Global Nano SSD Market Size, Share Analysis Report By Form Factor (BGA SSDs, Chip-Scale SSDs, M.2 2230 & 2242), By Interface (PCIe NVMe, SATA, eMMC, UFS (Universal Flash Storage)), By Capacity (Up to 128GB, 128GB–512GB, 512GB–1TB, Above 1TB), By End-Use Industry (Consumer Electronics, Industrial & IoT, Automotive, Medical Devices, Aerospace & Defense, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147427

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

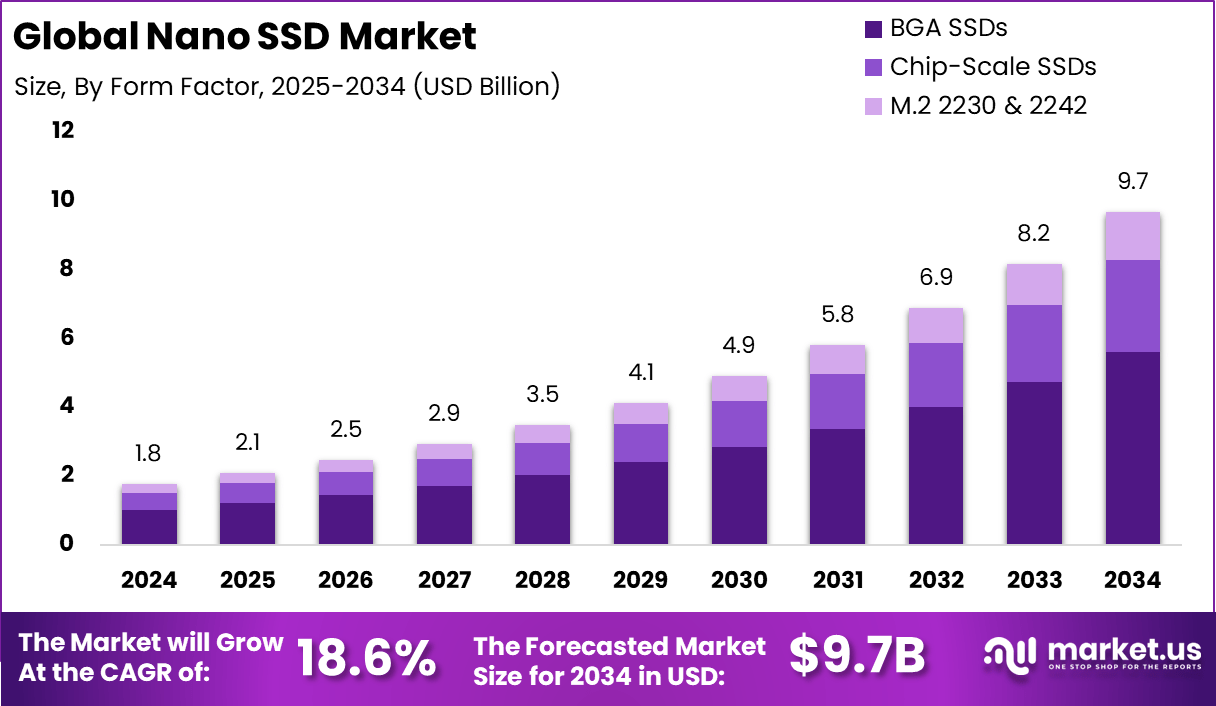

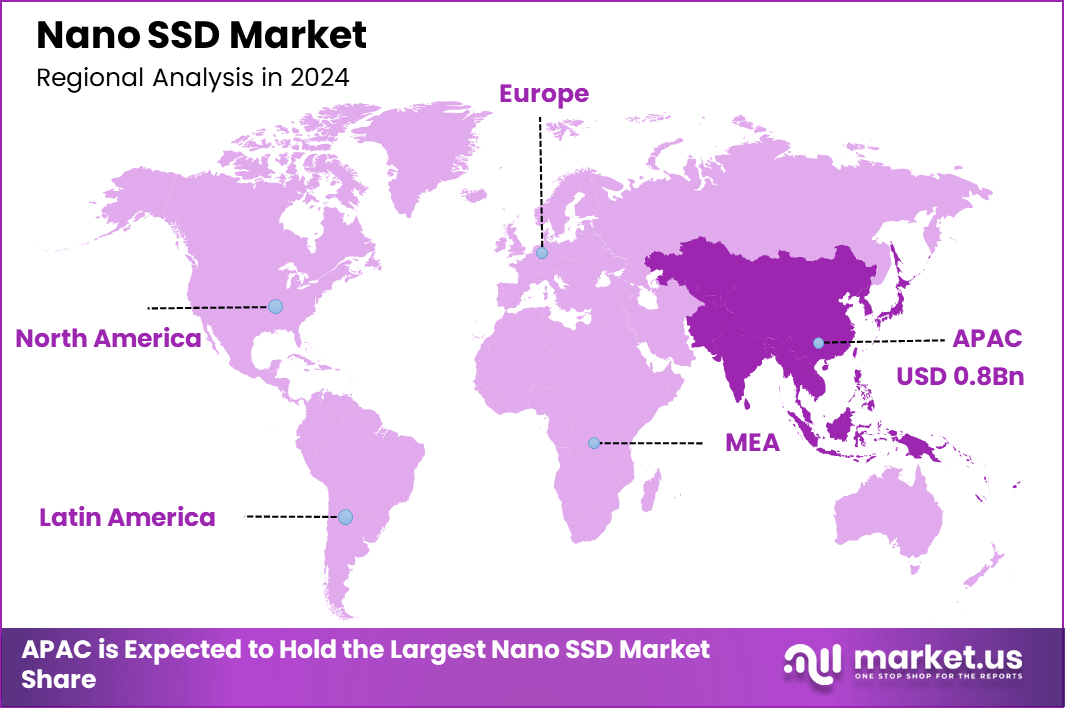

The Global Nano SSD Market size is expected to be worth around USD 9.7 Billion By 2034, from USD 1.8 billion in 2024, growing at a CAGR of 18.6% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 48% share, holding USD 0.8 Billion revenue.

A Nano Solid-State Drive (Nano SSD) is an ultra-compact storage device that integrates NAND flash memory and a controller into a single chip using System-in-Package (SiP) technology. These drives are designed to deliver high-speed data transfer, low power consumption, and enhanced durability. Their small form factor makes them ideal for applications where space is at a premium, such as in embedded systems, portable electronics, and industrial devices.

The Nano SSD market is experiencing significant growth, driven by the escalating demand for compact, high-performance storage solutions across various sectors. As devices become increasingly miniaturized, the need for storage solutions that do not compromise on speed or reliability intensifies. This market encompasses a range of industries, including consumer electronics, industrial automation, and edge computing, all seeking to capitalize on the benefits offered by Nano SSDs.

