Global Seaweed Extract Biostimulant Market Size, Share, Growth Analysis By Form (Liquid and Solid), By Source (Brown Seaweed, Red Seaweed, and Green Seaweed), By Mode Of Application (Foliar Treatment, Soil Treatment, Seed Treatment, and Others), By Crop Type (Cereals And Grains, Oilseeds And Pulses, Fruits And Vegetables, Turf And Ornamentals, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168225

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

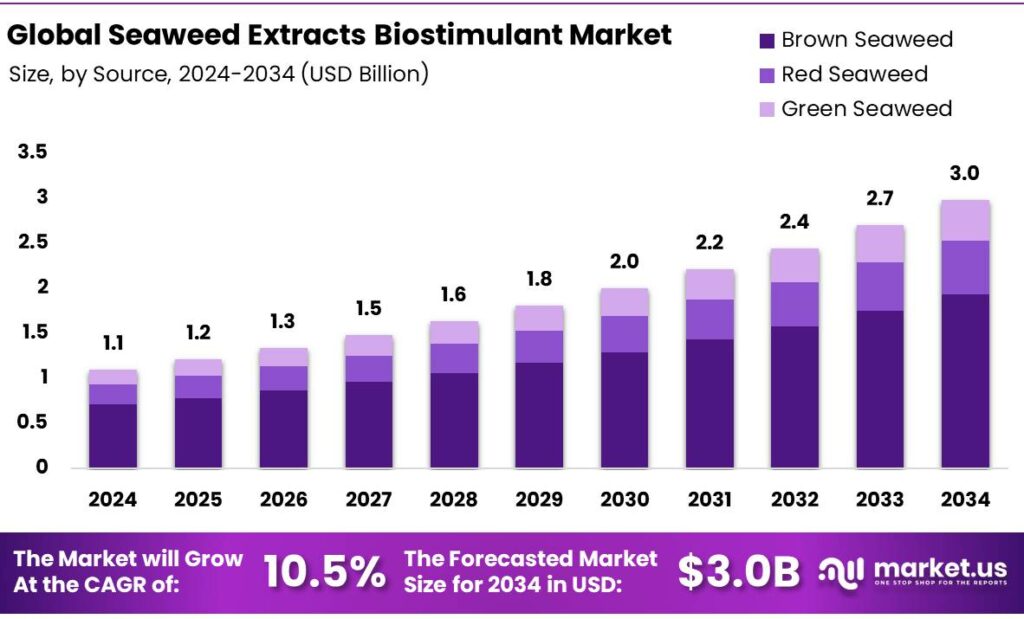

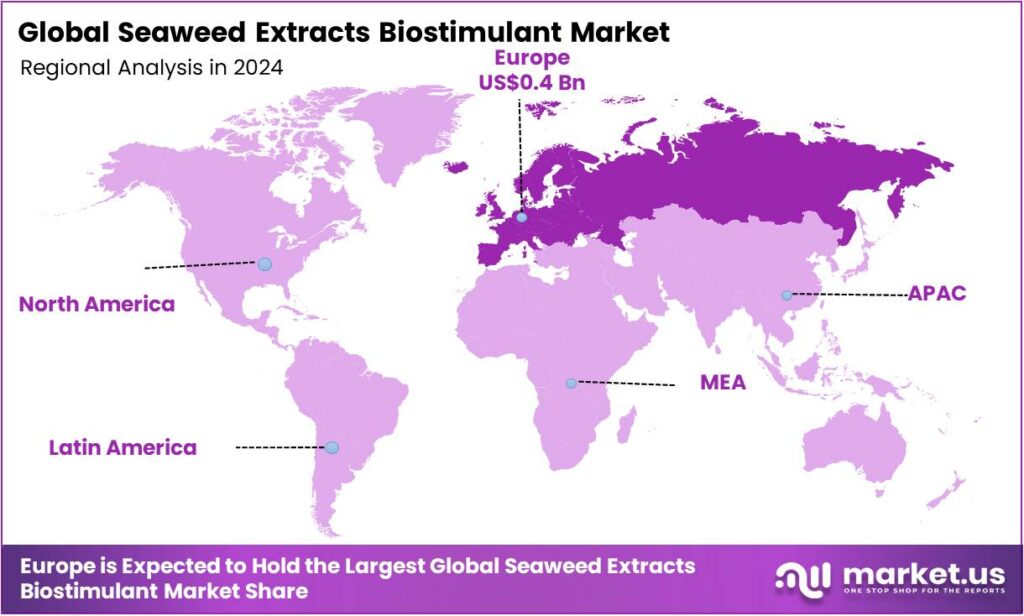

The Global Seaweed Extract Biostimulant Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 10.5% during the forecast period from 2025 to 2034. In 2024, Europe held a dominan market position, capturing more than a 42.6% share, holding USD 0.4 Billion revenue.

Seaweed extract biostimulants, primarily derived from brown seaweed, are rich in bioactive compounds like alginates, cytokinins, and auxins, which improve stress tolerance, stimulate root development, and enhance nutrient uptake in crops. The market for these biostimulants is thriving due to the growing demand for sustainable agricultural solutions and the proven benefits of seaweed-based products in enhancing plant growth and resilience. While most commonly used in cereal and grain production, seaweed extracts are also applied to a variety of crops, including fruits, vegetables, and turf.

Liquid formulations dominate the market due to their ease of application and rapid absorption by plants. The shift towards organic farming, the demand to reduce chemical inputs, and the need to combat climate-induced stress on crops are major drivers of