Global Real-time Monitoring Solutions For Cold Chain Market Size, Share, Statistics Analysis Report By Component (Hardware (Sensors, GPS Trackers, RFID Tags and Labels, Data Loggers, Others (Wireless Communication Devices, Portable Monitoring Units)), Software (On-premise, Cloud), Services (Installation Services, Maintenance and Support Services, Consulting Services)), By End-User Industry (Food & Beverage, Pharmaceuticals, Chemicals, Healthcare, Retail & E-commerce, Logistics & Transportation, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147654

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

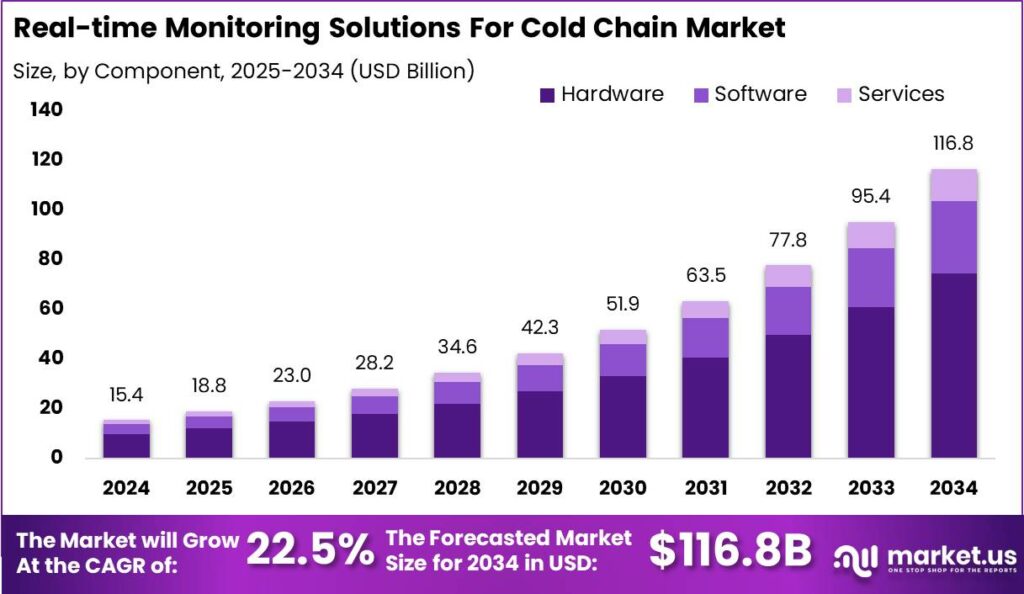

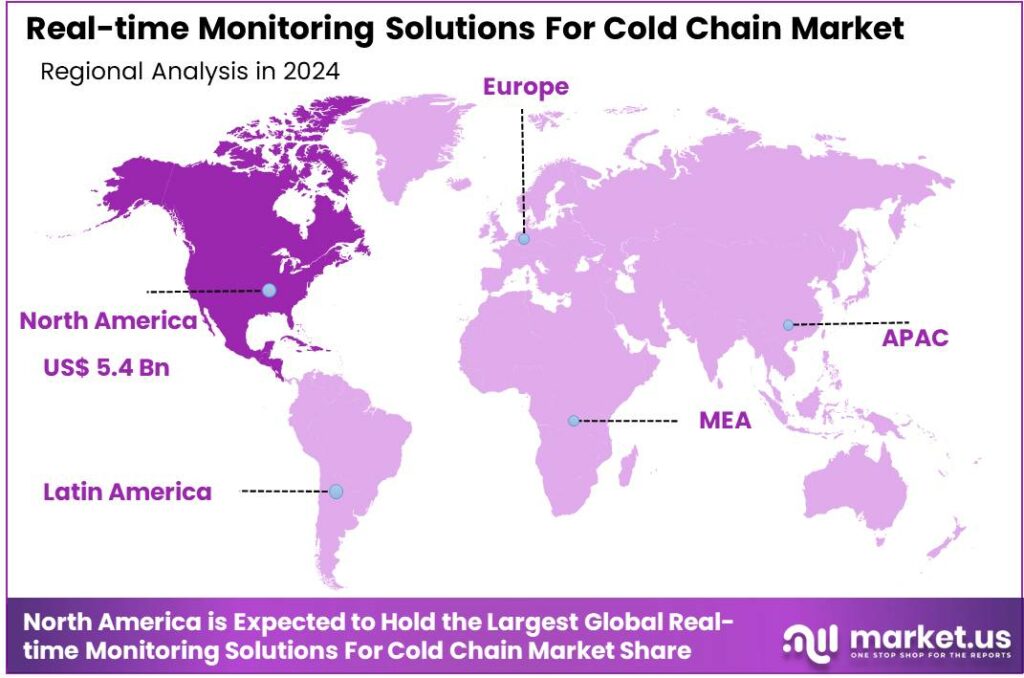

The Global Real-time Monitoring Solutions For Cold Chain Market size is expected to be worth around USD 116.8 Billion By 2034, from USD 15.35 Billion in 2024, growing at a CAGR of 22.50% during the forecast period from 2025 to 2034. North America led the global market in 2024, accounting for more than 35.4% of the share and generating roughly USD 5.4 billion in revenue.

Real-time Monitoring Solutions for Cold Chain refer to integrated systems that continuously track and manage the temperature and environmental conditions of temperature-sensitive products throughout the supply chain. These solutions employ technologies such as Internet of Things (IoT) sensors, GPS tracking, data loggers, and cloud-based platforms to provide immediate data on parameters like temperature, humidity, and location.

The primary objective is to ensure product integrity, compliance with regulatory standards, and to mitigate risks associated with temperature excursions during storage and transportation. The Real-time Monitoring Solutions for Cold Chain Market has witnessed significant growth, driven by the increasing demand for efficient and reliable cold chain logistics.

Government mandates and global standards, like the FDA’s DSCSA and EU GDP guidelines, are driving organizations to invest in traceable, real-time solutions. Moreover, rising consumer awareness and expectations for the safety and quality of perishables are pushing brands to visibly demonstrate compliance and control throughout the supply chain.

