Global Rail Freight Transport Market Size, Share, Growth Analysis By Cargo Type (Dry Bulk, Containerised / Intermodal, Liquid Bulk, Break-bulk and Project Cargo), By Service Type (Transportation, Services Allied to Transportation), By Traction Type (Diesel, Electric, Hybrid / Hydrogen and LNG), By Destination (Domestic, International/Cross-border), By End-user (Mining and Minerals, Oil, Gas and Chemicals, Agriculture and Food, Manufacturing and Automotive, Retail and FMCG, Construction Materials and Forestry), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170696

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

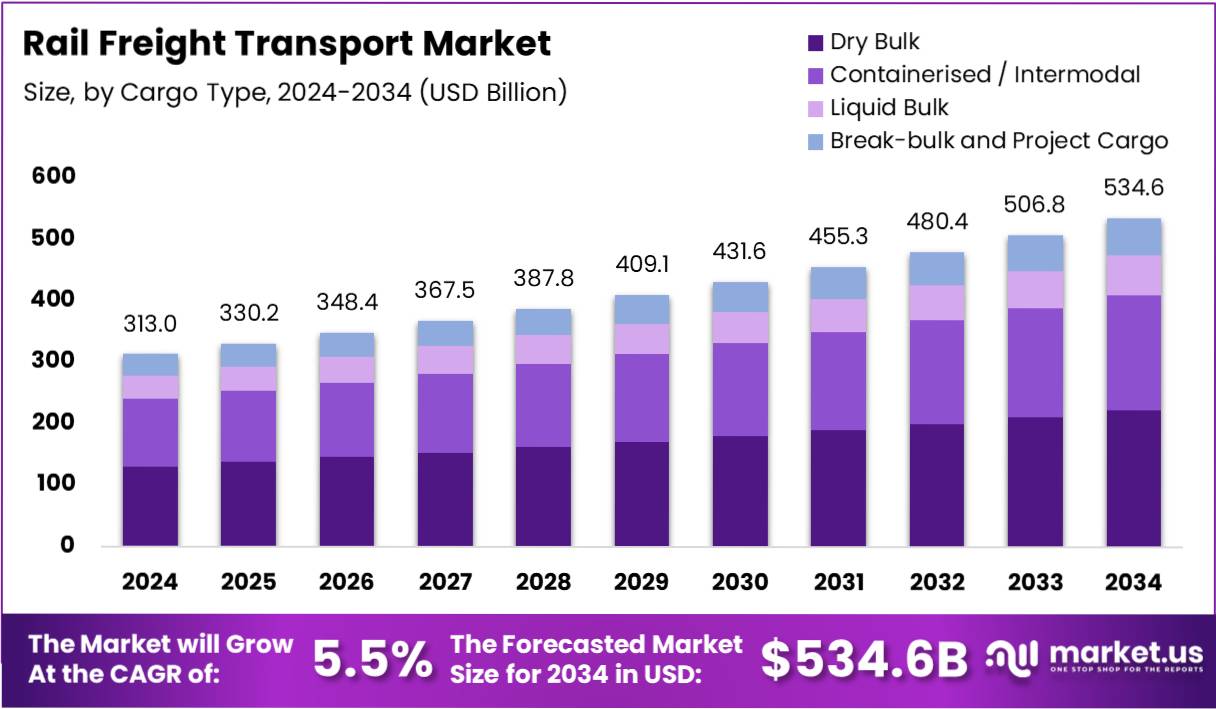

The Global Rail Freight Transport Market size is expected to be worth around USD 534.6 Billion by 2034, from USD 313.0 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

Rail freight transport refers to the structured movement of goods using railway systems for domestic and cross-border logistics. It supports bulk, containerized, and specialized cargo movement efficiently. As a result, rail freight transport strengthens supply chain continuity while enabling stable freight flows across industrial and commercial ecosystems.

The rail freight transport market represents the organized commercial framework enabling rail-based cargo operations. It includes infrastructure utilization, service integration, and logistics coordination. Consequently, the market benefits from long-term freight contracts, predictable demand cycles, and growing reliance on structured freight transport solutions.

