Global Privacy Enhancing Technologies Market Size, Share, Statistics Analysis Report By Component (Software, Service), By Type (Cryptographic Technique, Anonymization Technique, Pseudonymization Techniques), By Application (Compliance Management, Risk Management, Reporting & Analytics, Others), By End-User (BFSI, Healthcare, IT & Telecom, Government & Public Sector, Retail & E-commerce, Manufacturing, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: February 2025

- Report ID: 138714

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

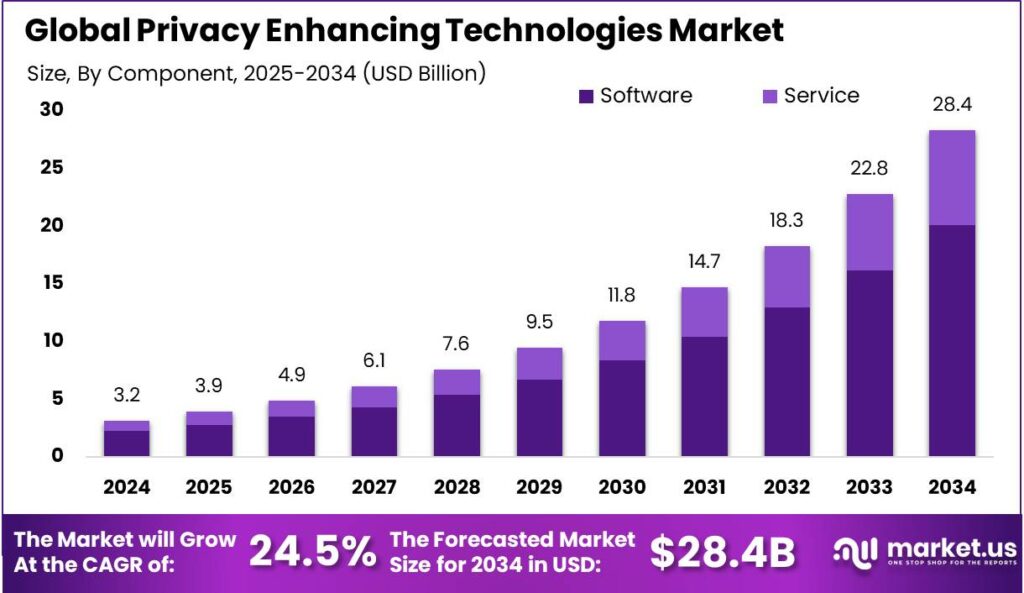

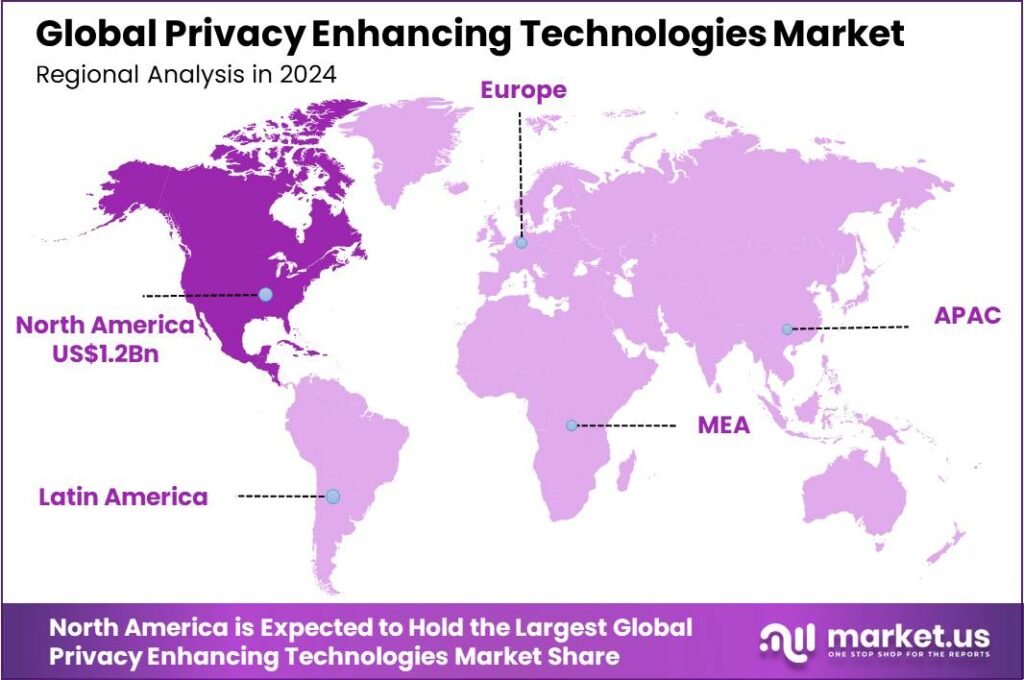

The Global Privacy Enhancing Technologies Market size is expected to be worth around USD 28.4 Billion By 2034, from USD 3.17 Billion in 2024, growing at a CAGR of 24.50% during the forecast period from 2025 to 2034. In 2024, North America led the PETs market with over 40% share and revenues of USD 1.2 Billion.

Privacy Enhancing Technologies (PETs) are tools and methods designed to safeguard user data by minimizing personal data usage without compromising the functionality of an information system. PETs play a critical role in enhancing privacy by implementing data protection from the design stage of systems.

These technologies are crucial in enabling secure data processing, storage, and sharing, while complying with privacy regulations and ensuring that personal information is handled responsibly. PETs include a range of solutions like encryption, differential privacy, secure multi-party computation, and zero-knowledge proofs, each providing ways to protect individual identities and sensitive data in various contexts.