The demand for real-time cold chain monitoring solutions is growing due to the need to maintain product quality and meet strict regulatory standards. These systems help reduce spoilage, ensure compliance, and boost customer satisfaction. IoT technology has further increased demand by offering more precise and accessible monitoring capabilities.

Real-time monitoring solutions are increasingly popular across industries, playing a crucial role in sectors like food and beverage, where they help maintain the freshness and safety of perishable goods, and pharmaceuticals, where they ensure the efficacy of temperature-sensitive medications. Their widespread adoption underscores their importance in modern supply chain management.

As per the report from Market.us, The Blockchain for Cold Chain Logistics Market is projected to reach approximately USD 1,867.6 billion by 2034, up from USD 478.0 billion in 2024, expanding at a CAGR of 14.6% between 2025 and 2034. In 2024, North America led the market, accounting for over 40.0% share with USD 191.2 billion in revenue.

Current trends in the cold chain monitoring market include the adoption of cloud-based platforms, which offer scalable and flexible solutions for data storage and analysis. There is a growing focus on integrating AI and machine learning to predict issues and optimize logistics, alongside the emerging use of blockchain to improve transparency and traceability in the supply chain.

The real-time cold chain monitoring market is set for substantial growth. With advancements in sensor technology and data analytics, systems will become more accurate and efficient. As global supply chains grow more complex, the demand for reliable monitoring solutions will increase, making them essential for maintaining product integrity and safety.

Key Takeaways

- The Global Real-time Monitoring Solutions for Cold Chain Market is projected to reach approximately USD 116.8 billion by 2034, growing from USD 15.35 billion in 2024, with a CAGR of 22.50% during the forecast period from 2025 to 2034.

