Global Reusable Period Panties Market By Product Type (Brief, Bikini, Boyshort, Hi-waist, Others), By Absorbency Level (Light Flow, Medium Flow, Heavy Flow), By Price Range (Premium, Mid-range, Economy), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133634

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

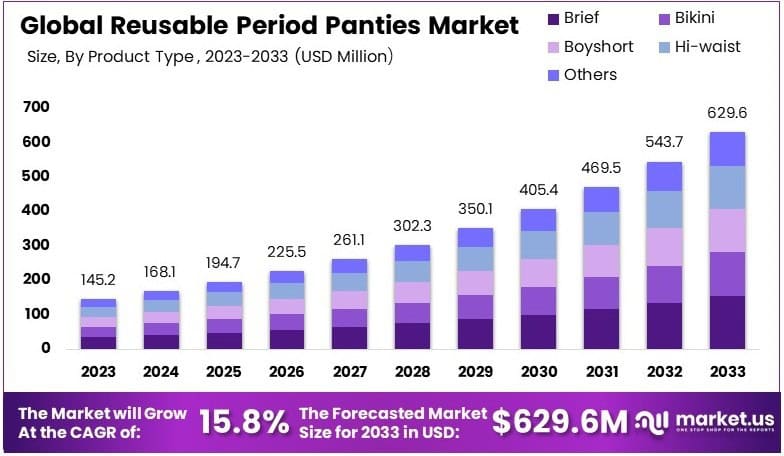

The Global Reusable Period Panties Market size is expected to be worth around USD 629.6 Million by 2033, from USD 145.2 Million in 2023, growing at a CAGR of 15.8% during the forecast period from 2024 to 2033.

Reusable period panties are washable undergarments designed to absorb menstrual flow. Made with multi-layered fabrics, they provide comfort and protection without the need for disposable products. These panties are eco-friendly, cost-effective, and available in various sizes and absorbency levels, appealing to consumers seeking sustainable menstrual solutions.

The reusable period panties market includes the production, distribution, and sale of washable menstrual underwear. It targets consumers looking for sustainable and cost-efficient alternatives to traditional hygiene products. This market spans various demographics, emphasizing comfort, eco-consciousness, and affordability, supported by increasing consumer awareness and product innovation.

Reusable period panties are washable and eco-friendly alternatives to disposable hygiene products. They help reduce waste generated by traditional options, estimated at 200 kg per woman over a lifetime, according to the London Assembly. These panties offer comfort, sustainability, and long-term cost savings, appealing to environmentally conscious consumers globally.

The reusable period panties market is driven by the growing demand for sustainable hygiene products. A 2024 Capital One Shopping survey found that 85% of consumers prefer eco-friendly options, with 10% exclusively buying them. This shift creates opportunities for manufacturers to target an expanding market focused on sustainability and comfort.

Increasing awareness of waste management and environmental impacts boosts the demand for reusable period panties. Rising urbanization and lifestyle shifts further support their adoption. Companies focusing on innovative designs and materials can tap into this demand while addressing the growing consumer interest in durable and eco-conscious solutions.

The market shows moderate saturation with several established players and emerging brands competing. High-quality offerings and unique features drive differentiation. Although smaller companies face barriers, the increasing focus on sustainability and government initiatives promoting waste reduction create room for new entrants to establish themselves in niche markets.

Locally, reusable period panties help reduce waste generation and support small-scale manufacturers. On a broader scale, they contribute to global sustainability goals by addressing environmental challenges. These products align with consumer demand for responsible choices and demonstrate the growing impact of sustainable innovations in personal care industries worldwide.

Key Takeaways

- The Reusable Period Panties Market was valued at USD 145.2 million in 2023 and is expected to reach USD 629.6 million by 2033, with a CAGR of 15.8%.

- In 2023, Briefs dominated the product type segment with 24.6%, reflecting their high consumer preference for comfort and versatility.

