Global Refrigerated Transport Market By Product (Chilled Food, Frozen Food), By Transport Type (Refrigerated Road Transport, Refrigerated Sea Transport, Refrigerated Rail Transport, Refrigerated Air Transport), By Technology (Vapor Compression Systems, Air Blown Evaporators, Eutectic Devices), By Temperature (Multiple Temperature, Single Temperature), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: April 2024

- Report ID: 12508

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

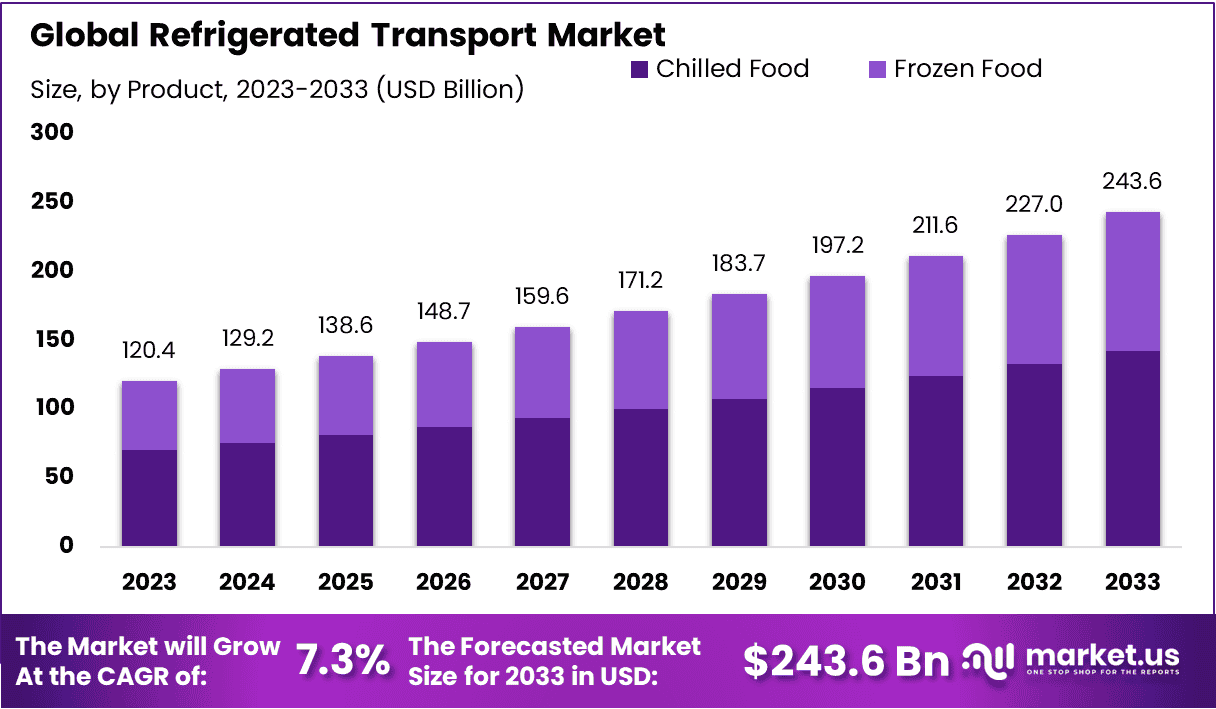

The Global Refrigerated Transport Market size is expected to be worth around USD 243.6 Billion by 2033, from USD 120.4 Billion in 2023, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

The refrigerated transport market involves the transportation of perishable goods using temperature-controlled vehicles. This sector is crucial for maintaining the quality and safety of food, pharmaceuticals, and other perishable products during transit.

Key drivers include the global demand for fresh produce, stringent food safety regulations, and advancements in refrigeration technologies. The market serves a broad spectrum of industries, including food and beverage, healthcare, and floral sectors, catering primarily to needs for freshness and compliance with health standards. Strategic growth in this market is driven by innovations in vehicle efficiency and eco-friendly refrigeration solutions.

