Global Proteomics Outsourcing Market By Product/Service (Protein Identification & Characterization Services, Bioinformatics & Data Analysis Services, Protein Separation & Quantification Services, and Sample Preparation Services), By Application (Drug Discovery & Development, Proteome Profiling, Biomarker Discovery, and Others), By End User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, and Contract Research Organizations (CROs)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159120

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

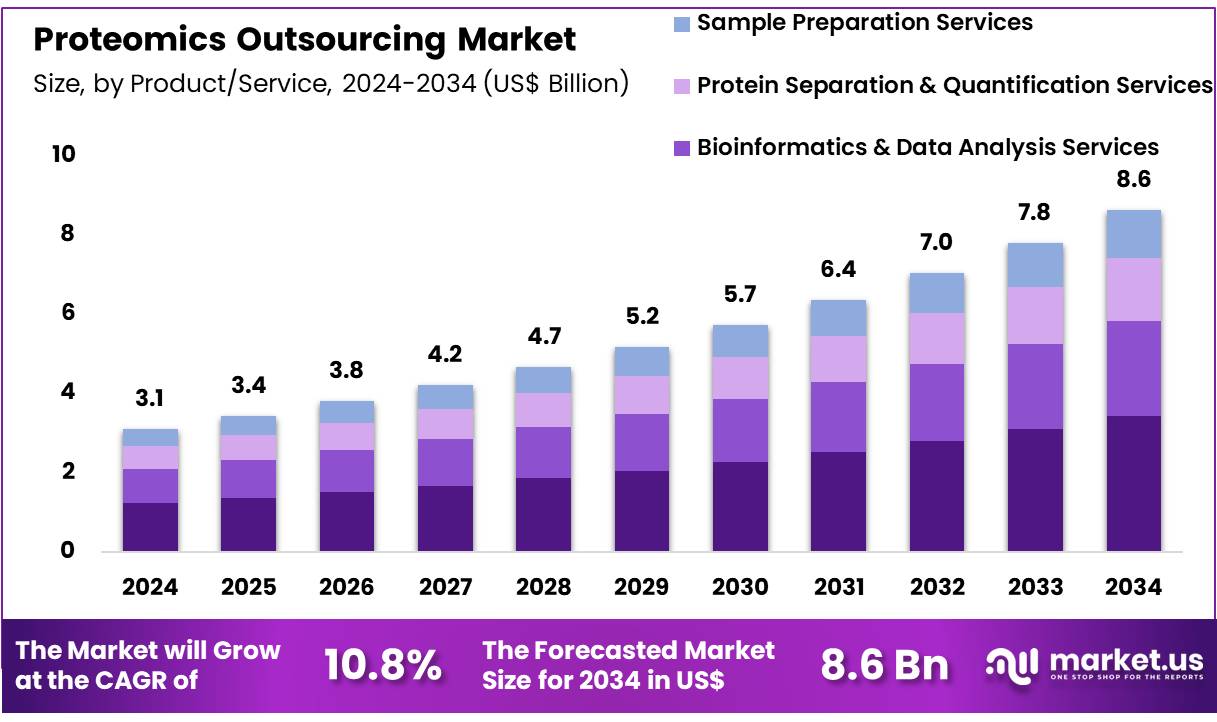

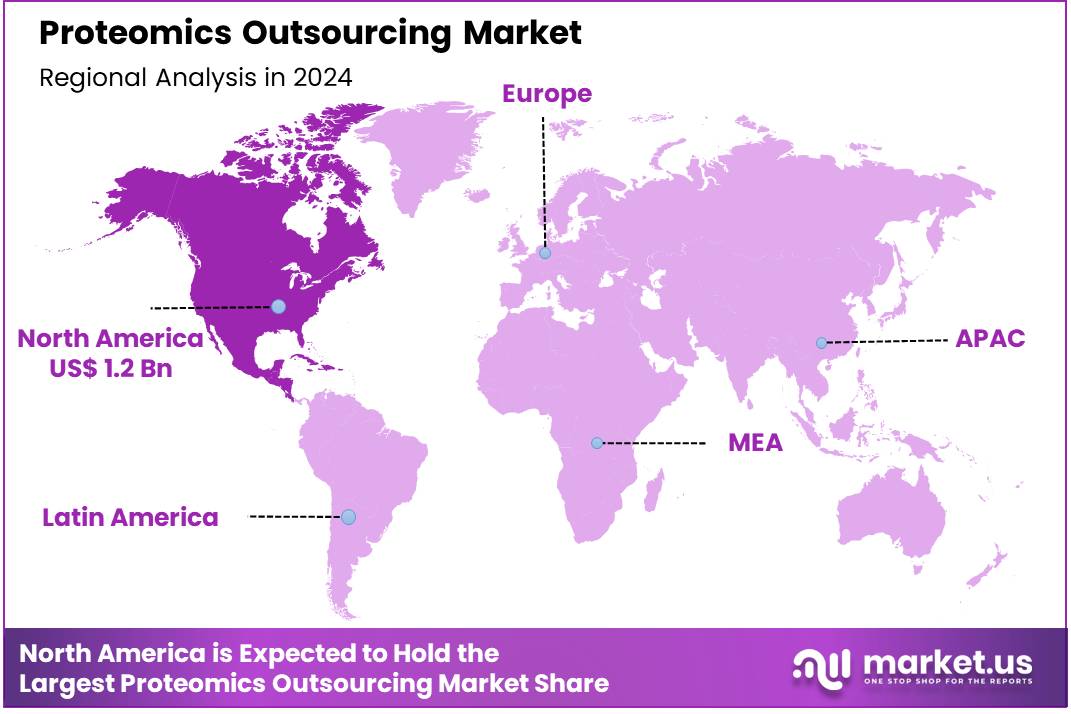

Global Proteomics Outsourcing Market size is expected to be worth around US$ 8.6 Billion by 2034 from US$ 3.1 Billion in 2024, growing at a CAGR of 10.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.8% share with a revenue of US$ 1.2 Billion.

Rising complexities in biological research and a growing need for specialized expertise are primary drivers of the proteomics outsourcing market. Proteomics, the large-scale study of proteins, requires significant capital investment in advanced mass spectrometry equipment and highly skilled personnel for data analysis.

For a typical research lab, the setup and operational costs can easily run into hundreds of thousands of dollars annually. To bypass these high barriers to entry, many biopharmaceutical companies, particularly small- and mid-sized biotech firms, are increasingly turning to contract research organizations for their proteomic needs, allowing them to focus on core competencies like drug discovery and clinical development

