Global Semiconductor Intellectual Property (IP) Market Size, Share, Statistics Analysis Report By Design IP (Processor IP, Interface IP, Memory IP, and Other Design IPs), By IP Core (Soft Core and Hard Core), By IP Source (Royalty, Licensing), By Vertical (Consumer Electronics, Telecom & Datacenters, Automotive, Industrial, Aerospace & Defense, Other Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2024

- Report ID: 73380

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Impact of AI on Semiconductor IP Market

- Design IP Analysis

- IP Core Analysis

- IP Source Analysis

- Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

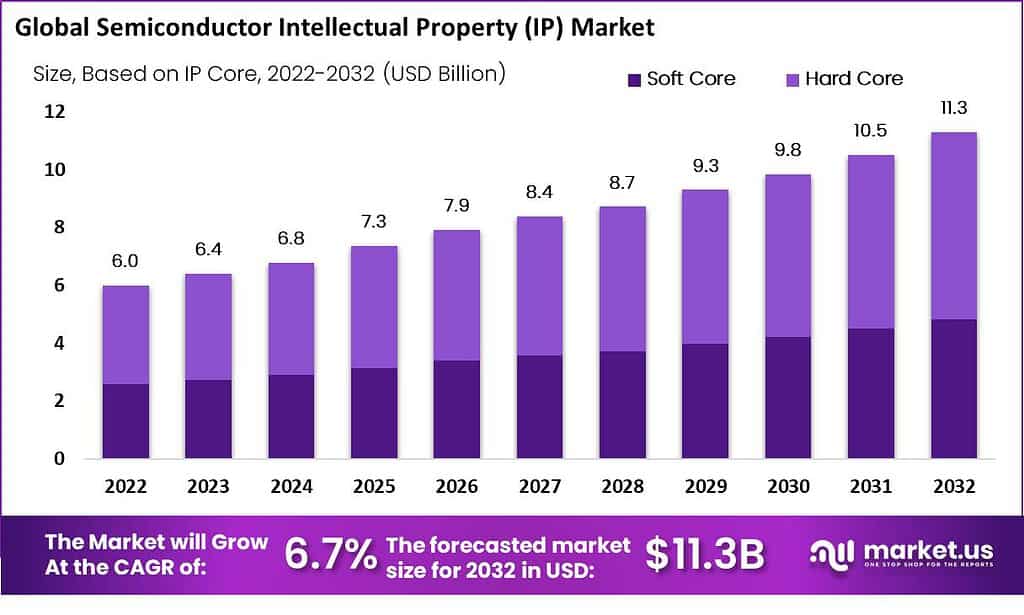

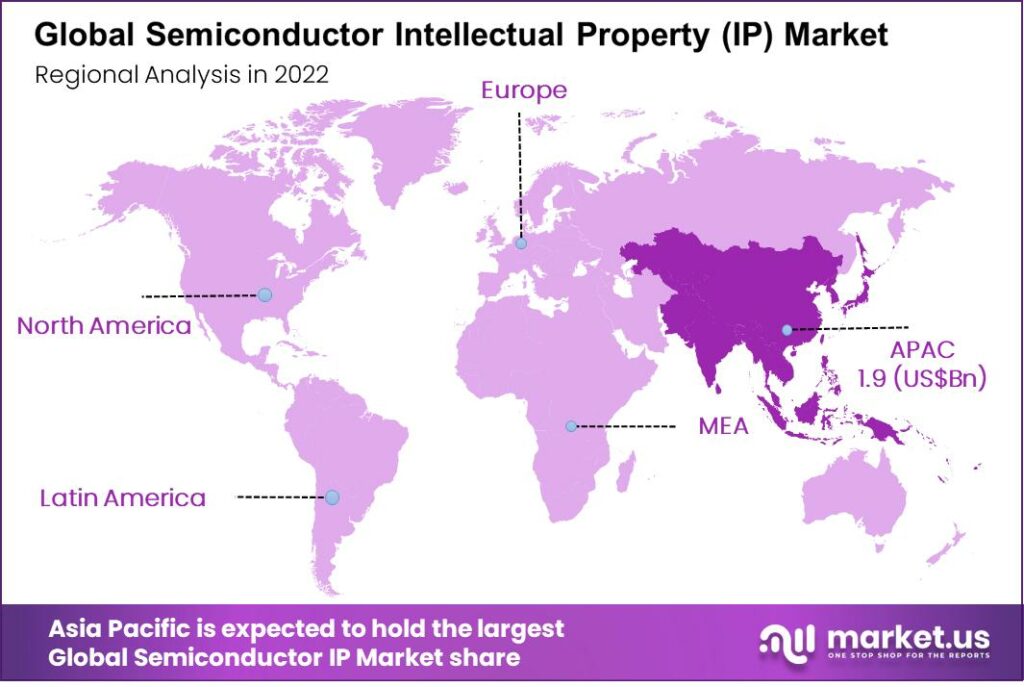

The Global Semiconductor Intellectual Property (IP) Market size is expected to be worth around USD 11.3 Billion By 2033, from USD 6.4 billion in 2023, growing at a CAGR of 6.7% during the forecast period from 2024 to 2033. In 2023, APAC held a dominant market position, capturing more than a 38% share, holding USD 1.9 Billion revenue.

Semiconductor Intellectual Property (IP) comprises design elements that can be reused in various chip designs. These design elements represent a form of intellectual property created by one party, available to be licensed by multiple vendors. This licensing is commonly conducted under set terms, which often include payment of royalties based on usage.

Semiconductor IPs are crucial because they facilitate the design and manufacture of integrated circuits with greater efficiency and lower costs. The Semiconductor IP market is characterized by its focus on licensing well-tested functional units such as microprocessors and digital interfaces to other companies. These companies integrate these IPs into their semiconductor devices, allowing for more efficient design processes and reduced development costs.

The market has shown stable growth over the years, with projections indicating continued expansion due to the increasing demand for more sophisticated technology in devices across various industries. The growth of the semiconductor IP market is primarily driven by the increasing complexity of semiconductor devices and the need for more efficient design methodologies.

