Global Red Phosphorus Market Size, Share Analysis Report By Product Type (General Purity, High Purity), By Application (Safety Matches, Flame Retardants, Fertilizers, Pyrotechnics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152093

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

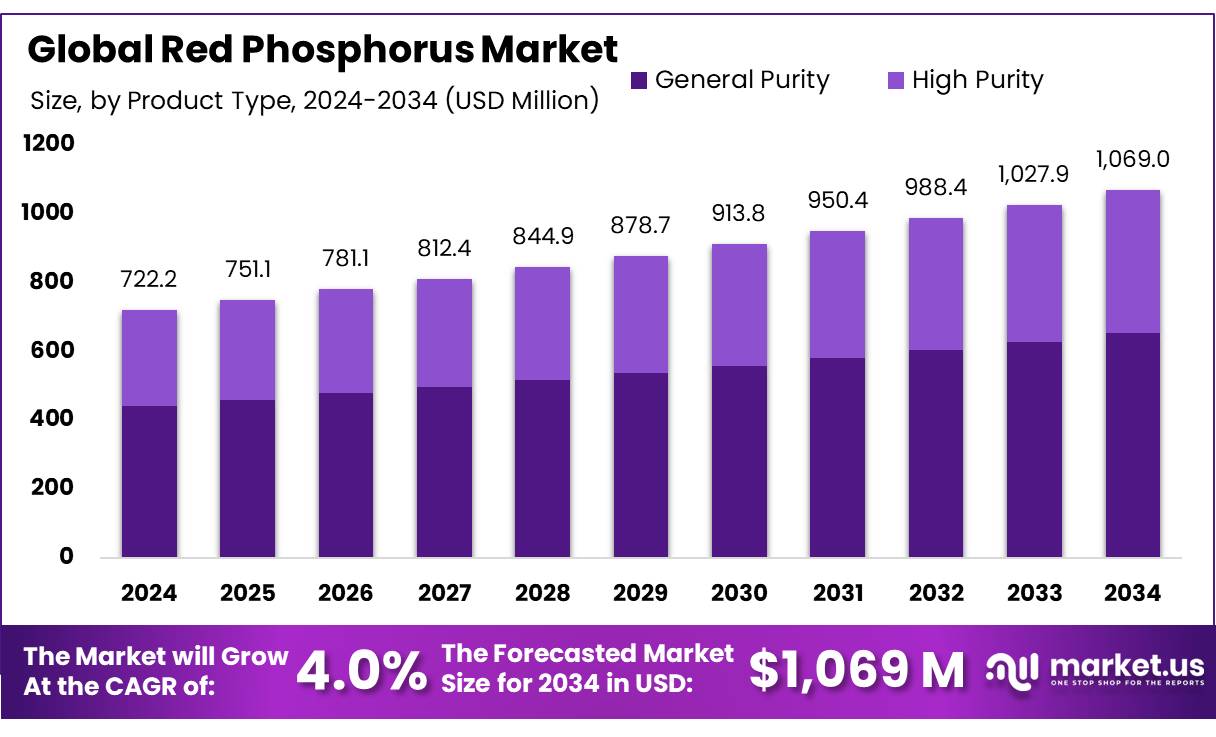

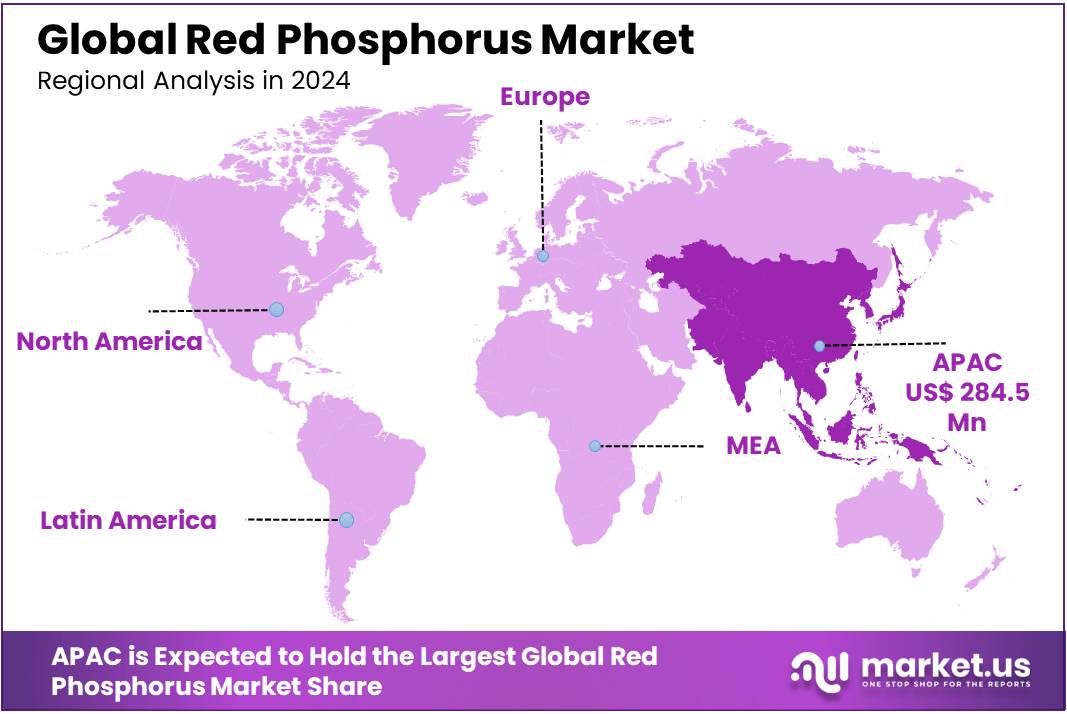

The Global Red Phosphorus Market size is expected to be worth around USD 1069.0 Million by 2034, from USD 722.2 Million in 2024, growing at a CAGR of 4.0% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 39.4% share, holding USD 284.5 Million revenue.

Red phosphorus is an allotrope of elemental phosphorus, characterized by its polymeric amorphous structure and improved stability under ambient conditions compared to white phosphorus. It is obtained industrially via thermal conversion of white phosphorus at approximately 400°C, yielding a non-pyrophoric, air-stable red form. Density of approximately 2.34 g/cm³ and melting point around 590°C underscores material suitability for high-temperature industrial processes.

Global production and consumption are influenced significantly by the agricultural and chemical sectors. According to the United States Geological Survey (USGS), global phosphate rock—a precursor of elemental phosphorus—reserves are estimated at 72 billion tons as of 2023, with annual mining volumes of 220 million tons in 2022.

Government initiatives play a pivotal role in supporting the red phosphorus industry. In March 2025, the Indian government approved a total budget of ₹37,216 crore (approximately $4.35 billion) for the subsidy of phosphatic and potassic fertilizers for the Kharif season, marking a 42% increase from the previous season . This subsidy aims to alleviate the financial burden on farmers and promote the use of phosphorus-based fertilizers, indirectly boosting the demand for red phosphorus in agrochemical applications.

The Department of Chemicals and Petrochemicals has also established quality standards for red phosphorus, mandating a minimum purity of 98.5% for domestic manufacturing and imports. These standards ensure the production of high-quality red phosphorus suitable for various industrial applications, including the manufacture of phosphorus-based intermediates essential for pesticide production .

Key Takeaways

- Red Phosphorus Market size is expected to be worth around USD 1069.0 Million by 2034, from USD 722.2 Million in 2024, growing at a CAGR of 4.0%.

- General Purity held a dominant market position, capturing more than a 61.2% share of the total red phosphorus market.

