Global Hair Removal Products Market Size, Share, Growth Analysis By Product (Creams, Ready-To-Use Wax Strips, Electronic Devices, Razors), By Application (Women, Men), By Distribution Channel (Supermarkets& Hypermarkets, Convenience Stores, Drugstores, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146019

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

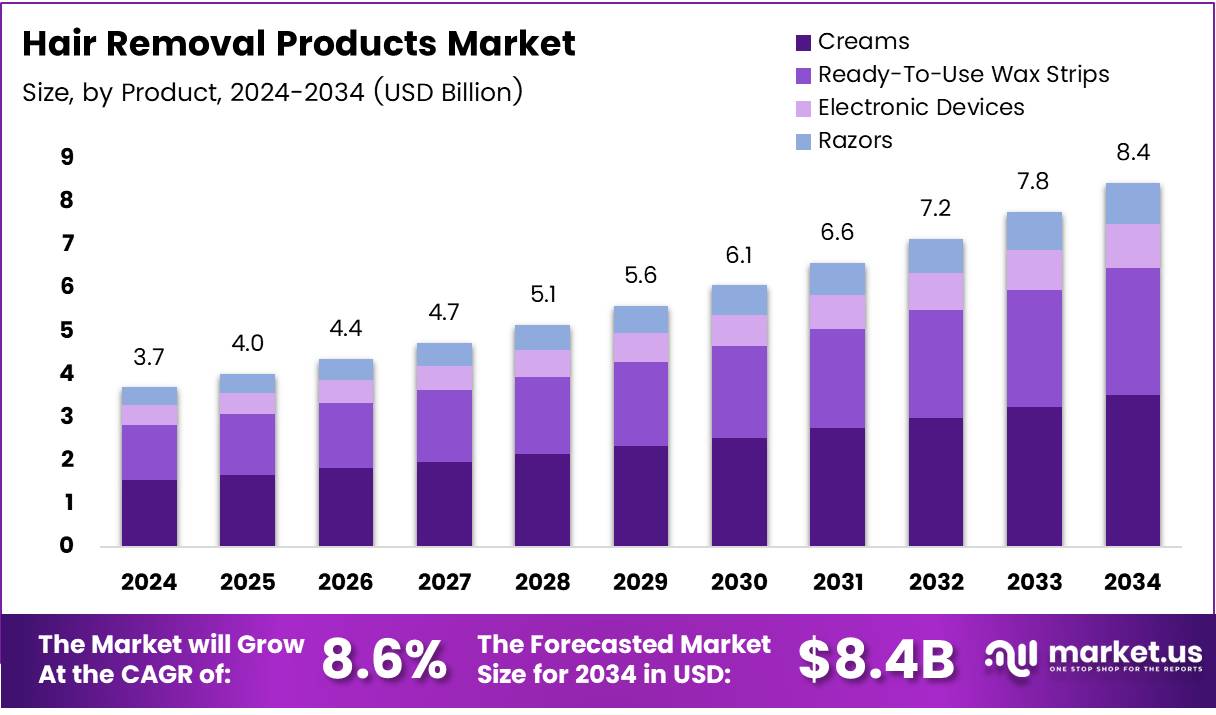

The Global Hair Removal Products Market size is expected to be worth around USD 8.4 Billion by 2034, from USD 3.7 Billion in 2024, growing at a CAGR of 8.6% during the forecast period from 2025 to 2034.

The hair removal products market encompasses a diverse range of solutions aimed at aiding the removal of unwanted body hair. This market includes both consumer-level products such as razors, depilatory creams, waxing kits, and more advanced professional-grade equipment like laser and intense pulsed light (IPL) devices.

The demand within this market is largely driven by cultural and social trends towards body hair removal, not only for aesthetic reasons but also for hygiene. Consumer awareness and the availability of various methods suitable for home use have broadened the scope of this market.

