Global Propionic Acid Market, By Purity (Upto 99% and Above 99%), By Application (Animal Feed and Food Preservative, Sodium Salts, Herbicides, Plasticizers, and Other Applications), By End-User (Agriculture, Food and Beverage, Personal Care, Pharmaceuticals, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 13039

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

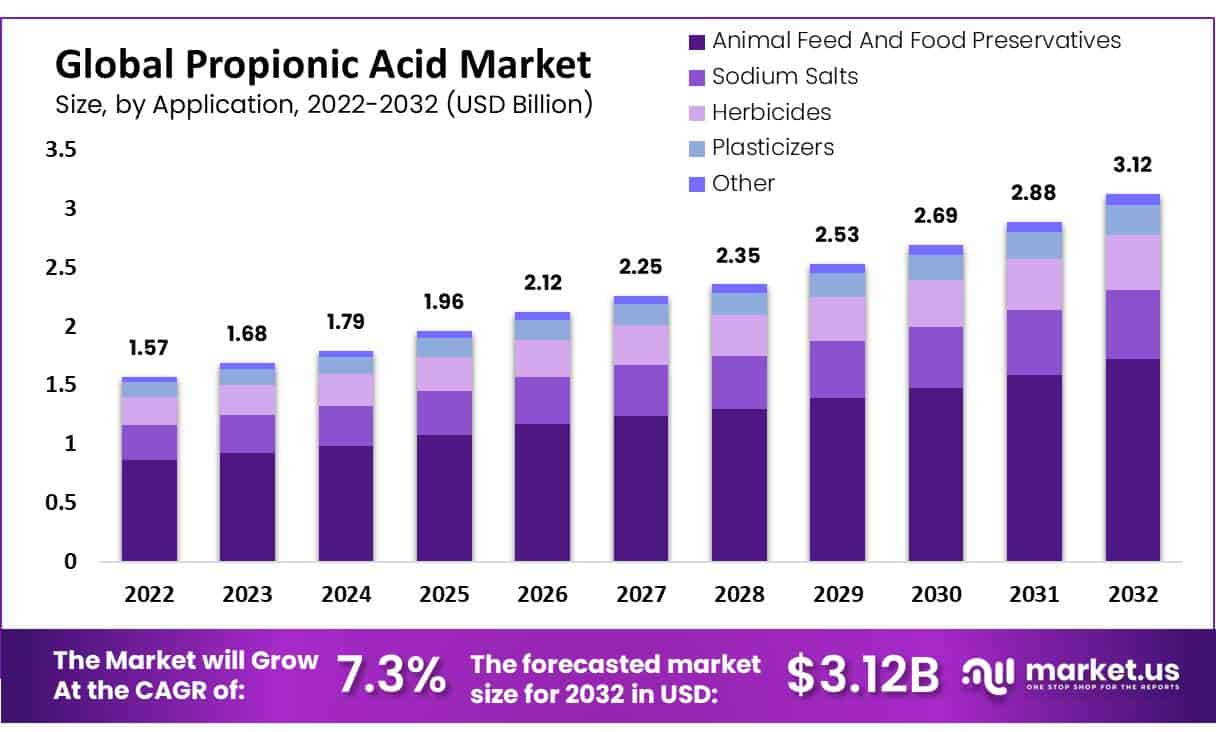

In 2022, the global propionic acid market size was valued at USD 1.57 billion and is expected to grow to USD 3.12 billion in 2032. Between 2023 and 2032, this market is estimated to register the highest CAGR of 7.3%.

Propionic acid is a three-carbon carboxylic acid with the chemical formula CH3CH2COOH. It is a clear, colorless liquid with a strong odor. It is created for commercial use by hydrocarboxylating ethylene with a catalyst made of nickel carbonyl. Propionic acid and its derivatives are often used to make preservatives for feed and food. It prevents the development of mold and germs.

Moreover, it is used to create a variety of specialty propionates, such as the expensive thermoplastic cellulose acetate propionate (CAP). Other applications include herbicides, drugs, and solvents. Because it could irritate the body if, in contact, some health groups are keenly interested in routinely monitoring its exposure levels.

Key Takeaways

- Proportion of Markets Growing: The world propionic acid market has been witnessing a significant growth rate, with an annual Compound Ratio (CAGR) in the range of 7.3% during the timeframe from 2023 through 2032.