The growth of the Privacy Enhancing Technologies market is driven by several key factors. The increasing regulatory pressures such as the General Data Protection Regulation (GDPR) in Europe and similar laws worldwide are compelling companies to adopt PETs to comply with legal requirements.

The ongoing digital transformation across industries and advancements in technologies like cloud computing and big data analytics are increasing the need for stronger data protection, which is accelerating the adoption of PETs and driving market growth.

PETs are popular because they not only boost security but also build trust between service providers and customers. As digital interactions grow, these technologies are becoming a key competitive advantage, with companies recognizing that strong data protection can enhance their brand image, especially among privacy-conscious consumers.

The opportunities in the PETs market are vast and varied. Innovations such as homomorphic encryption, secure multi-party computation, and zero-knowledge proofs are opening new avenues for application. These technologies allow businesses to analyze and share encrypted data without ever exposing it, thereby broadening the potential for collaborative data-driven projects without compromising privacy.

Market expansion is on the horizon with the continuous evolution of Internet of Things (IoT) devices and smart technologies. As more devices connect to the internet and generate vast data, the need for PETs grows. This expansion requires new privacy solutions to keep up with evolving digital interactions and technological advancements.

Key Takeaways

- The Global Privacy Enhancing Technologies (PETs) Market is projected to reach a value of USD 28.4 Billion by 2034, up from USD 3.17 Billion in 2024, growing at a CAGR of 24.50% during the forecast period from 2025 to 2034.

