Global Rare Disease Genetic Testing Market, By Disease Type (Endocrine & Metabolism Diseases, Immunological Disorders, Neurological Diseases, Hematology Diseases, Cancer, and Other Disease Types), By Technology, By Specialty, By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 100151

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

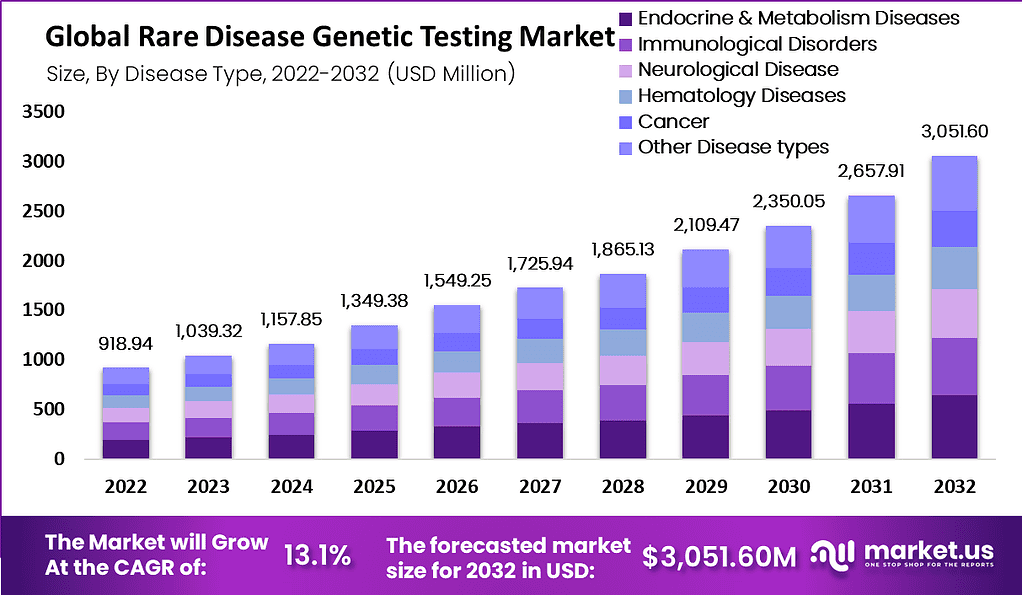

The Global Rare Disease Genetic Testing Market Size is expected to be worth around USD 3,051.6 million by 2032 from USD 918.94 million in 2023, growing at a CAGR of 13.1% during the forecast period from 2022 to 2032.

The testing of rare diseases has gained popularity because of the decrease in sequencing costs. Additionally, the market is anticipated to rise as a result of the growing need for rapid and fast diagnosis. Translational research and genomic technologies play a crucial role in enhancing the analysis and detection of new mutations and are expected to support business growth.

The use of genetic testing in disease diagnostics is expected to see rapid expansion throughout the anticipated time frame as a result of increased research activity in this field. The increase in registries in this field is one of the main factors boosting the industry since they allow data to be gathered to provide a sufficient number of samples for epidemiological and clinical research. They are essential in figuring out whether clinical trials are feasible, which aids in effective trial planning and attracting patients.

Key Takeaways

- Market Valuation: Projected to reach USD 3,051.6 million by 2032 from USD 918.94 million in 2023, growing at a CAGR of 13.1%.

- Increasing Prevalence: Population growth drives the need for genetic testing for rare diseases, fueling market expansion.

- Technological Advancements: Improved genetic testing technologies enhance accuracy, promoting usage for diagnosing rare diseases.

- Product Innovations: New diagnostic products continue to stimulate market growth.

- High Costs: Genetic testing affordability remains a barrier in low- and middle-income regions.

- Endocrine Disorders: Expected to grow rapidly, with a CAGR of 21.0%, due to advances in understanding genetic causes.

- NGS Technology: Leads the technology segment, accounting for over 35.22% of the market revenue.