Hair removal products are a critical segment within the beauty and personal care industry, significantly influenced by evolving beauty standards and consumer behavior trends. According to the University of Washington Press Blog, between 92% and 99% of women in the US, UK, Australia, New Zealand, and much of Western Europe regularly remove their leg and underarm hair.

Additionally, from 50% to 98% of women report that they removed some or all of their pubic hair. This widespread practice underscores the deep market penetration and consistent demand for hair removal products.

The hair removal products market is poised for significant growth, thanks to a combination of technological advancements and shifting consumer preferences. Innovations in products that offer longer-lasting results, such as those using advanced formulations and light-based technologies, are creating new opportunities for both manufacturers and service providers.

Government investments in healthcare and beauty standards, along with regulatory frameworks ensuring product safety and efficacy, further stimulate this market’s expansion. With approximately 40% of women dealing with unwanted facial hair, as reported by AARP, the demand for effective and safe hair removal solutions is increasingly critical.

Government involvement in the hair removal products market primarily revolves around regulatory measures, which ensure the safety and effectiveness of hair removal devices and formulations. These regulations are crucial in maintaining consumer trust and promoting industry standards.

Furthermore, investments in dermatological research and public health initiatives occasionally boost the market by introducing innovative and safer methods of hair removal. Such government-led interventions not only protect consumers but also encourage market growth by facilitating the introduction of pioneering products that meet stringent safety standards.

Key Takeaways

- Global Hair Removal Products Market projected to reach USD 8.4 Billion by 2034 from USD 3.7 Billion in 2024, growing at a CAGR of 8.6%.

- Creams dominated the By Product segment in 2024 with a 42.4% market share, driven by pain-free use, affordability, and wide availability.

- Women led the By Application segment in 2024 due to high grooming standards, workforce participation, and beauty trend influence.