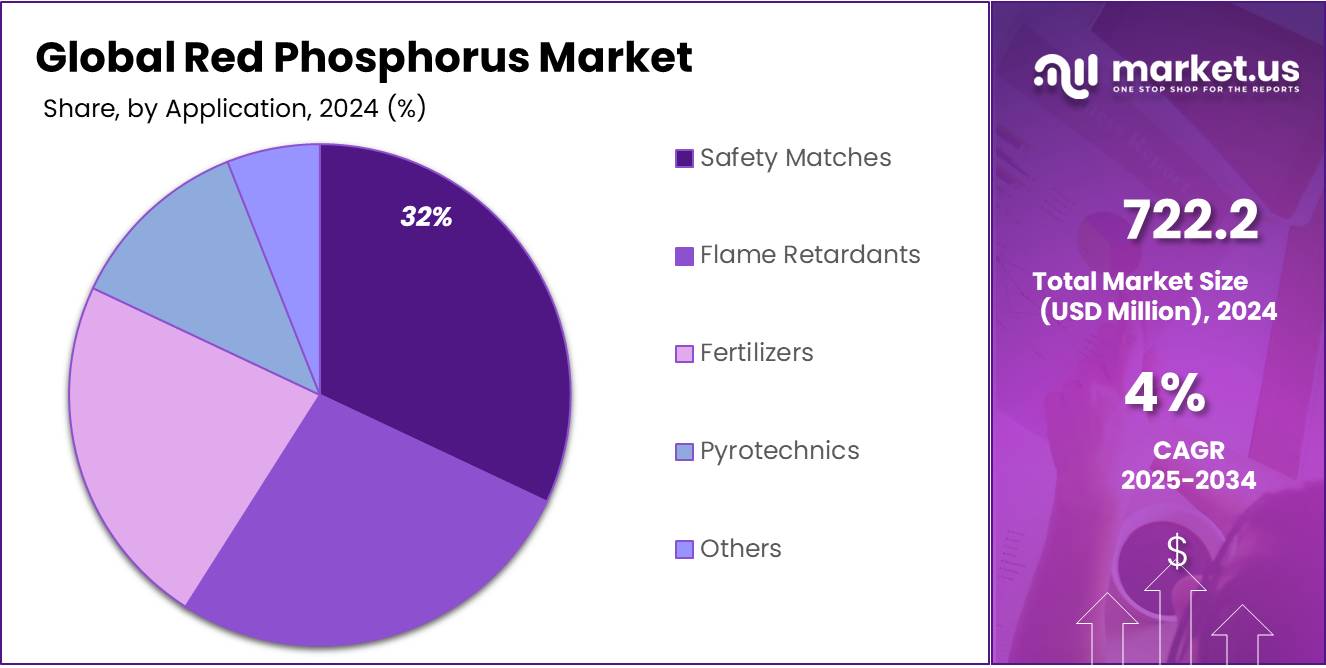

- Safety Matches held a dominant market position, capturing more than a 32.9% share of the overall red phosphorus market.

- Asia-Pacific (APAC) region emerged as the dominant force within the global red phosphorus market, accounting for 39.4% of total demand, equating to approximately USD 284.5 million

By Product Type Analysis

General Purity leads the Red Phosphorus Market with 61.2% share in 2024

In 2024, General Purity held a dominant market position, capturing more than a 61.2% share of the total red phosphorus market. This segment’s strong performance is mainly driven by its suitability for large-scale industrial applications such as flame retardants, safety matches, and pyrotechnics. General purity red phosphorus is preferred by manufacturers due to its lower cost, reliable performance, and ease of processing, which make it ideal for mass production across several end-use industries.

Its availability in stable, non-pyrophoric form further supports its widespread use in developing countries where safety handling and cost factors are critical. As demand for flame-retardant additives and agricultural chemicals continues to rise in 2025, the general purity segment is expected to maintain its leading position, especially in regions focusing on cost-effective industrial solutions without compromising on functional performance.

By Application Analysis

Safety Matches lead Red Phosphorus Market with 32.9% share in 2024 due to consistent consumer demand

In 2024, Safety Matches held a dominant market position, capturing more than a 32.9% share of the overall red phosphorus market. This segment’s leadership is supported by steady demand from both domestic and industrial match production across emerging economies. Red phosphorus is a critical component in the matchbox striking surface, offering controlled ignition properties and enhanced safety during handling and use.

Countries in Asia and Africa continue to rely heavily on traditional safety matches for household and commercial use, keeping the demand for red phosphorus stable. By 2025, the match industry is expected to show slow but steady growth, particularly in rural areas and regions with limited access to modern ignition devices, ensuring continued demand for red phosphorus in this segment.

Key Market Segments

By Product Type

- General Purity

- High Purity

By Application

- Safety Matches

- Flame Retardants

- Fertilizers

- Pyrotechnics

- Others

Emerging Trends

Precision agriculture adoption enhances red phosphorus efficiency — boosting market potential

A key trend in the red phosphorus market is the growing use of precision agriculture to apply phosphate fertilizers more accurately, reducing waste and optimizing nutrient use. Farmers are increasingly relying on satellite imagery, soil sensors, and AI-driven advisory systems to pinpoint where phosphorus is most needed. This approach has lifted fertilizer-use efficiency by as much as 20% in major farming regions in 2024. As red phosphorus is a core ingredient for phosphoric acid production used in fertilizers, this efficiency gain helps reduce overall consumption while sustaining crop yields.

