Global Anti-Drone Market Size, Share Analysis Report By Mitigation Type (Non-destructive System, Destructive System (Laser System, Missile Effector, Electronic Countermeasure)), By Defense Type(Drone Detection System, Drone Detection and Disruption System), By Type(Radar-Based Detection, Radio-Frequency (RF), Electro-Optical (EO), Infrared Radiation (IR), Others), By Technology (Electronic System, Laser System, Kinetic System), By Platform (Ground-based, Handheld, UAV-based), By End User (Commercial, Military and defense, Government, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147337

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- US Market Growth

- Mitigation Type Analysis

- Defense Type Analysis

- Type Analysis

- Technology Analysis

- Platform Analysis

- End User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

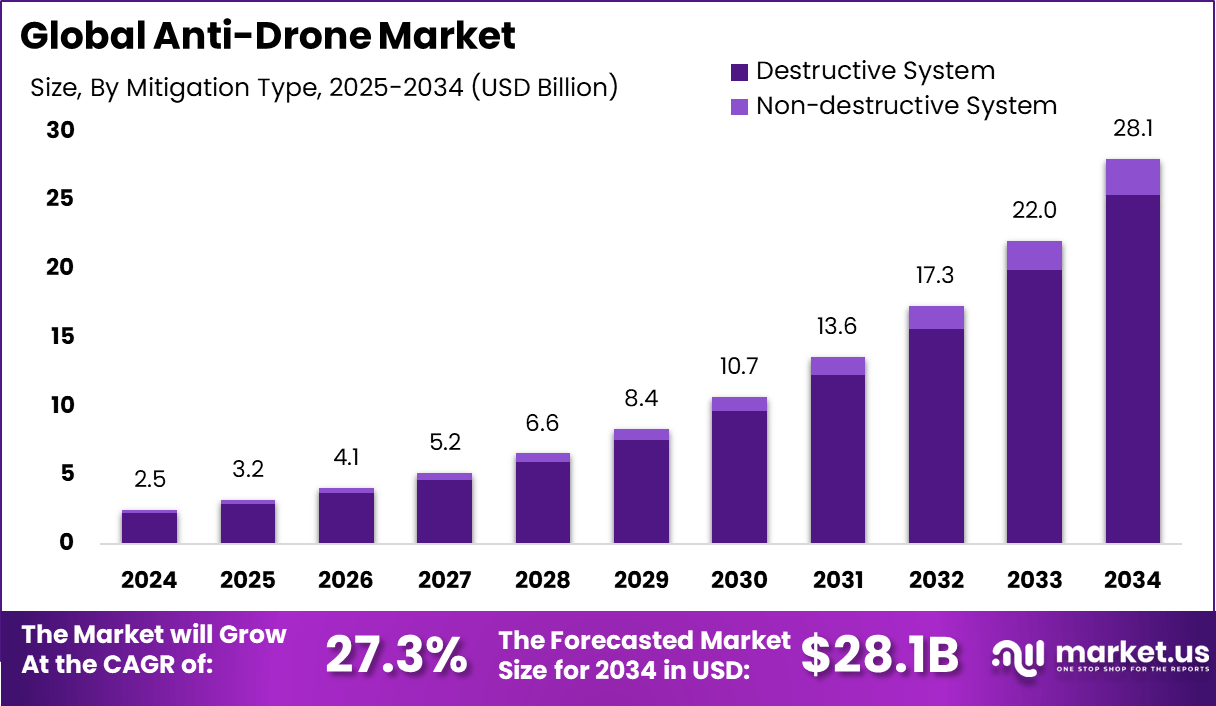

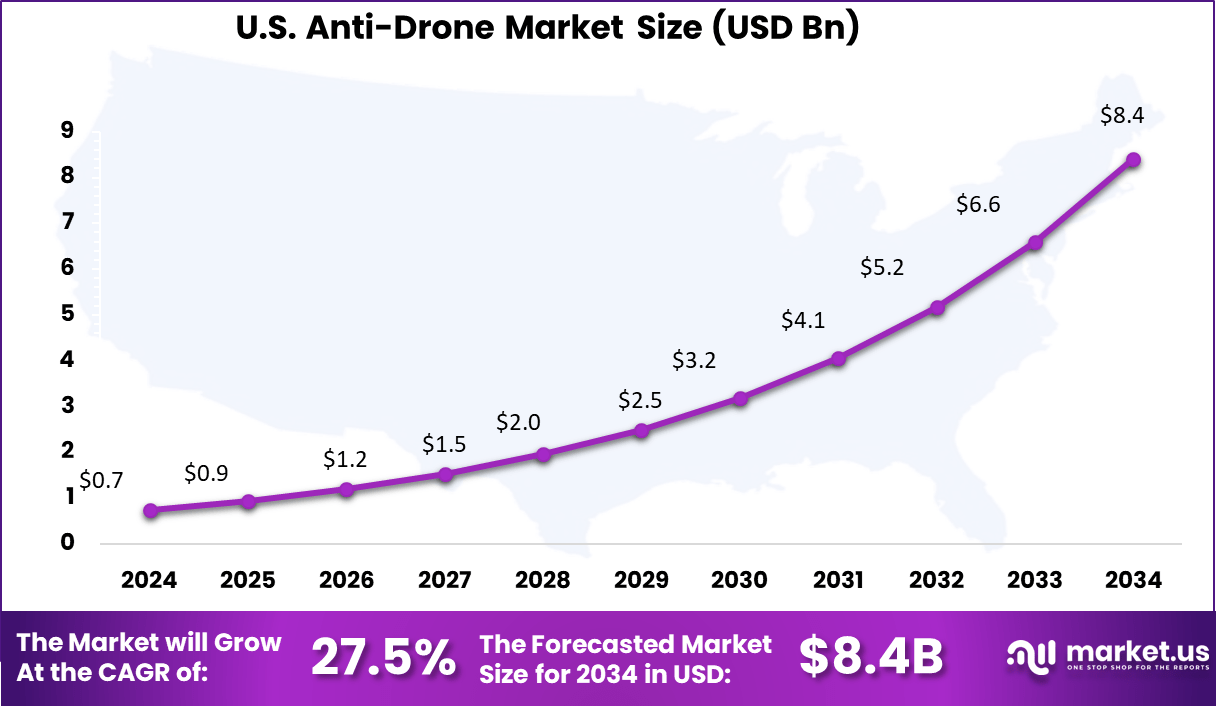

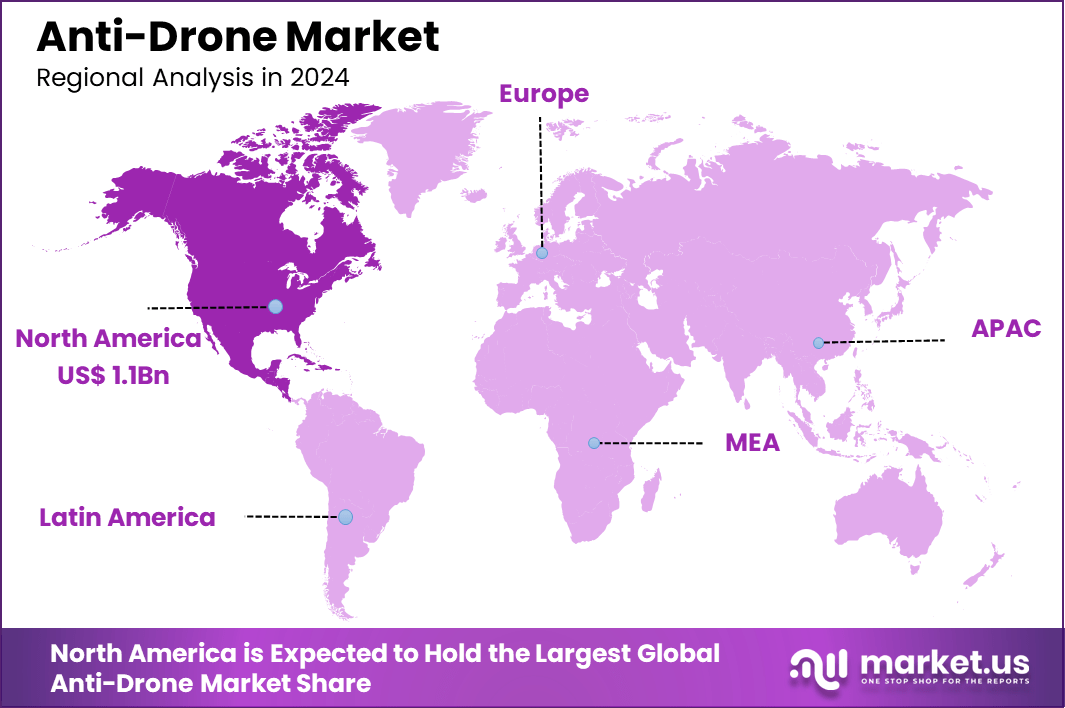

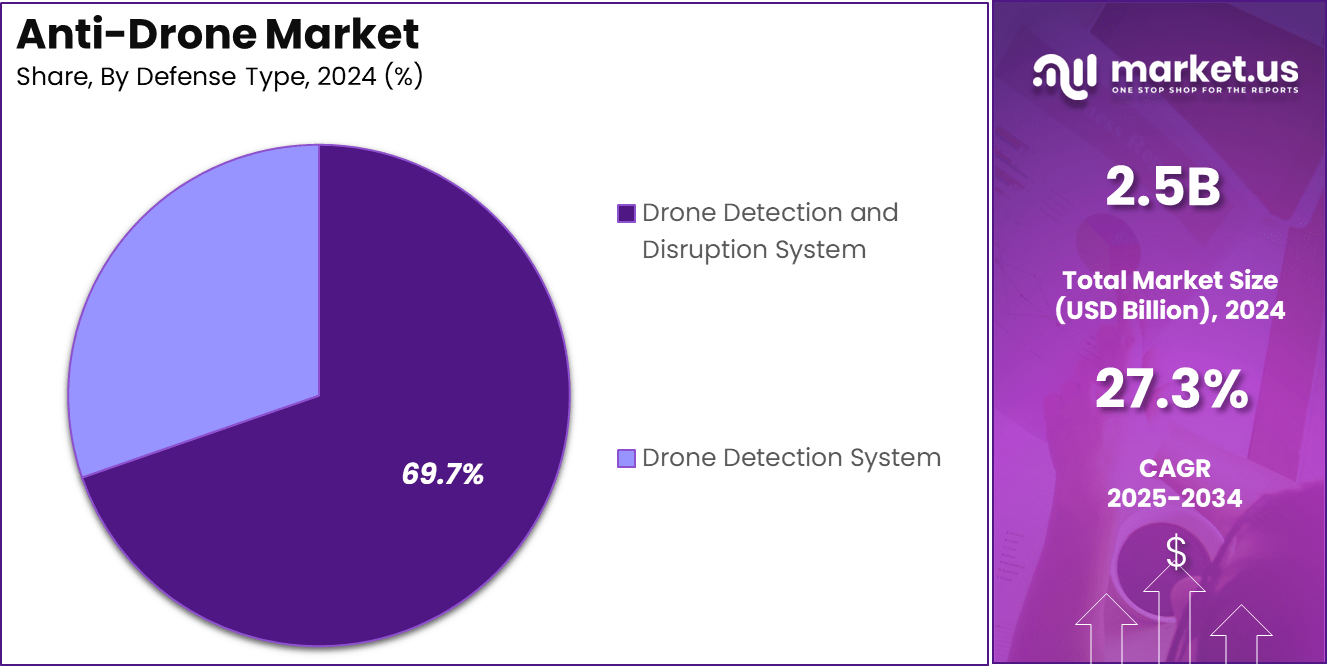

The Global Anti-Drone Market size is expected to be worth around USD 28.1 Billion By 2034, from USD 2.5 billion in 2024, growing at a CAGR of 27.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 46.8% share, holding USD 1.1 Billion revenue. In the United States, the market is valued at USD 0.74 Billion in 2024 and is projected to grow at a CAGR of 27.5% during the forecast period.

Anti-drone technology encompasses a suite of systems and methodologies designed to detect, track, and neutralize unauthorized or hostile unmanned aerial vehicles (UAVs). These technologies are critical in safeguarding sensitive areas such as military installations, airports, and public events from potential threats posed by drones.

The systems employed include radio frequency (RF) jammers, radar systems, optical sensors, and directed energy weapons, among others. The primary objective is to ensure airspace security by preventing unauthorized drone activities that could compromise safety and privacy.

