Global Rigid Mine Dumper Market Size, Share, Growth Analysis By Type (Mechanical Drive Dumper, Electric Drive Dumper), By Application (Mining Operations, Bulk Material Handling, Construction Sites, Quarrying, Infrastructure Projects), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151198

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

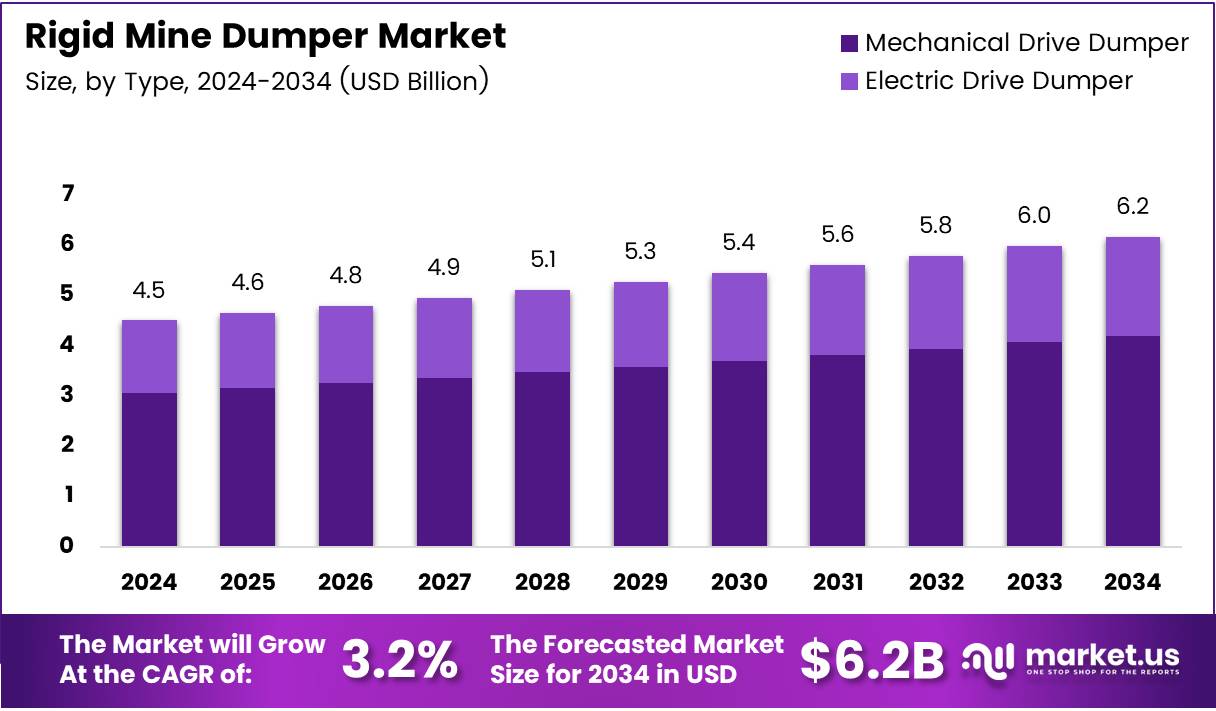

The Global Rigid Mine Dumper Market size is expected to be worth around USD 6.2 Billion by 2034, from USD 4.5 Billion in 2024, growing at a CAGR of 3.2% during the forecast period from 2025 to 2034.

The Rigid Mine Dumper Market is a key segment in the mining and construction industries, where dumpers are crucial for transporting materials across mining sites. These rigid dump trucks are engineered to handle tough terrains and carry heavy loads, typically between 6.5 and 30 tons of material. According to Almarwan, this load capacity range is a significant factor in the dumper’s popularity in mining operations.

The market is expected to grow as mining activities expand globally. The increasing demand for raw materials such as coal, minerals, and metals is fueling the need for efficient transportation solutions. Buildingradar reports that approximately 745,000 construction businesses, including a large number dedicated to commercial projects, indicate strong demand for machinery like rigid mine dumpers. As more mining companies ramp up operations, the need for robust equipment grows, directly boosting market growth.

The opportunity for growth in the rigid mine dumper market is driven by technological advancements. Manufacturers are focusing on producing more efficient, fuel-saving, and environmentally friendly vehicles. Additionally, increasing automation and the adoption of autonomous mining equipment is anticipated to shape future market trends. These innovations not only enhance operational efficiency but also reduce labor costs in the long term.

