Global Smart Appliances Market Based on Product(Smart Washing Machine, Smart Refrigerators, Smart Air Purifiers, Smart TV, Other Products), Based on Technology(Wi-Fi, Bluetooth, Near Field Communication (NFC), Other Technologies), Based on the Distribution Channel(Offline, Online), Based on End-User(Residential, Commercial), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 29347

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Based on Product Analysis

- Based on Technology Analysis

- Based on the Distribution Channel Analysis

- Based on End-User Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

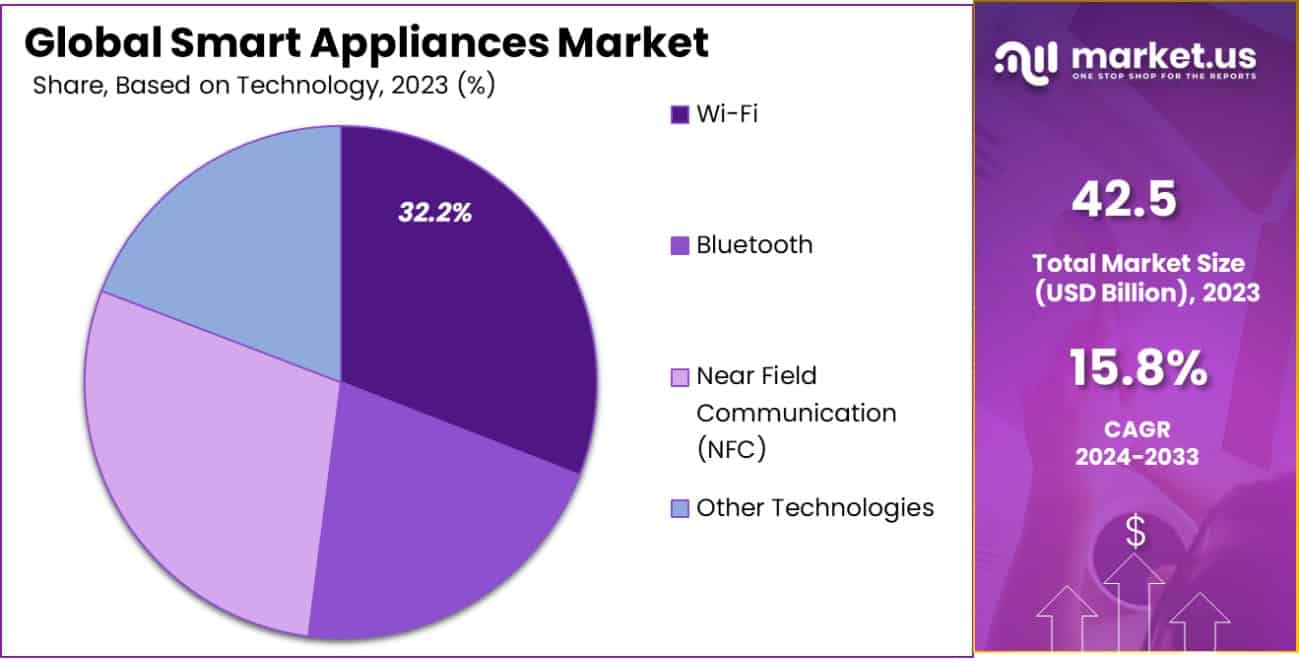

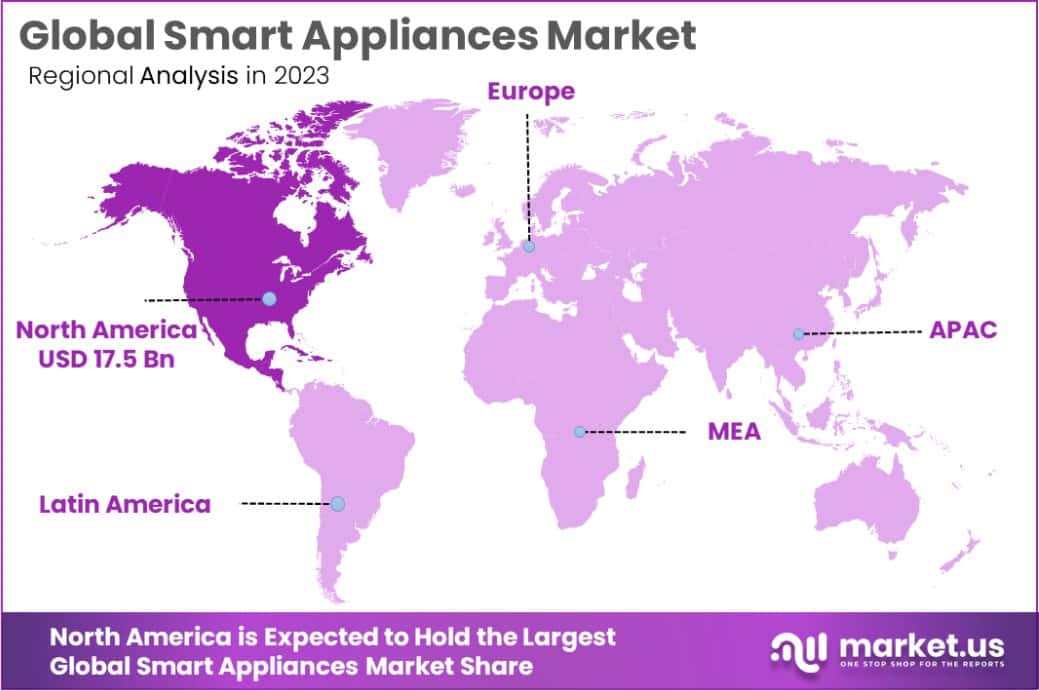

The Global Smart Appliances Market size is expected to be worth around USD 184.3 Billion by 2033, from USD 42.5 Billion in 2023, growing at a CAGR of 15.8% during the forecast period from 2024 to 2033. North America dominated a 41.3% market share in 2023 and held USD 17.5 Billion in revenue from the Smart Appliances Market.

Smart appliances are advanced devices integrated with technology that allows them to connect and interact with user networks, enhancing functionality and user experience. These appliances can be remotely controlled through smartphones or voice assistants and are capable of adaptive learning to optimize energy usage and maintenance, making everyday tasks more efficient.

The smart appliances market refers to the industry involved in the design, manufacture, and sale of connected devices for residential and commercial environments. This market encompasses a range of products including smart refrigerators, washers, dryers, ovens, and HVAC systems, which leverage Internet of Things (IoT) connectivity to offer enhanced operational efficiency, convenience, and energy management.

The growth of the smart appliances market is primarily driven by the increasing consumer demand for convenience and connectivity in household management. Advances in IoT technology and the widespread adoption of smart home ecosystems facilitate this trend, enabling devices that seamlessly integrate and provide enhanced user control.

Demand in the smart appliances market is fueled by rising energy costs and environmental concerns. Consumers are increasingly seeking appliances that not only reduce energy consumption but also offer remote monitoring and control, which are key attributes of smart appliances that help manage household energy usage more effectively.

Opportunities in the smart appliances market are abundant with the growing integration of AI and machine learning technologies. These technologies enable appliances to learn from user behaviors and optimize their functions, thus not only improving user experience but also opening new avenues for energy efficiency and personalized consumer engagement.

The Smart Appliances market is poised for significant growth, propelled by robust governmental support and consumer inclination towards energy efficiency and connectivity. In the United States, the Department of Energy administers over $20 billion in grants under initiatives aimed at enhancing clean energy technologies, which includes investments in smart manufacturing.

This is further bolstered by the Biden Administration’s allocation of $1.1 trillion across various sectors, with 17% earmarked specifically for smart manufacturing modernization encompassing smart technologies. At a more localized level, states like Indiana and Iowa are actively promoting the adoption of these innovations.

