Global Roasted Coffee Market Size, Share, And Industry Analysis Report By Product (Arabica, Robusta), By Distribution Channel (B2B, B2C, Hypermarkets and Supermarkets, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173626

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

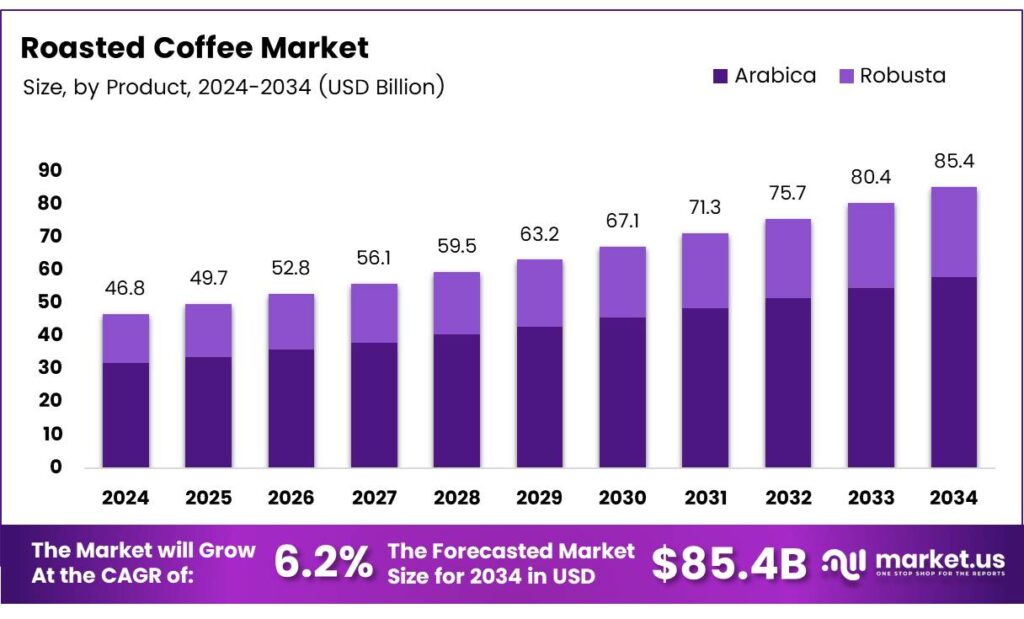

The Global Roasted Coffee Market size is expected to be worth around USD 85.4 billion by 2034, from USD 46.8 billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

The Roasted Coffee Market covers the commercial production, distribution, and consumption of green coffee beans transformed through controlled roasting processes. Broadly, it serves households, foodservice operators, cafes, and ready-to-brew segments. Importantly, roasting defines aroma, flavor strength, shelf stability, and consumer perception across premium, specialty, and mass-market coffee formats.

Roasted coffee demand continues to expand due to urban lifestyles and daily caffeine routines. Moreover, growth is supported by rising café culture, premiumization, and convenient brewing formats. As disposable incomes improve, buyers increasingly trade up to dark roast profiles, origin-specific blends, and consistent quality roasted beans.

- Specifically, chlorogenic acids decrease from 15.72% to 1.71% in Arabica and from 19.42% to 1.72% in Robusta with higher roasting degrees, according to Food Chemistry. Further, about 30% of CGAs convert into chlorogenic lactones through dehydration and hydrolysis reactions during roasting.

Opportunities are emerging through product storytelling and blending innovation. For instance, elegant packs such as 1Kg (35.2oz) Colombian Brew with 70% Arabica and 30% Robusta appeal to quality-focused consumers. Dark roast positioning adds intensity and differentiation, while heritage-driven narratives enhance brand recall and repeat purchasing behavior.

Scientifically, roasting impacts functional compounds, influencing health-related messaging. Chlorogenic acids decline as roasting intensifies, affecting antioxidant profiles. This scientific understanding helps roasters balance flavor development with perceived wellness attributes, especially in premium and specialty roasted coffee segments.

Key Takeaways

- The Global Roasted Coffee Market is projected to grow from USD 46.8 billion in 2024 to USD 85.4 billion by 2034, registering a 6.2% CAGR during 2025–2034.

- Arabica is the leading product segment, holding a dominant market share of 65.9% in 2024.

