Global Roaming Tariff Market Size, Impact of 5G and eSIM Adoption Analysis Report By Service Type (Voice Roaming, Data Roaming, SMS Roaming), By Roaming Type (International Roaming, Domestic Roaming), By Business Model (Retail Roaming, Wholesale Roaming), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 76141

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

- Roaming Tariff Market Size

- Key Takeaways

- Market Overview

- Analysts’ Viewpoint

- Europe Market Expansion

- Service Type Analysis

- Roaming Type Analysis

- Business Model Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Roaming Tariff Market Size

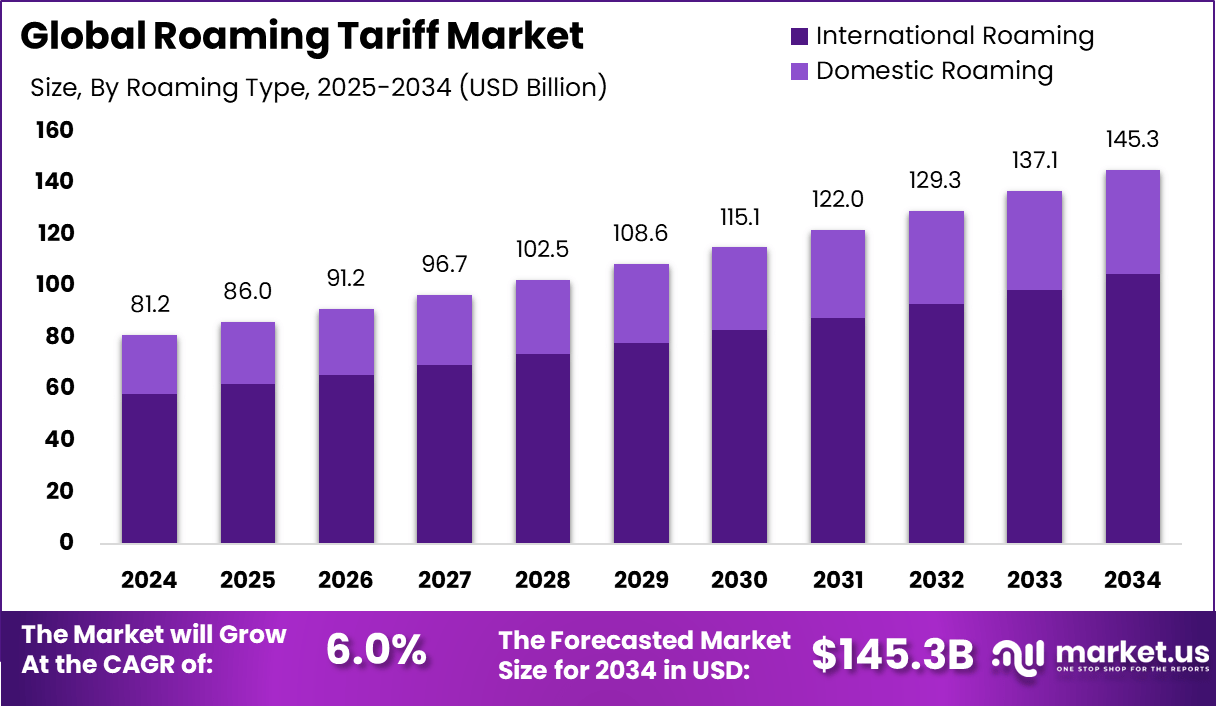

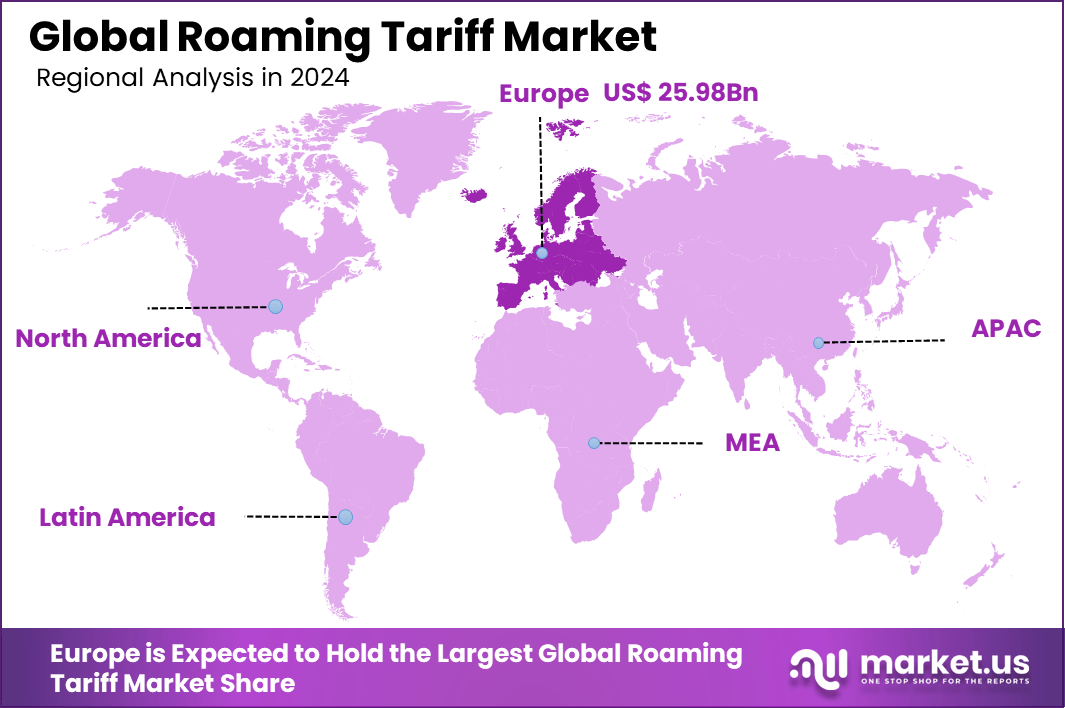

The Global Roaming Tariff Market size is expected to be worth around USD 145.3 Billion By 2034, from USD 81.2 billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 32% share, holding USD 25.98 Billion revenue. Roaming services in Germany are valued at USD 6.49 billion, expanding at a 4.7% CAGR.

The expansion of international travel, increasing mobile subscriber base, and rapid adoption of 5G services across borders are expected to be the primary drivers fueling this steady market growth. Additionally, regulatory reforms promoting fair usage policies and competitive tariff structures are likely to further support long-term expansion.

Moreover, the integration of 5G technology and embedded SIM (eSIM) capabilities is accelerating market adoption. These technologies enable faster speeds, improved reliability, and more personalized roaming experiences, thereby supporting growth across both developed and emerging economies. Regulatory reforms, such as reduced interconnection fees and international roaming agreements among countries, are also playing a pivotal role in market expansion.