- Overview: Propionic Acid is an important chemical compound that is getting considerable attention due to its numerous uses in the preservation of food as well as animal feed and a variety of industrial processes. It has antimicrobial capabilities that are effective and play a crucial role in the creation of propionates.

- The Purity Analysis: in terms of pureness, the propionic acids market can be divided into levels of 99% and over the 99% mark. The between 99% and 99percent purity segment is predicted to be the most lucrative of the propionic acid industry, with an impressive CAGR of 8.5 percent over the time frame of the forecast.

- Applications: The world propionic acid market segment for food preservatives is anticipated to be one of the highest-profitable and is forecast to grow at a rate of 7.4% over the forecast time. This is due to the popular preference of a significant portion of Americans to have readily accessible and market-sourced options for food.

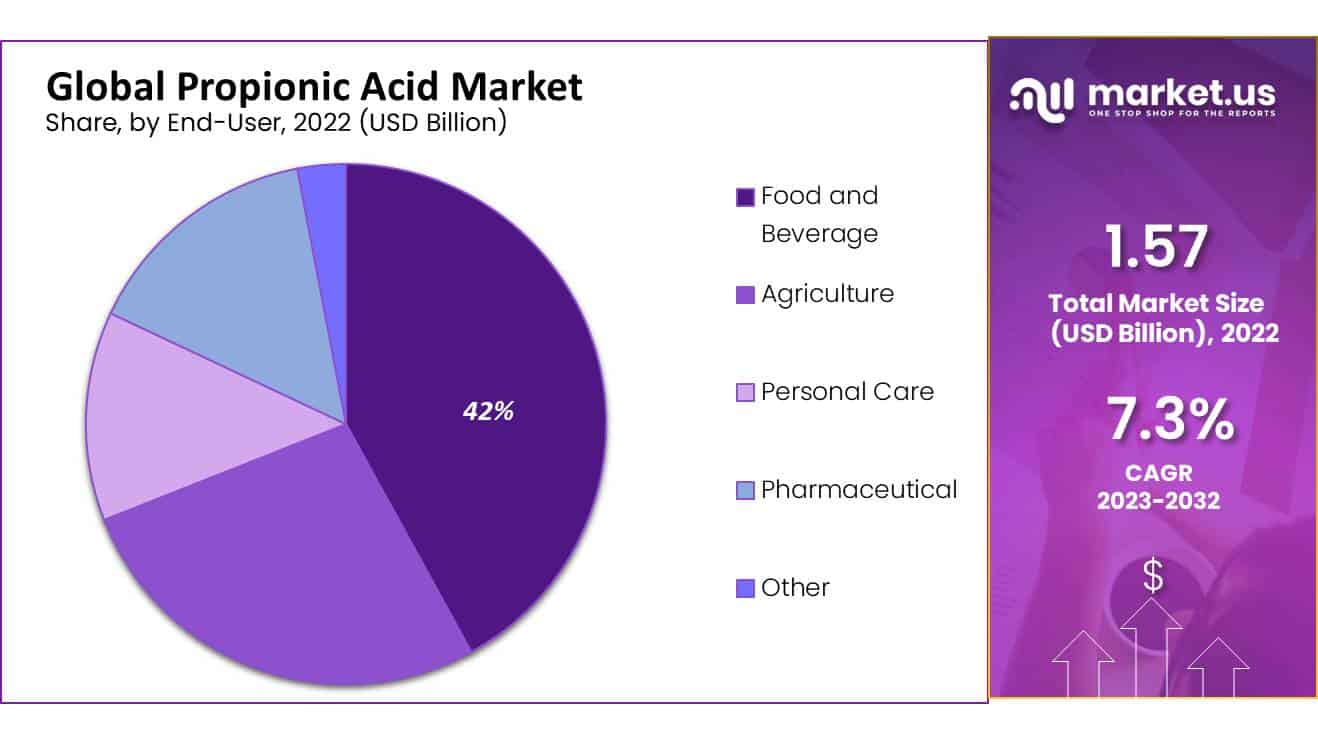

- End-Users: In the world propionic acid food and beverages segment is expected to be one of the highest-profitable with an expected CAGR of 7.5 percent over the timeframe. In 2022 the food and beverages segment was already holding a substantial market share and contributed to 42% of total income.

