Global Rotary Drum Cleaner Market Size, Share, Growth Analysis By Product Type (Stationary Rotary Drum Cleaners, Mobile Rotary Drum Cleaners), By Type (25 TPH, 50 TPH, 75 TPH, 100 TPH), By Application (Agriculture, Food Processing, Mining, Waste Management, Others), By Distribution Channel (Direct Sales, Distributors, Online Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177106

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

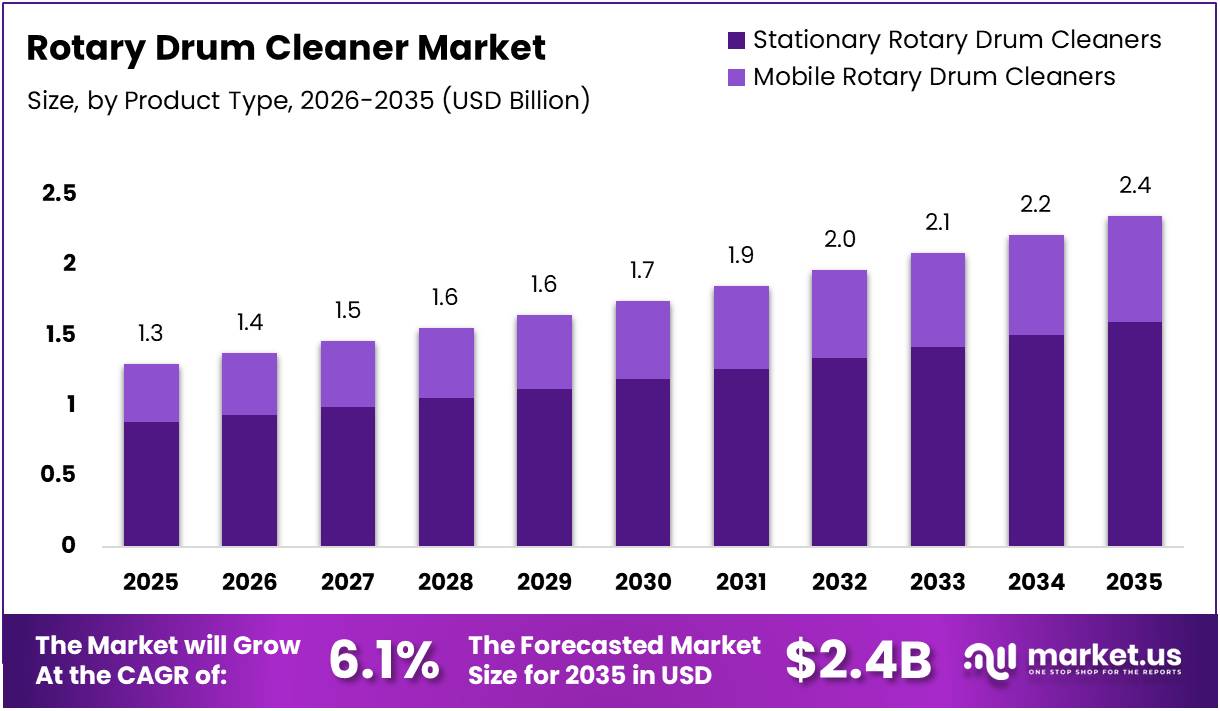

The Global Rotary Drum Cleaner Market size is expected to be worth around USD 2.4 Billion by 2035 from USD 1.3 Billion in 2025, growing at a CAGR of 6.1% during the forecast period 2026 to 2035.

Rotary drum cleaners are mechanical screening devices designed to separate solid particles from liquids in industrial and municipal applications. These systems employ rotating cylindrical screens to continuously filter suspended solids, debris, and contaminants from wastewater streams. Their automated operation significantly reduces manual intervention requirements.

The market encompasses both stationary and mobile configurations serving diverse sectors including agriculture, food processing, mining, and waste management. Moreover, these cleaners feature customizable mesh sizes to accommodate varying particle separation needs. Consequently, they provide efficient solid-liquid separation across multiple industrial processes.

Market growth is driven by increasing infrastructure investments in wastewater treatment facilities globally. Additionally, stricter environmental regulations mandate enhanced effluent quality standards. Therefore, industries are adopting advanced automated screening technologies to ensure compliance and operational efficiency.

Government initiatives promoting sustainable water management practices further accelerate market expansion. However, adoption rates vary across regions based on industrialization levels and regulatory frameworks. Emerging economies are witnessing substantial investments in municipal wastewater infrastructure development.

