Global Residential Lithium-ion Battery Energy Storage Systems Market By System Type(On-Grid Systems, Off-Grid Systems, Hybrid Systems), By Capacity(Less than 3kW, 3 kW to 5 kW, Above 5kW), By Application(Solar Energy Storage, Backup Power, Load Balancing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 117094

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

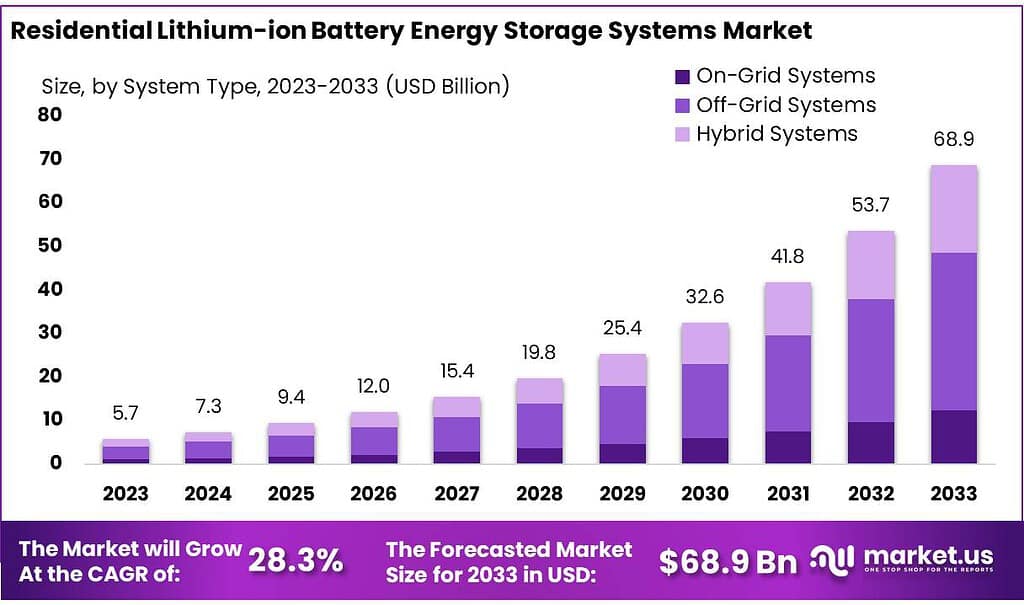

The global Residential Lithium-ion Battery Energy Storage Systems Market size is expected to be worth around USD 68.9 billion by 2033, from USD 5.7 billion in 2023, growing at a CAGR of 28.3% during the forecast period from 2023 to 2033.

The Residential Lithium-ion Battery Energy Storage Systems Market refers to the segment of the energy storage industry that focuses on the production, distribution, and use of lithium-ion batteries specifically designed for energy storage in residential settings.

These systems are employed to store electricity generated from renewable energy sources, such as solar panels, or the grid during off-peak hours for later use. The primary purpose of these energy storage systems is to enhance energy efficiency, reduce electricity costs for homeowners, and provide a reliable backup power supply in case of grid outages.

Lithium-ion batteries are favored in residential energy storage applications due to their high energy density, relatively long lifespan, and ability to provide high power output. These characteristics make them well-suited to meet the demands of residential energy consumption, which can vary significantly throughout the day.

The market for residential lithium-ion battery energy storage systems is driven by several factors, including the decreasing cost of lithium-ion battery technology, government incentives and policies supporting renewable energy and energy storage, the increasing adoption of solar photovoltaic (PV) systems in homes, and growing awareness of energy independence and sustainability among consumers.

The growth of the market can be attributed to technological advancements that improve the efficiency and reduce the cost of lithium-ion batteries, as well as to the increasing prevalence of smart grid technologies. Additionally, the rising demand for renewable energy sources in residential sectors across the globe is expected to fuel the expansion of this market.

Key Takeaways

- Market Growth: Residential Lithium-ion Battery Energy Storage Systems Market to reach USD 68.9 billion by 2033, with a CAGR of 28.3%.

- Segment Dominance: On-grid systems hold over 42.6% market share, favored for direct grid connectivity and cost savings.