The anti-drone market has witnessed substantial growth, driven by escalating security concerns and the proliferation of drones in both civilian and military domains. The evolving nature of modern warfare has increased the demand for advanced aerial threat detection systems, while the rise in illegal activities such as smuggling, surveillance, and unauthorized drone intrusions has further underscored the need for robust counter-UAS technologies.

Government investments and strategic initiatives are playing a pivotal role in accelerating the deployment of anti-drone infrastructure. These efforts are further supported by expanding smart city projects, where integrated security systems, including anti-drone solutions, are becoming essential components of urban resilience.

Demand analysis indicates a surge in the adoption of anti-drone systems across various sectors, including defense, critical infrastructure, and public safety. The defense sector, in particular, accounts for a significant share of the market, driven by the need to protect military assets and personnel from drone threats.

The primary reasons boosting demand encompass the escalating use of drones for malicious purposes, such as espionage and contraband delivery, and the consequent need for effective countermeasures. Furthermore, the evolving regulatory landscape mandates the implementation of anti-drone technologies to ensure compliance with airspace security norms.

Key Takeaways

- The Global Anti-Drone Market is projected to surge from USD 2.5 Billion in 2024 to approximately USD 28.1 Billion by 2034, reflecting an impressive CAGR of 27.3%.

- North America led the market in 2024, accounting for 46.8% share, with revenue around USD 1.1 Billion, while the U.S. market alone stood at USD 0.74 Billion, set to grow at 27.5% CAGR.

- The Destructive System segment dominated with over 90.7% share, showing strong preference for physical neutralization over jamming techniques.

- Drone Detection and Disruption Systems captured 69.7% of the global market, indicating high deployment of integrated defense mechanisms.

- Radar-Based Detection emerged as the top detection technology in 2024, favored for its effectiveness in complex and wide-area surveillance.

- The electronic systems segment recorded the largest share among technologies, driven by the adoption of jamming and signal disruption solutions.

- On the basis of platform, ground-based systems held the lead in 2024, due to their scalability and ease of deployment in border and strategic zones.

- The military and defense sector was the key end-user, capturing over 58.9% market share, reflecting growing concerns over drone threats in national security operations.

Analysts’ Viewpoint

The increasing adoption of technologies such as RF jamming, laser systems, and kinetic interceptors is transforming the anti-drone landscape. These technologies offer scalable and adaptable solutions to counter a wide range of drone threats. The integration of AI and ML further empowers these systems with predictive analytics and autonomous decision-making capabilities, enhancing their operational efficacy.

Key reasons for adopting these technologies include the need for real-time threat detection, minimal collateral damage, and compliance with regulatory standards. The versatility and scalability of modern anti-drone systems make them suitable for diverse applications, from protecting large-scale events to securing critical infrastructure.

Investment opportunities in the anti-drone market are burgeoning, with significant funding directed towards startups and established firms specializing in counter-drone technologies. For instance, defense tech startup Epirus secured $250 million in a Series D funding round to scale up production of its anti-drone weapons. Such investments underscore the market’s potential and the growing investor confidence in the sector.

The regulatory environment plays a pivotal role in shaping the anti-drone market. Governments and regulatory bodies are formulating policies and frameworks to govern the deployment and operation of anti-drone systems. In the United States, for example, the Federal Aviation Administration (FAA) regulates drone operations under Part 107 rules, necessitating compliance from operators and influencing the development of counter-drone technologies .

US Market Growth

The U.S. anti-drone market is estimated to reach USD 0.74 Billion in 2024 and is expected to grow at a robust CAGR of 27.5% over the forecast period. This surge is primarily attributed to the rising demand for advanced counter-drone systems to safeguard critical infrastructure, airports, defense bases, and public events.

The proliferation of commercial drones, coupled with growing concerns about national security, has accelerated the adoption of anti-drone technologies such as radar-based detection, radio frequency jammers, and laser-based interception. Moreover, continuous innovation in AI-enabled threat detection and regulatory support for drone mitigation frameworks are further strengthening the market outlook in the U.S.

In 2024, North America held a dominant market position in the global anti-drone sector, capturing more than a 46.8% share and generating approximately USD 1.05 billion in revenue. This leadership is primarily attributed to the United States’ substantial investment in defense and security technologies, alongside stringent regulations governing unmanned aerial vehicle (UAV) operations.