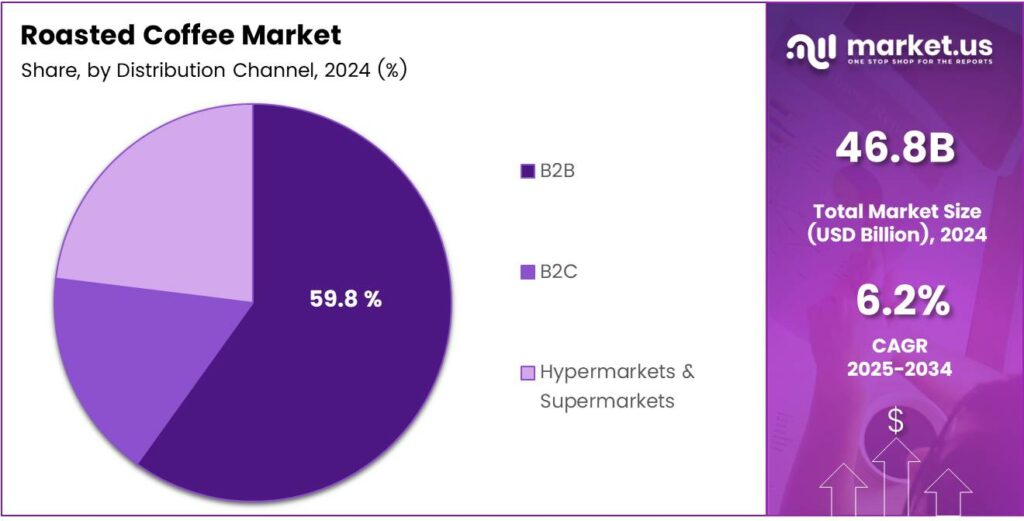

- The B2B distribution channel dominates with a market share of 59.8%, driven by high-volume demand from cafés and foodservice operators.

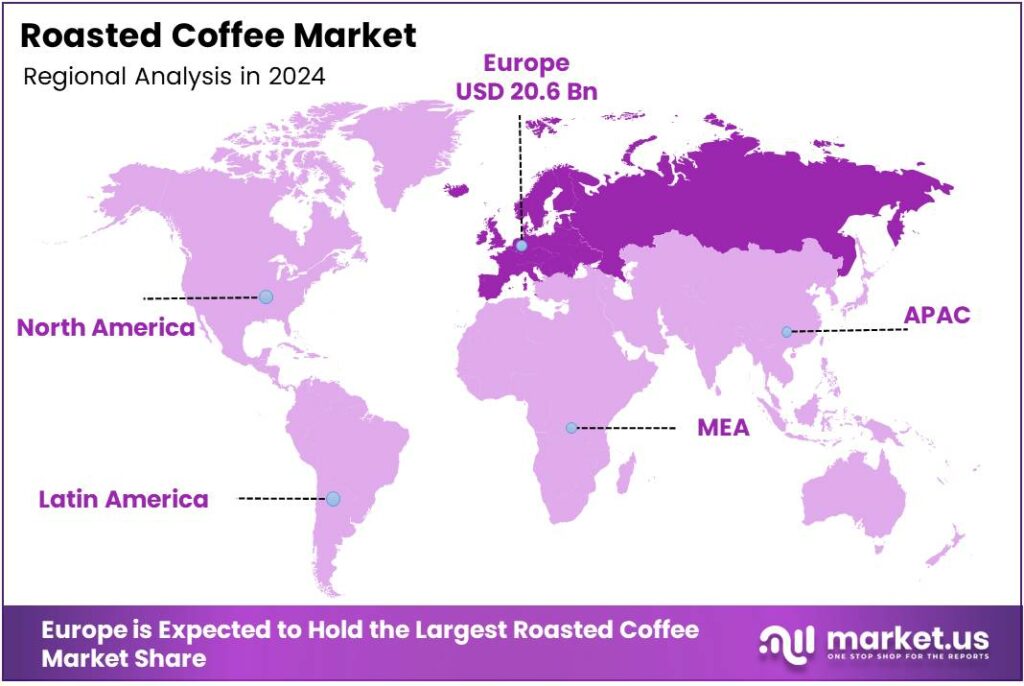

- Europe leads the global market with a 44.2% share, valued at USD 20.6 billion in 2024.

By Product Analysis

Arabica dominates with 65.9% due to its smooth flavor profile, premium positioning, and strong global consumer preference.

In 2024, Arabica held a dominant market position in the By Product Analysis segment of the Roasted Coffee Market, with a 65.9% share. Arabica beans are widely preferred because they offer a smoother taste, lower bitterness, and aromatic complexity. Cafés, specialty roasters, and premium retail brands increasingly focus on Arabica-based roasted coffee offerings.

