Real-Time E-Healthcare System Market By Product Type (Wireless body sensor network-based, System on chip, Cloud-based, and Cellular & smartphone-based), By Technology (IoT, Cloud Computing, Blockchain, Big Data Analytics, and AI & Machine Learning), By Application (Patient Monitoring, Telemedicine, Health & Fitness Tracking, Emergency Care, Diagnosis & Treatment, and Chronic Disease Management), By End User (Hospitals, Homecare Settings, Diagnostic Centers, and Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159887

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

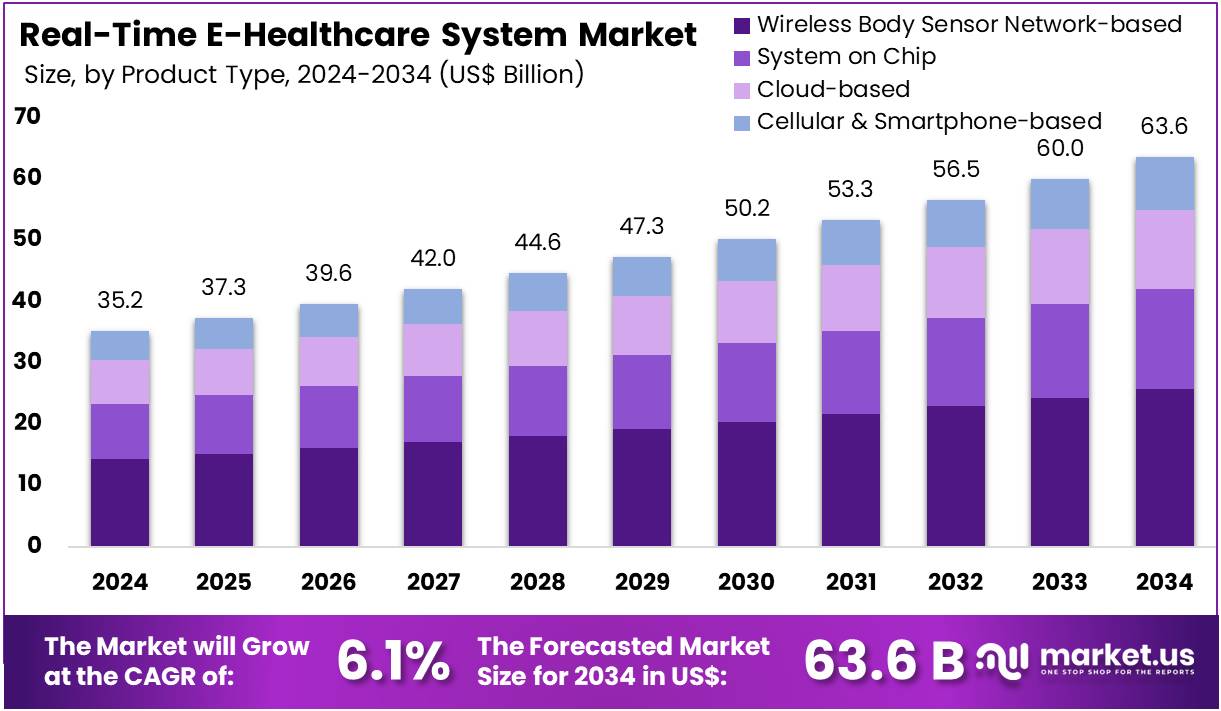

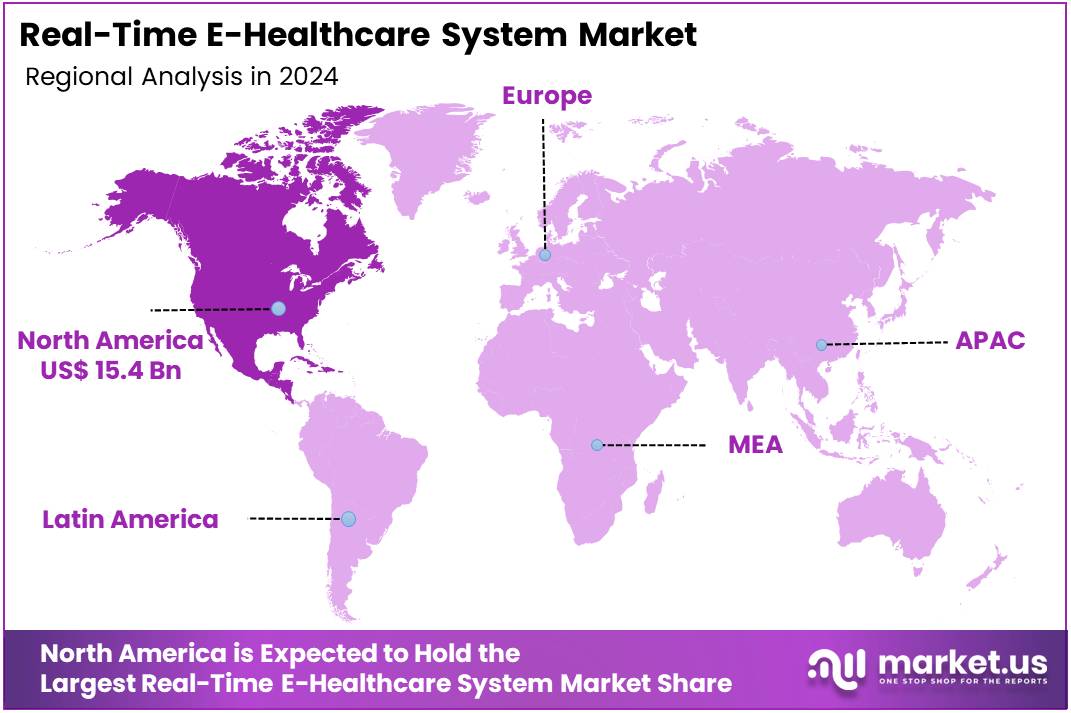

The Real-Time E-Healthcare System Market Size is expected to be worth around US$ 63.6 billion by 2034 from US$ 35.2 billion in 2024, growing at a CAGR of 6.1% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 43.7% share and holds US$ 15.4 Billion market value for the year.

A major factor driving the real-time e-healthcare system market is the rising number of people with chronic diseases. The Centers for Disease Control and Prevention (CDC) reports that six in ten Americans live with at least one chronic illness, such as diabetes, hypertension, or heart disease. These conditions require consistent monitoring and proactive care to avoid serious health issues.

Real-time e-healthcare systems, using tools like remote patient monitoring (RPM) and digital therapeutics, continuously collect data from wearable devices and sensors. This stream of data enables healthcare providers to monitor patient health, track medication use, and act quickly, leading to better health outcomes and fewer expensive hospital visits.