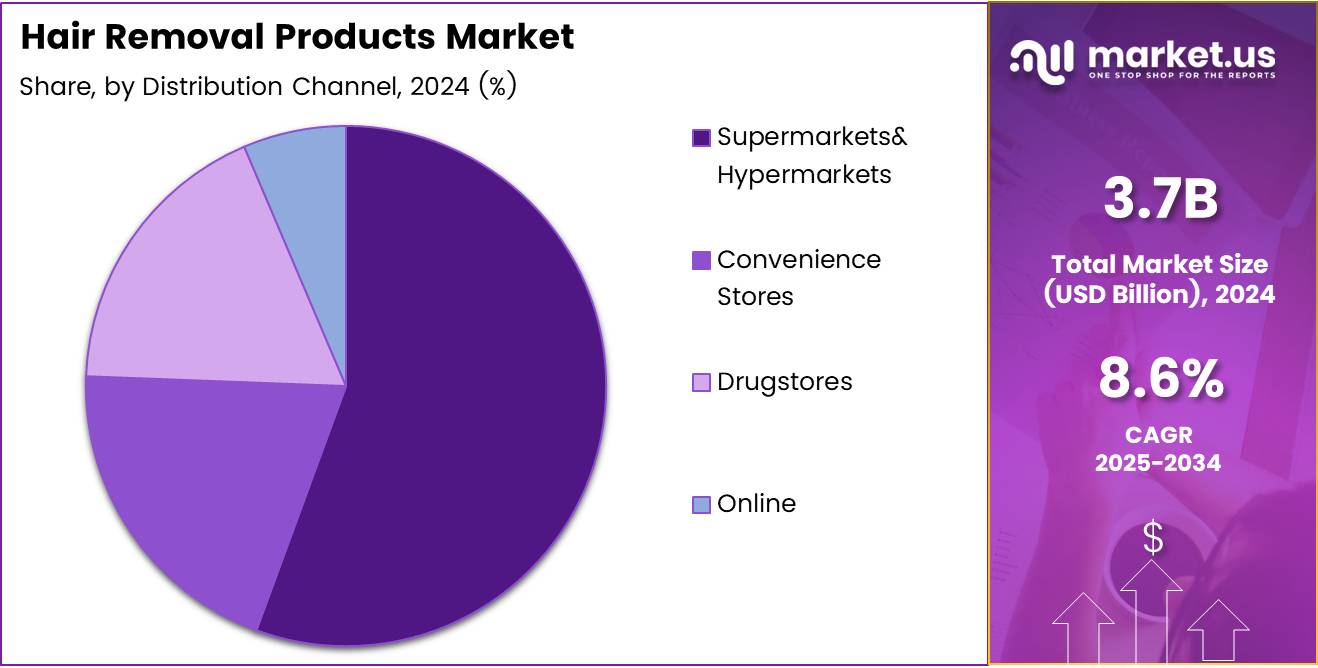

- Supermarkets & Hypermarkets topped the By Distribution Channel in 2024, favored for their product variety, discounts, and consumer trust.

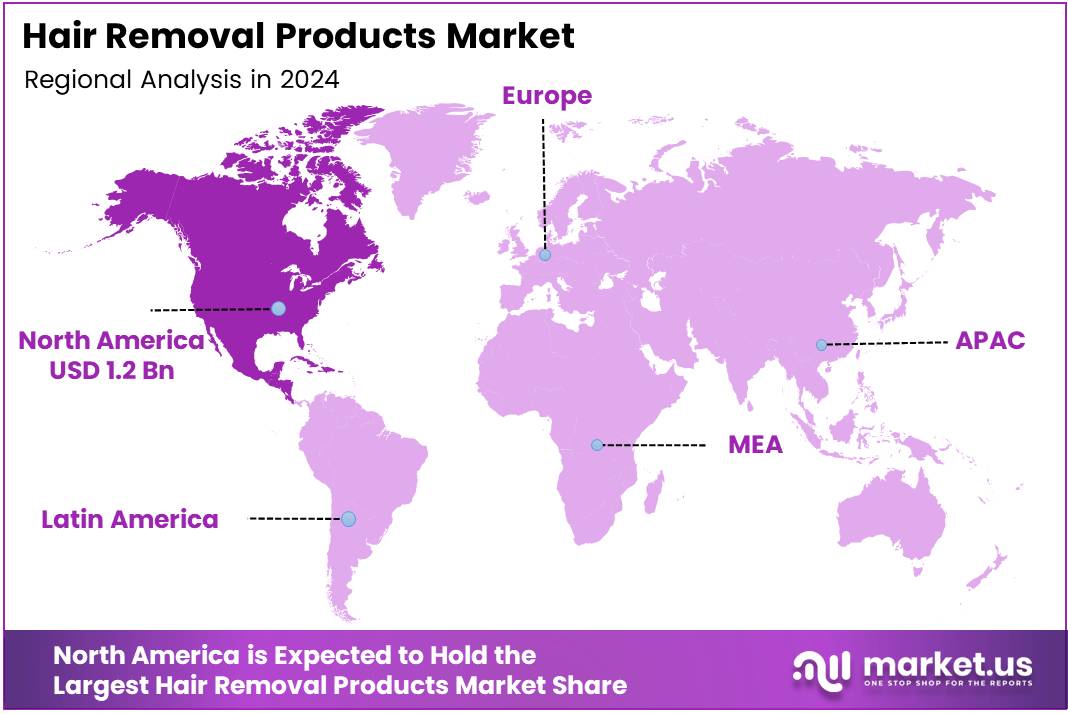

- North America accounted for 32.6% of the global market share in 2024, valued at USD 1.2 Billion, fueled by high consumer awareness and advanced grooming standards.

Product Analysis

Creams dominate with 42.4% due to ease of use and pain-free application

In 2024, Creams held a dominant market position in the By Product Analysis segment of the Hair Removal Products Market, with a 42.4% share. Their popularity stems from being pain-free, affordable, and widely accessible in both physical and online retail channels. The quick application process and compatibility with sensitive skin types have made creams a preferred choice among consumers.

