Global Setting Spray Market Size, Share, Growth Analysis By Product Type (Matte Setting Sprays, Hydrating Setting Sprays, Long-Lasting Setting Sprays), By Distribution Channel (Offline, Online), By End-User (Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 105161

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

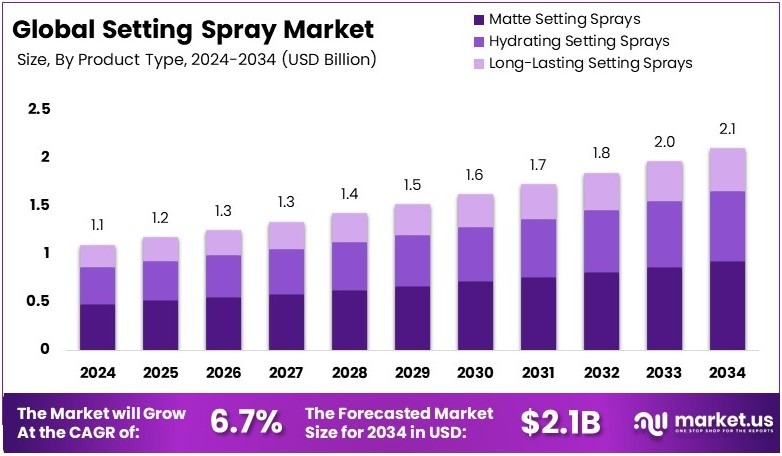

The Global Setting Spray Market size is expected to be worth around USD 2.1 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034.

Setting spray is a beauty product used after applying makeup. It helps keep makeup in place for longer hours. The spray forms a light layer over the skin, reducing smudging and fading. Many formulas also include skincare benefits like hydration or oil control.

The Setting Spray Market includes the production, distribution, and sales of setting sprays. It involves cosmetics brands, retailers, and beauty service providers. Growth is driven by rising demand for long-lasting makeup, beauty influencers, and skincare-infused formulas. The market is expanding with new product innovations and wider consumer adoption.

Setting spray is now seen as a must-have in everyday makeup routines. It helps keep makeup in place longer and prevents smudging. As more people seek long-lasting, polished looks, demand continues to grow. Consumers also prefer setting sprays with skincare benefits like hydration and oil control, adding to their appeal.

The Setting Spray market is expanding due to rising interest in personal grooming. According to LendingTree, 75% of Americans consider beauty products important and spend an average of $1,754 yearly. This trend reflects high consumer interest and strong spending in the cosmetics segment, including setting sprays.

In addition, platforms like YouTube and TikTok are driving demand. Beauty creators share tutorials and “Get Ready With Me” videos, often using setting sprays. These formats influence buyers, especially young users. As social media trends grow, so does awareness of setting sprays and their everyday use.

Currently, market saturation is moderate, mostly in urban regions. In smaller towns or developing areas, there’s still room to grow. Local salons, beauty stores, and e-commerce platforms can drive expansion. Offering smaller, budget-friendly packs can also reach cost-conscious buyers and first-time users.

Meanwhile, competition remains high, with many global and local brands. Players focus on product innovation—such as vegan formulas and dual-use sprays. Eco-friendly packaging and multifunctional sprays are also trending. These features help brands stand out in a crowded, fast-moving beauty market.

Key Takeaways

- The Setting Spray Market was valued at USD 1.1 billion in 2024 and is expected to reach USD 2.1 billion by 2034, with a CAGR of 6.7%.

- In 2024, Matte Setting Sprays dominated the product type with 63.2% segment due to high demand for long-lasting, oil-control formulations.

- In 2024, Offline distribution channels led the market with 57.8%, benefiting from strong consumer preference for in-store testing before purchase.

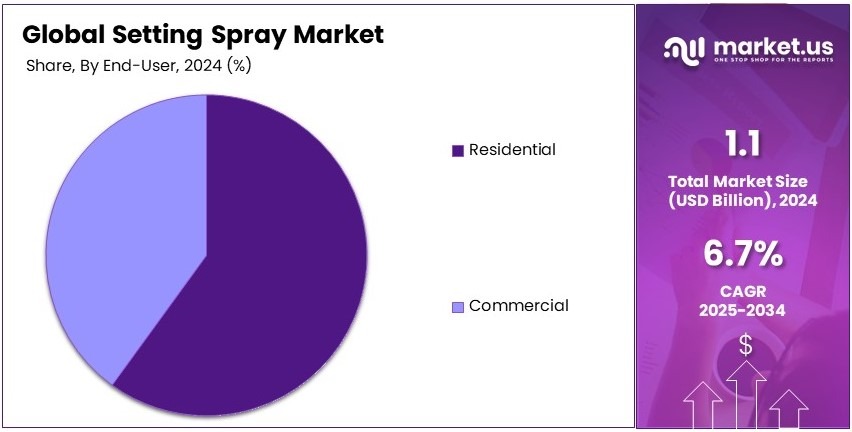

- In 2024, Residential end-users dominated with 68.4%, driven by the increasing popularity of at-home makeup applications.