As devices become more integrated and packed with features, companies seek reliable and tested IP cores to reduce design time and ensure product quality. Additionally, the shift towards Internet of Things (IoT) devices and the automotive sector’s growing reliance on electronics are significant drivers, pushing for more advanced and secure semiconductor technologies.

The demand in the Semiconductor IP market is primarily driven by the rising need for more sophisticated electronic components in consumer electronics, IT, telecommunications, and automotive industries. As these sectors continue to innovate, they require high-quality, reliable semiconductor IPs to support new functionalities and improve performance. Market opportunities are particularly notable in the development of IPs that support emerging technologies such as autonomous driving, IoT devices, and mobile technologies.

For instance, In July 2023, Cadence Design Systems, Inc. acquired the SerDes and memory interface PHY IP business from Rambus Inc. This move expands Cadence’s portfolio in hyperscale computing, 5G, and other high-demand tech areas, bolstering its position as a leader in electronic systems design. The acquisition includes not just technology but also seasoned engineering teams from the US, India, and Canada, enhancing Cadence’s resources and capabilities in global markets.

The Semiconductor IP market is witnessing significant technological advancements. Companies are increasingly focusing on creating IPs that reduce power consumption and enhance processing capabilities. Innovations include the development of advanced memory, processor, and interface IPs. Furthermore, collaborations among semiconductor companies are fostering the development of IPs that are tailored for specific technological requirements, enhancing the overall efficiency and performance of semiconductor devices.

Key Takeaways

- Semiconductor IP Market revenues are projected to reach USD 11.3 billion by 2032 with compound annual growth rates estimated at 6.7% over 2023-2032.

- Processor IP has been identified as the highest-valued segment, driven by increasing use of laptops, smartphones and tablets; memory IP is anticipated to experience the highest compound annual compound growth during this forecast period due to rising acceptance and usage of storage devices.

- Hard IP cores dominate the market due to their superior reliability and predictability in chip timing performance, particularly in electronic equipment such as smartphones, personal computers, and laptops.

