Global Serviced Apartment Market Size, Share, Growth Analysis By Type (Short-Term (30 Nights)), By End Use (Corporate/Business Traveler, Leisure Traveler, Expats and Relocators), By Booking Mode (Direct Booking, Corporate Contracts, Online Travel Agencies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 152433

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

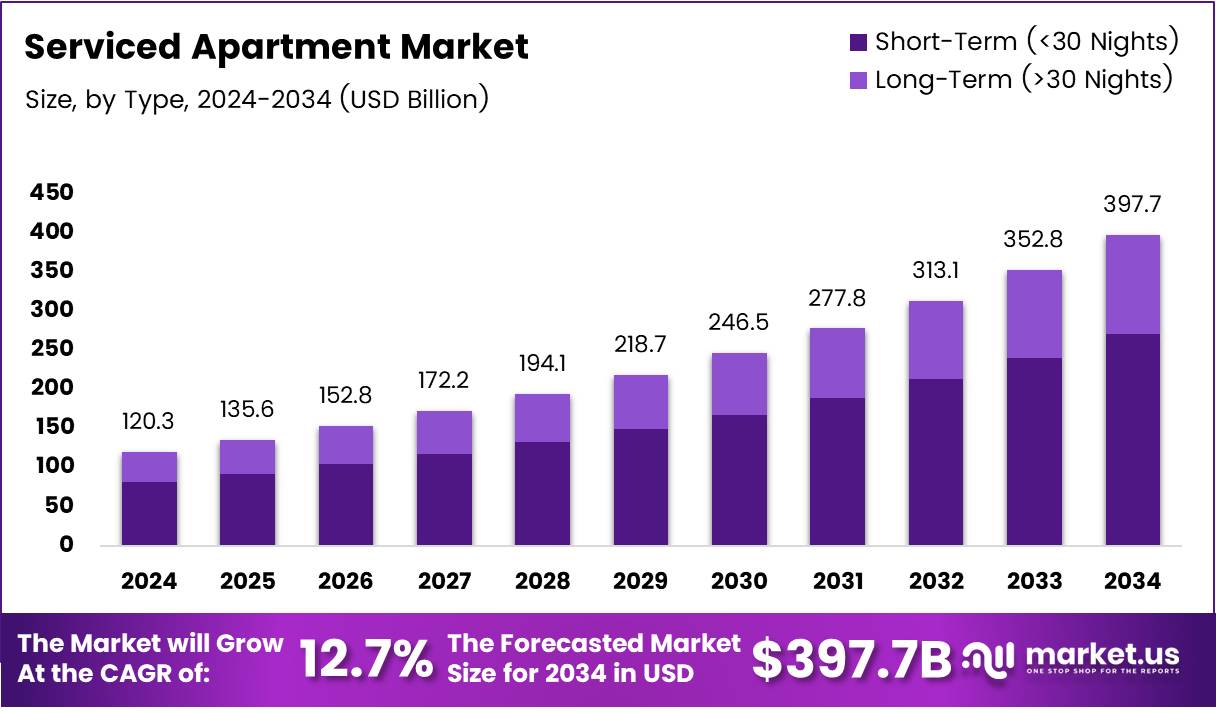

The Global Serviced Apartment Market size is expected to be worth around USD 397.7 Billion by 2034, from USD 120.3 Billion in 2024, growing at a CAGR of 12.7% during the forecast period from 2025 to 2034.

The serviced apartment market is a growing sector within the broader hospitality industry, catering to business and leisure travelers seeking flexible accommodation options. These properties combine the benefits of hotel services with the comforts of home, offering fully furnished spaces with amenities such as kitchens, laundry, and cleaning services.

This trend is especially appealing to long-term stay guests, particularly those on business trips or relocating for work. As the demand for more home-like accommodations continues to rise, serviced apartments are seen as a viable alternative to traditional hotels, offering better value for extended stays.

The growth of the serviced apartment market has been propelled by shifting consumer preferences and changing travel habits. In particular, more travelers are opting for longer stays, particularly in major urban hubs, where serviced apartments offer significant cost savings and more space.

According to Address Apartments, occupancy rates for serviced apartments reached an impressive 80% in the UK, showcasing the growing popularity of these properties. Additionally, increasing global mobility, particularly in the corporate sector, continues to fuel demand. Companies increasingly prefer serviced apartments for employees on international assignments, valuing the flexibility and cost-efficiency they offer over traditional hotels.

However, the sector faces challenges, including fierce competition and the potential for market oversaturation in key locations. It is important for businesses in the serviced apartment market to differentiate themselves through superior services and unique offerings.