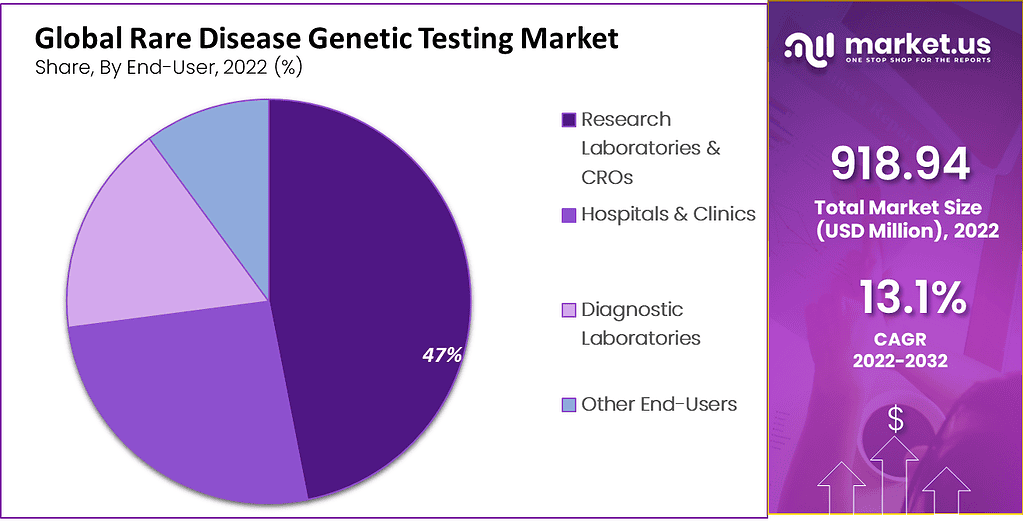

- Research Labs & CROs: Dominated end-user market share in 2022, with over 47%.

- Diagnostic Labs: Forecasted to grow at the fastest rate, a CAGR of 16.1%, through the forecast period.

- Asia Pacific Growth: Expected to see the highest regional growth rate, with an 18.1% CAGR, driven by increased diagnostic awareness and supportive policies.

Disease Type Analysis

Based on disease type the market is segmented into endocrine & metabolism diseases, immunological disorders, neurological diseases, hematology diseases, cancer, musculoskeletal disorders, cardiovascular disease, and other disease types. In the course of the forecast period, the segment of endocrine and metabolism diseases is anticipated to grow at a CAGR of 21.0%.

The understanding of the molecular and genetic causes of endocrine conditions, such as Cushing’s syndrome, has increased significantly in recent years. This encourages the use of genetic testing for endocrine diseases. Furthermore, it is predicted that the identification of genetic mutations in patients with bilateral macronodular adrenal hyperplasia and primary pigmented nodular adrenocortical disease will accelerate the development of instruments for genetic testing for early disease diagnosis. The segment that had the second-highest revenue share was immunological diseases.

Technology Analysis

By Technology the rare disease genetic testing market is further divided into next-generation sequencing, array technology, PCR-based testing, FISH, sanger sequencing, karyotyping, and other technologies. In 2022, the Next-Generation Sequencing (NSG) technology segment led the global market and was responsible for the highest revenue share of more than 35.22%.

The market has been driven by the wide availability and use of NGS-based gene panels for testing cancer, neurologic diseases, cardiovascular disease, and other diseases. Over the forecast duration, WES is a used genetic testing method to identify the genetic cause of rare diseases and is becoming the standard of care for undiagnosed rare diseases.

Specialty Analysis

This market is segmented into molecular genetic testing, chromosomal genetic tests, and biochemical genetic tests based on specialties. In 2022, the market for molecular genetic testing held the largest market share, contributing more than 41.10% of worldwide revenue.

During the forecast period, the segment will maintain the lead by the fastest CAGR. The segment is likely to develop because of quick technology developments and experience using and managing high throughput technologies in clinical settings. The study of single genes or short DNA segments for the detection of mutations or changes resulting in genetic diseases is made possible by molecular genetic tests. Molecular testing isn’t only limited to rare diseases but also involves testing of ultra-rare disorders.