- drivers: drivers behind market growth are the growing demands for products to help preserve food as well as the growing consumption of processed foods and the rising awareness about food safety and animal nutrition. Propionic acid is a natural antimicrobial acid as well and its crucial importance in ensuring the safety of food boosts market growth.

- Restrictions: Market-related challenges include strict regulations regarding the use of chemicals in food items, fluctuations of raw materials, and health issues that may be related to excessive consumption of propionic acids. Environmental and sustainable concerns as well as competitive pressures add additional constraints.

- Opportunity: The opportunities for market growth are found in the improvement of environmentally sustainable methods for production as well as innovations in the formulation of products as well and the exploration of new solutions in new industries. The need for secure and effective food preservation methods is one of the major growth areas.

- Trends: The latest trends in the market for propionic acids are characterized by advancements in manufacturing technologies as well as a shift to organic and natural preservatives and studies aimed at increasing the use of propionic acid in food as well as different industries. Sustainable production and sourcing practices are also prominent aspects of.

- Asia-Pacific: By 2022, the feed for animal supplement market across India, China, and Australia is expected to expand at an annual rate of more than 3.5%. India as well as China combined made up a substantial portion of the Asia-Pacific market. In addition, the growing need for preservatives and pharmaceuticals will be driving expansion within China. Chinese market.

- Key players: The propionic acid market is characterized by a wide range of players including established firms and new companies that specialize in propionic acid manufacturing and application. These key players frequently invest in the development of research and development sustainable initiatives, as well as strategic partnerships to satisfy the changing needs of the market and keep an edge. Building credibility and showing the advantages of propionic acids is essential to succeed in today’s competitive market.

Driving Factors

In both packaged food and animal feed, propionic acid serves as a preservative. Throughout the projected period, the market is anticipated to rise due to the rising need for safe animal feed and grain preservatives. Herbicides and cellulose acetate propionate (CAP) are also produced using propionic acid. These additional uses are expected to fuel market expansion. 538 kilotons of propionic acid are anticipated to be consumed by 2022, up from 471 kilotons in 2020.

It is anticipated that rising consumer demand for convenience foods will drive market expansion. Due to people’s changing lifestyles, there is an increase in the need for hygienic packaged food products. To stop mold, germs, and fungi from growing on food goods, propionic acid is used as a preservative.

Throughout the projection period, market growth is anticipated to be fueled by the upstream industry’s rising demand for CAP. An enormous amount of physical stress can be tolerated by it and is also the reason behind the stiffness of the sunglasses and spectacles. One significant cellulose ester for thermoplastics is cellulose acetate propionate. Between cellulose butyrate and cellulose acetate resins, cellulose acetate propionate has qualities that are in the middle.

Restraining Factors

In the upcoming years, market growth is probably going to be constrained by the growing environmental concerns surrounding the usage of pesticides. A further aspect that is anticipated to impede market expansion is a lack of creative ideas despite the availability of a variety of items. Due to the current circumstance, which is pressuring market competitors to decrease margins on product sales, the overall market revenue is being impacted.

It is projected that the negative effects of propionic acid on human health will impede market expansion. Propionic acid has several negative Propionic acid side effects when it is directly ingested, including nausea, vomiting, headaches, diarrhea, and abdominal pain. It can also severely irritate and burn the skin and eyes, perhaps causing permanent eye damage. It is confirmed that plasma and liver fatty acid levels are decreased by propionic acid. Moreover, it decreases food consumption, raises tissue insulin sensitivity, and has immunosuppressive effects.

Growth Opportunities

Propionic acid esters are an alternative to chemical solvents and artificial flavorings. Smelling like fruit, these acids can be employed as solvents or flavorings in biogas facilities where propionic acid is produced through fermentation using propionic acid bacteria. Industry participants are anticipating propionic acid esters to present them with profitable opportunities.

Trending Factors

Propionic acid is mostly used as a preservative in grain and animal feed. Additionally, it’s employed to clean storage areas where grain and silage are stored. Also, they act as an antibacterial agent in water that cattle consume for drinking, and even in the poultry litter it is sprayed to eliminate bacteria and fungi. As the cattle industry expands, feed demand will likely increase; according to projections 75% of global feed needs will be met through imports of maize, wheat, and protein meals due to policies that prioritize food crops over feed crops.