market growth. Additionally, all major companies are focusing on advanced extraction methods and targeted product development. However, challenges such as high production costs, raw material inconsistencies, and geopolitical disruptions continue to pose obstacles to market expansion.

- According to the OECD-FAO Agricultural Outlook, global food consumption is projected to grow by approximately 1.3% annually over the next decade. Much of this rise is driven by middle-income countries, particularly India, Southeast Asia, and parts of Africa, where calorie intake per capita is expected to increase by 7% by 2033. This intensification in food demand directly fuels the need for agrochemicals to maintain and extend agricultural productivity.

- According to the Food and Agriculture Organization (FAO), the world will need 50% more food by 2050 to feed the increasing global population in the context of natural resource constraints, environmental pollution, ecological degradation, and climate change.

Key Takeaways

- The global seaweed extract biostimulant market was valued at USD 1.1 billion in 2024.

- The global seaweed extract biostimulant market is projected to grow at a CAGR of 10.5% and is estimated to reach USD 3.0 billion by 2034.

- On the basis of form, liquid seaweed extract biostimulant dominated the market, constituting 76.8% of the total market share.

- Based on the source of seaweed extract biostimulant, brown seaweed dominated the market, with a substantial market share of around 64.7%.

- Based on the mode of application of seaweed extract biostimulant, foliar treatment led the market, comprising 71.2% of the total market.