Technological advancements enable integration of smart monitoring systems and IoT capabilities for predictive maintenance. Furthermore, manufacturers are developing corrosion-resistant materials to extend equipment lifespan in harsh operating environments. These innovations enhance overall system reliability and performance.

According to ResearchGate, rotary drum washers for root crops demonstrated a maximum mechanical washing efficiency of 93.11% and machine efficiency of 94.28% when operated at 15 kg loading weight and 16 rpm speed. Additionally, industrial brush-roller type rotary washers show a 96.75% yield recovery with minimal weight loss of only 3.25% during cleaning processes.

According to ScienceDirect, rotating drum dryers achieve energy utilization rates between 50-95% and specific energy consumption as low as 1.0 kWh/kg. These performance metrics demonstrate the operational efficiency and cost-effectiveness of rotary drum cleaning technologies across various applications.

Key Takeaways

- Global Rotary Drum Cleaner Market projected to reach USD 2.4 Billion by 2035 from USD 1.3 Billion in 2025.

- Market expected to grow at a CAGR of 6.1% during the forecast period 2026-2035.

- Stationary Rotary Drum Cleaners segment dominates with 68.1% market share in 2025.

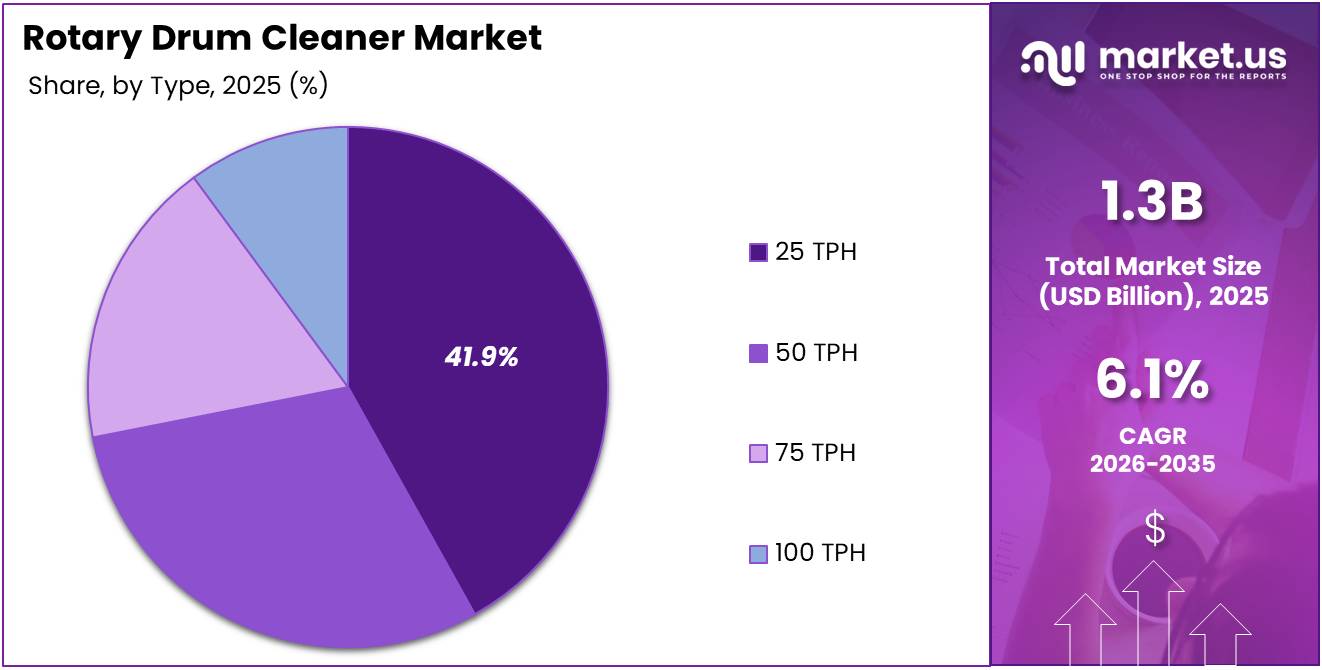

- 25 TPH capacity segment leads with 41.9% share by Type.

- Agriculture application holds 37.8% market share as dominant segment.

- Direct Sales channel accounts for 49.3% of distribution in 2025.

