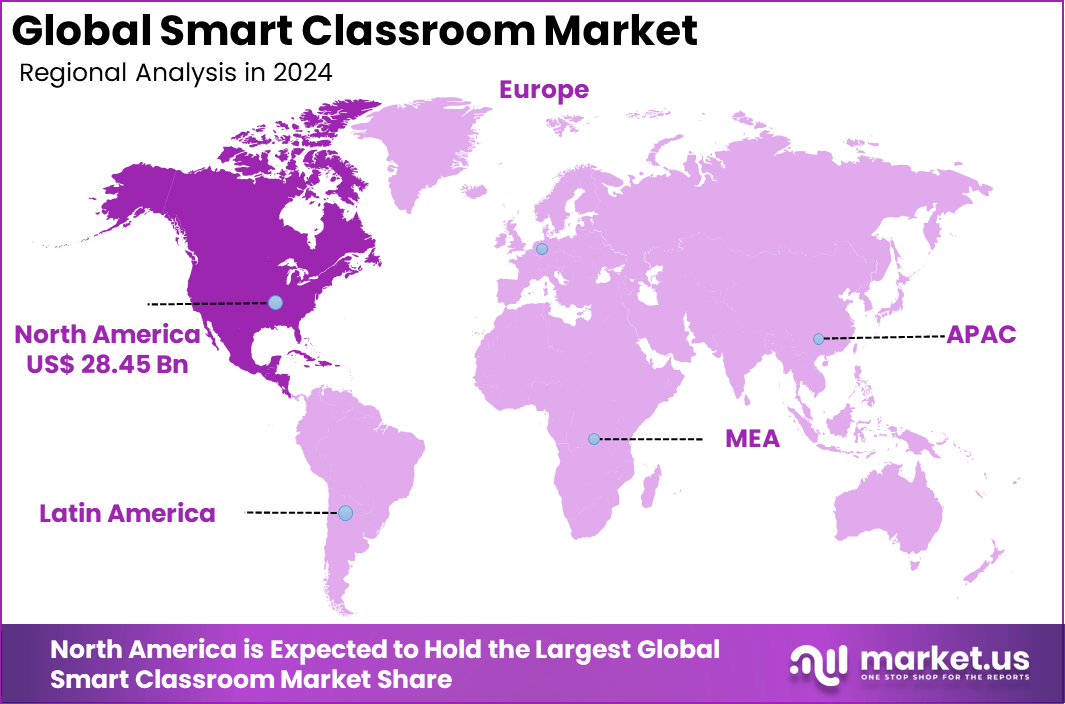

The Global Smart Classroom Market size is expected to be worth around USD 302.19 billion by 2034, from USD 83.69 billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34% share, holding USD 28.45 billion in revenue.

The Smart Classroom Market is undergoing significant transformation as educational institutions embrace interactive technology and data-driven learning environments. One Top Driving Factor is the rapid digitalization of education, which was catalyzed by the COVID‑19 pandemic and is now being sustained by institutional strategies to deliver hybrid and personalized learning.

Increased internet penetration, widespread mobile device usage, and supportive government initiatives are creating a foundation for technology-rich teaching systems. An Increasing Adoption of Technologies such as IoT sensors, AI analytics, VR/AR tools, and integrated hardware-software systems is reshaping instructional design. Smart tables with embedded screens and real-time data capture are enabling differentiated instruction and performance tracking.

For instance, in July 2024, the Haryana government unveiled its plan to introduce smart classrooms in 1,000 additional primary schools by the 2024–25 academic year. This initiative is focused on strengthening foundational education by integrating digital tools, interactive learning content, and improved internet connectivity.

As per the latest data from School Education in India – Samagra Shiksha, only 24.4% of schools nationwide are reported to have functional Smart Classrooms, indicating that the digital transformation in Indian education remains in its early stages.

Adoption is notably higher in private unaided schools, where 34.6% have implemented smart classrooms, compared to 21.2% in government schools and 31.0% in aided institutions, highlighting disparities in infrastructure readiness across different school management types.