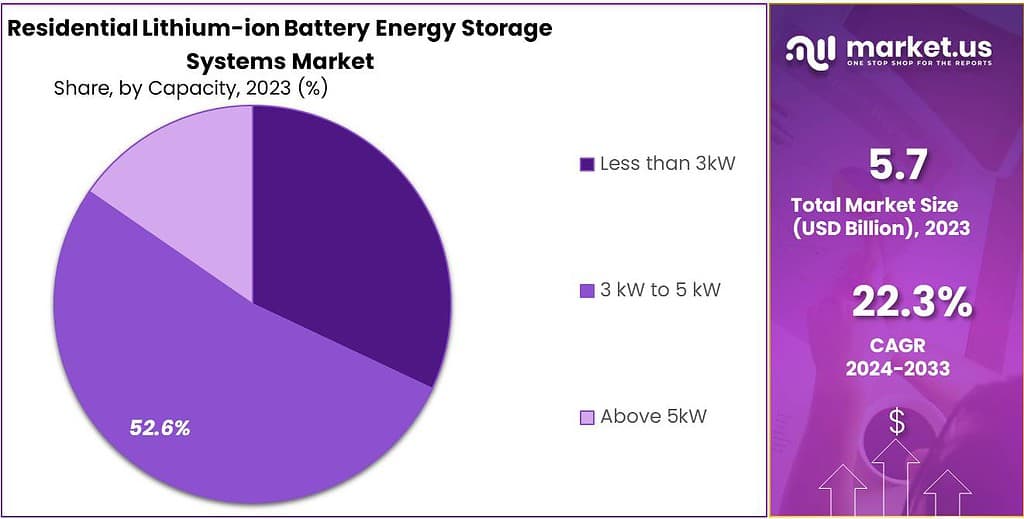

- Capacity Preference: The 3 kW to 5 kW segment captures over 52.6% market share, balancing capacity and cost effectively.

- Application Focus: Solar Energy Storage leads with a 42.6% market share, driven by global renewable energy trends.

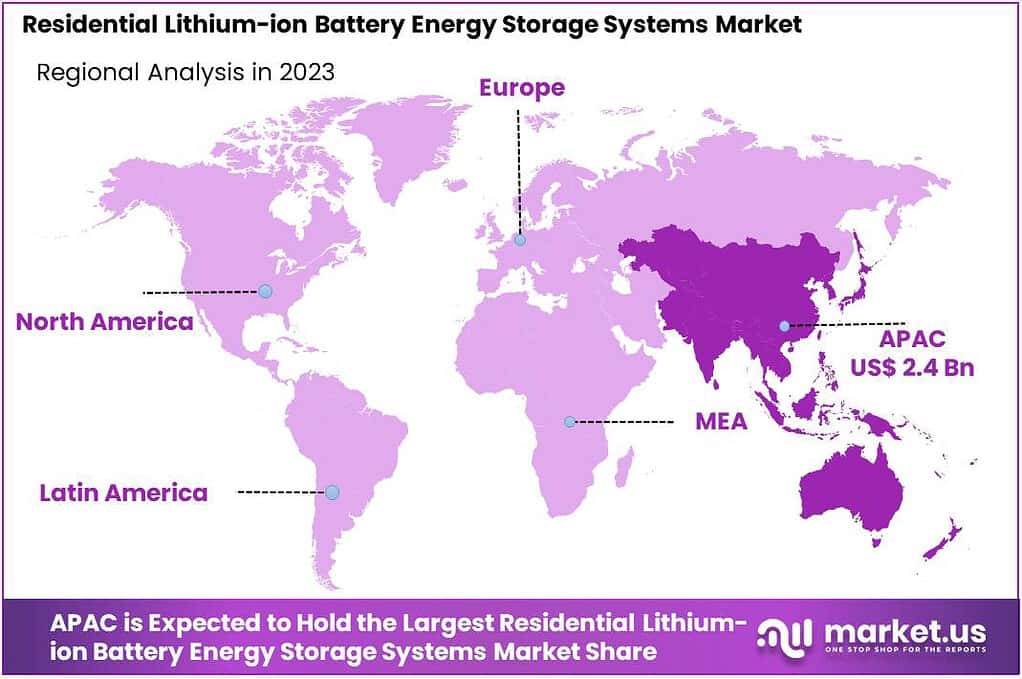

- Regional Strength: Asia Pacific dominates with a 42.6% market share, driven by renewable energy demand and smart tech adoption.