Moreover, the region’s technological prowess has facilitated the rapid adoption of sophisticated anti-drone solutions. Companies based in North America have been instrumental in advancing detection and mitigation technologies, leveraging artificial intelligence and machine learning to enhance the efficacy of these systems.

The integration of such technologies ensures real-time monitoring and swift neutralization of potential threats, thereby reinforcing the region’s commitment to maintaining airspace security. Additionally, regulatory frameworks and policies have been conducive to the deployment of these systems, further solidifying North America’s leading position in the anti-drone market.

Mitigation Type Analysis

In 2024, the Destructive System segment held a dominant position in the global anti-drone market, capturing more than 90.7% of the market share. This dominance is primarily attributed to the immediate and reliable neutralization capabilities these systems offer against unauthorized drones, especially in high-security environments.

Destructive systems, which include laser systems, missile effectors, and electronic countermeasures, are favored for their effectiveness in mitigating threats swiftly and decisively. The preference for destructive systems is further reinforced by their integration into military and defense operations, where the rapid elimination of aerial threats is crucial.

Technological advancements have enhanced the precision and efficiency of these systems, making them indispensable in scenarios where non-destructive methods may fall short. Moreover, the increasing incidents of drone-related security breaches have compelled governments and organizations to invest in robust counter-drone measures, thereby propelling the growth of the destructive systems segment.

Defense Type Analysis

In 2024, the Drone Detection and Disruption System segment held a dominant position in the global anti-drone market, capturing more than 69.7% of the market share. This significant market share is primarily attributed to the increasing need for comprehensive solutions that not only detect unauthorized drones but also effectively neutralize them.

The rise in incidents involving rogue drones has underscored the necessity for systems that can provide both detection and immediate countermeasures to mitigate potential threats. The preference for detection and disruption systems is further reinforced by their versatility and effectiveness in various applications. These systems are capable of identifying and disabling drones through methods such as radio frequency jamming and GPS spoofing, which are non-destructive and minimize collateral damage.

Such capabilities are particularly valuable in sensitive environments like airports, government buildings, and public events, where safety and minimal disruption are paramount. Additionally, the integration of advanced technologies, including artificial intelligence and machine learning, has enhanced the precision and responsiveness of these systems, making them indispensable tools in modern security infrastructure.

Type Analysis

In 2024, the Radar-Based Detection segment held a dominant position in the global anti-drone market, capturing a significant share due to its superior capability to detect and track unmanned aerial vehicles (UAVs) across various environments.

This dominance is primarily attributed to the technology’s effectiveness in identifying drones at extended ranges and under diverse weather conditions, making it indispensable for critical infrastructure protection, military installations, and public event security.

The integration of advanced radar systems, such as 3D pulse-Doppler radar, enhances the detection range both horizontally and vertically, allowing for comprehensive airspace monitoring. For instance, the ND-BU002 high-end anti-drone system employs such radar technology to significantly increase its drone detection capabilities.

The preference for radar-based systems is further reinforced by their ability to distinguish between drones and other airborne objects, reducing false positives and ensuring accurate threat assessment. These systems are often equipped with features like electronic scanning and mechanical scanning modes, providing flexibility and adaptability in various operational scenarios.

Additionally, the scalability of radar-based detection systems allows for their deployment in both stationary and mobile configurations, catering to the dynamic needs of defense and security agencies. The ongoing advancements in radar technology, coupled with increasing investments in counter-UAV measures, are expected to sustain the leading position of the Radar-Based Detection segment in the anti-drone market.

Technology Analysis

In 2024, the electronic systems segment held a dominant position in the global anti-drone market, capturing the largest share among all technology types. This leadership is primarily attributed to the segment’s ability to provide non-destructive and cost-effective solutions for neutralizing unauthorized drones.

Electronic systems, encompassing radio frequency (RF) jammers, GPS spoofers, and electromagnetic interference devices, effectively disrupt the communication links between drones and their operators, rendering the drones inoperative without causing physical damage. Such capabilities are particularly valuable in sensitive environments like airports, government buildings, and public events, where safety and minimal disruption are paramount.