Business Benefits from subscription models include predictable revenue streams, reduced costs in customer acquisition, and improved player retention. These services foster deeper analytics-driven insights into consumer behavior, enabling targeted content strategies and refined monetization approaches such as in-game purchases and premium tiers.

Key Takeaway

- The Global Smart Classroom Market is projected to grow from USD 83.69 Billion in 2024 to approximately USD 302.19 Billion by 2034, reflecting a CAGR of 7.9% during the forecast period.

- In 2024, North America led the global market with over 34% share, generating USD 28.45 Billion in revenue, driven by strong digital infrastructure and widespread adoption of EdTech solutions.

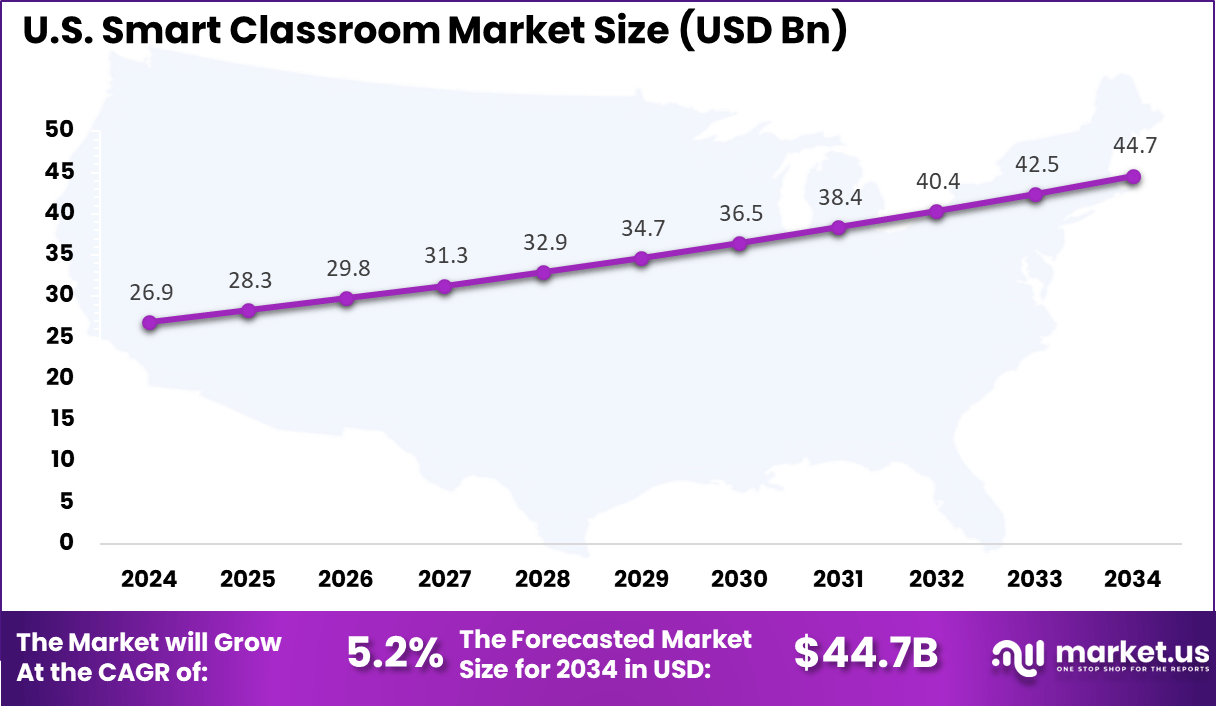

- The U.S. market alone contributed USD 26.9 Billion in 2024 and is projected to expand at a CAGR of 5.2%, supported by federal investments in connected learning environments.

- By component, the Hardware segment accounted for 52% of the market, with growing deployment of interactive displays, tablets, and classroom sensors.

- In terms of educational level, Secondary Schools led with a 30% share, reflecting increased integration of digital tools in curriculum delivery and assessment.