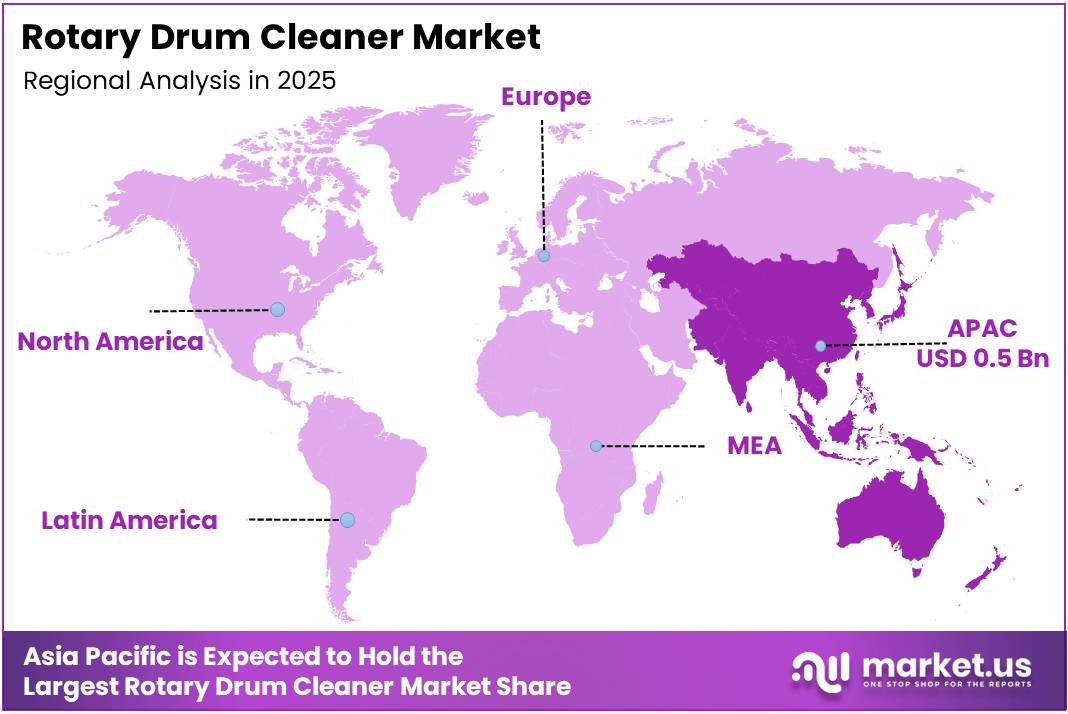

- Asia-Pacific dominates regional market with 39.40% share, valued at USD 0.5 Billion.

Product Type Analysis

Stationary Rotary Drum Cleaners dominate with 68.1% due to continuous operation capabilities and lower maintenance requirements.

In 2025, Stationary Rotary Drum Cleaners held a dominant market position in the By Product Type segment of Rotary Drum Cleaner Market, with a 68.1% share. These systems offer permanent installation advantages for high-volume wastewater treatment facilities requiring consistent performance. Moreover, stationary units provide superior stability and integration with existing infrastructure. Their fixed positioning enables automated continuous operation without relocation needs.

Mobile Rotary Drum Cleaners serve specialized applications requiring flexible deployment across multiple locations. These portable units address temporary wastewater treatment needs at construction sites, emergency response situations, and seasonal agricultural operations. Additionally, mobile configurations offer rapid installation and transportation benefits. However, their market share remains limited due to higher operational complexity and reduced processing capacity.

Type Analysis

25 TPH capacity dominates with 41.9% due to suitability for small to medium-scale operations and cost-effectiveness.

In 2025, 25 TPH held a dominant market position in the By Type segment of Rotary Drum Cleaner Market, with a 41.9% share. This capacity range meets the operational requirements of municipal wastewater facilities and small industrial plants. Furthermore, these systems balance processing efficiency with affordable capital investment. Consequently, they represent the most widely adopted configuration across emerging markets.

50 TPH capacity systems serve medium-sized industrial facilities requiring enhanced throughput capabilities. These units accommodate growing wastewater volumes in food processing and agricultural operations. Moreover, they provide scalability for expanding production facilities. Their adoption increases proportionally with industrial development and urbanization trends.

75 TPH capacity systems serve large-scale industrial facilities and municipal treatment plants requiring high throughput capabilities. These units efficiently handle substantial wastewater volumes from extensive manufacturing operations and urban treatment facilities. Moreover, they provide reliable performance for medium to large infrastructure projects.

100 TPH capacity systems represent the highest throughput category, catering to major mining operations and large municipal complexes. These high-capacity units deliver maximum processing efficiency for facilities managing extreme wastewater volumes. Additionally, they offer economies of scale for major infrastructure investments.

