Global Second-hand Furniture Market By Product (Beds, Tables and Desks, Sofa and Couch, Chairs and Stools, Cabinets and Shelves, Others), By Material (Wood, Metal, Plastic, Glass, Others), By Application (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139281

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

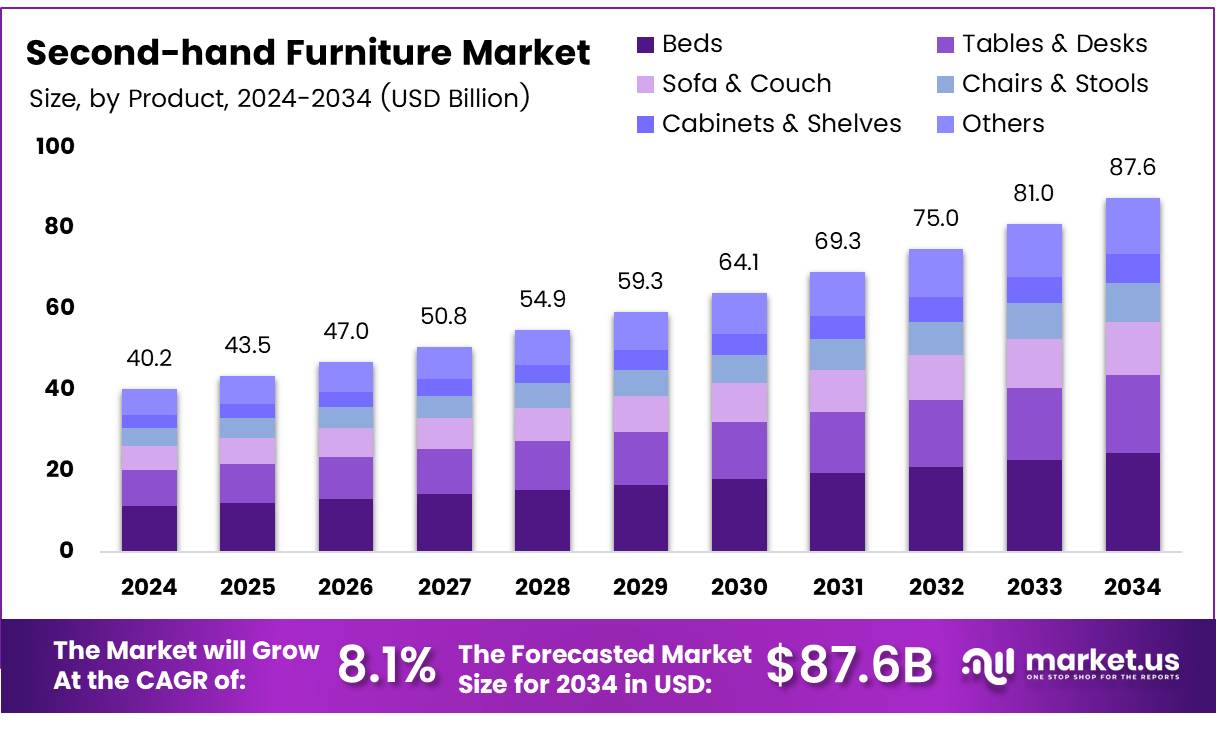

The Global Second-hand Furniture Market size is expected to be worth around USD 87.6 Billion by 2034, from USD 40.2 Billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034.

The second-hand furniture market represents a distinct segment within the broader furniture industry, characterized by the sale and purchase of pre-owned furniture items. This market caters to a diverse consumer base, ranging from budget-conscious individuals to environmentally aware consumers seeking to reduce their ecological footprint.

With advancements in technology and the proliferation of online marketplaces, the second-hand furniture market has become more accessible and transparent, allowing for a broader reach and better consumer trust. Platforms that facilitate the sale of pre-loved furniture not only offer economic benefits but also promote recycling and reuse, aligning with global sustainability goals.

From an analytical perspective, the second-hand furniture market is poised for substantial growth, driven by several key factors. Firstly, economic fluctuations often lead consumers to seek more affordable options for furnishing their homes, which boosts the demand for second-hand furniture.

