Global Run-of-river hydroelectricity (ROR) Market By Turbine Type(Kinetic Turbine, Reaction Turbine, Propeller Turbine, Others), By Capacity(Small, Medium, Large), By End use(Industrial, Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121103

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

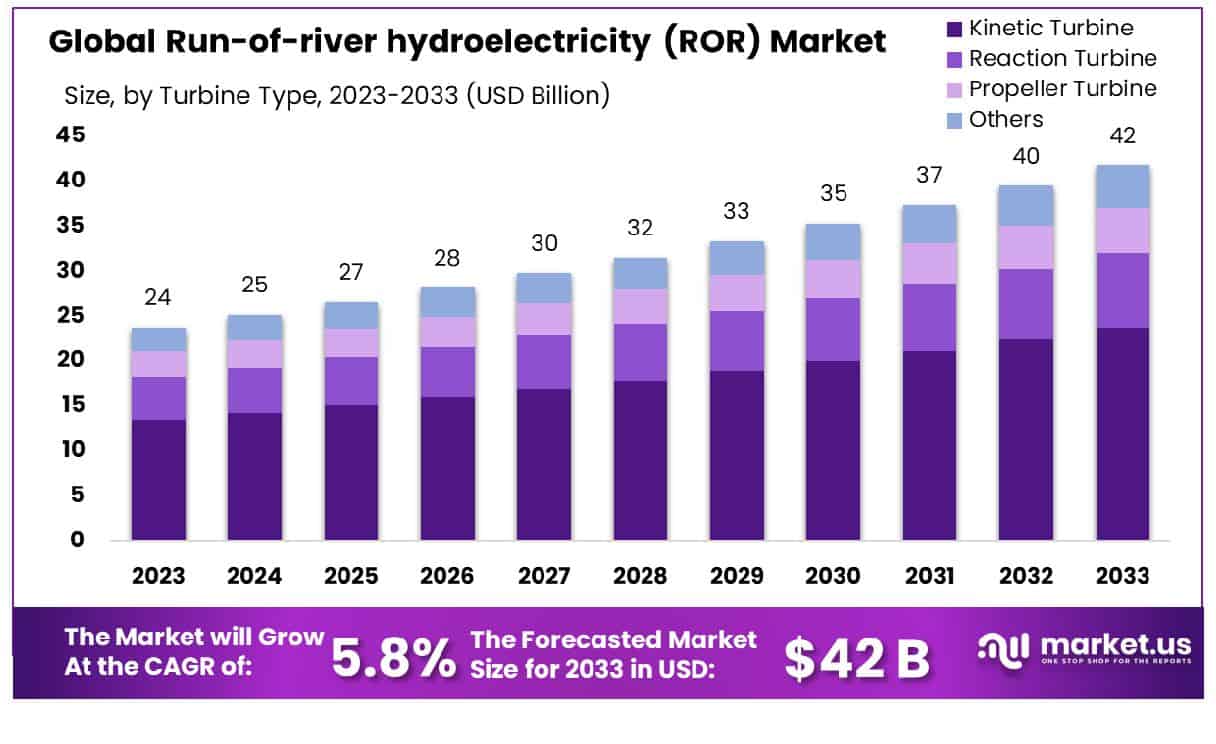

The Global Run-of-river hydroelectricity (ROR) Market size is expected to be worth around USD 42 Billion by 2033, From USD 24 Billion by 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

Run-of-river (ROR) hydroelectricity market refers to the segment of the energy sector that harnesses the natural flow of rivers to generate electricity without the extensive use of reservoirs. This technology captures the kinetic energy of flowing water to operate turbines, offering a sustainable and low-impact energy solution.

Particularly attractive for regions with consistent river flows, the ROR market provides a reliable and renewable power source, contributing to reduced carbon emissions. This market appeals to energy companies and investors seeking sustainable growth opportunities in renewable energy, aligning with global efforts toward achieving greener power generation.

The Run-of-River (ROR) hydroelectricity market has demonstrated notable growth, driven by the strategic deployment of new capacities and heightened energy production. In the period of 2021-2022, electricity generation from ROR sources increased significantly, rising by almost 70 terawatt-hours (TWh), a near 2% increase, culminating at 4,300 TWh. This growth can largely be attributed to an aggressive capacity expansion, particularly noted in China, which accounted for approximately three-quarters of the global increase.

