Global Recovered Carbon Black Market By Type (Primary Carbon Black, and Inorganic Ash), By Grade (Commodity and Specialty), By Form (Granular and Powder), By End-use (Transportation, Industrial, Printing and Packaging, Building and Construction, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 128899

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

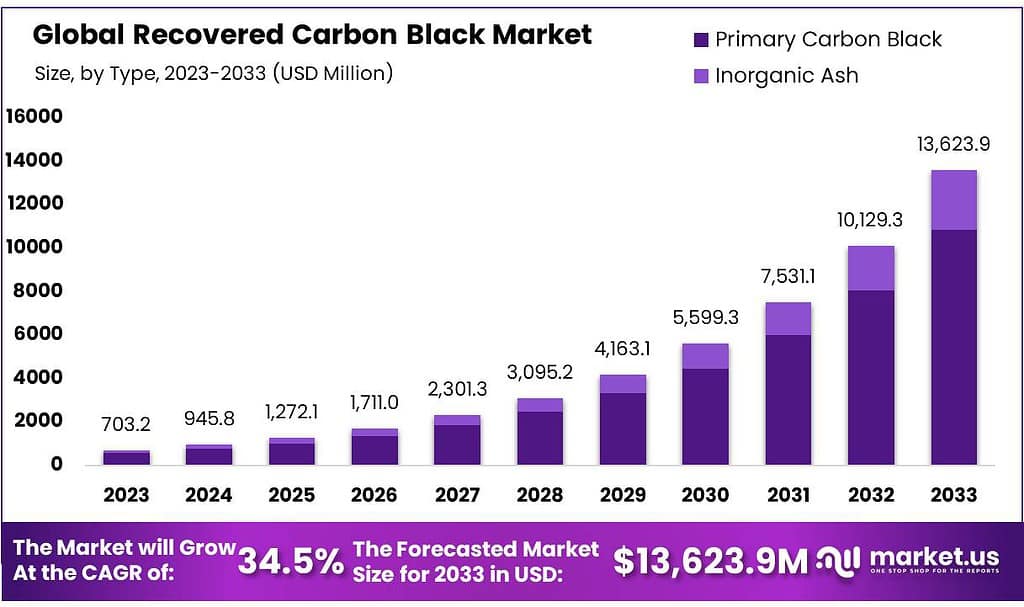

The Global Recovered Carbon Black Market size is expected to be worth around USD 13,623 million by 2033 from USD 703.2 million in 2023, growing at a CAGR of 34.5% during the forecast period 2024 to 2033.

The global recovered carbon black market (RCB) is obtained from end-of-life tires. The waste tires and other carbonaceous materials are treated through pyrolysis or thermal decomposition process to obtain RCB char. It has properties similar to virgin carbon black (VCB) and is used in various applications, especially tire manufacturing.

Its other applications include manufacturing plastics, coatings, batteries, technical rubbers, inks, and others. The production process includes collecting & sorting waste tires followed by shredding & grinding, and pyrolysis. This sustainable material reduces waste tire disposal concerns as it helps conserve natural resources, reduces greenhouse emissions, and provides a genuine alternative to virgin carbon black.

The increasing demand for eco-friendly materials in industries, the rising consumer awareness, and the surging need for tire waste management are projected to drive the global recovered carbon black market during the forecast period. However, the increasing digitalization of manufacturing industries and the rising adoption of industrial automation are projected to fuel this market in the coming years.

Advanced technologies such as AI are helping the RCB manufacturing industries optimize their productivity and maximize the production output. This is achieved by seamless management of supply chains and raw materials powered by automation and predictive analytics. The players in the RCB market are focused on investing in collaborative studies and operations to expand the product applications.

For instance, the August 2021 partnership between Black Bear Carbon B. V. and HELM AG, aimed to cater to the growing need for effective waste tire management. The Black Bear Carbon B. V. worked on tire pyrolysis while utilizing HELM’s extensive supply chain and market presence to sustainably grow in the market.

Key Takeaways

- In 2023, the global recovered carbon black market generated a revenue of USD 703.2 million, with a CAGR of 34.5%, and is expected to reach USD 13,623 million by the year 2033.

- The type held a major share of the market, with the primary carbon black segment taking the lead in 2023 with a market share of 79.7%.

- By grade, the commodity segment accounted for a significant share of 69.6%

- By form, the granular segment among the other sub-segments held a significant revenue share of the market with 66.5% of the global recovered carbon black market.