According to Business Conceptor, 60% of new hospitality ventures fail within the first three years due to insufficient planning. This highlights the importance of thorough market research, strategic planning, and adaptation to emerging trends. Players in the serviced apartment market must continuously innovate to meet evolving customer expectations and ensure long-term profitability.

Government investment and regulatory frameworks play a crucial role in the serviced apartment market. Many governments, particularly in regions like Europe and Asia, have started to recognize the importance of serviced apartments in their national tourism and housing strategies.

Regulatory measures, such as short-term rental laws and zoning regulations, are designed to strike a balance between commercial interests and residential needs. Such regulations can directly impact the operational model of serviced apartments, influencing their pricing and availability. Additionally, local governments are increasingly investing in infrastructure and amenities that make these properties more accessible to both business and leisure travelers.

Key Takeaways

- The Global Serviced Apartment Market is expected to reach USD 397.7 Billion by 2034, growing at a CAGR of 12.7% from 2025 to 2034.

- The Short-Term (<30 Nights) segment holds 65.2% of the market share in 2024, driven by business travel and tourism.

- The Corporate/Business Traveler segment dominates with a 52.3% market share in 2024, fueled by demand for flexible accommodation.

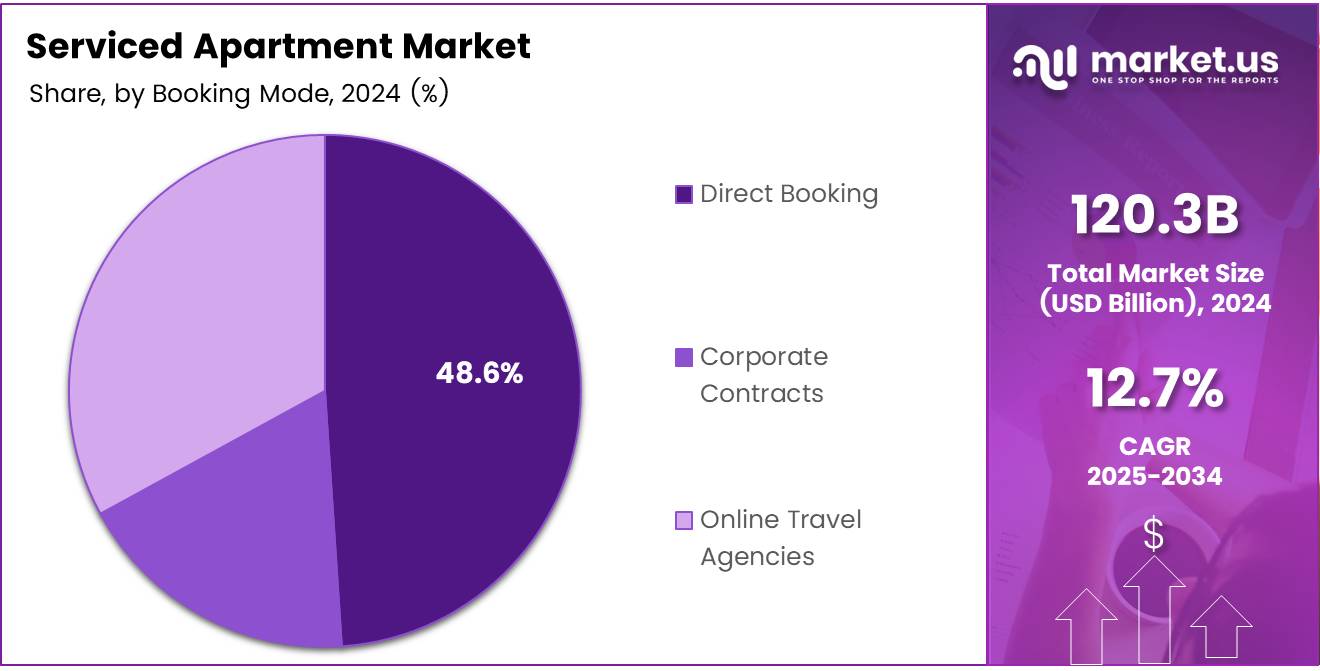

- The Direct Booking segment leads with 48.6% market share in 2024, attributed to cost-effectiveness and personalized services.