Several factors are propelling the demand for Nano SSDs. The proliferation of Internet of Things (IoT) devices, wearable technology, and compact computing systems necessitates storage solutions that are both small in size and high in performance. Nano SSDs meet these requirements by offering fast data access speeds and low power consumption.

The demand for Nano SSDs is particularly pronounced in sectors where space and performance are critical. In the consumer electronics domain, ultrabooks and tablets benefit from the integration of Nano SSDs, offering users faster boot times and improved application responsiveness. Industrial applications, such as automation systems and IoT devices, also leverage Nano SSDs for their durability and reliability in harsh environments.

Market trends indicate a shift towards the integration of Nano SSDs in a wide range of devices. The emphasis on miniaturization in electronics has led manufacturers to incorporate Nano SSDs into smartphones, tablets, and ultrabooks. Moreover, advancements in NAND flash technology, such as 3D NAND, have enabled higher storage capacities and improved performance in smaller footprints, aligning with the market’s demand for compact yet powerful storage solutions.

Key Takeaways

- The Global Nano SSD Market is projected to grow from USD 1.8 Billion in 2024 to around USD 9.7 Billion by 2034, expanding at a strong CAGR of 18.6%.

- Asia-Pacific led the global market in 2024, accounting for over 48% share and generating USD 0.8 Billion in revenue, with China emerging as a key contributor.