The Refrigerated Transport Market is witnessing robust growth, driven by increasing consumer preferences for convenience and quality in food consumption. According to the American Frozen Food Institute, 38% of consumers engaging with frozen foods do so on a daily or near-daily basis, underpinning a significant demand surge. This trend is complemented by rising incomes and lifestyle changes that favor processed, frozen, and chilled foods, necessitating enhanced refrigerated transport capabilities.

The Frozen Food Market was valued at USD 269.1 billion. Between 2023 and 2032, this market is estimated to register the highest CAGR of 5.1%. This growth trajectory underscores the critical role of refrigerated transport in ensuring the integrity and quality of food products from manufacturers to consumers. The demand for these services extends beyond food to include pharmaceuticals and other temperature-sensitive goods, amplifying the need for advanced cold chain solutions.

Significant capital investments are being channeled into the supply chain infrastructure to support this expanding market. For instance, in December 2023, A.P. Moller-Maersk (Maersk) announced a substantial investment of $530 million to expand its supply chain operations in Southeast Asia, highlighting the strategic importance of enhancing logistical efficiencies and capabilities in key growth regions.

Key Takeaways

- The global refrigerated transport market is projected to grow from USD 120.4 billion in 2023 to USD 243.6 billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 7.30% during the forecast period from 2024 to 2033.

- Chilled food dominates the market with a 58.6% share, driven by its critical role in maintaining the freshness and nutritional value of perishable goods.

- Refrigerated road transport holds the largest market share at 38.4%, favored for its flexibility and efficiency in direct delivery of perishable goods to consumers and businesses.

- Vapor compression systems lead the market with a 42.6% share, valued for their efficiency and reliability in maintaining precise temperature control.

