Global Salon Furniture Market Size, Share, Growth Analysis By Product (Styling & All-Purpose Chairs, Shampoo Stations/Backwash Units, Styling Stations & Mirrors, Back Bars & Cabinetry, Reception Desks & Seating, Trolleys, Carts, & Storage, Manicure Tables & Pedicure Chairs, Display Units, Others), By Sales Channel (Indirect Sales, Direct Sales), By End-User (Hair Salons, Beauty Salons), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 150795

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

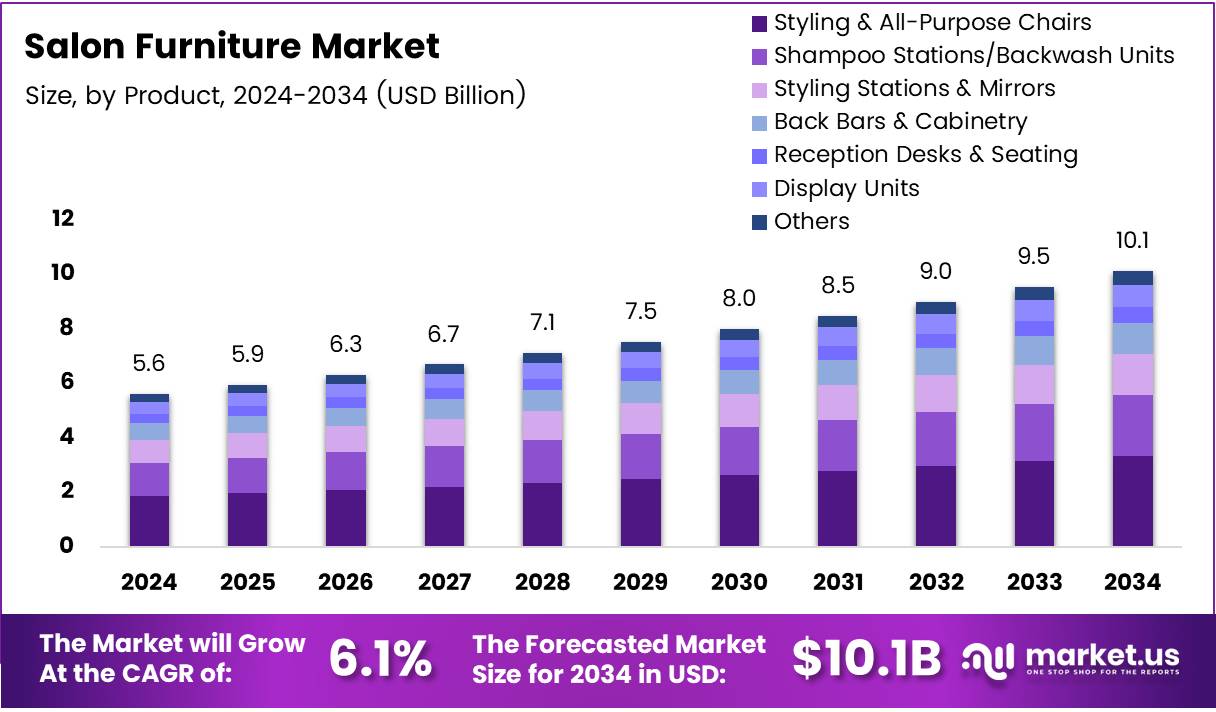

The Global Salon Furniture Market size is expected to be worth around USD 10.1 Billion by 2034, from USD 5.6 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The salon furniture market has seen significant transformations, driven by evolving customer preferences, technological advancements, and shifts in consumer behavior. Growth in the salon industry, fueled by increasing demand for grooming services, particularly among younger generations, has boosted the need for high-quality, ergonomic furniture.

According to Civicscience, 40% of typical salon-goers continue to visit salons, but 24% have fully switched to DIY beauty routines, with Gen Z leading this shift, followed by Millennials and Gen X. This shift toward DIY beauty is compelling salon owners to create more inviting and comfortable environments to attract and retain customers.

Technological integration in salons also influences furniture demands. As per ElectroIQ, 15% of beauty shoppers in China own smart mirrors, and over 50% are aware of them. This increasing reliance on tech-enhanced services is pushing salon owners to invest in furniture that complements these innovations, such as adjustable chairs and tables with integrated smart features.

The market is also experiencing opportunities due to government investments in the wellness and beauty sectors. Government regulations encouraging health and safety standards in salon environments are driving investments in high-quality, durable salon furniture.

