Global Ship Repair and Maintenance Service Market Size, Share, Growth Analysis By Service Type (Hull Part Maintenance, Engine and Mechanical Repairs, Electrical and Instrumentation Services, Retrofit and Upgrades, Dry Docking, Underwater Inspection and Maintenance, Others), By Vessel Type (Cargo Ships, Tankers, Container Ships, Passenger Ships & Ferries, Offshore Vessels, Naval Ships, Fishing Vessels, Others), By End-User (Commercial, Defense, Private), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144397

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

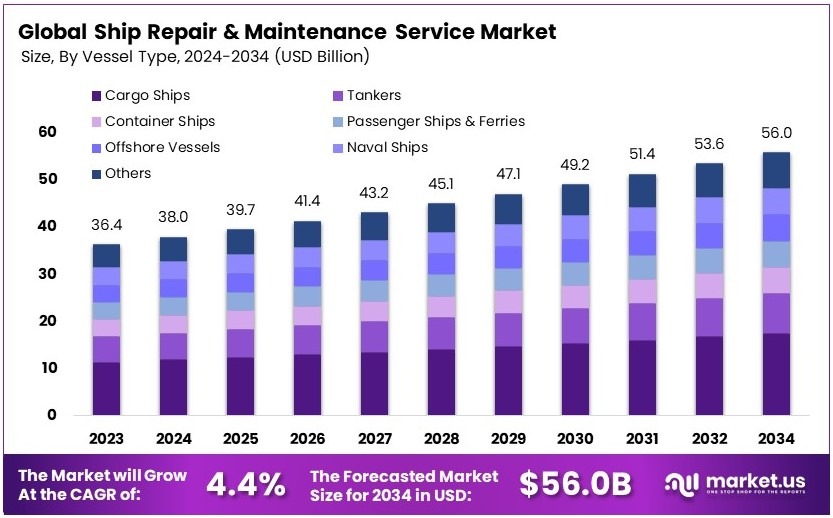

The Global Ship Repair and Maintenance Service Market size is expected to be worth around USD 56.0 Billion by 2034, from USD 36.4 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

Ship repair and maintenance services involve checking, fixing, and upgrading ships. Services include engine repairs, painting, hull cleaning, and safety checks. These are essential to keep ships running safely and efficiently. Regular maintenance reduces breakdowns and meets global maritime standards.

The ship repair and maintenance service market includes shipyards, repair companies, and service providers. Growth is driven by international trade, aging fleets, and stricter marine safety rules. The market also benefits from technological upgrades, increased sea transport, and demand for fast, cost-effective repair solutions.

The ship repair and maintenance service sector is growing with global trade expansion. Ships need regular checks to stay safe and efficient. For example, the U.S. Navy recently repaired the USNS Wally Schirra in South Korea. This marked the first full-scale overhaul in the Indo-Pacific, showing growing international collaboration.

The ship repair and maintenance service market is becoming more active as maritime trade increases. With more cargo ships, tankers, and naval fleets operating globally, regular servicing is a must. This drives demand for skilled labor, better dry dock facilities, and faster turnaround solutions at global ports.

In addition, government investments are creating long-term opportunities. In February 2025, India announced a ₹250 billion (about $2.9 billion) maritime fund. The government will fund 49% of this total. This project will boost shipbuilding and repair infrastructure, especially in coastal regions where repair demand is high.

Meanwhile, the U.S. is pushing new policies. Proposed fees of up to $1.5 million per Chinese-built vessel could generate $52 billion yearly. This is aimed at reducing reliance on foreign shipbuilders and supporting local yards. These regulations may shift where ships go for repairs in the future.

On the other hand, market competition is increasing. Many shipyards offer similar repair services, leading to pricing challenges. Still, shipyards that invest in advanced tools and skilled workers gain an edge. Quality, speed, and location remain top factors for clients choosing repair partners.

Broader impacts are also becoming clear. In Europe, Greek shipyards are recovering after years of decline. In the last year, 37 ships were repaired at Skaramangas. That number is expected to double. As a result, Greece’s shipbuilding sector may grow from 1.5% to 2.5% of its GDP.

Locally, this boosts jobs and regional growth. Ports in Greece, India, and the U.S. are becoming economic hubs. Skilled labor demand rises, and nearby businesses benefit too. Therefore, investment in this sector brings both national economic value and strong local development opportunities.