Indiana has disbursed $57 million across 526 grants since 2020 for digital manufacturing solutions, while Iowa’s IIoT Infrastructure Investment Grants provide up to $25,000 for Industry 4.0 hardware or software enhancements.

Furthermore, the Bipartisan Infrastructure Law has already facilitated a $22 million fund distribution across 12 states to aid small and medium-sized manufacturers in integrating smart manufacturing technologies.

On a predictive note, a UK government consultation reveals a divergent forecast where one respondent anticipates that up to 50% of households could deploy smart appliances by the mid-2020s, contrasting with a more conservative estimate of 20% by 2030.

These dynamics underscore a transformative phase in the smart appliances market, reflecting a trajectory bound by technological integration and significant policy-driven financial backing, signaling a bullish outlook for market stakeholders.

Key Takeaways

- The Global Smart Appliances Market size is expected to be worth around USD 184.3 Billion by 2033, from USD 42.5 Billion in 2023, growing at a CAGR of 15.8% during the forecast period from 2024 to 2033.

- In 2023, Smart Washing Machines held a dominant market position in the Based on Product segment of the Smart Appliances Market, with a 32.5% share.

- In 2023, Wi-Fi held a dominant market position in the Based on Technology segment of the Smart Appliances Market, with a 32.2% share.

- In 2023, Offline held a dominant market position Based on the Distribution Channel segment of the Smart Appliances Market, with a 65.4% share.

- In 2023, Residential held a dominant market position in the Based on End-User segment of the Smart Appliances Market, with a 73.2% share.

- North America dominated a 41.3% market share in 2023 and held USD 17.5 Billion in revenue from the Smart Appliances Market.

Based on Product Analysis

In 2023, the Smart Washing Machine held a dominant market position in the Based on Product segment of the Smart Appliances Market, with a 32.5% share. This was followed by Smart Refrigerators, which captured a 24.8% share, underscoring the growing consumer preference for enhanced convenience and energy efficiency in kitchen appliances.

Smart Air Purifiers also made a significant impact, securing 18.3% of the market, driven by heightened health and air quality awareness among consumers. Smart TVs, with their continuous technological advancements and integration capabilities, held a 15.4% market share, reflecting the ongoing demand for connected home entertainment solutions.

The remaining 9% of the market was distributed among other smart products, including ovens, dishwashers, and HVAC systems, which are gaining traction as integral components of the connected home ecosystem.

This segmentation highlights a clear consumer trend towards automation and connectivity in household appliances, which not only offer convenience but also contribute to energy management and cost savings.

The leading position of smart washing machines can be attributed to innovations in appliance technology that offer users significant control over their washing routines, energy usage, and water conservation, aligning with global sustainability goals.

As technology progresses and consumer awareness increases, the demand for these smart appliances is expected to grow, with manufacturers continuing to innovate and expand their product ranges to meet the evolving needs of the modern consumer.

Based on Technology Analysis

In 2023, Wi-Fi held a dominant market position in the Based on Technology segment of the Smart Appliances Market, with a 32.2% share. This prominent position reflects the widespread adoption of Wi-Fi as the backbone for high-speed, reliable connectivity in smart home ecosystems. Bluetooth followed, capturing a 26.5% market share, valued for its ease of pairing and low energy consumption in smaller household devices.

Near Field Communication (NFC) accounted for 21.1% of the market, favored in applications requiring close-range communication to simplify the synchronization between smart appliances and mobile devices. The remaining 20.2% was distributed among other emerging technologies that enhance smart appliance functionality, including Zigbee, Z-Wave, and Thread.

Wi-Fi’s leading position is driven by its ability to support a larger bandwidth, enabling seamless operation of multiple smart appliances without interference. As consumers continue to integrate more devices into their smart home networks, the demand for robust and secure connectivity solutions like Wi-Fi is expected to grow.