The market expands steadily due to rising industrial production and increased freight volumes. Moreover, manufacturers and exporters prefer rail for long-distance and heavy cargo movement. This shift improves network efficiency while supporting scalable logistics planning across core economic sectors.

At the same time, opportunities continue emerging through intermodal rail freight transport solutions. Integration with ports, warehouses, and inland terminals enhances cargo flexibility. Therefore, logistics providers increasingly leverage rail freight transport market capabilities to reduce congestion, improve turnaround times, and strengthen multimodal freight connectivity.

Government investment plays a critical role in sustaining market momentum. Authorities prioritize rail corridor modernization, capacity expansion, and electrification projects. Additionally, evolving regulatory frameworks encourage freight modal shifts. These initiatives support rail freight transport adoption while aligning national logistics strategies with long-term infrastructure resilience goals.

Operational efficiency remains a key market driver. According to research, freight railroads move nearly 59 tons of freight per American annually. This highlights rail’s ability to handle high freight volumes reliably. Consequently, rail freight transport continues serving as a backbone for large-scale cargo movement.

Environmental performance further strengthens the rail freight transport market outlook. According to research, railroads are 3–4 times more fuel-efficient than trucks. This efficiency leads to a 75% average reduction in greenhouse gas emissions when freight moves by rail, supporting sustainability-focused logistics decisions.

Key Takeaways

- Global Rail Freight Transport Market is projected to reach USD 534.6 Billion by 2034 from USD 313.0 Billion in 2024, growing at a CAGR of 5.5%.

- Dry Bulk dominates the cargo type segment with a 39.5% share in 2024.

- Transportation leads the service type segment with a 76.2% share in 2024.

- Diesel traction holds the largest share in traction type at 59.8% in 2024.

- Domestic rail freight dominates the destination segment with a 71.3% share in 2024.

