Global Shooting and Gun Accessories Market Size, Share, Statistics Analysis Report By Type (Air Rifle, Air Pistol, Others), By End-Use (Law Enforcement, Competitive Sports), By Distribution (Online, Offline), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134981

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

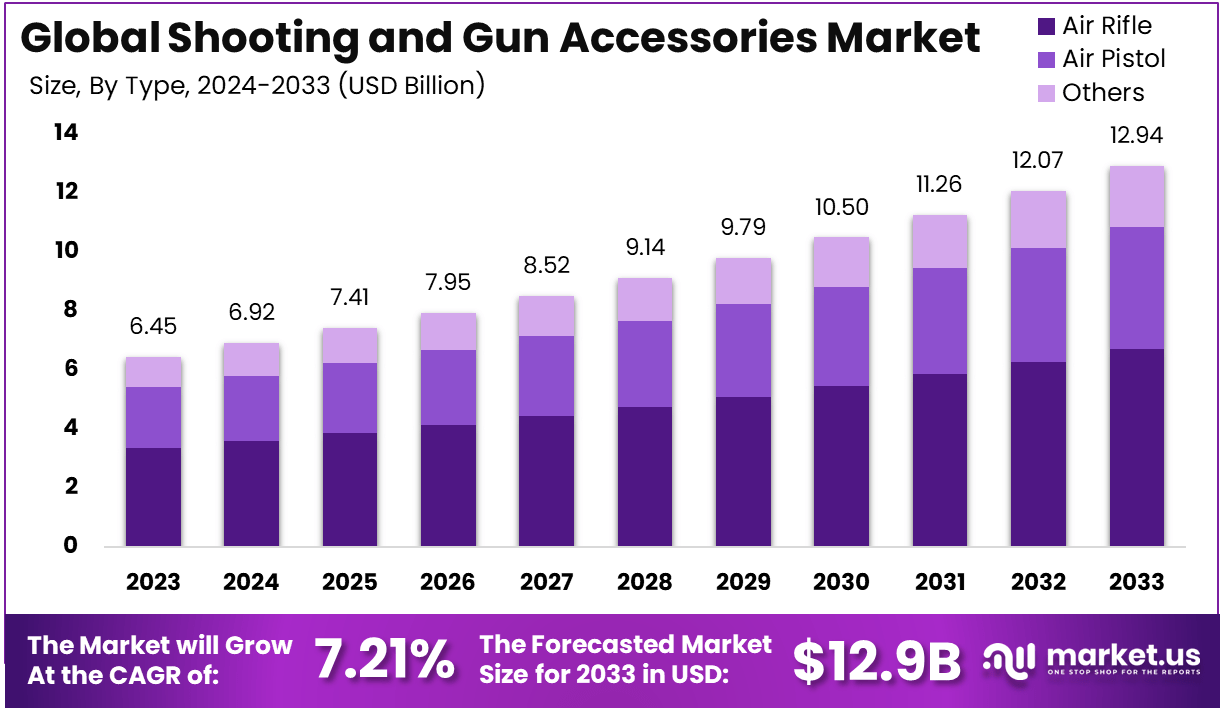