- In 2023, Heavy Flow absorbency level led with 64.6%, driven by consumer demand for reliable, high-capacity products.

- In 2023, the Economy price range dominated with 52.7%, attributed to affordability and accessibility to a broad audience.

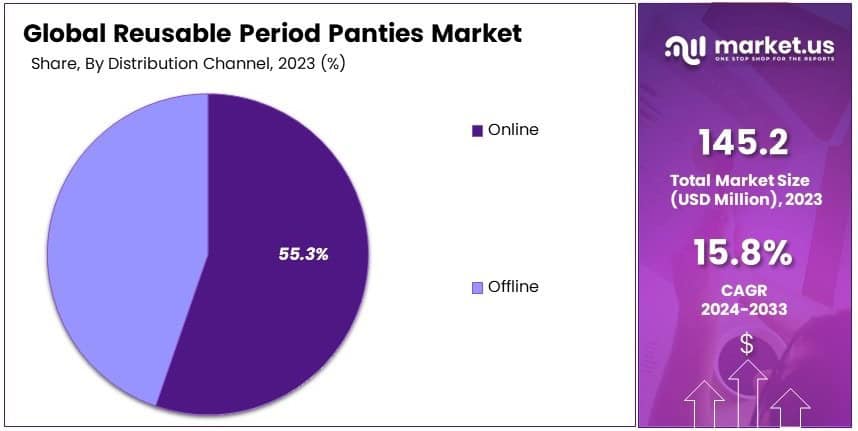

- In 2023, Online distribution channels accounted for 55.3%, highlighting the growing popularity of e-commerce platforms.

- In 2023, North America held the leading market share due to increased consumer awareness and sustainable product adoption.

Product Type Analysis

Briefs dominate with 24.6% due to their comfort and familiarity among consumers.

In the Reusable Period Panties Market, the Product Type segment includes Briefs, Bikinis, Boyshorts, Hi-waist, and Others. Briefs lead the segment with a 24.6% market share, mainly because they offer a familiar fit and sufficient coverage, making them a preferred choice for everyday use. This sub-segment’s growth is supported by consumer preference for traditional cuts that provide comfort and security during menstrual cycles.

Bikinis are popular for their aesthetic appeal and comfort, suitable for light to medium flow days. They cater to a segment of consumers looking for balance between functionality and style.

Boyshorts offer an extended coverage and are favored by those seeking extra protection, especially during physical activities or overnight use.

Hi-waist panties provide high coverage and support, making them ideal for heavy flow days. Their popularity is increasing as they offer additional security against leaks.

The “Others” category includes less common styles that cater to specific preferences or needs, showing the market’s diversity and adaptability to consumer demands.

Absorbency Level Analysis

Heavy Flow products lead with 64.6% due to their high absorbency and reliability.

The Absorbency Level segment is categorized into Light Flow, Medium Flow, and Heavy Flow. Heavy Flow panties dominate this category with a 64.6% share, primarily because of their capability to provide superior protection and confidence during the heaviest days of a menstrual period. This sub-segment benefits from advanced fabric technologies that enhance absorbency without compromising on comfort.

Light Flow panties are designed for days with minimal menstrual discharge or for use as a backup with other menstrual products, providing a lightweight and less bulky option.

Medium Flow panties strike a balance between the Light and Heavy Flow options, offering adequate protection for most days of the menstrual cycle without the need for additional sanitary products.

Price Range Analysis

Economy segment leads with 52.7% as consumers seek cost-effective and sustainable menstrual solutions.

Within the Price Range segment, the categories are Premium, Mid-range, and Economy. Economy period panties hold the majority market share at 52.7%, appealing to a broad consumer base looking for affordable and sustainable menstrual products. This price segment is particularly attractive in developing markets where consumers are more price-sensitive.

Premium products offer high-end features such as enhanced absorbency and special fabric technologies but cater to a smaller, niche market that prioritizes luxury and specialized features over cost.