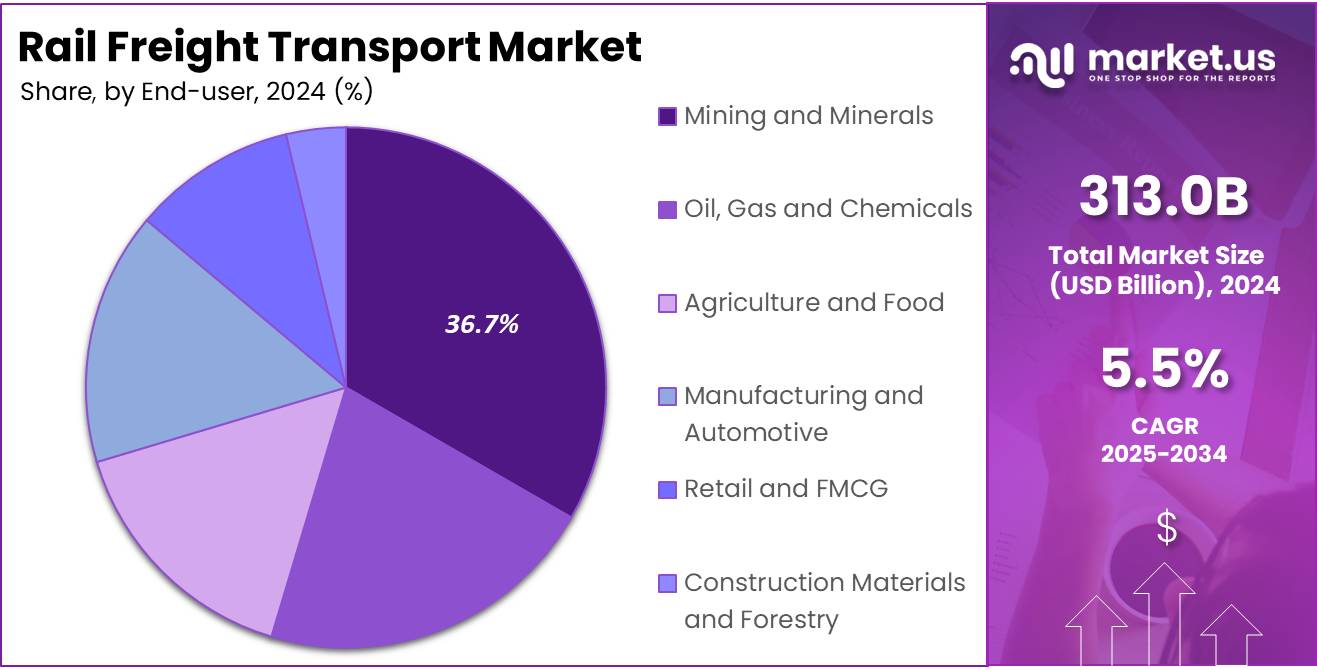

- Mining and Minerals is the leading end-user segment with a 36.7% share in 2024.

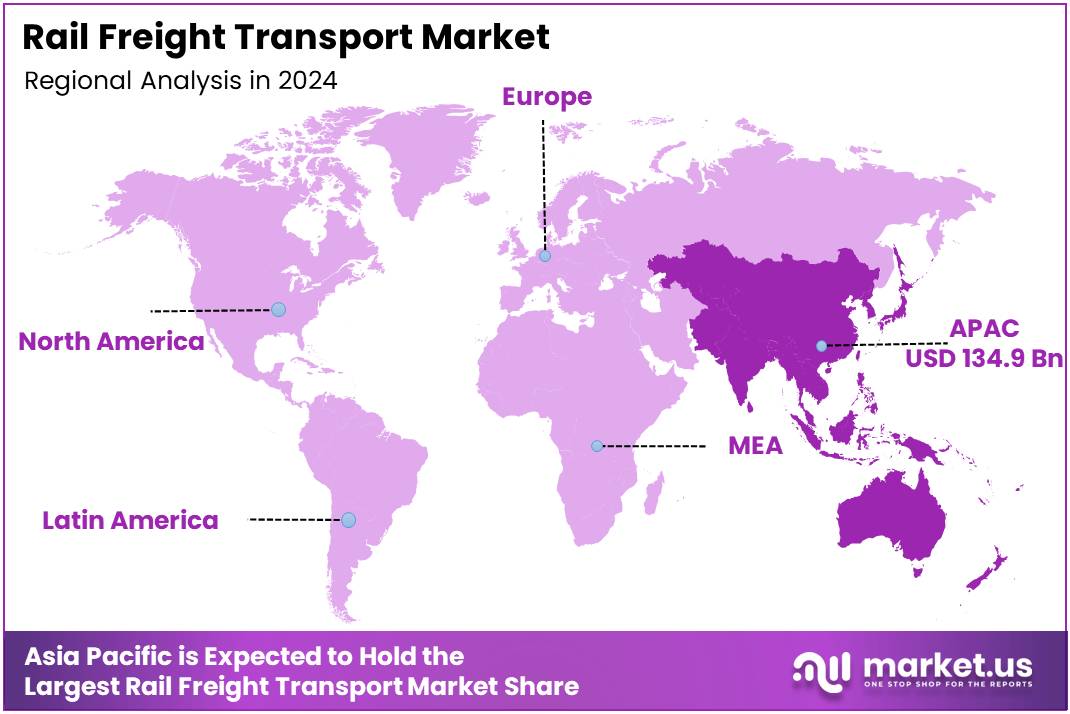

- Asia Pacific is the largest regional market with a 43.1% share, valued at USD 134.9 Billion.

By Cargo Type Analysis

Dry Bulk dominates with 39.5% due to high demand for bulk commodities and industrial materials transport.

In 2024, Dry Bulk held a dominant market position in the By Cargo Type Analysis segment of Rail Freight Transport Market, with a 39.5% share. Rail transport is widely used for coal, minerals, grains, and ores, supporting large-scale industrial and agricultural logistics efficiently. Its ability to move massive volumes over long distances reliably ensures consistent supply chain operations.

