Global Real Estate Software Market Report By Software Type (Customer Relationship Management [CRM] Software, Property Management Software, Enterprise Resource Planning [ERP] Software, Contract Management Software, Other Software Types), By Deployment Mode (Cloud-Based, On-Premise), By Application (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 128639

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

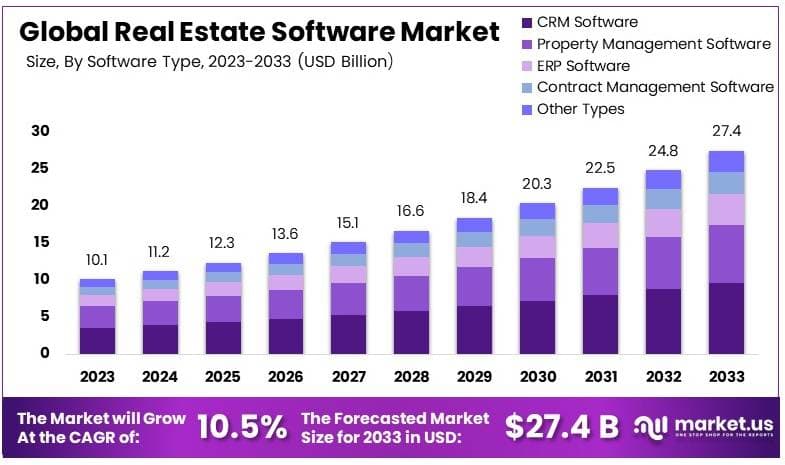

The Global Real Estate Software Market size is expected to be worth around USD 27.4 Billion by 2033, from USD 10.1 Billion in 2023, growing at a CAGR of 10.5% during the forecast period from 2024 to 2033.

Real estate software refers to digital tools designed to help real estate professionals manage their daily operations. This includes property management, sales, marketing, and financial reporting. These tools simplify tasks and improve efficiency in real estate businesses.

Growth in this market is driven by several factors. First, the rise of cloud-based solutions makes it easier for companies to access and manage data from anywhere. Then, the need for automation in real estate processes is increasing as businesses look to improve efficiency. Moreover, the trend of remote work and virtual property tours is boosting the need for real estate software.

Opportunities are also emerging due to government investments in smart city projects and real estate regulations promoting transparency. This will encourage the use of advanced software tools in the industry. Companies that offer innovative and easy-to-use platforms will be well-positioned for growth.

A key factor driving this market is the correlation between the adoption of CRM systems and enhanced business performance. Companies leveraging CRM systems report a 29% increase in sales, a 34% rise in sales productivity, and a 42% improvement in sales forecast accuracy according to Salesforce.

Despite these clear benefits, 30% of real estate companies have yet to implement CRM systems in their business, presenting a considerable opportunity for growth and market penetration.

The rising number of real estate transactions, along with the increasing need for efficient management of property listings and client data, is pushing demand. The National Association of Realtors predicts 4.71 million existing-home sales in 2024, up from 4.09 million in 2023, highlighting strong market activity.

Additionally, the US homeownership rate rose to 65.8% in 2024, surpassing pre-pandemic levels. These factors create a robust environment for the continued adoption of software solutions that improve agent productivity and client management.

Government regulations also play a key role in shaping the real estate market, and by extension, the demand for real estate software. The U.S. Census Bureau reported that 619,000 new single-family homes were sold on a seasonally adjusted annual rate in May 2024.

As housing development accelerates, government programs and incentives for homeownership create opportunities for real estate professionals to expand their client base, making CRM systems and property management software more essential for handling increased business.

The lack of CRM adoption in 30% of real estate companies represents a major opportunity. While nearly 72.5% of real estate agents already use some form of CRM, many are unsure of which system fits their needs best.

This gap highlights the potential for software providers to offer tailored solutions, particularly as high-earning realtors (those with gross commission incomes above USD 100,000) are more than twice as likely to use advanced software tools. There is a clear opportunity for market leaders to address the needs of realtors who have not yet optimized their businesses through technology.

The real estate software market is positioned for continued growth. Increased demand for housing, ongoing digital transformation, and supportive government policies will drive the market forward, offering software providers numerous opportunities for expansion.

Key Takeaways

- The Real Estate Software Market was valued at USD 10.1 billion in 2023, and is expected to reach USD 27.4 billion by 2033, with a CAGR of 10.5%.