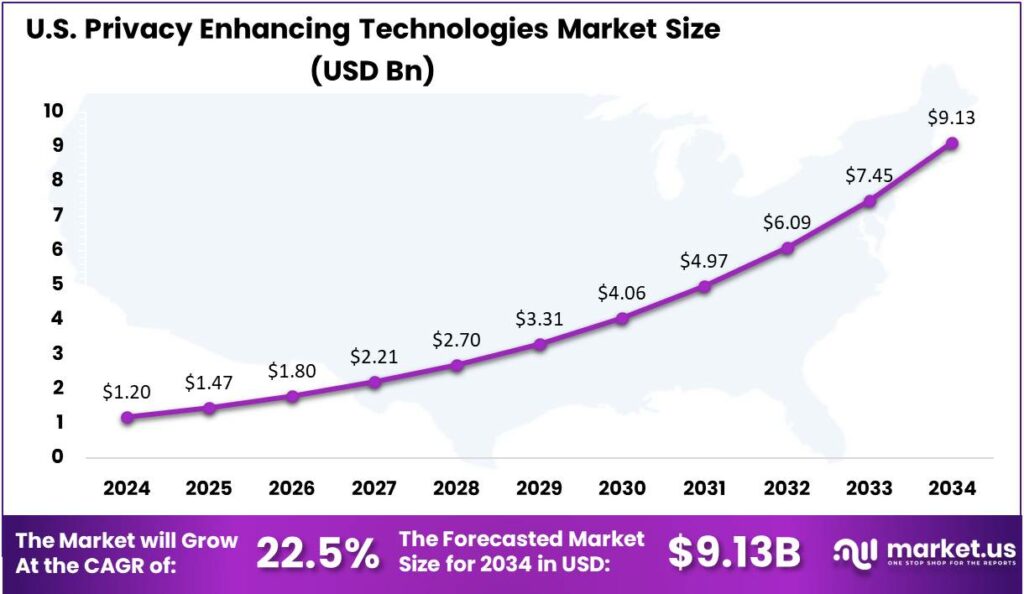

- The United States PETs market, valued at USD 1.2 Billion in 2024, is expected to grow at a CAGR of 22.5%.

- In 2024, North America dominated the PETs market, accounting for over 40% of the market share, with revenues reaching USD 1.2 Billion.

- The Software segment led the PETs market in 2024, holding more than 71% of the total market share.

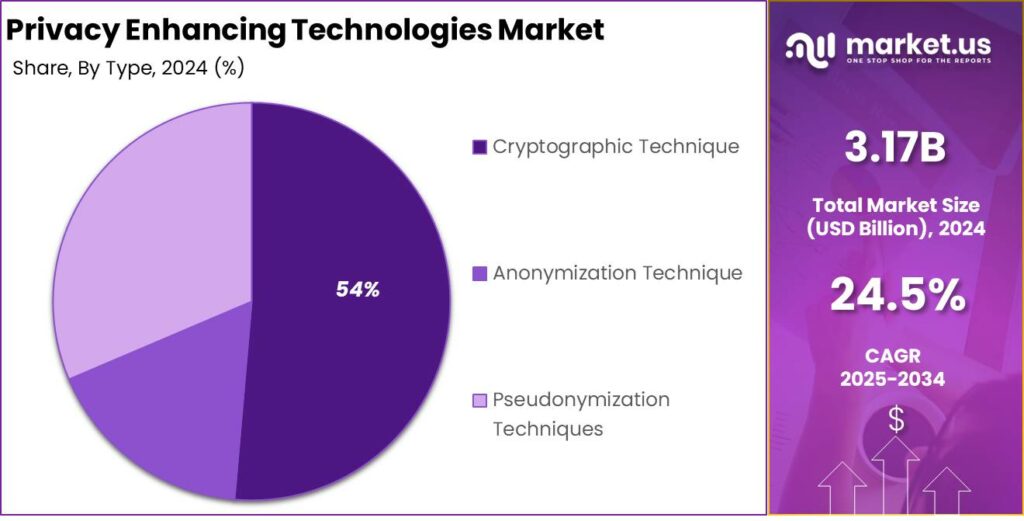

- The Cryptographic Techniques segment also held a dominant position in 2024, capturing more than 54% of the market share.

- The Compliance Management segment was a key player in the PETs market, holding more than 40% of the market share in 2024.

- The BFSI (Banking, Financial Services, and Insurance) sector dominated the PETs market, accounting for more than 30% of the market share in 2024.

- The US Privacy Enhancing Technologies Market size was exhibited at USD 1.2 Billion in 2024 with CAGR of 22.5%.

U.S. Market Size and Growth

The market for Privacy Enhancing Technologies (PETs) in the United States, which reached a value of USD 1.2 billion in 2024, is projected to expand at a compound annual growth rate (CAGR) of 22.5%. This robust growth underscores the increasing emphasis on data privacy and security across various sectors.

As businesses and organizations continue to navigate the complexities of data regulation and cybersecurity threats, the demand for PETs is surging. These technologies play a crucial role in enhancing data protection measures without compromising the utility of the data.

The growing awareness of privacy rights and tightening regulations like the GDPR and CCPA are driving market growth. These frameworks require strict data protection, pushing companies to adopt PETs, which in turn spurs innovation and technological advancements, fueling further market expansion.

In 2024, North America held a dominant market position in the Privacy Enhancing Technologies (PETs) sector, capturing more than a 40% share with revenues amounting to USD 1.2 billion. This leading position can be attributed to several factors that uniquely characterize the North American market.

North America hosts major tech companies that are driving innovation in data security and privacy. These companies not only contribute to the PETs market but also fuel demand as they navigate strict regulations like the California Consumer Privacy Act (CCPA), pushing them to adopt privacy-enhancing solutions.