However, it is not just about precision—it is also about plant biology. Research from early 2025 reports that nanoscale phosphorus-based agrochemicals, including forms derived from red phosphorus, increased tomato biomass by 17.2% and rice by 29.2% in controlled trials. These results hint at a future where phosphorus fertilizers are not only applied more smartly but are also formulated at the molecular level to boost plant uptake and growth.

Governments are supporting this trend. The European Union’s “From Farm to Fork” initiative aims to reduce fertilizer use by 20% by 2030 while cutting nutrient losses by half. These targets align perfectly with the advantages offered by precision phosphorus use and specialized formulations—areas where red phosphorus derivatives are key.

Drivers

Surging global phosphate fertilizer demand propels red phosphorus market

A major driving factor for the red phosphorus market is its integral role in phosphate fertilizers, which are essential to global food production. In 2024, global phosphate fertilizer demand is expected to exceed 50 million metric tons as farming intensifies to feed a growing population. This high usage directly influences the red phosphorus market because derivatives of elemental phosphorus—including red phosphorus—are vital precursors in producing phosphoric acid, a key intermediate for fertilizer manufacture.

Government initiatives further reinforce this trend. The European Union implemented new phosphorus management policies in 2024 aimed at optimizing use efficiency and reducing environmental runoff. These initiatives require improved control over phosphorus inputs and outputs, emphasizing recovery and reuse strategies. Consequently, fertilizer producers are incentivized to secure reliable phosphorus inputs, including red phosphorus derivatives, to meet both compliance and efficiency targets.

In addition, scientific studies underline the long-term significance of phosphorus. A Nature published report estimated that cropland and grassland soils contain residual phosphorus stocks equivalent to 146–186 years’ worth of annual fertilizer application. While this indicates abundant in field reserves, it does not diminish the ongoing need for fertilizer production to maintain yields. Instead, it points to a long-term shift toward sustainability and recycling—areas where red phosphorus technologies may play a role in closed-loop nutrient systems.

Restraints

Stricter environmental regulations on phosphorus runoff hinder red phosphorus expansion

One prominent restraining factor affecting the red phosphorus market arises from tightened environmental controls aimed at preventing phosphorus runoff and its ecological consequences. In the United States, approximately 4 million tons of phosphorus fertilizer are applied to crops each year. When excess phosphorus from fertilizers enters waterways, it fuels eutrophication—leading to harmful algal blooms, oxygen-depleted zones, and declining aquatic health. According to the UN Environment Programme, nearly 80 percent of applied phosphorus is lost or wasted, resulting in an estimated global cost of $265 billion per year from environmental damage.

Governments have responded with sweeping regulations. Under the U.S. Clean Water Act, the EPA supports nutrient management programs in agriculture to curb runoff. Currently, about 46 percent of rivers and streams exhibit excess nutrient levels, and 21 percent of lakes are impacted by algal growth—a direct consequence of phosphorus pollution. In the Lake Erie basin alone, a bilateral U.S.–Canada agreement pledged a 40 percent phosphorus reduction by 2025. As of late 2024, efforts have achieved a 32 percent decrease, though the full target remains unmet.

These environmental mandates impose costs and operational constraints on fertilizer and chemical manufacturers. The processing of red phosphorus, a precursor in phosphoric acid and fertilizers, must now align with increasingly rigorous effluent standards, buffer zones, and application restrictions. Such compliance efforts demand capital investments in downstream technologies like wastewater treatment and containment systems, raising operating costs—especially for smaller producers.

Opportunity

Phosphorus recovery through circular economy boosts red phosphorus demand

A major growth opportunity for the red phosphorus market lies in the shift toward phosphorus recovery and circular economy models. Each year, roughly 45 million tonnes of phosphate fertilizer are applied to soils globally—yet an estimated 70% of that fertilizer is not absorbed by crops, instead becoming “legacy phosphorus” in soils or lost to waterways. This inefficiency represents both an environmental challenge and an opportunity: recovering phosphorus from waste streams and converting it into usable inputs helps close the nutrient loop and creates value for red phosphorus-derived products.

