Global Semiconductor Yield Analytics Tools Market Size and Forecast Industry Analysis Report By Component (Software, Hardware, Services), By Tool Type (Yield Management Software, Data Analytics Platforms, Test and Inspection Tools), By Application (Wafer Fabrication, Packaging and Assembly, Testing and Validation, Failure Analysis, Process Optimization), By End User (Semiconductor Foundries, IDM (Integrated Device Manufacturers), Fabless Semiconductor Companies, OSAT (Outsourced Semiconductor Assembly and Test) Providers, Others (Academic/Research Institutions, Equipment OEMs), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159021

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

- Market Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Role of Generative AI

- By Component Insight

- By Tool Type Insight

- By Application Insight

- By End-User Insight

- Regional Market Trends

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Market Overview

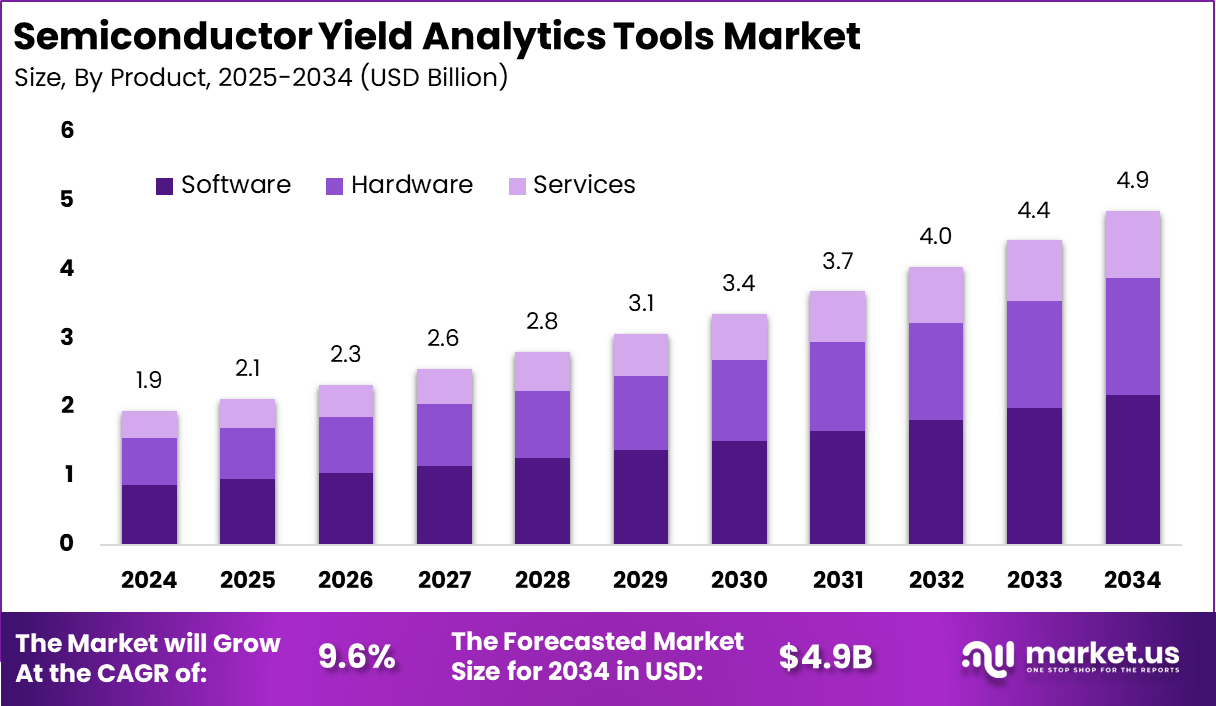

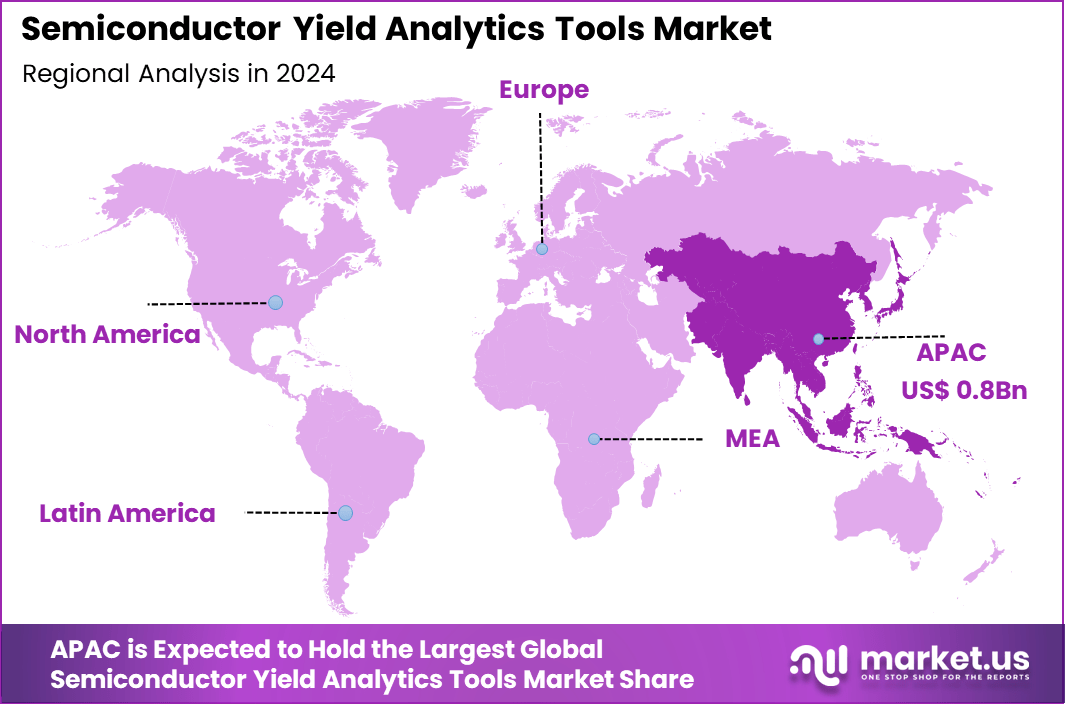

The Global Semiconductor Yield Analytics Tools Market size is expected to be worth around USD 4.9 Billion By 2034, from USD 1.9 billion in 2024, growing at a CAGR of 9.6% during the forecast period from 2025 to 2034. In 2024, APAC held a dominan market position, capturing more than a 46.9% share, holding USD 0.8 Billion revenue.

The Semiconductor Yield Analytics Tools Market refers to software platforms and analytical solutions designed to monitor, analyze, and optimize semiconductor manufacturing processes. These tools collect data from wafer fabrication, testing, and assembly stages to identify yield variations, detect defects, and improve production efficiency.

Yield analytics plays a critical role in reducing manufacturing costs, accelerating time-to-market, and enhancing the reliability of semiconductor devices across industries such as consumer electronics, automotive, telecommunications, and industrial applications.

According to Market.us, The global Semiconductor Market was valued at USD 840.60 billion in 2024 and is projected to grow from USD 917.94 billion in 2025 to about USD 2,026.82 billion by 2034, at a CAGR of 9.20% (2025–2034). In 2024, APAC dominated with over 40% share, generating USD 336.2 billion in revenue.

In parallel, The Global Generative AI for Semiconductor Design Market is projected to grow significantly, rising from USD 1,511.6 million in 2023 to approximately USD 24,092.7 million by 2033. This expansion reflects a strong CAGR of 31.9% during the forecast period from 2024 to 2033, highlighting the increasing adoption of AI-driven design tools in the semiconductor industry.

Key Insight Summary

- By component, the Software segment dominated with a 45% share, reflecting the rising need for advanced data-driven yield optimization.