The Food and Agricultural Organization of the United States recently released statistics that determine how food production must increase by almost 70% by 2050 in order to feed a global population of 9.1 billion people. By that same year, output in developing nations is likely to double. Such encouraging growth prospects are expected to propel global agriculture leading to increased propionic acid usage over the projected period.

Purity Analysis

Based on purity, the market for propionic acid is segmented into up to 99% and above 99%. Among these types, the up to 99% is the most lucrative in the global propionic acid market with a projected CAGR of 8.5% during the forecast period. A propionic acid (PA) is a type of naturally existing carboxylic acid that has a terrible odor, is colorless, corrosive in its pure form, and dissolves in water.

It is made industrially by hydrocarboxylating ethylene with nickel carbonyl which acts as a catalyst. Also, propionic acid contains various advantages such as reducing food consumption, lowering the amount of fat in the plasma and liver, increasing tissue insulin sensitivity, and immunosuppressive effects.

Application Analysis

By application, the market is divided into herbicides, sodium salts, plasticizers, animal feed, food preservatives, and others. The food preservative segment is the most lucrative in the global propionic acid market with a projected CAGR of 7.4% during the forecast period. The majority of Americans prefer market-available and ready-to-eat food.

Propionic acid is an additive and preservative used in such foods to retain quality and prevent deterioration which increases its demand. Also, the rising demand for food preservatives fuels the expansion of the propionic acid market around the world. The market is expanding because of the rising demand for natural preservatives.

End-User Analysis

By end-user, the market for global propionic acid is segmented into pharmaceuticals, personal care, food & beverage, agriculture, and others. The food and beverage segment is the most lucrative in the global propionic acid market with a projected CAGR of 7.5% during the forecast period. The total revenue share of the food and beverage segment is 42% in 2022.

The market of the food and beverage sector is expected to move upward due to the increasing usage of propionic acid in cheese, bread, cakes, jellies, non-alcoholic drinks, jams, and other processed foods as a common food preservative to overcome the formation of mold and bacteria and widen shelf life.

The robust economic and population growth are both contributing to the rapid growth of the global food and beverage industry and is predicted to rise the demand for propionic acid in the food and beverage sector.