- In 2023, Customer Relationship Management (CRM) Software dominates with 29.5%, driven by its essential role in client management.

- In 2023, Cloud-Based deployment leads with 68.9% due to its scalability and lower maintenance costs.

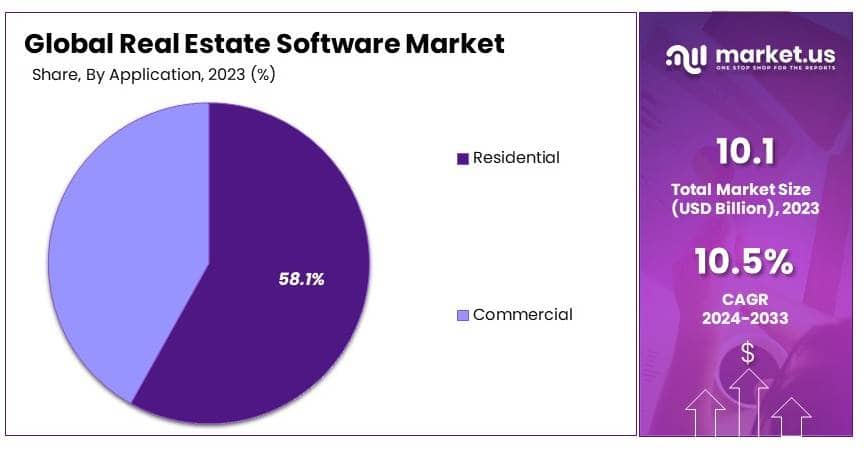

- In 2023, Residential applications account for 58.1%, emphasizing the growing demand for residential real estate solutions.

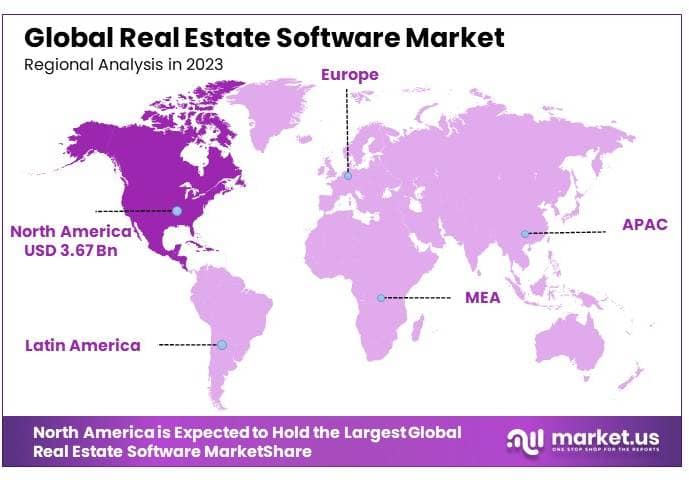

- In 2023, North America leads with 36.3% due to strong technology adoption and real estate development.

Type Analysis

CRM software dominates with 29.5% due to its critical role in enhancing customer relationships and streamlining sales processes.

The Real Estate Software market can be segmented by various software types, with Customer Relationship Management (CRM) Software emerging as the dominant sub-segment. CRM software’s prominence in the market, accounting for 29.5% of the segment, can be attributed to its indispensable utility in managing interactions with clients and improving the efficiency of sales and marketing operations in the real estate sector.

Other types of software in this segment include Property Management Software, Enterprise Resource Planning (ERP) Software, Contract Management Software, and other specialized applications. Each plays a critical role but does not match the market share or the extensive utility provided by CRM systems.

For example, Property Management Software simplifies the administration of rental and real estate properties, enhancing the management of tenant relationships and maintenance operations. ERP Software integrates various functions into a cohesive system to facilitate information flow and financial management across large real estate enterprises.

Contract Management Software streamlines the management of legal documents and compliance-related processes, which is crucial for real estate transactions but does not dominate the market like CRM software. The “other software types” often include niche solutions tailored for specific real estate functions, such as marketing automation or real estate analytics, contributing to the overall growth and technological advancement within the sector.

Deployment Mode Analysis

Cloud-based solutions dominate with 68.9% due to their scalability, cost-effectiveness, and ease of integration.

In the analysis of deployment modes for real estate software, cloud-based solutions stand out as the predominant choice, commanding a significant 68.9% market share. The dominance of cloud-based deployment can be largely attributed to its scalable nature, which allows real estate companies of all sizes to adapt their software usage based on current needs and budget constraints.