- EIA, the average cost of residential lithium-ion battery systems in the United States is expected to decrease by 20% by 2024.

- Lawrence Berkeley National Laboratory stated that residential battery storage systems can reduce peak electricity demand by up to 30% in some areas.

- University of Michigan found that residential battery storage systems can increase the value of a home by up to 5% in certain markets.

By System Type

In 2023, On-Grid Systems held a dominant market position, capturing more than a 42.6% share. This segment benefits from direct connectivity to the public electricity grid, enabling homeowners to store excess energy generated from solar panels or to draw from the grid when rates are lower. The growth in this segment is driven by increasing solar panel installations and the demand for energy cost savings and efficiency. On-grid systems are popular in areas with reliable grid infrastructure and where policies support net metering, allowing residents to sell excess energy back to the grid.

Off-grid systems, serving areas without access to the central electricity grid, accounted for a significant portion of the market. These systems are essential for energy independence, providing a full solution for electricity generation, storage, and use.

Their adoption is encouraged by improvements in battery technology and cost reductions, making them viable for remote locations and homes aiming for self-sufficiency. The demand in this segment is propelled by the desire for resilience against power outages and the lack of grid infrastructure in rural or isolated areas.

Hybrid Systems, combining the features of on-grid and off-grid systems, are emerging as a versatile solution for residential energy storage. These systems offer the flexibility to store and use solar energy, while also maintaining a connection to the grid for additional security and efficiency.

The interest in hybrid systems is growing, as they provide homeowners with the best of both worlds: the ability to reduce energy costs and carbon footprint, and the assurance of grid connectivity when needed. This segment is gaining traction due to its ability to adapt to varying energy needs and regulations, marking it as a key area of future growth in the residential lithium-ion battery energy storage market.

By Capacity

In 2023, the 3 kW to 5 kW capacity segment held a dominant market position, capturing more than a 52.6% share. This range is particularly favored by residential users due to its optimal balance between capacity and cost, making it suitable for the average household energy needs. The segment’s popularity is bolstered by its ability to efficiently store energy for daily use, including lighting, appliances, and charging, without the need for frequent recharging. Its appeal is further enhanced in regions with moderate climate conditions, where energy demands for heating and cooling are within this capacity range.

The segment for systems with a capacity of less than 3 kW also plays a crucial role in the market, catering to smaller homes or those with lower energy requirements. These systems are appreciated for their affordability and compact size, making them accessible to a broader audience. While they hold a smaller market share, their significance is underscored in urban areas and for individuals looking to reduce their carbon footprint or achieve partial energy independence.

Systems with a capacity of above 5 kW represent the high-end of the market, designed for larger homes or households with higher energy consumption. This segment addresses the needs of consumers with significant energy demands, such as electric vehicle charging, large appliances, and extensive heating or cooling systems. Although these systems come with a higher upfront cost, their long-term savings and efficiency make them a valuable investment for those requiring substantial energy storage.

By Application

In 2023, Solar Energy Storage held a dominant market position, capturing more than a 42.6% share. This segment benefits significantly from the global shift towards renewable energy, with homeowners increasingly installing solar panels to reduce electricity bills and carbon footprints. The integration of lithium-ion batteries enables the efficient storage of surplus solar energy generated during the day for use at night or during low sunlight periods, enhancing the viability and appeal of solar installations.

Backup Power is another critical application, providing a dependable power supply during outages or interruptions. This segment addresses the growing demand for resilience and reliability in electricity supply, especially in regions prone to extreme weather or with unstable grid infrastructure. Homeowners value the peace of mind that comes with having a reliable backup power source, driving the adoption of residential energy storage systems for this purpose.

Load Balancing, focusing on optimizing energy use and reducing peak demand charges, represents a strategic application of energy storage systems. By storing energy during off-peak times when rates are lower and using it during peak periods, households can achieve significant cost savings. This application is gaining traction as more consumers become aware of dynamic pricing models and seek ways to manage their energy consumption more efficiently.

