Global Semiconductor Filter Market Size, Share, Statistics Analysis Report By Type (Gas Filters, Liquid Filters, Air Filters), By Material (Metal, Plastics, Ceramic, Others), By Application (Semiconductor Manufacuring, Electronics, Photovoltaics, Others), By End-User (IDMs, Foundries, OSATs, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147202

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

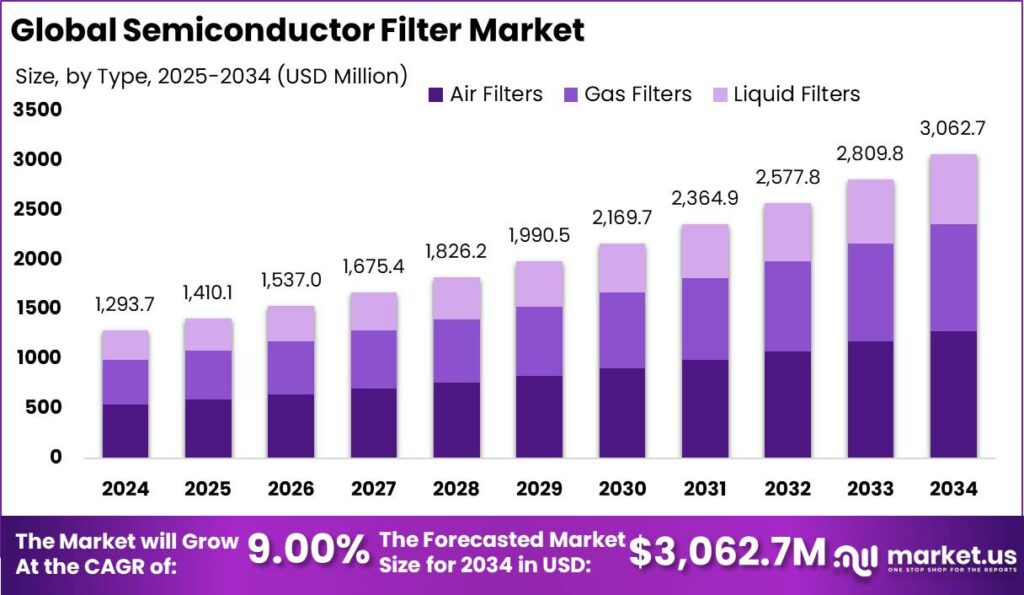

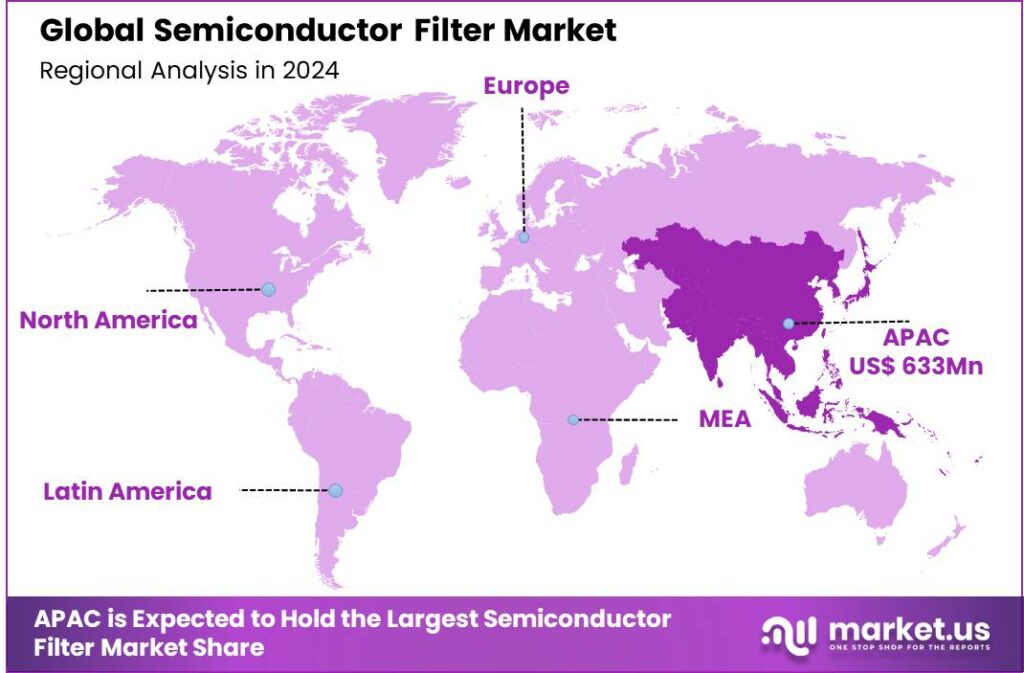

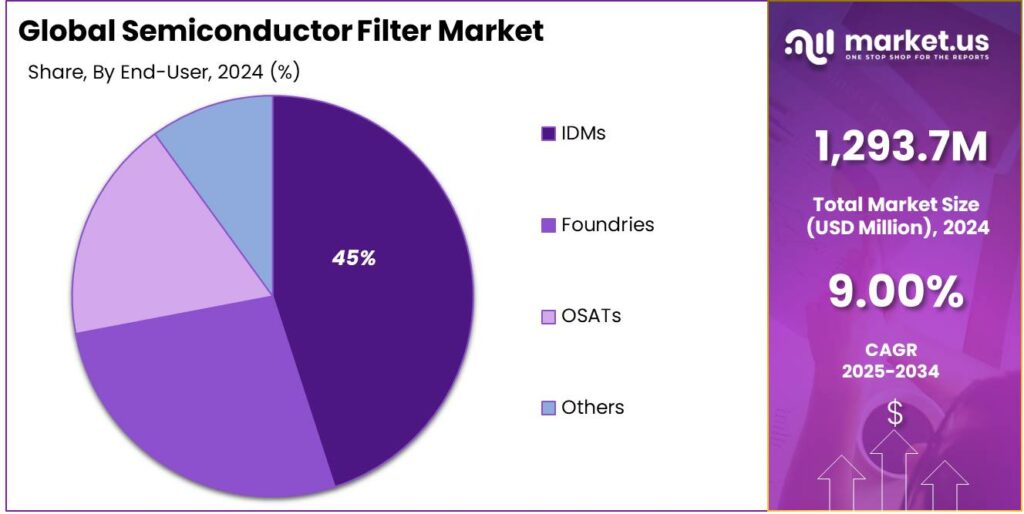

The Global Semiconductor Filter Market size is expected to be worth around USD 3,062.7 Million By 2034, from USD 1,293.7 Million in 2024, growing at a CAGR of 9.00% during the forecast period from 2025 to 2034. Asia-Pacific dominated the semiconductor filter industry in 2024, accounting for over 49% of the market share and generating USD 633 Million in revenue.

A semiconductor filter is a specialized component used in the manufacturing of semiconductor devices to ensure the purity of process environments. These filters are designed to remove contaminants such as particles, chemicals, and gases that can adversely affect the performance and yield of semiconductor products. By maintaining ultra-clean conditions, semiconductor filters play a crucial role in achieving high-quality and reliable semiconductor devices.

The semiconductor filter market is driven by the growing global semiconductor industry, which requires higher purity levels due to miniaturization. Increased production of consumer electronics, IoT devices, and advancements in automotive electronics are boosting demand for advanced filtering solutions. Additionally, stringent environmental and manufacturing regulations are spurring innovation, further fueling market growth.