The alternative deployment mode, on-premise software, remains relevant for organizations seeking greater control over their data and systems. However, the higher initial costs, need for ongoing maintenance, and slower implementation times make it less attractive compared to cloud managed services. Despite these challenges, on-premise solutions are crucial for large enterprises or in regions where data residency regulations require local data hosting.

The shift towards cloud-based deployment is driven by broader trends in technology adoption, where flexibility, cybersecurity, and remote accessibility are increasingly vital. This trend is expected to continue as more real estate firms prioritize operational efficiency and data security, further boosting the growth of cloud-based solutions in the real estate software market.

Application Analysis

The residential sector dominates with 58.1% due to the high volume of transactions and the ongoing need for housing.

Focusing on the application of real estate software, the residential sector emerges as the leading segment, holding a 58.1% share. This dominance is primarily due to the consistent demand for residential properties and the high volume of transactions in the housing market, which necessitate efficient and reliable software solutions.

Real estate software in the residential sector helps agents, brokers, and property managers handle listings, client communications, and transaction management more effectively, driving demand for this technology.

The commercial sector, while also significant, does not reach the same level of dominance. Commercial real estate software solutions are vital for managing business properties, such as office spaces, retail units, and industrial properties, which require specialized features for lease management, commercial financing, and operational logistics.

The residential market’s predominance is supported by demographic trends, urbanization, and the increasing complexity of residential transactions, which demand sophisticated management tools. This trend underscores the importance of continued innovation and user-friendly design in software solutions catering to the residential sector, ensuring sustained growth and relevance in the evolving market landscape.

Key Market Segments

By Software Type

- Customer Relationship Management (CRM) Software

- Property Management Software

- Enterprise Resource Planning (ERP) Software

- Contract Management Software

- Other Software Types

By Deployment Mode

- Cloud-Based

- On-Premise

By Application

- Residential

- Commercial

Driver

Digital Transformation and Automation Drive Market Growth

The growing digital transformation in the real estate industry is a key factor driving the growth of the real estate software market. Real estate firms are increasingly adopting software solutions to streamline operations, reduce manual work, and improve data management. This shift towards automation enhances efficiency and allows for better decision-making, pushing demand for specialized real estate software.

Another driving factor is the rise of cloud-based solutions. With more businesses moving to cloud platforms, real estate software providers are offering scalable, flexible solutions that enable users to access data and tools from anywhere. This flexibility is essential for a mobile workforce and increases the appeal of cloud-based real estate software.

Additionally, the growing need for better customer relationship management (CRM) tools is fueling market expansion. Real estate companies rely on CRM systems to manage client interactions and improve customer service, making this software essential for businesses looking to enhance client engagement and satisfaction.

The increasing focus on data analytics in real estate is boosting demand for advanced software tools. Real estate professionals use data analytics to gain insights into market trends, property values, and client preferences, all of which are critical for making informed business decisions. These driving factors collectively contribute to the growth of the real estate software market.

Restraint

High Implementation Costs and Data Security Concerns Restraint Market Growth

One of the primary restraints on the growth of the real estate software market is the high cost of implementation. For smaller real estate companies, the expense associated with adopting advanced software systems can be prohibitive. This limits the market potential for real estate software providers, as smaller firms may hesitate to invest in these tools.

Another significant restraint is data security concerns. As real estate software increasingly handles sensitive client information, businesses are wary of potential data breaches. These concerns may slow down adoption, particularly among companies that prioritize privacy and security in their operations.

Additionally, the complexity of integrating new software with existing legacy systems acts as a barrier. Many real estate firms still rely on outdated systems, and transitioning to modern software platforms can be difficult and costly. This integration challenge can discourage companies from upgrading their systems, restraining market growth.

A lack of technical expertise among some real estate professionals can limit the adoption of software solutions. Companies may struggle to train staff on using new systems, leading to slower adoption rates and limited market expansion.

Opportunity

Cloud Integration and Market Expansion Provide Opportunities for Growth

The integration of cloud technology provides a significant opportunity for growth in the real estate software market. Cloud-based solutions enable real estate professionals to access their tools and data from any location, allowing for greater flexibility and scalability. This shift to cloud platforms opens doors for software providers to capture more market share.

Another opportunity lies in the expansion of real estate markets in emerging economies. As the real estate industry grows in developing regions, the demand for sophisticated software solutions increases. This trend allows companies offering real estate software to expand their presence in new geographical markets.