Additionally, the environmental impact of furniture production, including deforestation and carbon emissions, compels a significant segment of the population towards sustainable purchasing choices.

Second-hand furniture also presents unique business opportunities for companies willing to innovate in their business models, such as through refurbishment services or verified product listings to ensure quality and customer satisfaction. However, the market faces challenges such as consumer perceptions of quality and the logistical complexities associated with the transportation and storage of large items.

The growth trajectory of the second-hand furniture market is influenced by several factors including, but not limited to, government investments in sustainability initiatives and favorable regulations promoting recycling and waste reduction. These governmental actions not only encourage the growth of eco-friendly industries but also assure consumers about the quality and safety of second-hand products.

Opportunities within this market are expansive, particularly in regions with high environmental consciousness and economic incentives for sustainable practices. For businesses, engaging in the second-hand furniture market can lead to diversification and tapping into new customer segments that prioritize green consumption.

According to YouGov, in the UAE, 31% of consumers would consider purchasing second-hand furniture, indicating a significant market potential in the region. In North America, Canadians are most likely to consider pre-loved furniture (46%), followed by Americans (42%), where the market is projected to grow significantly by 2025.

However, in Mexico, the inclination drops to 32%, suggesting varied market dynamics across the continent. Additionally, Chainstoreage reports that nine in ten Americans (89%) will look for lightly used or resale options before purchasing new furniture, highlighting a strong consumer preference for second-hand options in the United States. This data underscores the growing consumer interest and market potential for second-hand furniture, making it an increasingly viable segment for investors and businesses alike.

Key Takeaways

- The second-hand furniture market is projected to grow from USD 40.2 billion in 2024 to USD 87.6 billion by 2034, with a CAGR of 8.1%.

- Beds are the leading product category, representing 26.5% of the market in 2024.

- Wood is the most popular material, accounting for 40.1% of the market by material in 2024.