End-User Analysis

In 2022, the research labs & CROs industry segment held the largest market share, contributing more than 47% of the total revenue. Because the majority of end users are laboratories. The testing services provided by laboratories include molecular genetic tests and biochemical genetic tests.

Additionally, the use of molecular genetic testing in laboratories is expanding quickly globally. Many laboratories do genetic testing, including those that are CLIA-accredited for specialties such as clinical cytogenetics, pathology, and chemistry. Over the research period, the diagnostic lab’s sector is anticipated to grow at the fastest CAGR of 16.1%.

Key Market Segments

Based on Disease Type

- Endocrine & Metabolism Diseases

- Immunological Disorders

- Neurological Disease

- Hematology Diseases

- Cancer

- Musculoskeletal Disorders

- Cardiovascular Disease

- Other Disease types

Based on Technology

- Next-Generation Sequencing( NGS)

- Whole Exome Sequencing

- Whole Genome Sequencing

- Array Technology

- PCR-Based Testing

- FISH

- Sanger Sequencing

- Karyotyping

- Other Technology

Based on Specialty

- Molecular Genetic Tests

- Chromosomal Genetic Tests

- Biochemical Genetic Tests

Based on End-User

- Research Laboratories & CROs

- Hospitals & Clinics

- Diagnostic Laboratories

- Other End-Users

Driving Factors

Increasing prevalence of rare diseases

The growing global population correlates with an increase in the incidence of rare diseases, amplifying the demand for genetic testing. This form of testing is crucial for identifying and managing rare diseases, facilitating earlier diagnosis and tailored treatment plans. The rising prevalence of these conditions underscores the urgent need for advanced diagnostic solutions, contributing significantly to the expansion of the genetic testing market.

Developments in genetic testing technology

There have been substantial advancements in genetic testing technology, enhancing its accuracy and effectiveness. This progress has been pivotal in increasing the adoption of genetic testing for both diagnosing and treating rare diseases. Furthermore, the market has benefited from a surge in innovative products specifically designed for rare disease diagnosis, driving further growth in this sector.

Restraints

High cost of genetic testing

The high cost of genetic testing poses a significant barrier for both patients and healthcare professionals. This challenge is especially pronounced in low- and middle-income countries, where limited financial resources can impede access to such advanced medical diagnostics. The affordability of genetic testing remains a critical issue, preventing widespread adoption and integration into standard healthcare practices. As a result, individuals in these regions may lack access to crucial genetic information that could influence treatment decisions and preventive healthcare strategies.

Moreover, the economic constraints in these countries exacerbate the inequality in healthcare services. The limited availability of genetic testing can delay the diagnosis of genetic disorders, affecting patient outcomes. It also hinders the ability of healthcare systems to evolve and incorporate modern technological advances that could benefit a broader population. Addressing the affordability and accessibility of genetic testing is essential to ensure equitable healthcare delivery and improve health outcomes globally.

Limited availability of treatment

Despite the availability of diagnoses for rare diseases, the range of treatment options is often limited. This scarcity of effective treatments may lead some patients to question the utility of undergoing genetic testing. When a cure or substantial treatment is lacking, the motivation to determine a genetic predisposition or confirmation of such diseases diminishes. Consequently, this could lead to a reduction in the demand for genetic tests, as patients might see little advantage in confirming a diagnosis without available therapeutic options.

The connection between the availability of treatment options and the demand for genetic testing is evident. In cases where rare diseases are diagnosed but lack comprehensive treatment methods, patients may feel that genetic testing is futile. This perception can negatively impact the demand for these tests, as patients prioritize practical outcomes over mere knowledge of their genetic status. Thus, a decrease in testing demand may be observed, driven by the limited therapeutic benefits perceived by the patients.

Opportunities

Expanding Genetic Testing Opportunities

The rising popularity of non-invasive genetic testing methods, such as blood-based and saliva-based tests, is reshaping the industry. These tests are favored for their ease of administration and less invasive nature, which could encourage more companies to develop and market tests tailored for diagnosing rare diseases. As these non-invasive options become more widespread, they offer significant potential for companies looking to innovate and capture new segments within the genetic testing market.