Additionally, the high level of digitalization across industries in North America has led to vast amounts of data being generated, which in turn increases the risk of data breaches and privacy issues. This scenario has heightened the demand for PETs as businesses and organizations prioritize data protection to maintain consumer trust and comply with legal standards.

Component Analysis

In 2024, the Software segment held a dominant position in the Privacy Enhancing Technologies (PETs) market, capturing more than a 71% share. This leadership stems primarily from the increasing deployment of privacy software solutions across various industries aiming to meet stringent compliance regulations and protect sensitive data.

Software solutions are integral to implementing PETs as they directly embed privacy into data processes and systems. Organizations increasingly rely on software for encryption, data masking, and access management, which are crucial for maintaining data integrity and privacy.

The prominence of the Software segment is also bolstered by the continuous advancements in technology that demand robust privacy solutions. As businesses expand their digital infrastructure, the need for sophisticated software that can efficiently manage and protect large volumes of data grows.

The Software segment thrives due to the scalability and flexibility of privacy-enhancing solutions. Unlike hardware, software can be easily updated and scaled to meet evolving threats and needs, making it ideal for organizations aiming to future-proof privacy practices and stay compliant with diverse regional privacy laws.

Type Analysis

In 2024, the Cryptographic Techniques segment held a dominant position in the Privacy Enhancing Technologies market, capturing more than a 54% share. This segment’s leadership can be attributed to its robust security features, which are crucial in sectors where the protection of sensitive information is paramount.

Cryptographic techniques lead the PETs market primarily because of their proven effectiveness in safeguarding data integrity and confidentiality. As businesses and organizations increasingly move towards digital operations, the reliance on these methods has grown significantly.

Furthermore, the evolving regulatory landscape concerning data privacy has played a critical role in this segment’s growth. Regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) have enforced stricter data security standards, compelling companies to adopt more secure data handling practices.

Technological advancements, like quantum-safe cryptography and improved encryption algorithms, have expanded the use of cryptographic solutions. These innovations help cryptography stay ahead of emerging threats, maintaining its leadership in the Privacy Enhancing Technologies market.

Application Analysis

In 2024, the Compliance Management segment held a dominant market position within the Privacy Enhancing Technologies (PETs) industry, capturing more than a 40% share. This segment’s prominence is largely due to the increasing global emphasis on compliance with data protection regulations.

The necessity for Compliance Management solutions has become more acute as penalties for non-compliance have grown steeper, and public awareness of data privacy issues has risen. Companies are investing in these technologies not just to avoid fines but also to build trust with their customers and maintain their reputation in the market.

Additionally, this segment’s growth is fueled by the technological advancements that make Compliance Management systems more accessible and effective. Innovations in AI and machine learning have enhanced the ability to monitor, audit, and report on privacy practices across large datasets without compromising the integrity of the data being protected.

Looking ahead, the Compliance Management segment is expected to maintain its leading position as more regions around the world tighten their data privacy laws. As businesses continue to expand their digital footprints, the demand for robust privacy management solutions will only grow, ensuring that this segment remains at the forefront of the PETs market.

End-User Analysis

In 2024, the BFSI (Banking, Financial Services, and Insurance) sector held a dominant position in the Privacy Enhancing Technologies (PET) market, capturing more than a 30% share. This significant market share can be attributed primarily to the stringent regulatory requirements and the critical need for data privacy in financial transactions.

Financial institutions are increasingly investing in PETs to secure sensitive customer data against cyber threats, ensure compliance with global data protection regulations such as GDPR and CCPA, and maintain consumer trust in an era of increasing digital transactions.

The leading role of the BFSI sector in the PET market is also driven by the high volume of personal and financial data that these institutions handle. Banks, insurers, and other financial services providers are at the forefront of adopting advanced encryption methods, multi-factor authentication, and secure access management technologies.

The competitive landscape in the BFSI sector drives ongoing tech advancements as companies aim to protect customer data while using it for personalized services and AI insights. This dual focus on security and utility fuels heavy investment in PETs, helping institutions balance data privacy with value, boosting customer satisfaction, loyalty, and regulatory compliance.