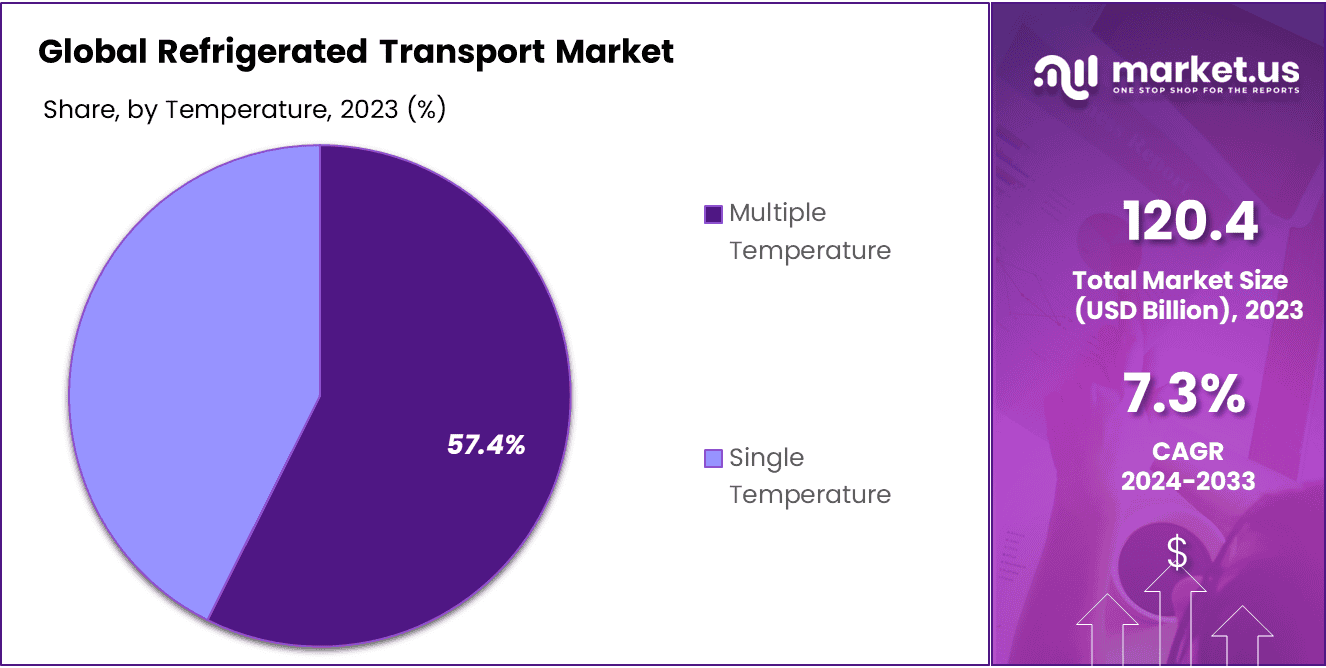

- Multiple temperature systems dominate with a 57.4% share, offering versatility in simultaneously handling different types of cargo at varying temperatures.

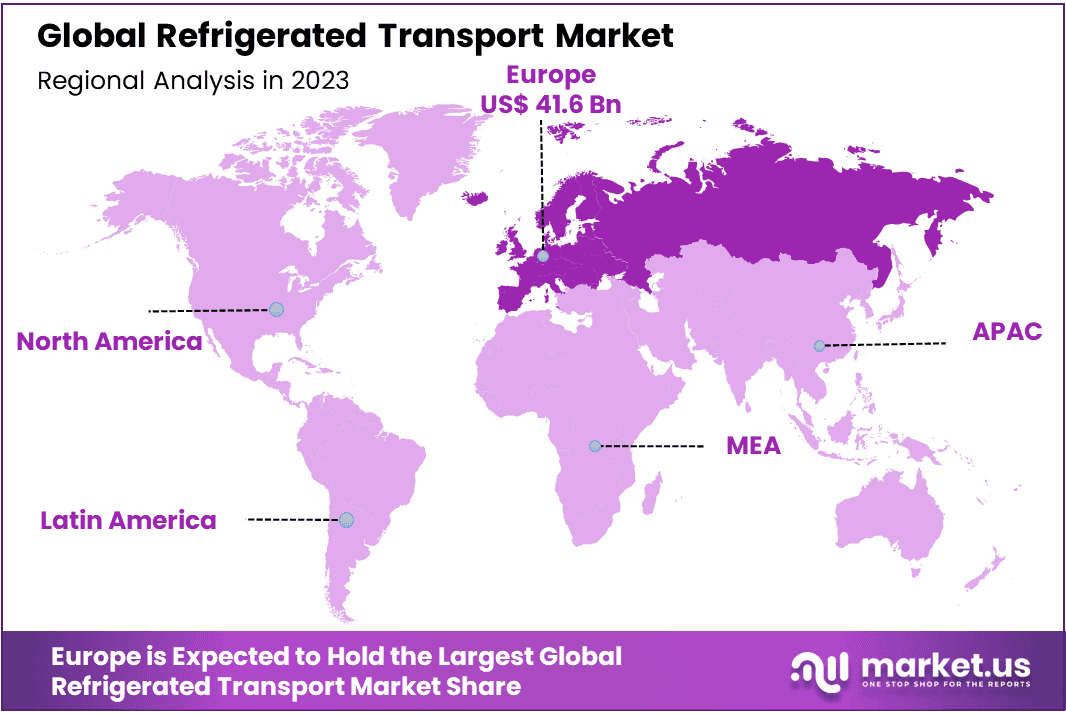

- Europe leads the refrigerated transport market with a 34.6% share, benefiting from stringent food safety regulations and a well-developed infrastructure that supports efficient transport networks.

Driving Factors

Growth in the Cold Chain Logistics Industry Drives Market Growth

The expansion of the cold chain logistics sector is a significant catalyst for the refrigerated transport market. As global trade intensifies and consumer demands for quality perishable goods increase, the requirement for specialized logistics solutions that maintain temperature integrity escalates. This trend is evident in the pharmaceutical industry, where the transportation of temperature-sensitive products like vaccines must adhere to strict thermal conditions to ensure efficacy.