There are significant opportunities in connecting real-time systems with advanced AI and analytics. These systems can analyze large amounts of patient data to spot health trends, predict problems, and create custom treatment plans.

The American Medical Association found that physicians’ use of telemedicine grew from 14% in 2016 to 80% in 2022, highlighting the quick shift to remote care and the need for systems that can manage real-time data. For instance, in September 2023, Abbott acquired Bigfoot Biomedical, a leader in smart insulin management. This move allows Abbott to improve its diabetes care solutions with more advanced, personalized tools, which are essential for a disease where real-time data is crucial.

The market is also moving toward creating integrated patient care ecosystems. This involves combining different real-time systems, like remote monitoring devices, electronic health records (EHRs), and communication platforms.

A single, connected system ensures that everyone involved—patients, caregivers, and clinicians-has immediate access to the same information, resulting in better-coordinated care. This is especially important for managing chronic conditions, where a disconnected system can cause medication errors and delayed treatment. By linking all data points in real time, these platforms are making patient care more proactive, continuous, and collaborative, ultimately improving both patient satisfaction and clinical results.

Key Takeaways

- In 2024, the market generated a revenue of US$ 35.2 billion, with a CAGR of 6.1%, and is expected to reach US$ 63.6 billion by the year 2034.

- The product type segment is divided into wireless body sensor network-based, system on chip, cloud-based, and cellular & smartphone-based, with wireless body sensor network-based taking the lead in 2023 with a market share of 40.5%.