Growing industry consolidation and a focus on building comprehensive service portfolios are key trends shaping the market. Companies are pursuing strategic acquisitions and facility expansions to enhance their service offerings and gain a competitive edge. For example, in July 2024, Thermo Fisher Scientific completed the acquisition of Olink Holding AB for US$3.1 billion, strengthening its portfolio of next-generation proteomics solutions and expanding its capabilities in advanced protein analysis. Similarly, in May 2024, Bruker Corporation opened a new manufacturing facility in Bremen, Germany, which is expected to foster innovation, sustainable practices, and collaborative development in mass spectrometry technologies.

Increasing adoption of personalized medicine and a greater emphasis on biomarker discovery are creating significant opportunities for market expansion. The FDA’s Center for Drug Evaluation and Research has approved numerous new therapies guided by specific biomarkers, highlighting the critical role of proteomics in identifying and validating these targets.

The National Institutes of Health (NIH) also plays a vital role in advancing this field, with its Office of Cancer Clinical Proteomics Research actively supporting projects that integrate proteomics into cancer research to improve diagnosis, treatments, and outcomes. These efforts are driving the demand for outsourcing partners that can handle large-scale, high-throughput proteomic studies to accelerate the development of targeted therapies.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.1 Billion, with a CAGR of 10.8%, and is expected to reach US$ 8.6 Billion by the year 2034.

- The product/service segment is divided into protein identification & characterization services, bioinformatics & data analysis services, protein separation & quantification services, and sample preparation services, with protein identification & characterization services taking the lead in 2023 with a market share of 39.6%.