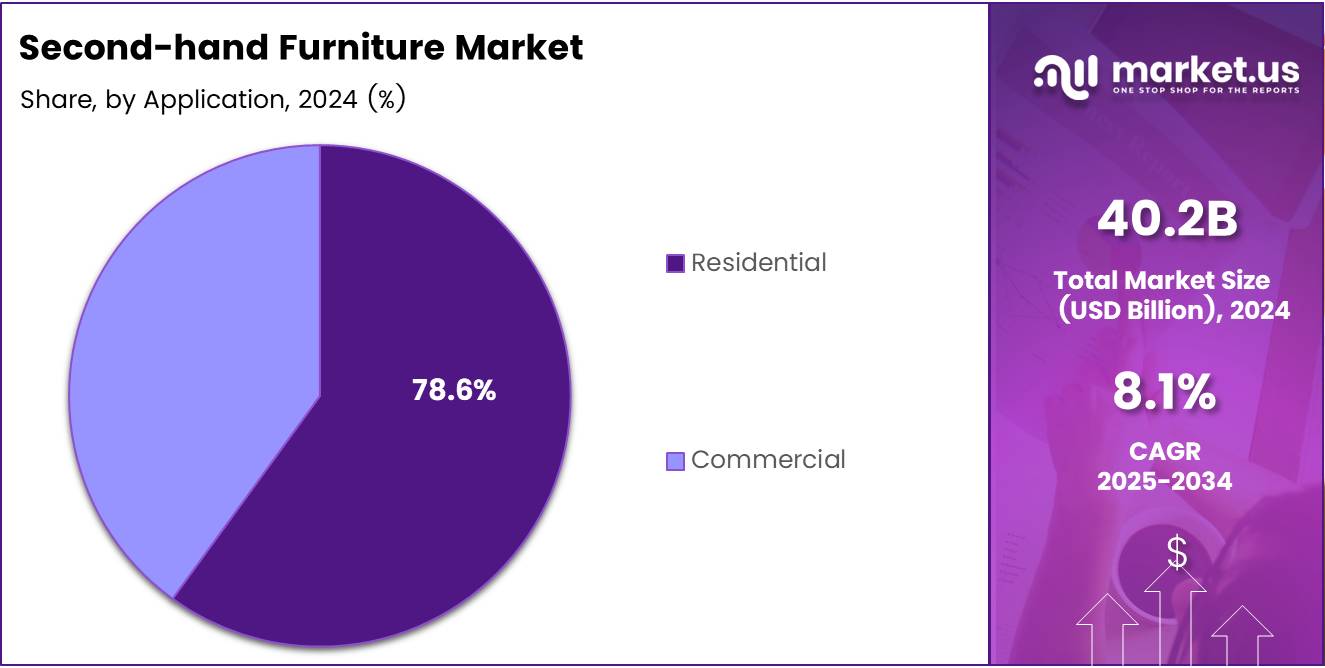

- The residential sector dominates the application of second-hand furniture, holding 78.6% of the market in 2024.

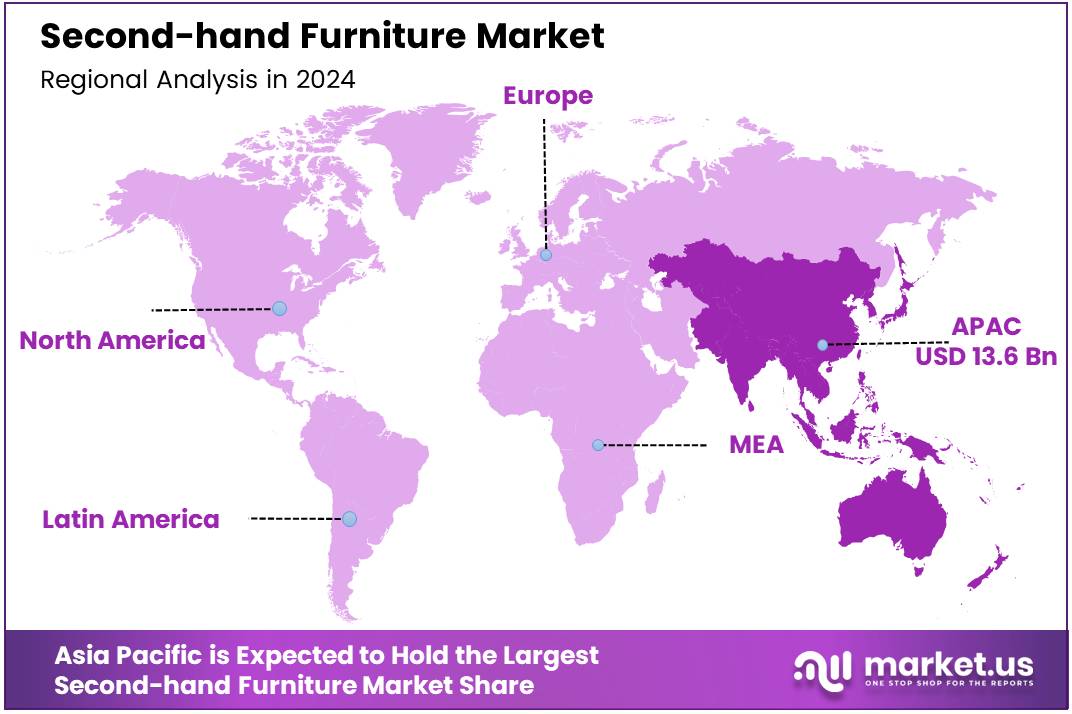

- Asia Pacific is the largest regional market, contributing 34.6% to the global market with revenues of USD 13.6 billion in 2024.

Product Analysis

Beds Secure Leading Position with 26.5% Share in the Second-hand Furniture Market

In 2024, beds held a dominant market position in the By Product Analysis segment of the second-hand furniture market, accounting for a 26.5% share. This strong performance reflects a growing consumer preference for affordable and sustainable furniture choices, as well as the practical durability of beds.

Following beds, tables and desks carved out a significant niche, appreciated for their versatility and frequent availability. Sofas and couches, staples in home comfort, also captured a noteworthy market portion, underlining a consistent demand for cost-effective home seating solutions.