Key Takeaways

- The Ship Repair and Maintenance Service Market was valued at USD 36.4 billion in 2024 and is expected to reach USD 56.0 billion by 2034, with a CAGR of 4.4%.

- In 2024, Dry Docking dominates the service type segment with 31.4%, crucial for vessel maintenance and regulatory compliance.

- In 2024, Cargo Ships lead the vessel type segment with 27.8%, requiring frequent repairs due to heavy operational use.

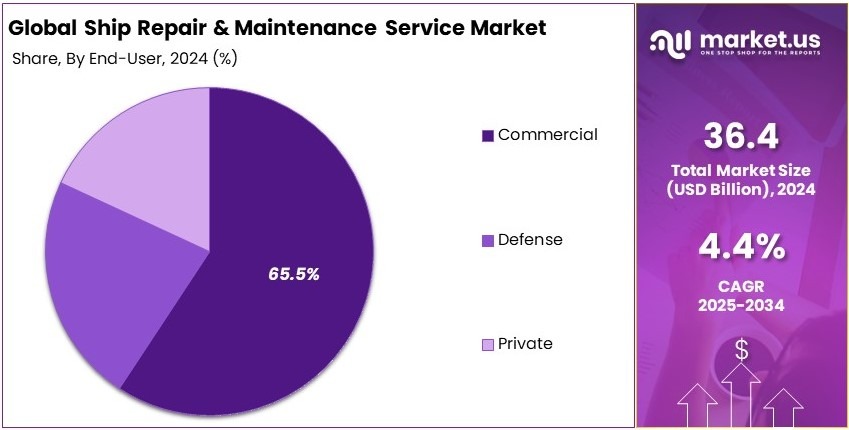

- In 2024, Commercial is the dominant end-user segment with 65.5%, driven by rising global trade and fleet expansions.

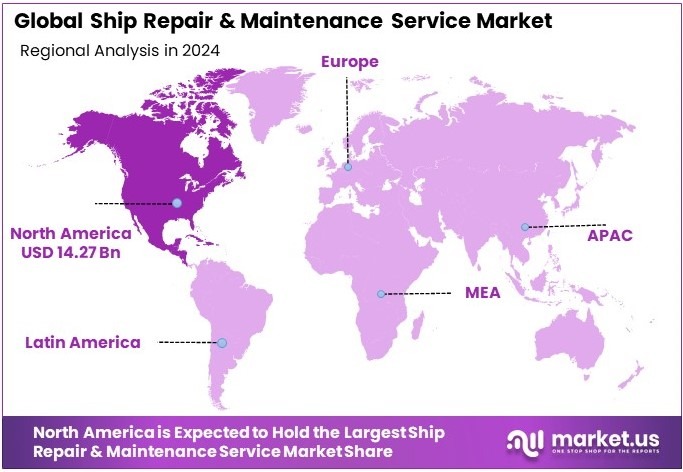

- In 2024, North America holds 39.2% of the market, valued at USD 14.27 billion, due to its strong maritime infrastructure.

Service Type Analysis

Dry Docking dominates with 31.4% due to strict regulatory needs, full access to vessel parts, and routine structural inspections.

In the Ship Repair and Maintenance Service Market, dry docking holds the highest share under the service type segment. This method is essential for ships to undergo full maintenance while out of water. It allows access to the hull, propellers, and underwater sections that cannot be inspected during normal operations.

Many shipping companies plan dry docking every 3 to 5 years, depending on international safety regulations. During this time, cleaning, painting, and structural repairs are completed. Dry docking helps extend vessel life and prevents long-term damage. It also ensures the ship complies with safety, fuel efficiency, and environmental standards.

Hull part maintenance follows in demand. It focuses on surface cleaning, painting, and minor damage fixes. Engine and mechanical repairs are critical when vessels face internal failures or need overhauls. Electrical and instrumentation services support navigation, lighting, and control systems, especially in newer ships.

Retrofit and upgrades are growing with the rise of green shipping, where old systems are replaced with energy-efficient solutions. Underwater inspection and maintenance include propeller checks and minor underwater tasks without full docking. The “Others” segment includes emergency repairs, welding, and small-scale part replacements on-demand, often done at ports.