The preference for electronic systems is further reinforced by their versatility and adaptability across various applications. These systems can be deployed in fixed installations, mobile units, or handheld devices, catering to the dynamic needs of military, law enforcement, and commercial sectors. Advancements in artificial intelligence and machine learning have enhanced the precision and responsiveness of electronic countermeasures, enabling real-time detection and mitigation of drone threats.

Platform Analysis

In 2024, the ground-based systems segment held a dominant position in the global anti-drone market, capturing the largest share among all platform types. This leadership is primarily attributed to the segment’s ability to provide comprehensive and scalable solutions for detecting, tracking, and neutralizing unauthorized drones.

Ground-based systems are favored for their effectiveness in safeguarding critical infrastructure, military installations, and public spaces, where the risk of drone-related threats is significant. The integration of advanced technologies, such as radar, radio frequency (RF) sensors, and electro-optical systems, enhances the capability of these platforms to identify and mitigate potential threats in real-time.

The preference for ground-based systems is further reinforced by their adaptability and ease of integration with existing security infrastructures. These systems can be deployed in fixed installations or mounted on mobile units, offering flexibility to address diverse operational requirements.

Moreover, the increasing incidents of drone-related security breaches have compelled governments and organizations to invest in robust counter-drone measures, thereby propelling the growth of the ground-based systems segment. The ongoing advancements in detection and neutralization technologies are expected to sustain the leading position of this segment in the anti-drone market.

End User Analysis

In 2024, the military and defense sector held a dominant position in the global anti-drone market, capturing more than 58.9% of the market share. This significant share is primarily attributed to the escalating threats posed by unauthorized drones in conflict zones and sensitive military areas.

The increasing incidents of drone incursions have compelled defense organizations worldwide to invest heavily in advanced counter-drone technologies to safeguard their assets and personnel. The preference for anti-drone solutions in the military and defense sector is further reinforced by the integration of sophisticated technologies such as electronic warfare systems, directed energy weapons, and radar-based detection systems.

These technologies provide comprehensive protection against a wide range of drone threats, including swarms and stealth drones. Moreover, the development of portable and vehicle-mounted anti-drone systems has enhanced the operational flexibility of military forces, allowing for rapid deployment in various terrains and scenarios.

Key Market Segments

By Mitigation Type

- Non-destructive System

- Destructive System

- Laser System

- Missile Effector

- Electronic Countermeasure

By Defense Type

- Drone Detection System

- Drone Detection and Disruption System

By Type

- Radar-Based Detection

- Radio-Frequency (RF)

- Electro-Optical (EO)

- Infrared Radiation (IR)

- Others

By Technology

- Electronic System

- Laser System

- Kinetic System

By Platform

- Ground-based

- Handheld

- UAV-based

By End User

- Commercial

- Military and defense

- Government

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Escalating Security Threats from Unmanned Aerial Vehicles (UAVs)

The proliferation of drones has introduced significant security challenges across various sectors. Unauthorized drone activities, including surveillance, smuggling, and potential terrorist attacks, have heightened the need for effective countermeasures. For instance, incidents involving drones near airports have raised concerns about aviation safety, prompting authorities to seek advanced detection and mitigation solutions.

Moreover, the use of drones in conflict zones, such as Ukraine, has demonstrated their potential in modern warfare, further emphasizing the urgency for robust anti-drone systems. Governments and private entities are increasingly investing in anti-drone technologies to safeguard critical infrastructure, public spaces, and national security.

Restraint

High Costs Associated with Anti-Drone Systems

Despite the growing demand, the adoption of anti-drone technologies is hindered by the substantial costs involved in their development and deployment. Advanced systems often require sophisticated components, such as radar, RF sensors, and AI-powered software, leading to high research and production expenses . These costs can be prohibitive for smaller organizations and developing countries, limiting the widespread implementation of anti-drone solutions.

Additionally, the maintenance and operational expenses associated with these systems further contribute to the financial burden. The need for specialized personnel to operate and manage anti-drone technologies adds to the overall cost, making it challenging for some entities to justify the investment. Consequently, cost remains a significant barrier to the broader adoption of anti-drone systems.

Opportunity

Emerging Markets and Infrastructure Development

Emerging markets, particularly in regions like Asia-Pacific and the Middle East, present significant growth opportunities for the anti-drone industry. Rapid urbanization and infrastructure development in these areas have increased the demand for security measures to protect critical assets . Governments and private sectors are recognizing the importance of implementing anti-drone technologies to mitigate potential threats.