- By end-use, the transportation segment accounted for the dominant share of the 49.6%.

- The North American region led the market by securing a market share of 34.5% in 2023.

- Recoverable carbon black is widely used as a reinforcing filler in tire production by replacing virgin carbon black.

- RCB naturally has UV resistance and mechanical properties which is why it is used as a pigment or filler in 3D printing materials and plastic preparations.

- RCB acts as a prominent filler in heavy-duty equipment such as industrial belts and hoses that operate at high temperatures and pressure environments. Such equipment is widely used in harbors to load and unload heavy objects and to carry them on a conveyor belt to the destination.

By Type Analysis

Based on type, the market is divided into primary carbon black and inorganic ash. The primary carbon black segment held a dominant share of 79.7% in 2023, owing to its wide range of applications across various industries including rubber products, tire manufacturing, plastics, and coatings. The growing demand for sustainable tires surges the adoption of primary carbon black which is a crucial component in tire production.

Additionally, its unique properties make it a suitable choice in emerging non-tire applications in the market. The growing focus on sustainability and the production of primary carbon black from waste tires aligns with the circular economy and sustainable development goals for many industries.

The product is also cost-effective compared to that of VCB, which attracts price-sensitive industries or emerging businesses in the market. The growing awareness about the potential advantages of the primary carbon black is expected to fuel this segment in the coming years.

By Grade Analysis

Based on grade, the market is segmented into commodity and specialty segments. Among these, the commodity segment held a significant share of 69.6% due to its growing adoption in low-to-medium-grade industries, such as rubber, plastics, and paints & coatings production. This is driven by the commodity grade RCB’s high-grade material which is available at lower prices. The growing demand for sustainable materials from the emerging markets of Asia Pacific and Latin America is expected to gain traction for the segment.

This is mainly attributed to the increasing applications of the commodity recovered carbon black in the aerospace & defense sector for electromagnetic shielding and radar-absorbing as well as in the production of sports sector for high-performance sports equipment. Furthermore, the segment is expected to leverage the wide availability of old, worn-out, waste tires, to avail cheaper or free-of-cost raw materials for the production of high-quality recovered carbon black. As a result of this, the commodity segment is poised for significant growth owing to its versatility and affordability during the forecast period.

By Form Analysis

The global recovered carbon black market is segmented based on form into granular and powder. The granular segment held the largest share of the market at 66.5%, owing to the versatile nature of the granular form of recovered carbon black. The granulated RCB offers improved handling and dispersion properties, making it ideal for use in rubbers and plastics. This segment is expected to benefit from the growing demand for sustainable and recyclable materials across several industries.

The market is also expected to be favored by the increasing need for seamless tire waste disposal and material handling solutions. The granular recovered carbon black is easier to carry, store, and impart to various product formulations as compared to its powdered form. Additionally, the granular form’s ability to improve product density and consistency is projected to attract more functional applications in various sectors. This is projected to fuel this segment in the years to come.

By End-use Analysis

Based on end-use, the market is divided into transportation, industrial, printing & packaging, building & construction, and others. The transportation segment held a dominant share of 49.6% in 2023, owing to the growing demand for eco-friendly raw materials in the automotive industry worldwide. RCB is mainly used in the production of vehicle tires.

It is also used to manufacture rubber components that make the interior of vehicles. Other components of the vehicle such as tubes, tire treads, carcasses, and belts are also produced with recovered carbon black. These components are highly durable, and reliable, and can be used in heavy-duty vehicles.

The growing demand for sustainable vehicles such as EVs is expected to create several opportunities for the market. This is attributed to the growing popularity of lightweight electric vehicles such as two-wheelers or three-wheelers, worldwide. The light weight of such vehicles helps reduce the overall energy consumption of the vehicle, which provides users with added mileage.

Additionally, exponentially rising petroleum prices and the growing importance of eco-friendly transportation are anticipated to boost the adoption of electric vehicles, thereby fueling the global recovered carbon black market in the coming years. For instance, the 2024 report published by the International Energy Agency (IEA), on the 2024 EV outlook, suggests that electric car sales grew by about 35% in 2023, compared to that in the previous year, with about 14 million new electric car registrations during 2023.

Key Market Segments

By Type

- Primary Carbon Black

- Inorganic Ash

By Grade

- Commodity

- Specialty

By Form

- Granular

- Powder

By End-use

- Transportation

- Industrial

- Printing and Packaging

- Building and Construction

- Others

Drivers

Increasing demand for sustainable and eco-friendly materials is expected to drive the market.