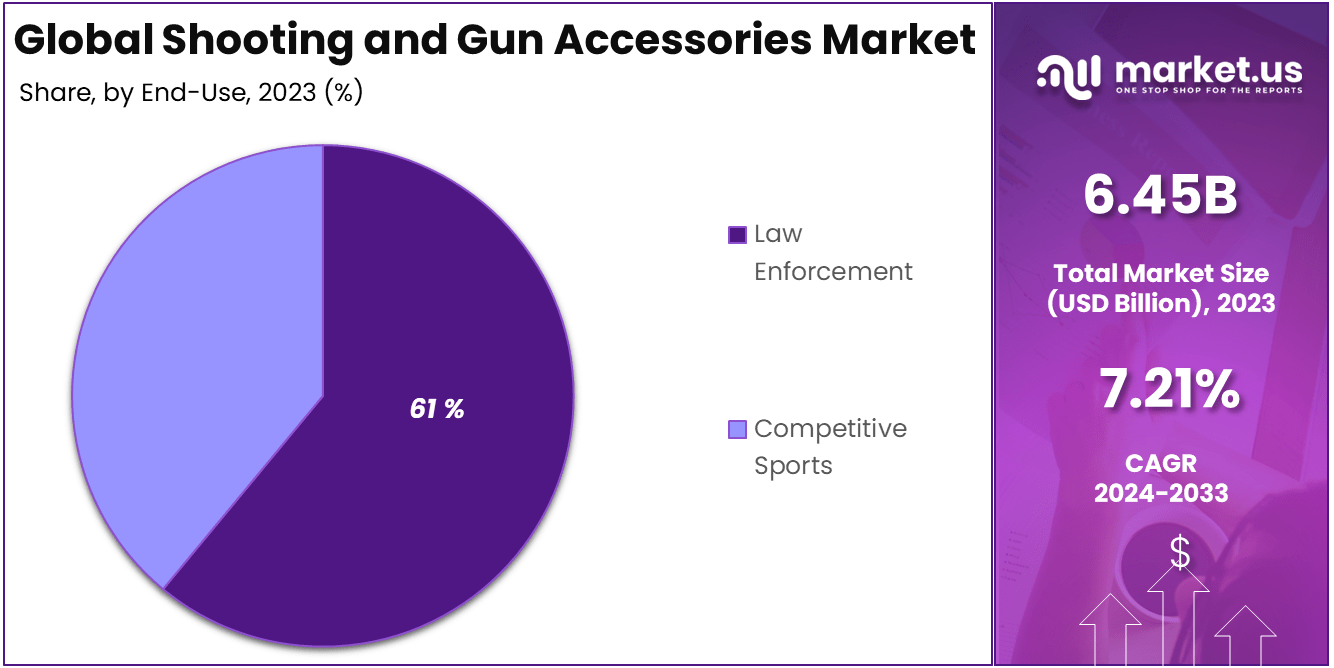

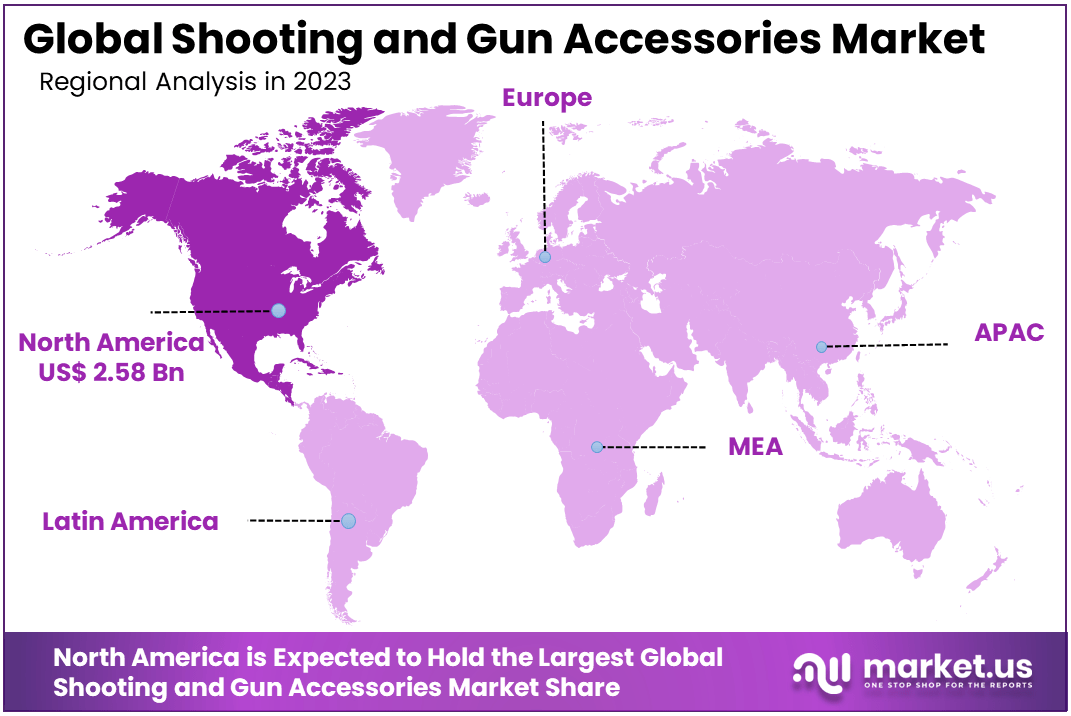

The Global Shooting and Gun Accessories Market is expected to be worth around USD 12.94 Billion By 2033, up from USD 6.45 billion in 2023, growing at a CAGR of 7.21% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 40% share and holding USD 2.58 billion in revenue.

