Global RF GaN Market Size, Share Analysis Report By Device Type (Discrete RF Device, Integrated RF Device), By Wafer Size (200 and More), By End-Use (Telecom Infrastructure, Satellite Communication, Military and Defence, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147364

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

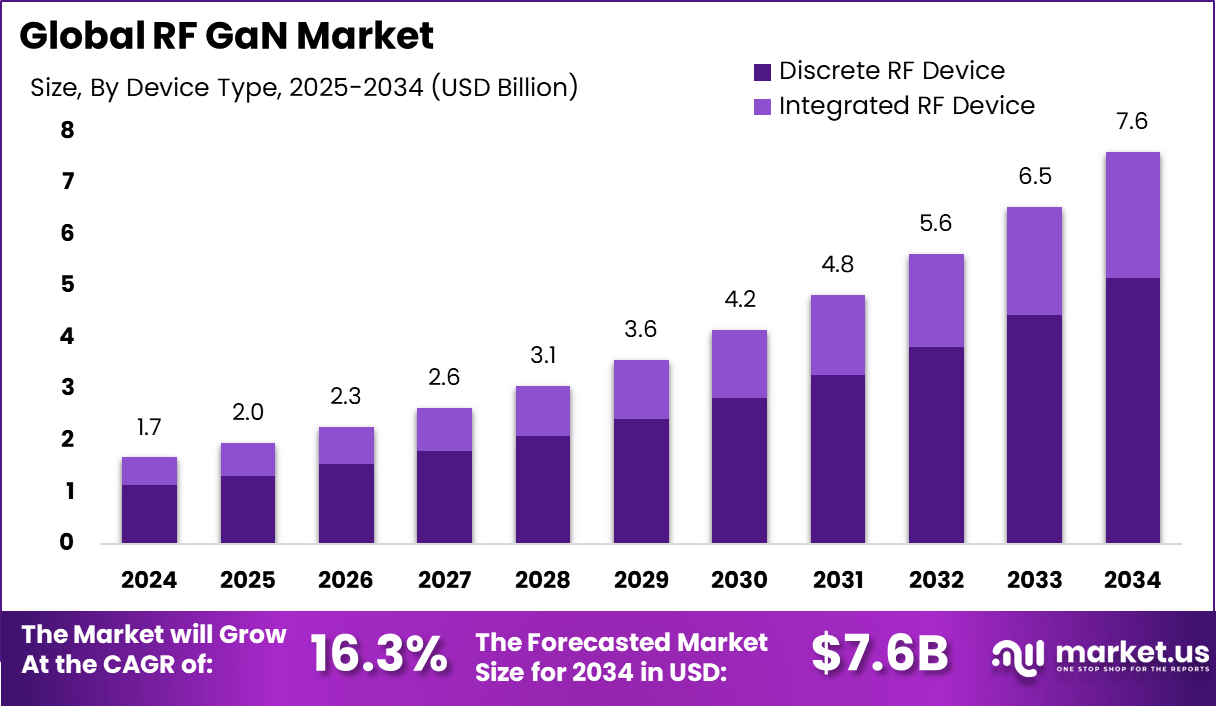

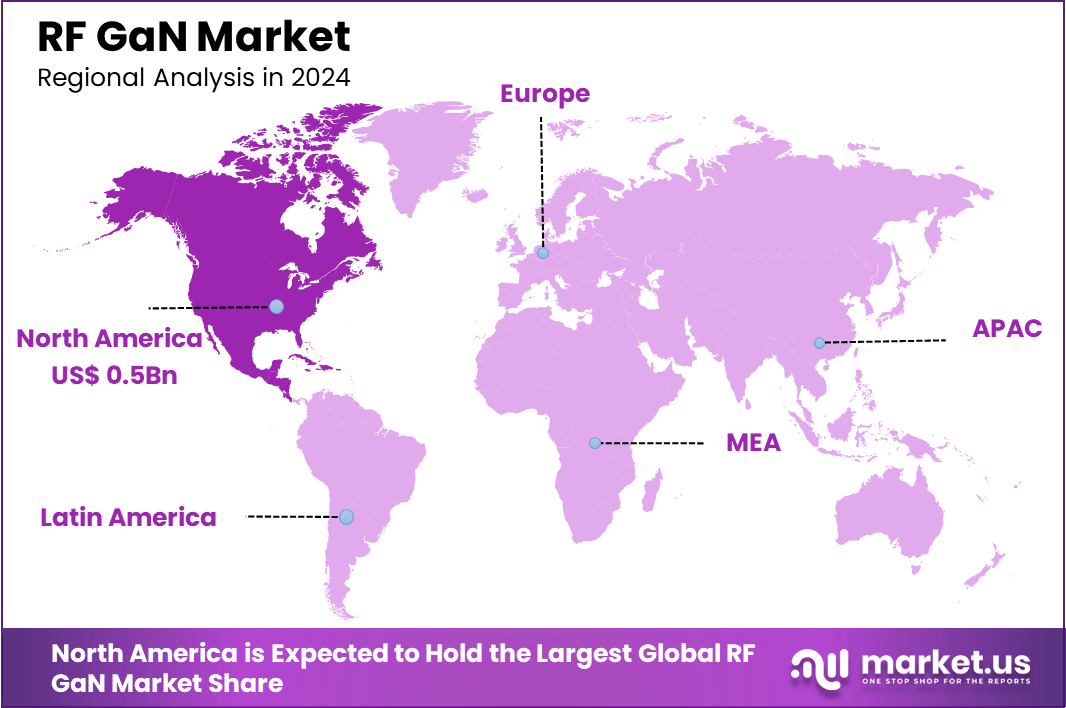

The Global RF GaN Market size is expected to be worth around USD 7.6 Billion By 2034, from USD 1.7 billion in 2024, growing at a CAGR of 16.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34% share, holding USD 0.5 Billion revenue.

Radio Frequency Gallium Nitride (RF GaN) is a semiconductor technology that utilizes gallium nitride to enhance the performance of radio frequency devices. Known for its high electron mobility and thermal conductivity, RF GaN enables devices to operate at higher voltages and frequencies, making it ideal for applications requiring high power and efficiency, such as radar systems, satellite communications, and 5G infrastructure.

The global RF GaN market is experiencing significant growth, driven by the increasing demand for high-performance RF components in various sectors. Several factors are propelling the RF GaN market forward. The rollout of 5G networks necessitates components that can handle higher frequencies and power levels, areas where RF GaN excels.

Additionally, the defense sector’s demand for advanced radar and communication systems has led to increased adoption of RF GaN technology. The technology’s ability to operate efficiently at high temperatures and voltages makes it suitable for these demanding applications.

The market is also witnessing a surge in demand due to the proliferation of wireless communication devices and the need for more efficient power amplifiers. RF GaN’s superior performance over traditional silicon-based technologies makes it a preferred choice for manufacturers aiming to enhance device efficiency and reduce size.