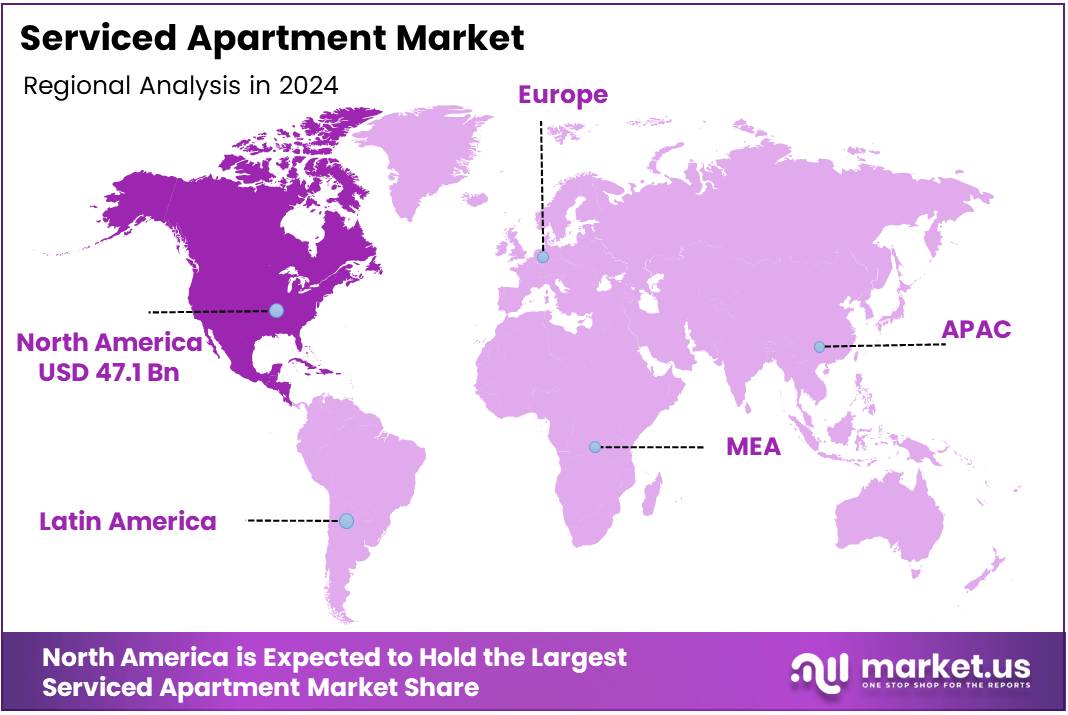

- North America holds 39.2% of the serviced apartment market, valued at USD 47.1 Billion, driven by long-term stays and corporate travel.

Type Analysis

Short-Term (<30 Nights) held a dominant market position in 2024 with a 65.2% share due to increasing demand for temporary stays.

In 2024, the Short-Term (<30 Nights) segment held a significant lead in the Serviced Apartment Market, capturing a strong market share of 65.2%. This dominance can be attributed to the increasing trend of short-term business travel, tourism, and flexible accommodation needs.

The ability to accommodate corporate and leisure travelers looking for convenience without long-term commitments plays a key role in the success of this segment. Additionally, the surge in demand for stays related to project-based work and temporary relocation has further strengthened the short-term market position.

On the other hand, the Long-Term (>30 Nights) segment, while growing, holds a relatively smaller share of the market. The increasing preference for flexibility and short-duration stays makes this segment more appealing to a broader demographic, from individual travelers to business professionals.

End Use Analysis

Corporate/Business Traveler dominated in 2024 with a 52.3% share due to the growing need for flexible accommodation options.

In 2024, the Corporate/Business Traveler segment held the largest share in the Serviced Apartment Market with 52.3%. The growing trend of business travelers seeking more flexibility and comfort than traditional hotels has significantly contributed to this market share.

Companies are increasingly opting for serviced apartments to accommodate their employees, particularly for extended stays or relocation purposes. These accommodations offer a more personalized experience while maintaining a high level of professionalism, making them a preferred choice for business purposes.

In contrast, the Leisure Traveler segment, while significant, occupies a smaller portion of the market. The Expats and Relocators segment also remains a niche market, driven by global mobility trends and the need for long-term housing solutions in new locations.

Booking Mode Analysis

Direct Booking led in 2024 with a 48.6% share, driven by ease of access and customer preference for direct interactions.

In 2024, the Direct Booking segment took the lead in the Serviced Apartment Market with a dominant share of 48.6%. This growth can be attributed to the convenience and cost-effectiveness of direct booking channels, allowing customers to engage directly with property owners or operators. Furthermore, businesses and travelers increasingly prefer direct bookings due to the potential for personalized services, discounts, and more flexible terms.