The demand for semiconductor filters is closely linked to the semiconductor manufacturing sector, driven by investments in cleanroom technology and high-purity environments across North America, Asia, and Europe. Additionally, the miniaturization of electronic devices and advancements in nanotechnology increase the need for precise contaminant management.

Implementing high-efficiency semiconductor filters offers key business benefits, such as reducing defects in wafers, extending product lifespan, and improving performance. This leads to higher customer satisfaction and fewer warranty claims. Additionally, efficient filtration systems help lower operational costs by prolonging the lifespan of cleanroom equipment.

As per the report from Market.us, The global semiconductor market was valued at approximately USD 530 Billion in 2023 and is projected to grow steadily, reaching around USD 996 Billion by 2033, expanding at a CAGR of 6.5% during the forecast period from 2024 to 2033.

This growth is being driven by rising demand across consumer electronics, electric vehicles, AI-driven applications, and 5G infrastructure. In terms of regional dominance, Asia-Pacific (APAC) led the global landscape in 2023, capturing over 63.91% of the total market share, equivalent to USD 388.7 Billion in revenue.

Several opportunities exist in the semiconductor filter market, particularly in developing products that handle smaller contaminants for advanced manufacturing. The shift to ultra-pure water systems, IoT integration in cleanrooms, and expanding semiconductor production in regions like Southeast Asia provide new growth avenues for filter manufacturers.