Mid-range products provide a balance between quality and affordability, targeting the average consumer who seeks effective menstrual solutions without a significant financial outlay.

Distribution Channel Analysis

Online sales dominate with 55.3% due to the convenience and privacy they offer.

The Distribution Channel for reusable period panties includes Offline and Online platforms. The Online channel leads with a 55.3% market share, driven by the convenience of home shopping and the privacy it offers, which are significant factors for many consumers purchasing menstrual products. E-commerce platforms also provide a wider range of options and the ability to easily compare products and prices.

Offline channels, such as retail stores and specialty boutiques, play a crucial role in allowing consumers to physically assess the product before purchasing. However, the trend is shifting towards online purchases as consumers become more comfortable with e-commerce.

Each of these segments demonstrates distinct characteristics and growth drivers that collectively enhance the market dynamics of the Reusable Period Panties industry, catering to diverse consumer needs and preferences across various demographics.

Key Market Segments

By Product Type

- Brief

- Bikini

- Boyshort

- Hi-waist

- Others

By Absorbency Level

- Light Flow

- Medium Flow

- Heavy Flow

By Price Range

- Premium

- Mid-range

- Economy

By Distribution Channel

- Offline

- Online

Drivers

Awareness and Cost-Effectiveness Drive Market Growth

The Reusable Period Panties Market is experiencing notable growth, driven by increasing awareness of sustainable menstrual products. With rising environmental concerns, consumers are seeking eco-friendly alternatives to traditional disposable sanitary items.

Additionally, their cost-effectiveness over time is attracting budget-conscious consumers. Although the initial purchase price is higher, the long-term savings compared to disposable products are a compelling factor for many buyers.

Furthermore, growing focus on personal hygiene and comfort is fueling market demand. Reusable period panties are designed to provide all-day protection with enhanced breathability and softness, meeting the needs of modern consumers. The availability of these products in various absorbency levels and designs has made them versatile for different consumer needs.

Social campaigns advocating for sustainable menstrual health solutions have also played a pivotal role in driving adoption. These campaigns, often led by activists and organizations, normalize reusable products and educate women about their benefits. Increasing endorsements by influencers and celebrities further enhance consumer confidence in making the switch.

Restraints

High Costs and Stigma Restrain Market Growth

Several factors are restraining the growth of the Reusable Period Panties Market. One primary issue is the higher upfront cost compared to disposable options. This price disparity can discourage low-income consumers from switching to reusable products, especially in developing regions.

Additionally, the lack of awareness in rural areas further limits adoption. Many potential users are unaware of the benefits or availability of reusable menstrual products.

Concerns about washing and maintenance convenience also deter some consumers. The need to clean and reuse period panties may feel labor-intensive compared to simply discarding disposable pads. Moreover, cultural taboos and stigma surrounding menstruation continue to hinder market expansion, particularly in conservative societies where open discussions about menstrual health remain rare.

Resistance to changing traditional menstrual habits further delays adoption in these markets. These issues emphasize the need for targeted educational campaigns to reduce stigma and encourage awareness about the benefits of reusable products.

Opportunity

E-Commerce and Material Innovation Provide Opportunities

Expanding e-commerce platforms are creating significant opportunities for the Reusable Period Panties Market. These platforms allow brands to reach a global audience, particularly in underserved regions.

Innovations in materials, such as moisture-wicking fabrics and antimicrobial textiles, further enhance product appeal. These advancements ensure that reusable period panties offer better performance, increasing consumer satisfaction.

Partnerships with NGOs present another promising opportunity. By working with organizations focused on menstrual health, companies can educate underserved communities about sustainable options. The integration of innovative subscription models on e-commerce platforms also facilitates recurring purchases, helping brands establish long-term customer loyalty.

Additionally, customization options, including inclusive sizing and design preferences, help brands cater to diverse consumer needs. The increasing adoption of digital marketing strategies is further enabling companies to tap into new market segments and strengthen their foothold globally.