Application Analysis

Agriculture dominates with 37.8% due to extensive irrigation water recycling needs and crop processing requirements.

In 2025, Agriculture held a dominant market position in the By Application segment of Rotary Drum Cleaner Market, with a 37.8% share. Agricultural operations utilize rotary drum cleaners for removing soil, debris, and organic matter from irrigation water. Moreover, these systems clean harvested crops including root vegetables and grains. Therefore, they ensure product quality while minimizing water consumption in processing operations.

Food Processing applications require stringent hygiene standards for cleaning raw materials and managing wastewater streams. These facilities employ rotary drum cleaners to remove solid contaminants from processing water before discharge or recycling. Additionally, food safety regulations mandate effective particulate removal systems. Consequently, adoption continues expanding across dairy, beverage, and meat processing sectors.

Mining operations generate substantial volumes of sediment-laden water requiring efficient solid-liquid separation. Rotary drum cleaners remove mineral particles and tailings from process water before environmental discharge. Furthermore, these systems enable water recycling to reduce freshwater consumption. Their robustness suits harsh mining environments with abrasive materials and challenging operating conditions.

Waste Management facilities employ rotary drum cleaners for municipal wastewater treatment and solid waste processing operations. These systems effectively remove suspended solids and debris from treatment plant influent streams. Moreover, automated screening reduces manual labor requirements while improving operational consistency.

Others segment includes aquaculture operations and industrial effluent processing applications requiring specialized filtration solutions. Fish farming facilities utilize rotary drum cleaners to maintain water quality and remove organic particulates. Additionally, various manufacturing industries deploy these systems for process water treatment.

Distribution Channel Analysis

Direct Sales dominate with 49.3% due to customization requirements and technical support needs.

In 2025, Direct Sales held a dominant market position in the By Distribution Channel segment of Rotary Drum Cleaner Market, with a 49.3% share. Manufacturers engage directly with end-users to provide customized solutions matching specific application requirements. Moreover, direct relationships facilitate technical consultation, installation support, and after-sales service. Therefore, complex industrial equipment purchases predominantly occur through manufacturer sales teams.

Distributors serve regional markets by maintaining local inventory and providing accessible sales channels for standard configurations. These intermediaries offer faster delivery times and localized customer support across geographically dispersed markets. Additionally, distributors reduce manufacturers market entry costs in emerging regions. However, their role remains limited for highly customized or large-scale projects requiring direct manufacturer involvement.

Online Sales channels are emerging for smaller capacity units and replacement components. Digital platforms enable price transparency and simplified purchasing processes for standardized products. Furthermore, online channels reduce transaction costs and expand market reach. Nevertheless, technical complexity and installation requirements limit online adoption primarily to aftermarket parts and accessories rather than complete systems.

Key Market Segments

By Product Type

- Stationary Rotary Drum Cleaners

- Mobile Rotary Drum Cleaners

By Type

- 25 TPH

- 50 TPH

- 75 TPH

- 100 TPH

By Application

- Agriculture

- Food Processing

- Mining

- Waste Management

- Others

By Distribution Channel

- Direct Sales

- Distributors

- Online Sales

Drivers

Rising Demand for Automated Wastewater Treatment Solutions Drives Market Expansion

Municipal and industrial wastewater treatment facilities increasingly adopt rotary drum cleaners for continuous solid-liquid separation capabilities. These automated systems significantly reduce manual cleaning labor while improving operational efficiency and throughput consistency. Moreover, continuous screening operation minimizes process downtime compared to batch treatment methods. Therefore, facilities achieve superior cost-effectiveness and reliability in wastewater management operations.

Stricter environmental regulations mandate efficient removal of suspended solids from industrial and municipal effluents before discharge. Regulatory compliance requires advanced screening technologies capable of meeting stringent particulate removal standards. Additionally, automated equipment reduces human error and ensures consistent treatment quality. Consequently, industries invest in rotary drum cleaners to avoid regulatory penalties and environmental liabilities.

Growing infrastructure investments in emerging economies accelerate adoption of modern wastewater treatment equipment. Governments prioritize water resource management and pollution control through upgraded municipal treatment facilities. Furthermore, industrial expansion creates substantial demand for efficient effluent processing solutions. These combined factors drive sustained market growth across developed and developing regions globally.