Key Takeaways

- The Global Semiconductor Filter Market size is projected to reach USD 3,062.7 Million by 2034, up from USD 1,293.7 Million in 2024, growing at a CAGR of 9.00% during the forecast period from 2025 to 2034.

- In 2024, the Air Filters segment held a dominant market position, accounting for more than 42% of the market share.

- The Ceramic segment also held a dominant market share in 2024, capturing over 38% of the semiconductor filter market.

- The Semiconductor Manufacturing segment led the semiconductor filter market in 2024, with more than 56% of the market share.

- The Integrated Device Manufacturers (IDMs) segment was the leading player in the semiconductor filter market in 2024, holding more than 45% of the market share.

- Asia-Pacific dominated the semiconductor filter industry in 2024, accounting for over 49% of the market share and generating USD 633 Million in revenue.

Analysts’ Viewpoint

The semiconductor filter market is driven by advancing semiconductor technology and the move to smaller node sizes, which require higher purity and better contamination control. Advanced filters are essential for maintaining cleanroom standards, improving production yield, and ensuring the reliability and quality of semiconductor devices.

The semiconductor filter market presents significant investment opportunities due to the expansion of semiconductor manufacturing facilities worldwide. As semiconductor production demands increasingly cleaner environments, the need for advanced filtration solutions is growing especially in regions like East Asia and North America, where semiconductor manufacturing is rapidly expanding.

The regulatory environment is increasingly focusing on environmental sustainability and safety standards in manufacturing practices, influencing the semiconductor filter market. Regulations that mandate the reduction of emissions and waste in manufacturing plants are pushing companies to invest in effective and efficient filtration solutions to comply with these stricter standards.

Regional Analysis

In 2024, Asia-Pacific held a dominant market position in the semiconductor filter industry, capturing more than a 49% share and generating USD 633 Million in revenue. This region’s leadership is driven by its strong semiconductor manufacturing base, particularly in South Korea, Taiwan, and China. These countries house some of the world’s largest semiconductor facilities, where high-efficiency filters are essential to maintain strict cleanroom standards.

The substantial investment in semiconductor production capacity, especially for advanced microelectronics, drives the demand for high-quality filters to prevent contamination that can lead to significant yield losses. Furthermore, the Asia-Pacific region benefits from government policies that support technological advancements and the localization of semiconductor supply chains.

These initiatives have attracted increased investments from global semiconductor giants aiming to mitigate geopolitical risks and supply chain vulnerabilities. Additionally, the rapid growth of industries like consumer electronics, automotive, and telecommunications in the region has driven higher semiconductor demand, further boosting the need for semiconductor filters.

As digitalization and smart technologies continue to advance, demand in the Asia-Pacific region is expected to grow, reinforcing its leading position in the global semiconductor filter market. This trend highlights the region’s critical role in the semiconductor supply chain, underscoring its strategic importance and appeal for investment.

Type Analysis

In 2024, the Air Filters segment held a dominant market position, capturing more than a 42% share. This leadership in the market can be attributed to the critical role air filters play in maintaining the stringent cleanliness standards required in semiconductor fabrication plants.

Airborne particles pose a major contamination risk in semiconductor manufacturing, making effective air filtration critical to preventing defects in chips. As semiconductor devices become more complex and geometries shrink, the demand for advanced air filtration systems intensifies to maintain high purity standards and ensure defect-free production.

The adoption of technologies like extreme ultraviolet (EUV) lithography amplifies the need for advanced air filtration to control contaminants. This has driven a surge in demand for high-efficiency particulate air (HEPA) and ultra-low penetration air (ULPA) filters, significantly boosting the market share of air filters in the semiconductor industry.

The expansion of semiconductor manufacturing, particularly in Asia-Pacific’s key production hubs, fuels the growth of the air filters segment. These factors ensure that air filters continue to play a vital role in maintaining purity in semiconductor manufacturing, cementing their dominant position in the market.

Material Analysis

In 2024, the Ceramic segment held a dominant market position, capturing more than a 38% share of the semiconductor filter market. Ceramic filters lead the market due to their superior properties, including high chemical stability and excellent thermal resistance. These attributes make them ideal for semiconductor manufacturing, where high temperatures and aggressive chemicals are common.

