Global RTD Cocktail Market Size, Share, And Industry Analysis Report By Type (Spirit-based, Malt-based, Wine-based), By Cocktail Type (Margarita, Cosmopolitan, Manhattan, Martini), By Packaging (Bottles, Cans), By Distribution Channel (Hypermarkets and Supermarkets, Online, Liquor Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172256

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

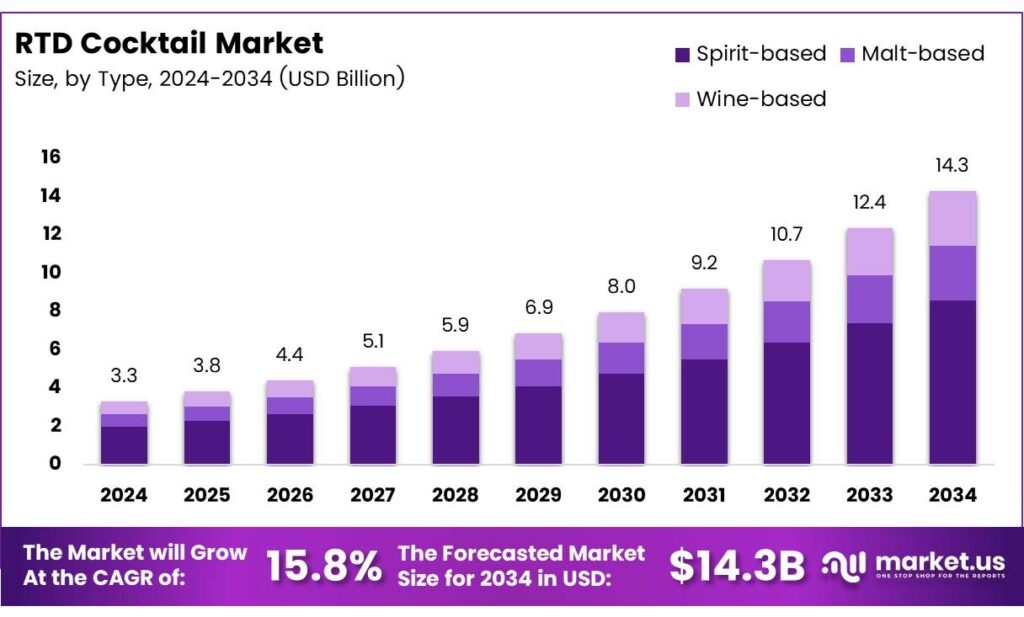

The Global RTD Cocktail Market size is expected to be worth around USD 14.3 billion by 2034, from USD 3.3 billion in 2024, growing at a CAGR of 15.8% during the forecast period from 2025 to 2034.

The RTD cocktail market refers to ready-to-drink alcoholic beverages that combine spirits, mixers, and flavors in pre-measured formats. These products remove preparation complexity while maintaining cocktail authenticity. RTD cocktails sit at the intersection of convenience, premiumization, and controlled consumption, appealing to modern lifestyle-driven alcohol consumers.

The market benefits from changing social habits and at-home consumption trends. Consumers increasingly prefer portable, consistent, and portion-controlled beverages. RTD cocktails support casual occasions like brunches, picnics, and small gatherings, while also fitting urban living patterns. This shift continues to support steady volume and value expansion globally.

Innovation continues to strengthen opportunity creation in the RTD cocktail market. Brands are prioritizing reduced sugar, calorie-conscious recipes, and natural ingredients to match wellness-focused buying behavior. For instance, canned mimosas with 80% less sugar and 60% fewer calories attract health-aware consumers without compromising taste.

- Packaging and formulation consistency remain essential for brand credibility. Premixed cocktails must deliver precise ingredient balance to replicate traditional bar-quality flavors. Packaging ranges from 100ml single-serve cans to 750ml bottles, while alcohol content varies from 4–5% ABV for lighter drinks to 14–22% ABV for spirit-forward options.

Consumption trends further support market momentum. The UK RTD alcoholic beverage market grew 8.1% in value to £866 million, with 37% consumer participation and 61% of buyers aged 18–34. Pandemic-driven adoption increased global RTD cocktail consumption by 43%, reinforcing long-term demand.