According to Market.us’s research, The Global Travel eSIM Market is projected to witness exponential growth, reaching an estimated value of USD 2,60,735 million by 2034, up from USD 2,030.8 million in 2024. This surge reflects an impressive CAGR of 62.50% during the forecast period from 2025 to 2034, signaling a profound transformation in how international travelers access mobile connectivity.

In 2024, the Asia-Pacific region emerged as the undisputed leader in this market, accounting for more than 56.7% of the global share, with total revenues crossing USD 1,151.4 million. The dominance of this region can be attributed to several factors, including the sharp rise in outbound tourism, increasing adoption of digital SIM technology across tech-savvy populations, and robust investments by telecom operators in cross-border mobile services

Key Takeaways

- The Global Roaming Tariff Market is projected to grow from USD 81.2 billion in 2024 to approximately USD 145.3 billion by 2034, registering a steady CAGR of 6.0% during the forecast period.

- Europe dominated the global market in 2024, contributing over 32% share and generating nearly USD 25.98 billion in revenue, driven by a unified telecom regulatory environment and high travel volume across EU nations.

- Germany alone accounted for USD 6.49 billion in roaming service revenue in 2024 and is set to grow at a CAGR of 4.7%, supported by consistent international traffic and strong mobile subscriber penetration.

- By service type, Data Roaming led the market with a 58% share, as rising demand for mobile internet access while abroad outpaced traditional voice or SMS usage.

- International Roaming held a dominant 72% share by roaming type in 2024, highlighting the significance of cross-border telecom activity and partnerships among global carriers.