Containerised / Intermodal enables flexible and modular cargo movement. It integrates rail with road and port transportation, reducing handling times and enhancing security. Businesses increasingly adopt this sub-segment for international and domestic logistics, as it simplifies multi-modal shipments and supports faster delivery of goods while lowering risks of damage during transit.

Liquid Bulk includes fuels, chemicals, and other liquid commodities requiring specialized tank cars and careful handling. Rail provides secure transport with minimal risk of spills or accidents. This segment is particularly important for energy and chemical industries, ensuring reliable delivery of liquids to refineries, plants, and distribution centers across regions.

Break-bulk and Project Cargo handles oversized, heavy, or irregular cargo such as machinery, construction equipment, and industrial parts. Rail transport offers safe and efficient solutions for complex loads that cannot fit standard containers. The segment supports infrastructure projects and large-scale industrial developments requiring specialized logistics planning.

By Service Type Analysis

Transportation dominates with 76.2% due to direct cargo movement and reliable delivery across regions.

In 2024, Transportation held a dominant market position in the By Service Type Analysis segment of Rail Freight Transport Market, with a 76.2% share. It covers the direct movement of goods, ensuring timely deliveries and predictable schedules. Industries such as mining, manufacturing, and retail rely heavily on rail for bulk cargo transport, maintaining efficient supply chains.

Services Allied to Transportation encompass warehousing, inventory management, cargo tracking, and logistics support. These services enhance the main transportation process by offering real-time monitoring, faster cargo handling, and optimized supply chain operations. Companies increasingly rely on these complementary services to streamline workflows and improve customer satisfaction.

By Traction Type Analysis

Diesel dominates with 59.8% due to operational flexibility and compatibility across non-electrified routes.

In 2024, Diesel held a dominant market position in the By Traction Type Analysis segment of Rail Freight Transport Market, with a 59.8% share. Diesel locomotives handle heavy loads effectively and operate reliably where electrification is limited. Their widespread use ensures flexibility and continuous movement across diverse geographical regions, supporting industrial transport needs.

Electric traction is growing due to its energy efficiency and lower environmental impact. Electrified rail networks reduce emissions, improve operational sustainability, and lower long-term energy costs. This sub-segment is favored in regions with advanced infrastructure and government support for green logistics initiatives.

Hybrid / Hydrogen and LNG traction is emerging as a sustainable solution. It combines cleaner energy sources with traditional power, reducing carbon emissions while maintaining heavy-load capability. Though adoption is still limited, this technology is gaining attention from environmentally conscious rail operators seeking to comply with future regulations.

By Destination Analysis

Domestic dominates with 71.3% due to high internal trade and regional logistics demand.

In 2024, Domestic held a dominant market position in the By Destination Analysis segment of Rail Freight Transport Market, with a 71.3% share. Domestic rail freight supports regional supply chains, moving raw materials, finished goods, and essential commodities across internal markets. It ensures reliability and speed, helping businesses meet local demand efficiently.

International/Cross-border rail transport connects countries and facilitates trade between regions. Though smaller in market share, this sub-segment is crucial for global logistics, providing cost-effective alternatives to road and air freight. It also supports export-import operations while overcoming geographical and regulatory barriers effectively.

By End-user Analysis

Mining and Minerals dominates with 36.7% due to heavy demand for bulk material transport.

In 2024, Mining and Minerals held a dominant market position in the By End-user Analysis segment of Rail Freight Transport Market, with a 36.7% share. Rail transport efficiently moves coal, ores, and other minerals over long distances, supporting industrial production and energy sectors. Its capacity for large volumes ensures continuous operations, reduces dependency on road transport, and strengthens regional economic growth.

Oil, Gas and Chemicals rely on rail for transporting hazardous and bulk materials safely. Specialized tankers, strict safety protocols, and compliance with regulatory standards make this segment critical for the energy and chemical industries. Rail ensures timely delivery to refineries, plants, and distribution hubs while minimizing risk of accidents or environmental hazards.