- Considering technology, the market is divided into IoT, cloud computing, blockchain, big data analytics, and AI & machine learning. Among these, IoT held a significant share of 50.3%.

- Furthermore, concerning the application segment, the patient monitoring sector stands out as the dominant player, holding the largest revenue share of 35.8% in the market.

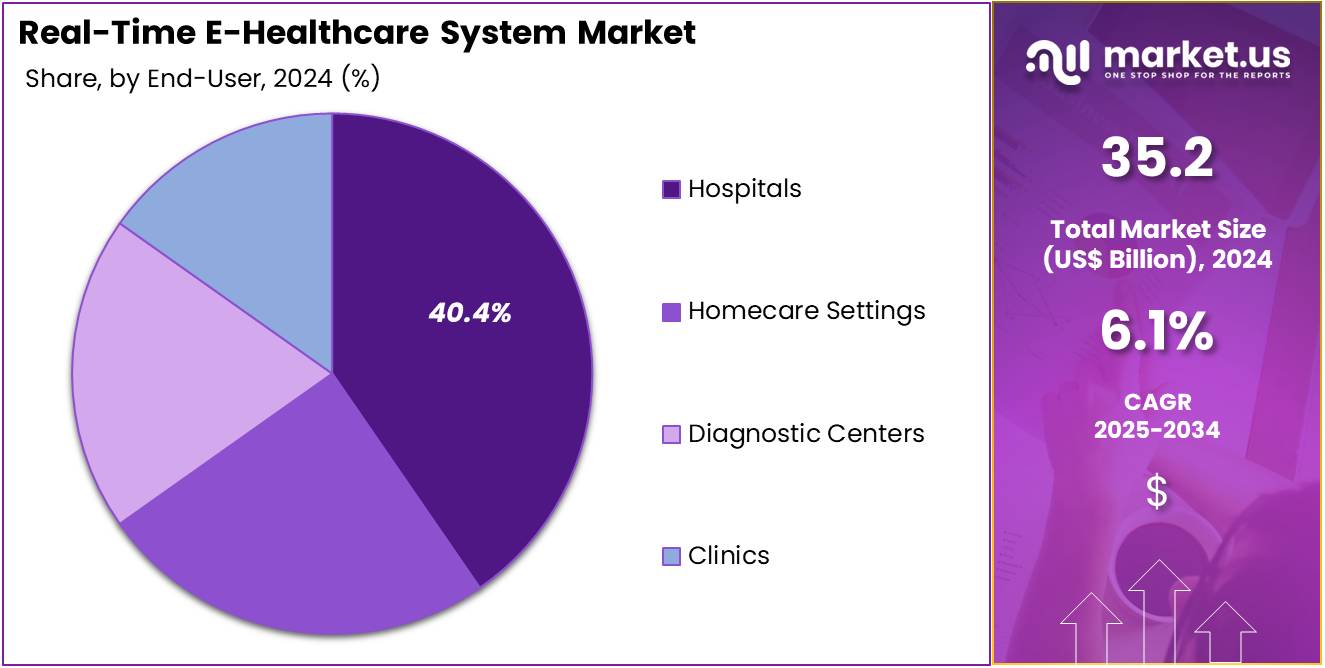

- The end user segment is segregated into hospitals, homecare settings, diagnostic centers, and clinics, with the hospitals segment leading the market, holding a revenue share of 40.4%.

- North America led the market by securing a market share of 43.7% in 2023.

Product Type Analysis

Wireless body sensor network-based systems dominate the market with a 40.5% share. This growth is driven by the rising demand for real-time health monitoring and remote patient care, particularly in chronic disease management. These networks offer continuous tracking of vital health metrics, which significantly improves patient outcomes.

With an increasing focus on remote care, wireless body sensor networks provide a valuable solution for patients requiring constant monitoring, such as those with diabetes or heart conditions. Moreover, the growing popularity of wearable devices and the need for personalized healthcare solutions will further accelerate the adoption of wireless body sensor network-based systems.

Technology Analysis

IoT technology leads the market with a 50.3% share. The adoption of IoT in healthcare is growing rapidly as it enables real-time data collection and analysis, improving patient care and operational efficiency. IoT applications in healthcare, such as remote patient monitoring, smart hospitals, and connected medical devices, are gaining significant traction.