Furthermore, the integration of anti-drone systems into smart city initiatives and public safety programs offers additional avenues for market expansion. As these regions continue to invest in modern infrastructure, the need for comprehensive security solutions, including counter-drone measures, is expected to rise, providing a favorable environment for industry growth.

Challenge

Regulatory and Legal Constraints

The deployment of anti-drone technologies faces significant regulatory and legal challenges. In many countries, the use of counter-drone systems, especially those involving jamming or interception, is subject to strict regulations to prevent interference with legitimate communications and ensure public safety . These legal constraints can impede the implementation of anti-drone measures, particularly in civilian areas.

Moreover, the lack of standardized international regulations complicates the global deployment of anti-drone technologies. Manufacturers and operators must navigate a complex landscape of varying legal requirements, which can delay the adoption and integration of these systems. Addressing these regulatory hurdles is essential for the effective and lawful utilization of anti-drone solutions worldwide.

Growth Factors

Escalating Drone Threats and Technological Advancements

The anti-drone market is experiencing significant growth, driven by the increasing threats posed by unauthorized drones and advancements in counter-drone technologies. Incidents involving drones near airports, public events, and critical infrastructure have raised security concerns globally.

For instance, the deployment of the Marine Air Defense Integrated System (MADIS) by the US Marine Corps in the Philippines underscores the strategic importance of countering unmanned aerial systems (UAS) in sensitive regions. Technological innovations are enhancing the effectiveness of anti-drone systems.

The integration of artificial intelligence (AI) and machine learning (ML) enables real-time detection, classification, and neutralization of drone threats. Advanced systems can now differentiate between various drone types and assess threat levels more accurately. These capabilities are crucial in environments where rapid response is essential to mitigate potential risks.

Emerging Trends

AI Integration and Portable Counter-Drone Systems

Emerging trends in the anti-drone market highlight the integration of AI and the development of portable counter-drone systems. AI-powered solutions are enhancing the precision and speed of threat detection, allowing for automated responses to unauthorized drone activities. These systems can process vast amounts of data from various sensors, improving situational awareness and decision-making processes.

The demand for portable and user-friendly counter-drone systems is on the rise, particularly among law enforcement and security agencies. Handheld devices equipped with jamming and interception capabilities provide flexibility and rapid deployment options in diverse operational scenarios. The development of such systems caters to the need for mobility and ease of use in dynamic environments.

Additionally, the market is witnessing a shift towards multi-layered defense strategies, combining various technologies such as radar, RF detection, and optical sensors. This approach enhances the reliability and effectiveness of counter-drone measures, ensuring comprehensive protection against evolving threats.

Business Benefits

Implementing anti-drone systems offers substantial business benefits, primarily by enhancing security and operational efficiency. Organizations can protect critical infrastructure, sensitive data, and personnel from potential drone-related threats, thereby minimizing risks and potential liabilities. For example, during the 2024 Paris Olympics, French authorities intensified their anti-drone efforts to safeguard the event, demonstrating the importance of such systems in ensuring public safety.

Beyond security, anti-drone technologies contribute to operational efficiency by preventing disruptions caused by unauthorized drones. Airports, for instance, can avoid flight delays and cancellations resulting from drone incursions, thereby maintaining service reliability and customer satisfaction. Similarly, in the energy sector, protecting facilities from drone-related incidents ensures uninterrupted operations and reduces downtime.

Moreover, the adoption of anti-drone solutions can lead to cost savings by mitigating the financial impacts of security breaches and operational disruptions. Investing in these technologies reflects a proactive approach to risk management, enhancing an organization’s resilience and reputation. As drone usage continues to proliferate, the integration of counter-drone measures becomes an essential component of comprehensive security strategies across various industries.

Key Player Analysis

The anti-drone market is witnessing significant advancements, driven by strategic initiatives from leading defense companies. Among these, Airbus Group SE, Dedrone, and Raytheon Company have emerged as key players, each contributing uniquely through acquisitions, product innovations, and collaborations.

Airbus has expanded its capabilities in unmanned aerial systems by acquiring Aerovel, the U.S.-based manufacturer of the Flexrotor drone. This move strengthens Airbus’s portfolio in tactical unmanned solutions. Additionally, Airbus introduced the LOw-cost Air Defence (LOAD) system, a counter-drone solution featuring a modified Do-DT25 drone equipped with up to three guided missiles.