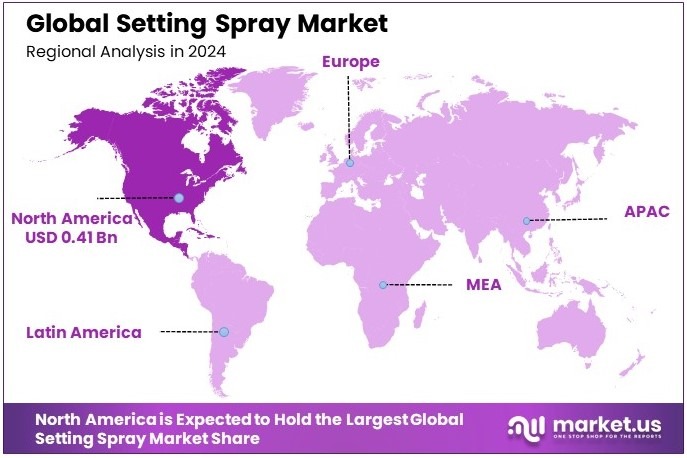

- In 2024, North America held 37.5% market share, valued at USD 0.41 billion, driven by strong beauty industry growth.

Product Type Analysis

Matte Setting Sprays dominate with 63.2% due to their effectiveness in controlling oil and providing a smooth finish.

Matte Setting Sprays are the leading product type in the Setting Spray Market, holding a significant 63.2% share. This dominance stems from their ability to control excess facial oil and reduce shine, which is highly valued by consumers seeking a flawless makeup finish. These sprays are especially popular in warmer climates and among individuals with oily skin, as they help maintain the makeup’s appearance for longer periods without the need for frequent touch-ups.

Hydrating Setting Sprays and Long-Lasting Setting Sprays are also vital to the market. Hydrating sprays are essential for dry skin types, offering moisture and a dewy finish, while long-lasting sprays cater to the needs of users requiring extended makeup wear, such as for events or long workdays. Both segments contribute to the overall growth by addressing specific consumer needs and preferences.

Distribution Channel Analysis

Offline dominates with 57.8% due to consumer preference for testing products before purchase.

Offline channels are the predominant distribution method for setting sprays, capturing 57.8% of the market. This preference is largely due to the tactile nature of beauty product shopping, where consumers often prefer to test sprays firsthand to assess their feel and finish on the skin before making a purchase. Retail locations like beauty stores and cosmetics departments in malls play a crucial role in facilitating these consumer habits.

Online channels, while growing, supplement the main sales by offering convenience and often broader selections, including reviews that help consumers make informed decisions. Despite their smaller current share, online sales are on an upward trend, driven by the increasing comfort of consumers with online shopping and the proliferation of e-commerce platforms.

End-User Analysis

Residential dominates with 68.4% as home users increasingly seek professional-quality products.

Residential users form the largest end-user segment for setting sprays, accounting for 68.4% of the market. This segment’s growth is fueled by the increasing trend of consumers applying professional makeup techniques at home, driven by the widespread availability of tutorials and beauty influencers on social media platforms. Residential consumers appreciate the ability to achieve long-lasting, professional-quality makeup results using products like setting sprays.

Commercial users, including salons and professional makeup artists, although smaller in market share, rely heavily on setting sprays to ensure client satisfaction with makeup longevity during events. As this sector recovers and grows post-pandemic, its demand for high-quality, durable makeup products like setting sprays is expected to increase, further contributing to the market’s expansion.

Key Market Segments

By Product Type

- Matte Setting Sprays

- Hydrating Setting Sprays

- Long-Lasting Setting Sprays

By Distribution Channel

- Offline

- Online

By End-User

- Commercial

- Residential

Driving Factors

Consumer Lifestyle and Digital Influence Drive Market Growth

The Setting Spray market is witnessing steady growth, largely driven by the rising demand for long-lasting makeup solutions among a wide range of consumers. In recent years, consumers have become more focused on maintaining fresh and smudge-free makeup throughout the day, especially in humid or long-wear conditions. This growing preference has significantly increased the use of setting sprays as an essential step in makeup routines.