Data indicates a projected growth in the pharmaceutical logistics market at a CAGR of 7.3% through 2026, underscoring the critical role of refrigerated transport in supporting global health initiatives. Moreover, the intersection of food safety regulations and consumer health awareness continues to push advancements in refrigerated transport technologies, further boosting market growth.

Increasing Consumer Demand for Fresh and Frozen Foods Drives Market Growth

Consumer preferences shifting towards fresher and healthier eating options have driven the demand for fresh and frozen foods, necessitating robust refrigerated transport solutions. The surge in online grocery sales, which saw a 30% increase in 2020 alone, has also significantly contributed to this demand.

Retail giants like Amazon and Walmart are continuously upgrading their logistics frameworks to ensure the integrity of perishable goods, from warehousing to last-mile delivery. This consumer-driven market expansion is supported by innovations in refrigerated vehicle technology that enhance energy efficiency and reliability, ensuring that the cold chain remains unbroken and products reach consumers in optimal condition.

Expansion of the Food Service Industry Drives Market Growth

The burgeoning growth of the food service industry, from restaurants to institutional caterers, heavily influences the demand for refrigerated transport. This sector’s need for fresh ingredients and ready-to-serve meals ensures the continuous throughput of refrigerated logistics.

As more food service businesses go global, their dependency on effective cold chain solutions becomes more pronounced. The industry’s evolution is marked by a heightened emphasis on food safety and quality, propelling advancements in refrigerated transport technologies. This growth trajectory is expected to sustain as the industry adapts to increasing consumer expectations and regulatory standards concerning food hygiene and safety.

Restraining Factors

Regulatory Complexities and Compliance Challenges Restrain Market Growth

The regulatory landscape for refrigerated transport is complex, involving strict standards for food safety and environmental protection. This sector faces substantial hurdles in adhering to these diverse regulations across different markets, which vary widely in terms of requirements and enforcement.

Ensuring compliance demands significant investments in technology, training, and systems to monitor and maintain temperature controls and food safety protocols. Non-compliance risks are high, with consequences that include hefty fines, product recalls, and severe reputational damage. These challenges can deter new entrants to the market and strain the resources of existing players, ultimately limiting market expansion.

Limited Infrastructure and Logistics Challenges Restrain Market Growth

Inadequate infrastructure is a major barrier to the growth of the refrigerated transport market, particularly in developing regions. The absence of specialized facilities like temperature-controlled warehouses and efficient cross-docking operations can severely disrupt the cold chain.

Moreover, common logistical issues such as traffic congestion and the long distances over which goods must be transported exacerbate the difficulty of maintaining required temperatures throughout transit. These factors contribute to higher operational costs and reduced reliability of refrigerated transport services, restricting their accessibility and efficiency, and by extension, market growth.

Product Analysis

Chilled Food dominates with 58.6% due to its critical role in maintaining the freshness and nutritional quality of perishable goods.

The Chilled Food segment stands as the predominant category in the Refrigerated Transport Market, accounting for 58.6% of the market share. This dominance is primarily due to the increasing consumer demand for fresh, high-quality perishable goods such as milk, bakery and confectionery products, dairy products, beverages, and fresh fruits & vegetables. These products require strict temperature control to preserve freshness, nutritional value, and taste, which chilled transportation solutions provide effectively.

Milk and dairy products form the core of this segment, as their need for constant temperature management during transport is crucial to prevent spoilage and maintain food safety standards. The bakery and confectionery products also significantly contribute to this segment. The rise in consumer preference for fresh, ready-to-eat food options has driven the demand for these products, which require quick and efficient distribution channels to maintain quality from production to consumption.