Genetic Testing in Emerging Markets

There is a growing need for genetic testing in emerging regions like Asia-Pacific (APAC) and the Middle East and Africa (MEA), particularly in countries with lower and middle incomes. These areas often face a higher prevalence of rare diseases, presenting a substantial market opportunity. Companies that can deliver genetic testing solutions that are both affordable and accessible are poised to expand their customer base significantly and boost their revenue streams in these underserved markets.

Trends

Expanding Genetic Testing Opportunities

The rising popularity of non-invasive genetic testing methods, such as blood-based and saliva-based tests, is reshaping the industry. These tests are favored for their ease of administration and less invasive nature, which could encourage more companies to develop and market tests tailored for diagnosing rare diseases. As these non-invasive options become more widespread, they offer significant potential for companies looking to innovate and capture new segments within the genetic testing market.

Genetic Testing in Emerging Markets

There is a growing need for genetic testing in emerging regions like Asia-Pacific (APAC) and the Middle East and Africa (MEA), particularly in countries with lower and middle incomes. These areas often face a higher prevalence of rare diseases, presenting a substantial market opportunity. Companies that can deliver genetic testing solutions that are both affordable and accessible are poised to expand their customer base significantly and boost their revenue streams in these underserved markets.

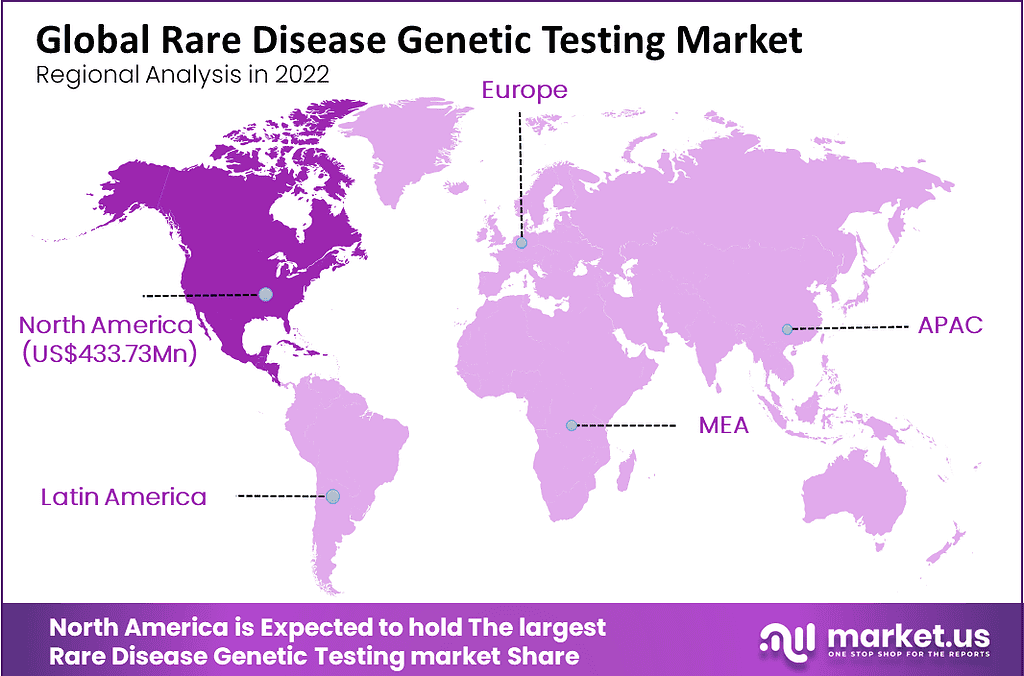

Regional Analysis

In 2022, North America led the global industry with a share of more than 47.2%. The high prevalence of rare diseases, the presence of several disease registries, a substantial number of research and development facilities for ultra-rare diseases, and significant expenditures in disease detection are all factors that contribute to the region’s high market share.