Meanwhile, the development of Bluetooth and NFC technologies continues to advance, focusing on enhancing user convenience and energy efficiency, which are critical factors for the adoption of smart home technology. This dynamic technological landscape underscores the vital role of innovative connectivity solutions in the expansion of the smart appliances market.

Based on the Distribution Channel Analysis

In 2023, Offline held a dominant market position in the Based on Distribution Channel segment of the Smart Appliances Market, with a 65.4% share. This substantial market share underscores the continued consumer preference for experiencing products firsthand before making a purchase, particularly when it comes to high-value items like smart appliances.

The tactile experience allows consumers to assess the look and feel of the appliances, which is a decisive factor for many. Online channels, while growing rapidly, accounted for the remaining 34.6% of the market share. This channel is gaining traction due to the convenience of home shopping and the often lower prices offered.

The offline dominance is also supported by extensive dealer networks and strong retailer relationships that smart appliance manufacturers have developed. These physical retail spaces not only facilitate immediate purchases but also provide consumers with expert advice and immediate customer service.

However, the online segment is poised for growth, driven by the increasing digitization of consumer lifestyles and enhancements in e-commerce platforms that improve the buying experience with detailed product information, customer reviews, and augmented reality applications.

As consumers become more comfortable with online purchases and as digital tools evolve, the gap between offline and online sales is expected to narrow.

Based on End-User Analysis

In 2023, Residential held a dominant market position in the Based on End-User segment of the Smart Appliances Market, with a 73.2% share. This overwhelming majority is indicative of the growing penetration of smart home technologies in private homes, driven by the escalating consumer demand for convenience, energy efficiency, and enhanced security.

The commercial sector accounted for the remaining 26.8% share, reflecting its gradual adoption of smart technologies to improve operational efficiencies and reduce long-term costs.

The strong performance in the residential sector can be attributed to the increased availability of connected appliances that integrate seamlessly with broader smart home systems, such as voice-controlled assistants and centralized home automation platforms.

These technologies appeal to residential users by offering significant improvements in household management and energy consumption. Conversely, the commercial sector, encompassing businesses, healthcare facilities, and hospitality industries, is adopting these innovations at a slower pace, focusing primarily on energy management and operational efficiency.

As technology advances and as more consumers and businesses recognize the benefits of smart appliances, both segments are expected to see robust growth. However, the residential sector is likely to maintain its lead due to the direct benefits these technologies offer to everyday consumers, such as cost savings, convenience, and lifestyle enhancements.

Key Market Segments

Based on Product

- Smart Washing Machine

- Smart Refrigerators

- Smart Air Purifiers

- Smart TV

- Other Products

Based on Technology

- Wi-Fi

- Bluetooth

- Near Field Communication (NFC)

- Other Technologies

Based on the Distribution Channel

- Offline

- Online

Based on End-User

- Residential

- Commercial

Drivers

Smart Appliances Market Drivers

The Smart Appliances Market is primarily driven by the increasing consumer demand for convenience and connectivity in household management. As households continue to adopt smart home technologies, the appeal of smart appliances grows, driven by their ability to integrate seamlessly with existing home systems like smartphones and voice assistants.

These appliances offer significant advantages such as remote operation, energy efficiency, and the ability to receive and analyze real-time data, which enhances the user’s ability to manage their home more effectively and economically.

Furthermore, advancements in IoT technology and a strong push towards energy conservation policies encourage consumers to replace traditional appliances with smarter, more energy-efficient models.

This trend is supported by demographic shifts, particularly the increasing number of tech-savvy millennials forming their households, who prefer products that provide convenience and sustainable living.

Restraint

Challenges in Smart Appliance Adoption

Despite the growth in the Smart Appliances Market, several restraints hinder its broader acceptance. High costs remain a significant barrier, as smart appliances typically command premium pricing compared to conventional devices. This price difference can deter budget-conscious consumers from upgrading to smarter technologies.