Agriculture and Food utilize rail to transport grains, fresh produce, and perishable items efficiently. Temperature-controlled wagons, scheduled delivery services, and high capacity support national and regional distribution networks. This sub-segment helps maintain product quality, reduces spoilage, and meets rising consumer demand across urban and rural markets effectively.

Manufacturing and Automotive benefit from rail for moving raw materials and finished products in bulk. Predictable schedules, high-volume capacity, and specialized freight solutions support production lines and supply chain operations. Rail connectivity also enables just-in-time delivery, reduces logistical bottlenecks, and strengthens inter-regional industrial networks.

Retail and FMCG leverage rail for fast and large-scale movement of packaged goods. Efficient bulk handling, wide regional coverage, and reliable schedules ensure products reach stores and distribution centers on time. This sub-segment supports large retail chains and FMCG companies in maintaining inventory flow and customer satisfaction consistently.

Construction Materials and Forestry depend on rail for transporting timber, cement, steel, and other heavy materials. Efficient bulk logistics enable timely delivery to construction sites, infrastructure projects, and industrial zones. Rail supports sustainable forestry practices by reducing road congestion and carbon emissions while ensuring project deadlines are met reliably.

Key Market Segments

By Cargo Type

- Dry Bulk

- Containerised / Intermodal

- Liquid Bulk

- Break-bulk and Project Cargo

By Service Type

- Transportation

- Services Allied to Transportation

By Traction Type

- Diesel

- Electric

- Hybrid / Hydrogen and LNG

By Destination

- Domestic

- International/Cross-border

By End-user

- Mining and Minerals

- Oil, Gas and Chemicals

- Agriculture and Food

- Manufacturing and Automotive

- Retail and FMCG

- Construction Materials and Forestry

Drivers

Connectivity and Transit Challenges Limit Rail Freight Growth

One of the main restraints for rail freight transport is limited first-mile and last-mile connectivity. Rail networks often cannot reach the exact origin or destination points of goods. This limitation requires additional transport modes, such as trucks, to complete door-to-door deliveries, which can add complexity and coordination challenges for logistics operations.

Longer transit times are another significant challenge. Compared to air or road transport, rail moves slower, making it less suitable for shipments that are time-sensitive. Industries dealing with perishable goods, urgent manufacturing components, or retail inventory may often prefer faster alternatives over rail freight.

These connectivity and speed issues can affect overall supply chain efficiency. Companies may experience delays in coordinating multiple transport modes, increasing operational complexity and sometimes affecting delivery reliability. Such challenges can limit the attractiveness of rail freight for specific cargo types, despite its capacity to move large volumes of goods.

Moreover, the integration of rail with other logistics systems is still developing in many regions. Without seamless multimodal solutions, the efficiency of rail freight for complete door-to-door delivery remains restricted.

Restraints

Limited First-Mile and Last-Mile Connectivity Affects Rail Freight Efficiency

Rail freight transport offers cost-effective and environmentally friendly solutions for moving large volumes of goods. However, one of the key restraints is the limited first-mile and last-mile connectivity. Rail networks often do not reach the exact origin or destination points, requiring additional road transport. This can delay shipments and increase operational complexity.

For businesses seeking seamless door-to-door delivery, this connectivity gap reduces rail freight’s competitiveness. Companies may need to invest in supplementary transport solutions, such as trucks or local logistics partners, which can complicate supply chain management. This limitation is particularly challenging for industries with dispersed suppliers or customers in remote locations.

Another significant restraint is longer transit times compared to air and road transport for time-sensitive cargo. Rail transport is generally slower, making it less suitable for urgent deliveries. Sectors such as perishable food, pharmaceuticals, or express e-commerce shipments may avoid rail due to these delays.

These factors combined restrict the adoption of rail freight for certain logistics needs. While rail is efficient for bulk and heavy cargo over long distances, its limitations in speed and connectivity continue to restrain broader market growth. Companies must weigh cost benefits against potential delays and supplementary transport requirements.