Key Market Segments

By Component

- Software

- Service

By Type

- Cryptographic Technique

- Anonymization Technique

- Pseudonymization Techniques

By Application

- Compliance Management

- Risk Management

- Reporting & Analytics

- Others

By End-User

- BFSI

- Healthcare

- IT & Telecom

- Government & Public Sector

- Retail & E-commerce

- Manufacturing

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Global Concerns Over Data Privacy

In today’s digital age, the escalating apprehension surrounding data privacy has become a significant catalyst for the adoption of Privacy Enhancing Technologies (PETs). With the proliferation of data breaches and unauthorized data exploitation, individuals and organizations are increasingly vigilant about safeguarding sensitive information.

This heightened awareness is not just a reaction to past incidents but also a proactive stance against potential threats.PETs, which include techniques like homomorphic encryption and secure multi-party computation, enable organizations to analyze and share data without compromising individual privacy. By integrating these technologies, businesses can ensure compliance with regulatory standards while maintaining the trust of their clients and stakeholders.

Restraint

Complexity in Implementation and Integration

Despite the clear advantages of Privacy Enhancing Technologies, their widespread adoption faces significant hurdles, primarily due to the complexities involved in their implementation and integration. Many PETs are built upon sophisticated cryptographic principles that require specialized knowledge to deploy effectively.

Organizations often find it challenging to incorporate these advanced technologies into their existing systems without disrupting current operations. The integration of Privacy-Enhancing Technologies (PETs) can be costly and time-consuming. Without standardized frameworks, organizations face a fragmented landscape, complicating the evaluation of these solutions’ performance and effectiveness.

Opportunity

Enhancing Data Collaboration While Preserving Privacy

The advent of Privacy Enhancing Technologies presents a remarkable opportunity to revolutionize data collaboration across various sectors. Traditionally, sharing data between organizations or departments has been fraught with privacy concerns, often leading to siloed information and missed opportunities for valuable insights.

PETs offer a solution by enabling secure data analysis and sharing without exposing sensitive information. For instance, in the healthcare industry, different institutions can collaborate on patient data to advance medical research while ensuring patient confidentiality. Financial institutions can share fraud detection data while protecting client privacy, promoting innovation and enabling new business models focused on secure data sharing.

Challenge

Lack of Awareness and Standardization

A significant challenge impeding the adoption of Privacy Enhancing Technologies is the prevalent lack of awareness and standardization within the industry. Many organizations remain unaware of the existence and benefits of PETs, leading to underutilization of these advanced solutions.

Without clear standards, organizations may struggle to choose appropriate solutions or may implement them ineffectively, resulting in suboptimal outcomes. The evolving legal landscape around data privacy adds another layer of complexity, as organizations grapple with understanding how PETs align with various regulatory requirements. This uncertainty can lead to hesitation in adopting PETs, as businesses fear potential legal repercussions from improper implementation.

Emerging Trends

One of the major advancements has been in cryptographic algorithms like homomorphic encryption, secure multi-party computation, and differential privacy, which allow computations on encrypted data without exposing sensitive information. This enables businesses to perform data analytics while ensuring the confidentiality of the underlying data.

Data masking techniques like pseudonymization, obfuscation, and anonymization are being widely adopted to protect personal data while maintaining its usefulness for analysis, helping organizations comply with strict regulations.

The regulatory landscape is also evolving, pushing companies towards adopting PETs. With regulations like the GDPR and others mandating stringent data protection measures, PETs are pivotal in ensuring compliance and shielding organizations from legal and reputational risks.

Business Benefits

- Boosting Consumer Trust: By prioritizing customer privacy through the use of PETs, businesses can build stronger relationships with their customers. People tend to prefer companies that are transparent about their data usage and are committed to protecting it.

- Enhancing Data Utility: Without compromising personal privacy, PETs enable the safe use of data for analysis and decision-making. This aspect is crucial for organizations that rely on data-driven insights but need to respect privacy.

- Innovation and Competitive Advantage: Businesses using PETs can safely explore new technologies and business models without compromising on privacy, giving them a competitive edge in markets where consumer trust is a factor.

- Efficient Data Management: PETs facilitate better control and management of data access within organizations, ensuring that only authorized personnel have access to sensitive information, which can streamline operations and enhance security.

- Market Expansion: PETs can enable businesses to expand into new markets that have stringent privacy laws, thus opening up new avenues for growth without the added burden of overhauling existing privacy and security measures.