The increasing global shift toward sustainable and eco-friendly materials is attributed to the growing awareness regarding environmental footprint among consumers and industries. This has encouraged the end-users to seek green alternatives to the traditional materials.

Recovered carbon black is manufactured from the old waste recycled tire, thereby offering a sustainable solution for waste control & management. It also helps reduce harmful emissions and the environmental impact of virgin carbon black production.

The increasing government regulations emphasizing sustainable industrial development is another factor responsible for this shift. Under such regulations, the industries are bound to meet the sustainability criteria to seamlessly operate further. Moreover, the growing adoption of the concept of circular economy is expected to drive the market during the projection period.

Restraints

Increasing market competition from the virgin carbon black is likely to hamper the market

The producers of virgin carbon black are well-established and have a strong market presence. They consistently offer a high-quality product making it challenging for the recovered carbon black to stand out. Virgin carbon black is available in a range of applications and is traditionally preferred by industries due to its superior quality output in end-products.

Virgin carbon black has economies of scale, enabling them to offer competitive pricing, which makes it difficult for recovered carbon black to penetrate the market.

Furthermore, the lack of awareness or uncertainty regarding the RCB quality refrains established industries from switching to the same as they are focused on maintaining their brand identity for providing ultimate quality products made out of virgin carbon black, which in turn is likely to hamper the market.

Opportunities

Growing applications of the product in non-tire rubber applications are projected to fuel the market.

Traditionally, RCB has been primarily used in tire manufacturing, however, its unique properties, such as UV resistance, thermal stability, and reinforcement capabilities, make it an ideal material for various non-tire rubber applications. These include automotive parts such as hoses, gaskets, and belts, along with industrial products such as grommets, seals, and vibration isolators.

Additionally, RCBs are being studied in advance to explore and diversify their application scope in consumer goods, such as footwear, sports equipment, and medical devices. As industries seek sustainable and cost-effective materials, the demand for these RCBs in these non-tire applications is expected to rise. This is projected to create lucrative opportunities for the market.

Latest Trends

The growing global shift toward a circular economy is projected to boost the market.

The rising end-user inclination toward circular economy is driven by the increasing environmental concerns creating significant damage to our surroundings. Industrial waste management is critical as large amounts of non-biodegradable materials such as plastics, synthetic rubbers, artificial fibers, and other wastes are being released into the environment.

This has created serious issues such as air, water, and soil pollution which is ultimately responsible for ozone layer depletion, pollution, and global warming. To effectively reduce such wastes by recycling or reusing them governments are taking serious initiatives.

The circular economy is one such concept that deals with reusing or recycling waste materials to obtain new and sanitized materials that have retained their original quality for industrial use, such as recovered carbon black. The materials are then reused and help reduce the demand for virgin carbon black. This is attributed to driving the market as it substantially supports the concept of circular economy.

Geopolitical Impact Analysis

The global recovered carbon black market has faced a significant impact of geopolitical events that took place over the last decade. The global energy crisis which arrived during the COVID-19 pandemic situation, made a majority of governments across the globe turn toward sustainable materials to meet the energy demands.

This was achieved by supporting grid resilience with energy storage systems, which ultimately helped industries control their reliance on fossil fuels for power generation. The RCB is majorly used in such storage systems and lithium-ion batteries, which consequently increased the demand for the market.

The US started a trade war with China in 2018 and updated its regulations in January 2020, where heavy tariffs were imposed on goods and materials imported from China, which created challenges for RCB traders based in China. This also created several opportunities for the local players in the market, based in the US.

Additionally, in 2022, the Russia-Ukraine conflict imposed various regulations on Russian carbon black exports, further impacting the market, as Russia is one of the greatest exporters of the RCB. Such events caused fluctuation in the prices of end-products and also affected the demand dynamics, which ultimately influenced the market shares.

Regional Analysis

North America is leading the global recovered carbon black Market

North America dominated the market with the highest revenue 249.6 million, commanding a share of 35.4% owing to the established industrial infrastructure and favorable regulations.

The US and Canada excel in RCB production and are focused on applications in tire manufacturing and rubber-derived products. This benefits the local manufacturers of consumer goods, textiles, accessories, paints & coatings, and automotive industries based in the region.

These manufacturers gain considerable profit by using RCB, owing to its cheap cost and good quality. The local production of RCB helps reduce the transportation costs of the raw materials. The region also has a strong infrastructure of industries such as automotive, technology, electronics, healthcare, and others.