The installation of 32 gigawatts (GW) of new capacity—40% higher than the average of the previous five years—underscores a robust global commitment to renewable energy sources. This trend is reflective of broader environmental objectives, aligning with global efforts to transition towards more sustainable and less ecologically disruptive energy solutions. The ROR market is particularly appealing due to its relatively low environmental impact compared to other hydroelectric methods, positioning it as a preferable choice in the sustainable energy portfolio.

Key Takeaways

- Market Growth: The Global Run-of-river hydroelectricity (ROR) Market size is expected to be worth around USD 42 Billion by 2033, From USD 24 Billion by 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

- Regional Dominance: The European Run-of-river hydroelectricity market holds a 39.1% share, valued at USD 9.3 billion.

- Segmentation Insights:

- By Turbine Type: Kinetic Turbine type dominates with a 56.35% market share.

- By Capacity: Small-capacity turbines hold a 46% share in the market.

- By End-use: Industrial end-use leads significantly, capturing 67.1% market.

- Growth Opportunities: The growing global power demand and shift towards renewable energy are key drivers for the run-of-river hydroelectricity market, offering scalable and environmentally friendly energy solutions.

Driving Factors

Increasing Demand for Renewable Energy Sources

The escalating global emphasis on sustainable development has significantly heightened the demand for renewable energy sources, which serves as a primary catalyst for the Run-of-River (ROR) hydroelectricity market’s expansion. ROR hydroelectricity, being a cleaner and more sustainable alternative to fossil fuels, directly benefits from this shift.

As countries strive to meet their carbon neutrality goals, the adoption of renewable energy technologies like ROR increases. For instance, the International Energy Agency notes that renewable energy capacity is set to expand by 50% between 2019 and 2024, largely propelled by enhanced policies and decreasing technology costs, with hydroelectric power playing a crucial role in this growth.

Government Policies and Incentives Promoting Clean Energy

Government initiatives and financial incentives play a pivotal role in fostering the development of ROR hydroelectricity. Many governments worldwide have introduced various subsidies, tax rebates, and feed-in tariffs specifically designed to reduce the financial burden associated with renewable energy projects.

For example, the European Union’s renewable energy directives and the U.S. Energy Policy Act which provides tax credits for electricity generated from renewable sources, significantly enhance the economic viability of ROR projects. These policies not only lower the initial capital investment required but also assure a stable return on investment, thereby accelerating market growth.

Technological Advancements in ROR Hydropower Turbines and Generators

Technological innovations in turbine and generator design have greatly increased the efficiency and reduced the ecological footprint of ROR hydroelectric systems. Modern turbines are capable of generating more power from the same water flow than older models, and their enhanced design minimizes environmental disruption. Additionally, advancements in materials science have led to more durable and less maintenance-intensive components, which reduce operational costs and extend the lifespan of hydroelectric facilities.

These technological improvements make ROR hydroelectricity a more attractive option for power generation, thus driving market growth. Together, these advancements ensure that ROR hydroelectricity remains at the forefront of renewable energy solutions, aligning with global sustainability objectives.

Restraining Factors

Cumulative Impact of Multiple River Systems on Ecosystems

The environmental impact of Run-of-River (ROR) hydroelectric systems, especially their cumulative effect on aquatic and riparian ecosystems, presents a significant restraint on market growth. ROR projects, despite being less invasive compared to large-scale hydroelectric facilities, can still alter natural water flows, affect sediment transport, and disrupt local wildlife habitats when implemented across multiple river systems.

Such ecological concerns can lead to stringent regulatory challenges, prolonged project approval processes, and increased costs associated with environmental mitigation measures. The apprehension about the ecological footprint of ROR installations, therefore, tempers their expansion, as stakeholders must balance energy production with environmental preservation.

Limited Availability of Suitable River Sites for ROR Hydropower Projects

Another major factor constraining the growth of the ROR hydroelectricity market is the scarcity of suitable river sites. ROR projects require specific hydrological conditions to be economically viable and environmentally feasible. They need rivers with consistent flow rates that do not exhibit extreme seasonal variation. However, suitable sites are often limited and may already be utilized or protected for ecological, cultural, or recreational reasons.