Beverages and fresh fruits & vegetables are other critical components of the Chilled Food segment. The global health trend has increased the consumption of fresh produce, which, in turn, requires enhanced refrigerated transport solutions to handle these sensitive items over varying distances. The integration of advanced cooling technologies and the adoption of environmentally friendly refrigerants are further propelling the growth of this segment.

The remaining sub-segments, though smaller in scale compared to Chilled Food, play significant roles in the market. Each sub-segment addresses specific consumer needs and has its own set of requirements for refrigerated transport. For instance, beverages often require different temperature settings compared to dairy products, which necessitates versatile and adaptable refrigerated transport solutions. The continuous development in refrigeration technologies and the growing emphasis on reducing food wastage are pivotal in supporting the expansion of these sub-segments within the chilled food market.

Transport Analysis

Refrigerated Road Transport dominates with 38.4% due to its flexibility and efficiency in delivering perishable goods directly to consumers and businesses.

Refrigerated Road Transport is the leading segment in the Refrigerated Transport Market, holding a 38.4% market share. This dominance is primarily attributed to the segment’s flexibility, cost-effectiveness, and capability to provide door-to-door service, which is essential for the timely delivery of perishable goods. Road transport is highly adaptable to varying delivery schedules and routes, making it indispensable for distributing food products, pharmaceuticals, and other temperature-sensitive goods.

The sub-segment of Light Commercial Vehicles (LCVs) plays a crucial role within this domain. LCVs are preferred for short-distance deliveries due to their maneuverability and lower operational costs. They are ideal for urban settings where navigating narrow streets and managing frequent stops are common. Medium & Heavy Commercial Vehicles (M&HCVs) are utilized for longer routes and bulk transport needs, offering larger cargo space and enhanced refrigeration capabilities to handle significant volumes of perishable goods.

Heavy Commercial Vehicles (HCVs) are essential for long-haul transport, providing robust refrigeration systems and large capacities necessary for intercity and cross-country transportation of chilled and frozen goods. This sub-segment is critical for connecting producers with markets and ensuring the supply chain’s efficiency across larger geographical areas.

The remaining modes of refrigerated transport—sea, rail, and air—although less dominant than road transport, are vital for international trade and long-distance shipments. Refrigerated Sea Transport is crucial for exporting large quantities of food products and other perishables across continents. Refrigerated Rail and Air Transport offer valuable alternatives for specific needs, such as faster delivery times required by air transport and the cost-effectiveness and environmental benefits offered by rail transport. Together, these modes complement the road transport segment by fulfilling the broader spectrum of transportation needs in the refrigerated transport market.

Technology Analysis

Vapor Compression Systems dominate with 42.6% due to their efficiency and reliability in maintaining precise temperature controls.

Vapor Compression Systems are the leading technology in the Refrigerated Transport Market, accounting for 42.6% of its segment. This technology’s predominance is driven by its ability to maintain precise and consistent temperature controls, which is crucial for the transport of temperature-sensitive goods such as food, pharmaceuticals, and chemicals. These systems are highly valued for their efficiency and reliability, characteristics that are essential in minimizing product spoilage and ensuring compliance with strict regulatory standards for quality and safety.

Air Blown Evaporators and Eutectic Devices are other significant technologies within this segment. Air Blown Evaporators are utilized for their capability to evenly distribute cool air within the cargo space, making them suitable for larger or irregularly shaped loads. Eutectic Devices, which function by storing cooling energy at night when electricity costs are lower and releasing it during the day, offer cost-effective solutions for smaller vehicles and routes with predictable temperature management needs.

The continued innovation in refrigeration technology, along with increasing environmental regulations, is pushing the development of more energy-efficient and environmentally friendly vapor compression systems. These advancements are likely to increase their market share further. Meanwhile, the roles of Air Blown Evaporators and Eutectic Devices in this market are also evolving, with technological improvements aimed at enhancing their efficiency and reducing operational costs, thus supporting the overall growth of the Refrigerated Transport Market.