Government investments and regulations also play a crucial role in shaping the market landscape. Governments worldwide are introducing stricter environmental regulations, pushing for the development of eco-friendly dumpers.

In addition, increased government spending in infrastructure development, especially in emerging economies, is expected to fuel demand for heavy-duty equipment, including rigid mine dumpers. Regulatory frameworks around safety standards are also expected to ensure market players focus on meeting high safety criteria in their vehicle designs.

Key Takeaways

- The Global Rigid Mine Dumper Market is expected to reach USD 6.2 Billion by 2034, growing at a CAGR of 3.2% from 2025 to 2034.

- In 2024, Mechanical Drive Dumper held a dominant market position in the By Type Analysis segment, with a 60.3% share.

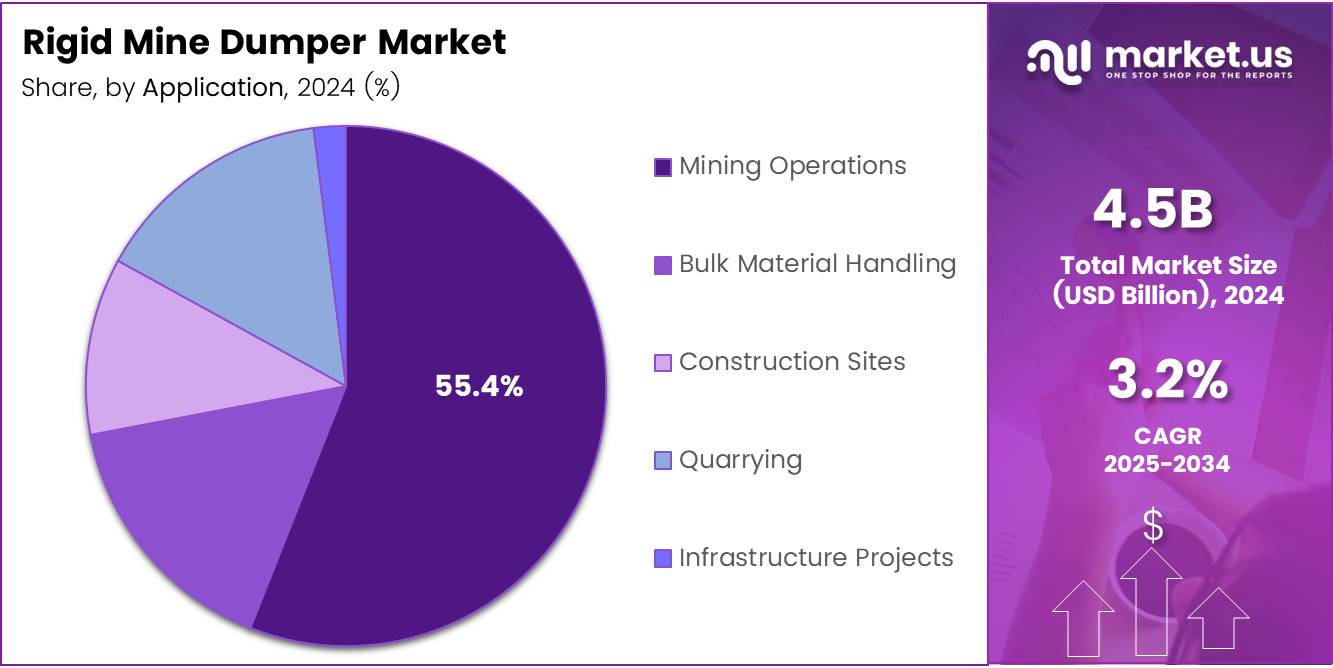

- In 2024, Mining Operations led the By Application Analysis segment, with a 55.4% market share.

- North America holds a 32.5% share of the global Rigid Mine Dumper market, valued at USD 1.5 Billion.

Type Analysis

Mechanical Drive Dumper dominates with 60.3% due to its widespread usage and established infrastructure in mining operations.

In 2024, Mechanical Drive Dumper held a dominant market position in the By Type Analysis segment of the Rigid Mine Dumper Market, with a 60.3% share. This type of dumper is favored in mining operations due to its robust mechanical systems, proven reliability, and ease of maintenance. The adoption of Mechanical Drive Dumpers is propelled by their cost-effectiveness, especially in large-scale mining projects where durability and efficiency are critical.

Electric Drive Dumper, while growing in popularity, accounted for a smaller market share. This type of dumper is seen as more environmentally friendly and efficient, offering lower operational costs in terms of fuel consumption. However, its market penetration is still lower compared to mechanical drive models due to higher initial investment costs and the need for specific infrastructure.