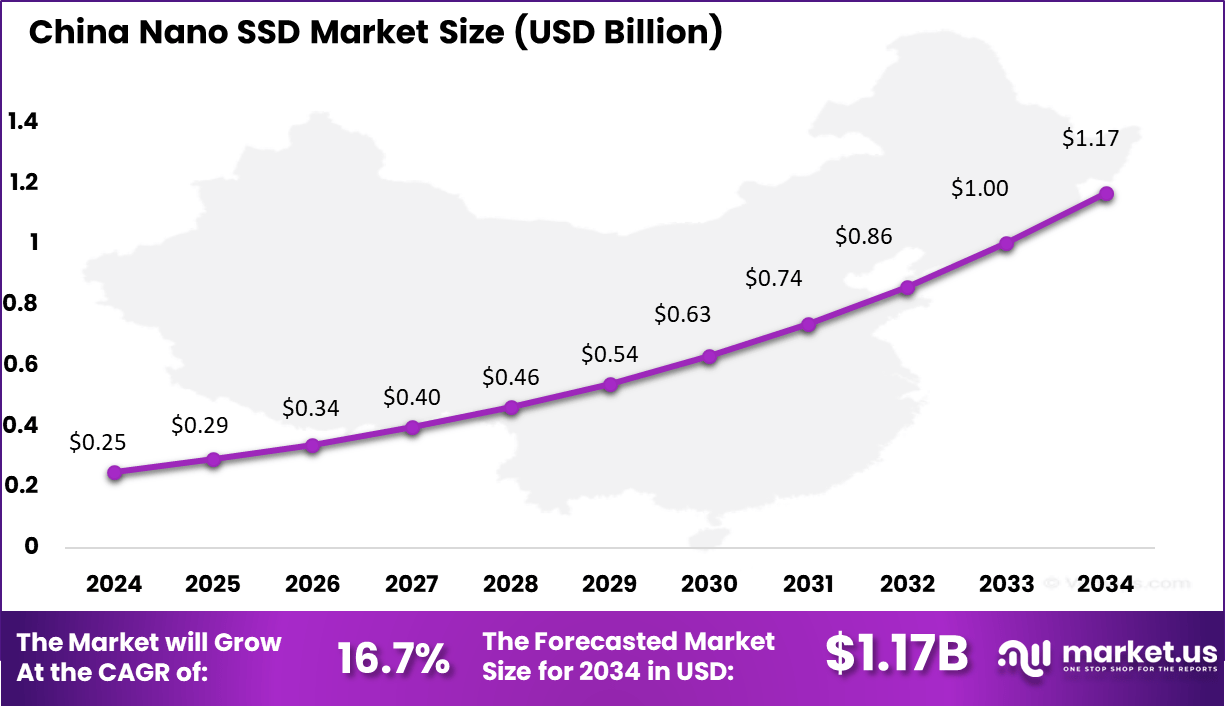

- The China Nano SSD Market, valued at USD 0.25 Billion in 2024, is forecast to reach USD 1.17 Billion by 2034, growing at a CAGR of 16.7%, driven by demand in electronics manufacturing.

- The Ball Grid Array (BGA) SSD segment dominated in 2024, capturing over 58% share, owing to its compact form factor and superior thermal management.

- PCIe NVMe interfaces led among technology types with more than 51% market share, favored for their high-speed performance in modern applications.