As the adoption of electric vehicles continues to rise, the demand for home charging solutions that integrate with energy storage systems is expected to grow. Additionally, the ability of residential batteries to contribute to grid stability through services like frequency regulation and demand response is opening new avenues for participation in energy markets.

Market Key Segments

By System Type

- On-Grid Systems

- Off-Grid Systems

- Hybrid Systems

By Capacity

- Less than 3kW

- 3 kW to 5 kW

- Above 5kW

By Application

- Solar Energy Storage

- Backup Power

- Load Balancing

- Others

Drivers

Growing Demand for Renewable Energy Sources

As more homeowners turn to renewable energy sources like solar and wind, the need for energy storage solutions to manage intermittent power supply has surged. Lithium-ion batteries, with their high energy density and long lifespan, are ideally suited to store this renewable energy for later use, driving the market forward.

Technological Advancements and Cost Reduction

Significant improvements in lithium-ion battery technology have not only enhanced their efficiency and lifespan but also led to substantial cost reductions. This makes residential energy storage systems more accessible and affordable for a broader range of consumers, propelling market growth.

Energy Independence and Resilience

Increasing concerns about energy security and resilience, especially in the face of climate change and potential grid instability, have motivated homeowners to invest in energy storage systems. Lithium-ion batteries offer a reliable way to store energy, ensuring power availability during outages and reducing reliance on the grid.

Restraints

High Initial Investment

Despite falling costs, the initial investment required for a residential lithium-ion battery energy storage system can still be a significant barrier for many homeowners. This initial cost is a major restraint in the market, limiting the accessibility of these systems to a wider audience.

Complex Installation and Maintenance Requirements

The installation of lithium-ion battery storage systems can be complex and requires professional expertise. Additionally, maintenance and safety concerns, including the risk of thermal runaway, can deter potential users from adopting these systems.

Regulatory and Environmental Concerns

There are regulatory hurdles and environmental concerns related to the disposal and recycling of lithium-ion batteries. These challenges pose restraints on the market, as they require solutions for sustainable production and end-of-life management of the batteries.

Opportunities

Expansion of Renewable Energy Incentives

Government incentives and subsidies for renewable energy installations and storage solutions present significant opportunities for market growth. Policies that encourage the adoption of solar panels and battery storage can drive demand and make these systems more financially viable for homeowners.

Advancements in Battery Technology

Ongoing research and development in battery technology offer opportunities for further improvements in efficiency, cost, and safety of lithium-ion batteries. Innovations that address current limitations can open up new markets and applications for residential energy storage.

Growing Awareness and Demand for Sustainability

Increasing consumer awareness about climate change and the importance of sustainability is driving demand for green energy solutions. Residential lithium-ion battery storage systems, as a key component of sustainable energy ecosystems, stand to benefit from this growing demand, presenting ample opportunities for market expansion.

Trends

Integration with Smart Home Technologies

The rise of smart home technologies has led to an increased integration of lithium-ion battery storage systems with home energy management systems. This allows for more efficient use of stored energy, optimizing consumption based on needs, preferences, and energy prices.

Increasing Adoption of Electric Vehicles (EVs)

As the adoption of electric vehicles continues to grow, so does the demand for home energy storage solutions. Lithium-ion batteries are not only used to store energy for household use but also offer a convenient charging solution for EVs, supporting the trend towards greener transportation.

Community Energy Storage Projects

There’s a growing trend toward community or neighborhood-scale energy storage systems, where lithium-ion batteries are used to store and share renewable energy among multiple homes. This approach enhances energy independence and sustainability on a larger scale, indicating a shift towards more collaborative energy usage models.

Regional Analysis

The Asia Pacific region is projected to be the most promising market for the residential lithium-ion battery energy storage systems, holding the largest market share of 42.6%. It is anticipated to achieve a of 2.4282 Bn during the forecast period. This significant growth is largely due to the rising demand for renewable energy solutions in key sectors such as residential, automotive, and utilities, coupled with an increase in solar panel installations across the region.

China, India, and Southeast Asian countries like Korea, Thailand, Malaysia, and Vietnam are pivotal to the market’s expansion, thanks to their increasing investments in renewable energy projects and initiatives to enhance energy efficiency and sustainability. The growing adoption of electric vehicles (EVs) and smart home technologies in these countries further fuels the demand for efficient and reliable energy storage solutions.