Temperature Analysis

Multiple Temperature systems dominate with 57.4% due to their versatility in handling diverse cargo types simultaneously.

Multiple Temperature systems hold the largest share in the Temperature segment of the Refrigerated Transport Market, representing 57.4%. This technology’s dominance stems from its versatility, as it allows for the transport of various types of goods that require different temperature settings within a single vehicle. This capability is particularly beneficial for service providers catering to a broad range of industries, including food and beverage, pharmaceuticals, and floral industries, where different products can be transported together, optimizing load efficiency and reducing transportation costs.

Single Temperature systems, while effective for uniform cargo, are less flexible compared to Multiple Temperature systems. They are typically used in specialized deliveries where only one type of temperature control is needed. Despite being less versatile, Single Temperature systems are essential in scenarios where the entire load has the same temperature requirement, providing a controlled environment that is simpler and sometimes more energy-efficient.

The market for Multiple Temperature systems is expected to continue growing, driven by the increasing complexity of supply chains and the need for more sophisticated logistics solutions that can handle diverse product types. Innovations that improve energy efficiency and reduce operational costs of these systems will further enhance their attractiveness and market penetration. On the other hand, the demand for Single Temperature systems will remain stable, supported by their continued necessity in specific transport scenarios.

Key Market Segments

By Product

- Chilled Food

- Milk

- Bakery & confectionery products

- Dairy products

- Beverages

- Fresh fruits & vegetables

- Frozen Food

- Ice cream

- Frozen dairy products

- Meat-processed

- Fish & sea food

- Bakery products

By Transport Type

- Refrigerated Road Transport

- Light Commercial Vehicles

- Medium & Heavy Commercial Vehicles

- Heavy Commercial Vehicles

- Refrigerated Sea Transport

- Refrigerated Rail Transport

- Refrigerated Air Transport

By Technology

- Vapor Compression Systems

- Air Blown Evaporators

- Eutectic Devices

By Temperature

- Multiple Temperature

- Single Temperature

Growth Opportunities

Integration of Advanced Technologies Offers Growth Opportunity

The integration of advanced technologies such as IoT, telematics, and data analytics into the refrigerated transport market heralds significant growth opportunities. These technologies enhance the efficiency of refrigerated transport operations by enabling real-time temperature monitoring, predictive maintenance, and optimized routing. Such capabilities not only reduce spoilage and operational costs but also boost customer satisfaction by ensuring the quality and safety of transported goods.

Companies like Daikin and Thermo King are leading the way with their advanced telematics systems and remote monitoring solutions. By leveraging these technologies, refrigerated transport providers can significantly differentiate their services in a competitive market, improving both their operational efficiency and their market positioning. The adoption of these technologies is expected to expand as more companies recognize their potential to drive cost savings and increase service reliability.

Focus on Sustainable and Eco-Friendly Solutions Offers Growth Opportunity

The shift towards sustainability presents lucrative opportunities in the refrigerated transport market. Environmental concerns and regulatory pressures are pushing companies to adopt eco-friendly solutions that reduce emissions, enhance energy efficiency, and decrease the overall environmental footprint of refrigerated transport operations.

The development of electric and hybrid refrigerated vehicles, along with the use of renewable energy sources for refrigeration units and sustainable packaging materials, meets this demand. Innovations by companies like Carrier Transicold and Mitsubishi Heavy Industries, which have introduced eco-friendly refrigerated transport solutions, highlight the market’s direction. This focus on sustainability not only caters to consumer preferences and compliance requirements but also opens up new market segments for providers, enabling them to capitalize on the growing global emphasis on environmental responsibility.

Trending Factors

Cold Chain Logistics Automation Are Trending Factors

The trend towards automation in cold chain logistics is accelerating, driven by the quest for greater efficiency, accuracy, and cost reductions in handling temperature-sensitive products. Recent advancements include robotic picking and packing systems, automated storage and retrieval systems (AS/RS), and automated guided vehicles (AGVs). These technologies are becoming essential in refrigerated warehouses and distribution centers to streamline operations, reduce labor costs, and minimize errors.