On the other side, Asia Pacific is predicted to grow at the highest rate throughout the forecasted time, with a CAGR of 18.1%. This is mostly due to improvements in diagnostic awareness and abilities. Additionally, the implementation of frameworks and policies to support disease management will present attractive prospects in this region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

To increase their market dominance, major competitors are using a variety of techniques, such as collaborations created via mergers and acquisitions, regional expansions, and strategic partnerships. Because there are so many competitors, the market for genetic testing for rare diseases is highly competitive. Quest Diagnostics Incorporated is one of these locally and internationally active players. Quest Diagnostics is a leading provider of genetic testing services, including genetic testing for rare diseases.

Market Key Players

- Quest Diagnostics Inc.

- Centogene N. V

- Invitae Corp

- 3billion, Inc.

- Arup Laboratories

- Eurofins Scientific

- Strand Life Sciences

- Ambry Genetics

- Perkin Elmer, Inc.

- Realm IDX, Inc.

- Macrogen, Inc.

- Baylor Genetics

- Color Genomics, Inc.

- Health Network Laboratories

- PreventionGenetics

- Progenity, Inc.

- Coopersurgical, Inc.

- Fulgent Genetics Inc.

- Myriad Genetics, Inc.

- Laboratory Corporation of America Holdings

- Opko Health, Inc.

- Other key players

Recent Developments

- In August 2024: Quest Diagnostics finalized the acquisition of LifeLabs from OMERS for approximately USD $1 billion. This strategic move aims to enhance access to diagnostic innovations and integrate LifeLabs’ capabilities, which align well with Quest’s advanced diagnostics and lab services. The acquisition is expected to generate about USD $710 million annually in revenues. This collaboration promises to improve healthcare and diagnostic services in North America, particularly for Canada’s expanding and aging population.

- In April 2023: Centogene launched NEW CentoGenome, a comprehensive Whole Genome Sequencing (WGS) test. This enhanced next-generation sequencing-based assay aims to provide a more detailed diagnostic overview for rare and neurodegenerative diseases. It includes the detection of Copy Number Variations and complex disease-causing variants, improving diagnostic accuracy and potentially accelerating access to treatments.

Report Scope

Report Features Description Market Value (2022) US$ 918.9 Mn Forecast Revenue (2032) US$ 3,051.6 Mn CAGR (2023-2032) 13.1% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Disease Type (Endocrine & Metabolism Diseases, Immunological Disorders, Neurological Disease, Hematology Diseases, Cancer, Musculoskeletal Disorders, Cardiovascular Disease, Other Disease types)

Based on Technology (Next-Generation Sequencing(NGS) (Whole Exome Sequencing, Whole Genome Sequencing), Array Technology, PCR-Based Testing, FISH, Sanger Sequencing, Karyotyping, Other Technology)

Based on Specialty (Molecular Genetic Tests, Chromosomal Genetic Tests, Biochemical Genetic Tests)

Based on End-User (Research Laboratories & CROs, Hospitals & Clinics, Diagnostic Laboratories, Other End-Users)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Quest Diagnostics Inc., Centogene N. V, Invitae Corp , 3billion, Inc., Arup Laboratories, Eurofins Scientific, Strand Life Sciences, Ambry Genetics, Perkin Elmer, Inc., Realm IDX, Inc., Macrogen, Inc., Baylor Genetics, Color Genomics, Inc., Health Network Laboratories, PreventionGenetics, Progenity, Inc., Coopersurgical, Inc., Fulgent Genetics Inc., Myriad Genetics, Inc., Laboratory Corporation of America Holdings, Opko Health, Inc., Other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Rare Disease Genetic Testing MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Rare Disease Genetic Testing MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Quest Diagnostics Inc.

- Centogene N. V

- Invitae Corp

- 3billion, Inc.

- Arup Laboratories

- Eurofins Scientific

- Strand Life Sciences

- Ambry Genetics

- Perkin Elmer, Inc.

- Realm IDX, Inc.

- Macrogen, Inc.

- Baylor Genetics

- Color Genomics, Inc.

- Health Network Laboratories

- PreventionGenetics

- Progenity, Inc.

- Coopersurgical, Inc.

- Fulgent Genetics Inc.

- Myriad Genetics, Inc.

- Laboratory Corporation of America Holdings

- Opko Health, Inc.

- Other key players