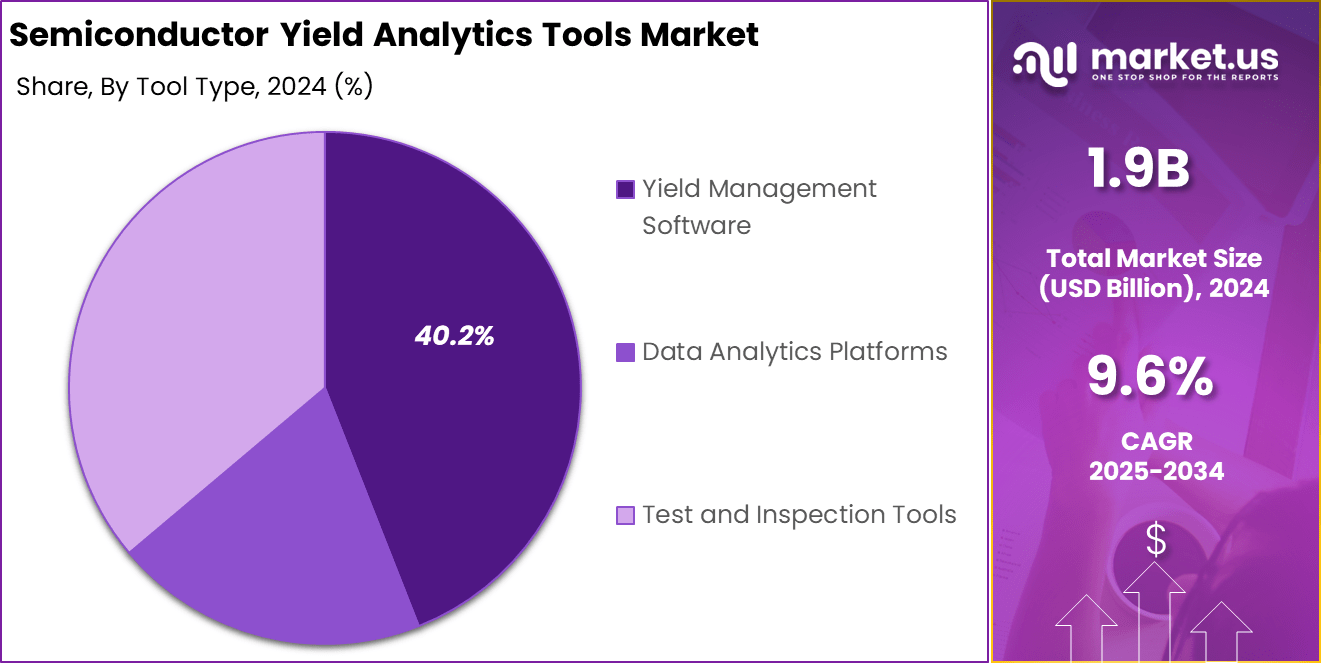

- By tool type, Yield Management Software led the market with a 40.2% share, driven by its role in defect detection and process improvement.

- By application, Wafer Fabrication held the top position with a 45% share, highlighting its critical role in improving chip production efficiency.

- By end user, Semiconductor Foundries (IDMs) captured 39% share, showing their reliance on yield analytics to maximize production output.

- Regionally, Asia Pacific dominated with 46.9% share, with the market valued at USD 0.8 Billion, supported by strong semiconductor manufacturing hubs in China, Taiwan, and South Korea.

Analysts’ Viewpoint

Top driving factors for this market include the rising complexity of semiconductor manufacturing processes, which involve smaller nodes and multi-layer architectures, increasing the risk of defects. The explosion of data generated in fabs requires advanced AI and machine learning tools to analyze patterns and predict defects in real-time. For example, implementations of predictive analytics have been shown to reduce product development time by up to 30%, enabling faster time-to-market.

Investment opportunities exist as semiconductor fabs expand and modernize with digital transformation initiatives, including Industry 4.0 tools. Over 72% of semiconductor manufacturers have already adopted AI and data analytics technologies, creating a strong market for integrated yield management software. Cloud-based analytics platforms are also expected to grow fastest due to their scalability and cost advantages, enabling fabless and foundry collaborations.

The business benefits of adopting yield analytics tools include cost reduction by minimizing scrap and rework, improved product quality through better defect management, and increased manufacturing capacity. Yield improvements from 93% to 98% can translate into hundreds of thousands of dollars in savings annually for a single product line. These tools accelerate decision-making and shorten product cycles, providing a competitive edge in the chip market.

Role of Generative AI

Generative AI is playing an increasingly important role in semiconductor yield analytics by enabling smarter defect prediction and process optimization. By analyzing vast amounts of production data, generative AI models can simulate manufacturing scenarios and uncover hidden patterns affecting yield.