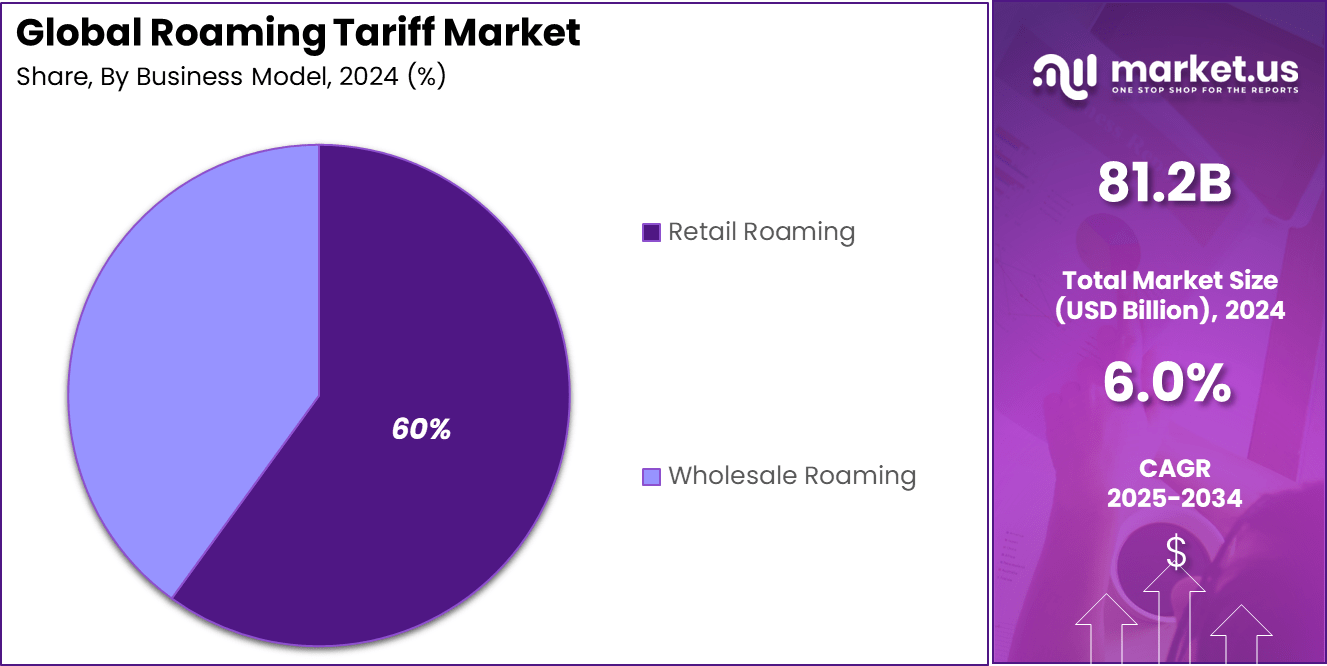

- Based on business models, Retail Roaming captured 60% of the market, underscoring the importance of end-user-driven subscriptions and competitive retail pricing by operators.

Market Overview

The growth of the roaming tariff market is propelled by several key factors. The surge in international travel for both business and leisure has increased the demand for reliable mobile services abroad. Additionally, the widespread adoption of smartphones and mobile applications necessitates consistent connectivity, further fueling the need for roaming services.

The expansion of global trade and cross-border collaborations also contributes to the market’s upward trajectory. The demand for roaming services is closely linked to global mobility trends. As more individuals travel internationally, either for work or personal reasons, the requirement for uninterrupted mobile communication intensifies.

Technological advancements play a pivotal role in shaping the roaming tariff market. The rollout of 5G networks offers enhanced speed and reduced latency, improving the quality of roaming services. The integration of eSIM technology allows users to switch between carriers without the need for physical SIM cards, simplifying the process of accessing roaming services.

Furthermore, the adoption of Wi-Fi calling enables users to make calls over wireless networks, reducing reliance on traditional roaming services. The adoption of advanced technologies in the roaming sector is driven by the need to enhance user experience, reduce operational costs, and increase efficiency. 5G technology provides faster data speeds and improved connectivity, meeting the growing demand for high-quality mobile services.

Analysts’ Viewpoint

The evolving landscape of the roaming tariff market presents numerous investment opportunities. Companies can explore the development of innovative roaming solutions that cater to the needs of modern travelers. Investments in infrastructure to support 5G and eSIM technologies can yield significant returns.