Furthermore, partnerships with reputable suppliers have been shown to decrease the rate of complaints about product quality problems by 40%-50%, according to Click2Connect. This is a major driver for salon owners who prioritize reliability and long-term durability of their furniture investments.

The market’s future looks promising with an increasing focus on the customization of salon furniture, as business owners strive to create unique and personalized customer experiences. Innovations in design and materials are expected to cater to the demand for luxury and comfort, particularly in high-end salons and spas.

Additionally, the increasing trend of self-care and wellness, coupled with advancements in furniture ergonomics, is likely to drive further growth in the salon furniture market. The competitive nature of the industry means that salon furniture suppliers must continue to adapt to these consumer demands while providing cost-effective and high-quality solutions.

Key Takeaways

- The Global Salon Furniture Market is projected to reach USD 10.1 Billion by 2034, up from USD 5.6 Billion in 2024, growing at a CAGR of 6.1% from 2025 to 2034.

- Styling & All-Purpose Chairs held the largest product share in 2024 with 27.6%, due to their versatility and essential role in salon operations.

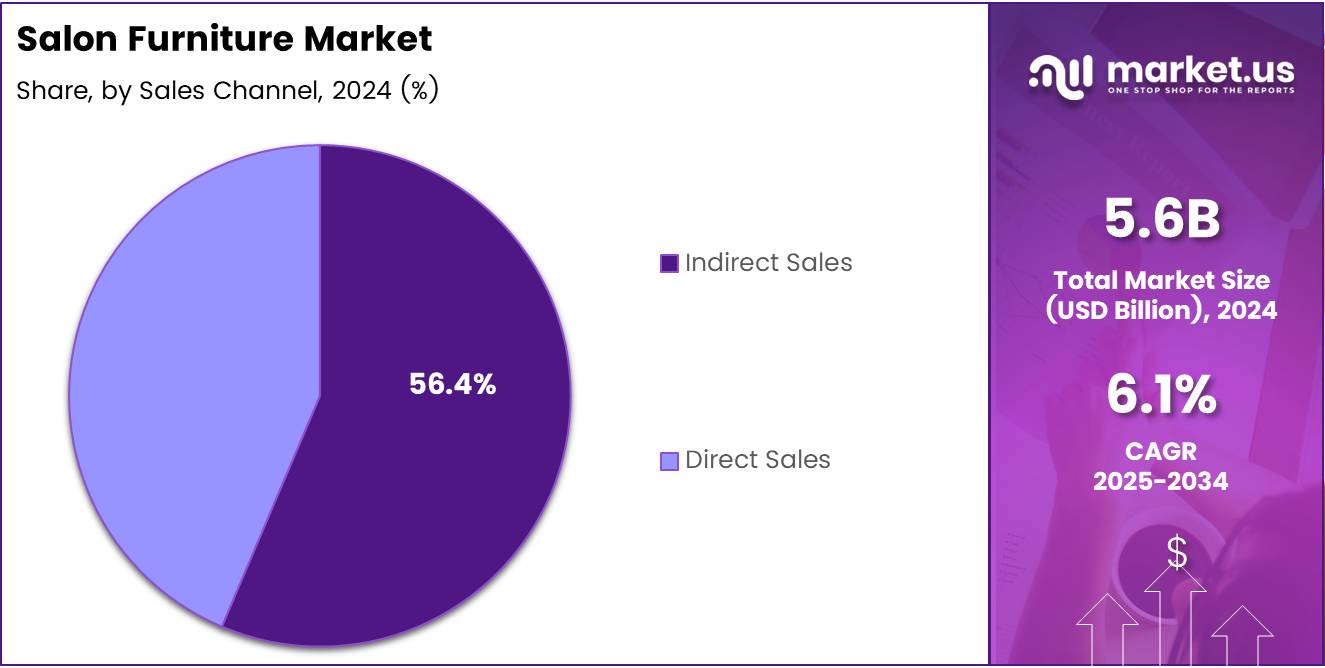

- Indirect Sales channels dominated the market in 2024 with a 56.4% share, supported by robust distribution networks and reseller partnerships.