Challenges

Behavior and Competition Challenge Market Growth

The Reusable Period Panties Market faces several challenges, including strong competition from other sustainable menstrual products like menstrual cups. These alternatives, which have already gained substantial consumer trust, often compete for the same environmentally conscious market segment.

Changing consumer behavior also remains a challenge. Many individuals are reluctant to switch from familiar disposable products to reusable solutions due to ingrained habits.

Lack of infrastructure for disposing of products at the end of their lifecycle poses another issue. Although reusable products reduce waste during use, consumers often lack access to proper disposal options when the product reaches the end of its usability.

Regulatory hurdles in certain regions, where sustainable menstrual products are either unregulated or face bureaucratic barriers, further complicate market dynamics. The limited availability of affordable and efficient washing facilities in some regions also affects adoption.

Growth Factors

Sustainability and Economic Growth Are Growth Factors

The Reusable Period Panties Market is being propelled by increasing environmental concerns. The growing awareness of the impact of disposable menstrual products on the environment is driving consumers toward sustainable solutions.

Rising disposable incomes, particularly in emerging markets, further support the market. Consumers with higher purchasing power are more likely to invest in premium, reusable alternatives.

Government support for sustainable practices also boosts market expansion. Policies promoting eco-friendly products provide a favorable regulatory environment for manufacturers. Additionally, the shift toward a circular economy emphasizes reducing waste and reusing resources, aligning perfectly with the concept of reusable period panties.

The involvement of international organizations promoting menstrual hygiene adds to the momentum. This combination of factors ensures that the market continues on a steady growth trajectory, supported by evolving consumer and institutional priorities.

Emerging Trends

Stylish Designs and Technology Are Latest Trending Factors

Emerging trends are reshaping the Reusable Period Panties Market. The integration of advanced technologies, such as antimicrobial and odor-control fabrics, is a notable development. These features enhance functionality and appeal to hygiene-conscious consumers. Additionally, gender-neutral designs are gaining popularity, aligning with the market’s focus on inclusivity.

Stylish and discreet aesthetics are another growing trend. Modern consumers prefer products that blend functionality with fashion, ensuring confidence and comfort. The influence of social media also plays a critical role.

Platforms like Instagram and TikTok amplify brand visibility, showcasing products and creating awareness among younger demographics. Innovations in packaging and sustainable branding are also trending, further elevating consumer engagement. As consumers increasingly share their positive experiences online, the visibility of reusable period panties continues to grow, driving demand.

Regional Analysis

North America Dominates with Major Market Share

North America leads the Reusable Period Panties Market with a dominant share, attributed to high awareness of sustainable menstrual products and widespread adoption of eco-friendly practices. The region benefits from strong consumer preference for innovative and comfortable alternatives to traditional menstrual products. Active marketing by leading brands and increasing online sales channels further bolster market growth.

Key factors driving the dominance include a high disposable income level, which enables consumers to invest in premium products like reusable period panties. Additionally, well-established retail and e-commerce networks make these products easily accessible to a wide audience. Rising awareness campaigns about menstrual health and sustainability have also contributed to the region’s significant market share.

North America’s advanced textile technology and emphasis on product innovation improve product quality and customer satisfaction. The region’s favorable regulatory environment encourages sustainable product adoption. These dynamics make North America a leading hub for innovation and development in this market.

Regional Mentions:

- Europe: Europe maintains a strong position in the Reusable Period Panties Market, driven by its focus on sustainable practices and high demand for eco-friendly menstrual products. Government policies supporting reusable alternatives further fuel market growth.

- Asia Pacific: Asia Pacific is rapidly expanding its footprint in the Reusable Period Panties Market. Growing awareness of sustainable menstruation solutions and rising disposable incomes in countries like India and China drive significant growth.