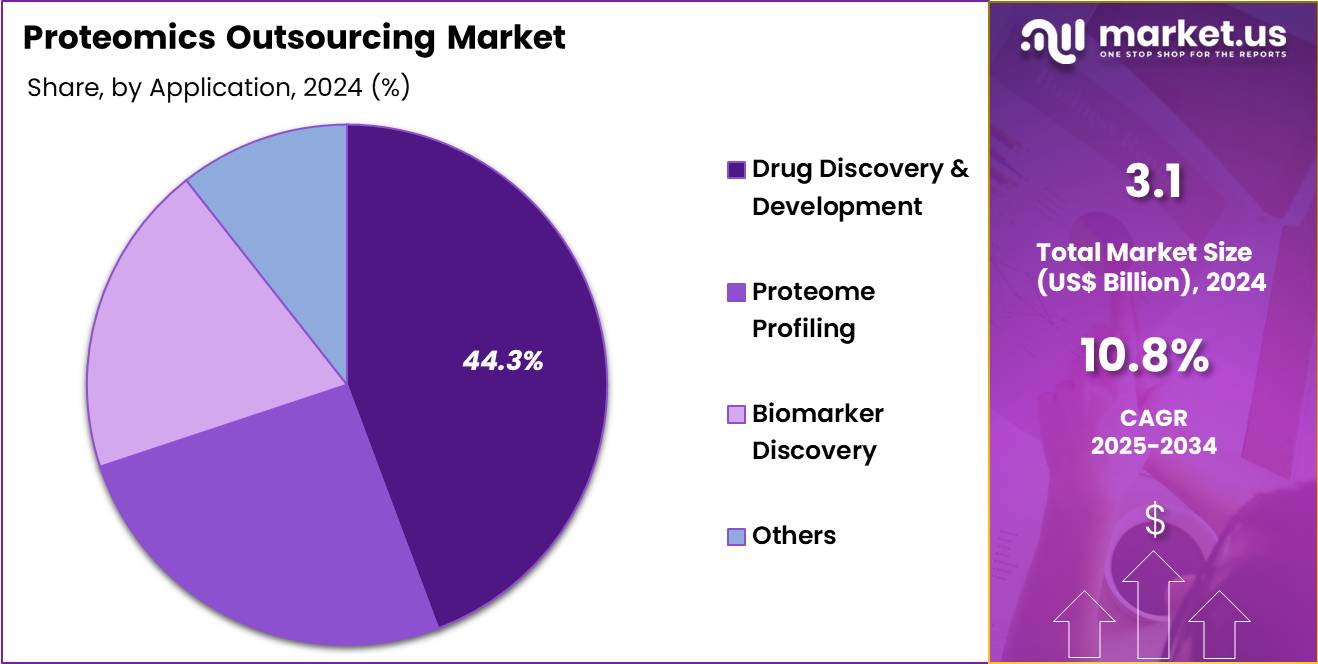

- Considering application, the market is divided into drug discovery & development, proteome profiling, biomarker discovery, and others. Among these, drug discovery & development held a significant share of 44.3%.

- Furthermore, concerning the end user segment, the market is segregated into pharmaceutical & biotechnology companies, academic & research institutes, and contract research organizations (CROs). The pharmaceutical & biotechnology companies sector stands out as the dominant player, holding the largest revenue share of 47.8% in the market.

- North America led the market by securing a market share of 38.8% in 2023.

Product/Service Analysis

Protein identification and characterization services hold the largest share at 39.6%. This growth is driven by the increasing demand for high-quality, reliable data in the fields of drug discovery, biomarker discovery, and proteomics research. As the complexity of protein analysis continues to rise, pharmaceutical and biotechnology companies are increasingly outsourcing these services to experts with specialized equipment and expertise.

These services are essential for understanding protein structure, function, and interactions, which are critical for drug development and disease understanding. The growing emphasis on precision medicine and personalized therapies is expected to drive further demand for protein identification services. As advancements in technologies like mass spectrometry and liquid chromatography enhance protein identification capabilities, these services are likely to become more integral to the life sciences industry.

Application Analysis

Drug discovery and development dominate the application segment with a share of 44.3%. The increasing complexity of drug development and the rising costs of in-house research and development are expected to boost the demand for outsourced proteomics services. These services play a critical role in identifying new drug targets, understanding drug mechanisms, and optimizing therapeutic strategies.