Chairs and stools offered compact and often designer-friendly alternatives, appealing to consumers looking to furnish smaller spaces or seeking unique styles. Cabinets and shelves responded well to the increasing consumer enthusiasm for organizing and decluttering, making them a popular choice among pragmatic buyers.

The ‘Others’ category, encompassing various furniture pieces like wardrobes and entertainment units, illustrated the diverse needs and tastes among second-hand furniture shoppers, highlighting the segment’s capacity to cater to a wide array of preferences and functionalities. This detailed product segmentation underscores the dynamic nature of the second-hand furniture market, where both functionality and aesthetic appeal drive consumer choices.

Material Analysis

Wood Leads with 40.1% in the Second-hand Furniture Market by Material Analysis

In 2024, wood maintained a prominent place in the second-hand furniture market, capturing a 40.1% share in the By Material Analysis segment. This substantial market share underscores wood’s enduring appeal and widespread use in furniture manufacturing.

The preference for wood is primarily driven by its durability, aesthetic versatility, and the growing consumer interest in sustainable and eco-friendly products. Wood furniture not only offers a timeless quality but also aligns with the increasing trend of ‘eco-conscious’ purchasing behaviors among consumers.

Following wood, metal materials also held a significant position, valued for their robustness and long lifespan, which are key considerations for second-hand buyers. Plastic and glass materials catered to a different segment of the market, focusing on affordability and modern design trends.

These materials are particularly popular in contemporary settings and among consumers looking for cost-effective furnishing solutions. The ‘Others’ category, which includes materials like bamboo, rattan, and fabric, captured a niche market, appealing to those seeking unique and artisanal pieces. This diversity in materials highlights the broad range of consumer preferences and the dynamic nature of the second-hand furniture market.

Application Analysis

Residential Segment Commands the Second-hand Furniture Market with 78.6% Share

In 2024, the residential sector maintained a dominant stance in the second-hand furniture market, seizing a 78.6% share in the By Application Analysis segment. This overwhelming majority underscores the significant role residential applications play in fueling the demand for second-hand furniture.

The driving force behind this trend is the increasing consumer inclination towards affordable, sustainable living options combined with the unique aesthetic that second-hand pieces offer. Homeowners are increasingly drawn to pre-owned furniture to add distinctive, character-rich items to their interiors without the steep prices associated with new, luxury furniture.

On the other hand, the commercial sector, encompassing offices, hospitality, and retail environments, accounted for the remainder of the market share. Although smaller in comparison, this segment benefits from businesses looking to reduce expenses and enhance their sustainability credentials by incorporating second-hand furnishings.

As companies increasingly align with green policies and cost-effective solutions, the demand within this sector is expected to grow, further invigorating the broader market dynamics of the second-hand furniture industry.

Key Market Segments

By Product

- Beds

- Tables & Desks

- Sofa & Couch

- Chairs & Stools

- Cabinets & Shelves

- Others

By Material

- Wood

- Metal

- Plastic

- Glass

- Others

By Application

- Residential

- Commercial

Drivers

Cost Savings Drive Consumer Interest in the Second-hand Furniture Market

The second-hand furniture market is experiencing robust growth, primarily driven by several key factors that appeal to consumers’ economic and aesthetic sensibilities. Foremost among these is the significant cost savings offered by used furniture, which attracts both budget-conscious buyers and those looking to furnish upscale spaces without the hefty price tag of new pieces.

Additionally, the expanding middle-class population in emerging markets is increasingly turning to second-hand furniture as a cost-effective solution to meet their growing home furnishing needs. The proliferation of online marketplaces like Facebook Marketplace, Craigslist, and niche resale websites has also simplified the process of buying and selling used furniture, making it more accessible and convenient for consumers worldwide.

Moreover, there is a noticeable surge in interest in vintage, retro, and antique furniture, as these pieces offer unique styles and historical value that new furniture cannot replicate. This trend not only caters to aesthetic preferences but also supports sustainable consumer practices by extending the lifecycle of furniture. Together, these drivers ensure a vibrant and growing market, providing numerous opportunities for buyers and sellers alike.