Emerging trends in the RF GaN market include the development of GaN-on-SiC and GaN-on-Si substrates, which offer improved thermal conductivity and cost-effectiveness, respectively. These advancements are facilitating broader adoption across various industries. Moreover, the integration of RF GaN in electric vehicles and renewable energy systems is opening new avenues for market expansion.

Based on data from eeworld, The global market for Gallium Nitride (GaN) RF devices is poised for substantial growth, with revenues projected to exceed USD 2 billion by 2025, according to estimates by Yole Développement. The market is expected to register a CAGR of 12% between 2019 and 2025, driven primarily by expanding demand from the telecom and defense sectors.

Defense applications, in particular, are anticipated to witness strong adoption, with military GaN RF device revenues forecasted to surpass USD 1 billion by 2025. This surge is attributed to increased investments in advanced defense electronics and radar modernization programs.

Technological advancements are further bolstering the RF GaN market. Innovations in fabrication processes have led to the production of RF GaN devices with higher efficiency and reliability. For instance, the development of 300mm GaN-on-silicon wafers has the potential to significantly reduce manufacturing costs and increase production volumes.

Key Takeaways

- The Global RF GaN Market is projected to expand significantly, growing from USD 1.7 Billion in 2024 to nearly USD 7.6 Billion by 2034, at a strong CAGR of 16.3%.

- In 2024, North America led the global market with a 34% share, accounting for around USD 0.5 Billion in revenue, driven by defense and telecom sectors.