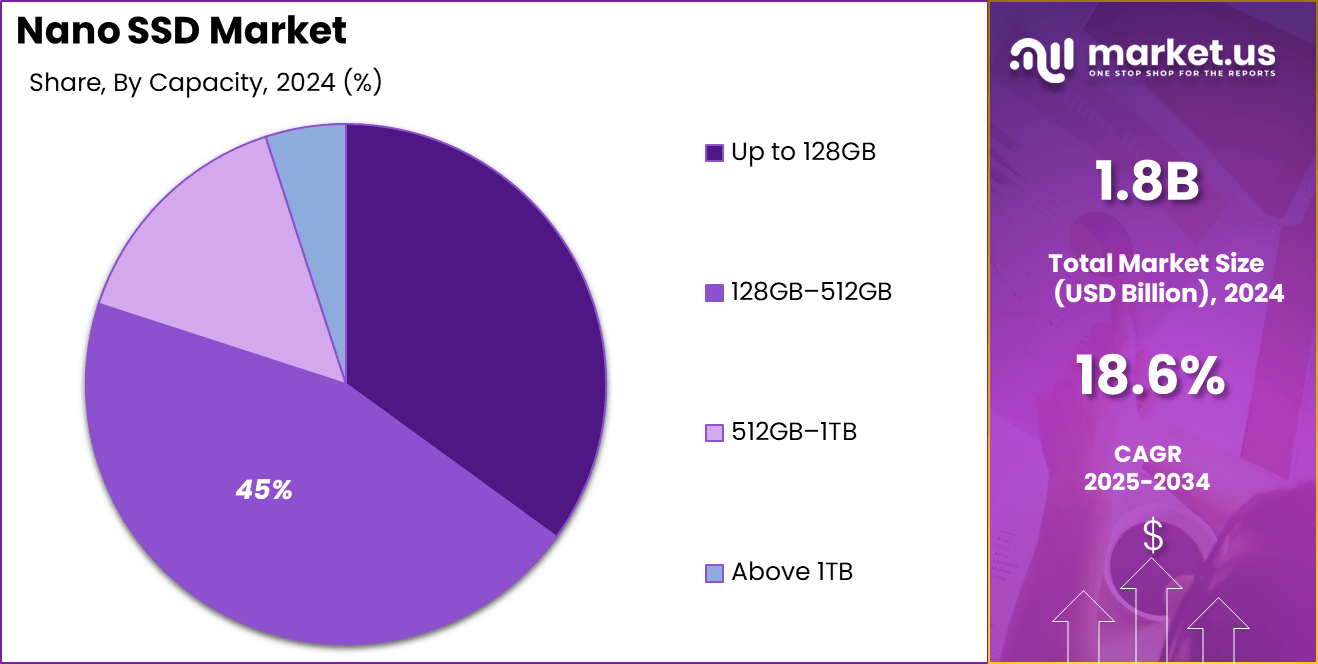

- The 128GB–512GB storage capacity segment held the largest share at over 45%, balancing price and performance for mainstream consumer needs.

- Consumer electronics remained the top application, commanding over 42% share, propelled by widespread adoption of ultra-compact, high-speed storage in smartphones, tablets, and laptops.

Analysts’ Viewpoint

Investment opportunities in the Nano SSD market are huge, given the technology’s applicability across multiple sectors. Companies investing in research and development of Nano SSDs stand to benefit from the growing demand in consumer electronics, automotive systems, and industrial automation. Strategic partnerships and collaborations can also facilitate the integration of Nano SSDs into emerging technologies, such as edge computing and artificial intelligence devices.

Businesses adopting Nano SSD technology can reap several benefits. The enhanced performance and reliability of these drives can lead to improved product quality and customer satisfaction. The reduced size and power consumption contribute to cost savings in manufacturing and operation. Moreover, the ability to offer cutting-edge storage solutions can provide a competitive advantage in the rapidly evolving technology market.

The regulatory environment for Nano SSDs is influenced by standards and guidelines pertaining to electronic devices and data storage. Compliance with international standards ensures interoperability and safety across different markets. Additionally, environmental regulations drive the adoption of energy-efficient and recyclable components in Nano SSD manufacturing, aligning with global sustainability goals.

China Market Growth

The China Nano SSD Market is valued at approximately USD 0.25 Billion in 2024 and is predicted to increase from USD 0.29 Billion in 2025 to approximately USD 1.17 Billion by 2034, projected at a CAGR of 16.7% from 2025 to 2034.

In 2024, APAC held a dominant market position, capturing more than a 48% share, with revenue exceeding USD 0.8 Billion in the global Nano SSD market. This leadership can be directly attributed to the region’s strong electronics manufacturing base, particularly in countries like China, Japan, South Korea, and Taiwan.

These nations are home to several of the world’s leading semiconductor and storage solution manufacturers, which actively integrate Nano SSDs into high-volume consumer electronics such as ultrabooks, compact PCs, tablets, and embedded systems. The increasing adoption of edge devices and the rapid digitization of industrial and healthcare sectors across Asia have created a robust foundation for Nano SSD deployment.

The dominance of the APAC region is further supported by favorable government policies that promote domestic semiconductor manufacturing and research. For instance, China’s “Made in China 2025” strategy and India’s “PLI Scheme” for IT hardware are both aimed at reducing import dependency and accelerating indigenous innovation in compact storage technologies.