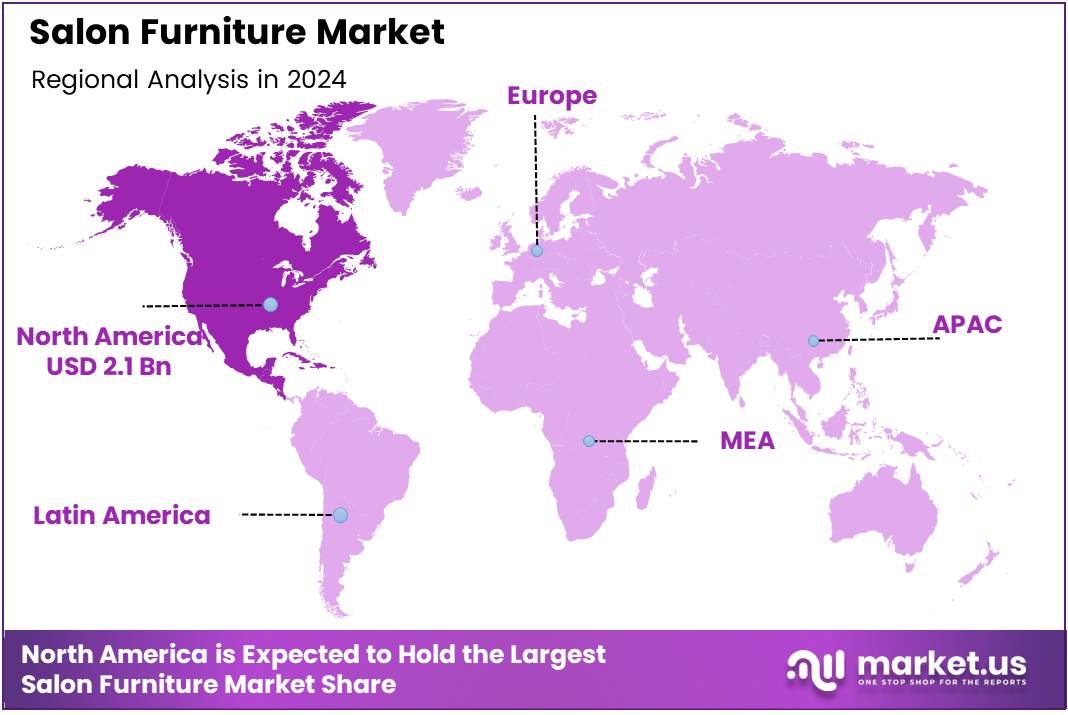

- North America led the global salon furniture market in 2024, accounting for 39.3% of the market share and valued at USD 2.1 Billion.

Product Analysis

Styling & All-Purpose Chairs lead with a 27.6% share in 2024.

In 2024, Styling & All-Purpose Chairs continued to lead the Salon Furniture Market, maintaining a strong presence with a significant 27.6% share. This dominance is attributed to their versatility and wide usage in various salon settings, offering comfort and functionality for both clients and professionals.

Shampoo Stations/Backwash Units followed closely, contributing to the overall growth with an increasing demand due to their importance in salon operations. Styling Stations & Mirrors also showed strong performance as essential elements in modern salons, enabling enhanced customer experience and salon aesthetics.

Back Bars & Cabinetry, along with Reception Desks & Seating, remained key contributors to market dynamics. These segments cater to the operational and customer-facing spaces, providing essential storage and comfort features for salons.

Trolleys, Carts, & Storage systems, along with Manicure Tables & Pedicure Chairs, continued to serve critical roles in providing mobility and specialized services. Display Units and Other accessories round off the diverse offerings within the market, each segment playing a vital role in creating a holistic salon experience.

Sales Channel Analysis

Indirect Sales dominate with a 56.4% share in 2024

In 2024, the Salon Furniture Market witnessed Indirect Sales take the lead in the By Sales Channel Analysis segment, capturing a significant 56.4% share. This dominance is driven by the widespread distribution networks and reseller partnerships that provide greater reach and accessibility to salon owners. These sales channels are instrumental in catering to a large pool of customers, enabling better penetration into different geographical regions.

Direct Sales, while important, held a smaller portion of the market due to its more personalized nature and the reliance on direct interactions with salon businesses. Although this channel allows for better customization and tailored solutions, it typically appeals to a more niche customer base.

Indirect Sales continue to dominate, benefiting from a broader market presence, more efficient distribution, and the ability to tap into a larger volume of salon businesses, making it a critical component of the overall market landscape in 2024.