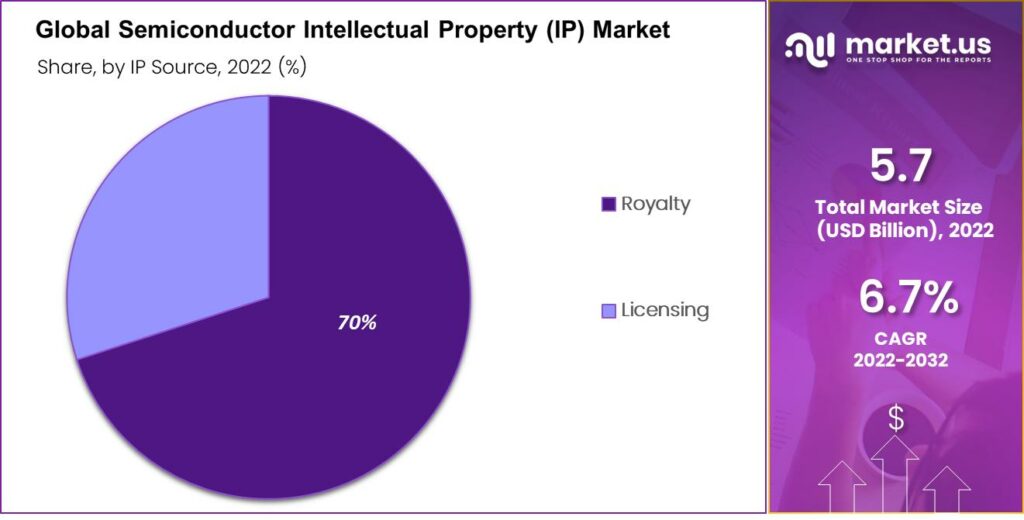

- The royalty segment currently holds the highest market share, primarily driven by bulk acquisitions of semiconductor IPs by leading electronic device manufacturers.

- Consumer electronics represents the industry with the highest market share and is projected to experience compound annual compound annual growth at 7.2% during this forecast period, due to rising wireless device demand.

- The market is propelled by growing demand for SoCs, consumer electronics, automotive systems and telecom & data center applications coupled with diminishing design and manufacturing costs in the semiconductor industry.

- Asia Pacific holds the largest market share, driven by increasing technological advancements and electronic manufacturing in the region, while North America and Europe are also key contributors to market growth.

- Major players in the Semiconductor IP Market include Arm Holdings Ltd., Fujitsu Limited, Synopsys Inc., Cadence Design Systems, Inc., and others, who are adopting strategies like product innovation and mergers & acquisitions to stay competitive.

- The latest trend in the market is the increasing adoption of wireless technology-based products, driven by advancements in 5G and other wireless devices, further supporting market growth.

Impact of AI on Semiconductor IP Market

The influence of Artificial Intelligence (AI) on the semiconductor Intellectual Property (IP) market is transformative, catalyzing significant changes in design methodologies and the operational efficiencies of semiconductor companies.

AI is fundamentally reshaping the semiconductor IP landscape by introducing advanced tools and technologies that optimize design processes, reduce errors, and shorten development cycles, thus enhancing overall productivity and market responsiveness.

AI’s impact on the semiconductor industry manifests primarily through its integration into chip design and manufacturing processes. AI-driven tools, such as Synopsys’s DSO.ai, leverage machine learning algorithms to automate and optimize semiconductor design. These tools learn from each design iteration, continuously improving their ability to detect potential design issues and suggesting optimizations, which significantly reduces design time and costs while improving performance and energy efficiency.

Furthermore, AI is pivotal in addressing the physical limitations of semiconductor manufacturing, such as yield optimization and defect reduction. Machine learning algorithms analyze vast datasets to predict and mitigate manufacturing issues before they occur, enhancing the yield and reducing the scrap rates during the semiconductor fabrication process.

The adoption of AI is also spurring the development of new semiconductor architectures, including those required for AI-specific workloads, which demand high levels of computational power and energy efficiency. This is leading to the emergence of specialized AI chips and memory systems designed to handle complex AI tasks such as deep learning and neural network processing more efficiently.