Regulatory frameworks significantly influence the roaming tariff market. In regions like the European Union, regulations have been implemented to eliminate roaming charges within member states, promoting fair pricing and consumer protection. Regulatory bodies continue to monitor and adjust policies to ensure transparency, prevent monopolistic practices, and encourage healthy competition among service providers.

Several factors impact the dynamics of the roaming tariff market. Consumer expectations for affordable and high-quality roaming services drive operators to innovate and offer competitive packages. Technological disruptions, such as the emergence of virtual SIMs and over-the-top (OTT) communication services, challenge traditional roaming models.

Europe Market Expansion

In 2024, Europe held a dominant market position, capturing more than a 32% share, with revenue reaching approximately USD 25.98 billion in the global roaming tariff market. This leadership can be attributed to the well-integrated telecom policies across the European Union, especially the “Roam Like at Home” regulation, which eliminates extra roaming charges for intra-EU travel.

The widespread movement of people for business and tourism within Schengen countries, combined with affordable roaming packages, has driven consistent demand. The region’s advanced mobile infrastructure and high smartphone penetration have further supported roaming usage, encouraging both voice and data services across borders.

Germany alone accounted for USD 6.49 billion in 2024, underscoring its pivotal role within the European roaming landscape. With a CAGR of 4.7%, Germany’s steady growth reflects both domestic regulatory support and increasing outbound travel by German residents.

Service Type Analysis

In 2024, the Data Roaming segment held a dominant market position, capturing more than a 58% share of the global roaming tariff market. This leadership is primarily attributed to the increasing reliance on mobile data services by international travelers.

The widespread use of smartphones and the proliferation of data-intensive applications have significantly elevated the demand for seamless internet connectivity while abroad. Travelers now prioritize data services over traditional voice or SMS, utilizing platforms like video conferencing, social media, and real-time navigation, which necessitate robust data roaming capabilities.

The expansion of 5G networks and the adoption of eSIM technology have further facilitated this growth. These advancements offer users faster data speeds and more flexible connectivity options, enhancing the overall roaming experience. Additionally, the increasing affordability of data roaming packages has made it more accessible to a broader consumer base, encouraging higher usage rates.

This trend underscores a significant shift in consumer behavior, where data connectivity is now considered essential during international travel, thereby solidifying the Data Roaming segment’s leading position in the market.

Roaming Type Analysis

In 2024, the International Roaming segment held a dominant market position, capturing more than a 72% share of the global roaming tariff market. This dominance is primarily attributed to the resurgence of international travel following the easing of pandemic-related restrictions.

The revival of global tourism and business travel has significantly increased the demand for international roaming services, as travelers seek seamless connectivity across borders. Additionally, the proliferation of affordable international roaming packages and the expansion of global mobile networks have facilitated easier access to roaming services, further bolstering this segment’s growth.

The expansion of 5G networks and the adoption of eSIM technology have also played a crucial role in enhancing international roaming experiences. These technological advancements offer faster data speeds and more reliable connections, meeting the growing expectations of international travelers for high-quality mobile services.

Furthermore, strategic partnerships between telecom operators across countries have streamlined roaming agreements, reducing costs and improving service quality. These factors collectively contribute to the International Roaming segment’s leading position in the market and are expected to sustain its growth trajectory in the coming years.

Business Model Analysis

In 2024, the Retail Roaming segment held a dominant market position, capturing more than a 60% share of the global roaming tariff market. This leadership is primarily attributed to the increasing demand for direct-to-consumer roaming services.

The proliferation of smartphones and the growing reliance on mobile data while traveling have led consumers to seek straightforward and cost-effective roaming solutions. Retail roaming offers users the convenience of managing their roaming needs directly through their service providers, without the complexities associated with wholesale agreements.

The expansion of 5G networks and the adoption of eSIM technology have further bolstered the retail roaming segment. These advancements provide travelers with faster data speeds and more flexible connectivity options, enhancing the overall user experience.

Additionally, the introduction of travel-specific data plans and competitive pricing strategies by telecom operators have made retail roaming more accessible and appealing to a broader consumer base. This trend reflects a significant shift in consumer behavior, where the emphasis is on seamless and affordable connectivity during international travel, thereby reinforcing the Retail Roaming segment’s leading position in the market.