The increasing demand for integrated healthcare solutions and the rise of digital health technologies are fueling this growth. IoT-driven healthcare systems offer efficient ways to monitor patient health remotely and manage healthcare resources, leading to enhanced care delivery and reduced costs. As the demand for connected healthcare devices and services continues to increase, IoT’s role in healthcare is projected to expand.

Application Analysis

Patient monitoring applications hold 35.8% of the market share and are expected to see significant growth. The increasing prevalence of chronic diseases, an aging population, and the need for continuous care are driving the demand for patient monitoring solutions. These systems allow for real-time tracking of vital signs, such as heart rate and blood pressure, improving the accuracy of diagnoses and the speed of interventions.

The rise of wearable health devices and mobile health apps is expected to further boost this segment, offering patients and healthcare providers convenient tools for monitoring health outside traditional clinical settings. With the growing shift toward preventative healthcare, patient monitoring systems are poised for continued expansion.

End-User Analysis

Hospitals dominate the end-user segment with a 40.4% market share. The adoption of real-time e-healthcare systems in hospitals is expected to continue growing, driven by the increasing complexity of healthcare delivery and the need for more efficient care models. Hospitals are increasingly implementing digital tools, including patient monitoring, telemedicine, and diagnostic systems, to enhance patient care, streamline operations, and reduce costs.

The demand for solutions that support various applications, such as emergency care, chronic disease management, and telemedicine, is anticipated to boost the adoption of these systems in hospital settings. As the healthcare industry continues to prioritize digital transformation, hospitals are likely to remain key drivers of growth in the real-time e-healthcare system market.

Key Market Segments

By Product Type

- Wireless body sensor network-based

- System on chip

- Cloud-based

- Cellular & smartphone-based

By Technology

- IoT

- Cloud Computing

- Blockchain

- Big Data Analytics

- AI & Machine Learning

By Application

- Patient Monitoring

- Telemedicine

- Health & Fitness Tracking

- Emergency Care

- Diagnosis & Treatment

- Chronic Disease Management

By End User

- Hospitals

- Homecare Settings

- Diagnostic Centers

- Clinics

Drivers

The rising prevalence of chronic diseases is driving the market

The growing global burden of chronic diseases is a significant driver for the real-time e-healthcare system market. Conditions such as diabetes, cardiovascular diseases, and chronic respiratory diseases require continuous monitoring and management, which real-time e-healthcare systems are uniquely positioned to provide. These systems allow for the remote collection of patient data, such as blood glucose levels, heart rate, and blood pressure, enabling healthcare providers to track a patient’s health status continuously and intervene proactively when necessary.

For instance, the Centers for Disease Control and Prevention (CDC) reported in 2024 that six in ten adults in the United States have at least one chronic disease. This high prevalence, combined with a growing aging population, necessitates a shift from episodic, in-person care to continuous, remote management. Real-time e-healthcare systems reduce the need for frequent hospital visits, lower healthcare costs, and improve the quality of life for patients. The ability to manage these conditions effectively from a distance is not only a convenience for patients but also an essential tool for healthcare systems to manage resources and improve outcomes on a larger scale.

Restraints

Data privacy and security concerns are restraining the market

One of the most significant restraints on the growth of the real-time e-healthcare system market is the critical concern surrounding data privacy and security. These systems collect, transmit, and store highly sensitive patient information, including personal health data, in real-time. The risk of data breaches, cyberattacks, and unauthorized access is a major deterrent for both patients and healthcare providers. Protecting this data is complex and costly, requiring robust cybersecurity measures that can be financially burdensome for many organizations.

The number of large healthcare data breaches reported to the US Department of Health and Human Services (HHS) has been on the rise, with 720 breaches affecting 500 or more records in 2022 and 725 in 2023. These breaches can result in substantial fines, legal penalties, and a significant loss of patient trust. The average cost of a healthcare data breach was US$10.93 million per incident in 2023, the highest of any industry. The inherent vulnerabilities in these interconnected systems and the strict regulatory environment make data security a persistent and complex challenge that restrains broader adoption.