Ceramic filters are favored in semiconductor applications due to their ability to withstand harsh processing environments without degrading. Their pore structure can be tightly controlled, allowing for precise filtration necessary in the production of semiconductors. Additionally, ceramics are less prone to shedding particles, a critical factor in maintaining the ultra-clean conditions required for semiconductor fabrication.

The demand for ceramic filters in semiconductor manufacturing is fueled by the trend toward smaller, more complex devices. As device architectures become more intricate, maintaining higher purity is essential. Ceramic filters efficiently remove sub-micron particles, organic compounds, and metallic contaminants, reducing defects and enhancing yield rates.

The ceramic filter segment is set for continued growth, driven by innovations in material science that enhance efficiency and reduce costs. With semiconductor manufacturers prioritizing sustainability, the recyclability and durability of ceramic filters make them a key player in eco-friendly manufacturing practices, solidifying their market leadership.

Application Analysis

In 2024, the Semiconductor Manufacturing segment held a dominant market position within the semiconductor filter market, capturing more than a 56% share. This dominance is primarily due to the critical role of filters in maintaining the ultrapure environments necessary for semiconductor fabrication.

The increasing complexity of semiconductor devices, along with the shift towards smaller process nodes, has heightened the need for more stringent contamination control. As semiconductor devices become more intricate, the tolerance for particles and other contaminants decreases, thereby increasing the dependency on high-efficiency filtration solutions.

Furthermore, the global demand for electronics featuring semiconductors, such as smartphones, computers, and IoT devices, continues to grow robustly. This demand surge necessitates expansive production capacities and, consequently, substantial investments in filter technology to ensure production environments are contaminant-free.

Regulatory pressures and industry standards requiring specific environmental conditions further drive the dominance of the ceramic filter segment. Compliance is essential for manufacturers to maintain market positions, reinforcing the critical role of filters in the industry. As semiconductor technologies evolve and production expands globally, the demand for high-quality filters is expected to grow.

End-User Analysis

In 2024, the Integrated Device Manufacturers (IDMs) segment held a dominant position in the semiconductor filter market, capturing more than a 45% share. This leadership stems from the integrated approach these companies use in manufacturing and designing semiconductor devices, ensuring a consistent demand for high-performance filters required in stringent fabrication environments.

A key reason for the prominence of IDMs in this market is their ability to manage the entire production process, from design to device fabrication. This control improves efficiency and heightens the demand for specialized filters that meet the exact specifications needed to maintain cleanroom standards, driving the segment’s growth.

Furthermore, IDMs are heavily invested in advancing their technological capabilities to keep up with the rapid pace of semiconductor innovation. This continuous push for technological enhancement necessitates regular upgrades in filter technology, which helps in managing contaminants effectively, crucial for high yield rates in semiconductor production.

The global trend toward more sophisticated electronic devices with enhanced functionalities is driving IDMs to expand their production capacities. This expansion further boosts the demand for semiconductor filters, as new and upgraded facilities incorporate advanced filtering technologies to ensure product quality and meet global standards.

Key Market Segments

By Type

- Gas Filters

- Liquid Filters

- Air Filters

By Material

- Metal

- Plastics

- Ceramic

- Others

By Application

- Semiconductor Manufacuring

- Electronics

- Photovoltaics

- Others

By End-User

- IDMs

- Foundries

- OSATs

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Demand for high-purity manufacturing in advanced semiconductor nodes.

The miniaturization of semiconductor devices, especially at sub-5nm nodes, requires ultra-clean manufacturing environments to prevent yield losses from even tiny contaminants. High-performance filters are crucial in maintaining process gas and liquid purity, removing particles, moisture, and impurities. These filters are particularly vital in processes like EUV lithography, where contaminants can significantly affect product quality and reliability.

The increasing adoption of technologies such as artificial intelligence (AI), 5G, and Internet of Things (IoT) devices further amplifies the demand for advanced semiconductor components, thereby driving the need for effective filtration solutions. As manufacturers strive to enhance yield and reduce defects, the integration of high-efficiency filters becomes indispensable, solidifying their role as a critical driver in the semiconductor industry.

Restraint

High Costs Associated with Advanced Filtration Solutions

The high costs of developing and implementing advanced semiconductor filters pose a significant challenge, especially for small and medium-sized enterprises (SMEs). These systems require substantial investment in R&D, specialized materials, and manufacturing processes, which can be a financial burden for smaller players in the semiconductor supply chain.