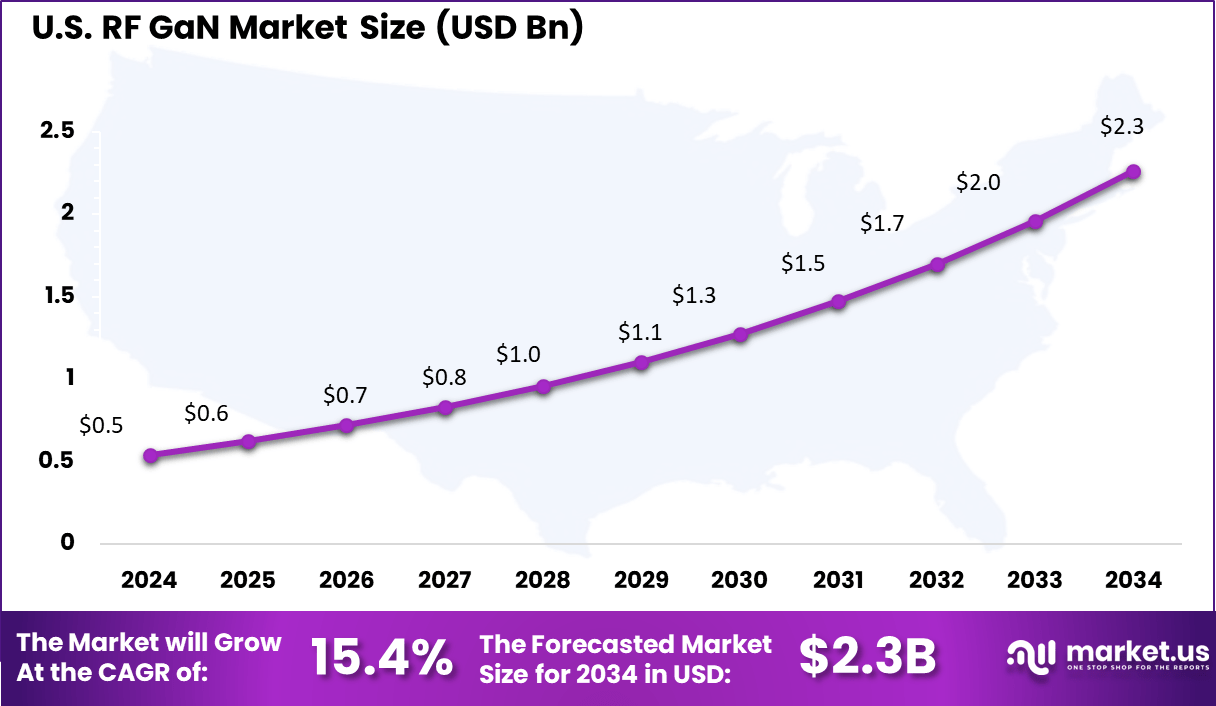

- The United States is expected to see RF GaN market growth from USD 0.6 Billion in 2025 to USD 2.3 Billion by 2034, reflecting a steady CAGR of 15.4%, backed by ongoing military modernization and 5G deployment.

- The Discrete RF Device segment captured over 68% market share, showing rising demand for high-power, standalone RF components across applications.