Key Takeaways

- The Global RTD Cocktail Market was valued at USD 3.3 billion in 2024 and is projected to reach USD 14.3 billion by 2034, at a CAGR of 15.8% during the forecast period from 2025 to 2034.

- Spirit-based RTD cocktails dominate the market with a 49.8% share due to their versatility and bold flavors.

- Margarita leads the cocktail type segment with a 28.4% market share, driven by its refreshing appeal.

- Bottles hold the largest packaging share at 56.1%, favored for their premium feel and recyclability.

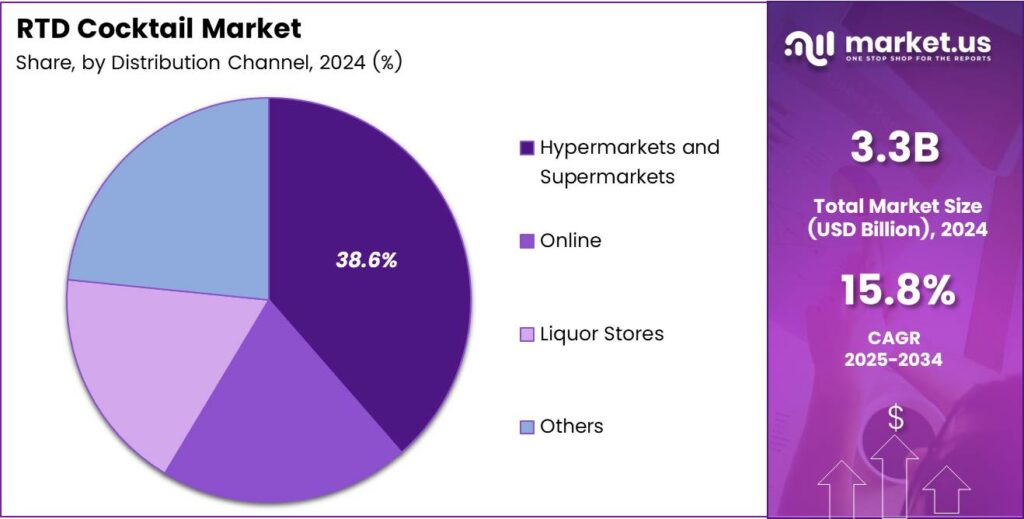

- Hypermarkets and Supermarkets are the leading distribution channels with a 38.6% share due to wide accessibility.

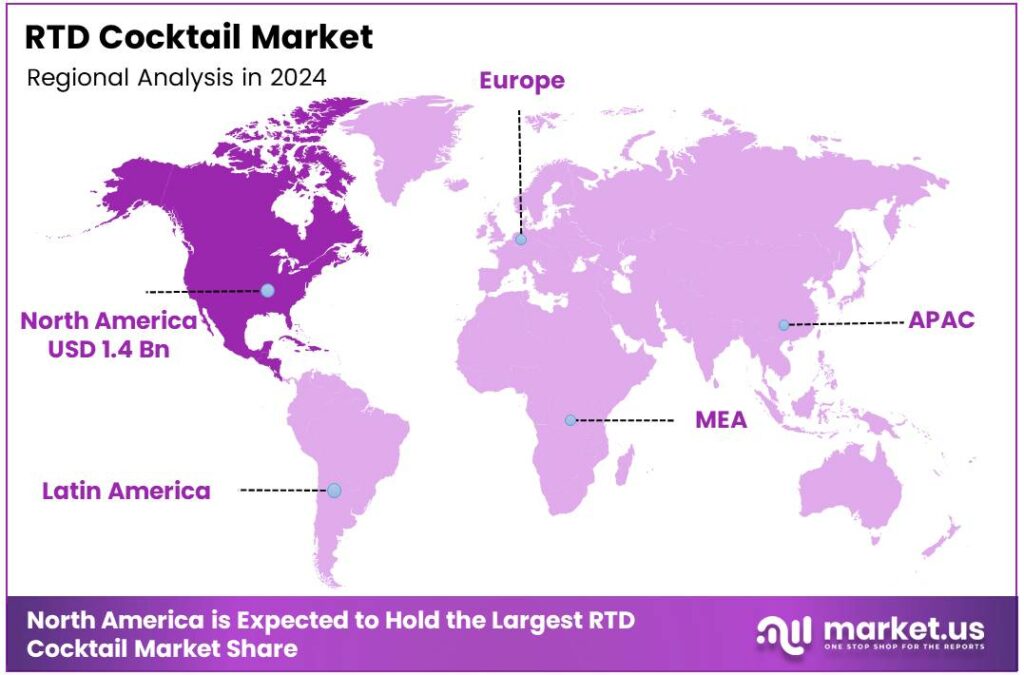

- North America dominates regionally with a 43.8% market share, valued at nearly USD 1.4 billion in 2024.