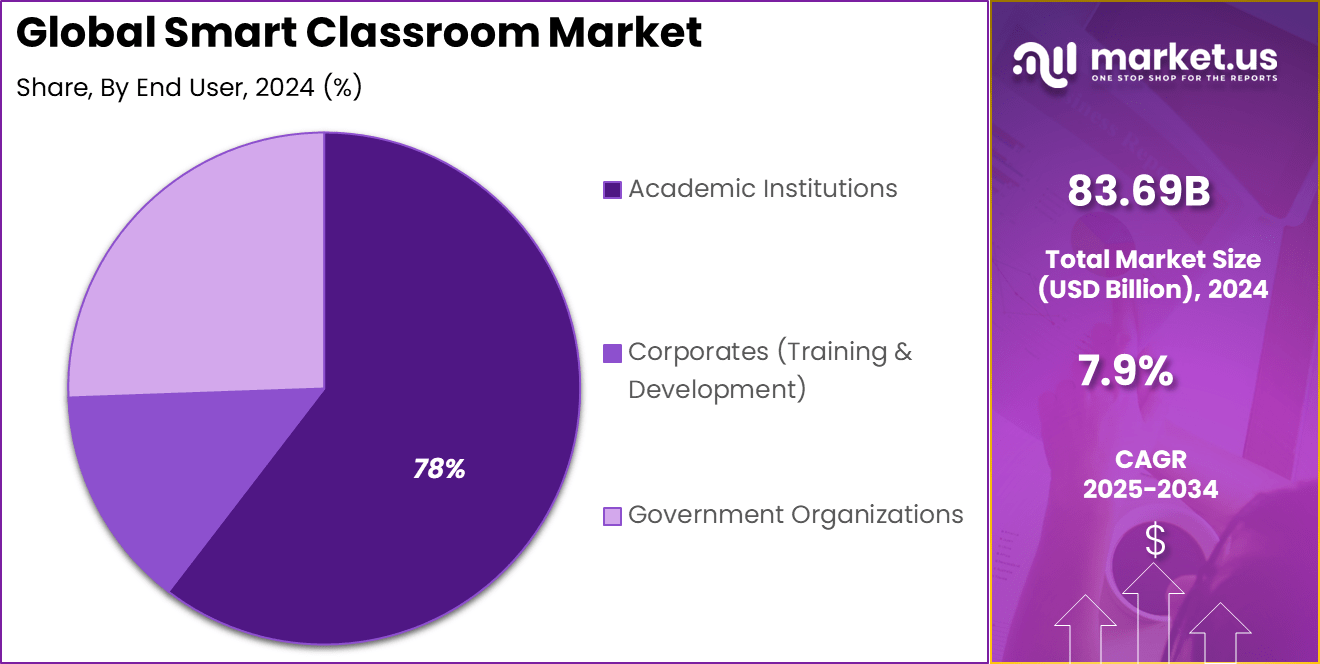

- Among end-users, Academic Institutions dominated the segment with a commanding 78% share, as schools and universities continue to modernize traditional learning spaces.

U.S. Market Size

The US Smart Classroom Market is valued at USD 26.9 Billion in 2024 and is predicted to increase from USD 34.7 Billion in 2029 to approximately USD 44.7 Billion by 2034, projected at a CAGR of 5.2% from 2025 to 2034. This market is driven by large-scale investments from both government and private sectors in educational technology and strategic partnerships.

E-learning platforms, digital content integration, and hybrid/remote learning models are the main drivers of educational technology growth. Federal programs to expand high-speed internet access and provide classroom devices have improved digital infrastructure, particularly in public schools. Moreover, the growing interest in personalized education, STEM training, and cutting-edge technologies like AI-driven analytics and online virtual labs is driving demand.

For instance, in January 2024, U.S. based edtech firm Class Technologies entered a strategic collaboration with Microsoft to launch “Class for Microsoft Teams,” a next-generation virtual classroom platform. This partnership is designed to improve digital learning by embedding advanced tools for classroom management, student assessment, and real-time engagement directly into Microsoft Teams.

In 2024, North America held a dominant market position in the Global Smart Classroom Market, capturing more than a 34% share, holding USD 28.45 billion in revenue. The country’s leadership is largely due to its advanced digital infrastructure, high adoption of education technology, and strong institutional support for innovation in learning.