Furthermore, the growing focus on digital marketing in real estate offers opportunities. Real estate professionals increasingly rely on software tools to manage online marketing campaigns, track leads, and improve conversion rates. Software providers can capitalize on this demand by offering comprehensive marketing solutions.

The trend toward automation in property management also presents opportunities for real estate software developers. By providing solutions that automate tasks such as rent collection, maintenance requests, and tenant communications, software providers can address the growing need for efficient property management tools.

Challenge

Customization and Integration Issues Challenge Market Growth

One major challenge in the real estate software market is the need for customization. Many real estate businesses require tailored solutions that fit their specific operations, but creating custom software can be costly and time-consuming. This challenge limits the ability of software providers to scale across different real estate sectors efficiently.

Another challenge is the complexity of integrating new software solutions with existing systems. Many real estate firms rely on a mix of legacy systems and newer tools, which makes integration difficult. This complexity can result in disruptions during the implementation phase and delays in achieving full operational efficiency.

Additionally, ensuring user adoption of these systems poses a challenge. Real estate professionals often have varied levels of technical expertise, and training staff to effectively use new software tools can be a hurdle. Without proper training and adoption, the benefits of real estate software may not be fully realized, slowing down market growth.

Data privacy and compliance with local regulations add to the challenges. Real estate software often handles sensitive client information, and ensuring that these systems comply with data protection laws is crucial. Navigating these regulations, especially for companies operating in multiple regions, is complex and can limit software adoption.

Growth Factors

Mobile Solutions and AI Integration Are Growth Factors for Market Expansion

The growing demand for mobile real estate solutions is a key growth factor for the real estate software market. As more real estate professionals work remotely, mobile-accessible software tools have become essential. These mobile solutions allow real-time access to property data, client information, and transaction updates, enabling more efficient operations.

Another significant growth factor is the integration of Artificial Intelligence (AI) in real estate software. AI-driven tools are being used to analyze large sets of property data, predict market trends, and provide personalized property recommendations to clients. This technology improves decision-making and enhances the overall client experience, driving market growth.

The adoption of automated marketing solutions is also contributing to market expansion. Real estate firms increasingly use software to automate their marketing campaigns, track leads, and manage customer relationships. These tools improve lead generation and conversion rates, making them an integral part of the real estate business strategy.

Furthermore, the increasing need for transparent and efficient transaction management is driving the growth of specialized real estate software. These platforms streamline the buying and selling process, reduce paperwork, and ensure compliance with legal requirements. The demand for such features is fueling the expansion of the real estate software market.

Emerging Trends

AI-Powered Tools and Blockchain Integration Are Latest Trending Factors

The integration of AI-powered tools into real estate software is one of the latest trends shaping the market. AI enhances property valuations, automates client interactions, and predicts market shifts, providing real estate professionals with smarter tools to improve efficiency. This trend is driving the development of more sophisticated software platforms.

Another significant trend is the rise of blockchain technology in real estate transactions. Blockchain allows for transparent and secure transactions, reducing the risk of fraud and streamlining processes like property ownership verification. The growing interest in blockchain is pushing real estate software providers to integrate this technology into their platforms.

The shift towards virtual property tours is another trending factor. As remote property viewings become more common, real estate software platforms are incorporating virtual tour features. This trend allows buyers and renters to explore properties from anywhere, increasing the demand for software solutions that offer these capabilities.

Data-driven decision-making tools are becoming increasingly popular. Real estate firms are leveraging big data analytics to forecast market trends, optimize pricing, and assess property investments. This trend toward data-driven strategies is fueling the adoption of advanced real estate software solutions in the market.

Regional Analysis

North America Dominates with 36.3% Market Share

North America leads the Real Estate Software Market with a 36.3% share, valued at USD 3.67 billion. This dominance is driven by a strong real estate sector, advanced digital infrastructure, and the adoption of cloud-based property management solutions. The U.S. and Canada are major contributors, where real estate firms are increasingly relying on software to streamline operations and improve customer management.

The region’s market benefits from the widespread use of mobile applications, cloud technologies, and AI-powered analytics, making real estate transactions and property management more efficient. North America’s robust economic landscape and growing urbanization drive demand for real estate software, while supportive government regulations and technological innovation further enhance market growth.