Vessel Type Analysis

Cargo Ships dominate with 27.8% due to their high global numbers, constant movement, and regular maintenance schedules.

Cargo ships are the backbone of global trade and require frequent servicing to stay operational. They carry goods across long distances, often facing rough sea conditions. As a result, these ships need regular repair and maintenance to avoid breakdowns.

Cargo vessels also run on tight schedules, so efficient service is key to avoid costly delays. Most large shipyards and repair centers are equipped to handle cargo ships, which adds to their dominance. Their size, fuel systems, and hulls demand specialized dry docking, engine overhauls, and hull treatments on a regular basis.

Container ships are next in line. These ships transport packaged goods and need well-maintained cargo handling systems. Tankers carry oil and chemicals and must follow strict environmental and safety checks. Passenger ships and ferries require high standards of comfort and reliability, with more attention to interior and safety systems.

Offshore vessels are used in oil rigs and need repair services in remote or deep-sea areas. Naval ships follow strict military protocols and timelines. Fishing vessels have lower budgets and simpler systems but still need periodic servicing. The “Others” group includes tugs, barges, and custom service boats used in ports and local transport.

End-User Analysis

Commercial dominates with 65.5% due to the massive global shipping industry, high operational risks, and constant trade movements.

The commercial segment is the largest end-user in the ship repair and maintenance market. Global shipping companies manage fleets that transport goods between continents every day. These ships face daily wear and tear due to heavy loads, saltwater exposure, and long trips. To avoid downtime, commercial shipowners invest heavily in routine repairs and planned maintenance.

Delays in commercial shipping can lead to huge financial losses, so scheduled services like dry docking and engine overhauls are crucial. In addition, rising fuel prices and emissions rules push companies to adopt more efficient and compliant systems. This creates a steady need for retrofit and inspection services.

Defense ships, though smaller in number, follow strict servicing needs due to national security demands. Naval ships must remain fully operational and ready at all times. Their maintenance schedules are often more frequent and confidential. The private end-user segment includes yachts, fishing boats, and tour vessels.

While they require less frequent servicing, they still need reliable support for safety and performance. Private owners also prefer fast service and aesthetic upgrades. This segment is growing slowly, mainly in regions with rising marine tourism and recreational boating.

Key Market Segments

By Service Type

- Hull Part Maintenance

- Engine and Mechanical Repairs

- Electrical and Instrumentation Services

- Retrofit and Upgrades

- Dry Docking

- Underwater Inspection and Maintenance

- Others

By Vessel Type

- Cargo Ships

- Tankers

- Container Ships

- Passenger Ships & Ferries

- Offshore Vessels

- Naval Ships

- Fishing Vessels

- Others

By End-User

- Commercial

- Defense

- Private

Driving Factors

Maritime Trade and Eco Regulations Drive Market Growth

The ship repair and maintenance service market is expanding steadily, supported by the rise in global maritime trade. With more cargo ships, tankers, and offshore vessels operating worldwide, there is a growing need for regular maintenance to ensure safety and performance. Ports across Asia, Europe, and the Americas are seeing more traffic, which increases demand for service facilities.

At the same time, stricter environmental regulations are reshaping the industry. Ships now must meet international emissions standards, such as IMO 2020, which limits sulfur emissions. These rules push shipowners to invest in eco-friendly upgrades like scrubbers, cleaner engines, and low-emission technologies.

Offshore oil and gas activities also fuel the market. These operations use supply vessels, rigs, and support ships that require frequent repairs due to harsh working conditions. As exploration increases, particularly in deep-sea locations, the need for vessel upkeep rises.

Lastly, advancements in AI-based monitoring and predictive maintenance are changing how fleets are managed. These systems help detect problems before breakdowns occur, improving efficiency and reducing repair costs.

Restraining Factors

High Costs and Operational Challenges Restrain Market Growth

Although the market is growing, several barriers limit broader expansion. One key restraint is the high cost of dry-docking and scheduled maintenance. These processes involve taking ships out of service, hiring skilled technicians, and using specialized equipment. This makes routine upkeep a significant expense for fleet operators.

Another major issue is the shortage of skilled workers. Many shipyards lack enough certified welders, marine engineers, and repair specialists. This workforce gap delays projects and affects service quality, especially in smaller or less-developed ports.