Shooting and gun accessories refer to the various equipment and tools that enhance the performance, safety, and convenience of firearms and shooting activities. These accessories include various products such as scopes, holsters, gun safes, cleaning kits, ammunition, magazines, sights, triggers, gun cases, and tactical gear. There are also accessories aimed at improving gun customization and comfort, like adjustable stocks, grip modifications, recoil pads, and even custom finishes for firearms.

These accessories play a crucial role in increasing the accuracy, usability, and safety of guns, making them essential for recreational shooters, hunters, law enforcement, and military personnel. The global market for shooting and gun accessories is experiencing steady growth due to increased interest in recreational shooting, hunting, and personal defense.

The shooting and gun accessories market has grown steadily over the years and is expected to continue expanding due to rising interest in hunting and shooting sports, as well as increased awareness about personal safety and self-defense. The market is driven by both civilian demand, including recreational and sport shooting, and professional demand from law enforcement and military agencies.

As regulations around gun ownership and safety tighten in many regions, consumers are seeking high-quality, reliable accessories that improve firearm safety, storage, and performance. Additionally, the increasing popularity of shooting sports like competitive shooting and tactical training is contributing to the demand for specialized accessories. Market players are focusing on developing innovative products, such as smart gun safes, modular tactical accessories, and ergonomic enhancements to attract both novice and experienced shooters.

Several factors are driving the growth of the shooting and gun accessories market. First and foremost, the rising interest in recreational shooting and hunting, particularly in North America and Europe, is fueling demand for firearms accessories. Many individuals participate in shooting as a hobby, which drives the need for specialized products that improve their shooting experience. Another key factor is the increasing concern about personal safety and self-defense.

As urbanization grows and security concerns rise, more people are turning to firearms for protection, which increases the demand for gun accessories like holsters, safes, and firearm storage solutions. Additionally, technological advancements in the firearms industry, including the development of smart accessories, are further boosting market growth. For instance, smart scopes, which allow shooters to track and hit targets with greater precision, are gaining popularity among hunters and tactical shooters.

The demand for shooting and gun accessories is being fueled by several market opportunities. With an increasing number of people participating in shooting sports and hunting activities, there is a growing need for specialized equipment to support these hobbies. As a result, manufacturers are focusing on creating high-quality, durable accessories that cater to specific needs, such as long-range shooting, precision training, or tactical operations.

Another opportunity lies in the growing popularity of women in shooting sports and self-defense, which is influencing the design and functionality of accessories to accommodate a more diverse customer base. Additionally, the surge in online retail channels provides a great opportunity for both established brands and new entrants to reach global customers, particularly with e-commerce platforms offering a wide variety of gun accessories.

Technological advancements are significantly shaping the evolution of shooting and gun accessories. Key developments include the integration of smart technologies into accessories, such as smart scopes that use digital technology to enhance targeting accuracy and provide real-time ballistic data. Another notable innovation is the development of smart gun safes, which use biometric authentication (fingerprint scanning) or app-based controls to enhance security and provide quick access to firearms.

Furthermore, manufacturers are focusing on enhancing the ergonomics and user experience of shooting accessories, incorporating materials that reduce recoil, improve comfort, and enable greater customization of firearms.

These advancements are not only making shooting more enjoyable but also improving the safety and efficiency of firearm usage across various sectors, including law enforcement and the military. As the industry continues to embrace technological innovation, the market for shooting and gun accessories is expected to experience sustained growth.

Law enforcement in the United States comprises approximately 18,000 federal, state, county, and local agencies. According to the Bureau of Justice Statistics, there were about 750,340 sworn law enforcement officers employed by state and local agencies as of 2012, with a rate of 2.51 sworn officers per 1,000 U.S. residents.

The Law Enforcement Management and Administrative Statistics (LEMAS) survey collects data from over 3,000 law enforcement agencies, covering various aspects such as agency responsibilities, officer demographics, and training requirements.