By Type Analysis

Spirit-based dominates with 49.8% due to its versatility and strong consumer preference for bold flavors.

Spirit-based RTD cocktails lead the market with a commanding 49.8% share, appealing to a wide audience seeking premium, ready-to-drink options. Their base in spirits like vodka and rum allows for diverse flavor profiles, enhancing mixability. Moreover, production efficiencies make them accessible, driving growth. However, competition from healthier alternatives persists, yet innovation keeps them ahead.

Malt-based variants offer a lighter alternative, attracting beer enthusiasts transitioning to cocktails. They blend malt’s familiarity with cocktail creativity, resulting in refreshing options like hard seltzers infused with flavors. Although smaller in share, their low-calorie appeal boosts popularity among health-conscious consumers. Consequently, brands focus on unique recipes to expand this niche.

Wine-based RTD cocktails cater to sophisticated palates, incorporating wines for elegant twists on classics. They emphasize natural ingredients and lower alcohol content, appealing to wellness trends. While not dominant, their premium positioning fosters loyalty in upscale markets. Thus, ongoing flavor experimentation supports steady, albeit modest, growth.

By Cocktail Type Analysis

Margarita dominates with 28.4% due to its refreshing appeal and easy customization.

Margarita RTD cocktails capture a significant 28.4% market share, favored for their tangy lime and tequila base that evokes summer vibes. Convenience in pre-mixed formats suits busy lifestyles, while variations like spicy or fruity enhance appeal. Furthermore, strong branding ties them to social gatherings, solidifying dominance amid rising demand.

Conversely, Cosmopolitan options provide a chic, cranberry-infused experience, popular among urban consumers seeking sophistication. Their vodka foundation offers a smooth, vibrant taste, often linked to pop culture. Though less prevalent, targeted marketing to millennials drives interest, encouraging seasonal editions for broader adoption.

Similarly, Manhattan RTDs deliver a classic whiskey blend with vermouth, attracting aficionados of bold, stirred drinks. They emphasize authenticity in packaging, appealing to traditionalists. Despite a niche following, quality ingredients promote premium pricing, fostering gradual expansion through bar-inspired innovations.

Martini variants focus on gin or vodka purity, offering dry or dirty options for refined tastes. Their elegance suits upscale occasions, with low-sugar versions gaining traction. Although not leading, consistent demand from cocktail enthusiasts supports ongoing recipe refinements.

By Packaging Analysis

Bottles dominate with 56.1% due to their premium feel and recyclability.

Bottles command a robust 56.1% share in RTD cocktail packaging, valued for their elegant presentation and portion control. Glass options convey quality, ideal for sharing or gifting, while preserving flavors effectively. Additionally, eco-friendly designs align with sustainability goals, bolstering consumer loyalty in competitive landscapes.

On the other hand, cans provide portable, lightweight alternatives, perfect for outdoor events and casual consumption. Their quick-chilling property enhances convenience, appealing to younger demographics. Though secondary, aluminum’s recyclability and vibrant graphics drive increasing adoption, especially in active lifestyles.

Furthermore, Others include pouches or cartons, offering flexible, space-saving solutions for on-the-go use. They prioritize affordability and minimal waste, attracting budget-conscious buyers. Despite a smaller presence, innovative resealable features support niche growth, complementing traditional formats.

By Distribution Channel Analysis

Hypermarkets and Supermarkets dominate with 38.6% due to their wide accessibility and promotional displays.

Hypermarkets and Supermarkets hold a leading 38.6% share, serving as one-stop shops for diverse RTD cocktail selections. Their vast aisles enable impulse buys, supported by in-store tastings and deals. Moreover, strategic placements near beverages amplify visibility, making them essential for mass-market reach.

Online channels facilitate convenient home delivery, growing rapidly with the e-commerce boom. They offer a wide variety and reviews, appealing to tech-savvy shoppers. Although not dominant, subscription models and virtual recommendations enhance engagement, expanding access beyond physical stores.