Robusta plays an important supporting role within the roasted coffee market. Robusta beans are valued for their strong flavor, higher caffeine content, and cost efficiency. Consequently, Robusta is widely used in blends, instant coffee production, and price-sensitive segments.

By Distribution Channel Analysis

B2B dominates with 59.8% due to high-volume procurement by cafés, restaurants, offices, and institutional buyers.

In 2024, B2B held a dominant market position in the By Distribution Channel Analysis segment of the Roasted Coffee Market, with a 59.8% share. This dominance is driven by consistent bulk demand from coffee shops, hotels, restaurants, and corporate offices. These buyers prioritize reliable supply, standardized quality, and long-term vendor relationships.

The B2B channel benefits from the expansion of café chains and foodservice outlets worldwide. As coffee consumption increasingly shifts toward out-of-home experiences, B2B distributors strengthen their role by offering customized roasts, private labeling, and contract-based supply models.

Within B2C, Hypermarkets and Supermarkets remain an important access point for roasted coffee. These stores offer a wide brand selection and competitive pricing. Consequently, they attract price-conscious consumers seeking familiar roasted coffee products while supporting regular household consumption patterns.

Key Market Segments

By Product

- Arabica

- Robusta

By Distribution Channel

- B2B

- B2C

- Hypermarkets and Supermarkets

- Convenience Stores

- Online

- Others

Emerging Trends

Shift Toward Fresh, Craft, and Sustainable Coffee Choices

One key trending factor in the roasted coffee market is the shift toward freshly roasted and craft coffee products. Consumers prefer coffee roasted in small batches, believing it delivers better taste and aroma. This trend supports local roasters and specialty brands.

- Buyers increasingly look for responsibly sourced coffee and environmentally friendly roasting practices. According to the International Coffee Organization, more than 70% of global coffee production comes from smallholder farmers, many of whom face climate and income pressure. This has pushed roasters to adopt ethical sourcing and transparent supply chains.

Digital sales channels are another important trend. Online platforms allow consumers to explore different roasted coffee options and learn about roast profiles easily. Direct-to-consumer sales are growing as convenience becomes a priority. Flavor experimentation is trending, with consumers exploring light, medium, and dark roasts based on personal preference.

Drivers

Rising Global Coffee Consumption and Daily Habit Culture

The roasted coffee market is strongly driven by rising daily coffee consumption across both developed and emerging economies. Coffee has become a routine beverage for millions of consumers, consumed at home, in offices, in cafés, and while traveling. Busy lifestyles and long working hours continue to support demand for ready-to-brew roasted coffee formats.

- Urbanization is another key driver, as city populations increasingly adopt café-style coffee habits. The International Coffee Organization reports that global coffee consumption exceeded 175 million bags in the most recent season. Busy work routines and café culture have made roasted coffee a daily habit rather than an occasional drink.

Consumers are shifting from traditional instant drinks to freshly roasted coffee for better taste and aroma. This change supports higher sales of whole bean and ground roasted coffee products. The growth of coffee shops and specialty cafés also drives market demand. These outlets rely heavily on roasted coffee beans, increasing bulk purchasing from roasters.

Restraints

Volatility in Coffee Bean Prices Limits Market Stability

One major restraint in the roasted coffee market is the fluctuating price of raw coffee beans. Coffee production is highly dependent on weather conditions, making supply unpredictable. Climate change, droughts, and crop diseases often disrupt harvests and raise costs for roasters.

- Large food and coffee organizations are investing in certified and traceable beans. The Food and Agriculture Organization shows that certified coffee production (such as organic and sustainability-labeled coffee) has grown by over 40% in the last decade.

Logistics and transportation costs also act as a restraint. Roasted coffee requires careful handling and timely delivery to preserve freshness. Any disruption in supply chains can lead to higher operating expenses and delayed distribution. Rising competition from alternative beverages such as tea, energy drinks, and functional beverages limits growth in certain consumer groups.

Growth Factors

Expansion of Specialty and Premium Coffee Segments

The roasted coffee market presents strong growth opportunities through the expansion of specialty and premium coffee segments. Consumers are increasingly interested in single-origin beans, artisanal roasting, and unique flavor profiles. This trend creates space for higher-margin roasted coffee products.

Growing home brewing culture opens new opportunities for roasters to offer customized roast levels and grind sizes. Subscription-based coffee delivery services also support steady demand and direct consumer engagement. Emerging markets offer untapped potential as coffee consumption rises among younger populations.