Key Market Segments

By Service Type

- Voice Roaming

- Data Roaming

- SMS Roaming

By Roaming Type

- International Roaming

- Domestic Roaming

By Business Model

- Retail Roaming

- Wholesale Roaming

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Surge in Mobile Data Usage During International Travel

The global roaming tariff market is experiencing significant growth, primarily driven by the increasing reliance on mobile data services by international travelers. With the proliferation of smartphones and the widespread use of data-intensive applications such as video conferencing, social media, and real-time navigation, there is a heightened demand for seamless internet connectivity abroad.

The expansion of 5G networks and the adoption of eSIM technology have further facilitated this growth. These advancements offer users faster data speeds and more flexible connectivity options, enhancing the overall roaming experience.

Additionally, the increasing affordability of data roaming packages has made it more accessible to a broader consumer base, encouraging higher usage rates. This trend underscores a significant shift in consumer behavior, where data connectivity is now considered essential during international travel, thereby solidifying the data roaming segment’s leading position in the market.

Restraint

High Roaming Charges and Consumer Awareness

Despite the growth in data roaming services, high roaming charges remain a significant restraint in the market. Many travelers are still wary of incurring substantial costs while using mobile services abroad, leading them to limit their usage or seek alternative solutions such as local SIM cards or Wi-Fi hotspots. This cautious approach can hinder the adoption of roaming services, particularly among price-sensitive consumers.

Moreover, there is a lack of awareness among consumers regarding the availability of affordable roaming packages and the benefits of newer technologies like eSIMs. This information gap can prevent users from taking full advantage of cost-effective roaming solutions, thereby limiting market growth.

To address this issue, telecom operators need to enhance their communication strategies, ensuring that customers are well-informed about the options available to them and the potential savings they can achieve through optimized roaming plans.

Opportunity

Expansion of 5G and eSIM Technologies

The ongoing expansion of 5G networks and the increasing adoption of eSIM technology present significant opportunities for the roaming tariff market. 5G offers faster data speeds, lower latency, and improved network reliability, which can enhance the user experience for international travelers relying on data-intensive applications.

As more countries roll out 5G infrastructure, the demand for high-quality roaming services is expected to rise correspondingly. eSIM technology, which allows users to switch between carriers without changing physical SIM cards, offers greater flexibility and convenience for travelers.

This innovation simplifies the process of accessing local networks and can lead to increased adoption of roaming services. By leveraging these technological advancements, telecom operators can develop more competitive and user-friendly roaming packages, thereby attracting a broader customer base and driving market growth.

Challenge

Regulatory Compliance and Market Fragmentation

Navigating the complex regulatory landscape of the global telecommunications industry poses a significant challenge for the roaming tariff market. Different countries have varying regulations concerning roaming charges, data privacy, and network interoperability, which can complicate the provision of seamless roaming services.

For instance, some regions have implemented strict caps on roaming fees, while others have more lenient policies, leading to inconsistencies that telecom operators must manage. Additionally, the market is fragmented, with numerous players offering diverse services and pricing models. This fragmentation can lead to confusion among consumers and make it difficult for operators to establish standardized offerings.

Growth Factors

Rising Global Travel and Mobile Connectivity

The roaming tariff market is experiencing robust growth, primarily driven by the resurgence of international travel and the increasing demand for seamless mobile connectivity. As global tourism and business travel rebound, travelers are seeking reliable and affordable roaming services to stay connected abroad.

The proliferation of smartphones and the widespread use of data-intensive applications have further amplified the need for comprehensive roaming solutions. Technological advancements, such as the expansion of 5G networks and the adoption of eSIM technology, have also contributed to market growth.

These innovations offer users faster data speeds and more flexible connectivity options, enhancing the overall roaming experience. Additionally, the increasing affordability of data roaming packages has made them more accessible to a broader consumer base, encouraging higher usage rates.

Emerging Trends

eSIM Adoption and IoT Integration

One of the most significant emerging trends in the roaming tariff market is the adoption of eSIM technology. eSIMs allow users to switch between carriers without changing physical SIM cards, offering greater flexibility and convenience for travelers. This innovation simplifies the process of accessing local networks and can lead to increased adoption of roaming services.