In competitive sports, statistics reveal a growing trend in participation and performance metrics. For instance, the National Federation of State High School Associations reported that in the 2018-2019 academic year, there were approximately 7.9 million high school athletes across the United States.

In collegiate athletics, the NCAA reported that nearly 500,000 student-athletes competed in various sports during the 2020-2021 academic year. Additionally, sports participation has been linked to improved physical health and mental well-being among youth, with studies indicating that regular participation can reduce the risk of obesity and improve overall fitness levels.

Key Takeaways

- Market Size: The global shooting and gun accessories market is valued at USD 6.45 billion in 2023 and is expected to grow to USD 12.94 billion by 2033, with a CAGR of 7.21%.

- Dominant Segment by Type: The Air Rifle segment holds the largest share, accounting for more than 52% of the market in 2023, driven by the growing popularity of air rifles in recreational shooting and hunting.

- Key End-Use: Law Enforcement is the dominant end-user segment, making up 61% of the market share. This is due to the significant demand for high-quality, tactical shooting accessories used by law enforcement agencies for training, operations, and firearms maintenance.

- Distribution Channel: Offline channels dominate the market, capturing 60% of the market share in 2023. Traditional retail outlets and specialty stores continue to play a critical role in distributing shooting and gun accessories.

- Regional Leadership: North America holds the largest regional share of the market, with 40% of the global market revenue. This is attributed to the high gun ownership rate, strong recreational shooting culture, and substantial law enforcement demand in the region.

By Type

In 2023, the Air Rifle segment held a dominant market position, capturing more than a 52% share of the global shooting and gun accessories market. This significant market share can be attributed to the growing popularity of air rifles in both recreational shooting and hunting activities.

Air rifles offer several advantages, including lower cost, reduced noise, and the ability to be used in a variety of settings, such as urban areas and shooting ranges, where traditional firearms may not be allowed. Additionally, air rifles are often used for training purposes due to their low recoil and ease of handling, making them highly appealing to novice shooters and law enforcement agencies alike.

The popularity of air rifles has also been bolstered by their widespread use in shooting sports and competitions, especially in regions like North America and Europe, where recreational shooting and hunting are deeply ingrained in the culture.

The increasing number of shooting ranges and the rise in organized competitions have also contributed to the growing demand for air rifles. These factors have made air rifles an attractive choice for both amateurs and seasoned shooters, further solidifying their dominant position in the market.

Moreover, the continuous innovation in air rifle technology, including the development of high-precision models and improved ammunition, has played a crucial role in the segment’s growth. The availability of customizable accessories for air rifles, such as scopes, silencers, and custom grips, has made them even more appealing to enthusiasts and competitive shooters.

As the market for air rifles continues to expand, manufacturers are investing in research and development to introduce more advanced and user-friendly models, ensuring that air rifles will remain a dominant force in the shooting and gun accessories market.

By End-Use

In 2023, the Law Enforcement segment held a dominant market position, capturing more than 61% share of the global shooting and gun accessories market. This strong market presence is primarily driven by the increasing adoption of advanced shooting and gun accessories by law enforcement agencies worldwide.

Modern law enforcement operations require reliable, accurate, and highly efficient weaponry, as well as associated accessories such as holsters, scopes, ammunition, and tactical gear. The demand for these accessories has surged due to growing concerns over public safety, rising crime rates, and the need for improved policing equipment.

Law enforcement agencies across various countries are continuously upgrading their firearms and accessories to meet operational needs. The trend toward equipping officers with advanced firearms, which are often paired with high-tech accessories like red-dot sights, tactical lights, and specialized holsters, has been a key factor driving growth in this segment.

Furthermore, there is an increasing emphasis on officer safety, prompting a higher demand for personal protection equipment, including body armor, shooting gloves, and other tactical accessories. These factors have contributed to law enforcement being the largest end-user segment in the shooting and gun accessories market.

Moreover, law enforcement agencies are increasingly adopting firearms and accessories designed to enhance operational efficiency during high-stakes situations, such as active shooter incidents and counter-terrorism operations. The focus on providing officers with the best equipment for precision shooting and rapid response further strengthens the dominance of the law enforcement segment.