This limitation not only restricts the number of new projects that can be undertaken but also intensifies competition for existing sites, potentially driving up project costs and complicating logistics. This scarcity of ideal locations makes it challenging to scale up ROR hydroelectricity operations to meet growing energy demands, thus impacting the market’s overall growth trajectory.

By Turbine Type Analysis

Kinetic turbines dominate the market, holding a substantial 56.35% share by turbine type.

In 2023, Kinetic Turbine held a dominant market position in the “By Turbine Type” segment of the Run-of-River Hydroelectricity (ROR) Market, capturing more than a 56.35% share. This segment includes various turbine types such as Kinetic Turbines, Reaction Turbines, Propeller Turbines, and others. The substantial market share of Kinetic Turbine can be attributed to their innovative technology and efficient designs tailored for low-head and low-flow water conditions typically found in run-of-river setups.

Reaction Turbines, which include both Francis and Kaplan types, also played a significant role in the market. These turbines are preferred in medium to high-head applications and are known for their durability and high efficiency. Propeller Turbines, similar to Kaplan but typically with fixed blades, are utilized in applications where water flow rates do not vary significantly.

The “Others” category comprises less commonly used turbines like Crossflow and Pelton wheel turbines, each suitable for specific niche applications depending on the hydraulic conditions and desired efficiency.

The dominance of Kinetic Turbines in the ROR market is crucial due to their adaptability to varying water conditions without the need for substantial infrastructure changes, which often results in lower installation and maintenance costs. This adaptability, combined with growing environmental concerns and the push for sustainable energy sources, continues to drive the demand for kinetic and other types of turbines in the run-of-river hydroelectricity sector. This trend is expected to persist as advancements in turbine technology further enhance efficiency and environmental compatibility.

By Capacity Analysis

Small-capacity turbines represent 46% of the market, highlighting their widespread adoption.

In 2023, the “Small” category held a dominant market position in the “By Capacity” segment of the Run-of-River Hydroelectricity (ROR) Market, capturing more than a 46% share. This segment includes various capacity ranges categorized as Small, Medium, and Large. Small ROR installations, typically characterized by capacities up to 10 MW, are increasingly favored due to their lower environmental impact and relatively modest infrastructure requirements, making them ideal for community-based or regional power generation projects.

Medium-sized ROR systems, which range from 10 MW to 100 MW, also constitute a significant portion of the market. These systems are suitable for larger communities and small cities, balancing efficiency and manageable environmental impact. Meanwhile, Large ROR systems, with capacities exceeding 100 MW, are less common due to the greater ecological and social challenges they pose, although they offer substantial power generation capabilities.

The prevalence of Small ROR systems can be attributed to their flexibility and lower cost barriers, which are particularly appealing in developing regions and remote areas where large-scale infrastructure projects are less viable. Additionally, the global shift towards sustainable and renewable energy sources has propelled the adoption of small-scale hydroelectric projects, which align well with regional sustainability goals and policies.

As governments and international bodies intensify their focus on renewable energy, the market for Small ROR systems is anticipated to continue growing. This trend is supported by technological advancements that enhance the efficiency and cost-effectiveness of small hydro installations, making them an increasingly attractive option for renewable energy developers globally.

By End-use Analysis

Industrial applications lead in end-use, accounting for 67.1% of the market share.

In 2023, the “Industrial” category held a dominant market position in the “By End Use” segment of the Run-of-River Hydroelectricity (ROR) Market, capturing more than a 67.1% share. This segment comprises Industrial, Residential, and Commercial applications. Industrial end users, which include manufacturing facilities, processing plants, and other heavy industry users, significantly benefit from the reliable and consistent power supply offered by ROR systems, aligning with their high energy demands.

Residential and Commercial categories also contribute to market dynamics but to a lesser extent. Residential use typically involves smaller-scale ROR systems that provide power to individual homes or small communities, often in remote or off-grid areas. On the other hand, Commercial use includes businesses, small enterprises, and institutions that require a sustainable and cost-effective energy supply but usually at scales smaller than industrial applications.

The substantial share held by the Industrial sector is driven by the ongoing global push towards sustainable energy practices, coupled with the industrial sector’s need to reduce operational costs and adhere to increasingly stringent environmental regulations. ROR systems offer a solution that meets these requirements, providing a continuous, low-emission power source that can significantly reduce reliance on fossil fuels.