Design IP Analysis

In 2023, the Processor IP segment held a dominant market position within the Semiconductor Intellectual Property (IP) industry. This dominance can be attributed to the crucial role that Processor IPs play in enhancing the computational capabilities and efficiency of electronic devices.

Processor IPs, being central to the function of various digital devices, are extensively implemented in sectors requiring robust processing power such as consumer electronics, telecommunications, and automotive systems.

Processor IPs are designed to offer the core logic for CPUs and GPUs, which are integral to managing the operations and user interface of devices. Their importance is underscored by the ongoing advancements in technology, such as the development of AI and machine learning models that require substantial processing power to function effectively.

The increasing complexity of digital applications, including those in smartphones, tablets, and IoT devices, further bolsters the demand for innovative and efficient Processor IPs. Moreover, the segment benefits from continuous innovations aimed at reducing power consumption while maximizing performance, which is particularly crucial for mobile and portable devices.

The emphasis on sustainability and longer battery life across consumer products has driven the need for Processor IPs that can deliver high performance without compromising on energy efficiency. In the broader landscape of the Semiconductor IP market, the Processor IP segment is poised for sustained growth. This is anticipated due to the escalating demand for high-performance computing solutions and the expanding applications of processors in emerging technologies such as autonomous vehicles and smart infrastructure.

The electric vehicle (EV) market has shown impressive growth in recent years, and the momentum continued throughout 2023. According to the latest report from the International Energy Agency (IEA), electric car sales surged by 35% compared to the previous year. This increase signifies a substantial shift in consumer preferences and manufacturer strategies, with EVs accounting for 18% of total global car sales.

As the digital economy expands and the adoption of sophisticated technologies accelerates, the Processor IP segment is expected to maintain its market leadership, underpinned by its critical role in powering the next generation of digital devices and systems.

IP Core Analysis

In 2023, the Hard Core segment held a dominant market position within the Semiconductor Intellectual Property (IP) market, capturing a significant share due to its robust performance characteristics and reliability. Hard Core IPs are pre-designed, pre-verified IP blocks that are essential for high-performance, power-efficient applications.

These cores are typically used in environments where the demand for speed and reliability is paramount, making them ideal for sectors such as automotive, aerospace, and high-end consumer electronics. The strength of Hard Core IPs lies in their ability to provide optimized, ready-to-integrate solutions that reduce design time and increase system reliability.

Because these IP cores are rigorously tested and optimized for specific manufacturing processes, they offer higher performance and lower risk compared to Soft Cores, which need further customization and verification. This reliability and efficiency are crucial in applications where failure or errors could have significant consequences, such as in safety-critical automotive systems or high-stakes data processing environments.

Furthermore, the market for Hard Core IPs is supported by the increasing complexity of electronic systems, which demands more specialized, high-performance components. As devices become smaller and more integrated, the precise and efficient functionality provided by Hard Core IPs becomes more valuable. This trend is particularly noticeable in the consumer electronics sector, where the ongoing push for miniaturization and better battery life drives the need for highly efficient, compact chip designs.

Looking ahead, the Hard Core segment is expected to maintain its market dominance due to ongoing technological advancements and increasing demand across various high-tech industries. As companies continue to seek out high-quality, dependable solutions that can be quickly integrated into sophisticated products, Hard Core IPs are likely to remain a cornerstone of the semiconductor IP landscape, reinforcing their pivotal role in the design and production of next-generation technologies.

IP Source Analysis

In 2023, the Royalty segment held a dominant market position within the Semiconductor Intellectual Property (IP) market, capturing a more substantial share due to its revenue-generating model that benefits IP creators continuously over time.

Royalties are payments made by one party (the licensee) to another (the licensor) for the ongoing use of an intellectual property. In the semiconductor industry, this model is particularly attractive because it allows IP developers to earn a return on each chip manufactured using their technology, reflecting the actual market success of their designs.

The appeal of the Royalty segment stems from its scalability and the direct alignment of incentives between IP providers and users. As semiconductor products incorporating these IPs achieve greater market penetration, both the IP licensors and licensees benefit from the increased volumes, thereby creating a mutually advantageous relationship. This model encourages ongoing innovation and support, as licensors are motivated to keep their IP relevant and competitive to maximize their royalty streams.