Notable companies like Ocado and Lineage Logistics are forefront in integrating these advanced automation solutions into their operations. Automation not only boosts productivity but also enhances the scalability of cold chain logistics, catering to growing global demands. The ongoing investment in automation technology by leading logistics providers is a clear indicator of its potential to reshape the future of refrigerated transport, making it a significant trending factor in the market.

Rise of Online Grocery and Meal Delivery Services Are Trending Factors

The surge in online grocery shopping and the expansion of meal delivery services are profoundly influencing the refrigerated transport market. This growing trend is supported by the increasing consumer preference for convenience and the rising demand for fresh and frozen food products delivered directly to their doorsteps.

Companies such as Instacart, FreshDirect, and HelloFresh are heavily reliant on efficient refrigerated transport solutions to maintain the quality and safety of perishable goods. The necessity for specialized refrigerated vehicles equipped with advanced temperature control systems, efficient routing software, and real-time tracking capabilities is becoming more critical. This sector’s growth is not just enhancing service delivery but is also stimulating innovations within the refrigerated transport industry to meet the specific needs of online grocery and meal delivery services, marking it as a significant trending factor.

Regional Analysis

Europe Dominates with 34.6% Market Share

Europe’s dominant position in the Refrigerated Transport Market, holding a 34.6% share, can be attributed to several key factors. Firstly, the region boasts stringent food safety and environmental regulations that drive the need for advanced refrigerated transport solutions.

Secondly, Europe’s highly developed road infrastructure and broad adoption of cutting-edge technologies in logistics enhance operational efficiency and compliance. Additionally, the presence of major food processing and pharmaceutical companies, which require reliable cold chain logistics, further propels the demand for refrigerated transport services in this region.

The regional dynamics of Europe are characterized by a well-established logistics network and high consumer demand for fresh and frozen products. The integration of IoT and automation in refrigerated transport is more pronounced here, enabling better temperature control and tracking of goods. Europe’s commitment to sustainability also leads to innovations in eco-friendly refrigerated transport solutions, setting a trend that many regions are beginning to follow. This advanced market structure allows Europe to maintain its leadership in the global refrigerated transport market.

Other Regions’ Market Shares and Growth Rates:

- North America: Holds a market share of approximately 27.4%. The region benefits from advanced food processing industries and a growing e-commerce sector that demands efficient refrigerated transport solutions.

- Asia Pacific: Accounts for 21.9% of the market. This region is witnessing rapid growth due to increasing urbanization, rising disposable incomes, and expanding retail sectors, which boost the demand for refrigerated transport.

- Middle East & Africa: Represents a smaller share of the market at around 8.5%. However, it is experiencing gradual growth driven by improving infrastructure and increased food import needs.

- Latin America: Holds about 7.6% of the market. Growth in this region is spurred by the development of agricultural exports and the modernization of supply chain facilities.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Refrigerated Transport Market, several key players are significantly shaping the industry landscape through strategic positioning and market influence. Companies like LAMBERET SAS and Schmitz Cargobull are renowned for their innovative refrigerated trailers and bodies, enhancing efficiency and compliance with stringent temperature control standards. Great Dane LLC and Utility Trailer Manufacturing Company are pivotal in advancing trailer durability and thermal efficiency, critical for long-haul transport.

Hyundai, DAIKIN INDUSTRIES Ltd., and Carrier Corporation (United Technologies Corporation) stand out for their technological advancements in refrigeration units that offer superior temperature management, crucial for sensitive cargo like pharmaceuticals and perishable foods. Wabash National Corporation and China International Marine Containers (Group) Co., Ltd. contribute robust container solutions that support global trade, especially in sea transport.