As industries continue to seek more sustainable and economically feasible energy solutions, the demand within this sector is expected to grow. Technological advancements that improve efficiency and reduce the ecological footprint of ROR systems will further enhance their attractiveness to industrial users, supporting the sector’s expansion in the global ROR market.

Key Market Segments

By Turbine Type

- Kinetic Turbine

- Reaction Turbine

- Propeller Turbine

- Others

By Capacity

- Small

- Medium

- Large

By End use

- Industrial

- Residential

- Commercial

Growth Opportunities

Growing Power Demand and Consumption

The global demand for electricity continues to escalate, driven primarily by burgeoning populations and the rapid economic growth of developing nations. This surge in power consumption necessitates the expansion of energy production capacities, where run-of-river (ROR) hydroelectricity plays a critical role.

ROR hydroelectricity, distinguished by its ability to generate power without substantial storage facilities, aligns well with regions where environmental concerns and land availability limit the feasibility of large-scale reservoirs. As the demand for electricity grows, the strategic placement of ROR projects along smaller rivers and streams provides a sustainable solution that can be scaled and adapted to local conditions, potentially driving substantial growth in this sector.

Shifting Towards Renewable Energy

The shift towards renewable energy sources is a significant factor propelling the ROR hydroelectricity market. Amidst growing environmental concerns and the urgent need for sustainable development, governments and private sectors are increasingly investing in renewable resources to achieve energy security and reduce carbon footprints. ROR hydroelectricity, with its minimal environmental impact compared to traditional hydroelectric plants, offers an attractive alternative.

The technology’s ability to operate with low ecological disruption enhances its appeal in sensitive environments, thus positioning it as a key player in the transition towards greener energy portfolios. This shift is supported by regulatory frameworks and incentives that favor renewable over conventional energy sources, setting a favorable landscape for the growth of the ROR hydroelectricity market.

Latest Trends

Government Support and Regulations

In 2023, government support and regulations have been pivotal in shaping the run-of-river (ROR) hydroelectricity market globally. Enhanced regulatory frameworks and supportive policies, including subsidies and tax incentives, have been strategically implemented to encourage the adoption of ROR hydro projects. These initiatives aim to meet national energy requirements sustainably while complying with international agreements on carbon emissions reduction.

Governments are also facilitating the licensing process for ROR installations, further stimulating market growth. This trend reflects a broader commitment to renewable energy as a cornerstone of future energy strategies, recognizing ROR hydroelectricity for its lower environmental footprint and ability to provide reliable, renewable power.

Increasing Awareness of Environmental Benefits

There is a growing recognition of the environmental benefits associated with ROR hydroelectricity among policymakers, businesses, and the general public. Unlike traditional hydroelectric power stations, ROR systems do not require large reservoirs, thus preserving natural landscapes and minimizing ecosystem disruptions. This characteristic significantly enhances their appeal, particularly in environmentally sensitive areas.

Educational campaigns and published research highlighting these benefits have led to increased public and corporate interest in investing in ROR technology. The trend towards more eco-conscious energy solutions, coupled with the intrinsic efficiency and reliability of ROR systems, is driving the market forward, aligning with global priorities to tackle climate change and promote sustainable development practices.

Regional Analysis

In 2023, Europe holds a 39.1% share of the global ROR hydroelectricity market, valued at approximately USD 9.3 billion.

The run-of-river hydroelectricity (ROR) market is analyzed across various global regions including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Europe is the dominating region, holding a significant market share of 39.1%, with a valuation of USD 9.3 billion.

This prominence is attributed to rigorous environmental regulations and the adoption of sustainable energy practices across European nations. Europe’s strategic focus on reducing carbon emissions and substantial investments in renewable energy infrastructure contribute to its leadership position.

In North America, the market is driven by advancements in technology and strong governmental support through incentives and policies favoring green energy. The region demonstrates a robust commitment to enhancing the capacity of run-of-river hydroelectricity projects, particularly in Canada where hydroelectric power is a major component of the national energy management system.

Asia Pacific is witnessing rapid growth due to increasing energy demands and the shift towards renewable energy sources in countries like China and India. Governments in the region are actively promoting small-scale hydroelectric projects to leverage abundant river systems and support rural electrification.

The Middle East & Africa region, though smaller in comparison, is experiencing gradual growth. This growth is spurred by the rising awareness of sustainable energy sources and the potential for hydroelectric projects in its numerous untapped rivers and streams.