- In 2024, the Hardware segment dominated the market, capturing more than 64% of the global Real-time Monitoring Solutions for Cold Chain market.

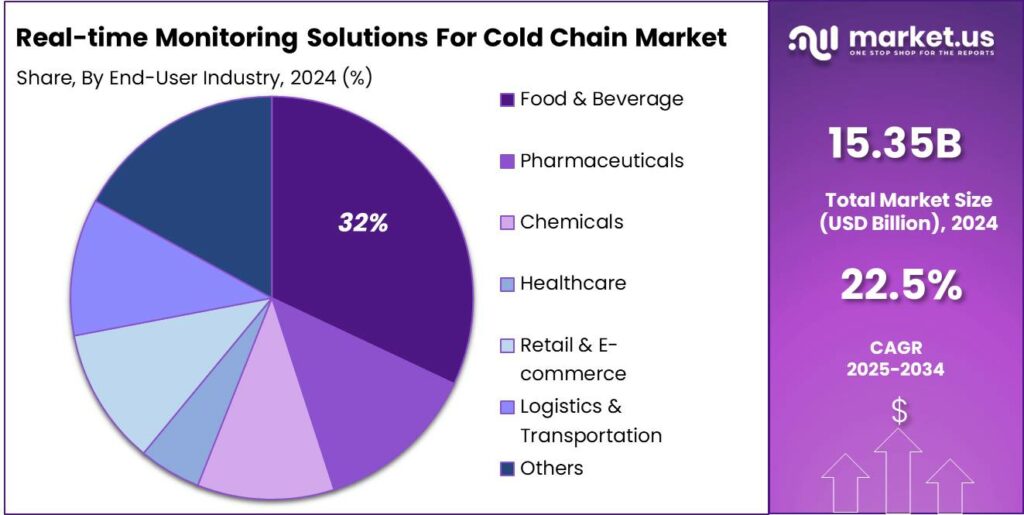

- The Food & Beverage segment held a significant share in 2024, with over 32% of the global market for real-time monitoring solutions for cold chain.

- North America led the global market in 2024, accounting for more than 35.4% of the share and generating roughly USD 5.4 billion in revenue.