Opportunities

The rise of remote patient monitoring is creating growth opportunities

The rapid adoption of remote patient monitoring (RPM) is driving substantial growth in the real-time e-healthcare system market. With the increasing demand for more efficient and cost-effective healthcare delivery, RPM provides a solution that extends the reach of healthcare providers beyond traditional clinical settings. By utilizing real-time data from wearable devices and connected sensors, RPM enables clinicians to monitor patients with chronic conditions or those recovering from surgery remotely, improving patient convenience and satisfaction.

Additionally, RPM facilitates early detection of health issues, reducing the need for emergency room visits and hospital readmissions. A 2024 survey by the Healthcare Information & Management Systems Society (HIMSS) revealed that 40% of healthcare organizations are planning to expand their telehealth and RPM initiatives in the near future. This growth is further bolstered by changes in policy and reimbursement, such as the US Centers for Medicare & Medicaid Services (CMS) expanding coverage for telehealth and RPM services, which enhances the financial feasibility of these solutions for healthcare providers.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical forces are creating significant headwinds for the real-time e-healthcare market. Global inflation, economic slowdowns, trade frictions, and cybersecurity threats are tightening budgets and complicating secure data flows. Despite these challenges, surging chronic disease rates and an aging population are accelerating adoption. For instance, the number of Americans using remote patient monitoring (RPM) is projected to reach an estimated 70.6 million by the end of 2025. In response, industry leaders are diversifying suppliers and investing in edge-computing to enhance resilience and efficiency.

Current US tariffs are reshaping the market by intensifying import costs for critical hardware and IoT devices, which erodes profit margins and delays integrations. These policies have also stimulated domestic production and innovation, encouraging companies to leverage subsidies for reshoring and developing modular, duty-exempt architectures that emphasize data sovereignty. By securing exemptions for vital components, the industry is converting these economic pressures into an accelerator for growth, delivering resilient, high-performance e-health solutions.

Latest Trends

The increased adoption of AI and wearable devices is a recent trend

A significant and recent trend in the real-time e-healthcare system market is the growing integration of artificial intelligence (AI) with wearable health devices. This trend goes beyond simple data collection, as AI algorithms are now being used to analyze the real-time data from wearables to provide personalized health insights, predictive analytics, and automated alerts. For example, AI-powered wearables can not only track a patient’s heart rate but also use that data to predict the risk of a cardiac event before it occurs.

The American Medical Association’s 2024 survey showed that 66% of physicians reported using AI in their practice, a 78% increase from 2023, which indicates a rapid acceleration in the adoption of these technologies. This synergy between AI and wearable devices is leading to more proactive and preventative care models. It allows for the continuous monitoring of patient vitals and activity levels, and with AI’s analytical power, this data can be translated into actionable insights for both patients and healthcare providers, creating a more responsive and intelligent healthcare ecosystem.

Regional Analysis

North America is leading the Real-Time E-Healthcare System Market

In 2024, North America secured a 43.7% share of the global Real-Time E-Healthcare System market, fueled by urgent needs to tackle chronic diseases and staffing shortages through instant data-driven care. Hospitals embraced wearable sensors and AI dashboards to monitor vitals live, slashing emergency visits by enabling swift interventions. The Centers for Medicare & Medicaid Services’ 2024 telehealth reimbursement extensions sparked widespread adoption, ensuring seamless virtual consults for rural and underserved patients.

Tech-hospital partnerships honed low-latency platforms for real-time triage, easing clinician workloads while maintaining diagnostic precision. Post-pandemic demand for hybrid care cemented video-based systems into daily practice, balancing in-person visits. Value-based care incentives drove cloud platform investments, cutting readmissions and costs. Startups leveraging edge computing for mobile monitoring thrived, aligning with strict HIPAA standards. The Centers for Medicare & Medicaid Services noted a rise in telehealth facility fees from 2.1% in 2022 to 4.6% in 2024, reflecting booming utilization.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific Real-Time E-Healthcare System sector to rocket as soaring chronic illness rates push governments to bolster digital health frameworks. Nations invest heavily in 5G networks, enabling clinics to deploy live-monitoring apps for rapid epidemic response and tailored treatments. Pharma firms team up with local coders to craft AI telemetry, anticipating faster drug trial insights across diverse populations.