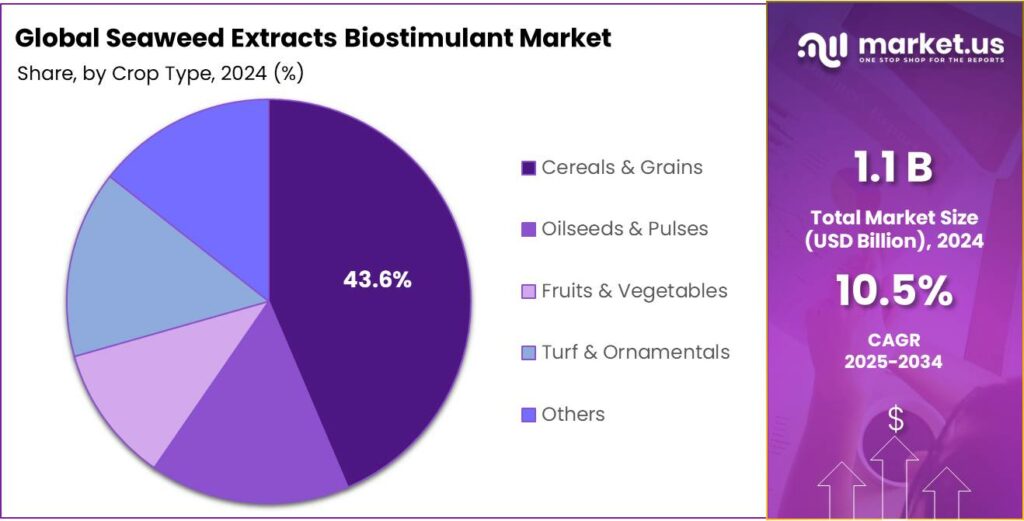

- Among the crop types, cereals and grains held a major share in the seaweed extract biostimulant market, 43.6% of the market share.

- In 2024, Europe was the most dominant region in the seaweed extract biostimulant market, accounting for 42.6% of the total global consumption.

Form Analysis

Liquid Seaweed Extract Biostimulant is a Prominent Segment in the Market.

The seaweed extract biostimulant market is segmented based on forms into liquid and solid. The liquid seaweed extract biostimulant led the market, comprising around 76.8% of the market share. They are more widely utilized than their solid counterparts due to their ease of application, faster absorption, and versatility. Liquid formulations rapidly mix with water, allowing for uniform distribution through foliar sprays or fertigation methods. This ensures that crops receive consistent and immediate access to the bioactive compounds, leading to faster results in plant growth and stress tolerance. Additionally, liquid extracts are easier to integrate into modern farming practices, where automation and precision agriculture are on the rise.

Similarly, they allow for more precise dosage control, reducing the risk of over-application or waste. In contrast, solid seaweed extracts often require more time to dissolve and may not be as readily absorbed, making them less efficient and more cumbersome to apply on a large scale. This combination of convenience and effectiveness makes liquid seaweed extract biostimulants the preferred choice for many farmers.

Source Analysis

Most Seaweed Extract Biostimulants in the Market Are Produced from Brown Seaweed.

On the basis of the source of the seaweed extract biostimulant, the market is segmented into brown seaweed, red seaweed, and green seaweed. The brown seaweed dominated the market, comprising around 64.7% of the market share. Most seaweed extract biostimulants are produced from brown seaweed rather than red or green seaweed due to its higher concentration of bioactive compounds that are beneficial for plant growth.

Brown seaweed, particularly species such as Ascophyllum snodosum and Fucus vesiculosus, contains rich amounts of alginates, fucoidans, and phytohormones such as auxins, cytokinins, and gibberellins. These compounds are highly effective in stimulating plant growth, enhancing stress tolerance, and improving nutrient uptake.

Additionally, brown seaweed has a robust structure that is easier to process, yielding higher quantities of active ingredients compared to red and green seaweeds. Furthermore, brown seaweed thrives in colder, nutrient-rich waters, making it abundant and easier to harvest on a large scale. While red and green seaweeds offer certain benefits, they typically have lower concentrations of these plant-enhancing compounds, making brown seaweed the preferred source for biostimulant production.

Mode of Application Analysis

Seaweed Extract Biostimulants Are Mostly Utilised for Foliar Treatment.

Based on the mode of applications of seaweed extract biostimulant, the market is divided into foliar treatment, soil treatment, seed treatment, and others. The foliar treatment dominated the market, with a notable market share of 71.2%. Most seaweed extract biostimulants are used for foliar treatment as this method allows for more efficient absorption and quicker results. When applied to plant leaves, seaweed extracts are rapidly absorbed through stomata and epidermal cells, delivering nutrients and bioactive compounds directly to the plant. This ensures immediate uptake and activation of growth-promoting substances, which can enhance plant growth, stress tolerance, and yield in a short period.