The US and Canada are the global leaders in using advanced technologies, especially in the sustainability sector. Modern advancements in technology facilitate effective waste collection, segregation, sanitization, and recovery of waste carbon black.

Furthermore, the ongoing research and development activities are aiming to find novel areas of applications of RCB to improve the product’s sustainability. The governments in the region are focused on enhancing RCB production efficiency and recovering maximum RCB which is expected to fuel the market in North America in the coming years.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major players in the global recovered carbon black market are constantly driving innovation in the market. They implement multiple business strategies such as collaborations, acquisitions, and production expansions, to attain a higher position on the competitive ground.

Black Bear Carbon B.V., Black Pellets Denmark ApS, Blackwoods Protector, Bolder Industries, Bolder Industries, Cabot Corporation, and Carbon Clean Tech AG are among the major players known for diversified global recovered carbon black production and supply chain networks. These key players along with blooming industry participants collectively influence the global recovered carbon black market’s growth.

Top Key Players

- Black Bear Carbon B.V

- Black Pellets Denmark ApS

- Blackwoods Protector

- Bolder Industries

- Cabot Corporation

- Carbon Clean Tech AG

- Carbon Recovery GmbH

- Continental Carbon Company

- Delta Techniks GmbH

- Delta-Energy Group, LLC

- Dharmapuri Carbon Black Pvt Ltd.

- Dron Industries Ltd.

- Enrestec Inc.

- ERG Materials and Aerospace Corp.

- Hosokawa Micron B.V

- Klean Industries Inc.

- Pyrolyx AG

- Radhe Group of Energy

- ResourceCo Pty Ltd

- SAE Specialty Polymers

- Scandinavian Enviro Systems AB

- Scandinavian Recycling Solutions AS

- SR2O Holdings, LLC

- Other Key Players

Recent Developments

- On June 17, 2024, Klean Industories Inc. announced its expansion in India and Malaysia. The company aims to cater to the growing demand in Asia Pacific with this expansion while improving the quality of RCb char, aiming to completely replace VCB.

- In February 2024, Michelin announced the collaboration with Antin and Enviro to build the first tire recycling facility at the end of its useful life. The supply of end-of-life tires recovered carbon black, and pyrolysis oil forms the foundation of this partnership.

Report Scope

Report Features Description Market Value (2023) $ 703.2 million Forecast Revenue (2033) $ 13,623 million CAGR (2024-2033) 34.5% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Primary Carbon Black, and Inorganic Ash), By Grade (Commodity and Specialty), By Form (Granular and Powder), By Application (Tire, Non-Tire Rubber, Plastics, Inks, Coatings, and Others), By End-use (Transportation, Industrial, Printing and Packaging, Building and Construction, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Black Bear Carbon B.V, Black Pellets Denmark ApS, Blackwoods Protector, Bolder Industries, Cabot Corporation, Carbon Clean Tech AG, Carbon Recovery GmbH, Continental Carbon Company, Delta Techniks GmbH, Delta-Energy Group LLC, Dharmapuri Carbon Black Pvt Ltd., Dron Industries Ltd., Enrestec Inc., ERG Materials and Aerospace Corp., Hosokawa Micron B.V, Klean Industries Inc., Pyrolyx AG, Radhe Group of Energy, ResourceCo Pty Ltd, SAE Specialty Polymers, Scandinavian Enviro Systems AB, Scandinavian Recycling Solutions AS, SR2O Holdings, LLC, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Recovered Carbon Black MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample

Recovered Carbon Black MarketPublished date: Sep 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Black Bear Carbon B.V

- Black Pellets Denmark ApS

- Blackwoods Protector

- Bolder Industries

- Cabot Corporation

- Carbon Clean Tech AG

- Carbon Recovery GmbH

- Continental Carbon Company

- Delta Techniks GmbH

- Delta-Energy Group, LLC

- Dharmapuri Carbon Black Pvt Ltd.

- Dron Industries Ltd.

- Enrestec Inc.

- ERG Materials and Aerospace Corp.

- Hosokawa Micron B.V

- Klean Industries Inc.

- Pyrolyx AG

- Radhe Group of Energy

- ResourceCo Pty Ltd

- SAE Specialty Polymers

- Scandinavian Enviro Systems AB

- Scandinavian Recycling Solutions AS

- SR2O Holdings, LLC

- Other Key Players