The overall trend shows a strong preference for Mechanical Drive Dumpers, particularly in regions with established mining operations and infrastructure. The electric alternatives are expected to witness growth as the industry gradually shifts towards more sustainable technologies.

Application Analysis

Mining Operations holds the largest market share with 55.4%, driven by ongoing demand for excavation and hauling activities.

In 2024, Mining Operations held a dominant market position in the By Application Analysis segment of the Rigid Mine Dumper Market, with a 55.4% share. The primary driver of this growth is the ongoing demand for efficient and durable equipment in mining sites where rigid dumpers are used for transporting extracted materials. Mining operations require robust, high-capacity dumpers to meet the demands of large-scale excavation projects, making this application the largest market segment.

Bulk Material Handling also contributes significantly to the market, as industries involved in construction and infrastructure rely on dumpers to handle large volumes of materials like sand, gravel, and other aggregates. However, the dominance of Mining Operations indicates that this market is still largely driven by the resource extraction sector.

Other applications, such as Quarrying, Construction Sites, and Infrastructure Projects, also utilize rigid dumpers but represent smaller shares. As the demand for these sectors grows, particularly in emerging markets, these applications are expected to experience steady growth, contributing to the overall market expansion.

Key Market Segments

By Type

- Mechanical Drive Dumper

- Electric Drive Dumper

By Application

- Mining Operations

- Bulk Material Handling

- Construction Sites

- Quarrying

- Infrastructure Projects

Drivers

Increasing Demand for Mining and Construction Activities Drives Market Growth

The demand for mining and construction activities is a major driver for the rigid mine dumper market. As the global demand for minerals and construction materials continues to grow, mining companies need more efficient machinery to transport materials.

Rigid mine dumpers, which are used to carry heavy loads in tough conditions, are essential for mining operations. As these industries expand, the need for reliable and durable dumpers also rises. This results in increased market demand.

Technological advancements in dumper design and fuel efficiency are also contributing to market growth. With improvements in engine technology and fuel-saving features, modern dumpers can operate more efficiently while reducing operating costs. These advancements allow dumpers to carry larger loads while consuming less fuel, making them an attractive choice for mining operations looking to optimize productivity.

Additionally, there is a rising focus on safety standards in mining operations. Regulatory bodies have made safety a priority, ensuring that mining equipment, including dumpers, meet strict guidelines. As safety becomes more emphasized, dumpers equipped with advanced safety features are becoming increasingly popular, further boosting market demand.

Restraints

High Initial Investment and Maintenance Costs Restrain Market Growth

High initial investment and maintenance costs present significant challenges for the rigid mine dumper market. Purchasing these heavy-duty machines requires substantial capital investment, which can be a barrier for smaller mining companies or those with limited budgets. This high upfront cost can discourage companies from upgrading or expanding their fleets.

Moreover, the maintenance and operational costs of rigid mine dumpers are also relatively high. Frequent servicing and replacement of parts are necessary to maintain their performance in harsh mining environments. These ongoing expenses add to the overall cost of ownership, making it harder for companies to justify their purchase or investment in new units.

Additionally, the lack of skilled labor for advanced machinery operation is a restraint in the market. The operation of these dumpers requires highly skilled operators who can handle complex machinery. With a shortage of trained professionals in the workforce, mining companies may face challenges in efficiently utilizing their equipment, which could hinder the overall productivity of operations.

Growth Factors

Adoption of Electric and Hybrid Mine Dumpers Creates Growth Opportunities

One of the most promising growth opportunities in the rigid mine dumper market is the adoption of electric and hybrid mine dumpers. With the increasing focus on reducing environmental impact, mining companies are exploring alternatives to diesel-powered dumpers. Electric and hybrid models offer lower emissions, better fuel efficiency, and reduced operational costs, making them an attractive option for companies looking to meet sustainability goals.

The integration of automation and IoT (Internet of Things) in dumper operations also presents significant growth opportunities. Automation technologies, such as autonomous dumpers, can improve operational efficiency by reducing human error and improving the speed of material transport. IoT integration allows for real-time monitoring of dumper performance, enabling predictive maintenance and ensuring the equipment runs at optimal levels.

Moreover, there is a growing demand for sustainable and eco-friendly equipment. As environmental regulations become stricter, mining companies are increasingly focusing on adopting equipment that minimizes carbon emissions. This shift towards eco-friendly machinery is expected to create a positive impact on the rigid mine dumper market, driving demand for environmentally-conscious solutions.