Additionally, the global rise in security concerns, including terrorism and civil unrest, has also led to the continued growth of this sector. The requirement for cutting-edge accessories to assist law enforcement in their duties ensures that this segment remains at the forefront of the market.

By Distribution Channel

In 2023, the Offline segment held a dominant market position, capturing more than 60% of the share in the shooting and gun accessories market. This segment continues to lead due to several key factors that drive consumer preference for in-person shopping experiences.

Traditional brick-and-mortar stores, including sporting goods stores, gun shops, and specialized retailers, have long been the primary point of purchase for shooting accessories. Consumers in this market often prefer to physically examine products, especially firearms and accessories, to assess their quality, functionality, and fit before making a purchase.

The offline retail experience also offers consumers the benefit of personal interaction with knowledgeable sales staff who can provide expert advice and answer specific questions about gun accessories. For first-time buyers or those looking to upgrade their equipment, the ability to consult with experts is a significant advantage. Additionally, consumers are often drawn to offline stores due to the immediate availability of products, which allows them to make an instant purchase and avoid shipping delays associated with online orders.

Moreover, the offline distribution channel is also heavily influenced by regulations surrounding the sale of firearms and gun accessories. In many regions, there are stringent laws governing the purchase of such products, and offline retailers are typically required to follow these regulations closely, ensuring compliance and building trust with customers. In-person purchases provide an added layer of security and reassurance for buyers, particularly in countries with strict gun laws.

Key Market Segments

By Type

- Air Rifle

- Air Pistol

- Others

By End-Use

- Law Enforcement

- Competitive Sports

By Distribution

- Online

- Offline

Driving Factors

Rising Popularity of Shooting Sports and Hunting

One of the key drivers of growth in the shooting and gun accessories market is the increasing popularity of shooting sports and hunting activities across the globe. With a growing number of enthusiasts participating in recreational shooting, competitions, and hunting, the demand for related accessories has surged. These activities, often influenced by cultural traditions or as part of outdoor sporting events, have led to a higher consumption of firearms, ammunition, and various accessories such as scopes, grips, and holsters.

The increasing acceptance of shooting sports as a recreational activity has been a catalyst for growth. Shooting sports like skeet shooting, target shooting, and air rifle competitions have gained widespread popularity, both at the amateur and professional levels.

This growing interest in shooting sports has significantly boosted demand for related accessories, as participants require high-quality equipment for safety and performance. Furthermore, as more individuals engage in outdoor recreational hunting, there is a heightened need for accessories that enhance performance, accuracy, and comfort in varying environmental conditions.

In many countries, government regulations have become more lenient, allowing more people to access shooting sports and hunting activities legally. This accessibility has expanded the market potential, especially in North America and parts of Europe, where hunting and shooting are deeply ingrained in the culture. Additionally, there has been a rise in organized hunting tours and shooting clubs, which further fuels the demand for specialized accessories.

Restraining Factors

Stringent Government Regulations and Compliance Issues

A significant restraint faced by the shooting and gun accessories market is the stringent government regulations and compliance requirements that limit the accessibility and distribution of firearms and related accessories.

The sale and use of firearms are strictly regulated in many countries, and these regulations often extend to the accessories used in shooting activities. These laws can make it difficult for manufacturers and retailers to expand their market reach, especially in countries with very tight restrictions.

In countries such as the United States, Canada, and the European Union, gun laws vary significantly. In some jurisdictions, the purchase of firearms and related accessories requires background checks, firearm registration, and compliance with various state or federal laws.

Additionally, retailers may face limitations on the types of accessories they can sell or restrictions on the marketing of these products. For example, the sale of high-capacity magazines or specific types of gun scopes may be prohibited in certain regions, creating challenges for businesses in those markets.

For international manufacturers, these diverse regulations can be particularly cumbersome, as they may need to navigate multiple legal frameworks and adapt their products or services to meet specific regional requirements. This results in increased operational costs, delays in product distribution, and potential legal risks associated with non-compliance.

Growth Opportunities

Increasing E-Commerce Adoption in the Shooting Accessories Market

The growing trend of e-commerce presents a significant opportunity for expansion in the shooting and gun accessories market. Online sales have rapidly gained traction across various industries, and the shooting accessories market is no exception. With the increasing adoption of e-commerce platforms, customers now have easy access to a wide range of products, from hunting gear to high-performance shooting accessories, all from the comfort of their homes.