Pharmaceutical and biotechnology companies rely heavily on proteomics to expedite drug discovery processes and improve the efficacy of their products. The growing focus on biologics and the need for more effective treatments for complex diseases, such as cancer and neurological disorders, is anticipated to further drive the growth of this segment. As the pharmaceutical industry seeks to streamline drug discovery and reduce costs, outsourced proteomics services will continue to be an essential part of their research strategies.

End User Analysis

Pharmaceutical and biotechnology companies hold the largest share at 47.8%. The demand for proteomics outsourcing services from these companies is expected to grow as they continue to invest in novel therapies and diagnostic solutions. These companies require high-quality proteomics data to support the development of targeted treatments and personalized medicine. Outsourcing proteomics services allows them to leverage specialized expertise and technology without the need for significant capital investment.

The growing prevalence of chronic diseases and the push toward precision medicine are expected to drive more pharmaceutical and biotech companies to rely on outsourcing for protein analysis and biomarker discovery. As these companies look to accelerate their drug development pipelines and reduce time to market, the demand for outsourced proteomics services is projected to continue growing.

Key Market Segments

By Product/Service

- Protein Identification & Characterization Services

- Bioinformatics & Data Analysis Services

- Protein Separation & Quantification Services

- Sample Preparation Services

By Application

- Drug Discovery & Development

- Proteome Profiling

- Biomarker Discovery

- Others

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

Drivers

The increasing complexity of research is driving the market.

The proteomics outsourcing market is being driven by the escalating complexity and specialized nature of research and development in the life sciences sector. As pharmaceutical and biotechnology companies strive to develop more targeted therapies and diagnostic tools, the need to comprehensively analyze the proteome has grown exponentially.

In-house proteomics labs require significant capital investment in advanced instrumentation, highly specialized personnel, and sophisticated bioinformatics software for data analysis. This creates a substantial financial burden that many companies, particularly small to mid-sized biotech firms, cannot bear. By outsourcing, these companies can access cutting-edge technologies and expertise without the prohibitive costs associated with establishing and maintaining their own facilities. This trend is clearly demonstrated by the significant R&D spending of key industry players.

For example, Thermo Fisher Scientific reported that it invested US$1.4 billion in research and development in 2024, a substantial portion of which is dedicated to creating and improving the very technologies, such as advanced mass spectrometers and software, that are the cornerstone of high-end proteomics services. This investment highlights the sheer scale of the resources required to stay at the forefront of this field.

Restraints

Concerns over data security is restraining the market.

A significant restraint on the proteomics outsourcing market is the persistent and growing concern over data security and the protection of intellectual property (IP). The data generated from proteomic analysis, particularly in drug discovery and personalized medicine, is highly sensitive and valuable. It can contain proprietary information about drug targets, biomarkers, and patient-specific health data. Companies are therefore hesitant to share this critical information with third-party vendors due to the risk of data breaches, theft, or unauthorized use.

Any breach could lead to a loss of competitive advantage, severe financial penalties, and a violation of regulations such as HIPAA in the United States. This risk is not theoretical but is a demonstrable threat to the industry. According to the US Department of Health and Human Services (HHS) Office for Civil Rights (OCR), a total of 725 large data breaches were reported in 2023, exposing or impermissibly disclosing the protected health information of more than 133 million individuals. This high volume of security incidents across the healthcare sector, which includes many biotech and pharma clients, creates a palpable sense of risk that acts as a major drag on the willingness of companies to outsource sensitive proteomic work.

Opportunities

The growing number of drug discovery pipelines is creating growth opportunities.

A key growth opportunity for the proteomics outsourcing market lies in the ever-expanding pipeline of drug discovery and development projects, particularly in targeted therapies and biopharmaceuticals. The development of a new drug is a lengthy and complex process that requires extensive research to identify and validate protein targets, understand disease mechanisms, and monitor a drug’s efficacy and safety.