Key Market Segments

Based on Purity

- Upto 99%

- Above 99%

Based on Application

- Animal Feed and Food Preservatives

- Sodium Salts

- Herbicides

- Plasticizers

- Other Applications

Based on End-User

- Agriculture

- Food and Beverage

- Personal Care

- Pharmaceuticals

- Other End-Users

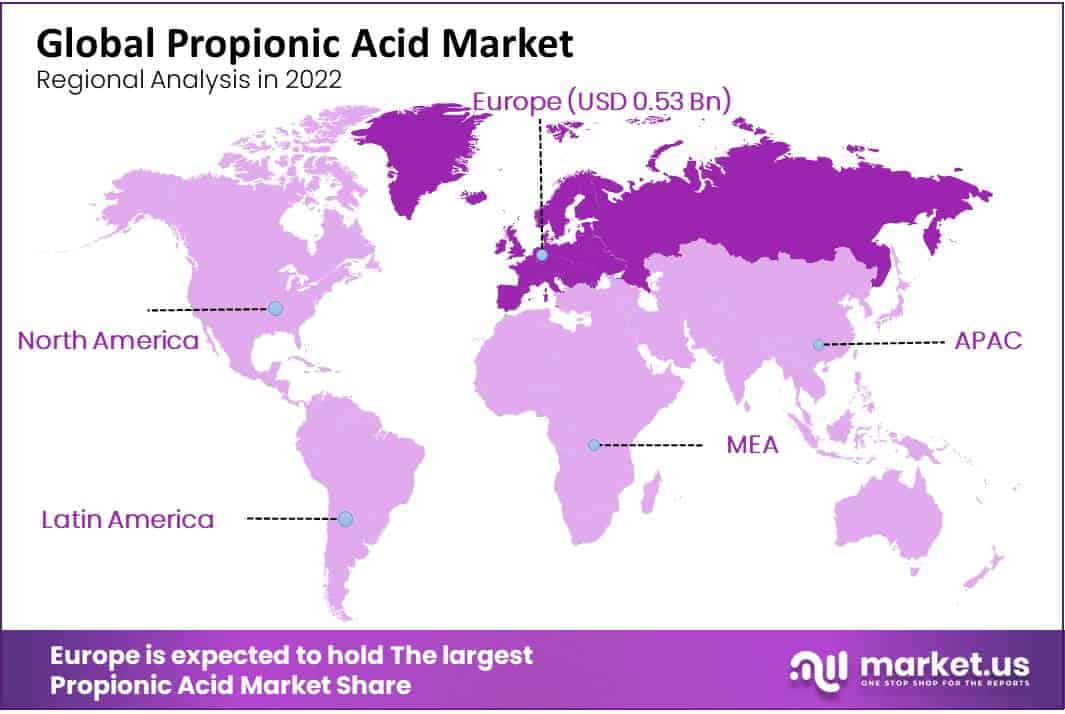

Regional Analysis

The propionic acid market is divided into the following geographical segments: Asia Pacific, North America, Latin America, Europe, and Middle East & Africa. Due to the presence of major industry players in the region, Europe is anticipated to dominate the market throughout the forecast period.

It is projected that the region’s abundance of propionic acid sources and producers will accelerate market growth. The region’s leading market for the food and agriculture industries is Germany.

The continued investments in the food industry together with the use of propionic acid, both contribute to the market’s growth. Because of the expanding population and increased production of food and feed in the region, the market in the Asia Pacific is expected to grow quickly over the projected period.

As of 2022, it is predicted that the animal feed additives market in India, China, and Australia will develop at a CAGR of over 3.5%. India and China together held a sizeable portion of the Asia-Pacific market. Furthermore, the rising need for pharmaceuticals and preservatives is expected to increase the Chinese market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

BASF SE, Dow Inc., Eastman Chemical Company, Perstorp Holding AB, and Hawkins Inc. are some of the major players in the worldwide propionic acid market. To build a strong consumer base and increase their share in this lucrative sector they use various techniques such as acquisitions, partnerships, collaborations, joint ventures, agreements, expansions, and product launches.

BASF SE recently opened a second production facility for propionic acid in Nanjing, China which should help them provide this essential chemical to customers worldwide.

Market Key Players

- BASF SE

- Dow Inc

- Eastman Chemical Company

- Perstorp Holding AB

- Hawkins, Inc

- CORBION N.V

- Otto Chemie Pvt. Ltd

- Merck KGaA

- Oman Oil Company SAOC

- Celanese Corporation

- Other Key Players

Recent Developments

- In April 2023, BASF said it would make more propionic acid in China. It will be done in 2024 and will raise BASF’s production by 50%.

- In May 2023, Eastman Chemical Company joined DuPont to create a new company called Eastman DuPont Biofuels and Chemicals. They will produce propionic acid and start in 2025.

- In June 2023, Solvay made a deal with a big food and drink company to supply them with propionic acid starting in 2024.

Report Scope

Report Features Description Market Value (2022) US$ 1.57 Bn Forecast Revenue (2032) US$ 3.12 Bn CAGR (2023-2032) 7.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Purity, By Application, By End-User Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, Dow Inc, Eastman Chemical Company, Perstorp Holding AB, Hawkins, Inc, CORBIN N.V, Otto Chemie Pvt. Ltd, Merck KGaA, Oman Oil Company SAOC, Celanese Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Who are the leading players in Propionic Acid market?The key players operating in the global propionic acid market are BASF SE,Dow Inc., Eastman Chemical Company, Perstorp Holding AB, Hawkins, Inc., Corbion N.V., Otto Chemie Pvt. Ltd., Merck KGaA, Oman Oil Company SAOC, and Celanese Corporation.

What is the market size of Propionic Acid market?In 2022, the global propionic acid market was valued at US$ 1.57 billion.

What is the growth rate of the Propionic Acid Market?Between 2023 and 2032, this market is estimated to register the highest CAGR of 7.3%.

-

-

- BASF SE

- Dow Inc

- Eastman Chemical Company

- Perstorp Holding AB

- Hawkins, Inc

- CORBION N.V

- Otto Chemie Pvt. Ltd

- Merck KGaA

- Oman Oil Company SAOC

- Celanese Corporation

- Other Key Players