Government programs like the U.S. Digital Learning Tools and STEAM have been funded by the Department of Education, and schools are using AI and cloud-based platforms to teach students or implementing many interactive devices in their classrooms, driving market growth. Moreover, North America’s focus on personalized education and teacher development, coupled with significant EdTech firms driving innovation, further fuels the market.

For instance, in April 2025, VIAIM launched the NoteKit AI Voice Recorder in North America, targeting a transformation in classroom efficiency and teacher productivity. This AI-powered tool captures, transcribes, and summarizes lectures in real time, enabling educators to shift their focus from note-taking and administrative work to more meaningful student interaction and engagement.

Component Analysis

In 2024, the Hardware segment held a dominant market position, capturing more than a 52% share of the smart classroom ecosystem. This leadership can be attributed to the foundational role of hardware assets – such as interactive whiteboards, projectors, tablets, laptops, audio-visual systems, and networking infrastructure – that establish the essential physical layer for technologically advanced learning environments.

Moreover, continual innovation in hardware technology has sustained its dominant status. Manufacturers consistently deliver advanced features – multi-touch capabilities, wireless connectivity, ergonomic designs, and high-resolution displays – that enhance classroom interactivity and engagement. Such hardware investments directly influence the creation of immersive teaching spaces and multisensory learning experiences, further justifying the emphasis on physical device deployment.

For instance, in February 2025, the Delhi government introduced its education-focused budget under the “CM Shri Schools” program. As outlined by Education Minister Rekha Gupta, the plan includes free laptops for students and the expansion of smart classrooms in government schools. This move highlights Delhi’s commitment to bridging the digital divide and advancing public education through greater access to technology and modern teaching tools.

Segmental Summary – Component Analysis

Component Market Position Key Drivers Hardware Dominant with >52% share Core infrastructure: interactive panels, tablets/laptops, audio/projectors; anchors subsequent software and services Software Rapid growth Adoption of LMS, content platforms, AI-powered tools enhances personalization and administrative efficiency Services Rising demand Integration support, maintenance, training services expand as systems scale in complexity Educational Level Analysis

In 2024, the Secondary Schools segment held a dominant market position, capturing more than 30 % share of the global smart classroom market. This leadership is attributable to several interrelated factors. First, secondary schools serve a large, diverse student population facing increasing academic and examination pressures, which necessitate sophisticated, interactive learning environments.

Adoption of smart boards, integrated learning management systems, and digital assessment tools has been particularly strong at this level, supported by growing investments in digital infrastructure within this segment. Second, government initiatives aimed at bolstering STEM education and bridging learning gaps have been most actively directed toward secondary education – stimulating high uptake of smart classroom solutions tailored for complex curriculum delivery.

For instance, in January 2025, Tamil Nadu marked a major achievement in digital education by inaugurating its 22,931st smart classroom at a Government Higher Secondary School, completing the transformation of all government primary schools into smart classrooms. This initiative, driven by the state government, demonstrates a strong commitment to technology-enabled learning, aiming to improve educational outcomes and provide equal access to digital infrastructure across both urban and rural regions.

Segmental Summary – Educational Level Analysis

Educational Level 2024 Position & Key Drivers Secondary Schools Leading with >30% share; driven by significant ICT integration, blended learning models, AR/VR adoption, and targeted teacher training initiatives Higher Education Strong presence; universities deploy smart classrooms for virtual labs, adaptive learning, and administrative automation Primary Schools Moderate growth; foundations in interactive displays and early-stage digital pedagogy, but less AR/VR and personalized tools compared to secondary Kindergarten Emerging segment; focused on child-friendly tablets, educational games, and interactive storytelling panels Vocational Education Specialized usage; implements simulators, practical labs, and industry-linked virtual training tools End-User Analysis

In 2024, Academic Institutions segment held a dominant market position, capturing more than a 78% share. This dominance is driven by the extensive adoption of smart classroom technologies by schools, colleges, and universities worldwide. Around 78% of educational institutions have integrated digital learning tools, such as interactive displays, virtual collaboration platforms, and learning management systems – enhancing classroom engagement and curriculum delivery.