In addition, foliar application allows for precise targeting of specific crops, even in adverse soil conditions or areas with poor nutrient availability. In contrast, soil treatments may take longer to show effects as nutrients must first travel through the soil and be absorbed by the roots. Similarly, seed treatments are less common for seaweed extracts as they often don’t provide the same immediate growth benefits that foliar applications do, where the effects can be more directly observed and controlled.

Crop Type Analysis

Cereals and Grains Held a Major Share of the Seaweed Extract Biostimulant Market.

Among the crop types, 43.6% of the total global consumption of seaweed extract biostimulants is utilised for cereals and grains, as these crops tend to benefit significantly from the growth-enhancing and stress-resistant properties of seaweed extracts. Cereal crops such as wheat, corn, and rice are typically produced in large monocultures, where stress factors such as drought, soil degradation, and pests can severely impact yields. Additionally, cereals are the most harvested crops in the world. According to the Food and Agriculture Organisation of the United Nations, global cereal production in 2024 was approximately 2,860 million tons.

Similarly, cereals have a fast growth cycle, allowing farmers to see the effects of biostimulants more swiftly. While oilseeds, pulses, fruits, vegetables, and ornamentals can benefit from seaweed extracts, these crops often have different nutrient requirements or are more sensitive to certain biostimulants. The scalability of seaweed-based biostimulants for large-scale cereal production makes them a more popular choice in regions with extensive cereal farming.

Key Market Segments

By Form

- Liquid

- Solids

By Source

- Brown Seaweed

- Red Seaweed

- Green Seaweed

By Mode of Application

- Foliar Treatment

- Soil Treatment

- Seed Treatment

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Turf & Ornamentals

- Others

Drivers

Consumer Demand for Organic Food Drives the Seaweed Extract Biostimulant Market.

Seaweed extract biostimulants are gaining significant traction in agriculture due to their ability to enhance plant growth and productivity organically. Rich in essential nutrients, trace elements, amino acids, and plant growth hormones, seaweed extracts provide natural resistance to stress factors such as pests and diseases, which ultimately leads to improved crop yields. For instance, seaweed extracts can increase the germination rate and root development in plants, contributing to stronger, healthier crops.

As consumer demand for organic food continues to rise, driven by a growing awareness of the environmental and health impacts of synthetic chemicals, farmers are increasingly turning to these biostimulants as a sustainable alternative. By the end of 2023, 98.9 million hectares of farms were managed organically, marking a 2.6% increase, which is an addition of 2.5 million hectares, from 2022, reflecting the continued expansion of organic farming systems across the globe. This shift reflects broader trends toward eco-friendly and efficient agricultural practices, supporting both environmental sustainability and food security.

- In 2023, there were 4.3 million organic producers worldwide, with India remaining the country with the most organic producers, approximately 2.36 million.

- Globally, 2.1% of agricultural land was managed organically in 2023. Oceania remained the leading region for organic farming, with 53.2 million hectares, accounting for more than half of the global organic area.

Restraints

High Production Costs Might Pose a Challenge to the Seaweed Extract Biostimulant Market.

High production costs and product inconsistency are significant challenges in the seaweed extract biostimulant market, potentially limiting widespread adoption. The extraction process itself can be labour-intensive and energy-consuming, especially when advanced methods such as enzyme-assisted extraction (EAE) or supercritical fluid extraction are used, leading to higher manufacturing costs. Additionally, sourcing quality seaweed from sustainable, pollution-free environments adds to the expense. For instance, seaweed harvested from pristine coastal regions often requires careful processing to preserve its active compounds, driving up production costs.