Ready-to-use wax strips are gaining traction, particularly among young adults seeking semi-permanent results at home. Their convenience and effectiveness are drawing consumers looking for professional-like results without salon visits.

Electronic devices, including epilators and laser-based gadgets, continue to rise in popularity as long-term hair removal solutions. Although relatively costlier, growing disposable income and interest in at-home beauty tech have fueled this segment’s momentum.

Razors remain a staple, especially for last-minute grooming needs. Their affordability, portability, and no-preparation usage make them an ideal everyday solution, though concerns over skin irritation and temporary results slightly hinder growth.

Application Analysis

Women lead usage in hair removal products driven by grooming trends and beauty standards

In 2024, Women held a dominant market position in the By Application Analysis segment of the Hair Removal Products Market. High grooming standards, increasing workforce participation, and the strong influence of beauty trends across media have significantly shaped product demand among female consumers.

Brands continue to focus their marketing efforts on female-centric campaigns, introducing products with skin-nourishing ingredients and customized solutions for different body areas. This has further solidified the category’s growth.

Meanwhile, the men’s segment is witnessing growing engagement, albeit at a smaller scale. Evolving perceptions of male grooming and rising popularity of men personal care regimens among men are encouraging adoption, particularly of razors and electric devices. Brands are increasingly launching male-specific product lines, signaling growth potential in the upcoming years.

Distribution Channel Analysis

Supermarkets & Hypermarkets drive sales with strong shelf presence and consumer trust

In 2024, Supermarkets & Hypermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Hair Removal Products Market. Their vast product assortments, promotional discounts, and consumer trust have played a pivotal role in making them the go-to point for personal care product purchases.

These retail formats offer tactile assurance, instant purchase gratification, and well-informed in-store assistance, further enhancing consumer experience.

Convenience stores continue to support impulse buying behavior, especially in urban settings. They serve as a handy option for purchasing razors and creams, particularly during travel or emergency needs.

Drugstores are establishing a firm footprint in this space by offering dermatologically tested and pharmacist-recommended options. Their appeal lies in catering to skin-sensitive and health-conscious consumers.

Online channels are rapidly emerging as a competitive force, particularly among the digitally savvy generation. The ease of doorstep delivery, access to reviews, and wide product availability contribute to growing traction, especially for devices and subscription-based hair removal products.

Key Market Segments

By Product

- Creams

- Ready-To-Use Wax Strips

- Electronic Devices

- Razors

By Application

- Women

- Men

By Distribution Channel

- Supermarkets& Hypermarkets

- Convenience Stores

- Drugstores

- Online

Drivers

Increasing Beauty Consciousness Among Men and Women Boosts Demand

One of the main reasons for the growth of the hair removal products market is the rising awareness about personal grooming. Both men and women are paying more attention to their appearance, influenced by social media trends, celebrity culture, and overall self-care awareness. Hair removal has become a regular part of beauty routines, creating consistent demand for easy-to-use products like razors, waxing kits, and depilatory creams.

Another factor contributing to this growth is the increase in disposable incomes, especially in emerging markets such as India, Brazil, and parts of Southeast Asia. As people have more money to spend, they are willing to buy premium personal care items, including advanced hair removal products that offer better results and comfort.

The expansion of e-commerce platforms has also played a major role. Online shopping has made these products easily available to consumers even in smaller towns and rural areas. With the convenience of home delivery, wide product choices, and online reviews, people are more confident about trying and buying hair removal solutions online. These combined factors are driving the steady growth of the market.

Restraints

Availability of Long-lasting Alternatives Slows Down Market Growth

While the market is growing, some challenges are slowing it down. One key restraint is the availability of long-lasting alternatives like laser hair removal or professional salon treatments. These methods provide longer or even permanent results, which reduces the frequent use of traditional products such as razors or wax creams.