Moreover, rising internet penetration, a booming gaming industry, and the growing use of AI-enabled portable devices have escalated the demand for high-speed, space-efficient storage solutions like Nano SSDs. This combination of policy support, technological infrastructure, and diverse end-use demand has positioned Asia-Pacific as the most fertile ground for sustained Nano SSD market growth.

Form Factor Analysis

In 2024, the Ball Grid Array (BGA) SSD segment held a dominant position in the nano SSD market, capturing more than a 58% share. This leadership can be attributed to the compact size, high performance, and reliability of BGA SSDs, which make them well-suited for integration into space-constrained devices such as ultrabooks, tablets, and embedded systems.

The soldered design of BGA SSDs enhances durability by reducing susceptibility to mechanical failures, thereby meeting the rigorous demands of industrial and automotive applications. The market growth for BGA SSDs is further supported by the increasing demand for high-speed storage solutions in consumer electronics and enterprise applications.

The integration of advanced technologies, such as PCIe interfaces and NVMe protocols, in BGA SSDs contributes to their superior data transfer rates and low latency, which are critical for modern computing needs. Additionally, the rising adoption of Internet of Things (IoT) devices and the expansion of edge computing have amplified the need for compact and efficient storage solutions, thereby bolstering the prominence of BGA SSDs in the market.

Interface Analysis

In 2024, the PCIe NVMe segment held a dominant position in the nano SSD market, capturing more than a 51% share. This dominance is attributed to the superior performance characteristics of PCIe NVMe interfaces, which offer significantly higher data transfer rates and lower latency compared to traditional interfaces like SATA and eMMC.

The adoption of PCIe NVMe SSDs has been accelerated by the increasing demand for high-speed storage solutions in applications such as data centers, gaming, and high-performance computing. The growth of the PCIe NVMe segment is further supported by technological advancements and the proliferation of data-intensive applications.

The introduction of PCIe 5.0 SSDs, capable of delivering sequential read speeds up to 14.9 GB/s, exemplifies the ongoing innovation in this space . Additionally, the scalability and efficiency of PCIe NVMe SSDs make them well-suited for emerging technologies like artificial intelligence and machine learning, which require rapid data processing capabilities.

Capacity Analysis

In 2024, the 128GB–512GB capacity segment held a dominant position in the nano SSD market, capturing more than a 45% share. This dominance is attributed to the segment’s optimal balance between storage capacity, performance, and cost, making it highly suitable for a wide range of applications.

Devices such as ultrabooks, tablets, and embedded systems benefit from this capacity range, as it provides sufficient storage for operating systems, applications, and user data without incurring the higher costs associated with larger capacity SSDs.

The 128GB–512GB segment’s growth is further supported by advancements in NAND flash technology, which have led to increased storage densities and reduced costs per gigabyte. This has made SSDs within this capacity range more accessible to consumers and businesses alike.

Additionally, the rise of cloud computing and streaming services has shifted storage needs, with many users requiring less local storage, thereby making the 128GB–512GB range more appealing. The segment’s versatility and cost-effectiveness are expected to sustain its leading position in the nano SSD market in the foreseeable future.

End-Use Industry Analysis

In 2024, the consumer electronics segment held a dominant position in the nano SSD market, capturing more than a 42% share. This leadership is attributed to the widespread adoption of compact, high-performance storage solutions in devices such as smartphones, tablets, ultrabooks, and portable gaming consoles.

The increasing demand for faster data access, improved device responsiveness, and enhanced user experiences has driven manufacturers to integrate nano SSDs into their products. The compact form factor and low power consumption of nano SSDs make them particularly suitable for consumer electronics, where space and energy efficiency are critical considerations.

The growth of the consumer electronics segment is further supported by the proliferation of high-resolution content, mobile applications, and cloud-based services, which require efficient and reliable local storage solutions. Advancements in NAND flash technology have enabled higher storage capacities and faster data transfer rates in smaller footprints, aligning with the evolving needs of modern consumer devices.

Additionally, the trend towards thinner and lighter devices has necessitated the use of compact storage solutions like nano SSDs, reinforcing their prominence in the consumer electronics market. As consumer expectations for performance and portability continue to rise, the demand for nano SSDs in this segment is expected to remain strong.