Furthermore, another challenge is the natural variability in seaweed composition, which can result in inconsistent product quality. Factors such as seaweed species, harvesting conditions, and even seasonal variations can affect the concentration of key bioactive compounds, making it difficult to ensure uniform product performance. This inconsistency can be a challenge for farmers who rely on predictable results for optimal crop yields, and it can hinder the credibility and widespread acceptance of seaweed extract biostimulants in the agricultural industry.

Opportunity

Stress Tolerance and Resilience Create Opportunities in the Seaweed Extract Biostimulant Market.

Seaweed extract biostimulants are particularly valued for their ability to enhance stress tolerance and resilience in crops, which is becoming increasingly important in the face of climate change. These biostimulants contain compounds such as alginic acids, cytokinins, and auxins that help plants manage environmental stressors such as drought, extreme temperatures, and soil salinity. The crops treated with seaweed extracts exhibit improved water retention, better root development, and enhanced photosynthesis under stressful conditions. For instance, studies on wheat and tomatoes have shown that seaweed extracts can reduce the negative effects of heat stress, improving yield and quality.

In regions where water scarcity is a growing concern, such as parts of the Mediterranean or the Middle East, the use of seaweed biostimulants is becoming more common to boost crop resilience in arid climates. This ability to reduce crop vulnerability to environmental stresses presents a significant opportunity for farmers seeking sustainable ways to improve productivity and food security.

Trends

Focus on Developing More Sophisticated Extraction Technologies.

The trend of developing more sophisticated extraction methods for seaweed extract biostimulants is gaining momentum as companies and researchers strive to maximise the efficiency and potency of active compounds. Traditional extraction techniques, such as hot water or ethanol-based methods, often result in lower yields of the bioactive compounds that are key to enhancing plant growth and stress resilience. However, novel advanced techniques, such as enzyme-assisted extraction (EAE), supercritical fluid extraction, and cold-press methods, are being explored to increase the concentration and bioavailability of beneficial compounds such as alginates, fucoidan, and plant hormones.

For instance, using enzyme-assisted extraction can break down complex cell walls of seaweed more efficiently, releasing higher amounts of active molecules that promote root growth and stress tolerance. These refined methods improve the efficacy of the biostimulants and reduce the environmental impact of the extraction process, making it more sustainable. These innovations in extracted technologies allow producers to offer higher-quality, more potent products, enhancing the appeal of seaweed-based biostimulants to a growing number of environmentally-conscious farmers.

Geopolitical Impact Analysis

Increased Seaweed Extract Biostimulant Prices Amid Geopolitical Tensions.

The geopolitical tensions are having a noticeable impact on the seaweed extract biostimulant market, influencing both supply chains and the global trade of raw materials. Seaweed, a key ingredient in biostimulants, is primarily harvested from coastal regions in countries such as Iceland, Ireland, Japan, and the Philippines.

Ongoing geopolitical issues, such as trade disputes, border tensions, or restrictions on marine resources, can disrupt the steady flow of raw seaweed. For instance, political instability in regions such as the South China Sea and the Baltic has led to delays in harvesting and transportation, affecting the timely availability of seaweed for processing.

In addition to supply chain disruptions, geopolitical tensions have driven up the cost of shipping and logistics. Rising fuel prices and trade barriers, particularly from sanctions or tariffs, increase operational costs for manufacturers. For instance, tensions between major seaweed-producing nations and the European Union and the U.S. have led to higher import/export tariffs, making biostimulants more expensive.

Furthermore, since 2024, the export of bio-stimulant products such as seaweed extracts in China has been affected by unclear classification with fertilisers, requiring a month-long wait for inspection, leading to delayed delivery and price fluctuations. Moreover, uncertain political climates may deter investments in seaweed farming or biostimulant production facilities, limiting innovation and production capacity. This combination of supply instability, increased costs, and limited access to raw materials can hinder the growth potential of the seaweed extract biostimulant market in affected regions.

Regional Analysis

Europe Held the Largest Share of the Global Seaweed Extract Biostimulant Market.