Restraints

Performance Limitations and Maintenance Requirements Constrain Market Growth

Rotary drum cleaners demonstrate reduced efficiency when processing highly viscous or fibrous waste streams containing stringy materials. These challenging waste characteristics cause screen clogging and mechanical complications requiring frequent operational interventions. Moreover, fibrous content wraps around rotating components, diminishing separation effectiveness and increasing maintenance frequency. Therefore, alternative screening technologies may prove more suitable for specific waste stream compositions.

Regular maintenance requirements prevent screen clogging and maintain optimal screening efficiency throughout equipment lifespan. Operators must implement scheduled cleaning protocols to remove accumulated debris from mesh surfaces and mechanical components. Additionally, periodic replacement of worn screens and bearings adds ongoing operational costs. Consequently, facilities must balance equipment performance benefits against maintenance resource requirements.

Initial capital investment and installation costs remain substantial for industrial-grade rotary drum cleaning systems. Smaller facilities may find equipment costs prohibitive relative to their operational budgets and wastewater volumes. Furthermore, integration with existing treatment infrastructure may require additional civil works and piping modifications. These financial barriers limit adoption among cost-sensitive operations despite long-term efficiency benefits.

Growth Factors

Infrastructure Development and Technological Innovation Accelerate Market Expansion

Growing infrastructure investments in emerging economies create substantial opportunities for wastewater and sludge management equipment deployment. Rapid urbanization and industrialization increase municipal wastewater volumes requiring advanced treatment solutions. Moreover, governments allocate significant budgets toward environmental infrastructure development and water quality improvement programs. Therefore, equipment suppliers access expanding markets with favorable growth conditions and sustained demand.

Increasing use of rotary drum cleaners in aquaculture and seawater intake applications diversifies market opportunities beyond traditional wastewater treatment. Fish farming operations require continuous water filtration to maintain optimal aquatic environments and prevent disease outbreaks. Additionally, coastal industrial facilities use rotary screens for seawater intake filtration protecting downstream equipment. These emerging applications expand addressable market segments and revenue potential.

Technological upgrades enabling customizable mesh sizes accommodate diverse industrial applications with varying particle separation requirements. Manufacturers develop modular screen designs allowing rapid mesh configuration changes without extensive downtime. Furthermore, advanced materials and coatings improve durability in corrosive environments and abrasive applications. These innovations enhance equipment versatility and performance across multiple industry sectors.

Emerging Trends

Digital Integration and Sustainable Design Transform Equipment Capabilities

Integration of smart sensors and IoT technology enables real-time monitoring and predictive maintenance capabilities for rotary drum cleaners. Connected equipment transmits performance data to cloud platforms for continuous condition assessment and anomaly detection. Moreover, predictive analytics identify potential failures before they occur, reducing unplanned downtime and maintenance costs. Therefore, operators achieve superior equipment reliability and optimize maintenance scheduling efficiency.

Shift toward stainless steel and corrosion-resistant materials extends equipment lifespan in harsh chemical and marine environments. Advanced alloys and protective coatings resist degradation from acidic wastewater, saltwater exposure, and abrasive particulates. Additionally, durable materials reduce replacement frequency and lifecycle costs despite higher initial investment. Consequently, end-users increasingly specify premium materials for long-term operational economics.

Growing preference for low-water-consumption cleaning mechanisms addresses water scarcity concerns and reduces operational costs. Manufacturers develop spray nozzle configurations and backwash systems minimizing freshwater requirements for screen cleaning. Furthermore, water recycling integration enables closed-loop cleaning processes. Adoption of modular rotary drum cleaner designs facilitates easy scalability and simplified maintenance through standardized component replacement.

Regional Analysis

Asia-Pacific Dominates the Rotary Drum Cleaner Market with a Market Share of 39.40%, Valued at USD 0.5 Billion

Asia-Pacific leads global market growth driven by rapid industrialization and expanding wastewater treatment infrastructure investments. In 2025, the region holds 39.40% market share valued at USD 0.5 Billion. Moreover, stringent environmental regulations in China, India, and Japan mandate advanced effluent treatment systems. Consequently, agricultural and industrial sectors increasingly adopt automated screening technologies.

North America Rotary Drum Cleaner Market Trends

North America demonstrates steady demand supported by aging infrastructure replacement and regulatory compliance requirements. United States and Canada prioritize municipal wastewater system upgrades incorporating energy-efficient treatment technologies. Additionally, food processing and mining industries invest in advanced solid-liquid separation equipment. Therefore, the region maintains significant market presence despite mature market conditions.