Singapore and South Korea spearhead federated data systems, empowering remote clinics with instant specialist access. India’s health programs aim to expand mobile diagnostics for maternal care, easing rural hospital strain. China rolls out 5G hubs for stroke prediction, linking to public health registries. Japan integrates robotic interfaces with genomic data, enhancing elderly rehab precision. India’s eSanjeevani platform hit 276 million telemedicine consultations by 2024, showcasing robust digital health momentum.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading companies in the real-time e-healthcare sector drive expansion by launching AI-powered tools that provide immediate vital sign analysis and predictive notifications for healthcare providers. They pursue strategic acquisitions to integrate advanced sensor technologies, enhancing their platforms for holistic patient monitoring. Firms forge partnerships with healthcare systems and device manufacturers to develop flexible, interconnected solutions that speed up implementation and improve care coordination.

Leaders invest heavily in innovation centers, leveraging IoT for seamless data integration and chronic condition management. They expand into high-growth regions like Asia-Pacific and Latin America, tailoring solutions to meet local regulations and infrastructure demands. Additionally, they offer tiered analytics and support subscriptions to strengthen client relationships and ensure steady revenue streams.

Medtronic plc, based in Dublin, Ireland, and listed on the NYSE (MDT), designs cutting-edge medical devices and digital solutions to enhance patient monitoring and chronic disease care globally. Its platforms, such as the MyCareLink Heart app, enable remote cardiac data sharing with clinicians for timely interventions. Medtronic directs significant R&D toward AI and wireless technologies to anticipate health issues and optimize treatments.

Under CEO Geoff Martha, the company operates in 150 countries, focusing on compliance and global reach. It collaborates with health systems to integrate solutions into telehealth frameworks, improving care for millions. Medtronic maintains its leadership by combining innovative hardware with digital precision to redefine healthcare delivery.

Top Key Players in the Real-Time E-Healthcare System Market

- Omada Health

- Medtronic

- GE Healthcare

- Epic Systems Corporation

- Dexcom, Inc.

- Comarch SA

- Cerner Corporation

- Archer

- Arcadia Healthcare Solutions

- Abbott

Recent Developments

- In November 2024, DexCom, Inc., a leader in glucose biosensing technology, joined forces with OURA, the creator of the leading smart ring, to revolutionize metabolic health management. The partnership integrates Dexcom’s glucose monitoring data with Oura Ring’s insights on vital signs, sleep, stress, heart health, and physical activity, offering users a holistic view of their health to improve lifestyle choices and overall well-being.

- In April 2024: GE HealthCare Technologies Inc. completed the acquisition of MIM Software, further enhancing its medical imaging and diagnostic portfolio. By adding MIM Software’s advanced imaging analytics and digital workflow solutions, GE strengthens its global footprint in medical technology, driving more efficient clinical operations and enabling more accurate diagnostics across healthcare settings.

Report Scope

Report Features Description Market Value (2024) US$ 35.2 billion Forecast Revenue (2034) US$ 63.6 billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Wireless body sensor network-based, System on chip, Cloud-based, and Cellular & smartphone-based), By Technology (IoT, Cloud Computing, Blockchain, Big Data Analytics, and AI & Machine Learning), By Application (Patient Monitoring, Telemedicine, Health & Fitness Tracking, Emergency Care, Diagnosis & Treatment, and Chronic Disease Management), By End User (Hospitals, Homecare Settings, Diagnostic Centers, and Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Omada Health, Medtronic, GE Healthcare, Epic Systems Corporation, Dexcom, Inc., Comarch SA, Cerner Corporation, Archer, Arcadia Healthcare Solutions, Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Real-Time E-Healthcare System MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Real-Time E-Healthcare System MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Omada Health

- Medtronic

- GE Healthcare

- Epic Systems Corporation

- Dexcom, Inc.

- Comarch SA

- Cerner Corporation

- Archer

- Arcadia Healthcare Solutions

- Abbott