In North America, economic development, along with the expansion of the renewable energy sector and the adoption of EVs, is expected to drive a substantial demand for residential lithium-ion battery energy storage systems. The region’s commitment to reducing carbon emissions and enhancing energy independence plays a crucial role in this trend.

Europe is set to exhibit significant growth in the residential lithium-ion battery energy storage market during the forecast period, driven by stringent environmental regulations and a strong focus on energy sustainability. The increasing penetration of solar energy and the rise in smart homes are contributing to the heightened demand for lithium-ion battery storage solutions in the European market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The residential lithium-ion battery energy storage systems market is characterized by the presence of several key players who play a pivotal role in shaping the industry’s landscape through innovation, strategic partnerships, and expansion activities. Leading companies such as Tesla, LG Chem, Panasonic, and Samsung SDI dominate the market with their advanced energy storage solutions.

Tesla’s Powerwall, for instance, has gained significant popularity for its sleek design, high efficiency, and smart integration capabilities, making it a preferred choice for homeowners seeking to enhance their renewable energy usage.

LG Chem and Panasonic, on the other hand, are well-regarded for their reliability and performance, offering a range of battery capacities to meet diverse energy needs. Samsung SDI’s contributions to the market are notable for their focus on sustainability and cutting-edge technology, ensuring high energy density and longer life spans.

Top Key Players

- BYD Company Limited

- SAMSUNG SDI Co., Ltd.

- LG Energy Solutions Co., Ltd.

- Panasonic Corporation

- A123 Systems LLC

- Envision AESC Limited

- Toshiba Corporation

- Amperex Technology Limited

- BAK Group

- Blue Energy Limited

- Tianjin Lishen Battery Joint-Stock CO., LTD

- Lithion Battery Inc.

- SK innovation Co., Ltd

- Farasis Energy

- EnerDel

Recent Developments

2023 BYD Company Limited announced the launch of its new high-capacity residential energy storage solution, designed to provide homeowners with a more reliable and efficient way to store solar energy. The company also expanded its operations by opening new manufacturing facilities in Europe and Asia to meet the growing global demand.

2023 SAMSUNG SDI Co., Ltd. introduced a next-generation battery module with enhanced energy density and improved safety features. The company’s focus on R&D led to the development of this module, which is tailored for residential use, providing longer life spans and better performance.

2023 LG Energy Solution Co., Ltd. strengthened its market presence through strategic collaborations with solar energy companies, aiming to offer integrated energy solutions that combine solar panels with lithium-ion battery storage. This initiative seeks to enhance the adoption of renewable energy in residential sectors across various regions.

Report Scope

Report Features Description Market Value (2024) USD 5.7 Bn Forecast Revenue (2033) USD 68.9 Bn CAGR (2023-2033) 28.3% Base Year for Estimation 2022 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By System Type(On-Grid Systems, Off-Grid Systems, Hybrid Systems), By Capacity(Less than 3kW, 3 kW to 5 kW, Above 5kW), By Application(Solar Energy Storage, Backup Power, Load Balancing, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BYD Company Limited, SAMSUNG SDI Co., Ltd., LG Energy Solutions Co., Ltd., Panasonic Corporation, A123 Systems LLC, Envision AESC Limited, Toshiba Corporation, Amperex Technology Limited, BAK Group, Blue Energy Limited, Tianjin Lishen Battery Joint-Stock CO., LTD, Lithion Battery Inc., SK innovation Co., Ltd, Farasis Energy, EnerDel Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Residential Lithium-ion Battery Energy Storage Systems MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Residential Lithium-ion Battery Energy Storage Systems MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BYD Company Limited

- SAMSUNG SDI Co., Ltd.

- LG Energy Solutions Co., Ltd.

- Panasonic Corporation

- A123 Systems LLC

- Envision AESC Limited

- Toshiba Corporation

- Amperex Technology Limited

- BAK Group

- Blue Energy Limited

- Tianjin Lishen Battery Joint-Stock CO., LTD

- Lithion Battery Inc.

- SK innovation Co., Ltd

- Farasis Energy

- EnerDel