Likewise, Liquor Stores specialize in curated assortments, providing expert advice on RTD options. Their focus on quality and exclusives attracts connoisseurs. While specialized, strong community ties and tastings sustain loyalty, contributing to targeted sales growth.

Key Market Segments

By Type

- Spirit-based

- Malt-based

- Wine-based

By Cocktail Type

- Margarita

- Cosmopolitan

- Manhattan

- Martini

- Others

By Packaging

- Bottles

- Cans

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Online

- Liquor Stores

- Others

Emerging Trends

Premiumization and Health-Conscious Choices Shape RTD Cocktail Market Trends

Premiumization is a key trending factor in the RTD cocktail market. Consumers are shifting toward high-quality ingredients, natural flavors, and well-known spirits. This trend reflects a preference for better taste and brand experience rather than quantity-based consumption.

- The World Health Organization (WHO) reported that global per-capita alcohol consumption fell from 5.7 liters to 5.5 liters, showing a slow but steady move toward moderation. This behavior directly supports demand for lighter RTD cocktails that fit social occasions without heavy drinking.

Health awareness is also influencing trends. Low-calorie, low-sugar, and low-alcohol RTD cocktails are gaining attention. Many consumers seek balanced indulgence without compromising wellness goals. Clear labeling and transparency further support buying decisions.

Drivers

Rising Preference for Convenient Alcoholic Beverages Drives RTD Cocktail Market Growth

The growing demand for convenience is a major driver for the RTD cocktail market. Consumers prefer ready-made drinks that save preparation time and reduce effort. RTD cocktails fit well with busy lifestyles, especially among working professionals and urban consumers. These products offer consistent taste without the need for mixing skills.

- The U.S. Department of Health and Human Services recommends limiting alcohol to up to 1 drink per day for women and 2 for men, reinforcing consumer interest in portion-controlled RTD formats. RTD cocktails naturally fit these limits because they come in fixed can sizes.

The shift in social drinking habits. Home gatherings, casual parties, and outdoor events are increasing, where easy-to-serve beverages are preferred. RTD cocktails provide portion control and reduce wastage compared to traditional spirits. This makes them attractive for both consumers and hosts.

Restraints

High Product Pricing Limits Wider Adoption in the RTD Cocktail Market

One key restraint for the RTD cocktail market is higher pricing compared to traditional spirits or beer. RTD cocktails often include premium ingredients and branded packaging, which raises costs. Price-sensitive consumers may avoid these products, especially in emerging economies.

- Alcohol regulations differ widely across countries, affecting production, labeling, and distribution. Strict rules on alcohol advertising limit brand visibility, making it harder to reach new consumers. In the European Union, excise duties on alcohol can account for over 40% of the retail price of spirits. Licensing requirements further increase operational complexity for manufacturers.

Shelf-life concerns add another restraint. RTD cocktails require proper storage to maintain taste and quality. Any compromise in storage conditions can affect product safety. These factors together slow down market penetration, particularly in regions with limited cold-chain infrastructure.

Growth Factors

Expansion of Online Alcohol Sales Creates New Growth Opportunities

The rise of online alcohol retail presents strong growth opportunities for the RTD cocktail market. E-commerce platforms make it easier for consumers to explore new brands and flavors. Home delivery services increase accessibility, especially in urban areas. This channel supports higher product visibility and consumer engagement.

- Consumers are willing to pay more for craft-style, organic, or low-sugar RTD cocktails. Brands focusing on health-conscious formulations can attract younger demographics. The UN World Tourism Organization (UNWTO) reported 1.3 billion international tourist arrivals, showing renewed interest in regional food and drink experiences.

Limited-edition launches help build brand loyalty and repeat purchases. Geographic expansion into emerging markets is another opportunity. Rising disposable income and westernized lifestyles support alcohol consumption growth. Localized flavors and affordable pack sizes can help brands enter new regions effectively.

Regional Analysis

North America Dominates the RTD Cocktail Market with a Market Share of 43.8%, Valued at USD 1.4 Billion

North America leads the RTD cocktail market, accounting for 43.8% share and reaching nearly USD 1.4 billion in value. High consumer preference for convenience beverages and premium ready-to-drink alcohol strongly supports regional demand. The U.S. drives growth through innovative flavors, sustainable packaging, and wide retail availability. Strong brand penetration and evolving lifestyle consumption further reinforce market dominance.