Investments in virtual labs, AI‑assisted teaching tools, and cloud‑based educational environments have reinforced smart classroom adoption among academic users. Moreover, academic institutions benefit from breadth in end‑users – from K‑12 to higher education – resulting in large-scale technology rollout. Governments and education bodies have prioritized digital transformation, issuing funding and establishing policies that support ICT integration in classrooms.

Segmental Summary – End-User Analysis

End-User Segment 2024 Position & Drivers Academic Institutions Dominant with >78% share; driven by large-scale ICT integration across K–12 and higher education, supported by infrastructure investments and teacher training Corporates (Training & Development) Moderate adoption; enterprises are integrating smart learning platforms for employee development, soft skills, and compliance training Government Organizations Emerging use; deployed mainly for public service training, e-governance programs, and capacity building in civil services For instance, in July 2024, the Haryana government launched a major initiative to equip 1,000 primary schools with smart classrooms, supporting its mission to modernize the education system. The program focuses on enhancing early learning through digital tools and interactive technologies, aiming to strengthen foundational education.

Key Market Segments

By Component

- Hardware

- Interactive Displays

- Student Response Systems

- Smart Tables

- Audio Systems

- Software

- Learning Management Systems (LMS)

- Student Information Systems (SIS)

- Classroom Management Software

- Language Learning Software

- Services

- Consulting

- Deployment & Integration

- Support & Maintenance

By Educational Level

- Kindergarten

- Primary Schools

- Secondary Schools

- Higher Education (Colleges/Universities)

- Vocational Education

By End-User

- Academic Institutions

- Corporates (Training & Development)

- Government Organizations

Latest Trends

Smart classrooms are increasingly embedding AI and IoT to create more responsive learning environments. Devices such as smart sensors, AI tutors, and connected whiteboards collect real-time data on student engagement and classroom dynamics. Educators can then tailor lessons to individual learning patterns – boosting interaction and improving outcomes. This trend is being driven by investments in IoT-enabled devices and AI-powered academic tools.

As AI algorithms evolve, the classroom experience becomes more adaptive and personalized. These systems can suggest activities, flag struggling students, and recommend differentiated content. This intelligent automation supports educators and helps manage larger groups more effectively, leading to more efficient and meaningful learning.

For instance, in June 2024, Samsung introduced its new AI Class Assistant for the WAD Interactive Display at ISTELive 2024. Designed to support teachers in real time, the AI assistant automates tasks such as summarizing lessons, tracking student participation, and generating interactive content. This innovation reinforces Samsung’s commitment to enhancing smart classrooms by integrating AI to boost instructional efficiency and student engagement.

Drivers

Digital Transformation in Education

The integration of digital technologies in education has grown rapidly, leading to the adoption of smart classrooms for more engaging and immersive learning. With the widespread availability of high-speed internet and mobile devices, educational institutions are increasingly incorporating smart classroom technologies such as interactive displays, cloud-based platforms, and AI-powered tools to improve pedagogical outcomes.

For instance, in May 2025, Jammu & Kashmir achieved a significant milestone in digital education by establishing 3,427 smart classrooms across the region. This initiative forms part of a larger strategy to modernize the education infrastructure and improve learning outcomes through technology. Each smart classroom is equipped with interactive boards, projectors, and curated digital content, designed to address learning disparities, particularly in remote and underserved locations.

Restraint

High Implementation and Maintenance Costs

The implementation and ongoing expenses of smart classrooms are major hurdles for underfunded or rural institutions. Hardware, software installations, internet access, maintenance, and teacher training are all part of the expenses associated with interactive whiteboards, tablets, and projectors.

The costs vary greatly depending on the region, infrastructure readiness, and technology standards. The cost of education in rural schools must prioritize essential resources such as reliable electricity and internet, which contribute to higher costs as compared to cities.

For instance, in April 2024, the Tamil Nadu government unveiled a major initiative to transform classrooms into smart learning environments, with an estimated investment exceeding ₹1,000 crore. This large-scale upgrade aims to elevate the quality of education by integrating digital teaching aids, interactive content, and modern infrastructure across schools.