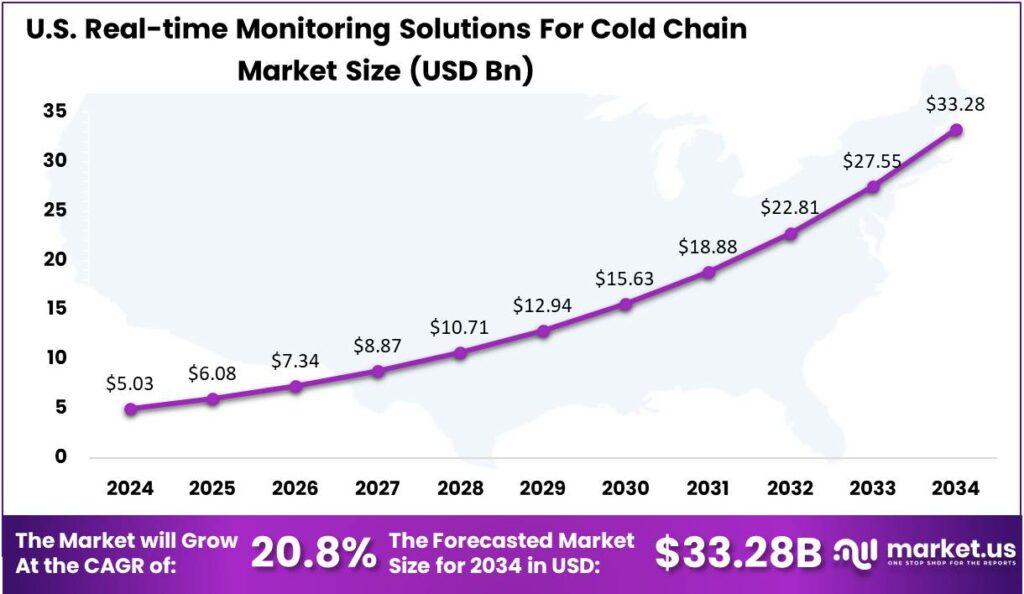

- In 2024, the U.S. real-time monitoring solutions market for cold chain logistics was valued at USD 5.03 billion, driven by the growing demand for supply chain visibility and integrity, and expanding at a rapid rate of 20.8% CAGR.

U.S. Economic Market Expansion

In 2024, the U.S. real-time monitoring solutions market for cold chain logistics was valued at approximately USD 5.03 billion, reflecting the growing emphasis on end-to-end visibility and supply chain integrity.Adoption of these technologies has surged due to stricter regulations, growing consumer safety concerns, and rising demand for temperature-sensitive delivery in pharma and perishable foods.

The market is growing rapidly at a 20.8% CAGR, driven by digital transformation in logistics and the rise of IoT-enabled sensor networks. Real-time cold chain monitoring systems help prevent spoilage, reduce costs, and ensure compliance through alerts, predictive analytics, and GPS tracking. Growth is especially strong in the healthcare sector, where temperature-sensitive products like vaccines and biologics demand strict cold chain control.

The rise of e-commerce in pharmaceuticals, online groceries, and third-party logistics is boosting demand for cold chain monitoring to ensure safe, traceable deliveries. U.S. companies are adopting cloud platforms, AI, and blockchain to enhance transparency. With growing biopharma exports and premium food trade, real-time monitoring is becoming essential, driving continued investment in this high-growth sector.

In 2024, North America held a dominant market position in the global real-time monitoring solutions for cold chain market, capturing more than a 35.4% share and generating approximately USD 5.4 billion in revenue. The region leads due to advanced logistics, strict food and pharma regulations, and early IoT supply chain adoption.

The dominance of North America is also reinforced by the presence of major global solution providers and technology integrators based in the region. These companies are actively deploying AI-enabled data loggers, cloud-based tracking systems, and integrated software platforms to ensure end-to-end monitoring of cold chain operations.

The growing focus on minimizing product spoilage, ensuring drug efficacy, and reducing carbon emissions in refrigerated logistics is pushing enterprises across the U.S. and Canada to prioritize real-time data tracking and analytics as a core operational function. The region’s strong pharmaceutical supply chain, especially for vaccines and biologics, drives steady demand for advanced monitoring solutions.

North America’s leadership is reinforced by the post-pandemic overhaul of healthcare and pharmaceutical logistics, a surge in demand for temperature-sensitive last-mile delivery, and strong government support for cold chain modernization. With ongoing innovation and adoption of AI, blockchain, and cloud technologies, the region is set to lead in real-time cold chain monitoring worldwide.

Component Analysis

In 2024, the Hardware segment held a dominant market position, capturing more than a 64% share of the global Real-time Monitoring Solutions for Cold Chain market. This leadership is primarily driven by the widespread deployment of physical monitoring devices such as sensors, GPS trackers, RFID tags, and data loggers that form the backbone of any cold chain monitoring infrastructure.

Hardware’s importance is reinforced by its role in real-time visibility and automation. IoT-enabled sensors and wireless modules enable continuous monitoring, reducing manual checks and errors. GPS trackers enhance location tracking, particularly in long-haul and cross-border logistics, improving accountability and transparency.

Moreover, the integration of smart hardware with cloud-based analytics platforms is pushing the evolution of cold chain monitoring into a predictive and intelligent system. New-generation sensors and data loggers come with enhanced capabilities, such as longer battery life, higher accuracy, and the ability to operate in extreme environmental conditions.