As more consumers in urban areas opt for these alternatives, the demand for at-home hair removal solutions could decline. People are increasingly looking for convenience and long-term results, and advanced treatments offer both, making them more attractive compared to frequently repurchasing disposable or temporary-use products.

Additionally, traditional hair removal methods come with recurring costs. Buying razors, shaving creams, or waxing strips regularly can become expensive over time. For budget-conscious consumers, this ongoing expense can feel burdensome, leading them to either reduce their usage or explore more cost-efficient alternatives. These factors may limit market growth and push brands to reconsider their pricing and long-term value offerings.

Growth Factors

Expanding Male Grooming and Natural Products Create New Opportunities

The hair removal products market holds several promising growth opportunities. A key trend is the rising focus on male grooming. Men are becoming more interested in personal care and grooming, which creates a relatively untapped market for specialized products. Companies that design hair removal products specifically for men can gain a competitive edge and increase their consumer base.

There’s also growing interest in natural, chemical-free, and organic personal care products. Consumers today prefer plant-based ingredients that are gentle on the skin, especially for sensitive grooming areas. This shift is opening up space for innovation in eco-friendly and skin-friendly hair removal solutions.

Another major growth area is the geographic expansion into developing regions like Southeast Asia, Africa, and Latin America. These areas are witnessing rapid urbanization and increasing awareness about personal care, offering fresh demand. As more consumers in these markets look for affordable and effective grooming options, companies have a great chance to enter and establish themselves early.

Emerging Trends

Rise of DIY Kits and Gender-neutral Branding Shapes Market Trends

Recent trends are reshaping the hair removal products market in interesting ways. One of the biggest shifts is the rise of DIY and at-home hair removal kits. Since the COVID-19 pandemic, people have become more inclined to perform grooming routines at home. Easy-to-use kits like waxing strips, electric trimmers, and depilatory creams offer a convenient alternative to salon visits.

Another trend gaining momentum is gender-neutral marketing. Brands are now launching unisex products that can be used by all genders, promoting inclusivity and expanding their appeal. This approach resonates strongly with younger consumers who value personal choice and diversity.

Sustainability is also influencing buying behavior. More consumers are concerned about environmental impact and prefer products with recyclable or biodegradable packaging. Brands are responding by adopting eco-friendly packaging designs and reducing plastic waste. These trends not only enhance brand image but also help attract a loyal, conscious customer base, making them vital in shaping the future of the market.

Regional Analysis

North America Leads the Global Hair Removal Products Market with 32.6% Share, Valued at USD 1.2 Billion

North America dominates the global hair removal products market, accounting for 32.6% of the total market share and valued at approximately USD 1.2 billion. This leading position can be attributed to high consumer awareness, advanced beauty standards, and a significant focus on personal grooming.

The availability of a wide variety of hair removal products, ranging from traditional razors and waxing kits to technologically advanced at-home laser and IPL devices, contributes to the region’s strong market performance. Additionally, the presence of leading industry players and well-developed distribution networks further reinforce the region’s dominance.

Regional Mentions:

Europe holds the second-largest share in the market, driven by strong demand in countries such as Germany, the UK, and France. The region shows a sustained interest in personal care routines, with consumers seeking convenient and effective hair removal solutions. Innovation in product formulations, as well as the growing trend of sustainable and skin-friendly options, have played a pivotal role in boosting product penetration in this region.

The Asia Pacific region is witnessing rapid growth in the hair removal products market, fueled by rising urbanization, increasing disposable incomes, and a shift toward modern grooming practices. Countries like China, India, and Japan are seeing increased demand for both traditional and modern hair removal solutions. A younger population, coupled with growing influence from global beauty trends, is expanding the consumer base across the region.

The Middle East & Africa market is growing steadily, supported by a youthful demographic and increasing grooming consciousness. Cultural influences and social media exposure are key drivers, with consumers seeking both affordable and effective hair removal products.