Moreover, this segment’s strength is reinforced by the global surge in semiconductor demand across diverse industries, including consumer electronics, automotive, and telecommunications. Each of these sectors increasingly relies on advanced chip technologies to drive innovation and product differentiation, thereby expanding the royalty base for IP licensors.

As technologies such as IoT, AI, and 5G proliferate, the demand for specialized semiconductor IPs is expected to grow, further enhancing the revenue potential for the Royalty segment. Looking forward, the Royalty segment is poised to continue its market dominance due to the ongoing expansion of technology in everyday devices and industrial applications.

The segment’s business model, which effectively captures the value created by semiconductor IPs over the product lifecycle, ensures it remains a crucial component of the semiconductor IP market strategy. This approach not only secures a steady revenue stream for IP owners but also aligns with the broader industry trends towards more connected and intelligent devices.

Vertical Analysis

In 2023, the consumer electronics segment held a dominant market position within the Semiconductor Intellectual Property (IP) market, capturing a significant share due to the relentless expansion and innovation in consumer devices like smartphones, tablets, wearables, and home automation systems.

The continual push for new features and enhanced performance in consumer electronics necessitates frequent updates in semiconductor IP to support advanced functionalities and improve user experience. The dominance of the consumer electronics segment is further fueled by the global consumer demand for more powerful and energy-efficient devices.

As technology progresses, semiconductor IPs are increasingly required to support higher resolutions, better connectivity options, and longer battery life, all of which are critical selling points for consumer electronics products. Additionally, the growing trend toward smart homes and IoT-enabled devices opens up new avenues for semiconductor IPs, embedding intelligence into everyday objects.

Moreover, the rise of technologies such as 5G, artificial intelligence, and machine learning in consumer devices has led to a surge in the need for specialized semiconductor IPs that can handle these technologies’ demands. Semiconductor IPs that cater to these advanced capabilities enable manufacturers to deliver cutting-edge products that align with modern consumer expectations.

Looking ahead, the consumer electronics segment is expected to maintain its leading position due to continuous innovations and the launch of next-generation gadgets. As consumer expectations evolve and new technological frontiers are explored, the demand for sophisticated and highly specialized semiconductor IPs will continue to grow, further strengthening this segment’s market presence.

Key Market Segments

Based on Design IP

- Processor IP

- Interface IP

- Memory IP

- Other Design IPs

Based on IP Core

- Soft Core

- Hard Core

Based on IP Source

- Royalty

- Licensing

Based on Vertical

- Consumer Electronics

- Telecom & Datacenters

- Automotive

- Industrial

- Aerospace & Defense

- Other Verticals

Driver

Growing Demand in Consumer Electronics and Automotive Sectors

The semiconductor intellectual property (IP) market is primarily driven by the burgeoning demand across consumer electronics and automotive industries. The integration of advanced semiconductor components like System-on-Chip (SoC) designs in these sectors is a key growth catalyst. As consumer electronics devices increasingly incorporate sophisticated technologies for better connectivity and functionality, the need for specialized semiconductor IPs, including processor and interface IPs, has surged.

Similarly, the automotive sector’s shift towards more electronic and safety-focused designs, particularly with advancements in autonomous driving and electric vehicles, necessitates robust semiconductor IP solutions to manage complex computations and connectivity tasks effectively. These trends collectively push the demand for high-quality, reliable semiconductor IPs, underpinning the market’s growth trajectory.

Restraint

Complexity and Integration Challenges

Despite the growth opportunities, the semiconductor IP market faces significant challenges related to the complexity of IP integration and technology scaling. As semiconductor IPs become more advanced, integrating them into existing systems without compromising performance or reliability becomes increasingly challenging.

The complexity of managing IP integration escalates further with the scaling of technology to meet advanced design requirements, such as those in AI and IoT applications. These complexities can lead to extended development times and increased costs, potentially slowing down the adoption of new IP solutions across various industries. This integration challenge is a major restraint for the market as it limits the speed and efficiency with which new semiconductor technologies can be deployed.