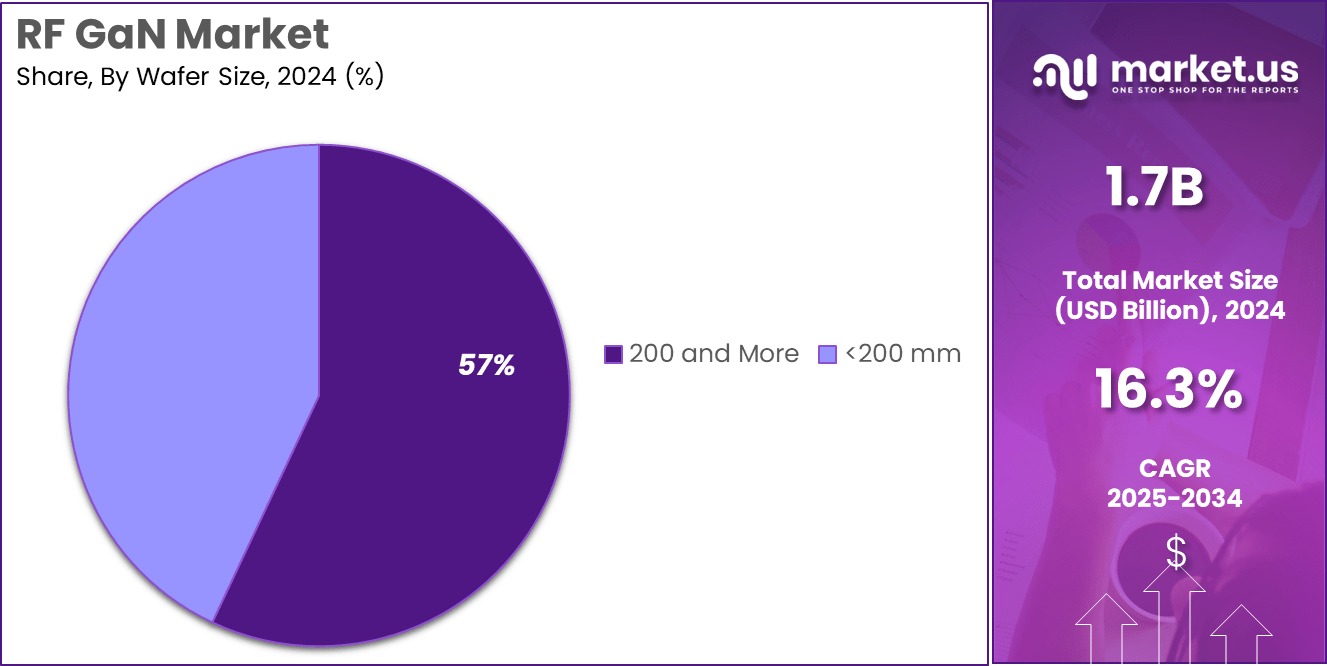

- By wafer size, the “200 mm and More” segment dominated with over 57% share, as larger wafers enhance cost-efficiency and output volume in advanced GaN fabrication.

- The Telecom Infrastructure segment held more than 40% share, underlining the importance of RF GaN in supporting high-frequency, high-efficiency 5G and satellite communication systems.

Analysts’ Viewpoint

Investment opportunities in the RF GaN market are large, particularly in areas such as 5G infrastructure, satellite communications, and defense systems. Companies investing in RF GaN technology stand to benefit from the growing demand for high-performance, energy-efficient components. Moreover, the expansion of applications into sectors like electric vehicles and renewable energy presents additional avenues for growth.

The regulatory environment is also playing a role in shaping the RF GaN market. Government initiatives aimed at enhancing communication infrastructure and defense capabilities are encouraging the adoption of advanced semiconductor technologies like RF GaN. Additionally, policies promoting the development of domestic semiconductor manufacturing are influencing market dynamics.

Key factors impacting the RF GaN market include the high cost of GaN materials and the complexity of fabrication processes. However, ongoing research and development efforts are focused on overcoming these challenges to make RF GaN more accessible and cost-effective. Collaborations between industry players and research institutions are pivotal in driving these advancements.

AI-Driven RF GaN Market

The integration of Artificial Intelligence (AI) into the Radio Frequency Gallium Nitride (RF GaN) market is driving significant advancements across telecommunications, defense, and data center applications. AI algorithms enhance the performance of GaN-based RF systems by enabling real-time diagnostics, adaptive communication, and efficient power management.

In July 2024, GlobalFoundries acquired Tagore Technology’s Gallium Nitride technology to expand its power management solutions serving automotive and IoT systems and AI data centers. Through this acquisition, GlobalFoundries improved its power management capabilities and enhanced its GaN intellectual property for Generative AI technologies.

AI-integrated GaN devices are pivotal in advancing radar and communication systems, offering superior detection, range, and response times. In satellite and space communications, GaN-based RF systems, enhanced by AI, ensure reliable and efficient performance. Moreover, in the realm of AI-powered IoT devices, GaN amplifiers support seamless connectivity, with AI algorithms optimizing device communication and network stability.

US Market Growth

The United States is poised to lead the global RF Gallium Nitride (GaN) market, with its valuation projected to rise from $0.6 billion in 2025 to approximately $2.3 billion by 2034, reflecting a compound annual growth rate (CAGR) of 15.4% during this period. This growth trajectory is underpinned by strategic investments in defense, telecommunications, and semiconductor manufacturing.

A significant driver of this expansion is the U.S. Department of Defense’s early adoption of GaN-on-SiC technology, which offers superior output power and efficiency compared to traditional materials like GaAs and Si LDMOS. This technological edge has positioned the U.S. at the forefront of RF GaN applications in advanced radar systems, electronic warfare, and satellite communications.