This capability helps reduce defects, waste, and downtime while accelerating time-to-market for chips. Companies that utilize generative AI in yield analytics benefit from faster design optimization and improved manufacturing simulations, which directly translate to better product quality.

Advanced AI features such as automated documentation and innovative process adjustments provide competitive advantages, helping fabs optimize complex chip fabrication in real-time. Approximately 78% of U.S. chipmakers emphasize supply chain resilience and AI-driven yield improvements as critical investment areas, highlighting the technology’s growing strategic importance.

By Component Insight

In 2024, the software segment leads the semiconductor yield analytics tools market with a 45% share. Software solutions are central to yield analytics as they help process complex data generated during semiconductor manufacturing.

These tools provide real-time monitoring, defect detection, and predictive analytics, allowing manufacturers to identify issues early and optimize their production processes more efficiently. This capability is critical given the rising complexity of semiconductor devices and shrinking process margins.

Growing integration of artificial intelligence and machine learning in software tools further improves the accuracy and speed of yield analysis. Manufacturers increasingly rely on these advanced software systems to handle large volumes of production data, reduce defects, and enhance product quality, making software the backbone of yield analytics solutions in this market.

By Tool Type Insight

In 2024, Yield management software commands a leading 40.2% share among tool types. This software focuses specifically on maximizing the number of functional semiconductor chips from each wafer by analyzing defects, process deviations, and equipment performance. It enables chip manufacturers to quickly isolate and understand yield-limiting factors and take corrective actions to improve outcomes.

The growing complexity of semiconductor processes and the push for cost-efficiency have increased reliance on yield management software. With its data-driven approach, the software helps fabs reduce wastage, optimize equipment utilization, and shorten production cycles, all of which are crucial for maintaining competitiveness in the high-stakes semiconductor industry.

By Application Insight

In 2024, Wafer fabrication stands out as the key application area with a 45% share in the semiconductor yield analytics tools market. This phase of semiconductor manufacturing is highly sensitive to defects, process variations, and equipment anomalies, making advanced analytics indispensable for maintaining high yield rates. Tools designed for wafer fabrication help in early detection of defects and provide actionable insights to improve process control.

As manufacturing nodes shrink and architectures become more intricate, wafer fabrication requires sophisticated yield analytics to ensure production efficiency and product reliability. These tools are essential for manufacturers to meet quality standards, reduce scrap rates, and support the delivery of cutting-edge semiconductor devices.

By End-User Insight

In 2024, Semiconductor foundries, including Integrated Device Manufacturers (IDMs), represent the largest end-user group with a 39% share. These entities are under constant pressure to deliver high-quality chips with fewer defects and at competitive costs. Yield analytics tools allow foundries to monitor the wafer production process continuously, identify yield bottlenecks, and improve overall operational efficiency.

IDMs and foundries operate complex fabrication lines requiring precise defect analysis and process optimization. The adoption of yield analytics tools in this segment supports faster time-to-market for new chips and enhances profitability by minimizing costly production losses.

Regional Market Trends

Asia Pacific Market Trends

In 2024, Asia Pacific commands a significant 46.9% share of the semiconductor yield analytics tools market, capitalizing on its vast semiconductor manufacturing base. The region benefits from strong government support, a concentration of leading foundries, and a growing focus on advanced process technologies. These factors fuel the adoption of yield analytics tools that support AI-driven defect detection and process optimization.

China, Taiwan, South Korea, and India are key hubs driving market growth in Asia Pacific. The aggressive expansion of fabs, investments in next-generation chips, and push toward self-sufficiency reinforce the need for advanced analytics. This region continues to lead due to its scale, technological innovation, and integration of Industry 4.0 practices in semiconductor production.

North America Market Trends

North America holds a prominent place in the yield analytics tools market, driven by its concentration of high-end semiconductor manufacturers and R&D investments. The region leads in adopting sophisticated AI and machine learning-based analytics to improve chip yields and production efficiency. Federal initiatives to boost domestic chip manufacturing have accelerated the deployment of yield management technologies.

US fabs, supported by government funding and private sector innovation, focus on producing advanced chips for applications like AI, 5G, and automotive electronics. These factors position North America as a fast-growing and technology-driven market segment for yield analytics tools.