Growth Factors

Rising Adoption of Rail Freight for Sustainable and Efficient Transport

Rail freight is gaining traction globally as companies increasingly prioritize reducing carbon emissions and promoting sustainability. Shifting from road and air transport to rail helps businesses lower their greenhouse gas emissions per ton-kilometer. This transition supports environmental goals, corporate social responsibility (CSR) initiatives, and government-led carbon reduction programs.

The transportation of hazardous and heavy-density materials is also driving rail freight growth. Rail networks provide safer, more stable, and regulated handling for chemicals, minerals, and other heavy goods. Compared to road transport, rail reduces the risk of accidents and spillage, ensuring compliance with strict safety and environmental regulations while enhancing supply chain reliability.

The development of dedicated freight corridors is significantly improving rail network efficiency. These specialized routes reduce congestion, optimize transit times, and allow better scheduling and tracking. Enhanced infrastructure and modern signaling systems attract more businesses to shift logistics operations to rail, offering predictable delivery schedules and lower environmental impact.

Emerging Trends

Integration of Technology and Standardization Driving Rail Freight Trends

Rail freight is increasingly integrating with multimodal logistics and inland container depots, improving overall efficiency. This trend allows seamless transfer between rail, road, and ports, reducing delays and enhancing cargo tracking. Businesses benefit from faster delivery and better coordination across the supply chain.

Another key trend is the adoption of predictive maintenance using AI and IoT technologies. Sensors and data analytics enable rail operators to detect potential issues before they cause disruptions. This reduces downtime, ensures smoother operations, and lowers the risk of unexpected service interruptions.

Standardized rail containers are also gaining attention to improve interoperability across networks. Uniform container sizes and handling methods simplify cargo transfers between different rail lines and modes of transport. This standardization supports faster operations and minimizes handling errors.

The combination of technology integration, predictive maintenance, and container standardization is shaping the future of rail freight. These factors not only optimize operational efficiency but also enhance reliability for shippers. As supply chains become more complex, these trends help rail freight remain competitive with other transport modes.

Regional Analysis

Asia Pacific Dominates the Rail Freight Transport Market with a Market Share of 43.1%, Valued at USD 134.9 Billion

The Asia Pacific region is the largest contributor to the global rail freight transport market, holding a substantial 43.1% market share and valued at USD 134.9 billion. Growth in this region is fueled by rapid industrialization, expanding manufacturing centers, and increasing urban logistics demands. Significant investments in dedicated freight corridors and modern rail infrastructure are enhancing operational efficiency and capacity. Additionally, the adoption of multimodal logistics solutions and supportive government policies for sustainable transport are further driving market development.

North America Rail Freight Market Trends

North America maintains a robust rail freight network, supported by well-established infrastructure and high cargo volumes across industrial and agricultural sectors. The focus on modernization of rail systems and integration with intermodal transport solutions drives growth. Investments in predictive maintenance and digital technologies further optimize operations, ensuring timely deliveries and improved operational efficiency.

Europe Rail Freight Market Trends

Europe’s rail freight market benefits from strong regulatory support, environmental initiatives, and cross-border connectivity. Standardized rail container systems and high-speed rail corridors enable efficient cargo movement across countries. Emphasis on sustainable transport and reducing carbon footprints encourages businesses to shift from road to rail, boosting market adoption.

Middle East and Africa Rail Freight Market Trends

The Middle East and Africa region is witnessing gradual growth in rail freight, with key investments in freight corridors and port connectivity projects. Emerging industrial zones and strategic trade routes contribute to rising cargo volumes. However, limited network density in certain areas remains a challenge, creating opportunities for future infrastructure development.