In 2024, North America held a dominant market position, capturing more than 34% share of the global RF GaN market, with an estimated revenue of approximately USD 0.5 billion. This regional leadership is primarily attributed to the United States’ robust defense spending, early adoption of next-generation communication technologies, and presence of established RF semiconductor manufacturers.

In addition, North America is home to several pioneering companies and research institutions that are accelerating the development and commercialization of GaN-based RF technologies. Strategic partnerships between private firms and federal agencies have contributed to rapid technological advancements in the region.

The increasing integration of AI-driven design tools and automation in RF system development has improved design cycles and enabled faster go-to-market timelines, giving North American firms a competitive edge globally.

For instance, In September 2023, the U.S. National Science Foundation (NSF) Directorate for Technology, Innovation and Partnerships (TIP) allocated $25 million to advance technologies and communications for secure 5G network operations. This investment supports five interdisciplinary teams selected for Phase 2 of the NSF Convergence Accelerator Track G: Securely Operating Through 5G Infrastructure.

Device Type Analysis

In 2024, the Discrete RF Device segment held a dominant position in the RF GaN market, capturing more than a 68% share. This leadership is attributed to the segment’s flexibility and adaptability across various applications.

Discrete RF devices, such as transistors and amplifiers, are preferred in sectors like defense, aerospace, and telecommunications due to their high power handling capabilities and efficiency. Their modular nature allows for tailored solutions, meeting specific performance requirements in complex systems.

The prominence of discrete devices is further reinforced by their role in high-frequency applications, where they offer superior thermal management and reliability. In contrast, Integrated RF Devices, which combine multiple functions into a single chip, are gaining traction in consumer electronics and IoT applications due to their compact size and cost-effectiveness.

However, their adoption in high-power scenarios remains limited. As the demand for robust and efficient RF solutions continues to grow, especially in critical infrastructure and defense, the Discrete RF Device segment is expected to maintain its leading position in the market.

Wafer Size Analysis

In 2024, the “200 mm and More” wafer size segment held a dominant position in the RF GaN market, capturing over 57% of the market share. This leadership is primarily attributed to the significant advantages offered by larger wafer sizes in terms of production efficiency and cost-effectiveness.

Manufacturing RF GaN devices on 200 mm wafers allows for a higher number of dies per wafer, thereby reducing the cost per device and enhancing overall manufacturing throughput. This scalability is particularly beneficial in meeting the growing demand for RF GaN devices across various applications, including telecommunications, defense, and automotive sectors.

The adoption of 200 mm and larger wafers is further propelled by advancements in fabrication technologies and the increasing availability of suitable substrates. These larger wafers facilitate the integration of more complex and high-performance RF GaN devices, which are essential for next-generation wireless communication systems and high-frequency applications.

Moreover, the transition to larger wafer sizes aligns with the industry’s pursuit of economies of scale, enabling manufacturers to optimize resource utilization and reduce operational costs. As a result, the “200 mm and More” segment is expected to maintain its leading position in the RF GaN market, driven by its capacity to support high-volume production and meet the stringent performance requirements of emerging applications.

End-Use Analysis

In 2024, the Telecom Infrastructure segment held a dominant position in the RF Gallium Nitride (RF GaN) market, capturing over 40% of the market share. This leadership is primarily driven by the rapid global deployment of 5G networks, which require high-frequency, high-power RF components to support increased data rates and connectivity demands.

RF GaN technology offers superior performance characteristics, such as higher efficiency and power density, making it ideal for 5G base stations and related infrastructure. The adoption of RF GaN in telecom infrastructure is further propelled by its ability to operate at higher voltages and temperatures, reducing the need for complex cooling systems and enhancing overall system reliability.

This is particularly beneficial in remote or densely populated urban areas where maintenance access is limited. Moreover, the compact size of RF GaN devices allows for more streamlined and space-efficient designs, which is crucial as telecom operators aim to densify their networks with small cells and distributed antenna systems. These advantages collectively contribute to the Telecom Infrastructure segment’s leading position in the RF GaN market and are expected to sustain its growth trajectory in the coming years.