Latin America, with its extensive river systems, particularly in countries like Brazil and Peru, has a high potential for ROR projects. The region is focused on harnessing this potential to meet its rising energy needs while maintaining environmental sustainability.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global Run-of-River (ROR) hydroelectricity market continues to attract significant attention from both investors and environmentalists due to its minimal environmental impact compared to traditional hydroelectric systems. In 2023, several key players have shaped the dynamics of this market, contributing to its growth and technological advancements.

ABB Ltd and GE Energy remain prominent for their advanced technological contributions, particularly in the development of efficient turbine and generator technologies that enhance the operational capacities of ROR hydroelectric plants. Their focus on integrating digital solutions to optimize water flow and energy production has set a benchmark in the industry.

Andritz Hydro, Alstom Hydro, and IHI Corporation are crucial for their engineering expertise and the successful implementation of turnkey projects worldwide. These companies have excelled in adapting their solutions to diverse geographical and ecological environments, making them vital players in expanding ROR’s reach.

China Hydroelectric Corporation and China Three Gorges Corporation continue to dominate the market in Asia, driven by substantial governmental support. Their large-scale projects demonstrate the scalability of ROR technologies in meeting regional energy demands while adhering to stringent environmental standards.

Lastly, companies like CPFL Energia S.A. and Gerdau S.A. illustrate the market’s diversification, with CPFL Energia expanding into the Latin American market and Gerdau S.A. leveraging its expertise in steel manufacturing to provide durable materials for hydroelectric construction.

Market Key Players

- ABB Ltd

- Alstom Hydro

- Andritz Hydro

- China Hydroelectric Corporation

- China Three Gorges Corporation

- CPFL Energia S.A.

- GE Energy

- Gerdau S.A.

- IHI Corporation

- Sinohydro Corporation

Recent Development

- In March 2024, The Aboitiz Group launched a major bulk water supply project in Davao, enhancing water infrastructure and supporting local hydropower through Hedcor and Apo Agua Infrastructura Inc.

- In February 2022, Researchers at the Technical University of Munich developed new fish-friendly tools to reduce mortality at hydropower plants, aligning with European Green Deal biodiversity goals.

Report Scope

Report Features Description Market Value (2023) USD 24 Billion Forecast Revenue (2033) USD 42 Billion CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Turbine Type(Kinetic Turbine, Reaction Turbine, Propeller Turbine, Others), By Capacity(Small, Medium, Large), By End use(Industrial, Residential, Commercial) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ABB Ltd, Alstom Hydro, Andritz Hydro, China Hydroelectric Corporation, China Three Gorges Corporation, CPFL Energia S.A., GE Energy, Gerdau S.A., IHI Corporation, Sinohydro Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Run-of-river hydroelectricity (ROR) Market Size in 2023?The Global Run-of-river hydroelectricity (ROR) Market Size is USD 24 Billion in 2023.

What is the projected CAGR at which the Global Run-of-river hydroelectricity (ROR) Market is expected to grow at?The Global Run-of-river hydroelectricity (ROR) Market is expected to grow at a CAGR of 5.8% (2024-2033).

List the segments encompassed in this report on the Global Run-of-river hydroelectricity (ROR) Market?Market.US has segmented the Global Run-of-river hydroelectricity (ROR) Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Turbine Type(Kinetic Turbine, Reaction Turbine, Propeller Turbine, Others), By Capacity(Small, Medium, Large), By End use(Industrial, Residential, Commercial)

List the key industry players of the Global Run-of-river hydroelectricity (ROR) Market?ABB Ltd, Alstom Hydro, Andritz Hydro, China Hydroelectric Corporation, China Three Gorges Corporation, CPFL Energia S.A., GE Energy, Gerdau S.A., IHI Corporation, Sinohydro Corporation

Name the key areas of business for Global Run-of-river hydroelectricity (ROR) Market?The Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, Eastern Europe, Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe are leading key areas of operation for Global Run-of-river hydroelectricity (ROR) Market.

Run-of-river hydroelectricity (ROR) MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Run-of-river hydroelectricity (ROR) MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd

- Alstom Hydro

- Andritz Hydro

- China Hydroelectric Corporation

- China Three Gorges Corporation

- CPFL Energia S.A.

- GE Energy

- Gerdau S.A.

- IHI Corporation

- Sinohydro Corporation