North America’s presence in the real estate software market is expected to grow. The increasing adoption of artificial intelligence (AI) and automation in property management, along with the expansion of smart city projects, will further boost demand for advanced software solutions in the real estate industry.

Regional Mentions:

- Europe: Europe’s real estate software market is growing steadily, driven by stringent regulations and increasing investments in smart building technologies. Real estate companies are adopting digital tools to meet sustainability goals.

- Asia Pacific: Asia Pacific is experiencing rapid growth due to urbanization and expanding real estate investments in countries like China and India. The region is adopting real estate software to manage the surge in commercial and residential projects.

- Middle East & Africa: The region is gradually adopting real estate software, focusing on property management and infrastructure development. Government-led smart city initiatives are driving software adoption.

- Latin America: Latin America is progressively embracing real estate software, particularly for property management in growing urban areas. The region’s push for digital transformation is helping to modernize real estate practices.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Real Estate Software Market is highly competitive and dominated by key players with global influence. Among the top companies, Yardi Systems, Inc., MRI Software LLC, and RealPage, Inc. stand out due to their significant market share, robust solutions, and wide customer base.

Yardi Systems, Inc. is a market leader known for offering integrated property management software. It serves various sectors, from residential to commercial real estate. Yardi’s focus on innovation and cloud-based services strengthens its market position, giving it a competitive edge in terms of scalability and efficiency.

MRI Software LLC is another key player, recognized for its versatile property management solutions. It caters to both small and large enterprises, leveraging technology to improve real estate operations. MRI’s commitment to providing flexible, customizable solutions has enhanced its influence across different market segments.

RealPage, Inc. focuses on data analytics and management software, offering advanced tools to streamline real estate operations. Its focus on innovation, particularly in areas like AI and machine learning, positions RealPage as a strategic player in the market, helping clients maximize profitability through data-driven insights.

These companies lead the market due to their focus on technology, innovation, and customer-centric strategies, driving the adoption of real estate software globally.

Top Key Players in the Market

- IBM Corporation

- Oracle Corporation

- SAP SE

- Accruent

- Trimble Inc.

- MRI Software LLC

- RealPage, Inc.

- Yardi Systems, Inc.

- CoStar Group, Inc.

- Zoho Corporation

- Other Key Players

Recent Developments

- MRI Software: On March 2024, MRI Software announced the launch of its next-generation Property Management X (PMX), revolutionizing property management with enhanced usability, data access, and AI-driven insights. The new features include mobile capabilities, customizable workflows, and AI-assisted decision-making tools. The solution currently supports over 2,500 clients and 50,000 users managing millions of residential and commercial properties globally.

- Planon: On March 2023, Planon announced its acquisition of control.IT, a major real estate software company in the DACH region. Control.IT’s flagship SaaS product, bison.box, manages over €600 billion in assets, serving more than 5,000 users globally. This acquisition strengthens Planon’s portfolio with advanced asset and portfolio management capabilities.

- Re-Leased: On September 2024, Re-Leased secured USUSD 12.5 million in funding, led by Movac, with support from Icehouse Ventures and other investors. The funds will drive the expansion of Re-Leased’s AI-powered property management software, focusing on the UK and US markets, as well as boosting the use of its AI tool, Credia.

- Commonwealth Bank of Australia (CBA) and MRI Software: In June 2024, Commonwealth Bank of Australia (CBA) and MRI Software announced a collaboration to integrate CBA’s Smart Real Estate Payments solution into MRI’s Property Tree software. This partnership aims to streamline payment processes for tenants, agents, and property managers in Australia, enhancing security and flexibility.

Report Scope

Report Features Description Market Value (2023) USD 10.1 Billion Forecast Revenue (2033) USD 27.4 Billion CAGR (2024-2033) 10.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Software Type (Customer Relationship Management [CRM] Software, Property Management Software, Enterprise Resource Planning [ERP] Software, Contract Management Software, Other Software Types), By Deployment Mode (Cloud-Based, On-Premise), By Application (Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Oracle Corporation, SAP SE, Accruent, Trimble Inc., MRI Software LLC, RealPage, Inc., Yardi Systems, Inc., CoStar Group, Inc., Zoho Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Real Estate Software MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Real Estate Software MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Oracle Corporation

- SAP SE

- Accruent

- Trimble Inc.

- MRI Software LLC

- RealPage, Inc.

- Yardi Systems, Inc.

- CoStar Group, Inc.

- Zoho Corporation

- Other Key Players