Opportunity

Expansion into AI and IoT

The market for semiconductor IPs holds substantial growth opportunities in the realms of artificial intelligence (AI) and the Internet of Things (IoT). With the proliferation of AI and IoT devices, there is a heightened demand for specialized IPs that can handle increased data processing and connectivity requirements. Semiconductor IPs that are optimized for AI applications, such as those providing support for machine learning algorithms and data-intensive tasks, are particularly in demand.

Furthermore, IoT devices require IPs that can ensure connectivity, low power consumption, and reliable operation under various conditions. By focusing on the development of IPs that cater to these technological areas, semiconductor IP providers can tap into new revenue streams and strengthen their market positions.

Challenge

Licensing and Royalty Management

One of the foremost challenges in the semiconductor IP market is the management of licensing and royalties. The IP business model heavily relies on the licensing of designs and technologies, which involves complex agreements concerning the usage rights and royalty payments. Ensuring compliance with these agreements while managing royalties efficiently is a labor-intensive process that requires robust systems and legal expertise.

Mismanagement in this area can lead to financial losses and legal disputes, which can tarnish a company’s reputation and its relationships with partners. Therefore, developing effective strategies and tools for managing these aspects is crucial for maintaining the profitability and integrity of IP providers in the semiconductor industry.

Growth Factors

Increasing Demand in Automotive and Consumer Electronics

The semiconductor intellectual property (IP) market is experiencing significant growth, driven primarily by its extensive applications in the automotive and consumer electronics sectors. In automotive, the push towards more advanced driver-assistance systems (ADAS) and electric vehicles (EVs) heavily relies on sophisticated semiconductor IPs such as microcontroller units (MCUs), sensors, and memory products.

Similarly, in the consumer electronics arena, the surge in demand for smarter and more connected devices is a critical driver. Devices such as smartphones, wearables, and smart home products require robust semiconductor IPs to manage increased data processing and connectivity needs efficiently. The continual evolution of these products towards greater functionality and the integration of AI and IoT technologies means that the need for specialized semiconductor IPs is likely to keep growing.

Emerging Trends

AI and IoT Integration

A prominent trend shaping the semiconductor IP market is the integration of artificial intelligence (AI) and the Internet of Things (IoT). As AI technology advances, semiconductor IPs are increasingly designed to support complex AI algorithms and manage large data flows efficiently. This is especially prevalent in sectors such as healthcare, automotive, and industrial applications, where AI’s capabilities can be leveraged for predictive maintenance, advanced diagnostics, and automation.

Furthermore, IoT devices’ proliferation demands semiconductor IPs that can ensure seamless connectivity, robust security, and low-power operation. These requirements are leading to innovations in processor IP, interface IP, and memory IP, which are tailored for the efficient performance of IoT devices across various applications.

Business Benefits

Enhanced Efficiency and Market Expansion

For businesses in the semiconductor IP sector, these growth factors and trends translate into opportunities for market expansion and enhanced operational efficiency. The demand from automotive and consumer electronics sectors ensures a steady market for IPs, driving revenue growth and stability.

At the same time, advancements in AI and IoT open up new market segments to explore, particularly in industrial and healthcare applications where the precision and efficiency provided by advanced semiconductor IPs can lead to significant operational improvements.

Moreover, as companies innovate to meet the specific demands of these technologies, they enhance their competitive edge in the market. This can lead to increased market share and the establishment of long-term customer relationships as businesses seek reliable providers of cutting-edge semiconductor IP solutions.

Regional Analysis

Asia Pacific holds the largest market share due to increasing technological advances and the manufacturing of electronics in the region.

The market is segmented into North America, Western Europe, Eastern Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa. Asia Pacific region dominates the market with about 34.6% market share and is expected to have a CAGR of 6.97% during the forecast period. This is due to the rising investment in electronics manufacturing in this region. The market is driven by the growing export of electronic components and the presence of electronic device manufacturers.