While software and services like cloud platforms and consulting are growing, hardware remains crucial for real-time cold chain monitoring. Hardware devices provide actionable data by interacting with the physical environment, making them indispensable. As supply chains grow more complex, demand for reliable, rugged hardware will continue to drive this segment’s leadership.

End-User Industry Analysis

In 2024, the Food & Beverage segment held a dominant market position, capturing more than a 32% share in the real-time monitoring solutions for cold chain market. This leadership is primarily driven by the perishable nature of food items, where even slight temperature deviations can compromise safety and shelf life.

Food producers, distributors, and retailers extensively use real-time temperature monitoring to track conditions for products like dairy, seafood, frozen meals, and fresh produce. With rising consumer expectations and strict regulations on cold storage and transport, the food sector is the leading adopter of these technologies.

The growing global trade of food products, especially across long distances and international borders, has heightened the demand for continuous visibility across every stage of the supply chain. Exporters and logistics companies in the food sector rely on IoT-enabled monitoring tools to provide live updates and automated alerts, reducing spoilage rates and ensuring that deliveries meet safety standards.

The rise of online grocery shopping and direct-to-consumer food delivery is boosting the dominance of the Food & Beverage industry. As e-commerce for perishables grows, companies are adopting real-time cold chain monitoring to gain a competitive edge. Consumers now demand transparency about food storage and transportation conditions, and companies use this data to build brand trust and customer loyalty.

Key Market Segments

By Component

- Hardware

- Sensors

- GPS Trackers

- RFID Tags and Labels

- Data Loggers

- Others (Wireless Communication Devices, Portable Monitoring Units)

- Software

- On-premise

- Cloud

- Services

- Installation Services

- Maintenance and Support Services

- Consulting Services

By End-User Industry

- Food & Beverage

- Pharmaceuticals

- Chemicals

- Healthcare

- Retail & E-commerce

- Logistics & Transportation

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Regulatory Compliance and Risk Mitigation

Stringent global regulations on temperature-sensitive goods are driving the adoption of real-time monitoring solutions in the cold chain. Industries like pharmaceuticals and food & beverages face increased scrutiny to maintain product integrity, with regulatory bodies requiring precise temperature control and detailed documentation for safety and efficacy.

Real-time monitoring technologies track environmental conditions continuously, alerting to deviations and ensuring compliance with regulations. This helps prevent product spoilage, recalls, and losses, while protecting company reputations.

IoT devices and cloud platforms enable seamless data collection and analysis, boosting transparency and accountability in the supply chain. These advancements help stakeholders make informed decisions, ensuring regulatory compliance and product quality.

Restraint

High Implementation Costs

The high initial investment for real-time monitoring solutions is a significant challenge for SMEs. Costs for advanced sensors, data loggers, and system integration, along with ongoing expenses for maintenance and data management, add to the financial burden.

The complexity of integrating new systems with legacy infrastructure can also lead to operational disruptions and additional costs. To address these challenges, scalable and cost-effective solutions tailored to smaller businesses are needed. Innovations like modular devices and subscription-based models could lower entry costs, while government incentives and industry partnerships may help ease financial barriers and encourage broader adoption of real-time monitoring in the cold chain.

Opportunity

Integration of Advanced Technologies

The integration of AI, ML, and blockchain offers a major opportunity to improve real-time monitoring in the cold chain. AI and ML can analyze IoT data to predict equipment failures, optimize routes, and enhance temperature control. This predictive power enables proactive maintenance, reducing downtime and ensuring product integrity.

Blockchain technology provides a decentralized, immutable ledger for recording transactions and environmental data, enhancing traceability, ensuring regulatory compliance, and building trust among stakeholders.

The convergence of blockchain, AI, and ML can create intelligent, autonomous systems for managing complex cold chain logistics with minimal human input. These advancements improve efficiency and open new innovation opportunities, giving early adopters a competitive edge.