Governments are increasingly promoting these circular approaches. For example, the European Union’s “From Farm to Fork” strategy, introduced in 2020, includes a target to reduce nutrient loss by at least 50% by 2030. This policy drives demand for technologies capable of recovering phosphorus from agricultural runoff, municipal wastewater, and other residues—areas where red phosphorus derivatives have critical roles in innovating sustainable fertilizer systems.

Further policy support is evident in research programs and national frameworks. The U.S. Environmental Protection Agency has urged Congress and federal agencies to prioritize phosphorus recovery from waste streams and discharge systems. Such initiatives often include grants and standards that encourage investment into phosphorus recycling infrastructure, thereby expanding the role of red phosphorus in processed fertilizer streams.

Regional Insights

APAC reigns supreme in the red phosphorus market with 39.4% share valued at USD 284.5 million in 2024

In 2024, the Asia-Pacific (APAC) region emerged as the dominant force within the global red phosphorus market, accounting for 39.4% of total demand, equating to approximately USD 284.5 million in market value. This commanding position is underpinned by the region’s robust agricultural activity, particularly in China, India, Japan, and South Korea.

Growth factors are further supported by national initiatives. China’s government has implemented policies aimed at stabilizing fertilizer supply and prices during critical planting seasons, ensuring steady feedstock availability for red phosphorus producers . Meanwhile, in India, expanding rural incomes and agricultural mechanization have escalated fertilizer adoption and, by extension, red phosphorus integration in agrochemicals.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Clariant AG is a Switzerland-based specialty chemicals company actively involved in producing flame retardants and phosphorus-based additives. In the red phosphorus market, the company focuses on halogen-free flame retardant technologies, primarily for electronics, automotive, and construction sectors. Clariant emphasizes sustainability and regulatory compliance, aligning its offerings with global fire safety standards. Its additives division has seen consistent growth, with particular demand from Asia and Europe, where environmental regulations continue to tighten, boosting interest in red phosphorus alternatives.

BASF SE, headquartered in Germany, is a leading global chemical manufacturer with significant operations in the phosphorus derivatives segment. The company utilizes red phosphorus in its development of flame-retardant systems, especially those used in thermoplastics and electronic enclosures. BASF’s research-driven strategy aims at innovating safer and more efficient fire-resistant materials. In recent years, the company has strengthened its footprint in Asia-Pacific through technical collaborations and infrastructure investments to support rising regional demand for phosphorus-based chemicals.

Changzhou Chuanlin Chemical Co., Ltd., based in China, is a key manufacturer of red phosphorus, supplying high-purity grades for both industrial and safety match applications. The company serves domestic and international markets, with a strong export portfolio across Southeast Asia and the Middle East. Known for its cost-effective production and adherence to quality standards, Changzhou Chuanlin continues to expand capacity to meet growing regional demand. It plays a vital role in supporting China’s large-scale fertilizer and pyrotechnic sectors.

Top Key Players Outlook

- CLARIANT AG

- BASF SE

- Changzhou Chuanlin Chemical Co., Ltd.

- NIPPON CHEMICAL INDUSTRIAL CO., LTD.

- Prasol Chemicals Pvt. Ltd

- UPL

Recent Industry Developments

In 2024, BASF SE achieved approximately €11 billion in sales from products launched over the past five years, supported by €2.1 billion in R&D investments and a global R&D workforce of roughly 10,000 professionals.

In 2024, Clariant AG continued to build its leadership in sustainable red phosphorus flame-retardant solutions through its Exolit™ RP line, which is produced using 100% green electricity and designed for high-performance use in engineering plastics, polyurethanes, and coatings.

Report Scope

Report Features Description Market Value (2024) USD 722.2 Mn Forecast Revenue (2034) USD 1069.0 Mn CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (General Purity, High Purity), By Application (Safety Matches, Flame Retardants, Fertilizers, Pyrotechnics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape CLARIANT AG, BASF SE, Changzhou Chuanlin Chemical Co., Ltd., NIPPON CHEMICAL INDUSTRIAL CO., LTD., Prasol Chemicals Pvt. Ltd, UPL Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CLARIANT AG

- BASF SE

- Changzhou Chuanlin Chemical Co., Ltd.

- NIPPON CHEMICAL INDUSTRIAL CO., LTD.

- Prasol Chemicals Pvt. Ltd

- UPL