The financial burden of upgrading or integrating these technologies may cause manufacturers to delay or avoid investments, affecting product quality. Additionally, the need for frequent updates due to rapid technological advancements further increases costs, limiting the adoption of advanced filtration solutions and restricting the semiconductor filter market’s growth potential.

Opportunity

Expansion of Semiconductor Manufacturing in Emerging Markets

The global expansion of semiconductor manufacturing, especially in emerging markets like India, Vietnam, and Malaysia, offers a major growth opportunity for the semiconductor filter industry. These countries are investing heavily in semiconductor fabrication plants to enhance their technological capabilities and reduce reliance on imports.

India’s government is attracting semiconductor manufacturers with incentives and infrastructure support. As new fabs are built, the demand for high-quality filtration systems to maintain contamination-free environments will increase. This expansion creates new opportunities for filter manufacturers and drives the development of region-specific solutions tailored to local needs.

Geopolitical tensions and the push for supply chain resilience are driving the diversification of semiconductor production. As companies expand manufacturing across regions, the ongoing need for advanced filtration systems will boost demand, creating growth opportunities for filter manufacturers worldwide.

Challenge

Technical Complexity in Achieving Ultra-High Purity Standards

Achieving ultra-high purity in semiconductor manufacturing is a complex challenge, as shrinking device geometries and stricter performance requirements demand filters that can remove particles at the nanometer scale. These filters must be made from materials that are chemically resistant, mechanically stable, and compatible with high temperatures and aggressive chemicals to ensure consistent performance under varying process conditions.

The integration of advanced filters into existing manufacturing lines demands careful planning to prevent disruptions and ensure compatibility with other system components. Ongoing monitoring and maintenance are necessary to maintain purity standards, adding to the complexity. Addressing these technical challenges is essential for filter manufacturers to meet the evolving demands of the semiconductor industry and ensure the reliability and efficiency of fabrication processes.

Emerging Trends

The semiconductor industry is witnessing several emerging trends in filtration technology. One notable development is the increasing use of metal filters. These robust filters ensure superior contaminant protection, boosting yields and minimizing maintenance in demanding semiconductor fabrication environments.

Another trend is the adoption of advanced filtration systems that enhance worker safety, improve product quality, and increase equipment longevity. These systems help manufacturers comply with stringent regulatory standards while minimizing waste and energy consumption .

The semiconductor gas phase filtration market is also experiencing significant growth. The growth is fueled by increasing semiconductor demand across sectors like electronics and telecom, alongside the need for advanced filtration to support evolving cleanroom manufacturing processes.

Business Benefits

High-performance filters effectively remove microscopic particles and contaminants from gases and liquids used in semiconductor manufacturing. This ensures a cleaner production environment, reducing defects and enhancing product quality and yield, which are crucial for profitability and competitiveness.

Semiconductor manufacturing requires adherence to stringent industry standards for cleanliness and contamination control. High-quality filtration systems help manufacturers meet these standards by effectively removing particles and impurities from the production environment. Compliance ensures product reliability and maintains customer trust.

Efficient filtration minimizes hazardous waste by capturing contaminants early, while durable filters reduce replacements, lowering waste and resource consumption. These practices support environmental sustainability and can enhance a company’s reputation for responsible manufacturing.

Key Player Analysis

The semiconductor filter market plays a critical role in maintaining the quality and purity of processes within the semiconductor manufacturing industry. A few key companies dominate this space, each bringing unique strengths to the market.

Entegris is a global leader known for its cutting-edge filtration and purification solutions tailored specifically for semiconductor manufacturing. The company stands out for its deep focus on innovation, offering highly engineered materials that meet the demands of advanced chip nodes.

Pall Corporation, a part of Danaher Corporation, brings decades of expertise in filtration and separation technologies. In the semiconductor space, Pall is well known for delivering reliable filters that improve yield and ensure cleanroom compliance.Their global presence and strong service network help them maintain a trusted reputation among top-tier semiconductor fabs.

Mott Corporation takes a different approach by focusing on porous metal filtration solutions. Their products are highly durable and customizable, making them ideal for harsh chemical environments often found in semiconductor fabs. Mott is particularly known for its engineered solutions that combine filtration with flow control.

Top Key Players in the Market

- Entegris Inc.

- Pall Corporation

- Mott Corporation

- Porvair Filtration Group

- Donaldson Company, Inc.