Latin America, particularly Brazil and Mexico, is showing significant potential due to strong beauty-conscious consumer behavior. Economic development and access to a broader range of products are contributing to consistent market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global hair removal products market is experiencing robust growth, driven by increasing consumer emphasis on personal grooming and hygiene.

Sally Hansen maintains a strong presence with its diverse range of depilatory creams, appealing to consumers seeking quick and painless hair removal solutions. Vijohnkart.com, with its Feather Touch line, continues to capture the Indian market by offering affordable and effective hair removal creams tailored to local preferences.

SI&D (Aust) Pty Ltd, known for its Nads brand, leverages its reputation for natural formulations, catering to the growing demand for organic and skin-friendly products. Philips Personal Care B.V. remains a leader in the electronic hair removal segment, with its innovative epilators and IPL devices that offer long-term solutions for consumers seeking convenience and efficiency.

Revitol focuses on the niche market of sensitive skin, providing gentle hair removal creams that minimize irritation, thus attracting a loyal customer base. Emjoi, Inc. continues to innovate in the epilator market, offering devices that combine precision and comfort, appealing to users desiring salon-quality results at home.

Helios Lifestyle Private Limited, through its brand The Man Company, taps into the burgeoning male grooming segment, offering products that address the specific needs of male consumers. Procter & Gamble, with its extensive portfolio, leverages its global reach and marketing prowess to maintain a significant share in the hair removal market.

Reckitt Benckiser Group PLC‘s Veet brand remains a household name, continuously innovating with products like Veet Pure, which promises a salon-smooth finish in just five minutes. Church & Dwight Co., Inc., through its Nair brand, sustains its market position by offering a variety of hair removal solutions that cater to different consumer preferences.

Overall, these companies are navigating the competitive landscape by focusing on product innovation, catering to diverse consumer needs, and expanding their global footprints to capitalize on the growing demand for hair removal products.

Top Key Players in the Market

- Sally Hansen

- Vijohnkart.com

- SI&D (Aust) Pty Ltd

- Philips Personal Care B.V.

- Revitol

- Emjoi, Inc.

- Helios Lifestyle Private Limited

- Procter & Gamble

- Reckitt Benckiser Group PLC

- Church & Dwight Co., Inc.

Recent Developments

- In February 2025, HairOriginals secured USD 5 million in a Series A funding round to scale its operations and enhance its presence in international markets. The funding is aimed at expanding the brand’s global footprint and strengthening its supply chain and technology capabilities.

- In July 2024, Moxie Beauty, a D2C haircare brand, raised Rs 17.3 crore in a funding round led by Fireside Ventures. The capital will be used for product innovation, marketing, and expanding distribution channels across India.

- In September 2024, SEEN Hair Care closed a $9 million Series A funding to accelerate its product development and expand into new retail markets. The round reflects growing investor interest in science-backed haircare solutions.

- In December 2024, Arata, a clean and sustainable haircare brand, raised $4 million in Series A funding led by Unilever Ventures. This investment will help the brand focus on R&D, sustainability initiatives, and strengthen its omnichannel presence.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Billion Forecast Revenue (2034) USD 8.4 Billion CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Creams, Ready-To-Use Wax Strips, Electronic Devices, Razors), By Application (Women, Men), By Distribution Channel (Supermarkets& Hypermarkets, Convenience Stores, Drugstores, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sally Hansen, Vijohnkart.com, SI&D (Aust) Pty Ltd, Philips Personal Care B.V., Revitol, Emjoi, Inc., Helios Lifestyle Private Limited, Procter & Gamble, Reckitt Benckiser Group PLC, Church & Dwight Co., Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hair Removal Products MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Hair Removal Products MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sally Hansen

- Vijohnkart.com

- SI&D (Aust) Pty Ltd

- Philips Personal Care B.V.

- Revitol

- Emjoi, Inc.

- Helios Lifestyle Private Limited

- Procter & Gamble

- Reckitt Benckiser Group PLC

- Church & Dwight Co., Inc.