At the same time, the surge in online beauty tutorials, influencer content, and social media trends has played a major role in popularizing setting sprays. Beauty influencers and professional makeup artists frequently showcase setting sprays in their tutorials, demonstrating their value in achieving polished, long-lasting looks. This digital exposure has helped boost consumer awareness and drive product trials.

Additionally, increasing disposable income, especially in urban areas, has encouraged consumers to invest more in cosmetic products. Setting sprays are now viewed not only as makeup fixatives but also as part of a complete beauty regimen. Innovation in product formulations—such as setting sprays that offer hydration, oil control, or added skin benefits—has further enhanced product appeal.

Restraining Factors

Ingredient Concerns and Market Competition Restraint Market Growth

Despite its upward trend, the Setting Spray market faces several challenges that may limit its full potential. One of the key concerns among consumers is the use of synthetic ingredients and chemicals in many setting spray formulas, which can lead to skin irritation or allergic reactions, particularly for those with sensitive skin. This has made some consumers hesitant to use the product regularly or at all.

Moreover, the market faces stiff competition from emerging beauty technologies and other long-lasting cosmetic products. For instance, advances in foundation and primer formulas that promise extended wear have, in some cases, reduced the perceived need for separate setting sprays. Consumers may opt for these multipurpose products instead, which simplifies their routines while offering similar results.

Economic slowdowns can also impact the market, as setting sprays are often seen as non-essential items within the broader cosmetics category. During periods of financial uncertainty, consumers may reduce discretionary spending, choosing basic skincare over additional cosmetic steps.

Lastly, regional differences in beauty standards and makeup preferences lead to inconsistent demand for setting sprays across different global markets. For example, consumers in some regions may favor natural looks, reducing the need for long-wear products. These challenges, while not insurmountable, require brands to adapt their strategies to maintain market momentum.

Growth Opportunities

Natural Formulas and Market Reach Provide Opportunities

The Setting Spray market presents several notable opportunities that can support future growth and product innovation. One of the most promising areas is the development of setting sprays formulated with organic and natural ingredients. As consumers become more health-conscious and ingredient-aware, demand for clean beauty products has increased significantly. Offering setting sprays with botanical extracts, aloe vera, or antioxidant-rich ingredients can attract a broader consumer base, including those with sensitive skin.

There is also growing interest in cosmetics tailored specifically for men, and the setting spray segment is beginning to explore this niche. As male grooming trends expand beyond skincare, brands can introduce lightweight, matte-finish sprays designed for male consumers, opening up new market segments.

Additionally, partnerships with beauty salons and online retailers present strong business potential. Salons serve as direct points of contact with customers, enabling live product demonstrations and cross-selling opportunities. Online platforms, meanwhile, allow for broader reach and the use of data analytics to target specific consumer groups.

Emerging markets—particularly in Asia, Latin America, and Africa—are also becoming key areas of opportunity due to the rise of middle-class populations and increased interest in Western beauty standards. Tapping into these growing markets with region-specific strategies can offer long-term growth potential.

Emerging Trends

Green Packaging and Celebrity Appeal Are Latest Trending Factor

Current trends in the Setting Spray market are being shaped by a strong focus on combining beauty and sustainability. One major trend is the enhancement of product formulations with added skincare benefits. Setting sprays are no longer seen solely as makeup fixatives but are now formulated to include moisturizing agents, antioxidants, and even SPF protection, turning them into hybrid products that support both skincare and makeup goals.

Another notable trend is the shift toward eco-friendly and sustainable packaging. As environmental awareness increases, consumers are actively seeking out brands that use recyclable materials, refillable packaging, or low-impact manufacturing processes. This focus on sustainability not only improves brand image but also aligns with the values of modern, environmentally conscious consumers.

Collaborations with celebrities and well-known makeup artists are also driving market appeal. These endorsements lend credibility and influence consumer perception, particularly among younger audiences who look to public figures for product recommendations.

Finally, technological advancements in spray mechanisms are making application more precise and user-friendly. Innovations such as fine-mist nozzles or continuous-spray designs enhance the user experience and ensure even product distribution. These evolving trends are redefining consumer expectations and will likely continue to shape the market landscape in the years ahead.

Regional Analysis

North America Dominates with 37.5% Market Share

North America leads the Setting Spray Market with a 37.5% share, totaling USD 0.41 billion. This substantial market presence is driven by a vibrant cosmetic industry, high consumer spending on beauty products, and a widespread culture of makeup use for both daily wear and professional applications.