Challenge

Infrastructure Limitations in Emerging Markets

A major challenge in implementing real-time monitoring is the lack of infrastructure in emerging markets, including unreliable power, limited internet access, and inadequate cold storage. These issues hinder the deployment and effectiveness of monitoring technologies, affecting the integrity of temperature-sensitive goods.

The lack of skilled personnel to manage these systems worsens the issue, with training and retaining staff in remote areas being particularly challenging. This results in inefficiencies and increased spoilage risks. Addressing these issues requires infrastructure investment, capacity building, and adapting technologies to local conditions.

Innovations like solar-powered refrigeration and mobile connectivity can provide alternatives in areas with limited infrastructure. Collaboration between governments, industry, and international organizations is key to ensuring the successful implementation of real-time monitoring.

Emerging Trends

The integration of Internet of Things (IoT) devices has become essential in modern cold chain management. Devices like temperature and humidity sensors, GPS trackers, and data loggers gather and transmit real-time data to centralized platforms. This constant data flow allows for the immediate detection of any deviations, enabling quick corrective actions to prevent spoilage or loss.

Advancements in artificial intelligence (AI) and machine learning are further enhancing predictive capabilities. By analyzing historical and real-time data, these technologies can forecast potential risks and suggest proactive measures to mitigate them.

Blockchain technology is being explored to enhance traceability and transparency in the cold chain by recording every transaction and condition change in an immutable ledger, ensuring data integrity and building trust among stakeholders. Additionally, the development of 5G connectivity is expected to boost data transmission speeds and reliability, enabling more responsive and efficient monitoring systems.

Business Benefits

Real-time monitoring allows for immediate detection of temperature deviations, enabling swift corrective actions. This proactive approach minimizes the risk of spoilage for perishable goods like food and pharmaceuticals. For instance, in the pharmaceutical industry, maintaining strict temperature controls is essential to ensure the efficacy of medicines.

Industries dealing with perishable goods are subject to strict regulations regarding storage and transportation conditions. Real-time monitoring tracks temperature and humidity, ensuring compliance with standards like those of the FDA and WHO. These records are crucial during audits and help prevent penalties for non-compliance.

Customers expect high-quality products, especially when it comes to food and healthcare items. By implementing real-time monitoring, businesses can assure customers that their products have been handled with care throughout the supply chain. Transparency builds trust, setting a brand apart in competitive markets. Over time, a reputation for quality and reliability boosts customer loyalty and market share.

Key Player Analysis

Thermo Fisher Scientific Inc. is a global leader in scientific solutions and has a strong presence in cold chain monitoring. The company offers advanced temperature monitoring systems with high accuracy and compliance-ready features. Its data loggers and cloud-based software are used widely in pharmaceuticals and biotech industries.

Zebra Technologies stands out with its robust IoT and tracking solutions. Known for its barcode scanners and RFID technology, Zebra has expanded into real-time monitoring for cold chains. Its systems provide complete visibility across the supply chain, enabling businesses to track conditions, location, and delivery times with precision.

Monnit Corporation focuses on wireless sensor technology and offers cost-effective monitoring solutions for small and large cold chain operations. Monnit’s plug-and-play sensors are easy to install and provide instant alerts when conditions go outside safe ranges. Their simplicity and flexibility make them ideal for industries like food service and healthcare.

Top Key Players in the Market

- Thermo Fisher Scientific Inc.

- Zebra Technologies

- Monnit Corporation

- Sensitech Inc.

- Emerson Electric Co.

- Cold Chain Technologies (CCT)

- Orbcomm Inc.

- Tive

- Celsius Logistics

- Vaisala

- Accent Systems

- ELPRO-BUCHS AG

- Other Key Players

Top Opportunities for Players

- Enhancing Product Safety and Reducing Waste: Real-time monitoring continuously tracks temperature and humidity to keep perishable goods within safe limits. Instant alerts enable quick action, reducing spoilage and waste. This proactive approach not only safeguards product quality but also leads to cost savings by preventing losses due to compromised goods.