- Parker Hannifin Corporation

- Camfil AB

- Cobetter Filtration Equipment Co., Ltd.

- Filtration Group Corporation

- Meissner Filtration Products, Inc.

- Sartorius AG

- Eaton Corporation

- Freudenberg Filtration Technologies

- AAF International

- Lydall, Inc.

- Porous Media Corporation

- Graver Technologies, LLC

- Mann+Hummel Group

- Clarcor Inc.

- Donaldson Ultrafilter GmbH

- Other Key Players

Top Opportunities for Players

The semiconductor filter market presents several significant opportunities for industry players, driven by technological advancements and expanding applications in various sectors.

- Expansion in IoT and 5G Technologies: The increasing adoption of Internet of Things (IoT) devices and the rollout of 5G networks are creating substantial opportunities for semiconductor filters. These technologies require robust filtering solutions to manage increased data traffic and ensure signal integrity, offering a growing market for advanced filter solutions.

- Electric Vehicles and ADAS: The automotive sector, especially with the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), is another promising avenue. These technologies require high-efficiency electronic components, where superior performance semiconductor filters play a critical role in ensuring safety and performance.

- Renewable Energy Integration: As renewable energy sources like solar and wind become more prevalent, there is a growing need for semiconductor filters in the energy sector. These filters ensure stable and reliable energy transmission when integrating renewable sources into the grid, marking a significant market expansion area.

- Advancements in Medical and Healthcare: The medical and healthcare industries are rapidly incorporating electronic devices that require high standards of purity and efficiency. Semiconductor filters are essential in devices like medical imaging and patient monitoring systems, where they help in delivering precise and reliable results.

- Technological Innovations in Semiconductor Manufacturing: Continuous technological advancements in semiconductor manufacturing processes also create opportunities. Filters are needed to manage contaminants in various manufacturing stages, such as photolithography and chemical mechanical planarization (CMP), ensuring high yields and product quality.

Recent Developments

- In June 2024, Pall Corporation inaugurated a state-of-the-art manufacturing facility in Singapore, investing approximately $150 million. The facility specializes in producing lithography and wet-etch filtration, purification, and separation solutions to meet the growing demand for advanced node semiconductor chips.

- In June 2024, Entegris secured a preliminary agreement with the U.S. government for up to $75 million in funding under the CHIPS Act. This investment aims to establish a new facility in Colorado Springs, Colorado, focusing on the production of liquid filter membranes and Front Opening Unified Pods (FOUPs), essential for semiconductor wafer handling.

- In July 2024, IDEX Corporation announced the acquisition of Mott Corporation for $1 billion in cash. This strategic move aims to enhance IDEX’s position in the semiconductor filtration market, among other sectors.

Report Scope

Report Features Description Market Value (2024) USD 1,293.7 Mn Forecast Revenue (2034) USD 3,062.7 Mn CAGR (2025-2034) 9.00% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Gas Filters, Liquid Filters, Air Filters), By Material (Metal, Plastics, Ceramic, Others), By Application (Semiconductor Manufacuring, Electronics, Photovoltaics, Others), By End-User (IDMs, Foundries, OSATs, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Entegris Inc., Pall Corporation, Mott Corporation, Porvair Filtration Group, Donaldson Company, Inc., Parker Hannifin Corporation, Camfil AB, Cobetter Filtration Equipment Co., Ltd., Filtration Group Corporation, Meissner Filtration Products, Inc., Sartorius AG, Eaton Corporation, Freudenberg Filtration Technologies, AAF International, Lydall, Inc., Porous Media Corporation, Graver Technologies, LLC, Mann+Hummel Group, Clarcor Inc., Donaldson Ultrafilter GmbH, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Semiconductor Filter MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Semiconductor Filter MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Entegris Inc.

- Pall Corporation

- Mott Corporation

- Porvair Filtration Group

- Donaldson Company, Inc.

- Parker Hannifin Corporation

- Camfil AB

- Cobetter Filtration Equipment Co., Ltd.

- Filtration Group Corporation

- Meissner Filtration Products, Inc.

- Sartorius AG

- Eaton Corporation

- Freudenberg Filtration Technologies

- AAF International

- Lydall, Inc.

- Porous Media Corporation

- Graver Technologies, LLC

- Mann+Hummel Group

- Clarcor Inc.

- Donaldson Ultrafilter GmbH

- Other Key Players