Restraints

Limited Availability Challenges the Second-Hand Furniture Market

As an analyst examining the second-hand furniture market, one of the significant restraints we observe is the limited availability of specific furniture pieces in desirable condition. This scarcity often leads to buyer frustration as finding the exact type of furniture to meet personal or stylistic preferences becomes a challenging endeavor.

Additionally, another critical factor impeding the market is the cost and logistics associated with transporting second-hand furniture. Particularly for larger items, the expenses and complexity of arranging safe and timely delivery can significantly deter potential buyers.

These transportation hurdles not only increase the overall cost of purchasing second-hand furniture but also complicate the buying process, making it less appealing compared to buying new. This combination of limited availability and logistical challenges crucially shapes the dynamics and growth potential of the second-hand furniture market.

Growth Factors

E-commerce Expansion Fuels Growth in the Second-Hand Furniture Market

As an analyst exploring the second-hand furniture market, notable growth opportunities emerge with the expansion of e-commerce platforms dedicated to this niche.

Developing robust online platforms and mobile apps specifically tailored for second-hand furniture sales can greatly enhance the ease and efficiency of the buying and selling process. This digital approach not only broadens the market reach but also appeals to a tech-savvy consumer base looking for convenient shopping options.

Additionally, offering localized delivery services at low cost or for free could significantly eliminate one of the biggest hurdles to purchasing second-hand furniture high delivery costs. By alleviating this concern, more consumers may be encouraged to buy second-hand items, boosting market growth. Furthermore, collaborating with interior designers to curate appealing collections of second-hand furniture can attract customers seeking unique, stylish pieces without the new furniture price tag.

There is also a burgeoning opportunity in the corporate sector, where businesses looking to cut costs might turn to second-hand office furniture, opening up a new, profitable market segment. These strategies collectively represent a vibrant pathway for growth in the second-hand furniture market, tapping into economic, environmental, and consumer trends.

Emerging Trends

Eco-Friendly Choices Propel Second-Hand Furniture Market

As an analyst monitoring the second-hand furniture market, several trending factors are notably shaping its dynamics. Firstly, the push towards environmentally conscious consumerism is significantly boosting the demand for second-hand furniture. This trend aligns with a broader societal shift towards sustainability, as purchasing used furniture helps reduce waste and carbon footprints.

Additionally, there is an increased interest in unique, vintage, or antique furniture pieces, which are prized for their craftsmanship and historical value. These items not only serve as functional pieces of furniture but also as decorative statements that reflect personal style and taste.

The rising trend in home renovations also plays a crucial role, as many individuals seek cost-effective furnishing solutions for their newly remodeled spaces, finding value and quality in second-hand options.

Moreover, the integration of technology such as augmented reality (AR) is transforming the shopping experience by allowing consumers to visualize how a piece of furniture would look in their space before making a purchase. This technological advancement enhances consumer confidence in buying second-hand items online, further driving market growth. Together, these factors create a vibrant ecosystem for the second-hand furniture market, fueled by ecological concerns, a love for uniqueness, cost efficiency, and technological integration.

Regional Analysis

Asia Pacific Leads Second-Hand Furniture Market with 34.6% Share, Driven by Sustainable Living and Economic Choices

The second-hand furniture market is witnessing significant growth across various regions, with Asia Pacific leading the charge. Accounting for 34.6% of the global market share, this region has amassed revenues amounting to USD 13.6 billion.

This dominance is largely driven by increasing consumer awareness towards sustainable living practices and the popularity of economical furniture options in densely populated countries such as China and India. Furthermore, the proliferation of online platforms specializing in second-hand goods has facilitated easier access and boosted consumer confidence in purchasing used furniture.

Regional Mentions:

In North America, the market is also experiencing robust growth, fueled by a strong culture of thrift shopping and environmental consciousness among consumers. The U.S. and Canada are seeing an uptick in the number of thrift stores and online marketplaces that offer a wide range of pre-owned furniture at competitive prices, making it a lucrative segment in the region.