Fuel price fluctuations also affect ship maintenance budgets. When prices rise, shipping companies often cut costs elsewhere, including repair schedules. This reduces demand for services and can delay needed upgrades or overhauls.

Operational disruption is another concern. Coordinating maintenance without affecting shipping routes or delivery times is difficult. Any delays in repair work can result in lost revenue and customer dissatisfaction, especially for commercial operators.

Growth Opportunities

Green Tech and Smart Solutions Provide Opportunities

There are several promising opportunities for growth in the ship repair and maintenance service market. One area gaining attention is AI and autonomous maintenance. These technologies use sensors and data to predict wear and tear, allowing for timely service and fewer unplanned outages. Smart ships with onboard diagnostics will drive demand for tech-enabled repair services.

Green retrofitting is another major opportunity. As regulations tighten, more ships need upgrades to reduce emissions and meet climate goals. Services such as engine conversions, ballast water treatment installations, and low-sulfur fuel systems are now in high demand. This shift toward sustainability is opening new markets for shipyards and repair providers.

Underwater and remote repair technologies are also advancing. Robotic systems now perform basic inspections, hull cleaning, and even minor fixes without dry-docking. This reduces downtime and keeps ships in operation longer.

Investment in shipyard infrastructure is rising too. Many ports are upgrading their facilities with automated tools, advanced cranes, and larger dry docks. These upgrades improve service quality and attract more international clients.

Emerging Trends

Smart Repairs and Digital Tools Are Latest Trending Factor

The ship repair market is being transformed by technology trends focused on speed, precision, and digital insights. Robotics and automation are becoming key tools in shipyards. Robots can now inspect hulls, clean surfaces, and even weld or paint, reducing the need for manual labor and speeding up service times.

3D printing is another exciting trend. It allows shipyards to produce spare parts on demand, right at the port or onboard. This reduces waiting time for replacements and avoids the need to stockpile rare or custom components. Ships can now be repaired faster and return to service more quickly.

Digital twin technology is also on the rise. These virtual models of ships monitor real-time data and simulate performance. Engineers can predict future problems and plan repairs more accurately, reducing downtime and repair costs.

Modular and portable repair stations are growing in popularity as well. These mobile units can be set up at smaller ports or onboard vessels, offering quick fixes without major detours. They are especially useful for fleets operating in remote or underserved regions.

Regional Analysis

North America Dominates with 39.2% Market Share

North America leads the Ship Repair and Maintenance Service Market with a 39.2% share, valued at USD 14.27 billion. This leadership is driven by a large commercial shipping fleet, strong naval presence, and well-established repair infrastructure across the U.S. and Canada. Regular service demand from defense, trade, and cruise operations supports continuous market growth.

Key factors behind this dominance include the presence of major commercial ports like Los Angeles, Houston, and Vancouver. These ports handle heavy shipping traffic and require frequent maintenance to ensure smooth operations. The U.S. Navy also plays a major role in the region’s ship repair needs, with dedicated shipyards and regular service contracts. In addition, strict maritime safety regulations in North America push shipowners to invest in routine inspections and upgrades.

Market dynamics are shaped by high labor standards, advanced technologies, and government-backed investments. North America’s repair yards use modern dry docking and underwater maintenance systems. The cruise industry, particularly in Florida and California, also contributes through periodic refurbishments and service checks. Environmental rules encourage engine upgrades and eco-friendly retrofits, fueling demand for skilled services.

Regional Mentions:

- Europe: Europe maintains a solid position in ship repair, with countries like Germany, Norway, and the Netherlands offering skilled labor and strong maritime regulations. The region is focusing on eco-friendly retrofitting and services for aging commercial fleets and ferries.

- Asia Pacific: Asia Pacific is growing fast due to high shipbuilding activity and low-cost labor. Countries like China, South Korea, and Singapore are key players, providing competitive repair solutions for cargo, tanker, and container ships.

- Middle East & Africa: The Middle East and Africa are emerging as ship repair hubs. UAE and South Africa are investing in dry dock facilities to serve oil tankers and offshore vessels operating in regional trade and energy sectors.