Key Market Segments

By Product

- Styling & All-Purpose Chairs

- Shampoo Stations/Backwash Units

- Styling Stations & Mirrors

- Back Bars & Cabinetry

- Reception Desks & Seating

- Trolleys, Carts, & Storage

- Manicure Tables & Pedicure Chairs

- Display Units

- Others

By Sales Channel

- Indirect Sales

- Direct Sales

By End-User

- Hair Salons

- Beauty Salons

Drivers

Expansion of Beauty and Wellness Franchise Models Fuels Market Demand

The growth of beauty and wellness franchise chains is creating strong demand for salon furniture. As more branded salons open across cities and towns, the need for uniform, high-quality furniture is increasing. Franchises often require multiple outlets to be furnished in the same way, boosting bulk orders from salon furniture suppliers.

Customers are now expecting salons to offer comfort, efficiency, and modern aesthetics. This has led to a rise in demand for ergonomic and multifunctional furniture. Salons are investing in chairs, workstations, and storage units that save space and improve client experience.

As urban lifestyles become more fast-paced and incomes rise, people are spending more on grooming and personal care. This shift supports the growth of the salon industry and, in turn, the furniture market. More people visiting salons means more wear and tear on equipment, encouraging regular updates and replacements.

Government programs and loans targeted at small and medium beauty businesses are also supporting new salon setups. This financial support allows entrepreneurs to invest in good-quality furniture, further pushing market growth.

Restraints

High Replacement Costs and Maintenance of Specialized Equipment Limit Market Growth

Salon furniture, especially high-end or specialized pieces, can be expensive to maintain or replace. Equipment like electric chairs or shampoo stations requires regular upkeep, which can be costly for smaller salons.

Fluctuating raw material prices, such as wood, metal, and upholstery, affect production costs. This inconsistency leads to unpredictable pricing, which can discourage salon owners from making large furniture investments.

Many furniture manufacturers face challenges reaching rural or Tier-III markets. The demand in these areas remains low, mostly due to limited infrastructure and affordability issues. As a result, market penetration stays focused around urban centers.

Custom and imported furniture often takes time to deliver. Supply chain delays affect timely installations, especially for new salon launches or renovations. These delays can slow down business operations and reduce trust in premium furniture suppliers.

Growth Factors

Surge in Demand for Eco-Friendly and Sustainable Salon Furniture Creates New Avenues

Eco-friendly salon furniture is gaining popularity as more salons look to reduce their environmental footprint. Materials like recycled wood or sustainable fabrics are now being used, which attracts eco-conscious consumers and gives salons a marketing edge.

There is a growing trend of home-based and mobile salon services. These setups need compact, foldable, and easy-to-carry furniture. As more professionals shift to this model, manufacturers have the chance to develop portable and lightweight product lines.

Men’s grooming salons and barber studios are expanding rapidly. This segment demands a different style of furniture, often with a more masculine design. Catering to this niche opens up new growth opportunities for furniture makers.

Technology is also entering the space. Smart chairs, adjustable settings, and built-in device charging are being integrated into salon furniture. These advanced features attract tech-savvy salon owners looking to enhance both function and customer experience.

Emerging Trends

Customization and Personalization of Salon Interiors Drive Design Trends

Today’s salons want to offer unique, branded experiences, leading to high demand for customized furniture. Personalized styling stations and branded chairs help salons stand out and create loyal customer bases.

Smart mirrors and digitally enhanced stations are being introduced to elevate the customer journey. These allow for virtual try-ons or personalized styling suggestions, adding a tech-savvy touch that appeals to younger clientele.

Minimalist and space-saving furniture is trending in urban areas where salons operate in smaller spaces. Foldable chairs, compact storage, and multi-use workstations help salons maintain a modern look without compromising functionality.

Collaborations with interior designers are turning salons into boutique-style spaces. This trend pushes demand for stylish, premium, and made-to-order furniture, encouraging innovation and creativity in the furniture market.

Regional Analysis

North America Dominates the Salon Furniture Market with a Market Share of 39.3%, Valued at USD 2.1 Billion

North America stands as the leading region in the salon furniture market, capturing a significant 39.3% of the market share and valued at USD 2.1 billion. This dominance is driven by the high demand for premium grooming services, a strong presence of professional salons, and ongoing trends toward modernization of salon infrastructure.

The region’s mature beauty industry, coupled with increased consumer spending on personal care, continues to bolster the market.

Europe Salon Furniture Market Trends

Europe follows closely, backed by a well-established beauty and wellness sector and increasing consumer inclination toward aesthetic enhancement services. Rising focus on luxurious salon interiors and ergonomic furniture designs contributes to the steady demand. Technological integration in salon settings across countries like Germany, France, and the UK further supports market growth.