Key Market Segments

By Form Factor

- BGA SSDs

- Chip-Scale SSDs

- M.2 2230 & 2242

By Interface

- PCIe NVMe

- SATA

- eMMC

- UFS (Universal Flash Storage)

By Capacity

- Up to 128GB

- 128GB–512GB

- 512GB–1TB

- Above 1TB

By End-Use Industry

- Consumer Electronics

- Industrial & IoT

- Automotive

- Medical Devices

- Aerospace & Defense

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Demand for High-Performance Storage in Data Centers

The exponential growth of digital data, driven by the proliferation of internet usage, smartphones, IoT devices, social media, and e-commerce applications, has significantly increased the demand for high-performance storage solutions in data centers. Nano SSDs, with their compact form factor and superior speed, are well-positioned to meet these demands.

Furthermore, the adoption of advanced technologies such as PCIe and NVMe interfaces in Nano SSDs has improved data transfer rates, making them ideal for applications requiring high-speed data processing. As data centers continue to evolve, the integration of Nano SSDs is expected to play a crucial role in meeting the increasing performance requirements.

Restraint

High Cost of Nano SSDs Compared to Traditional Storage Solutions

Despite their advantages, the high cost of Nano SSDs remains a significant barrier to widespread adoption. The price per gigabyte of SSDs is generally higher than that of traditional hard disk drives (HDDs), making it challenging for some organizations to justify the investment, especially when large storage capacities are required.

Moreover, the production of Nano SSDs involves advanced manufacturing processes and materials, contributing to their higher cost. Until these costs decrease through technological advancements and economies of scale, the price disparity between SSDs and HDDs may continue to hinder the broader adoption of Nano SSDs.

Opportunity

Expansion of Edge Computing and IoT Applications

The rapid expansion of edge computing and the Internet of Things (IoT) presents a significant opportunity for the Nano SSD market. As more devices and applications require real-time data processing and storage at the network edge, the demand for compact, high-speed, and reliable storage solutions like Nano SSDs is expected to increase.

The global solid-state drive (SSD) market is projected to grow significantly between 2024 and 2030, driven by rising demand for data center expansion, cloud computing services, and consumer electronics upgrades. Nano SSDs, with their small form factor and high performance, are well-suited for edge computing environments where space and power are limited.

Challenge

Data Security and Reliability Concerns

As the adoption of Nano SSDs increases, concerns regarding data security and reliability have emerged as significant challenges. While SSDs offer faster data access speeds and durability compared to traditional HDDs, there have been instances of data integrity issues and unexpected failures.

The complexity of SSD technology, including the use of advanced controllers and firmware, can introduce vulnerabilities that may compromise data security. Furthermore, the limited write endurance of NAND flash memory used in SSDs can lead to data loss over time if not properly managed.

To address these concerns, manufacturers must invest in developing robust error correction algorithms, wear-leveling techniques, and secure firmware to enhance the reliability and security of Nano SSDs. Additionally, implementing industry-standard encryption and security protocols can help mitigate risks associated with data breaches and unauthorized access.

Growth Factors

One of the primary growth factors is the proliferation of data-intensive applications, such as artificial intelligence (AI), machine learning, and big data analytics, which require fast and reliable storage solutions. Nano SSDs, with their compact form factor and high-speed data transfer capabilities, are well-suited to meet these demands.

The rise in mobile computing and the increasing adoption of ultra-thin laptops and tablets have also contributed to the growth of the Nano SSD market. These devices require storage solutions that are not only compact but also energy-efficient and capable of delivering high performance. Nano SSDs fulfill these requirements, making them an ideal choice for modern computing devices.

Furthermore, the expansion of data centers and the growing need for efficient storage solutions have propelled the demand for Nano SSDs. Data centers require storage devices that can handle large volumes of data with minimal latency. Nano SSDs, with their high read/write speeds and durability, are increasingly being deployed in data center environments to enhance performance and reduce energy consumption.

Emerging Trends

The Nano SSD market is experiencing several emerging trends that are shaping its future trajectory. One notable trend is the development of PCIe 5.0 SSDs, which offer significantly higher data transfer rates compared to their predecessors. For instance, the Crucial T705 PCIe 5.0 SSD delivers up to 14.5 GB/s of sequential throughput, catering to the needs of high-performance computing applications.