Another notable trend is the integration of the Internet of Things (IoT) into roaming services. As more devices become interconnected, there is a growing need for seamless and reliable connectivity across borders. Telecom operators are developing IoT-specific roaming solutions to cater to this demand, opening new revenue streams and expanding the scope of roaming services beyond traditional mobile devices.

Business Benefits

Enhanced Customer Loyalty and Revenue Streams

Offering competitive and user-friendly roaming packages can significantly enhance customer loyalty for telecom operators. By providing seamless connectivity and transparent pricing, operators can improve customer satisfaction and reduce churn rates. Satisfied customers are more likely to remain with their current providers and recommend their services to others, leading to increased market share.

Moreover, the development of tailored roaming solutions for specific customer segments, such as business travelers or frequent tourists, allows operators to tap into new revenue streams. By addressing the unique needs of these segments, telecom companies can differentiate themselves in a competitive market and drive sustainable growth.

Key Player Analysis

Key market players are actively pursuing inorganic growth strategies – including mergers and acquisitions, strategic partnerships, and regional expansions – to strengthen their market position and sustain competitiveness. These moves are largely driven by the rapid evolution of global roaming demands and shifting consumer expectations.

The continued reduction in roaming tariff prices has intensified price-based competition, compelling telecom operators to differentiate not just through cost, but also through value-added services. In response, several companies have begun offering digital-first solutions – such as bundled roaming packages that integrate data, voice, and SMS across regions – to enhance customer convenience and loyalty.

In the global roaming tariff market, leading telecom companies such as AT&T Inc., Verizon Communications Inc., Vodafone Group PLC, and T-Mobile play a critical role in shaping competition. These players have adopted aggressive pricing strategies due to the decreasing cost of roaming tariffs. To maintain user retention, they offer value-added services and digital solutions with bundled plans.

European and Asian providers including Deutsche Telekom AG, China Mobile Ltd., NTT Docomo Inc., and Orange International Carriers are actively involved in strategic expansions. These operators are improving roaming service quality through enhanced network coverage and regional alliances. eSIM and IoT technologies are helping telecom firms offer better cross-border roaming. These tools reduce service gaps and make data usage more transparent for users.

Top Key Players in the Market

- AT&T Inc.

- Verizon Communications Inc.

- Vodafone Group PLC

- T-Mobile

- Deutsche Telekom AG

- China Mobile Ltd.

- NTT Docomo Inc.

- Orange International Carriers

- Telefónica S.A.

- Airtel

- Bharat Sanchar Nigam Limited

- China Telecom Corporation Limited

- Claro Company

- Digicel Group

- Others

Recent Developments

- In February 2024, Bharti Airtel unveiled a new set of in-flight roaming plans starting at just ₹195, signaling a strategic move to capture the growing demand for mid-air connectivity. This initiative enables passengers to stay connected during flights through high-speed internet, voice calls, and other mobile services, thus meeting the rising expectations of Indian flyers who increasingly seek seamless digital access even at cruising altitudes.

- In January 2024, Reliance Jio Infocomm revised its international roaming portfolio, introducing new IR packs specifically for the US and UAE markets, where outbound Indian travel has seen a surge. Notably, the company reduced in-flight roaming charges by over 60%, reflecting a customer-first pricing strategy in response to growing international leisure and business travel.

Report Scope

Report Features Description Market Value (2024) USD 81.2 Bn Forecast Revenue (2034) USD 145.3 Bn CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Voice Roaming, Data Roaming, SMS Roaming), By Roaming Type (International Roaming, Domestic Roaming), By Business Model (Retail Roaming, Wholesale Roaming) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AT&T Inc., Verizon Communications Inc., Vodafone Group PLC, T-Mobile, Deutsche Telekom AG, China Mobile Ltd., NTT Docomo Inc., Orange International Carriers, Telefónica S.A., Airtel, Bharat Sanchar Nigam Limited, China Telecom Corporation Limited, Claro Company, Digicel Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AT&T Inc.

- Verizon Communications Inc.

- Vodafone Group PLC

- T-Mobile

- Deutsche Telekom AG

- China Mobile Ltd.

- NTT Docomo Inc.

- Orange International Carriers

- Telefónica S.A.

- Airtel

- Bharat Sanchar Nigam Limited

- China Telecom Corporation Limited

- Claro Company

- Digicel Group

- Others