The region’s beauty market is characterized by high demand for long-lasting makeup products due to busy lifestyles and diverse climate conditions. The availability of a wide range of setting sprays tailored to different skin types and needs also fuels growth. Additionally, the influence of social media and beauty influencers who endorse these products plays a significant role in shaping consumer preferences.

The future of North America’s influence in the global Setting Spray Market looks robust. Continued innovation in product formulations and packaging, coupled with growing awareness about cruelty-free and natural ingredients, is likely to attract more consumers. The market’s expansion is expected to continue as new demographics, including younger and more diverse consumer groups, become more engaged with personalized beauty solutions.

Regional Mentions:

- Europe: Europe maintains a strong presence in the Setting Spray Market, supported by luxury beauty brands and a focus on high-quality cosmetics. The region emphasizes sustainable and ethically sourced ingredients, which attract a conscientious consumer base.

- Asia Pacific: Asia Pacific is rapidly growing in the Setting Spray Market, driven by increasing urbanization and the influence of K-beauty trends. Innovations in cosmetic technology and a surge in e-commerce sales are key factors boosting the region’s market growth.

- Middle East & Africa: The Middle East and Africa are slowly increasing their market share in the Setting Spray Market. The demand is fueled by the growing beauty and personal care industry and an increasing number of young consumers adopting Western beauty routines.

- Latin America: Latin America shows promising growth in the Setting Spray Market. The region’s developing beauty sector and rising disposable incomes are leading to greater consumer expenditure on cosmetics, including advanced makeup products like setting sprays.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Setting Spray Market is led by a few well-established and highly influential beauty brands. The top four companies—Urban Decay (owned by L’Oréal), MAC Cosmetics (owned by Estée Lauder), Milani Cosmetics, and Make Up For Ever—play a major role in shaping trends, product innovation, and global reach.

These companies dominate through brand recognition, strong distribution networks, and consistent product quality. Urban Decay, for example, is known for its “All Nighter” setting spray, which has become a staple in both professional and personal makeup routines. MAC Cosmetics is popular for its multi-use Fix+ spray that blends skincare and setting in one product, appealing to both makeup artists and everyday users.

Product innovation is a key strength of these players. They focus on lightweight formulas, long-lasting results, and solutions tailored for different skin types. These companies also adapt quickly to consumer trends such as vegan formulas, clean beauty, and cruelty-free testing. Their presence in both offline and online channels allows them to reach a broad customer base worldwide.

Collaborations with influencers, makeup artists, and celebrities also boost visibility and trust. Marketing strategies built around social media platforms like Instagram, TikTok, and YouTube help drive consumer interest and keep products in demand.

The future looks strong for these key players as the demand for high-performance, skin-friendly makeup products continues to grow. Their ability to innovate, maintain strong brand loyalty, and expand in emerging markets will help them lead the setting spray market in the coming years.

Major Companies in the Market

- Urban Decay (Owned by L’Oréal)

- MAC Cosmetics (Owned by Estée Lauder)

- Milani Cosmetics

- Make Up For Ever

- Skindinavia

- Cover FX

- e.l.f. Cosmetics

- Tatcha

- Other Key Players

Recent Developments

- Gillian Anderson and L’Oréal Paris: On March 2025, actress Gillian Anderson endorsed L’Oréal Paris Infallible 3-Second Setting Spray at the SAG Awards. This budget-friendly spray, priced under £10, promises up to 36-hour wear with a lightweight, microfine mist that prevents spots, patches, or streaks. It is designed for all skin types and offers transfer-proof, waterproof, and sweat-proof protection while hydrating the skin to reduce cakiness and dry patches.

- ONE/SIZE: On March 2025, ONE/SIZE reintroduced its limited-edition On ‘Til Dawn Glitter Waterproof Setting Spray after selling out in one day the previous year. This glitter-infused version of the brand’s original setting spray adds a luminous shimmer while providing a matte, waterproof, and transfer-proof finish suitable for both face and body.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 2.1 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Matte Setting Sprays, Hydrating Setting Sprays, Long-Lasting Setting Sprays), By Distribution Channel (Offline, Online), By End-User (Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Da Urban Decay (Owned by L’Oréal), MAC Cosmetics (Owned by Estée Lauder), Milani Cosmetics, Make Up For Ever, Skindinavia, Cover FX, e.l.f. Cosmetics, Tatcha, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Da Urban Decay (Owned by L'Oréal)

- MAC Cosmetics (Owned by Estée Lauder)

- Milani Cosmetics

- Make Up For Ever

- Skindinavia

- Cover FX

- l.f. Cosmetics

- Tatcha

- Other Key Players