Europe represents a mature yet steadily expanding RTD cocktail market, supported by changing social drinking habits. Consumers increasingly favor low-alcohol and natural ingredient-based offerings across key countries. Growth is also influenced by café culture, tourism recovery, and the expansion of on-trade and off-trade distribution networks.

Asia Pacific is emerging as a high-growth region due to rapid urbanization and rising disposable incomes. Younger consumers show strong interest in flavored and convenient alcoholic beverages. The expansion of modern retail infrastructure and the increasing acceptance of Western drinking trends continue to accelerate regional adoption.

The Middle East and Africa market remains niche but is gradually expanding within regulated environments. Demand is primarily driven by tourism hubs and premium hospitality sectors. Growth opportunities exist in non-alcoholic and low-alcohol RTD formats aligned with regional consumption norms.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global RTD Cocktail Market in 2024 is witnessing an evolution, driven by a shift toward convenience without compromising on liquid quality. As premiumization becomes the standard, brands are moving toward spirit-based formulations, reflecting a more sophisticated palate among modern consumers prioritizing transparency and flavor integrity.

Ranch Rider Spirits Co. has carved a significant niche by championing the clean label movement within the spirits category. By utilizing real reposado tequila and vodka mixed with sparkling water, they successfully appeal to health-conscious consumers who are increasingly looking for ingredient transparency in their canned cocktails.

House of Delola, LLC leverages celebrity influence and lifestyle branding to capture the growing demand for low-calorie, high-quality spritzes. Their focus on botanicals and natural fruit flavors positions them as a leader in the luxury segment, catering specifically to social, occasion-based drinking.

Diageo plc maintains market dominance by aggressively scaling its most iconic global brands into portable, ready-to-serve formats. Their strategic focus on premium spirit-based RTDs, such as pre-mixed Tanqueray and Ketel One, ensures they capture a broad demographic across diverse international markets.

Brown-Forman remains a powerhouse by capitalizing on high-profile collaborations, most notably the global rollout of the Jack Daniel’s and Coca-Cola cocktail. This synergy between two legendary brands allows them to dominate the whiskey-cola segment while maintaining a reputation for consistency and premium quality.

Top Key Players in the Market

- Ranch Rider Spirits Co.

- House of Delola, LLC

- Diageo plc

- Brown-Forman

- Bacardi Limited

- Asahi Group Holdings, Ltd.

- Pernod Ricard

- Halewood Wines & Spirits

- Shanghai Bacchus Liquor Co., Ltd.

- Suntory Holdings Limited

Recent Developments

- In 2024, Ranch Rider Spirits Co. continues to operate and distribute its spirit-based RTD products (e.g., Ranch Water, Tequila Paloma, and The Buck), as evidenced by ongoing listings in state liquor control boards. Their products appear in the Wyoming Liquor Division’s spirit-based cocktails catalog, confirming availability for wholesale.

- In 2024, Diageo has shown active growth and innovation in the RTD cocktail sector, as detailed in recent SEC filings and industry awards. Diageo reported strong performance in non-alcoholic and low-ABV options, including double-digit growth for Guinness 0.0, and emphasized RTDs’ role in promoting moderation through convenience and lower alcohol content.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Billion Forecast Revenue (2034) USD 14.3 Billion CAGR (2025-2034) 15.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Spirit-based, Malt-based, Wine-based), By Cocktail Type (Margarita, Cosmopolitan, Manhattan, Martini, Others), By Packaging (Bottles, Cans, Others), By Distribution Channel (Hypermarkets and Supermarkets, Online, Liquor Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ranch Rider Spirits Co., House of Delola, LLC, Diageo plc, Brown-Forman, Bacardi Limited, Asahi Group Holdings, Ltd., Pernod Ricard, Halewood Wines & Spirits, Shanghai Bacchus Liquor Co., Ltd., Suntory Holdings Limited Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Ranch Rider Spirits Co.

- House of Delola, LLC

- Diageo plc

- Brown-Forman

- Bacardi Limited

- Asahi Group Holdings, Ltd.

- Pernod Ricard

- Halewood Wines & Spirits

- Shanghai Bacchus Liquor Co., Ltd.

- Suntory Holdings Limited