Increased exposure to global café culture encourages the trial of roasted coffee over traditional beverages. Sustainability-focused offerings, such as ethically sourced and responsibly roasted coffee, further enhance market opportunities. Consumers are more willing to support brands that emphasize transparency, quality sourcing, and responsible production practices.

Regional Analysis

Europe Dominates the Roasted Coffee Market with a Market Share of 44.2%, Valued at USD 20.6 Billion

Europe holds a commanding position in the roasted coffee market, driven by deeply rooted coffee-drinking traditions and strong out-of-home consumption. In 2024, the region accounted for a dominant 44.2% share, reaching a value of USD 20.6 billion. High per-capita consumption, premium roast preferences, and widespread café culture continue to support stable demand.

North America represents a mature yet innovative roasted coffee market, supported by strong household consumption and growing demand for premium and specialty roasts. Consumers increasingly prefer single-origin and ethically sourced roasted coffee, especially in urban areas. The region also benefits from well-established retail and foodservice distribution networks.

Asia Pacific shows steady growth in roasted coffee consumption due to rapid urbanization and changing lifestyle habits. Expanding middle-class populations and rising café culture support demand across metropolitan cities. Roasted coffee is gaining acceptance beyond traditional tea-drinking markets. The region also benefits from increasing exposure to global coffee trends and modern retail channels.

Latin America maintains a consistent demand for roasted coffee, supported by strong domestic consumption alongside its role as a coffee-producing region. Consumers show a preference for fresh and locally roasted products. Urban café culture and home brewing trends continue to expand. The market benefits from familiarity with coffee quality and origin-focused consumption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nestlé S.A. stayed a scale leader in roasted coffee in 2024 because it can play across price tiers, formats, and channels at once. Its advantage comes from tight sourcing, strong manufacturing footprints, and the ability to refresh blends and packaging quickly for supermarkets and e-commerce. Its biggest lever is “everyday reliability” plus consistent brand investment, which helps it defend share even when consumers trade down.

JDE Peet’s remained one of the most execution-focused players, with a strong grip on mainstream retail plus selective premium positioning. In 2024, it benefited from disciplined portfolio management—protecting core roasted lines while pushing efficiency in procurement and production. JDE’s edge is operational speed, which matters when green coffee volatility and private-label pressure rise.

Starbucks Corporation continued to influence roasted coffee demand well beyond cafés through branded at-home coffee and ready-to-brew offerings. In 2024, the company’s strength was brand pull—many buyers pay for taste familiarity, roast consistency, and perceived quality. Starbucks sets flavor cues and premium price anchors that shape how other brands position “dark roast, single-origin, and seasonal profiles.

The J.M. Smucker Company held a defensible position through household penetration and value-led roasted coffee options sold at scale. In 2024, Smucker’s practical advantage was shelf strength in grocery and mass retail, supported by steady promotions and dependable supply. It wins on accessibility and routine purchase behavior, making it resilient when shoppers prioritize price-per-cup.

Top Key Players in the Market

- Nestlé S.A.

- JDE Peet’s

- Starbucks Corporation

- The J.M. Smucker Company

- Luigi Lavazza SPA

- STRAUSS Coffee B.V. (Straus Group)

- Melitta Group

- Massimo Zanetti Beverage Group

- Farmer Bros. Co.

Recent Developments

- In 2025, Nestlé unveiled its food and beverage trends, emphasizing flavor mashups, tactile indulgence, and global coffee exploration to drive innovation in its coffee products. Nestlé invested in expanding its coffee plant in Brazil, adding production lines for capsules to meet rising demand.

- In 2025, JDE Peet’s reported strategic and operational progress, confirming its 2025 outlook with Q3 performance in line with expectations and ongoing productivity initiatives. The company unveiled its revamped Innovation Laboratory in Utrecht to accelerate coffee product development, processes, and packaging.

Report Scope

Report Features Description Market Value (2024) USD 46.8 Billion Forecast Revenue (2034) USD 85.4 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Arabica, Robusta), By Distribution Channel (B2B, B2C, Hypermarkets and Supermarkets, Convenience Stores, Online, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Nestlé S.A., JDE Peet’s, Starbucks Corporation, The J.M. Smucker Company, Luigi Lavazza SPA, STRAUSS Coffee B.V. (Straus Group), Melitta Group, Massimo Zanetti Beverage Group, Farmer Bros. Co. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Nestlé S.A.

- JDE Peet’s

- Starbucks Corporation

- The J.M. Smucker Company

- Luigi Lavazza SPA

- STRAUSS Coffee B.V. (Straus Group)

- Melitta Group

- Massimo Zanetti Beverage Group

- Farmer Bros. Co.