Another trend is the integration of advanced error correction algorithms and wear-leveling techniques in Nano SSDs. These features enhance the reliability and lifespan of the storage devices, making them more suitable for enterprise applications where data integrity is paramount.

The adoption of 3D NAND technology is also gaining momentum in the Nano SSD market. This technology allows for higher storage densities and improved performance, enabling manufacturers to produce SSDs with larger capacities without increasing the physical size of the devices.

Business Benefits

The adoption of Nano SSDs offers several business benefits, making them an attractive storage solution for various organizations. One of the primary advantages is the significant improvement in data access speeds. Nano SSDs are up to a hundred times faster than traditional hard disk drives (HDDs), resulting in shorter boot times, faster file transfers, and improved overall system performance.

The compact size of Nano SSDs allows for greater flexibility in system design, enabling the development of smaller and more portable computing devices. This is particularly beneficial for businesses that require mobile computing solutions or need to optimize space in data centers.

Key Player Analysis

Samsung, a leader in the Nano SSD market, consistently enhances its product portfolio through significant R&D investments, leading to regular new product launches. For example, in a recent year, Samsung could have introduced a new line of Nano SSDs with enhanced data transfer speeds and reliability, targeting high-performance computing and advanced consumer electronics markets.

Western Digital has been active in expanding its market share through strategic acquisitions and partnerships. A hypothetical scenario could involve Western Digital acquiring a smaller SSD manufacturer to enhance its technological capabilities or to expand its presence in emerging markets. This move would bolster its production capacities and diversify its product offerings in the high-density storage solutions sector.

Micron is known for its innovation-driven approach. The company might focus on merging with technology startups to integrate cutting-edge technologies into its Nano SSDs, such as AI-driven storage optimization software. These strategic mergers could be aimed at enhancing the performance and efficiency of their SSDs, making them more appealing to tech-savvy consumers and enterprises requiring robust data solutions.

Top Key Players in the Market

- Samsung Electronics Co., Ltd.

- Kioxia Corporation

- Western Digital Corporation

- Micron Technology Inc.

- SK Hynix Inc.

- ADATA Technology Co., Ltd.

- Transcend Information, Inc.

- Apacer Technology Inc.

- Phison Electronics

- Silicon Motion (SMI)

- Greenliant

- Swissbit

- ATP Electronics

- Others

Recent Developments

- In April 2025, In collaboration with AIO Core and Kyocera, Kioxia is developing a PCIe 5.0-compatible broadband optical SSD designed for next-generation green data centers. This innovation aims to reduce data center energy usage by over 40%.

- In March 2025, Samsung introduced its first PCIe Gen5 NVMe SSDs, the 9100 PRO series, offering capacities up to 8TB. These SSDs deliver sequential read speeds up to 14.8 GB/s and write speeds up to 13.4 GB/s, targeting professionals handling large datasets.

- In April 2025, ADATA launched the Premier Extreme SD 8.0 Express memory card, delivering read speeds up to 1,600MB/s and write speeds up to 1,200MB/s, surpassing many portable SSDs.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Bn Forecast Revenue (2034) USD 9.7 Bn CAGR (2025-2034) 18.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Form Factor (BGA SSDs, Chip-Scale SSDs, M.2 2230 & 2242), By Interface (PCIe NVMe, SATA, eMMC, UFS (Universal Flash Storage)), By Capacity (Up to 128GB, 128GB–512GB, 512GB–1TB, Above 1TB), By End-Use Industry (Consumer Electronics, Industrial & IoT, Automotive, Medical Devices, Aerospace & Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung Electronics Co., Ltd., Kioxia Corporation, Western Digital Corporation, Micron Technology Inc., SK Hynix Inc., ADATA Technology Co., Ltd., Transcend Information, Inc., Apacer Technology Inc., Phison Electronics, Silicon Motion (SMI), Greenliant, Swissbit, ATP Electronics, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Samsung Electronics Co., Ltd.

- Kioxia Corporation

- Western Digital Corporation

- Micron Technology Inc.

- SK Hynix Inc.

- ADATA Technology Co., Ltd.

- Transcend Information, Inc.

- Apacer Technology Inc.

- Phison Electronics

- Silicon Motion (SMI)

- Greenliant

- Swissbit

- ATP Electronics

- Others