Key Player Analysis

Among the top players in this field, IBM Corporation, Microsoft Corporation, and Oracle Corporation are making significant strides in developing and offering innovative solutions.

IBM is a leader in privacy-enhancing technologies, focusing on advanced tools like homomorphic encryption and secure multi-party computation (SMPC). The company’s data privacy solutions help businesses analyze data without ever exposing sensitive information.

Microsoft has emerged as a key player in privacy and data protection, particularly through its Azure platform. The company’s advancements in secure data sharing, differential privacy, and encryption are helping organizations secure data while still enabling innovation.

Oracle is another significant player in the privacy-enhancing technology space. Known for its robust enterprise solutions, Oracle integrates PETs such as data anonymization, encryption, and tokenization into its cloud offerings. Its solutions help clients safeguard sensitive customer data while enabling them to run analytics and business intelligence operations securely.

Top Key Players in the Market

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- SAS Institute

- Thales Group

- CipherTrust

- Socure

- TrustArc

- Veracod

- TokenEx

- ComplyAdvantage

- Tachyon Protocol

- Ocean Protocol

- Anonos

- DataGuardian

- Privitar

- Other Key Players

Top Opportunities Awaiting for Players

- Expansion in Cryptographic Techniques: The demand for cryptographic solutions is rising sharply, with significant growth anticipated in the privacy enhancing technology sector. Innovations in cryptographic methods are crucial as they provide robust data protection, ensuring that data remains secure even in transit or at rest.

- AI-Driven Privacy Enhancements: Artificial intelligence is set to revolutionize PETs by automating data protection processes, enhancing threat detection, and ensuring compliance through advanced analytics and real-time processing. AI-driven solutions can effectively anonymize personal data, reducing exposure risks while maintaining compliance with stringent global privacy regulations.

- IoT and Edge Data Security: With the proliferation of IoT devices, securing data at the edge is becoming increasingly critical. This presents a substantial opportunity for PET industries to develop solutions that ensure data integrity and privacy in decentralized environments. Focusing on robust IoT security frameworks and incorporating advanced encryption and continuous monitoring can significantly benefit businesses.

- Regulatory Compliance Automation: As global data protection regulations become more complex, there is a growing need for automated compliance solutions that can handle the evolving regulatory landscape efficiently. Tools that provide automation in compliance management not only save time but also enhance accuracy, helping businesses stay compliant and mitigate risks.

- Growth in Cyber Insurance: The increasing frequency and sophistication of cyberattacks have made cyber insurance a vital component of risk management strategies. As requirements for cyber insurance become more stringent, there is a compelling business case for PET industries to develop solutions that support businesses in meeting these standards, thus making them eligible for better insurance terms.

Recent Developments

- In September 2024, Salesforce announced its plan to acquire Own Company, a provider of data protection and management solutions, for $1.9 billion in cash. This move aims to strengthen Salesforce’s data security and privacy offerings, addressing the growing need to protect against data loss from various threats.

- In November 2024, the Future of Privacy Forum (FPF) introduced a new Privacy-Enhancing Technologies Repository. This centralized resource provides individuals and organizations with up-to-date information on PETs, including regulatory activities, external reports, and sandbox initiatives. The repository aims to promote a better understanding and awareness of PETs.

Report Scope

Report Features Description Market Value (2024) USD 3.17 Bn Forecast Revenue (2034) USD 28.4 Bn CAGR (2025-2034) 24.50% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Service), By Type (Cryptographic Technique, Anonymization Technique, Pseudonymization Techniques), By Application (Compliance Management, Risk Management, Reporting & Analytics, Others), By End-User (BFSI, Healthcare, IT & Telecom, Government & Public Sector, Retail & E-commerce, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, SAS Institute, Thales Group, CipherTrust, Socure, TrustArc, Veracod, TokenEx, ComplyAdvantage, Tachyon Protocol, Ocean Protocol, Anonos, DataGuardian, Privitar, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Privacy Enhancing Technologies MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Privacy Enhancing Technologies MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- SAS Institute

- Thales Group

- CipherTrust

- Socure

- TrustArc

- Veracod

- TokenEx

- ComplyAdvantage

- Tachyon Protocol

- Ocean Protocol

- Anonos

- DataGuardian

- Privitar

- Other Key Players