One of the key drivers behind this opportunity is the convenience that online shopping offers. Consumers are increasingly looking for the ability to compare prices, read reviews, and explore a vast array of products before making their purchase decisions.

In the shooting accessories market, where knowledge about the products is often crucial, the ability to access detailed product descriptions, specifications, and expert reviews can be highly beneficial for customers. Online platforms allow consumers to access niche products that may not be available in local stores, catering to specialized needs in shooting, hunting, and law enforcement applications.

Furthermore, the development of online platforms designed specifically for gun and shooting accessories has opened new avenues for both buyers and sellers. E-commerce giants such as Amazon and smaller specialized platforms have made it easier for consumers to access a wide variety of products, from ammunition to accessories like gun scopes, holsters, and cleaning kits.

Challenging Factors

Supply Chain Disruptions and Product Availability

A major challenge faced by the shooting and gun accessories market is the frequent disruptions in the global supply chain, which can result in delays in product availability and an overall increase in costs. The shooting accessories industry is heavily reliant on a well-established and efficient supply chain for sourcing raw materials, manufacturing products, and distributing them to end consumers. However, ongoing supply chain issues, exacerbated by global events such as the COVID-19 pandemic, geopolitical tensions, and trade restrictions, have posed significant obstacles.

One of the key factors contributing to supply chain disruptions is the reliance on overseas manufacturing. A large portion of gun accessories and related products are produced in countries such as China, India, and other parts of Asia. These regions have faced logistical challenges, including shipping delays, labor shortages, and rising costs of raw materials, which have disrupted the timely production and delivery of shooting accessories.

The global shortage of key materials like metals, plastics, and chemicals has made it harder for manufacturers to meet the growing demand for shooting accessories. As a result, businesses are often forced to raise prices to cover the increased production costs or face potential shortages of popular products. The combination of supply chain disruptions and rising material costs poses a challenge for companies in the market, as it threatens to affect profit margins and limit the availability of certain items.

Growth Factors

The growth of the shooting and gun accessories market is primarily driven by the increasing participation in shooting sports and outdoor recreational activities like hunting. As more individuals engage in target shooting, competitive sports, and hunting, the demand for high-quality shooting and gun accessories has significantly risen.

This is particularly evident in regions such as North America, where hunting and shooting have cultural significance. Additionally, the rising number of sports events like shooting competitions is fueling the demand for professional-grade accessories like scopes, grips, and protective gear.

Emerging Trends

One of the emerging trends in the market is the increasing adoption of technologically advanced gun accessories. For example, the integration of smart technologies such as electronic sights, digital scopes, and smart triggers is becoming more prevalent.

These innovations offer improved performance and accuracy, catering to both professional athletes and recreational shooters. Another trend is the growing preference for customization. Consumers are increasingly looking for personalized accessories that enhance their firearms’ appearance, performance, and comfort, which has led to the rise of aftermarket products.

Business Benefits

For manufacturers, the growing demand for shooting and gun accessories provides significant business opportunities. As shooting sports and recreational hunting continue to attract more participants, companies that offer high-quality, innovative products can capitalize on expanding market potential.

Additionally, the increasing interest in safety and training equipment presents an opportunity for businesses to diversify their product offerings, targeting a broader audience. Through e-commerce platforms and retail channels, manufacturers can reach a global customer base, further enhancing revenue generation.

Regional Analysis

In 2023, North America held a dominant market position in the shooting and gun accessories market, capturing more than 40% of the global share, with a revenue of USD 2.58 billion. The region’s leadership in this market can be attributed to the strong cultural connection to shooting sports, hunting, and law enforcement activities. Countries like the United States and Canada have long-standing traditions of hunting and shooting sports, which continue to drive the demand for a wide range of shooting accessories.

The region’s well-established and evolving recreational shooting community plays a significant role in the growth of this market. Additionally, the large law enforcement and military presence in North America contributes to a steady demand for shooting accessories, from protective gear to tactical firearm accessories. Law enforcement agencies often invest in high-quality accessories such as scopes, grips, and holsters, contributing to a strong market for tactical products.