Asia Pacific Salon Furniture Market Trends

Asia Pacific is experiencing rapid expansion in the salon furniture market due to growing urbanization, a booming middle-class population, and rising disposable incomes. Countries such as China, India, and South Korea are witnessing a surge in beauty consciousness, prompting salons to invest in modern, stylish furniture. The market is also benefitting from a rise in local manufacturing and e-commerce-driven accessibility.

Middle East and Africa Salon Furniture Market Trends

The salon furniture market in the Middle East and Africa is steadily developing, fueled by an increase in beauty salons and wellness centers across urban areas. Greater awareness of grooming and self-care, along with a youthful demographic, is shaping market demand. Luxury preferences and tourism in regions like the UAE further contribute to the growth trajectory.

Latin America Salon Furniture Market Trends

Latin America’s salon furniture market is gradually expanding, driven by rising beauty service penetration and evolving consumer lifestyles. Markets such as Brazil and Mexico are seeing a growing number of salons adopting high-end furniture to enhance client experience. Economic recovery and rising employment in the service sector are also influencing the growth of salon infrastructure investments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Salon Furniture Company Insights

In the 2024 global Salon Furniture Market, several key players continue to shape the industry landscape through innovation, design, and strategic expansion. Collins maintains a strong foothold in North America, offering customizable and durable salon furniture that appeals to upscale salon chains and boutique establishments alike. Its focus on quality craftsmanship and client-centric solutions enhances its market credibility.

AgvGroup S.r.l. leverages its Italian design heritage to deliver high-end, contemporary salon furnishings. Known for combining elegance with ergonomic functionality, AgvGroup strengthens its market presence through consistent product innovation and strong distribution networks across Europe.

Maletti Group stands out for its emphasis on sustainable production and modern aesthetics. The company’s collaborations with international designers give it an edge in offering luxurious and eco-friendly salon environments, particularly attractive to premium salons and spas.

Salon Ambience continues to grow by delivering customizable, modular furniture systems that balance affordability and style. With an emphasis on sleek, space-saving designs, the brand effectively caters to small and mid-sized salons looking to modernize their interiors without excessive costs.

These market leaders are collectively pushing the envelope in terms of innovation, sustainability, and design flexibility, responding to evolving consumer demands and salon business models. Their ongoing investment in R&D, along with attention to ergonomics and aesthetics, positions them strongly in a competitive global landscape.

Top Key Players in the Market

- Collins

- AgvGroup S.r.l.

- Maletti Group

- Salon Ambience

- GAMMA & BROSS S.p.A.

- Minerva Beauty

- REM UK Ltd

- Nelson Mobilier

- Takara Belmont Corporation

- Pietranera S.r.l.

Recent Developments

- In April 2025, Modern Beauty announced the acquisition of ESP Salon Sales, marking a strategic move to expand its distribution network and professional product offerings across Canada. This acquisition enhances Modern Beauty’s footprint in the salon and spa industry.

- In August 2024, River Associates Investments, L.P., a Chattanooga-based private equity firm, successfully acquired Minerva Beauty, LLC, a leading provider of salon and spa equipment. The investment aims to support Minerva’s continued growth and innovation in the beauty equipment market.

- In November 2024, Takara Belmont, a global leader in salon equipment and furnishings, acquired French salon furniture company Cindarella. This acquisition strengthens Takara Belmont’s presence in the European beauty market and complements its premium product portfolio.

Report Scope

Report Features Description Market Value (2024) USD 5.6 Billion Forecast Revenue (2034) USD 10.1 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Styling & All-Purpose Chairs, Shampoo Stations/Backwash Units, Styling Stations & Mirrors, Back Bars & Cabinetry, Reception Desks & Seating, Trolleys, Carts, & Storage, Manicure Tables & Pedicure Chairs, Display Units, Others), By Sales Channel (Indirect Sales, Direct Sales), By End-User (Hair Salons, Beauty Salons) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Collins, AgvGroup S.r.l., Maletti Group, Salon Ambience, GAMMA & BROSS S.p.A., Minerva Beauty, REM UK Ltd, Nelson Mobilier, Takara Belmont Corporation, Pietranera S.r.l. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Collins

- AgvGroup S.r.l.

- Maletti Group

- Salon Ambience

- GAMMA & BROSS S.p.A.

- Minerva Beauty

- REM UK Ltd

- Nelson Mobilier

- Takara Belmont Corporation

- Pietranera S.r.l.