Key Market Segments

By Device Type

- Discrete RF Device

- Integrated RF Device

By Wafer Size

- <200 mm

- 200 and More

By End-Use

- Telecom Infrastructure

- Satellite Communication

- Military and Defence

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Surge in 5G Infrastructure Deployment

The rapid global rollout of 5G networks has significantly propelled the demand for RF GaN (Radio Frequency Gallium Nitride) devices. These devices are integral to 5G infrastructure due to their superior performance characteristics, including high power density, efficiency, and thermal conductivity.

GaN-on-SiC (Silicon Carbide) technology, in particular, has been instrumental in meeting the stringent requirements of 5G base stations, especially in the high-frequency bands of 5G FR1. This technology offers an excellent crystallographic match and an efficient thermal path, making it ideal for high-power and high-voltage applications.

The adoption of GaN-on-SiC devices has been further accelerated by their suitability for deployment in 48V Doherty amplifiers, which are essential for achieving high efficiency and ruggedness in 5G base stations. As a result, GaN-on-SiC has emerged as a preferred choice, effectively replacing traditional LDMOS technology in many applications.

Restraint

High Production Costs and Capital Expenditure

Despite the promising advantages of RF GaN technology, high production costs remain a significant restraint in its widespread adoption. The manufacturing processes for GaN-on-SiC and GaN-on-Si devices involve advanced techniques that require substantial capital investment. These processes are more complex and costly compared to traditional silicon-based alternatives, leading to higher overall production expenses.

Additionally, the integration of GaN devices into existing systems poses challenges for manufacturers. The complexity associated with incorporating these devices can limit their adoption in applications where cost-effectiveness is a priority. This is particularly evident in markets that are sensitive to price fluctuations, where the higher costs of GaN technology can be a deterrent.

Opportunity

Expansion into Satellite Communications

The RF GaN market presents substantial opportunities in the satellite communications sector. GaN technology’s inherent advantages, such as high efficiency, power density, and thermal conductivity, make it well-suited for satellite applications, including transponders and ground terminals. These characteristics enable the development of compact, lightweight, and energy-efficient components essential for modern satellite systems.

The increasing demand for high-speed data transmission and global connectivity has led to a surge in satellite deployments, particularly in low Earth orbit (LEO) constellations. RF GaN devices are critical in supporting the high-frequency and high-power requirements of these satellites, ensuring reliable communication links.

Moreover, the integration of GaN technology into satellite systems contributes to reduced launch costs and extended operational lifespans, as the efficiency and thermal management capabilities of GaN devices minimize the need for bulky cooling systems. This results in more cost-effective and sustainable satellite operations.

Challenge

Competition from Emerging Technologies

The RF GaN market faces challenges from emerging technologies, particularly silicon carbide (SiC), which offers comparable advantages in high-power and high-frequency applications. SiC devices are gaining traction due to their high efficiency, thermal conductivity, and voltage handling capabilities, positioning them as strong competitors to GaN technology.

Additionally, the high material and fabrication costs associated with GaN devices pose challenges in cost-sensitive markets. The complexity of designing electrical layouts for GaN devices further complicates their adoption, as it requires specialized expertise and can lead to longer development cycles.

The limited availability of skilled professionals in GaN technology development exacerbates these challenges, potentially hindering innovation and slowing market growth. As alternative technologies continue to evolve and offer competitive performance at lower costs, the RF GaN market must address these challenges to maintain its growth trajectory.

Growth Factors

Technological Advancements and Market Expansion

The RF GaN market is experiencing robust growth, driven by technological advancements and expanding applications across various sectors. Innovations in GaN-on-SiC and GaN-on-Diamond technologies have enhanced device performance, enabling higher power densities, improved thermal management, and greater efficiency.

The proliferation of 5G networks has significantly contributed to market growth, as RF GaN devices are integral to the infrastructure required for high-speed, high-frequency communication. The Asia Pacific region, in particular, has seen substantial investment in 5G deployment, further boosting the demand for RF GaN components.

Emerging Trends

Integration into Automotive and Renewable Energy Sectors

Emerging trends in the RF GaN market indicate a growing integration of GaN technology into the automotive and renewable energy sectors. In the automotive industry, GaN devices are being explored for use in electric vehicles (EVs) and advanced driver-assistance systems (ADAS), where their high efficiency and power density can enhance performance and reduce system sizes.

The renewable energy sector is also recognizing the benefits of GaN technology, particularly in power conversion systems for solar and wind energy applications. GaN devices can improve the efficiency and reliability of these systems, contributing to more sustainable energy solutions.