Europe follows closely, with a well-established market for second-hand furniture, driven by consumer preference for vintage and antique pieces that add unique character to home decor. Countries like Germany, France, and the UK are leading in this region, supported by high disposable incomes and a strong network of second-hand shops and flea markets.

The Middle East & Africa, though smaller in comparison, is gradually embracing the trend of buying second-hand furniture, primarily due to the increasing expatriate community and the influence of western lifestyles. Urban centers in countries such as the UAE, Saudi Arabia, and South Africa are seeing a rise in the demand for affordable furniture options.

Latin America is witnessing a moderate growth in the second-hand furniture market. Economic fluctuations and a rising middle-class population are pushing consumers towards more cost-effective solutions for furnishing homes, with countries like Brazil and Mexico seeing an increase in local second-hand markets and online platforms.

Overall, the second-hand furniture market is expanding globally, with the Asia Pacific region taking the lead, followed by strong performances in North America and Europe, each contributing to the market dynamics with regional consumer behaviors and economic conditions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global second-hand furniture market is expected to see substantial growth, driven by increasing consumer interest in sustainable and affordable home solutions. The key players in this market are diversifying their offerings and expanding their reach to capitalize on this trend.

IKEA leads the pack with its initiative to buy back and resell used furniture, appealing to environmentally conscious consumers. This strategy not only promotes sustainability but also strengthens customer loyalty and attracts a broad demographic interested in affordable, stylish options.

Thrift Super Store and Almost Perfect Furniture are critical players in the more localized, community-focused segment of the market. These companies benefit from the growing thrift culture among consumers who prioritize unique finds and budget-friendly options, providing a vast assortment of used furniture that appeals to eclectic tastes and budget-conscious shoppers.

Envirotech Products Company and Steelcase Inc. are making significant inroads in the corporate and upscale market segments. Their focus on high-quality, refurbished office furniture meets the increasing demand from businesses looking to optimize their budgets without compromising on style and sustainability. This approach not only caters to economic needs but also aligns with corporate social responsibility goals.

Pottery Barn, Rework Office Furniture, Beverly Hills Chairs, Second-hand Office Furniture Co., and OneUp Furniture are further enhancing the market’s dynamics by offering specialized services and products that cater to specific needs, such as luxury consignment and premium office decor. Their targeted strategies help in maintaining a competitive edge by providing tailored solutions that attract niche markets.

Overall, the key players are strategically positioned to leverage the growing demand for second-hand furniture through innovative business models and customer-focused services, enhancing their market share and fostering sustainable industry practices.

Top Key Players in the Market

- IKEA

- Thrift Super Store

- Almost Perfect Furniture

- Envirotech Products Company

- Pottery Barn

- Rework Office Furniture

- Beverly Hills Chairs

- Steelcase Inc.

- Second-hand Office Furniture Co.

- OneUp Furniture

Recent Developments

- In September 2023, Helsinki’s Mjuk secured €2.5 million in funding to support minimal waste initiatives for brands.

- In October 2024, Furnishka raised Rs 27 crore in a pre-Series A round led by IndiaQuotient.

- In December 2024, Wooden Street secured Rs 354 crore in a Series C round from Premji Invest.

- In September 2023, Pepperfry raised $23 million from existing investors and appointed Ashish Shah as CEO.

Report Scope

Report Features Description Market Value (2024) USD 40.2 Billion Forecast Revenue (2034) USD 87.6 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Beds, Tables & Desks, Sofa & Couch, Chairs & Stools, Cabinets & Shelves, Others), By Material(Wood, Metal, Plastic, Glass, Others), By Application(Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IKEA, Thrift Super Store, Almost Perfect Furniture, Envirotech Products Company, Pottery Barn, Rework Office Furniture, Beverly Hills Chairs, Steelcase Inc., Second-hand Office Furniture Co., OneUp Furniture Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Second-hand Furniture MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Second-hand Furniture MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IKEA

- Thrift Super Store

- Almost Perfect Furniture

- Envirotech Products Company

- Pottery Barn

- Rework Office Furniture

- Beverly Hills Chairs

- Steelcase Inc.

- Second-hand Office Furniture Co.

- OneUp Furniture