Opportunities

Emerging Technologies Integration

Classroom interactivity is undergoing a transformation with the integration of Augmented Reality (AR), Virtual Reality (VR), and the Internet of Things (IoT). These technologies are enabling immersive and experiential learning environments that significantly boost student engagement and knowledge retention.

As the cost of implementation continues to decline and technical capabilities improve, their adoption presents a strategic opportunity for institutions to differentiate learning experiences and strengthen their overall educational value proposition in a competitive landscape.

For instance, In April 2025, Pankaj Bellad, Country Head of Logitech India, emphasized the transformative role of AV technology in revolutionizing education through smart classrooms and advanced collaboration tools. He highlighted how interactive displays, unified communication systems, and immersive learning experiences are reshaping traditional pedagogy, and making education more engaging and accessible.

Challenges

Infrastructure Limitations

The implementation of smart classrooms is still hindered by ongoing infrastructure challenges, such as unreliable power supply and limited or inconsistent internet bandwidth, which pose major challenges, particularly in rural or underdeveloped areas.

The lack of consistent power supply and broadband connectivity significantly limits operational reliability in numerous developing and rural areas. To ensure the functional viability and equitable distribution of smart classroom benefits, it is essential to address these fundamental deficiencies.

For instance, in January 2025, several government schools in Delhi continued to face significant challenges due to inadequate classroom infrastructure, which has delayed their shift toward smart classrooms. The absence of essential resources such as adequate classroom space, stable electricity, and reliable internet connectivity has made the implementation of digital learning technologies unfeasible

Key Players Analysis

Apple is leveraging its brand strength and ecosystem to support educational tools like iPads and interactive content frameworks. In early 2025, Apple announced a significant investment into education, committing to digital skills development and classroom technology integration.

Cisco delivers secure networking infrastructure and hybrid learning solutions for schools and universities. Its Webex-enabled classrooms support virtual and in-person interaction, managing audio/video, access control, and campus safety. These integrated systems ensure reliable connectivity and operational efficiency in smart-learning facilities.

Discovery offers rich digital-first curricula across STEM, literacy, and social studies. Its award-winning platform, Discovery Education Experience, is proven to boost academic outcomes – for instance, 73% of high-user students met state benchmarks in Texas. Seamless integration with leading LMS platforms enables easy embedding of digital resources, empowering teachers with adaptable tools

Top Key Players in the Market

- Apple Inc.

- Cisco Systems Inc.

- Discovery Communication

- Dell Inc.

- Fujitsu Limited

- HP

- IBM Corporation

- Microsoft Corporation

- Panasonic

- Toshiba

- Huawei Technologies Co.

- Blackboard Inc.

- SAP SE

- Others

Recent Developments

- In February 2025, Apple announced a strategic plan to invest over $500 billion in the U.S. over the next four years, with a significant focus on advancing education and workforce development. As part of this initiative, Apple aims to expand its support for educational programs, including those that enhance digital skills and integrate technology into classrooms.

- In April 2025, Discovery Education’s flagship digital platform, Discovery Education Experience, was honored with the EdTech Award in the product category, recognizing its excellence in transforming teaching and learning. This accolade underscores the platform’s impact in delivering high-quality, standards-aligned digital content, interactive tools, and real-time assessments to K-12 classrooms.

Report Scope

Report Features Description Market Value (2024) USD 83.69 Bn Forecast Revenue (2034) USD 302.19 Bn CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Educational Level(Kindergarten, Primary Schools, Secondary Schools, Higher Education (Colleges/Universities), Vocational Education), By End-User(Academic Institutions, Corporates (Training & Development), Government Organizations) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., Cisco Systems Inc., Discovery Communication, Dell Inc., Fujitsu Limited, HP, IBM Corporation, Microsoft Corporation, Panasonic, Toshiba, Huawei Technologies Co., Blackboard Inc., SAP SE, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Apple Inc.

- Cisco Systems Inc.

- Discovery Communication

- Dell Inc.

- Fujitsu Limited

- HP

- IBM Corporation

- Microsoft Corporation

- Panasonic

- Toshiba

- Huawei Technologies Co.

- Blackboard Inc.

- SAP SE

- Others