Proteomic analysis, which provides a snapshot of the proteins in a biological system, is becoming an indispensable tool at every stage of this pipeline, from initial target identification to clinical trial monitoring. As more potential drugs enter the development cycle, the demand for sophisticated proteomic services to support these projects escalates. This is best illustrated by the number of new drug approvals, which serves as a proxy for the health and productivity of the drug development pipeline.

According to the US Food and Drug Administration (FDA), the Center for Drug Evaluation and Research approved 55 novel drugs in 2023, a figure that showcases the high volume of new products entering the market and the immense amount of research required to bring each one to fruition. This trend ensures a sustained and growing need for specialized proteomic services.

Impact of Macroeconomic / Geopolitical Factors

Global economic challenges, with inflation at 5.9% in 2024 per International Monetary Fund data, push biopharma companies to cut R&D budgets and seek cost-effective outsourcing deals. Providers use automated systems to keep services affordable and maintain client demand. Geopolitical issues, like the Russia-Ukraine conflict, raise European energy costs by 20-30% based on International Energy Agency reports, disrupting lab supply chains and delaying international projects.

US-China trade tensions limit access to critical equipment, forcing firms to stockpile and face higher costs. These challenges drive investment in local production, especially in stable markets like India. This shift strengthens operations and supports steady industry growth through 2030.

US tariffs, including 25% duties on steel and aluminum since 2018 and up to 25% on US$300 billion of Chinese goods under Section 301, increase costs for lab equipment and supplies by 10-15%, squeezing profits and prompting biopharma firms to scale back projects. Smaller labs face higher expenses, potentially reducing outsourcing by 5-7%.

Retaliatory tariffs from China and the EU, including 25% on certain chemicals, disrupt global partnerships and add 15-20% to delivery delays. Ongoing US Trade Representative reviews create uncertainty, leading to costly stockpiling. However, tariffs encourage domestic production, with US$15 billion invested in US life sciences in 2024 per Biotechnology Innovation Organization data, creating jobs and boosting local capabilities. This strengthens supply chains and fuels innovation for future growth.

Latest Trends

The adoption of advanced, high-throughput technologies is a recent trend.

A defining recent trend in the proteomics outsourcing market in 2024 is the widespread adoption of advanced, high-throughput technologies, particularly in mass spectrometry. Traditional proteomics methods were often slow and lacked the depth and sensitivity required for modern research. However, a new generation of sophisticated mass spectrometers and related sample preparation workflows has enabled the rapid and comprehensive analysis of thousands of proteins from a single sample with unprecedented accuracy.

This technological leap has made proteomics more scalable and applicable to large-scale studies, from population-level health research to deep-dive clinical trials. This trend is exemplified by key industry acquisitions and product strategies and is a clear indicator that the market is rapidly moving toward more advanced, scalable technologies to meet the demands of modern biological research.

Regional Analysis

North America is leading the Proteomics Outsourcing Market

In 2024, North America held a 38.8% share of the global proteomics outsourcing market, driven by surging demand for high-throughput protein profiling in pharmaceutical R&D and personalized medicine initiatives. Biopharmaceutical firms increasingly relied on specialized service providers to expedite drug discovery pipelines, especially for biologics and targeted therapies, amid a rise in complex clinical trials. Regulatory advancements from the FDA streamlined approvals for proteomics-derived biomarkers, facilitating faster market entry for innovative diagnostics.

Robust academic-industrial collaborations, supported by NIH-backed consortia, amplified outsourcing needs for scalable data analysis and validation services. Technological integrations, including AI-driven mass spectrometry, reduced turnaround times and costs, encouraging mid-sized biotech firms to outsource rather than invest in in-house infrastructure.

Economic recovery post-pandemic also contributed, with venture capital inflows into North American life sciences reaching new highs, prompting greater reliance on external expertise for proteomics workflows. The region’s advanced research ecosystem further supported this growth by fostering innovation in protein analysis techniques. The FDA’s fiscal year 2024 budget rose to US$7.2 billion, a US$372 million increase from prior years, bolstering oversight and funding for proteomics-enabled regulatory pathways.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts anticipate the Asia Pacific proteomics outsourcing sector to grow significantly during the 2024-2030 forecast period, propelled by China’s aggressive biotechnology innovation strategies. Governments across the region actively invest in protein research infrastructure, encouraging biopharma companies to collaborate with contract labs for advanced mass spectrometry and bioinformatics support. Rapid urbanization and aging populations drive demand for outsourced biomarker discovery in oncology and metabolic disorders, positioning local providers as key players.