Emerging Trends

Increasing Focus on Autonomous Mining Vehicles and Smart Technologies Drive Trends

The rigid mine dumper market is witnessing a trend toward increasing adoption of autonomous mining vehicles. Mining companies are investing in autonomous technology to improve the efficiency and safety of operations. Autonomous dumpers can operate continuously without human intervention, allowing for more consistent and reliable transport of materials. This trend is expected to continue growing as technology becomes more advanced and cost-effective.

Another trending factor is the adoption of smart technologies for real-time monitoring. With the integration of sensors and IoT, mine dumpers can now be monitored remotely for issues such as maintenance needs, performance monitoring, and location tracking. This data-driven approach enables mining companies to improve the efficiency and longevity of their equipment while reducing downtime.

Additionally, there is a clear shift towards fuel-efficient and environmentally friendly machinery. As sustainability becomes a core focus in the mining industry, companies are prioritizing equipment that reduces fuel consumption and emissions. This trend is influencing the design and operation of mine dumpers, encouraging manufacturers to develop more energy-efficient models that align with the industry’s growing environmental expectations.

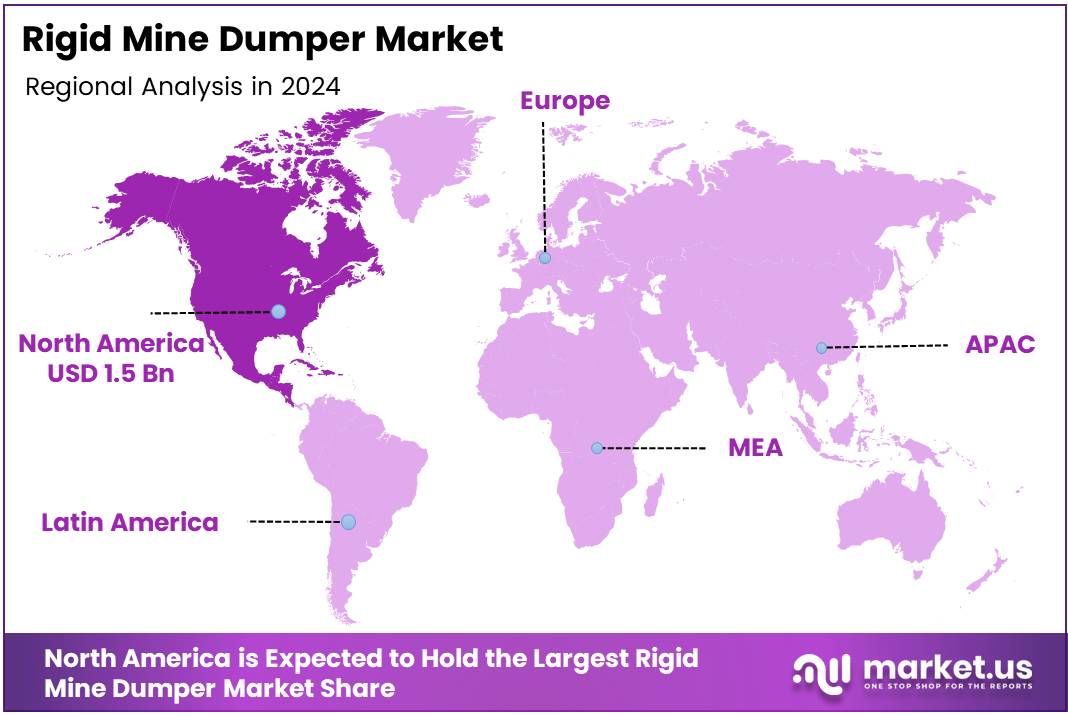

Regional Analysis

North America Dominates the Rigid Mine Dumper Market with a Market Share of 32.5%, Valued at USD 1.5 Billion

North America is the dominant region in the Rigid Mine Dumper market, accounting for 32.5% of the global market share, valued at USD 1.5 Billion. This dominance can be attributed to the strong demand for advanced mining equipment in the region, driven by ongoing mining activities in countries such as the United States and Canada. The region’s well-established mining infrastructure and significant investments in technology and innovation further contribute to the growth of the rigid mine dumper market.

Asia Pacific Rigid Mine Dumper Market Trends

Asia Pacific is a rapidly growing region in the Rigid Mine Dumper market, primarily driven by robust mining activities in countries like China, India, and Australia. The region’s increasing demand for high-efficiency mining equipment to support the growing mining industry is fueling market expansion. Technological advancements and the presence of large-scale mining operations are also expected to drive the region’s market growth.