North America is projected to grow at a moderate rate of CAGR over the forecast period due to the increasing accumulation of 5G and wireless technology developments. Specifically, the US in North America is going through these changes at the quickest pace. It is expected to have about 77% market share in North America in 2032. Many market vendors are from the US which gives the region a competitive edge. The US government plays a major role in the development of the regional semiconductor industry, directly contributing to the semiconductor IP market growth.

Europe is expected to experience a moderate growth rate due to increasing consumer demand for connected gadgets. This is due to the COVID-19 pandemic and the rapid adoption of digital technology-based devices. Slow investment in research and development in the semiconductor sector has caused Latin American countries like Brazil, Argentina, and Brazil to grow at a slower rate. The rising popularity of smart devices like smartphones and laptops will drive Latin America’s IP market.

Due to increased IoT spending and an increase in digital transformation strategies in many countries of the region, the Middle East and Africa are growing at a moderate rate. A potential growth opportunity in the region for semiconductor IP products is anticipated to be created by an increase in IoT spending.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Semiconductor IP Market share is well-consolidated. Large-scale vendors are capable of backward and forward integration. Many players also operate the business in both national and international territories. The major players are adopting strategies such as product innovation and mergers & acquisitions to stay ahead of their competition.

Synopsys, Inc. has solidified its market position through strategic acquisitions focused on enhancing its capabilities in verification and prototyping, such as the acquisition of companies like Valtrix and Imperas. These moves expand Synopsys’ technology offerings, particularly in areas crucial for AI and high-performance computing.Top Key Players in The Market

- Arm Holdings Ltd.

- Fujitsu Limited

- Synopsys Inc.

- Cadence Design Systems, Inc.

- Imagination Technologies

- CEVA Inc.

- eMemory Technology Inc.

- Lattice Semiconductor Corp.

- Open-Silicon Inc.

- Mentor Graphics Corporation

- Achronix Semiconductor Corporation

- Rambus Inc.

- Faraday Technology Corporation

- Verisilicon Holdings Co.

- Multicore Technology

- Other Key Players

Recent Developments

- In May 2024, Siemens, a leading technology firm from Germany, unveiled its latest product, the Solido™ IP Validation Suite. This innovative software serves as an automated signoff solution that significantly enhances the quality assurance process for various design intellectual properties (IPs). It supports a broad range of IP types, such as standard cells, memories, and IP blocks, ensuring thorough validation and robustness in design.

- Earlier in February 2024, Synopsys, Inc., a key player in advanced technology development, introduced a groundbreaking 1.6T Ethernet IP solution. This new offering is specifically designed to meet the escalating bandwidth and throughput requirements posed by artificial intelligence (AI) and hyperscale data centers. The 1.6T Ethernet IP solution is tailored to significantly boost bandwidth and throughput, catering to the demanding needs of data-intensive AI applications.

Report Scope

Report Features Description Market Value (2023) USD 6.4 Bn Forecast Revenue (2032) USD 11.3 Bn CAGR (2023-2032) 6.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Design IP- Processor IP, Interface IP, Memory IP, and Others Design IPs; By IP Core- Soft Core and Hard Core; By IP Source- Royalty and Licensing; and By Vertical- Consumer Electronics, Telecom & Datacenters, Automotive, Industrial, Aerospace & Defense, and Other Verticals. Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Arm Holdings Ltd., Fujitsu Limited, Synopsys Inc., Cadence Design Systems, Inc., Imagination Technologies, CEVA Inc., eMemory Technology Inc., Lattice Semiconductor Corp., Open-Silicon Inc., Mentor Graphics Corporation, Achronix Semiconductor Corporation, Rambus Inc., Faraday Technology Corporation, Verisilicon Holdings Co., Multicore Technology, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

Semiconductor Intellectual Property (IP) MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Semiconductor Intellectual Property (IP) MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Arm Holdings Ltd.

- Fujitsu Limited

- Synopsys Inc.

- Cadence Design Systems Inc.

- Imagination Technologies

- CEVA Inc.

- eMemory Technology Incorporated

- Lattice Semiconductor Corp.

- Open-Silicon Inc.

- Mentor Graphics Corporation

- Achronix Semiconductor Corporation

- Rambus Inc.