While Corporate Contracts and Online Travel Agencies (OTAs) also play an essential role in the market, they account for a smaller share compared to direct booking. Corporate Contracts cater to long-term business needs, while OTAs provide a broader reach, but neither channel has matched the growing preference for direct interactions between guests and serviced apartment providers.

Key Market Segments

By Type

- Short-Term (<30 Nights)

- Long-Term (>30 Nights)

By End Use

- Corporate/Business Traveler

- Leisure Traveler

- Expats and Relocators

By Booking Mode

- Direct Booking

- Corporate Contracts

- Online Travel Agencies

Drivers

Increasing Demand for Serviced Apartments Drives Market Growth

The growing demand for long-term stays is a key driver in the serviced apartment market. With more people traveling for extended business trips or relocating for work, serviced apartments offer a convenient and cost-effective alternative to traditional hotel stays. They provide a home-like atmosphere with the flexibility of short-term leases, making them an attractive option for those in need of extended accommodation.

Additionally, the rise of work-from-home arrangements has contributed to the demand for serviced apartments. As remote work becomes more common, professionals prefer to work from locations that offer both comfort and essential amenities. Serviced apartments are ideal for this purpose, providing spacious workspaces and high-speed internet, which appeals to remote workers.

The expansion of the global tourism industry is another driver. As more people travel for leisure or business, the need for flexible and comfortable accommodations grows. Serviced apartments, with their mix of hotel-like services and the benefits of home living, are well-positioned to cater to the increasing number of travelers seeking longer stays.

Restraints

Challenges Facing the Serviced Apartment Market

Despite the opportunities, several factors pose challenges to the serviced apartment market. High initial investment and operating costs are significant barriers for new entrants. Establishing a serviced apartment requires substantial capital for property acquisition and maintenance, which can deter investors.

The stringent regulatory environment also creates hurdles. Many regions have strict regulations regarding short-term rental businesses, which can impact the operations of serviced apartments, especially in urban areas where zoning laws are often complex.

Moreover, competition from traditional hotels and vacation rentals poses a challenge. Established hotel chains and vacation rental platforms have strong market presence, and they offer services that compete directly with serviced apartments, particularly in terms of price and brand recognition.

Lastly, economic downturns can have a negative impact on travel and leisure spending, directly affecting the demand for serviced apartments. In times of financial instability, businesses and consumers may cut back on travel expenses, leading to reduced bookings.

Growth Factors

Growth Opportunities in the Serviced Apartment Market

One of the most significant growth opportunities for serviced apartments lies in the increasing preference for sustainable and eco-friendly accommodations. As travelers become more environmentally conscious, they seek out accommodations that prioritize sustainability. Serviced apartments that incorporate green practices, such as energy-efficient appliances and waste reduction initiatives, are likely to attract a larger customer base.

Another opportunity exists in the rising demand for serviced apartments in emerging markets. As economies in regions like Asia Pacific and Africa continue to grow, the demand for both business and leisure travel increases. Serviced apartments in these markets can cater to the expanding middle class and multinational businesses.

The integration of technology for enhanced guest experiences is another growth opportunity. Features like mobile check-in, smart rooms, and virtual concierge services can appeal to tech-savvy travelers, making serviced apartments a more attractive option for those seeking convenience and modern amenities.

Finally, the increasing adoption of serviced apartments in urban areas presents a growth opportunity. As cities expand and become more business-oriented, the demand for flexible and convenient accommodations will continue to rise. Urban centers provide the perfect environment for serviced apartments, particularly in areas with a high concentration of corporate offices and commercial activity.

Emerging Trends

Trending Factors in the Serviced Apartment Market

Several trends are currently shaping the serviced apartment market. One major trend is the shift towards contactless check-in and digital services. As health and safety concerns rise, many serviced apartment operators are implementing digital check-in systems and keyless entry to enhance the guest experience and minimize physical contact.

The rise of short-term rental platforms offering serviced apartments is another notable trend. Platforms like Airbnb and Booking.com are increasingly listing serviced apartments, making them more accessible to a global audience and providing an alternative to traditional hotels.

Luxury and premium serviced apartments are gaining traction as more travelers seek upscale accommodations with personalized services. High-net-worth individuals and business executives are opting for high-end serviced apartments that offer exclusive amenities, adding a luxury touch to their travel experience.

Lastly, the adoption of flexible booking policies and extended stay options is a growing trend. As travelers prioritize flexibility, serviced apartments are adapting by offering longer stay options and more lenient cancellation policies. This trend is particularly popular among business travelers and those on extended holidays.