In 2024, Europe dominated the global seaweed extract biostimulant market, holding about 42.6% of the total global consumption. The region has emerged as a dominant player in the seaweed extract biostimulant market, driven by strong consumer demand for organic and sustainable agricultural practices. European countries, particularly those with a long history of organic farming, such as Germany, France, and Italy, are leading the adoption of seaweed-based biostimulants due to their eco-friendly properties and effectiveness in enhancing crop productivity.

The European Union’s emphasis on reducing the use of chemical fertilisers and pesticides further fuels the demand for alternative, natural solutions such as seaweed extracts. Additionally, Europe’s focus on sustainable agriculture is supported by various policies and initiatives aimed at promoting environmental stewardship and food security. For instance, seaweed extracts are increasingly used in vineyards, orchards, and vegetable farming, where they help improve plant growth, resilience to climate stress, and soil health. This strong alignment between regulatory support, environmental consciousness, and farmer demand makes Europe a key market for seaweed extract biostimulants.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the seaweed extract biostimulant market maintain a competitive edge by focusing on product innovation, sustainability, and strategic partnerships. Almost all major players invest in developing advanced extraction technologies to increase the potency and efficiency of their biostimulants, ensuring better results for farmers and higher-quality products.

Additionally, companies often create specialized formulations tailored to specific crops, such as cereals, fruits, or vegetables, addressing unique plant needs and environmental conditions. Similarly, several companies emphasize eco-friendly sourcing, responsible harvesting of seaweed, and environmentally conscious production processes to cater to increasingly environmentally aware consumers. Furthermore, some companies focus on forming partnerships with agricultural cooperatives, research institutions, and distributors to expand their reach and build credibility in various markets.

The Major Players in The Industry

- BASF SE

- TAGROW CO., LTD.

- Biolchim SPA.

- Rovensa

- UPL Limited

- FMC Corporation

- Syngenta AG

- Sumitomo Chemical

- Koppert B.V.

- Jiloca Industrial SA

- Nature S.A.

- IIFCO

- BioAtlantis Ltd.

- Kelpak

- C&B Agri Enterprises Ltd.

- Other Key Players

Key Development

- In November 2025, UPL launched seaweed-based biostimulant Hycoxa to combat abiotic stress and enhance nitrogen uptake. Hycoxa technology produces superior biostimulant ingredients from Ascophyllum nodosum, a remarkable seaweed species native to the North Atlantic coastlines.

- In February 2025, Ocean Rainforest announced the acquisition of a 60% stake in the Mexico-based company Alamarsa, owner of the renowned Algamar brand, celebrated for its biostimulants and food products derived from giant kelp and other seaweed species.

- In October 2024, BASF partners with Acadian Plant Health, a renowned marine plant harvesting, cultivation, and extraction company based in Canada, to expand its BioSolutions offering by incorporating seaweed biostimulants.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 3.0 Bn CAGR (2025-2034) 10.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid and Solid), By Source (Brown Seaweed, Red Seaweed, and Green Seaweed), By Mode Of Application (Foliar Treatment, Soil Treatment, Seed Treatment, and Others), By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Turf & Ornamentals, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, TAGROW Co., Biolchim, Rovensa, UPL Limited, FMC Corp., Syngenta AG, Sumitomo Chemical, Koppert, Jiloca Industrial, Nature, IIFCO, BioAtlantis, Kelpak, C&B Agri Enterprises Ltd, and Other Players. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Seaweed Extract Biostimulant MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Seaweed Extract Biostimulant MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample- BASF SE

- TAGROW CO., LTD.

- Biolchim SPA.

- Rovensa

- UPL Limited

- FMC Corporation

- Syngenta AG

- Sumitomo Chemical

- Koppert B.V.

- Jiloca Industrial SA

- Nature S.A.

- IIFCO

- BioAtlantis Ltd.

- Kelpak

- C&B Agri Enterprises Ltd.

- Other Key Players