Furthermore, companies like Ingersoll Rand and Singamas Container Holdings Limited focus on enhancing the global reach and versatility of refrigerated containers, catering to diverse market needs. European manufacturers like KRONE emphasize precision engineering to meet the high safety and quality standards of the European market. Indian companies like VE Commercial Vehicles Limited and Tata Motors are vital in addressing the rising demand in Asia through localized manufacturing and cost-effective solutions.

These companies collectively drive the market through continuous innovation, geographical expansion, and adaptation to regulatory environments, ensuring the efficient and safe transport of temperature-sensitive goods worldwide.

Market Key Players

- AMBERET SAS

- Great Dane LLC

- Utility Trailer Manufacturing Company

- Schmitz Cargobull

- Hyundai

- DAIKIN INDUSTRIES Ltd.

- Wabash National Corporation

- China International Shipping Containers (Group) Co. Ltd

- Ingersoll Rand

- Carrier Corporation (United Technologies Corporation)

- Singamas Container Holdings Limited

- KRONE

- Shaanxi Tianhui Inlong Trading Co. Ltd

- VE Commercial Vehicles Limited

- Tata Motors

Recent Developments

- On February 2024, Sumitomo Corporation and Orient Overseas Container Line Limited (OOCL) signed a business alliance agreement to provide refrigerated ocean transport. The transport utilises electric field technology, which realises the long-term preservation of freshness for several commercial products. The signatories aim to establish a new standard for freshness-preserving logistics and realise ocean transportation of non-freezing chilled products from distant locations.

- On February 2024, OOCL launched a new refrigerated ocean service that utilises electric field technology to preserve the freshness of perishable products during ocean transportation. The service enables long-term ocean transportation with minimal quality loss, which is necessary to expand food supply areas and ensure a stable supply of products. By meeting the demands of regions seeking to promote the export of fresh food products, OOCL aims to contribute to the stable supply of food products through diversification of supply locations, minimizing food loss, and reducing GHG emissions.

Report Scope:

Report Features Description Market Value (2023) USD 120.4 Billion Forecast Revenue (2033) USD 243.60 Billion CAGR (2023-2033) 7.30% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product[Chilled Food(Milk, Bakery & confectionery products, Dairy products, Beverages, Fresh fruits & vegetables), Frozen Food(Ice cream, Frozen dairy products, Meat-processed, Fish & seafood, Bakery products)], By Transport Type[Refrigerated Road Transport(Light Commercial Vehicles, Medium & Heavy Commercial Vehicles, Heavy Commercial Vehicles), Refrigerated Sea Transport, Refrigerated Rail Transport, Refrigerated Air Transport), By Technology(Vapor Compression Systems, Air Blown Evaporators, Eutectic Devices), By Temperature(Multiple Temperature, Single Temperature) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa. Competitive Landscape LAMBERET SAS, Great Dane LLC, Utility Trailer Manufacturing Company, Schmitz Cargobull, Hyundai, DAIKIN INDUSTRIES Ltd., Wabash National Corporation, China International Shipping Containers (Group) Co. Ltd, Ingersoll Rand, Carrier Corporation (United Technologies Corporation), Singamas Container Holdings Limited, KRONE, Shaanxi Tianhui Inlong Trading Co. Ltd, VE Commercial Vehicles Limited, Tata Motors. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User license (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Refrigerated Transport MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Refrigerated Transport MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- LAMBERET SAS

- Great Dane LLC

- Utility Trailer Manufacturing Company

- Schmitz Cargobull

- Hyundai

- DAIKIN INDUSTRIES Ltd.

- Wabash National Corporation

- China International Shipping Containers (Group) Co. Ltd

- Ingersoll Rand

- Carrier Corporation (United Technologies Corporation)

- Singamas Container Holdings Limited

- KRONE

- Shaanxi Tianhui Inlong Trading Co. Ltd

- VE Commercial Vehicles Limited

- Tata Motors