Additionally, the development of GaN-on-Si technology is making GaN devices more cost-competitive, facilitating their adoption in consumer electronics and other cost-sensitive markets. This trend is expected to continue as manufacturing processes become more refined and economies of scale are achieved.

Business Benefits

Enhanced Performance and Efficiency

The adoption of RF GaN technology offers significant business benefits, primarily through enhanced performance and efficiency. GaN devices provide higher power density and efficiency compared to traditional silicon-based components, enabling the development of more compact and energy-efficient systems.

In telecommunications, this translates to more efficient base stations with reduced energy consumption and operational costs. In the defense and aerospace sectors, GaN technology enables the creation of advanced radar and communication systems with superior performance characteristics.

Furthermore, the improved thermal management of GaN devices reduces the need for extensive cooling systems, leading to cost savings in system design and maintenance. The reliability and longevity of GaN components also contribute.

Key Player Analysis

The RF GaN (Radio Frequency Gallium Nitride) market is experiencing significant growth, driven by advancements in 5G infrastructure, defense applications, and satellite communications. Key players in this industry are actively engaging in acquisitions, product launches, and strategic mergers to strengthen their market positions.

In December 2023, Wolfspeed completed the sale of its radio frequency (RF) business to MACOM Technology Solutions for approximately $125 million. This transaction included $75 million in cash and $50 million in MACOM common stock. The sale encompassed a North Carolina wafer fabrication facility, over 1,400 associated patents, and design teams in Arizona, California, and North Carolina.

Qorvo has actively pursued acquisitions to bolster its RF GaN capabilities. In January 2024, the company announced its agreement to acquire Anokiwave, a supplier of high-performance silicon integrated circuits for intelligent active array antennas used in defense, satellite communications, and 5G applications. This acquisition is expected to enhance Qorvo’s High Performance Analog segment

Top Key Players in the Market

- Aethercomm Inc.

- Analog Devices Inc.

- Wolfspeed Inc. (Cree Inc.)

- Integra Technologies Inc.

- MACOM Technology Solutions Holdings Inc.

- Microsemi Corporation (Microchip Technology Incorporated)

- Mitsubishi Electric Corporation

- NXP Semiconductors NV

- Qorvo Inc.

- STMicroelectronics NV

- Sumitomo Electric Device Innovations Inc.

- HRL Laboratories

- Raytheon Technologies

- Mercury Systems, Inc

- Others

Recent Developments

- In January 2025, Guerrilla RF, Inc. unveiled the GRF0020D and GRF0030D models, marking the debut of their novel GaN on SiC HEMT power amplifier series. These transistors are designed to deliver 50W of saturated power, catering primarily to the needs of wireless infrastructure, military, aerospace, and industrial heating sectors. This introduction is particularly notable for applications requiring integrated bare die for customized monolithic microwave integrated circuits (MMICs).

- Tagore Technology launched the TS8729N and TS8728N series of high-power GaN SPDT switches in June 2024. These switches are engineered to provide superior power handling and exceptional insertion loss, making them ideal for L- and S-Band radar as well as cellular infrastructure applications.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 7.6 Bn CAGR (2025-2034) 16.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Device Type (Discrete RF Device, Integrated RF Device), By Wafer Size (<200 mm, 200 and More), By End-Use (Telecom Infrastructure, Satellite Communication, Military and Defence, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aethercomm Inc., Analog Devices Inc., Wolfspeed Inc. (Cree Inc.), Integra Technologies Inc., MACOM Technology Solutions Holdings Inc., Microsemi Corporation (Microchip Technology Incorporated), Mitsubishi Electric Corporation, NXP Semiconductors NV, Qorvo Inc., STMicroelectronics NV, Sumitomo Electric Device Innovations Inc., HRL Laboratories, Raytheon Technologies, Mercury Systems, Inc, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aethercomm Inc.

- Analog Devices Inc.

- Wolfspeed Inc. (Cree Inc.)

- Integra Technologies Inc.

- MACOM Technology Solutions Holdings Inc.

- Microsemi Corporation (Microchip Technology Incorporated)

- Mitsubishi Electric Corporation

- NXP Semiconductors NV

- Qorvo Inc.

- STMicroelectronics NV

- Sumitomo Electric Device Innovations Inc.

- HRL Laboratories

- Raytheon Technologies

- Mercury Systems, Inc

- Others