- Ensuring Regulatory Compliance: Pharmaceutical and food industries must meet strict rules for storing and transporting temperature-sensitive products. Real-time monitoring delivers continuous, accurate data to ensure compliance with FDA and WHO standards. This ensures that products are handled according to required guidelines, avoiding potential fines and legal issues.

- Improving Supply Chain Visibility: Integrating IoT devices and sensors into the cold chain allows for end-to-end visibility of products throughout the supply chain. This transparency enables better coordination among stakeholders, timely interventions when issues arise, and overall improved management of logistics operations. Enhanced visibility also builds trust with consumers by ensuring product integrity from origin to destination.

- Optimizing Operational Efficiency: Data collected from real-time monitoring systems can be analyzed to identify patterns and inefficiencies within the supply chain. This insight allows companies to optimize routes, improve inventory management, and make informed decisions that enhance overall operational efficiency. By streamlining processes, businesses can reduce costs and improve service levels.

- Facilitating Predictive Maintenance: Continuous monitoring detects early signs of equipment wear or malfunction, enabling proactive maintenance that minimizes downtime and avoids cold chain disruptions. This approach ensures the reliability of refrigeration units and other critical infrastructure, maintaining the integrity of temperature-sensitive products.

Recent Developments

- In March 2025, Cold Chain Technologies (CCT), a global leader in thermal packaging and digital monitoring for temperature-sensitive life sciences products, has expanded its reach with the acquisition of Global Cold Chain Solutions (GCCS), a top provider of passive cold chain solutions in Australia and India.

- In August 2024, Carrier’s Sensitech completed the acquisition of Berlinger & Co. AG, a well-regarded provider of temperature monitoring solutions for cold chain logistics. This move is expected to significantly strengthen Sensitech’s portfolio, particularly within the pharmaceutical and food industries, by expanding its temperature-sensitive product capabilities and global footprint.

- In June 2024, Sensitech, a subsidiary of Carrier Global Corporation, entered into an agreement to acquire the Monitoring Solutions business of Berlinger & Co. AG. This acquisition aims to strengthen Sensitech’s position in the pharmaceutical and life sciences cold chain monitoring market.

- Earlier, in June 2024, ELPRO-BUCHS AG and Cold Chain Technologies formed a strategic partnership to enhance cold chain monitoring. By combining ELPRO’s advanced temperature monitoring systems with Cold Chain Technologies’ logistics strength, the alliance aims to deliver more reliable, end-to-end cold chain visibility and compliance.

Report Scope

Report Features Description Market Value (2024) USD 15.35 Bn Forecast Revenue (2034) USD 116.8 Bn CAGR (2025-2034) 22.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware (Sensors, GPS Trackers, RFID Tags and Labels, Data Loggers, Others (Wireless Communication Devices, Portable Monitoring Units)), Software (On-premise, Cloud), Services (Installation Services, Maintenance and Support Services, Consulting Services)), By End-User Industry (Food & Beverage, Pharmaceuticals, Chemicals, Healthcare, Retail & E-commerce, Logistics & Transportation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Zebra Technologies, Monnit Corporation, Sensitech Inc., Emerson Electric Co., Cold Chain Technologies (CCT), Orbcomm Inc., Tive, Celsius Logistics, Vaisala, Accent Systems, ELPRO-BUCHS AG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Real-time Monitoring Solutions For Cold Chain MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Real-time Monitoring Solutions For Cold Chain MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- Zebra Technologies

- Monnit Corporation

- Sensitech Inc.

- Emerson Electric Co.

- Cold Chain Technologies (CCT)

- Orbcomm Inc.

- Tive

- Celsius Logistics

- Vaisala

- Accent Systems

- ELPRO-BUCHS AG

- Other Key Players