Regional Analysis

North America Dominates the Serviced Apartment Market with a Market Share of 39.2%, Valued at USD 47.1 Billion

North America holds the leading position in the serviced apartment market, with a significant market share of 39.2% and a valuation of USD 47.1 Billion. The region benefits from a robust demand for long-term stays, especially driven by corporate business travelers and the expansion of temporary housing options. This is further supported by the growing trend of remote work and flexible living arrangements across key urban centers in the U.S. and Canada.

Europe Serviced Apartment Market Trends

Europe follows as a strong market contender, characterized by an increasing preference for serviced apartments in major cities like London, Paris, and Berlin. The market benefits from a combination of tourism and corporate demand, with a focus on high-quality service and strategic location offerings. The growth of business travel and the ongoing shift towards flexible accommodations continue to support the market expansion in this region.

Asia Pacific Serviced Apartment Market Trends

Asia Pacific is emerging as one of the fastest-growing regions in the serviced apartment market. As urbanization and business activities intensify in cities such as Tokyo, Singapore, and Hong Kong, the demand for flexible accommodation options rises. Increasing investment in hospitality infrastructure and the growing number of international business travelers contribute significantly to the market’s upward trajectory.

Middle East and Africa Serviced Apartment Market Trends

The Middle East and Africa region is witnessing steady growth, particularly in key cities like Dubai, Doha, and Cape Town. The region’s expanding tourism sector, coupled with rising business events, is driving the demand for serviced apartments. The growing expatriate population and the rise in oil industry-related business travel are contributing to the increasing adoption of serviced apartments in this region.

Latin America Serviced Apartment Market Trends

Latin America is experiencing gradual growth in the serviced apartment market, with a focus on cities like São Paulo and Mexico City. The demand for extended-stay accommodations is supported by a growing number of international businesses and an expanding middle class. As economic conditions stabilize, the region is expected to see further growth, driven by an influx of foreign investments and tourism.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Serviced Apartment Company Insights

In 2024, The Serviced Apartment Company is expected to continue its prominent role in the market with a focus on delivering high-quality, long-term accommodation solutions, targeting both business and leisure travelers. Their strategic expansion into new locations is anticipated to enhance their global reach.

Staycity Ltd has established itself as a significant player in the serviced apartment sector, offering a blend of flexibility and comfort for both short and extended stays. Their commitment to sustainability and modern amenities is expected to strengthen their position in Europe and beyond.

Adiahotels.com is poised to leverage its extensive portfolio of serviced apartments to cater to the rising demand for mid-term stays. Their innovative approach to customer service, combined with strategic pricing models, will likely drive growth in competitive urban markets in 2024.

The Ascott Limited, one of the largest serviced apartment providers globally, is expected to maintain its leadership position with a robust expansion strategy across Asia Pacific and Europe. Their extensive brand offerings, such as Citadines and Somerset, are likely to attract a broad range of clientele, from business professionals to long-term residents.

Top Key Players in the Market

- Staycity Ltd

- adiahotels.com

- The Ascott Limited

- Marriott International, Inc.

- Frasers Hospitality

- Viridian Apartments

- Habicus Group

- Adagio

- THE SQUA.RE SERVICED APARTMENTS

Recent Developments

- In March 2024, Blueground secured US$ 45 million in a Series D funding round, aimed at expanding its portfolio of serviced apartments and enhancing its global operations.

- In July 2024, NUMA Group announced the strategic acquisition of UK’s Lifestyle Apart Hotel & Serviced Apartment Brand Native Places, further strengthening its presence in the UK’s growing hospitality market.

- In November 2024, Ando Living Group acquired London-based operator City Apartments, marking a key step in its expansion strategy in the UK serviced apartment sector.

Report Scope

Report Features Description Market Value (2024) USD 120.3 Billion Forecast Revenue (2034) USD 397.7 Billion CAGR (2025-2034) 12.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Short-Term (<30 Nights), Long-Term (>30 Nights)), By End Use (Corporate/Business Traveler, Leisure Traveler, Expats and Relocators), By Booking Mode (Direct Booking, Corporate Contracts, Online Travel Agencies) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape The Serviced Apartment Company, Staycity Ltd, adiahotels.com, The Ascott Limited, Marriott International, Inc., Frasers Hospitality, Viridian Apartments, Habicus Group, Adagio, THE SQUA.RE SERVICED APARTMENTS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Staycity Ltd

- adiahotels.com

- The Ascott Limited

- Marriott International, Inc.

- Frasers Hospitality

- Viridian Apartments

- Habicus Group

- Adagio

- THE SQUA.RE SERVICED APARTMENTS