Additionally, concerns about data privacy and security are prominent, with users wary of how their personal information is handled and protected by connected devices. The complexity of installation and maintenance also poses a challenge, especially for those not technologically inclined, potentially leading to frustration and reluctance to embrace smart appliances.

Moreover, the necessity for a reliable internet connection, which is not universally accessible, limits the practicality and functionality of these advanced devices in some areas.

Opportunities

Expanding Opportunities in Smart Appliances

The Smart Appliances Market is ripe with opportunities, particularly through technological advancements and increased consumer awareness of smart home benefits. Innovations in artificial intelligence (AI) and machine learning are enabling appliances to offer more personalized experiences and improved efficiency, which can attract a broader consumer base.

The push towards sustainable living is also driving demand for appliances that help reduce energy use and lower household costs. Additionally, as urbanization increases and smart city initiatives rise, smart appliances find a growing market in modern, connected homes.

Furthermore, the expansion of home automation technology and integration with popular ecosystems like Amazon Alexa, Google Home, and Apple HomeKit presents a significant opportunity for cross-device connectivity and enhanced user convenience, further stimulating market growth.

Challenges

Navigating Challenges in Smart Appliances

The Smart Appliances Market faces several challenges that could impede its growth. First, the high initial costs associated with these advanced appliances can deter average consumers from making purchases.

There is also a significant concern regarding data security and privacy, as these devices often collect and transmit personal user data, raising fears about potential breaches. Compatibility issues between different brands and platforms can frustrate users, limiting the seamless integration that is the hallmark of smart technology.

Moreover, the dependence on continuous internet connectivity can be a stumbling block in regions with unreliable network services. Lastly, there’s a need for consumer education as potential buyers must understand the benefits and operations of smart appliances to fully embrace this technology, which adds another layer of complexity to market penetration.

Growth Factors

Key Growth Drivers for Smart Appliances

The Smart Appliances Market is driven by several compelling factors that promise sustained growth. Technological advancements, particularly in the Internet of Things (IoT) and artificial intelligence (AI), are at the forefront, enabling appliances to offer greater efficiency and customized user experiences.

Rising energy costs and environmental concerns are pushing consumers towards energy-efficient and eco-friendly appliances, aligning with global sustainability trends. The increasing consumer preference for convenience and connected living also fuels demand, as more people look to enhance and simplify their daily routines through automation.

Additionally, government incentives for energy-saving appliances and the expansion of smart home product ecosystems create a conducive environment for market growth. Together, these elements are set to propel the widespread adoption and development of smart appliances.

Emerging Trends

Emerging Trends in Smart Appliances

Emerging trends in the Smart Appliances Market are shaping the future of household technologies. Integration with smart home ecosystems is becoming more seamless, allowing devices to communicate more effectively with each other for enhanced functionality.

Voice control is increasingly popular, facilitated by advancements in AI, making it easier for users to operate appliances through simple voice commands. There is also a growing trend toward the development of ultra-efficient appliances that use less energy and water, appealing to environmentally conscious consumers.

Another significant trend is the adoption of subscription-based models for appliance maintenance and upgrades, offering continuous improvements and services. Additionally, the use of augmented reality (AR) for troubleshooting and maintenance provides a futuristic edge to customer service in appliance care.

Regional Analysis

The Smart Appliances Market exhibits varied growth dynamics across global regions, with North America leading the charge. In 2023, North America held a dominant position with 41.3% of the global market share, translating to a market value of USD 17.5 billion.

This prominence is driven by high consumer readiness to adopt new technologies, well-established infrastructure for connectivity, and robust governmental policies supporting smart grid and smart home initiatives.

Europe follows with a strong focus on energy efficiency and the integration of renewable energy sources, which propels the adoption of smart appliances.