- Latin America: Latin America sees gradual growth in ship repair, with Brazil, Chile, and Mexico improving port infrastructure. Coastal trade and naval projects drive service demand, especially for fishing fleets and regional cargo operations.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The ship repair and maintenance service market is essential for global shipping, naval operations, and offshore activities. The top four companies—Huntington Ingalls Industries, Inc., General Dynamics NASSCO, Damen Shipyards Group, and Keppel Offshore & Marine Ltd.—lead the market with strong facilities, technical expertise, and global reach.

Huntington Ingalls Industries, Inc. is a key U.S. naval shipbuilder. It offers advanced maintenance and repair services for military fleets. The company operates major shipyards and has deep expertise in defense-grade vessels.

General Dynamics NASSCO provides full-service ship maintenance and conversion. It serves commercial and military ships with drydocking, engine work, and hull repairs. NASSCO is known for quality and on-time delivery.

Damen Shipyards Group is a global leader with shipyards in multiple countries. It offers repair, refit, and conversion services for all vessel types. Damen’s mobile repair teams and floating docks make it highly flexible.

Keppel Offshore & Marine Ltd. is based in Singapore and serves global shipping and oil sectors. It offers complex ship repairs, upgrades, and retrofitting. The company focuses on technology, safety, and turnaround speed.

These key players benefit from strategic locations, advanced facilities, and skilled workforces. They serve both commercial and defense sectors with reliable, cost-effective services.

In summary, the top companies in the ship repair and maintenance service market succeed through scale, technical ability, and global operations. Their strong infrastructure and trusted service help keep the world’s fleets running safely and efficiently.

Major Companies in the Market

- Huntington Ingalls Industries, Inc.

- General Dynamics NASSCO

- Damen Shipyards Group

- Keppel Offshore & Marine Ltd.

- ST Engineering (Singapore Technologies Engineering Ltd.)

- Hyundai Heavy Industries Co., Ltd.

- BAE Systems plc

- Fincantieri S.p.A.

- Vigor Industrial LLC

- Sembcorp Marine Ltd.

- Drydocks World

- ASRY (Arab Shipbuilding and Repair Yard)

- China Shipbuilding Industry Corporation (CSIC)

Recent Developments

- CSL and Maersk: On February 2025, CSL and Maersk signed a Memorandum of Understanding to explore collaborative opportunities in ship repair, maintenance, and building activities in India. The partnership aligns with India’s maritime objectives and is expected to bolster the nation’s maritime infrastructure.

- CSL: On April 2024, CSL entered into a Master Shipyard Repair Agreement with the United States Navy. This non-financial agreement enables CSL to undertake repair work on U.S. Navy vessels operating under the Military Sealift Command, demonstrating its competence in ship repair and maintenance.

Report Scope

Report Features Description Market Value (2024) USD 36.4 Billion Forecast Revenue (2034) USD 56.0 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Hull Part Maintenance, Engine and Mechanical Repairs, Electrical and Instrumentation Services, Retrofit and Upgrades, Dry Docking, Underwater Inspection and Maintenance, Others), By Vessel Type (Cargo Ships, Tankers, Container Ships, Passenger Ships & Ferries, Offshore Vessels, Naval Ships, Fishing Vessels, Others), By End-User (Commercial, Defense, Private) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Huntington Ingalls Industries, Inc., General Dynamics NASSCO, Damen Shipyards Group, Keppel Offshore & Marine Ltd., ST Engineering (Singapore Technologies Engineering Ltd.), Hyundai Heavy Industries Co., Ltd., BAE Systems plc, Fincantieri S.p.A., Vigor Industrial LLC, Sembcorp Marine Ltd., Drydocks World, ASRY (Arab Shipbuilding and Repair Yard), China Shipbuilding Industry Corporation (CSIC) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ship Repair and Maintenance Service MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Ship Repair and Maintenance Service MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Huntington Ingalls Industries, Inc.

- General Dynamics NASSCO

- Damen Shipyards Group

- Keppel Offshore & Marine Ltd.

- ST Engineering (Singapore Technologies Engineering Ltd.)

- Hyundai Heavy Industries Co., Ltd.

- BAE Systems plc

- Fincantieri S.p.A.

- Vigor Industrial LLC

- Sembcorp Marine Ltd.

- Drydocks World

- ASRY (Arab Shipbuilding and Repair Yard)

- China Shipbuilding Industry Corporation (CSIC)