Europe Market Trends

Europe’s semiconductor yield analytics market benefits from the region’s strong manufacturing tradition, especially in industrial automation and automotive electronics. Countries like Germany, France, and the Netherlands host advanced fabrication facilities that emphasize yield optimization and process innovation. These fabs increasingly adopt yield analytics platforms integrated with AI to meet stringent quality requirements.

Germany leads Europe’s market, driven by its emphasis on smart manufacturing and automotive semiconductor production. The region’s focus on R&D and industrial digitization supports demand for software and tool upgrades that enhance wafer yield and manufacturing reliability.

Latin America Market Trends

Latin America is an emerging market for semiconductor yield analytics tools, supported primarily by Brazil’s growing semiconductor and electronics manufacturing. While the market is smaller compared to Asia Pacific or North America, government initiatives and rising applications in automotive electronics and consumer devices create growth opportunities.

Increasing investments in hi-tech manufacturing solutions and growing local demand for semiconductors drive adoption of yield analysis tools. Latin America is gradually modernizing its fabrication capabilities, with analytics tools playing a key role in improving overall production yield and competitiveness in the global supply chain.

Emerging Trends

One prominent trend in semiconductor yield analytics is the adoption of AI-powered real-time defect detection tools integrated with machine learning that monitors wafer fabrication processes dynamically. The market is also witnessing development around predictive maintenance, spatial defect pattern analysis, and closed-loop process optimization.

Integration with Industry 4.0 automation is becoming a key focus, allowing semiconductor fabs to evolve into more self-learning and flexible manufacturing environments. Another trend is the rise of specialization, addressing the unique yield challenges posed by advanced nodes beyond 7 nanometers, extreme ultraviolet lithography, and complex packaging technologies.

Regionally, North America is emerging as the fastest-growing market due to heavy investment in manufacturing infrastructure and AI-integrated solutions, while Asia Pacific leads in overall market share fueled by large semiconductor hubs.

Growth Factors

The complexity of manufacturing cutting-edge semiconductor nodes has necessitated more sophisticated analytics tools capable of handling data across multiple wafer fabrication stages. The demand for high-performance and reliable chips in sectors like AI, 5G, automotive electronics, and quantum computing continues to grow, driving the need for superior yield management.

Additionally, government initiatives aimed at strengthening domestic semiconductor production and resilience in supply chains bolster investments in yield analytics technologies. Predictive analytics, in particular, has proven to reduce product development cycles by up to 30%, speeding chip introduction to markets where speed and quality matter most.

Key Market Segments

By Component

- Software

- Yield Enhancement Software

- Fault Detection Software

- Predictive Modeling Software

- Hardware

- Sensors and Measurement Systems

- Wafer Metrology Equipment

- Imaging and Scanning Systems

- Services

- Consulting and Implementation Services

- Data Integration Services

- Support and Maintenance

By Tool Type

- Yield Management Software

- Defect Analysis Software

- Process Control Software

- Statistical Process Control (SPC) Tools

- Data Analytics Platforms

- Big Data Analytics

- AI/ML-based Predictive Analytics

- Real-time Data Monitoring Tools

- Test and Inspection Tools

- Optical Inspection Systems

- Electron Microscopy Analysis

- Automated Test Equipment (ATE) Analytics

By Application

- Wafer Fabrication

- Packaging and Assembly

- Testing and Validation

- Failure Analysis

- Process Optimization

By End User

- Semiconductor Foundries

- IDM (Integrated Device Manufacturers)

- Fabless Semiconductor Companies

- OSAT (Outsourced Semiconductor Assembly and Test) Providers

- Others (Academic/Research Institutions, Equipment OEMs)

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Increasing Complexity of Semiconductor Manufacturing

As semiconductor devices become smaller and designs more intricate, manufacturing processes face greater challenges. Advanced nodes such as 5 nm and below require extreme precision in lithography and etching. This complexity leads to higher defect rates, making it difficult to maintain high yields without detailed process insights.

Yield analytics tools are essential because they analyze production data in real-time, helping manufacturers detect problems early and optimize process parameters to minimize defects. For instance, as chip architectures integrate AI and 5G technology, the demand for precise yield monitoring grows, ensuring efficient production and competitiveness in the market.