Latin America Rail Freight Market Trends

Latin America’s rail freight sector is evolving with expanding infrastructure and increasing industrial production. Investments in dedicated freight lines and intermodal logistics hubs support efficient transport of bulk commodities. Despite logistical challenges and varying terrain, the market is steadily growing with a focus on enhancing network reliability and cargo handling efficiency.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Rail Freight Transport Company Insights

Union Pacific Railroad Company continues to be a dominant force in the western U.S. freight market, leveraging its extensive network to provide reliable and efficient cargo transport. The company has invested heavily in precision scheduled railroading and advanced infrastructure, which allows it to manage higher volumes and optimize transit times, strengthening its operational resilience.

BNSF Railway Company maintains a strong market position through a diversified traffic portfolio, balancing intermodal shipments with bulk commodity transport. Its strategic investments in fleet modernization and technology-driven logistics solutions enhance service reliability and reduce operational costs, helping the company adapt effectively to demand fluctuations and economic shifts.

Canadian National Railway Company plays a pivotal role in connecting key industrial and port regions across North America. Its focus on operational efficiency, sustainability initiatives, and cross-border logistics enables seamless trade flows and positions the company favorably in an increasingly environmentally conscious market. CN’s emphasis on intermodal integration further supports its competitive advantage.

Canadian Pacific Kansas City Limited (CPKC) has significantly strengthened the North American rail landscape through its integration, establishing the first continuous rail network linking Canada, the U.S., and Mexico. This expanded footprint enhances trade opportunities, especially for north-south cargo movement, and supports diversified freight corridors. CPKC’s strategic investments in infrastructure and technology further improve network reliability and operational efficiency.

Top Key Players in the Market

- Union Pacific Railroad Company

- BNSF Railway Company

- Canadian National Railway Company

- Canadian Pacific Kansas City Limited (CPKC)

- CSX Transportation, Inc.

- Norfolk Southern Railway Company

- DB Cargo AG

- Fret SNCF

- SBB Cargo AG

- Russian Railways (RZD)

Recent Developments

- In May 2024, ÖBB Rail Cargo Group (RCG) completed the acquisition of Captrain Netherlands B.V. This strategic move extends RCG’s freight network significantly into the Benelux region, enhancing cross-border rail logistics capabilities.

- In May 2024, Hitachi Rail completed the €1,660m acquisition of Thales’ Ground Transportation Systems (GTS). This strengthens Hitachi’s signalling, systems, and global rail-systems capabilities, positioning it as a major player in rail technology.

- In May 2024, The European Union invested about USD 1.8 billion in German rail freight operations. The investment aims to enhance rail logistics efficiency while supporting Germany’s sustainability and Green Deal targets.

- In February 2024, PT Kereta Api Indonesia (PT KAI) signed a contract to procure 54 EMD GT38AC freight locomotives from Progress Rail (Caterpillar). These locomotives are intended to boost freight transport capacity and efficiency in South Sumatra.

Report Scope

Report Features Description Market Value (2024) USD 313.0 Billion Forecast Revenue (2034) USD 534.6 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Cargo Type (Dry Bulk, Containerised / Intermodal, Liquid Bulk, Break-bulk and Project Cargo), By Service Type (Transportation, Services Allied to Transportation), By Traction Type (Diesel, Electric, Hybrid / Hydrogen and LNG), By Destination (Domestic, International/Cross-border), By End-user (Mining and Minerals, Oil, Gas and Chemicals, Agriculture and Food, Manufacturing and Automotive, Retail and FMCG, Construction Materials and Forestry) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Union Pacific Railroad Company, BNSF Railway Company, Canadian National Railway Company, Canadian Pacific Kansas City Limited (CPKC), CSX Transportation, Inc., Norfolk Southern Railway Company, DB Cargo AG, Fret SNCF, SBB Cargo AG, Russian Railways (RZD) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Rail Freight Transport MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Rail Freight Transport MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Union Pacific Railroad Company

- BNSF Railway Company

- Canadian National Railway Company

- Canadian Pacific Kansas City Limited (CPKC)

- CSX Transportation, Inc.

- Norfolk Southern Railway Company

- DB Cargo AG

- Fret SNCF

- SBB Cargo AG

- Russian Railways (RZD)