Meanwhile, Asia Pacific is experiencing rapid growth due to increasing urbanization, rising disposable incomes, and the expansion of smart city projects, particularly in countries like China, Japan, and South Korea.

The Middle East & Africa, and Latin America are gradually catching up, with growth fueled by improving internet penetration and a growing middle class that is increasingly tech-savvy.

These regions are embracing smart technologies to enhance energy management and domestic convenience, setting the stage for further market expansion as connectivity and consumer awareness improve.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Smart Appliances Market, Samsung Electronics Co. Ltd., Whirlpool Corp., and LG Electronics are pivotal players, each demonstrating distinctive strategies and innovations that underline their market prominence in 2023.

Samsung Electronics Co. Ltd. stands out with its comprehensive range of connected products, from refrigerators to washing machines, all integrated within its SmartThings ecosystem. Samsung’s focus on IoT-enabled appliances and its extensive investment in AI technology position it as a leader in not only enhancing user convenience but also advancing the interoperability of smart home devices.

The company’s commitment to innovation is evident in its developments in voice recognition and energy-efficient technologies, making it a preferred brand among tech-savvy consumers.

Whirlpool Corp. maintains its competitive edge through its emphasis on user-centric designs and sustainability. Whirlpool has effectively leveraged its global R&D capabilities to introduce appliances that offer significant energy savings and adaptive learning capabilities, which appeal to environmentally conscious consumers.

The firm’s strategic partnerships and acquisitions have further strengthened its product offerings and market reach, particularly in emerging markets.

LG Electronics excels in marrying style with functionality, offering aesthetically pleasing and technologically advanced appliances. LG’s proactive approach in adopting ThinQ technology across its product line has enhanced its appliances’ ability to learn and adapt to user behaviors, promoting a more personalized user experience.

Additionally, LG’s aggressive marketing and after-sales service have fortified its brand loyalty and penetration in diverse markets.

Collectively, these companies are driving the Smart Appliances Market by focusing on technological integration, consumer engagement, and sustainable practices, ensuring their leadership status in the evolving landscape of smart home technologies. Their ongoing innovation and market adaptation strategies are pivotal in shaping the future directions of the smart appliance industry.

Top Key Players in the Market

- Samsung Electronics Co. Ltd.

- Whirlpool Corp.

- LG Electronics

- Haier Group

- Panasonic Corp.

- BSH Hausgerate GmbH

- Electrolux AB

- Koninklijke Philips N.V.

- GE Appliances

- Xiaomi Corp.

- Other Key Players

Recent Developments

- In June 2024, BSH Hausgerate GmbH acquired a startup specializing in AI kitchen technology to bolster its smart cooking appliances with automated recipes and dietary tracking.

- In April 2024, Panasonic Corp. partnered with Google to integrate enhanced voice control features across its smart appliance lineup.

- In February 2024, Haier Group secured a $50 million investment to expand its smart home appliance line into emerging markets, focusing on sustainability.

Report Scope

Report Features Description Market Value (2023) USD 42.5 Billion Forecast Revenue (2033) USD 184.3 Billion CAGR (2024-2033) 15.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Product(Smart Washing Machine, Smart Refrigerators, Smart Air Purifiers, Smart TV, Other Products), Based on Technology(Wi-Fi, Bluetooth, Near Field Communication (NFC), Other Technologies), Based on the Distribution Channel(Offline, Online), Based on End-User(Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung Electronics Co. Ltd., Whirlpool Corp., LG Electronics, Haier Group, Panasonic Corp., BSH Hausgerate GmbH, Electrolux AB, Koninklijke Philips N.V., GE Appliances, Xiaomi Corp., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Appliances MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Smart Appliances MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics Co. Ltd.

- Whirlpool Corp.

- LG Electronics

- Haier Group

- Panasonic Corp.

- BSH Hausgerate GmbH

- Electrolux AB

- Koninklijke Philips N.V.

- GE Appliances

- Xiaomi Corp.

- Other Key Players