The need to manage these shrinking tolerances is a core driver for adoption of yield analytics solutions. By enabling faster detection of variations and anomalies, these tools reduce waste and accelerate time-to-market for new chips. Some companies have reported a 30% reduction in product development cycles through predictive yield analytics.

Restraint Analysis

High Costs and Integration Challenges

One significant restraint in adopting semiconductor yield analytics tools lies in the substantial costs associated with implementation. The software, hardware, and supporting infrastructure investments are often high, creating barriers especially for smaller semiconductor manufacturers. These costs can slow down market growth as organizations weigh the expense against potential benefits.

Integration hurdles also come from legacy systems prevalent in many fabs. Older fabrication facilities may run on outdated manufacturing execution systems that do not easily interface with modern analytics tools. This lack of interoperability leads to operational disruptions and data inconsistencies, complicating seamless analytics deployment.

Opportunity Analysis

AI and Industry 4.0 Integration

The push toward smart manufacturing and Industry 4.0 practices presents a major opportunity for semiconductor yield analytics tools. Integrating artificial intelligence and machine learning enables these tools to anticipate yield issues proactively, detect defects faster, and automate the identification of root causes. This results in more flexible and efficient production lines, especially in multi-product fabs with complex process flows.

AI-driven analytics also support predictive maintenance, further reducing downtime and improving wafer yields. With over 70% of semiconductor manufacturers adopting AI and smart factory solutions, the potential to develop fully autonomous yield management systems is growing.

Combining yield analytics with advanced process control can enable real-time micro-adjustments to manufacturing parameters. This opportunity allows fabs to enhance throughput, reduce scrap, and sustain competitiveness in a market moving toward smaller and more sophisticated chips, such as sub-3nm nodes.

Challenge Analysis

Data Privacy and IP Protection Concerns

A notable challenge affecting semiconductor yield analytics tools is the concern over data security and intellectual property protection, especially in the context of global supply chains. Yield analytics rely heavily on sensitive manufacturing data that includes proprietary process parameters and defect information.

When semiconductor design houses and foundries collaborate across borders, there is apprehension about data sharing that could expose trade secrets or violate regulations. These concerns limit the willingness of some companies to fully embrace third-party analytics platforms.

Ensuring compliance with international data privacy laws and creating secure environments for sensitive data remain critical issues. Overcoming this challenge is vital to fostering broader collaboration and maximizing the benefits of analytics-driven yield improvement efforts worldwide.

Competitive Analysis

In the semiconductor yield analytics tools market, KLA Corporation, Applied Materials, ASML Holding, and Tokyo Electron are leading players. Their advanced inspection, metrology, and process control solutions are essential for identifying defects and improving wafer yields in semiconductor manufacturing.

Other major contributors such as Onto Innovation (including Rudolph Technologies), Nanometrics, Nova Measuring Instruments, SCREEN Holdings, and Hitachi High-Technologies strengthen the market with precision measurement and process optimization tools.

Additional players including Teradyne, Advantest, Brooks Automation, PDF Solutions, Fabmatics, Semiconductor Test Solutions (STS), Cadence Design Systems, Synopsys, and Mentor Graphics (Siemens EDA) expand the ecosystem. Their contributions include automated testing, design-for-yield software, and fab automation solutions.

Top Key Players in the Market

- Teradyne, Inc.

- Onto Innovation

- Rudolph Technologies (now Onto Innovation)

- Hitachi High-Technologies

- ASML Holding

- Tokyo Electron Limited

- Nanometrics, Inc.

- Brooks Automation

- SCREEN Holdings

- Nova Measuring Instruments

- Cadence Design Systems

- Synopsys, Inc.

- Mentor Graphics (Siemens EDA)

- KLA Corporation

- Applied Materials

- Lam Research Corporation

- Advantest Corporation

- PDF Solutions

- Semiconductor Test Solutions (STS)

- Fabmatics

- Others

Recent Developments

- January 2024, Teradyne partnered with NI to enhance semiconductor quality and yield. The collaboration focuses on NI’s Global Operations semiconductor analytics solution that collects and analyzes data across manufacturing, test, and enterprise systems to improve yield and quality.