Moreover, North America benefits from a robust retail infrastructure, with both online and offline stores catering to the diverse needs of shooting enthusiasts. The growing preference for customization and technological advancements, such as the integration of smart scopes and advanced optics, is also gaining traction. Consumers in the region are increasingly looking for personalized and performance-enhancing products, leading to more innovation in the accessories space.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

American Outdoor Brands Inc. has established itself as a leader in the shooting and gun accessories market. The company has expanded its market footprint through strategic acquisitions and product diversification. In recent years, American Outdoor Brands has continued to enhance its portfolio by acquiring companies like Smith & Wesson and focusing on expanding its offerings for both recreational shooters and law enforcement agencies.

The company has also launched several new product lines, including firearm accessories and personal safety products, to cater to the growing demand for customized and performance-enhancing gear. Their continued investment in innovation and high-quality manufacturing processes has strengthened their position in the market.

ANSCHÜTZ Rifles, renowned for its high-performance shooting products, has been a prominent player in the market for competitive sports and law enforcement. The company has consistently introduced advanced precision rifles and shooting accessories, gaining a reputation for innovation and quality.

ANSCHÜTZ is particularly popular in the sports shooting segment, where its target rifles and optical sights are highly regarded. By expanding its product range and collaborating with shooting associations globally, ANSCHÜTZ continues to lead in both the competitive sports and hunting segments. The company also invests in creating ergonomically designed accessories to improve the overall user experience.

BSA Guns (UK) Ltd, based in Birmingham, is another key player in the shooting and gun accessories market, particularly known for its rich history and craftsmanship in producing air rifles and shooting accessories. The company has focused on expanding its product range by introducing new lines of optics and scopes, which are increasingly in demand due to the growing popularity of long-range shooting.

Their commitment to quality has earned them a loyal customer base, especially among recreational shooters and hunters. Recently, BSA Guns has been working on launching eco-friendly products, such as compressed air-powered rifles, to align with growing environmental concerns within the industry.

Top Key Players in the Market

- American Outdoor Brands Inc.

- ANSCHÜTZ Rifles

- BSA Guns (UK) Ltd

- Crosman Corporation

- Daisy Outdoor Products

- Daystate Ltd.

- Fabbrica D’Armi Pietro Beretta S.p.A.

- Feinwerkbau GmbH

- FN Herstal

- Gamo

- Heckler & Koch

- Remington Ammunition

- Savage

- Other Key Players

Recent Developments

- In February 2024: American Outdoor Brands Inc. launched a new line of precision rifle scopes designed for both competitive sports and hunting enthusiasts. This product features advanced optical technology and improved durability to withstand extreme weather conditions, positioning the brand to capture a larger share of the growing outdoor sports accessories market.

- In January 2024: ANSCHÜTZ Rifles unveiled an upgraded range of competition-grade air rifles tailored for Olympic and international shooting events. This new series incorporates innovative trigger systems and adjustable stock designs, offering enhanced accuracy and comfort to professional shooters.

Report Scope

Report Features Description Market Value (2023) USD 6.45 Bn Forecast Revenue (2033) USD 12.94 Bn CAGR (2024-2033) 7.21% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Air Rifle, Air Pistol, Others), By End-Use (Law Enforcement, Competitive Sports), By Distribution (Online, Offline) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape American Outdoor Brands Inc., ANSCHÜTZ Rifles, BSA Guns (UK) Ltd, Crosman Corporation, Daisy Outdoor Products, Daystate Ltd., Fabbrica D’Armi Pietro Beretta S.p.A., Feinwerkbau GmbH, FN Herstal, Gamo, Heckler & Koch, Remington Ammunition, Savage, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Shooting and Gun Accessories MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Shooting and Gun Accessories MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- American Outdoor Brands Inc.

- ANSCHÜTZ Rifles

- BSA Guns (UK) Ltd

- Crosman Corporation

- Daisy Outdoor Products

- Daystate Ltd.

- Fabbrica D'Armi Pietro Beretta S.p.A.

- Feinwerkbau GmbH

- FN Herstal

- Gamo

- Heckler & Koch

- Remington Ammunition

- Savage

- Other Key Players