Europe Rigid Mine Dumper Market Outlook

Europe holds a significant share in the Rigid Mine Dumper market, driven by strong industrial activities and advancements in mining technology. The region benefits from a well-regulated mining industry and a focus on sustainability and efficiency, which influences the adoption of innovative mining equipment. The growing demand for high-capacity dumpers in key European countries such as Germany, Russia, and Sweden is propelling market growth.

Middle East and Africa Rigid Mine Dumper Market Trends

The Middle East and Africa (MEA) region is witnessing steady growth in the Rigid Mine Dumper market, particularly due to ongoing mining operations in countries like South Africa, Saudi Arabia, and Egypt. The region’s increasing focus on natural resource extraction and exploration is expected to drive demand for heavy-duty mining equipment. While the market in MEA is smaller compared to other regions, it holds substantial growth potential due to expanding mining operations.

Latin America Rigid Mine Dumper Market Insights

Latin America is a growing market for rigid mine dumpers, with key contributors such as Brazil, Chile, and Argentina. The region’s rich natural resources and expanding mining sector are central to the demand for advanced mining equipment. The region’s market growth is also supported by increasing foreign investments in mining projects, which boost demand for high-performance dumpers to enhance operational efficiency.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Rigid Mine Dumper Company Insights

In 2024, the global Rigid Mine Dumper Market is being significantly influenced by several key players that dominate the industry with their advanced technologies and strong market presence.

Caterpillar continues to be a major force in the rigid mine dumper market, offering a wide range of mining solutions, including high-efficiency dumpers that deliver superior performance in tough mining conditions. Their extensive global reach and strong after-sales services contribute to their market leadership.

Aerospace Heavy Industry Co., Ltd is enhancing its foothold in the rigid mine dumper market by leveraging cutting-edge technology in the design and manufacturing of robust mining machinery. The company is gaining traction with its reliable and cost-effective solutions that cater to large-scale mining operations.

China Metallurgical Group Corporation is investing heavily in the development of next-generation rigid dumpers, focusing on fuel efficiency and environmental sustainability. The company’s strong engineering capabilities and expanding production capacity are driving its growth within the market.

BelAZ has earned a reputation for manufacturing high-capacity dumpers tailored for mining environments. Known for their durability and performance under extreme conditions, BelAZ’s products are favored by many mining operations, particularly in large-scale mineral extraction projects.

These companies are expected to shape the trajectory of the global Rigid Mine Dumper Market by prioritizing technological innovation and expanding their product portfolios.

Top Key Players in the Market

- Caterpillar

- Aerospace Heavy Industry Co., Ltd

- China Metallurgical Group Corporation

- BelAZ

- Hitachi

- SANG

- Komatsu

- Liebherr

- Inner Mongolia North Hauler Joint Stock Co., Ltd.

- VOLVO

- XCMG

- CRRC

Recent Developments

- In April 2025, Thwaites announced its plans to launch the new Rotator dumper by Q2 2026, marking a significant advancement in their product lineup, focusing on enhanced functionality and performance.

- In May 2024, Oshkosh Corporation revealed its strategic acquisition of AUSA, a move expected to expand its product portfolio and strengthen its presence in the global construction equipment market.

- In November 2024, Coastline Equipment successfully acquired Nevada Transit & Laser, further solidifying its position in the market by incorporating innovative solutions and broadening its service capabilities.

Report Scope

Report Features Description Market Value (2024) USD 4.5 Billion Forecast Revenue (2034) USD 6.2 Billion CAGR (2025-2034) 3.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Mechanical Drive Dumper, Electric Drive Dumper), By Application (Mining Operations, Bulk Material Handling, Construction Sites, Quarrying, Infrastructure Projects) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Caterpillar, Aerospace Heavy Industry Co., Ltd, China Metallurgical Group Corporation, BelAZ, Hitachi, SANG, Komatsu, Liebherr, Inner Mongolia North Hauler Joint Stock Co., Ltd., VOLVO, XCMG, CRRC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Caterpillar

- Aerospace Heavy Industry Co., Ltd

- China Metallurgical Group Corporation

- BelAZ

- Hitachi

- SANG

- Komatsu

- Liebherr

- Inner Mongolia North Hauler Joint Stock Co., Ltd.

- VOLVO

- XCMG

- CRRC