- KLA continues leading in process control and yield management tools, benefiting from growing wafer fabrication spend expected to reach $105 billion in 2025. KLA’s product strength covers NAND, logic, DRAM, and advanced packaging segments. Analysts forecast optimistic full-year earnings for 2024 and 2025, reflecting confidence in KLA’s market position.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Bn Forecast Revenue (2034) USD 4.9 Bn CAGR(2025-2034) 9.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Hardware, Services), By Tool Type (Yield Management Software, Data Analytics Platforms, Test and Inspection Tools), By Application (Wafer Fabrication, Packaging and Assembly, Testing and Validation, Failure Analysis, Process Optimization), By End User (Semiconductor Foundries, IDM (Integrated Device Manufacturers), Fabless Semiconductor Companies, OSAT (Outsourced Semiconductor Assembly and Test) Providers, Others (Academic/Research Institutions, Equipment OEMs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teradyne, Inc., Onto Innovation, Rudolph Technologies (now Onto Innovation), Hitachi High-Technologies, ASML Holding, Tokyo Electron Limited, Nanometrics, Inc., Brooks Automation, SCREEN Holdings, Nova Measuring Instruments, Cadence Design Systems, Synopsys, Inc., Mentor Graphics (Siemens EDA), KLA Corporation, Applied Materials, Lam Research Corporation, Advantest Corporation, PDF Solutions, Semiconductor Test Solutions (STS), Fabmatics, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are semiconductor yield analytics tools?Semiconductor yield analytics tools are specialized software and platforms that analyze data from fabrication processes to identify defects, optimize production, and enhance overall chip yield. They are essential for minimizing manufacturing losses, improving quality, and accelerating time-to-market in advanced semiconductor fabrication.

How big is Semiconductor Yield Analytics Tools Market?The Global Semiconductor Yield Analytics Tools Market size is expected to be worth around USD 4.9 Billion By 2034, from USD 1.9 billion in 2024, growing at a CAGR of 9.6% during the forecast period from 2025 to 2034. In 2024, APAC held a dominan market position, capturing more than a 46.9% share, holding USD 0.8 Billion revenue.

Why is the semiconductor yield analytics tools market growing?The market is growing due to several factors, including:- The increasing complexity of modern chip designs and manufacturing processes.

- The widespread adoption of AI and machine learning for predictive analysis in manufacturing.

- The growing need for manufacturers to boost efficiency, reduce costs, and accelerate time-to-market.

- The shift to smaller process nodes (e.g., 5nm and below), which introduces new manufacturing challenges.

- The expansion of the fabless model, where companies rely on outsourced manufacturing and advanced analytics to optimize their designs.

What factors are driving the growth of this market?The growth is driven by increasing complexity of semiconductor nodes, rising demand for advanced process control, and the need to reduce production costs. Expanding adoption of AI and machine learning in fabs, alongside growing investments in 3nm and 2nm manufacturing technologies, further accelerate the market.

How are these tools applied in semiconductor manufacturing?Applications include defect detection, root cause analysis, process optimization, predictive maintenance, and real-time monitoring of wafer yields. They are also used to support design-for-manufacturing (DFM) strategies and reduce variability in high-volume production environments.

Which region dominates the semiconductor yield analytics tools market?Regionally, Asia Pacific dominated with 46.9% share, with the market valued at USD 0.8 Billion, supported by strong semiconductor manufacturing hubs in China, Taiwan, and South Korea.

Semiconductor Yield Analytics Tools MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Semiconductor Yield Analytics Tools MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Teradyne, Inc.

- Onto Innovation

- Rudolph Technologies (now Onto Innovation)

- Hitachi High-Technologies

- ASML Holding

- Tokyo Electron Limited

- Nanometrics, Inc.

- Brooks Automation

- SCREEN Holdings

- Nova Measuring Instruments

- Cadence Design Systems

- Synopsys, Inc.

- Mentor Graphics (Siemens EDA)

- KLA Corporation

- Applied Materials

- Lam Research Corporation

- Advantest Corporation

- PDF Solutions

- Semiconductor Test Solutions (STS)

- Fabmatics

- Others