Dedrone has solidified its position in airspace security through strategic acquisitions and product development. The company was acquired by Axon, enhancing its capabilities in public safety and national security. Prior to this, Dedrone acquired Aerial Armor, a Phoenix-based developer of drone detection systems, to broaden its technological offerings.

Raytheon has been at the forefront of counter-drone technology with its Coyote family of unmanned aerial systems. The latest variant, Coyote LE SR, is a multi-mission drone capable of reconnaissance, electronic warfare, and precision strikes. Notably, Raytheon successfully conducted the first-ever helicopter launch of the Coyote drone interceptor, demonstrating its versatility in various combat scenarios.

List of Anti-Drone Market Companies

- Airbus Group SE

- Blighter Surveillance Systems

- Dedrone

- Advanced Radar Technologies S.A.

- DeTect, Inc.

- Drone shield LLC

- Enterprise Control Systems

- Israel Aerospace Industries Ltd. (IAI)

- Lit eye Systems, Inc.

- Lockheed Martin Corporation

- Orelia

- Prime Consulting and technologies

- Raytheon Company

- Saab Ab

- Selex Es Inc.

- Thales Group

- The Boeing Company

Recent Developments

- In January 2025, India successfully conducted trials of its first indigenously developed micro-missile system, Bhargavastra, aimed at neutralizing swarm drone threats. The tests, held at the Gopalpur Seaward Firing Ranges on January 12 and 13, demonstrated the system’s multi-layered defense capability by effectively striking virtual drone targets located over 2.5 kilometers away.

- In October 2024, Turkey-based ASELSAN unveiled four advanced anti-drone systems – KORKUT 25 mm, BUKALEMUN, KANGAL-FPV, and SEDA 100-cUAV – during the opening of SAHA EXPO 2024. These technologies are designed to detect, track, and neutralize a broad spectrum of UAV threats. The launch affirms ASELSAN’s commitment to expanding its anti-drone portfolio and bolsters its competitiveness in the rapidly growing global counter-UAV market.

- In January 2024, India’s Defence Research and Development Organization (DRDO) completed the development of a homegrown anti-drone system, later transferred to Bharat Electronics Limited (BEL) and other defense firms for mass deployment. The system includes soft kill (jamming-based) and hard kill (kinetic) capabilities, enabling it to counter both commercial and combat-grade drones, including micro UAVs.

- In September 2024, Poland’s Advanced Protection Systems (APS) introduced a breakthrough autonomous interceptor drone capable of collision-based neutralization of aerial threats. The drone independently identifies and disables rogue UAVs through direct impact, representing a significant advancement in AI-driven kinetic interception.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Bn Forecast Revenue (2034) USD 28.1 Bn CAGR (2025-2034) 27.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Mitigation Type (Non-destructive System, Destructive System (Laser System, Missile Effector, Electronic Countermeasure)), By Defense Type(Drone Detection System, Drone Detection and Disruption System), By Type(Radar-Based Detection, Radio-Frequency (RF), Electro-Optical (EO), Infrared Radiation (IR), Others), By Technology (Electronic System, Laser System, Kinetic System), By Platform (Ground-based, Handheld, UAV-based), By End User (Commercial, Military and defense, Government, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Airbus Group SE, Blighter Surveillance Systems, Dedrone, Advanced Radar Technologies S.A., DeTect, Inc., Drone shield LLC, Enterprise Control Systems, Israel Aerospace Industries Ltd. (IAI), Lit eye Systems, Inc., Lockheed Martin Corporation, Orelia, Prime Consulting and technologies, Raytheon Company, Saab Ab, Selex Es Inc., Thales Group, The Boeing Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Airbus Group SE

- Blighter Surveillance Systems

- Dedrone

- Advanced Radar Technologies S.A.

- DeTect, Inc.

- Drone shield LLC

- Enterprise Control Systems

- Israel Aerospace Industries Ltd. (IAI)

- Lit eye Systems, Inc.

- Lockheed Martin Corporation

- Orelia

- Prime Consulting and technologies

- Raytheon Company

- Saab Ab

- Selex Es Inc.

- Thales Group

- The Boeing Company