Collaborative hubs in Singapore and South Korea promote cross-border outsourcing deals, integrating AI with traditional proteomics techniques for cost-effective solutions. India’s expanding generic drug industry expects to leverage regional expertise to scale up proteomics for biosimilar development, addressing internal capacity limitations. Japan’s focus on precision medicine initiatives is projected to boost demand for specialized outsourcing in glycomics and phosphoproteomics applications.

These dynamics establish Asia Pacific as a high-growth hub for protein analysis services. In 2023, China’s National Natural Science Foundation allocated 200 million Yuan to the “Deciphering Life’s Glycocode” project, a proteomics-focused effort under its Major Research Plan. Additionally, the NSFC supported 3,188 life sciences grants that year with 159.4 million Yuan, many incorporating proteomics methodologies for disease mechanism studies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the proteomics outsourcing market fuel growth by leveraging cutting-edge technologies and strategic initiatives tailored to biopharma and academic demands. Creative Proteomics expands its offerings with cost-effective label-free quantification services introduced in 2024, attracting clients seeking scalable, non-invasive protein profiling solutions.

Charles River Laboratories invests in global facility expansions to optimize workflows, slashing turnaround times and strengthening ties with pharmaceutical leaders. These companies also pursue collaborative R&D partnerships to co-develop novel assays and penetrate high-growth Asian markets, capitalizing on rising drug development needs. By aligning innovation with client-centric scalability, they solidify their competitive edge.

Thermo Fisher Scientific Inc., a global leader listed on the NYSE with annual revenues exceeding US$40 billion, anchors its dominance in the proteomics outsourcing landscape through relentless innovation and a broad service portfolio. Headquartered in Waltham, Massachusetts, the company employs over 130,000 professionals across life sciences, analytical instruments, diagnostics, and biopharma services.

Its proteomics division excels in delivering high-resolution mass spectrometry and bioinformatics solutions, supporting drug discovery and clinical research. Strategic acquisitions, such as PPD in 2021, bolster its end-to-end capabilities, while investments in AI-driven data analytics enhance protein characterization precision. Thermo Fisher’s global network of advanced laboratories and customer-focused ecosystems positions it as a trusted partner for pharmaceutical giants and academic institutions alike.

Top Key Players

- Waters Corporation

- VProteomics

- Thermo Fisher Scientific

- bio

- Merck KGaA

- LABTOO

- ICON plc

- Danaher

- Creative Proteomics

- Charles River Laboratories

Recent Developments

- In 2025, Thermo Fisher Scientific unveiled the Orbitrap Astral Zoom mass spectrometer at the ASMS 2025 conference. The device is engineered to elevate proteomics research, offering increased depth and coverage to support early disease detection and precision oncology studies.

- In 2024, Creative Proteomics enhanced its offerings with the launch of a label-free quantification service, enabling comprehensive protein analysis without the use of chemical or radioactive markers, thereby improving efficiency and accuracy in proteomic investigations.

Report Scope

Report Features Description Market Value (2024) US$ 3.1 Billion Forecast Revenue (2034) US$ 8.6 Billion CAGR (2025-2034) 10.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product/Service (Protein Identification & Characterization Services, Bioinformatics & Data Analysis Services, Protein Separation & Quantification Services, and Sample Preparation Services), By Application (Drug Discovery & Development, Proteome Profiling, Biomarker Discovery, and Others), By End User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, and Contract Research Organizations (CROs)) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Waters Corporation, VProteomics, Thermo Fisher Scientific, OHMX.bio, Merck KGaA, LABTOO, ICON plc, Danaher, Creative Proteomics, Charles River Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Proteomics Outsourcing MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Proteomics Outsourcing MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Waters Corporation

- VProteomics

- Thermo Fisher Scientific

- bio

- Merck KGaA

- LABTOO

- ICON plc

- Danaher

- Creative Proteomics

- Charles River Laboratories