Europe Rotary Drum Cleaner Market Trends

Europe emphasizes sustainable water management and circular economy principles driving advanced wastewater treatment adoption. Germany, France, and the United Kingdom lead regional markets with stringent environmental standards. Moreover, European manufacturers focus on energy-efficient designs and low-water-consumption technologies. Consequently, the region experiences stable growth supported by technological innovation and environmental policy frameworks.

Latin America Rotary Drum Cleaner Market Trends

Latin America witnesses growing investments in water infrastructure modernization and industrial wastewater treatment capabilities. Brazil and Mexico lead regional adoption driven by agricultural processing and mining sector expansion. Additionally, government initiatives promote environmental compliance and water resource conservation. However, economic constraints may limit adoption rates in smaller markets.

Middle East & Africa Rotary Drum Cleaner Market Trends

Middle East and Africa demonstrate emerging opportunities driven by water scarcity challenges and desalination facility development. Gulf Cooperation Council countries invest heavily in seawater intake filtration and industrial wastewater recycling systems. Moreover, mining operations in South Africa require robust solid-liquid separation technologies. Therefore, the region shows promising growth potential despite current market size limitations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Buhler AG maintains a leading position through comprehensive grain processing and food technology solutions including advanced cleaning equipment. The company leverages extensive global presence and technological expertise to serve agricultural and food processing sectors. Moreover, Buhler emphasizes innovation in automated cleaning systems with enhanced efficiency and sustainability features. Their established reputation and integrated equipment portfolios strengthen competitive positioning across multiple market segments.

Satake Corporation specializes in rice processing machinery and grain handling equipment incorporating rotary cleaning technologies. The company serves Asian agricultural markets with customized solutions addressing regional crop processing requirements. Additionally, Satake invests in research and development for improved cleaning efficiency and reduced operational costs. Their strong regional presence and technical support networks enhance market penetration particularly across Asia-Pacific.

PETKUS Technologie GmbH focuses on seed processing and grain cleaning equipment featuring advanced separation technologies. The company provides specialized solutions for agricultural cooperatives and seed production facilities requiring precise cleaning capabilities. Furthermore, PETKUS emphasizes modular system designs enabling flexible configuration for diverse crop types. Their technical expertise and application-specific engineering support differentiate offerings in competitive markets.

Cimbria A/S delivers comprehensive grain handling and processing systems including rotary drum cleaners for agricultural applications. The company maintains global distribution networks ensuring accessible service and parts availability across international markets. Moreover, Cimbria develops integrated solutions combining cleaning, drying, and storage equipment for complete facility installations. Their turnkey project capabilities and industry experience attract large-scale agricultural processing customers.

Key Players

- Alvan Blanch Development Company Ltd

- Buhler AG

- Cimbria A/S

- Grain Cleaning, LLC

- Kice Industries, Inc.

- Lambton Conveyor Limited

- Milltec Machinery Pvt Ltd

- Oliver Manufacturing Co., Inc.

- PETKUS Technologie GmbH

- Satake Corporation

Recent Developments

- October 2025 – Smith & Loveless Australia Pty. Ltd. announced the acquisition of CST Wastewater Solutions Pty. Ltd., expanding their wastewater treatment equipment portfolio and strengthening market presence across Australian municipal and industrial sectors.

- September 2025 – Parkson Corporation acquired assets of Pulsed Hydraulics Inc., enhancing their screening and filtration technology capabilities while broadening product offerings for water and wastewater treatment applications globally.

Report Scope

Report Features Description Market Value (2025) USD 1.3 Billion Forecast Revenue (2035) USD 2.4 Billion CAGR (2026-2035) 6.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Stationary Rotary Drum Cleaners, Mobile Rotary Drum Cleaners), By Type (25 TPH, 50 TPH, 75 TPH, 100 TPH), By Application (Agriculture, Food Processing, Mining, Waste Management, Others), By Distribution Channel (Direct Sales, Distributors, Online Sales) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Alvan Blanch Development Company Ltd, Buhler AG, Cimbria A/S, Grain Cleaning LLC, Kice Industries Inc., Lambton Conveyor Limited, Milltec Machinery Pvt Ltd, Oliver Manufacturing Co. Inc., PETKUS Technologie GmbH, Satake Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alvan Blanch Development Company Ltd

- Buhler AG

- Cimbria A/S

- Grain Cleaning, LLC

- Kice Industries, Inc.

- Lambton Conveyor Limited

- Milltec Machinery Pvt Ltd

- Oliver Manufacturing Co., Inc.

- PETKUS Technologie GmbH

- Satake Corporation