- Middle East & Africa: The Middle East & Africa are emerging markets with increasing efforts to improve menstrual health awareness. Rising urbanization and a gradual shift toward eco-friendly products contribute to the region’s potential growth.

- Latin America: Latin America is progressively adopting reusable period panties as sustainability becomes a regional focus. Awareness campaigns and growing middle-class incomes in countries like Brazil and Mexico are key factors driving market expansion.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Reusable Period Panties Market is shaped by top players focusing on innovation, comfort, and sustainability. Among the leading companies are Thinx, Modibodi, Knix, and Ruby Love, which play critical roles in market expansion and consumer awareness.

Thinx leads the market with its strong brand recognition and innovative designs that cater to diverse needs. The company prioritizes comfort and absorbency while incorporating sustainable materials. Its marketing campaigns, which emphasize body positivity and environmental benefits, have positioned it as a trusted name in the industry.

Modibodi excels in blending technology and fashion to create versatile and effective period solutions. Its products cater to a wide range of demographics, including maternity and activewear lines. The company’s commitment to sustainability and global outreach programs has strengthened its reputation and expanded its market reach.

Knix is known for its inclusive approach, offering diverse sizes and styles that appeal to a broad customer base. With a focus on innovative fabrics and seamless designs, Knix has established itself as a premium choice. The company’s strong e-commerce presence and community-driven marketing further enhance its growth.

Ruby Love emphasizes practicality and affordability without compromising on quality. Its product range includes options for teens, highlighting its commitment to meeting various consumer needs. Ruby Love’s partnerships with retailers and its emphasis on customer education contribute to its market presence.

These companies collectively drive the Reusable Period Panties Market by addressing consumer preferences for sustainable, comfortable, and stylish solutions. Their focus on innovation, inclusivity, and awareness ensures continued growth and consumer loyalty.

Top Key Players in the Market

- Thinx

- Modibodi

- Proof

- Period Panteez

- Ruby Love

- Dear Kate

- Knix

- Rael

- Lively

- Saalt

- Organicup

- Wuka Wear

- Flushed

- Bambody

- Her Loop

Recent Developments

- Eicher Goodearth Private Limited and Mahina: In March 2024, Eicher Goodearth Private Limited introduced Mahina, a brand specializing in women’s menstrual management and intimate health products. Mahina’s reusable, leak-proof period underwear features a three-layered gusset made from highly absorbent natural materials, offering up to 12 hours of protection.

- Thinx and LeakSafe™ Barrier Technology: In April 2024, Thinx, a leading reusable period underwear brand, launched new styles incorporating its LeakSafe™ Barrier technology. This innovation provides up to 12 hours of leak-proof protection, with a patent-pending four-layer gusset capable of absorbing up to 12 regular tampons’ worth of flow. The design emphasizes comfort, odor control, and breathable fabrics to enhance user experience.

- Desert Harvest and Lunation: In August 2024, Desert Harvest announced the launch of Lunation, a line of period underwear made from innovative plant-based materials. Lunation offers a sustainable and comfortable alternative to traditional menstrual products, emphasizing eco-friendly practices in its production while providing effective absorbency and environmental responsibility.

Report Scope

Report Features Description Market Value (2023) USD 145.2 Million Forecast Revenue (2033) USD 629.6 Million CAGR (2024-2033) 15.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Brief, Bikini, Boyshort, Hi-waist, Others), By Absorbency Level (Light Flow, Medium Flow, Heavy Flow), By Price Range (Premium, Mid-range, Economy), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thinx, Modibodi, Proof, Period Panteez, Ruby Love, Dear Kate, Knix, Rael, Lively, Saalt, Organicup, Wuka Wear, Flushed, Bambody, Her Loop Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Reusable Period Panties MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Reusable Period Panties MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Thinx

- Modibodi

- Proof

- Period Panteez

- Ruby Love

- Dear Kate

- Knix

- Rael

- Lively

- Saalt

- Organicup

- Wuka Wear

- Flushed

- Bambody

- Her Loop